AleaSoft Energy Forecasting, June 27, 2022. In the fourth week of June, prices of most spot and futures European electricity markets increased, dragged by the increase in gas prices. In the German, Belgian, French and Dutch markets, prices above €450/MWh were registered in some hours and even reached €500.00/MWh in one hour in the German market. The solar energy production increased in the Iberian market and registered a record in Portugal on June 26. The wind energy production increased in Portugal and Italy.

Photovoltaic and solar thermal energy production and wind energy production

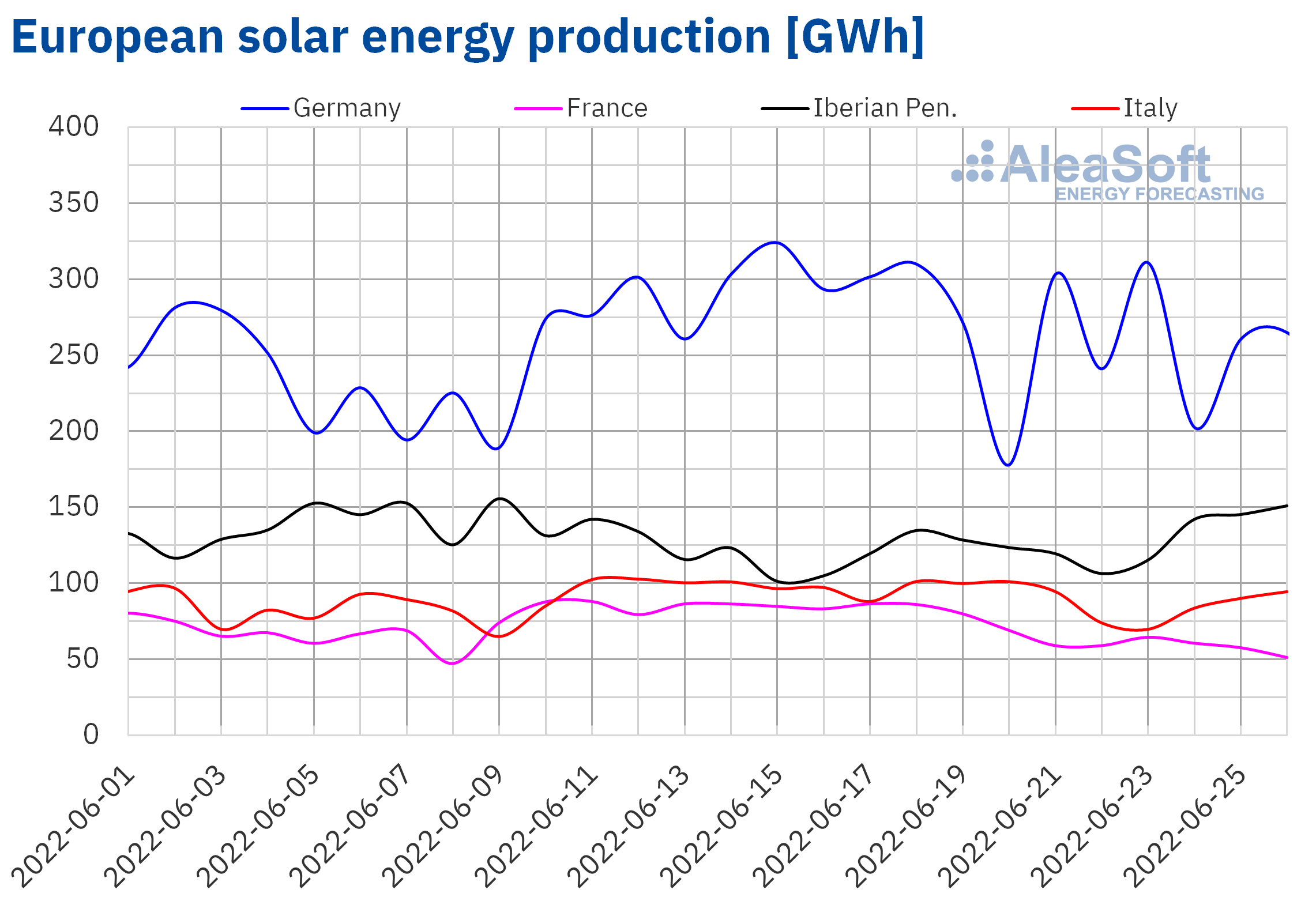

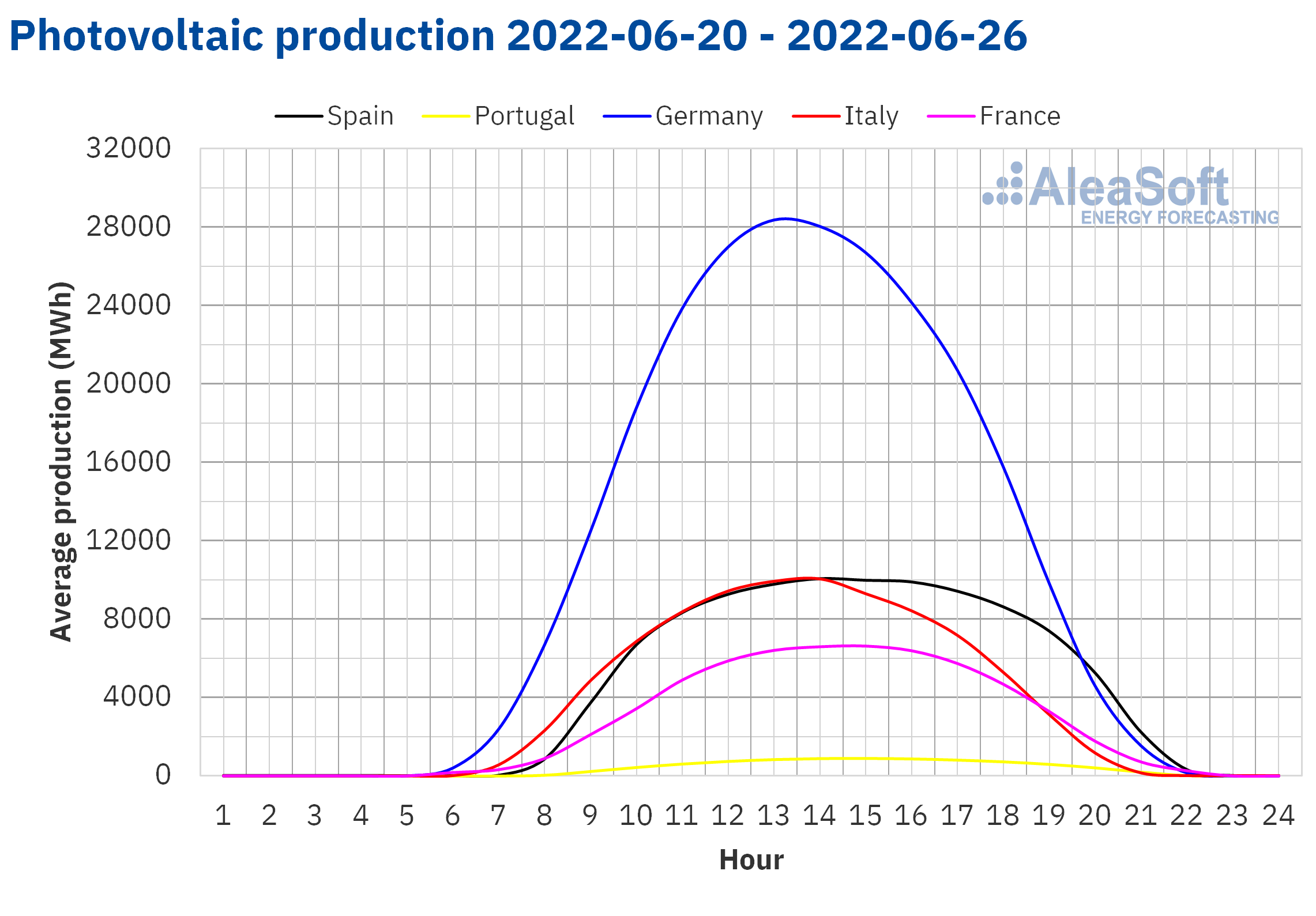

In the week of June 20, the solar energy production increased in the Iberian Peninsula, 10% in Spain and 2.6% in Portugal. In the Portuguese market, the production of June 26 was 11 016 MWh, the highest value registered so far in that market. However, the production with this technology fell by 29% in France, 15% in Germany and 11% in Italy.

