AleaSoft, November 16, 2020. To tackle the planning and financing of renewable energy projects, it is essential to have a vision of the future of the electricity market prices. The AleaSoft’s long‑term prices curves forecasts are robust, coherent and based on scientific methods. The level of disaggregation is hourly with a 30‑year horizon and with annual confidence bands with a probabilistic metric.

The long‑term prices curves forecasts are a fundamental input in the planning and financing of renewable energy projects, either through a PPA, through auctions, or directly through the markets. Having this type of forecasting is useful when it comes to hedging to minimise the risk and also to carry out the portfolio valuation and audits.

AleaSoft has extensive experience in obtaining forecasts with a long‑term horizon of the main European markets. But, what differentiates the AleaSoft‘s long‑term prices curves forecasts from others that can be found in the market?

Above all, the long‑term prices forecasts must be robust, coherent and based on scientific methods, characteristics that the Alea models fulfil. These models combine Artificial Intelligence with statistical methods mainly related to time series such as the SARIMA models.

At AleaSoft, 30‑year prices forecasts are made with hourly breakdown, which allows having a maximum level of detail to calculate the price that the renewable energy facilities that are being planned to build will receive each hour. The long‑term hourly forecasts at this time are essential to make decisions with greater precision. These hourly forecasts are also essential for planning the battery storage.

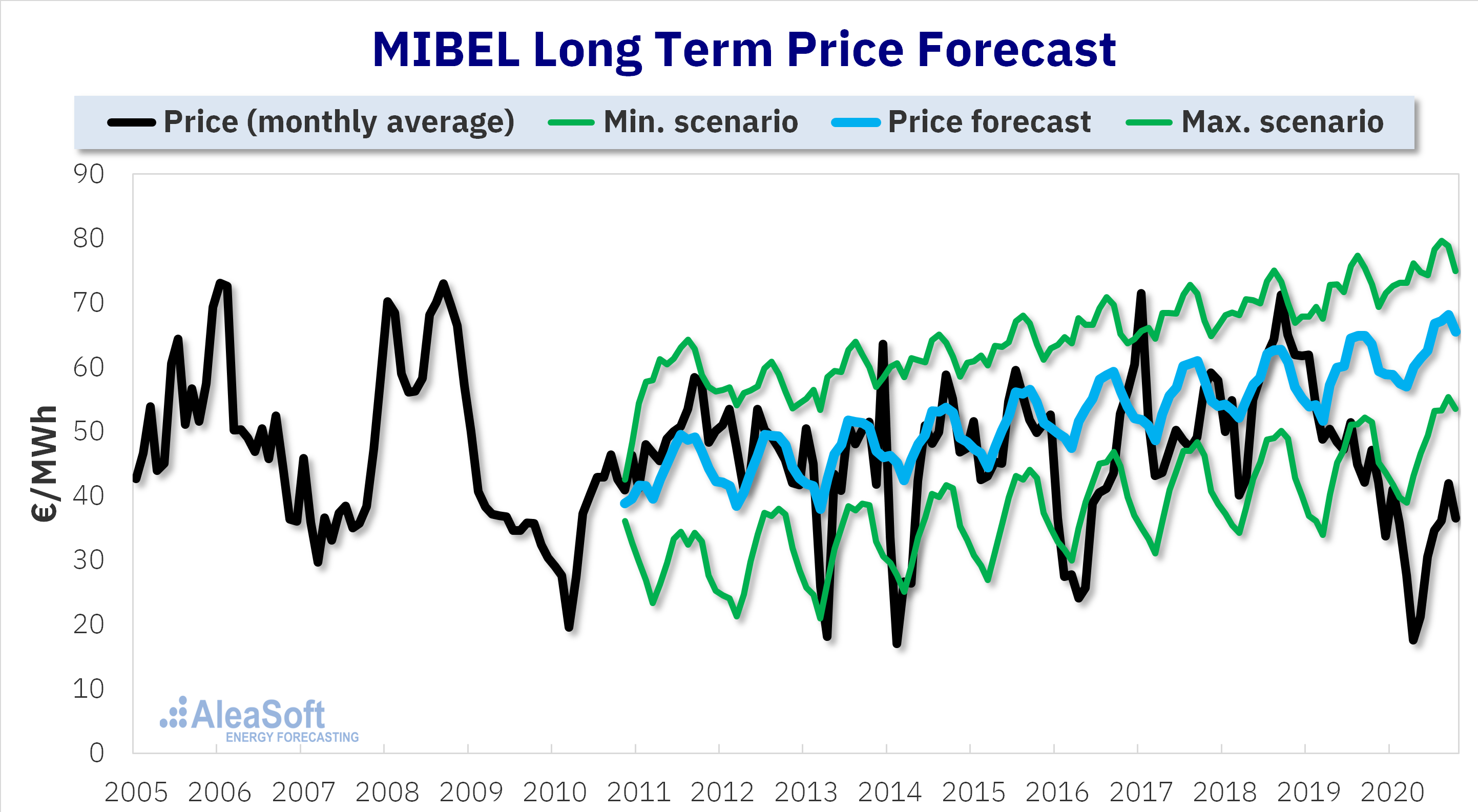

Another differentiating characteristic of the AleaSoft‘s methodology is obtaining annual confidence bands with a probabilistic metric. In other words, long‑term prices forecasts can be generated with the associated probabilities, for example, P15, P50 and P85. This probabilistic metric is essential for the valuation of the renewable energy portfolio and the quantification of the risk.

Source: Long term MIBEL market price forecast generated in November 2010.

Source: Long term MIBEL market price forecast generated in November 2010.

The models on which the AleaSoft‘s long‑term forecasts are based have a proven quality taking into account that they have been used for 21 years with great success and coherence to generate forecasts related to the energy sector in all time horizons: short, medium and long term. They are used both to obtain price forecasts for the main European electricity markets and to generate forecasts of electricity demand and production with renewable energy. This extensive experience is another distinctive feature of the AleaSoft‘s forecasts.

Throughout this period, the most important companies in the sector trusted in the robustness and quality of the AleaSoft‘s forecasts. Its clients include electricity system operators (TSO), utilities, traders, retailers, large consumers and electro‑intensives, companies in the renewable energy sector, investment funds and banks.

Next webinar of AleaSoft

Since the COVID‑19 pandemic began, several webinars were held at AleaSoft to analyse the evolution of the energy markets in this context of uncertainty. The next one will be on November 26 and will focus on the analysis of the perspectives from the year 2021. On this occasion, the renewable energy auctions and their effect on the market will be addressed, as well as the importance of technical Due Diligencies in the financing of renewable energy projects and there will be the participation of three speakers from Vector Renewables.

Source: AleaSoft Energy Forecasting.