AleaSoft Energy Forecasting, May 20, 2024. On May 14, in Germany, solar photovoltaic energy registered the highest production in the history of this market, exceeding 400 GWh. Wind energy production increased in most markets during the third week of May, which, together with lower gas and CO2 prices than the previous week, contributed to the fall in prices in most major European electricity markets compared to the previous week. Most markets registered hours with negative prices.

Solar photovoltaic, solar thermoelectric and wind energy production

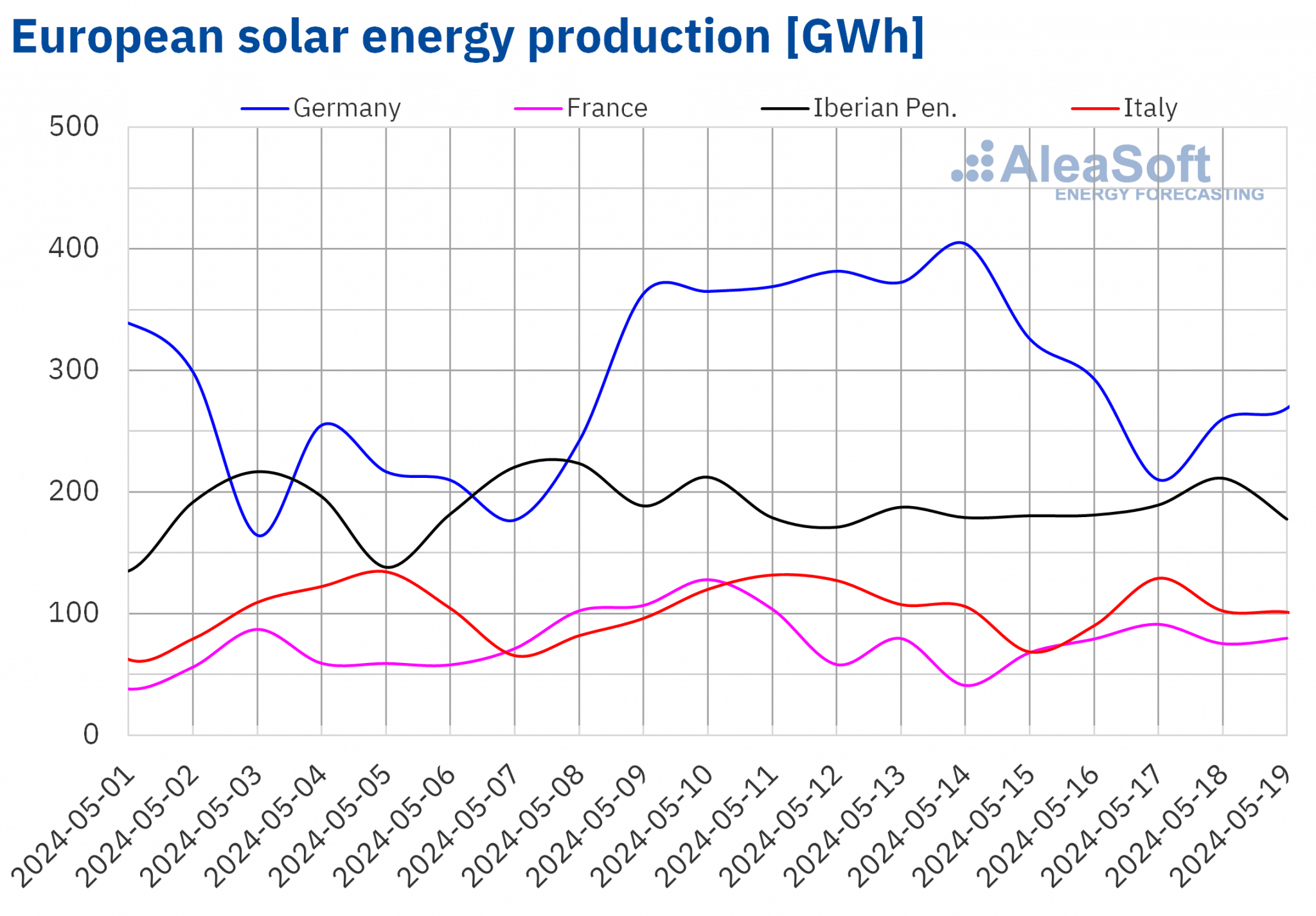

In the week of May 13, solar energy production decreased in most major European electricity markets compared to the previous week. The Portuguese market registered the largest decline, 26%, while the Spanish market registered the smallest decline, 3.0%, in both cases reversing the upward trend of the previous week. The exception was the German market, where solar energy production increased for the fourth consecutive week, this time by 1.3%.