According to the AleaSoft Energy Forecasting’s forecasts, in the last week of June the solar energy production will recover in Germany and Italy but will decrease in Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

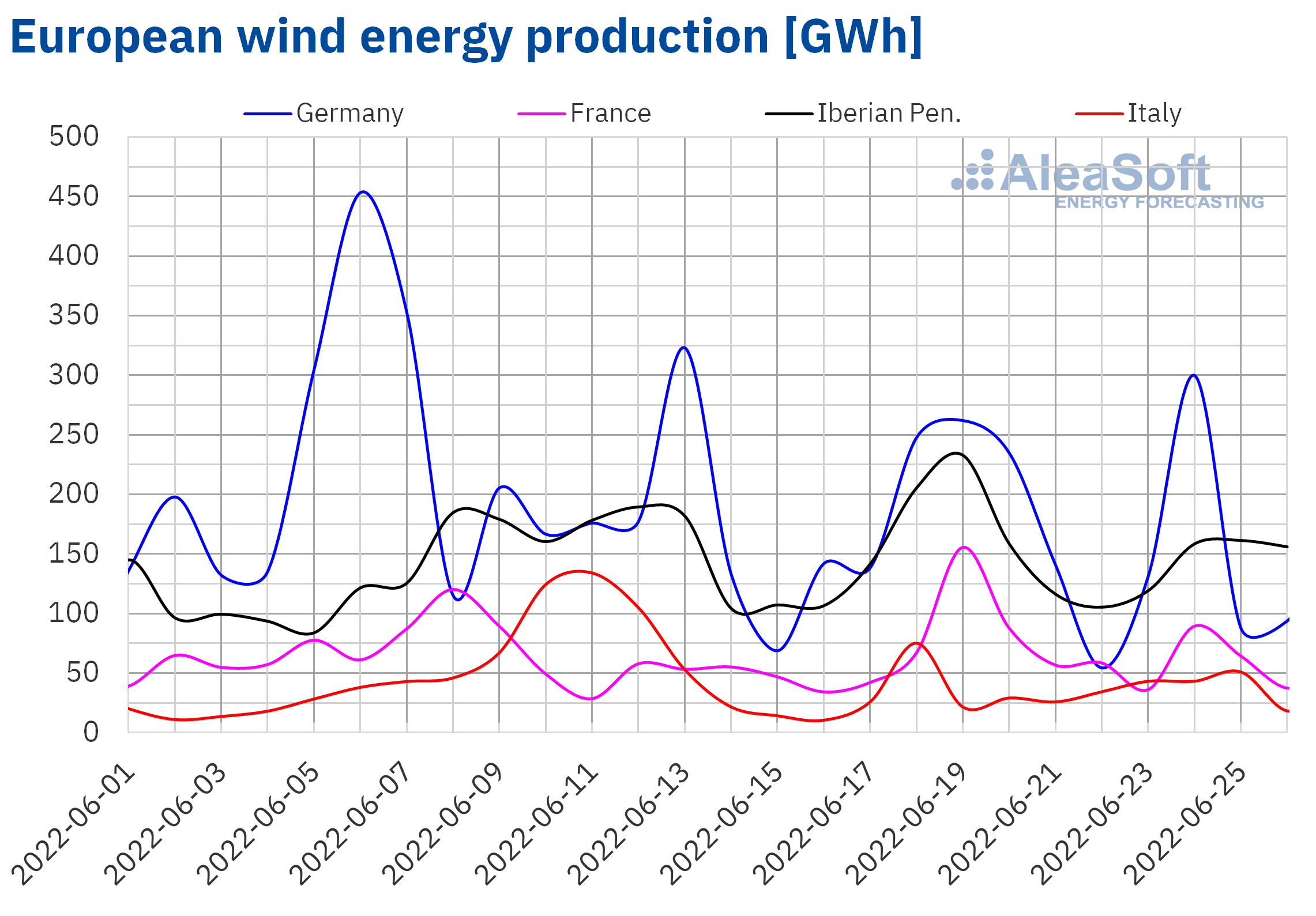

In the case of the wind energy production, in the fourth week of June it increased by 20% in Portugal and 11% in Italy. On the contrary, the production with this technology fell in the markets of Germany, Spain and France, by 21%, 14% and 5.1% respectively.

In the week of June 27, the wind energy production will increase in Germany and Italy but will decrease in the rest of the analysed markets, according to the AleaSoft Energy Forecasting’s forecasts.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

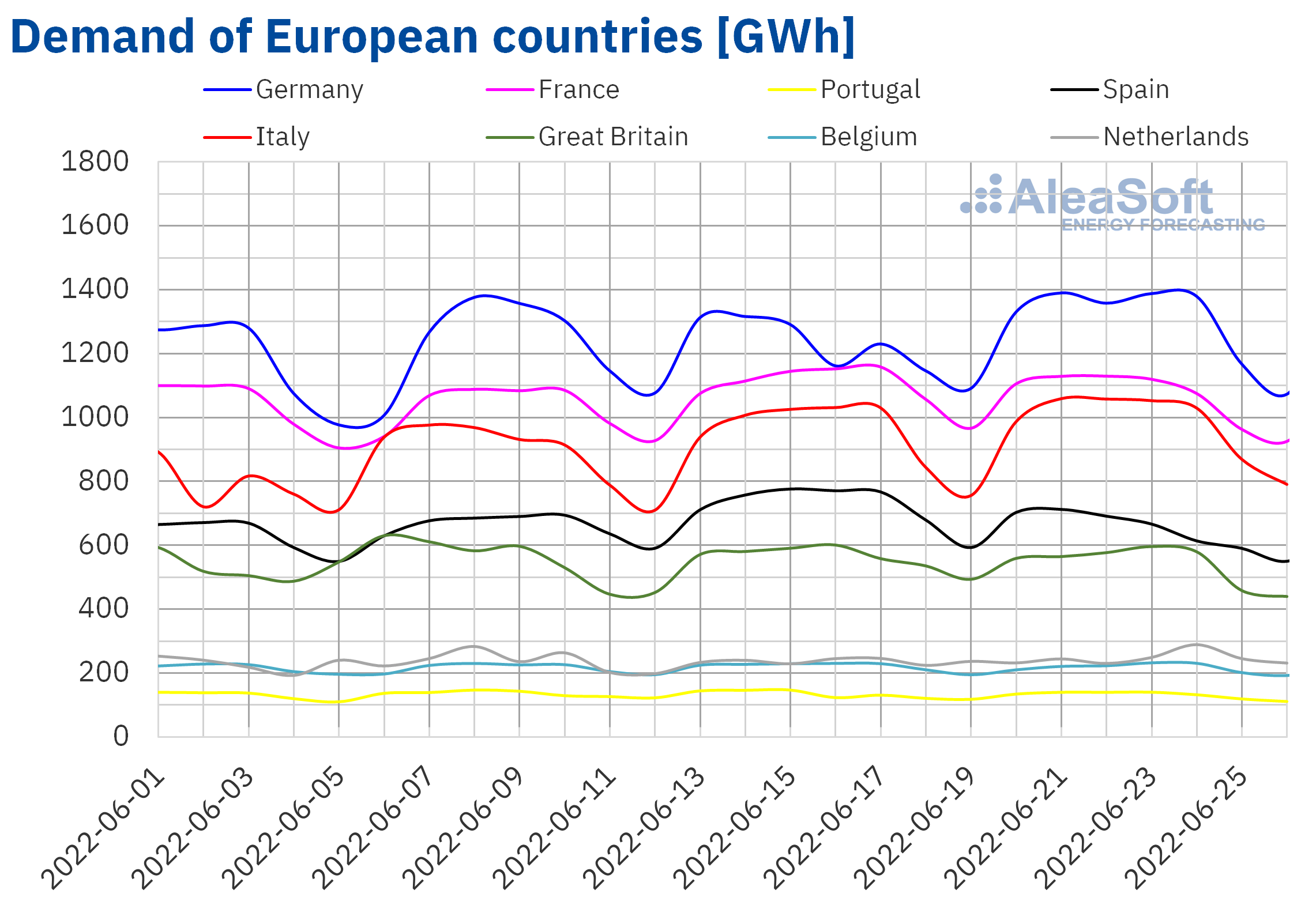

In the week of June 20, the electricity demand behaved mainly downwards in the analysed European markets compared to the previous week. The largest decrease was registered in the Spanish market, where the demand fell by 10%, favoured by the drop in temperatures once the heat wave registered during the week of June 13 ended, in addition to the fact that June 24, Day of Saint John, was a holiday in some autonomous communities. In the markets of Great Britain, France and Belgium the decreases were 4.0%, 2.9% and 2.3% respectively. In the Portuguese market, the demand fell by 1.5% for the second consecutive week, despite the recovery in demand after the holiday of Thursday, June 16, Corpus Christi Day.

As for the increases in demand, the German market registered the largest increase, 6.3% after the recovery in demand due to the Corpus Christi holiday. In the Dutch market, the demand increased by 4.0%, while in the Italian market, the rise was 3.2%. In the case of these two markets, the increase in demand was favoured by the increase in average temperatures during the week that ended.

For the last week of June, the AleaSoft Energy Forecasting’s forecasts estimate that the demand will decrease in most markets, with the exception of the market of the Netherlands, where it is expected to continue increasing.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