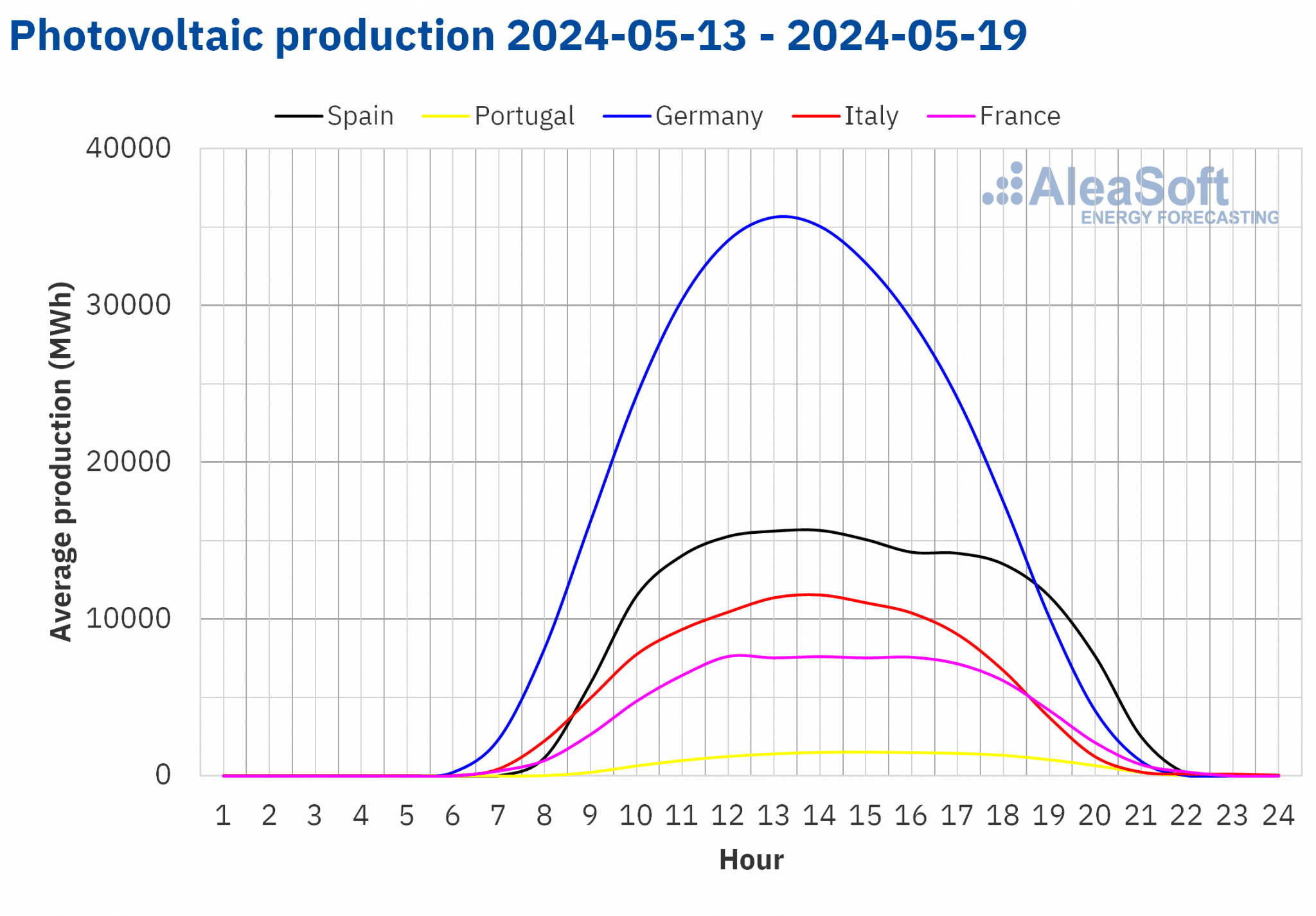

The German market broke the record for photovoltaic energy production on May 14 with 404 GWh generated using this technology.

In the week of May 20, according to AleaSoft Energy Forecasting’s solar energy production forecasts, there will be a downward trend in Germany and Italy. On the other hand, in Spain, solar energy production will increase.