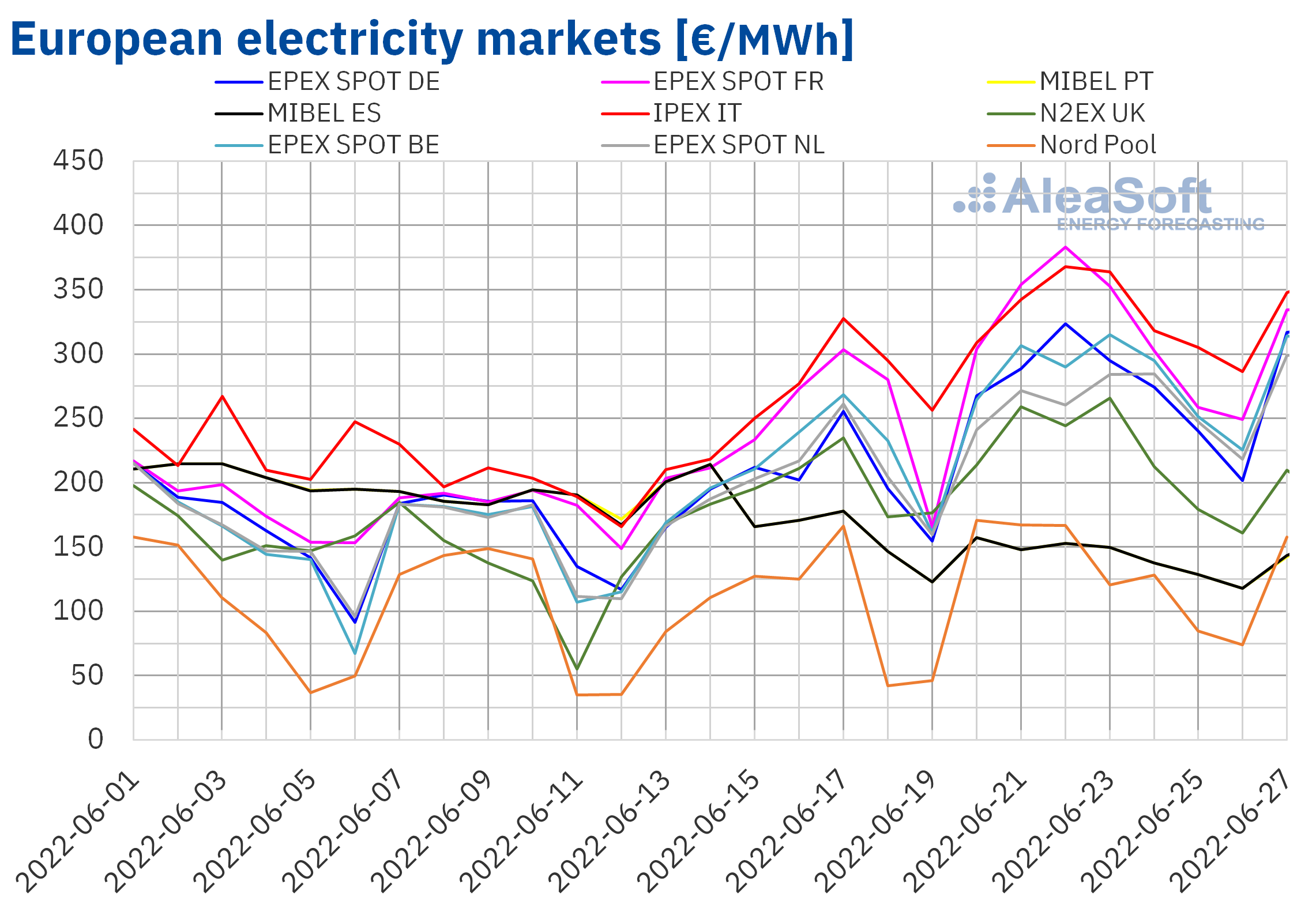

European electricity markets

In the week of June 20, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The exception was the MIBEL market of Spain and Portugal, where prices fell by 17%. The largest price rise was that of the EPEX SPOT market of Germany, of 37%, while the smallest increase, of 14%, was that of the N2EX market of the United Kingdom. In the rest of the markets, the price increases were between 25% of the IPEX market of Italy and 32% of the EPEX SPOT market of France and Belgium.

In the fourth week of June, there were large differences in the average prices of the analysed electricity markets. The highest averages, of €327.54/MWh and €314.83/MWh, corresponded to the Italian market and the French market, respectively. On the other hand, the lowest weekly average, of €130.29/MWh, was that of the Nord Pool market of the Nordic countries, followed by that of the MIBEL market, of €141.76/MWh. In the rest of the markets, prices were between €219.23/MWh of the British market and €278.16/MWh of the Belgian market.

Regarding hourly prices, in the fourth week of June prices above €450/MWh were registered in the German, Belgian, French and Dutch markets. The highest hourly price, of €500.00/MWh, was reached on Monday, June 20, at 8:00 in the German market. This price was the highest since March 9 in Germany.

During the week of June 20, the 19% rise in gas prices led to an increase in prices of most European electricity markets. In addition, in markets such as the German and French, the wind and solar renewable energy production decreased, also contributing to the rise in prices. In the case of the MIBEL market, the drop in demand and the fact that the mechanism that limits gas prices used as a reference in the combined cycle gas turbines, cogeneration and coal offers was in operation throughout the fourth week of June, while in the previous week it began to be applied from Wednesday 15, allowed prices to fall and be among the lowest in Europe.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of June 27 prices of most European electricity markets might increase, influenced by the decrease in wind energy production in some markets, as well as by the high gas prices.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

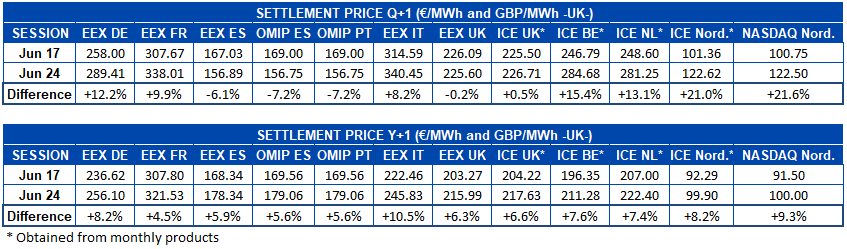

Electricity futures

Settlement prices of European electricity futures for the next quarter registered a predominantly upward behaviour between the sessions of June 17 and 24 in the markets analysed at AleaSoft Energy Forecasting. The exceptions were the EEX market of the United Kingdom and Spain and the OMIP market of Spain and Portugal, where prices fell by 6.1% in the case of the EEX market of Spain and by 7.2% in the case of the OMIP market for both countries. The variation of the EEX market of the United Kingdom was only ‑0.2%. In the rest of the markets, prices rose. In the case of the ICE market of the United Kingdom, the increase was also modest, 0.5%, while in the rest of the markets the increases were between 9.9% of the EEX market of France and 22% of the NASDAQ market of the Nordic countries.

When analysing the behaviour of electricity futures for 2023 in this same period, the picture is much more homogeneous, with general increases in all analysed markets. The smallest increase was 4.5% registered in the EEX market of France, while the largest rise, of 10%, was observed in the EEX market of Italy.