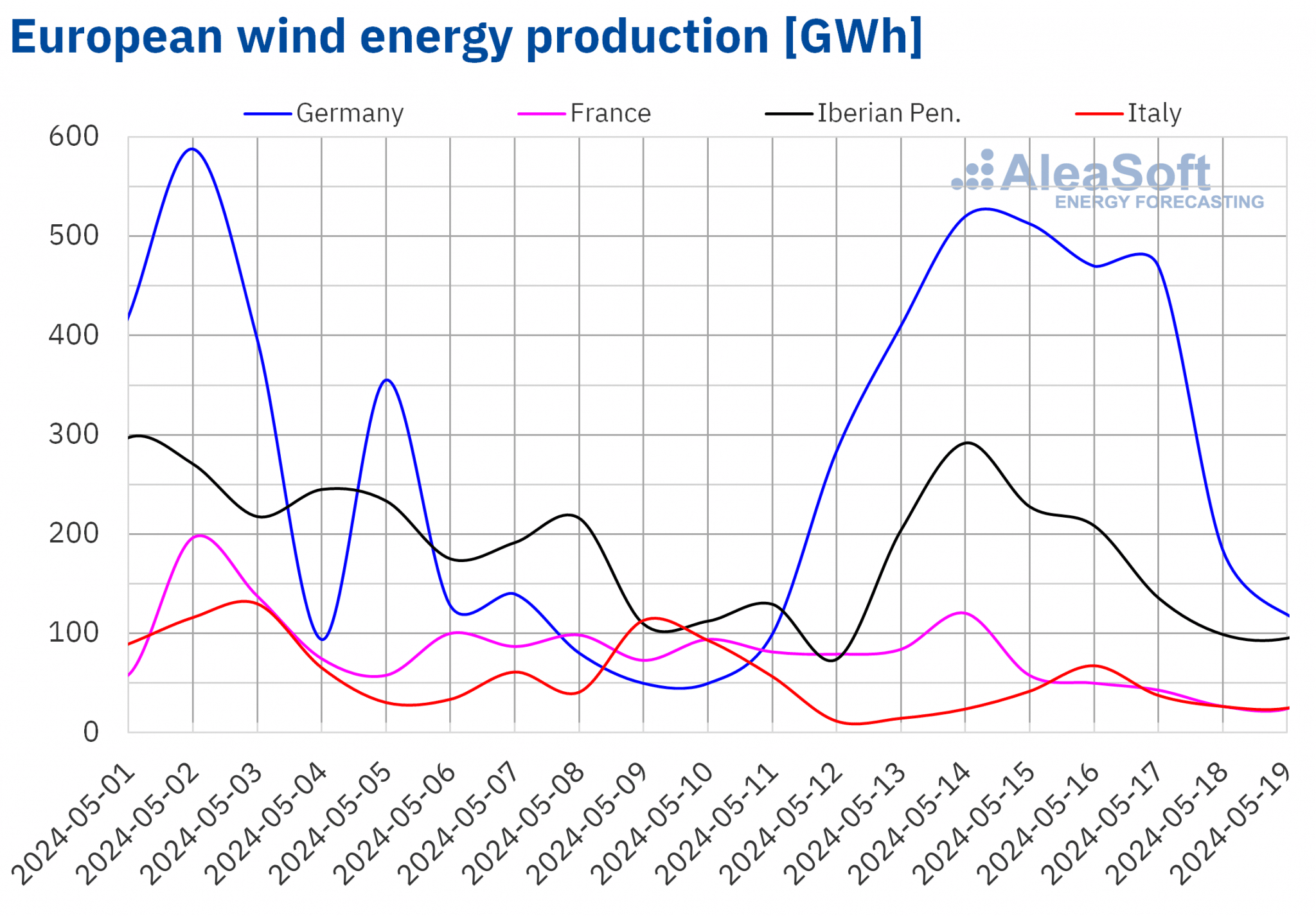

In the week of May 13, wind energy production increased in most major European markets compared to the previous week, reversing the downward trend of the previous week. Increases ranged from 14% in the Spanish market to 224% in the German market. The exceptions were the Italian and French markets, which registered decreases in wind energy generation of 42% and 34%, respectively. The French market continued its downward trend for the fourth consecutive week.

In the week of May 20, according to AleaSoft Energy Forecasting’s wind energy production forecasts, it will increase in France and Italy and it will decrease in Germany and the Iberian Peninsula.

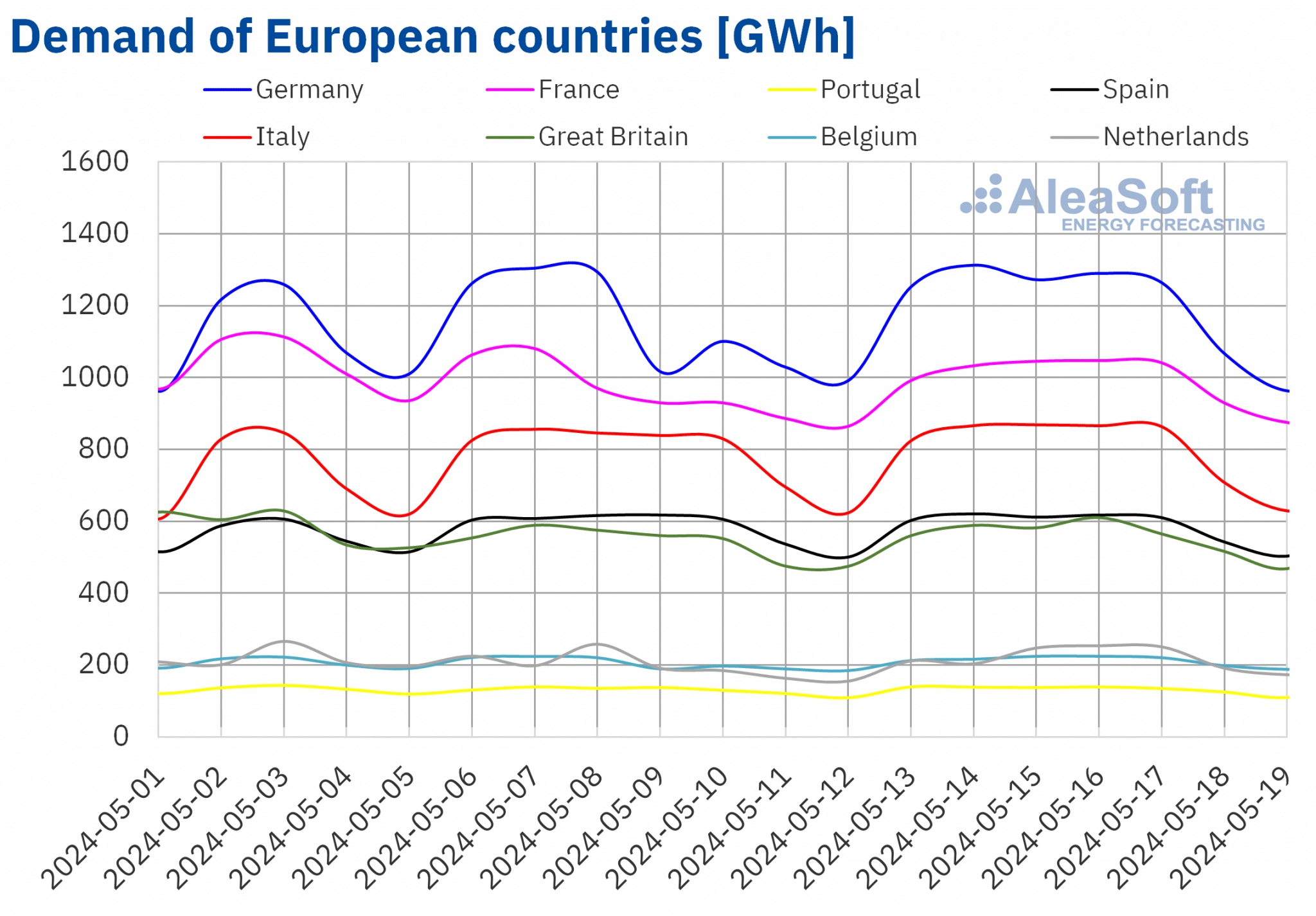

Electricity demand

In the week of May 13, electricity demand increased in all major European electricity markets compared to the previous week, reversing the downward trend registered in most markets in the previous week. In the markets of Germany, Belgium, France and the Netherlands, the recovery in demand after the celebration of the Ascension Day in the previous week, on May 9, favored the increases. Something similar happened in Great Britain that celebrated the “Early May bank holiday” on Monday, May 6. In the German, Spanish and Italian markets, demand increased for the second consecutive week. The Netherlands registered the largest increase in demand, 11%. On the other hand, the Spanish market registered the smallest increase, 0.5%. Madrid celebrated the San Isidro Labrador festivities on May 15, which limited the weekly increase in demand in Spain.

During the third week of May, average temperatures increased in most analyzed markets, ranging from 0.3 °C in France to 3.6 °C in the Netherlands. On the other hand, in Great Britain and the Iberian Peninsula, average temperatures decreased from 0.3 °C to 1.9 °C.

For the week of May 20, according to AleaSoft Energy Forecasting’s demand forecasts, the upward trend will reverse and demand will fall in Germany, Portugal, the Netherlands, France, Belgium, Spain and Great Britain. Demand will increase only in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