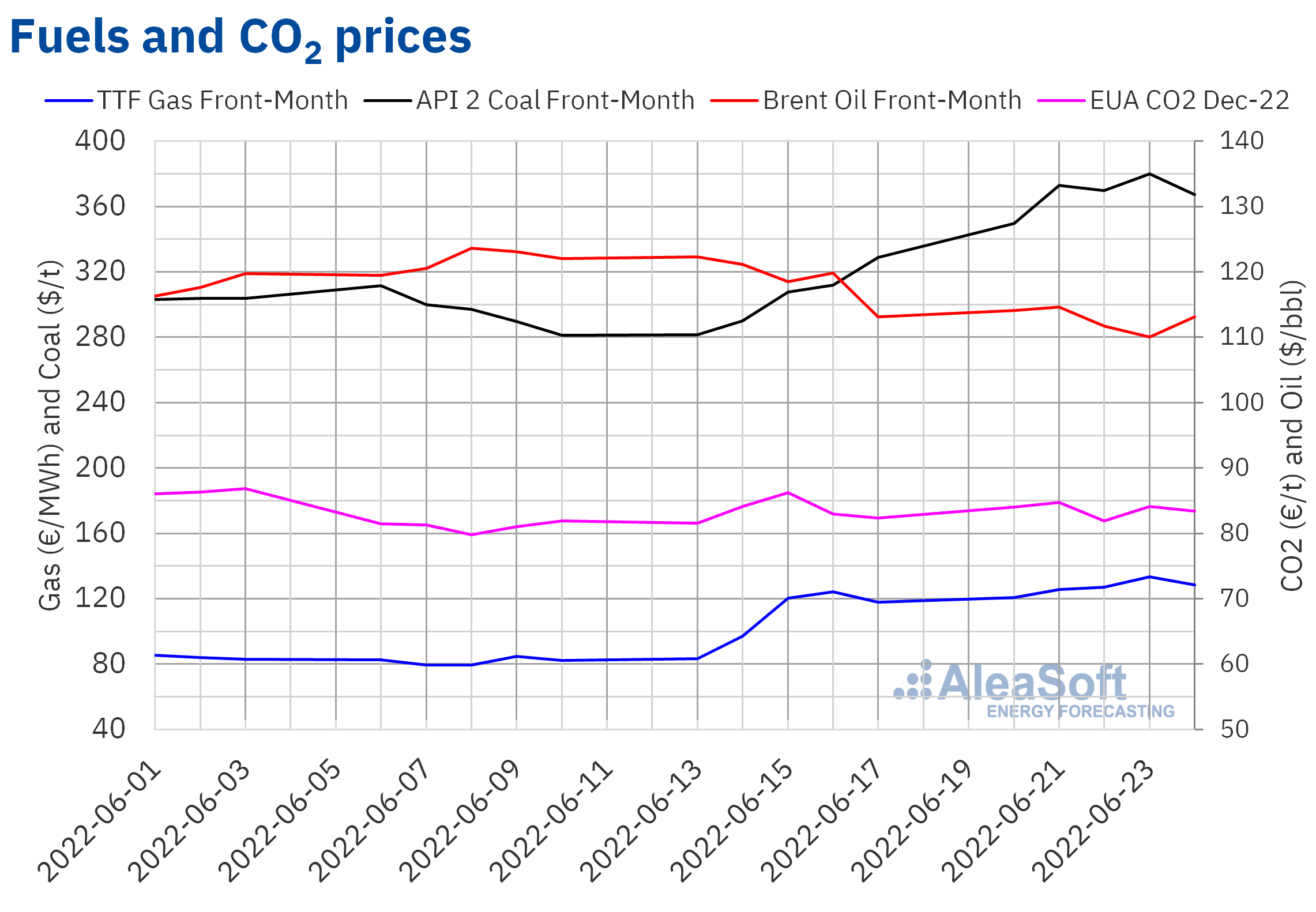

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front‑Month in the ICE market, in the fourth week of June, remained below $115/bbl, influenced by concerns about the evolution of the economy. The weekly minimum settlement price, of $110.05/bbl, was registered on Thursday, June 23, and was 8.1% lower than that of the previous Thursday. On the other hand, the statements made by the US president on Monday, June 20, affirming that the economic recession was avoidable in that country favoured the fact that the highest prices were reached in the first days of the week. The weekly maximum settlement price, of $114.65/bbl, was reached on Tuesday, June 21.

As for settlement prices of TTF gas futures in the ICE market for the Front‑Month, in the fourth week of June, they were higher than €120/MWh. Prices increased until reaching a maximum of €133.35/MWh on Thursday, June 23. This price was 7.2% higher than that of the previous Thursday and the highest since March 9. However, on Friday the settlement price fell by 3.6% compared to the previous day and it was €128.50/MWh.

The number of European countries affected by cuts or reductions in gas supply from Russia increased, exerting its influence on gas futures prices. According to Russia, the reduction in flow through the Nord Stream gas pipeline is related to technical problems, which cannot be resolved due to the sanctions that have been imposed on it. These declines in supply led to the increase in prices.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2022, in the fourth week of June they registered higher settlement prices than those of the same days of the previous week, except on Wednesday, June 22. That day the settlement price was €81.88/t, 5.0% lower than that of the previous Wednesday. On the other hand, the weekly maximum settlement price, of €84.73/t, was reached on Tuesday, June 21, but it was only 0.7% higher than that of the previous Tuesday.

In the fourth week of June, the European Parliament reached several agreements on the reform of the emission rights market, which include the gradual reduction of free emission rights from 2027 until their complete disappearance in 2032.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

On June 14, Royal Decree‑law 10/2022 started to be applied, which establishes a temporary mechanism for adjusting production costs in the Spanish electricity market, which will be in force until May 2023. This mechanism establishes a cap on gas that is used as a reference in the offers of the plants that use this fuel to generate electricity. The mid‑ and long‑term Spanish electricity market price forecasting of AleaSoft Energy Forecasting and AleaGreen take into account the effects of this mechanism. In addition, they include an estimate of the adjustment that some consumers must pay as compensation for the mechanism, information that is very useful for large and electro‑intensive consumers.

In the next webinar of AleaSoft Energy Forecasting and AleaGreen, which will take place on July 14, the effects of Royal Decree‑law 10/2022 during the first month in operation will be analysed, as part of the analysis of the European energy markets evolution. The main topic of this webinar will be green hydrogen, due to the important role it will play in the energy transition. To analyse the vision of the future of green hydrogen, there will be the participation of guest speakers from H2B2, a leading technology company for the vertical integration of the entire renewable hydrogen value chain.