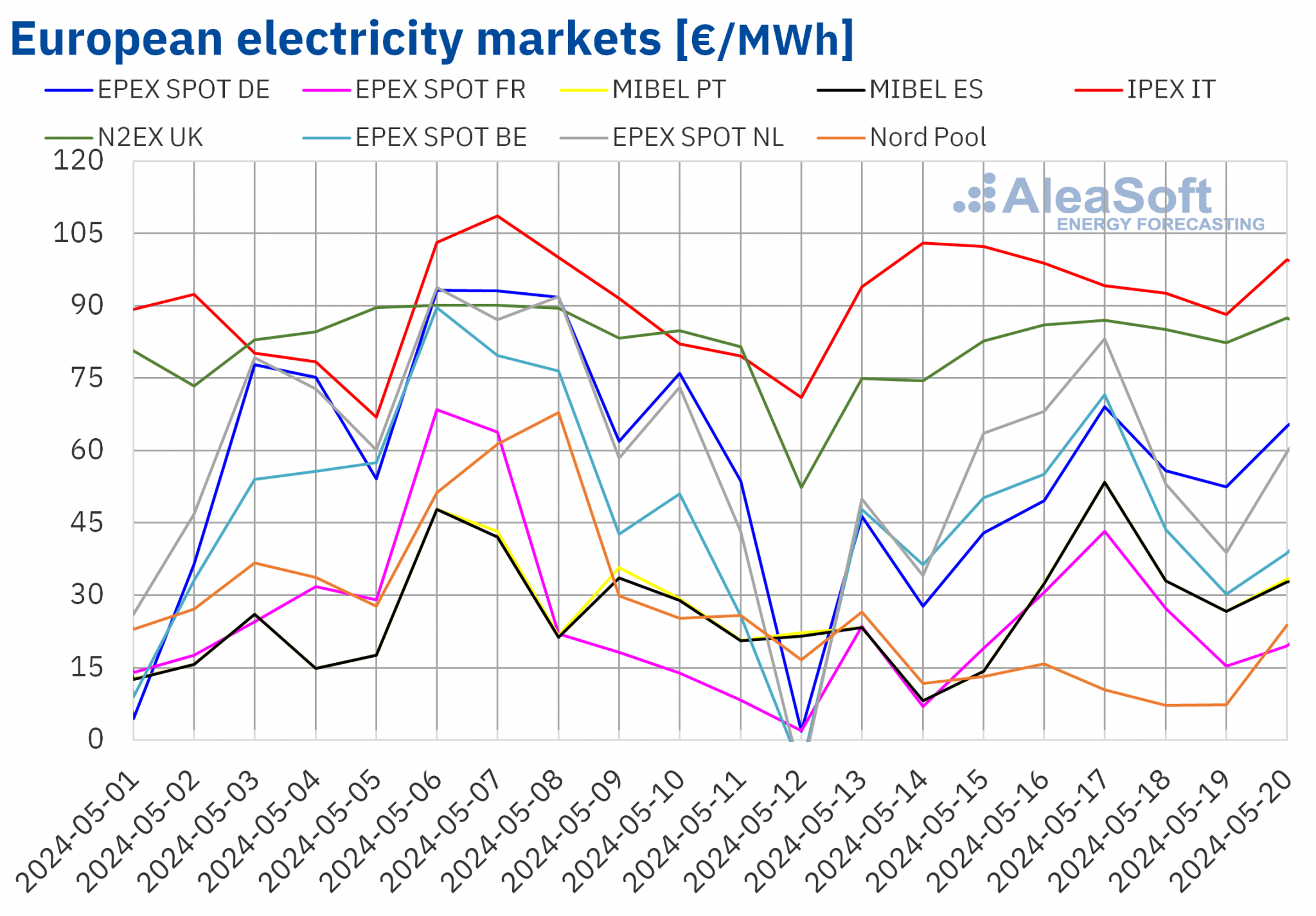

In the third week of May, prices in most major European electricity markets registered an upward trend between Tuesday, May 14, and Friday, May 17, reaching the highest daily price of the week on that day. However, this peak was lower than the previous week’s peak. Despite the aforementioned upward trend, weekly prices fell compared to the previous week. The exceptions were the N2EX market of the United Kingdom and the IPEX market of Italy, with increases of 0.2% and 5.8%, respectively. The Nord Pool market of the Nordic countries reached the largest percentage price decline, 67%. In contrast, the EPEX SPOT market of Belgium registered the smallest percentage decline, 6.9%. In the other markets analyzed at AleaSoft Energy Forecasting, prices fell between 11% in the EPEX SPOT market of the Netherlands and the MIBEL market of Spain and 27% in the EPEX SPOT market of Germany.

In the third week of May, weekly averages were below €50/MWh in most analyzed European electricity markets. The exceptions were the Dutch, British and Italian markets, with averages of €55.80/MWh, €81.80/MWh and €96.12/MWh, respectively. In contrast, the Nordic market registered the lowest weekly average, €13.18/MWh. In the rest of the analyzed markets, prices ranged from €23.68/MWh in the French market to €49.13/MWh in the German market.

Regarding hourly prices, most analyzed European markets registered negative prices on May 14 and 19. The exceptions were the British and Italian markets, which had no negative prices in the third week of May. On the other hand, the German, Belgian, French, Dutch and Nordic markets also had negative prices on May 18 and the first four markets on this list, on May 13. In addition, the Dutch market registered negative prices on May 15, while the German and Nordic markets had negative prices on May 15 and 16. In the third week of May, the Dutch market registered the lowest hourly price again, ‑€80.00/MWh, on Sunday, May 19, from 13:00 to 14:00.

During the week of May 13, the fall in the average price of gas and CO2 emission allowances and the increase in wind energy production in most analyzed markets had a downward influence on European electricity market prices. However, in the Italian market, wind and solar energy production fell, contributing to the price increase in this market.

AleaSoft Energy Forecasting’s price forecasts indicate that prices in some European electricity markets, such as Germany, Spain, the Netherlands or Portugal, might increase in the fourth week of May, influenced by the decrease in wind energy production. In the rest of the markets, prices will be slightly lower than the previous week.

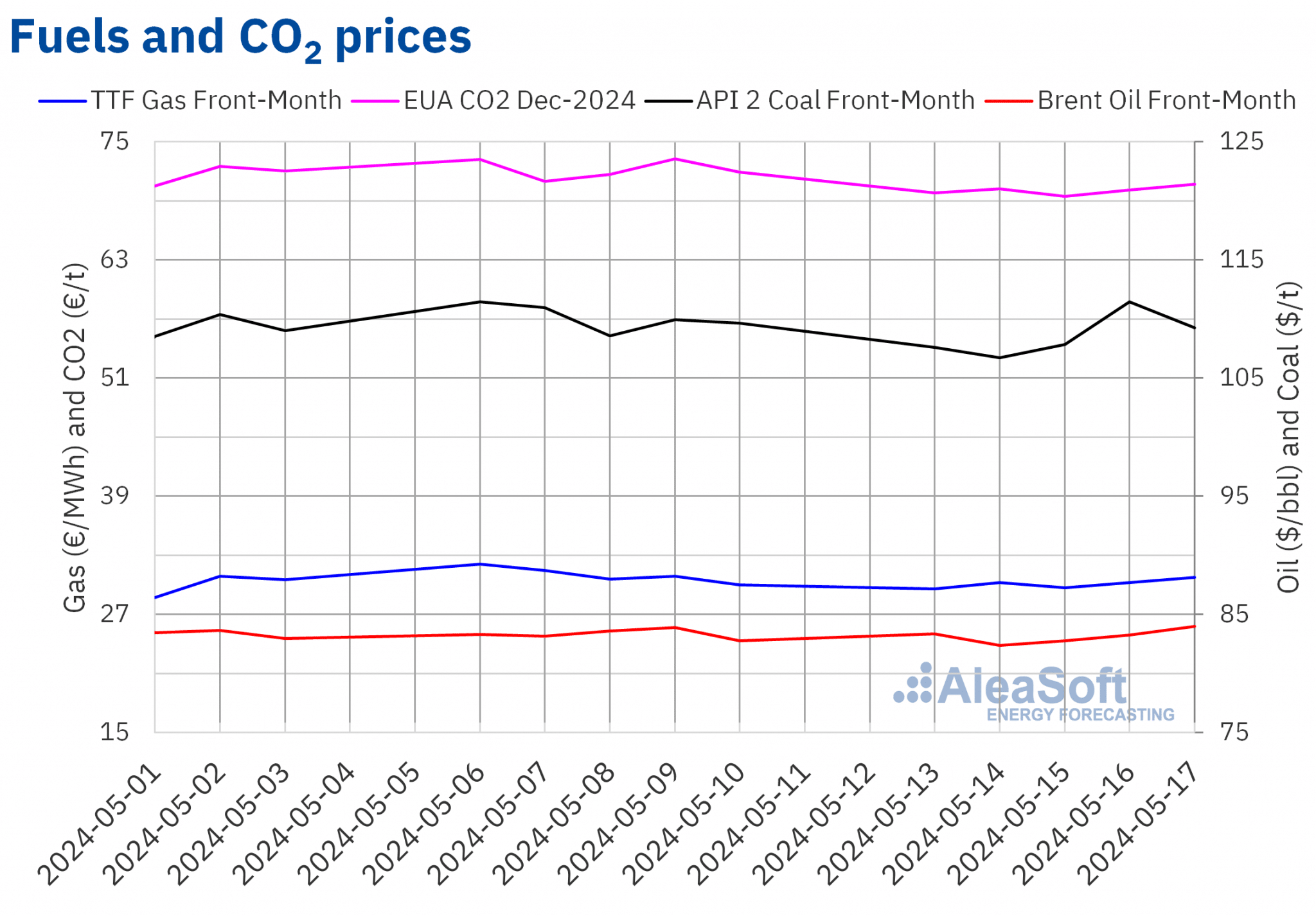

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front‑Month in the ICE market continued below $85/bbl during the third week of May. On Tuesday, May 14, these futures registered their weekly minimum settlement price, $82.38/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was 0.9% lower than the previous Tuesday and the lowest since March 13. Subsequently, prices began an upward trend. As a result, on Friday, May 17, these futures reached their weekly maximum settlement price, $83.98/bbl. This price was 1.4% higher than the previous Friday. For the week as a whole, the average of settlement prices was 0.2% below the previous week’s average.

In the third week of May, the release of economic data from China and the United States fueled expectations of demand increases. In addition, US oil reserves declined. On the other hand, the forest fires in Canada caused concern about the possible impact on Canadian production, also contributing to the increase in prices during the week.

As for TTF gas futures in the ICE market for the Front‑Month, on Monday, May 13, they continued with the declines of the previous week. On that day they reached their weekly minimum settlement price, €29.58/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was 8.0% lower than the previous Monday and the lowest since May 2. Subsequently, settlement prices recovered. As a consequence of the price increases of the third week of May, on Friday, May 17, these futures reached their weekly maximum settlement price, €30.77/MWh. This price was 2.5% higher than the previous Friday. However, despite the increases registered during the week, the weekly average of settlement prices was lower than that of the previous week.

In the third week of May, planned maintenance work and the corresponding decrease in gas flow from Norway starting the following week, as well as forecasts of lower renewable energy production in Europe, which would cause an increase in gas demand for electricity generation, drove TTF gas futures prices higher. Higher Asian demand for liquefied natural gas also contributed to the price increases.

As for CO2 emission allowances futures in the EEX market for the reference contract of December 2024, settlement prices remained around €70/t during the third week of May. On Wednesday, May 15, these futures reached their weekly minimum settlement price, €69.46/t. According to data analyzed at AleaSoft Energy Forecasting, this price was 3.1% lower than the previous Wednesday and the lowest since the beginning of May. In contrast, on Friday, May 17, these futures registered their weekly maximum settlement price, €70.69/t. However, this price was still 1.7% lower than the previous Friday. The weekly average of settlement prices was 3.0% lower than the second week of May.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

The next webinar of the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen will take place on Thursday, June 13. On this occasion, guest speakers from Engie Spain will participate for the sixth time. This webinar will analyze the evolution of European energy markets and the prospects in the second half of 2024, the growth opportunities in the renewable sector, the regulatory and design challenges of the wholesale market and the current affairs of the PPA market in Spain.

Source: AleaSoft Energy Forecasting.