AleaSoft, November 19, 2020. The European electricity markets prices fell in a generalised way in the first days of the third week of November, favoured by the increase in wind and solar energy production in most of the markets. The Brent oil futures exceeded $44/bbl and the CO2 futures €27/t, in both cases reaching values that were not registered since September.

Photovoltaic and solar thermal energy production and wind energy production

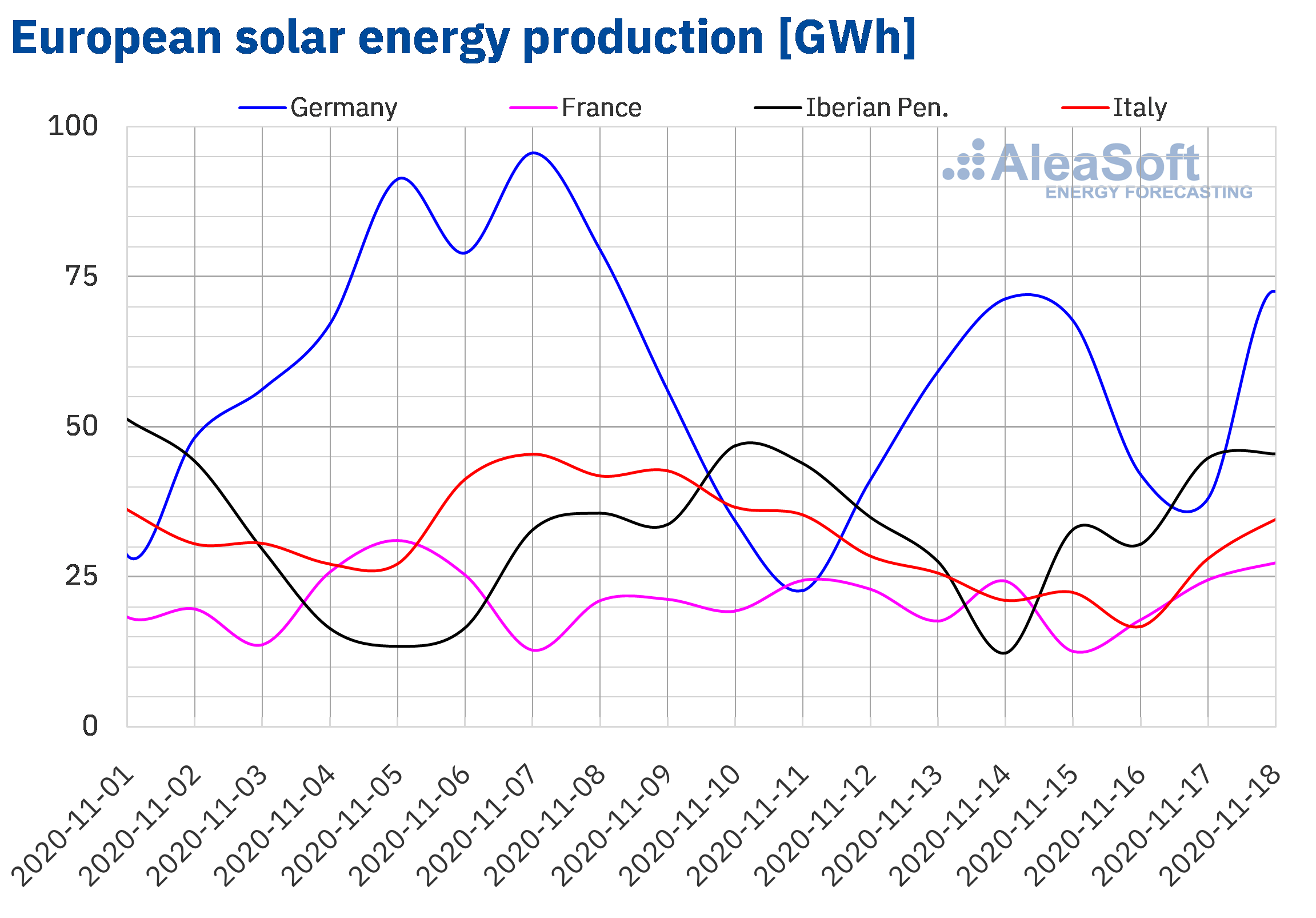

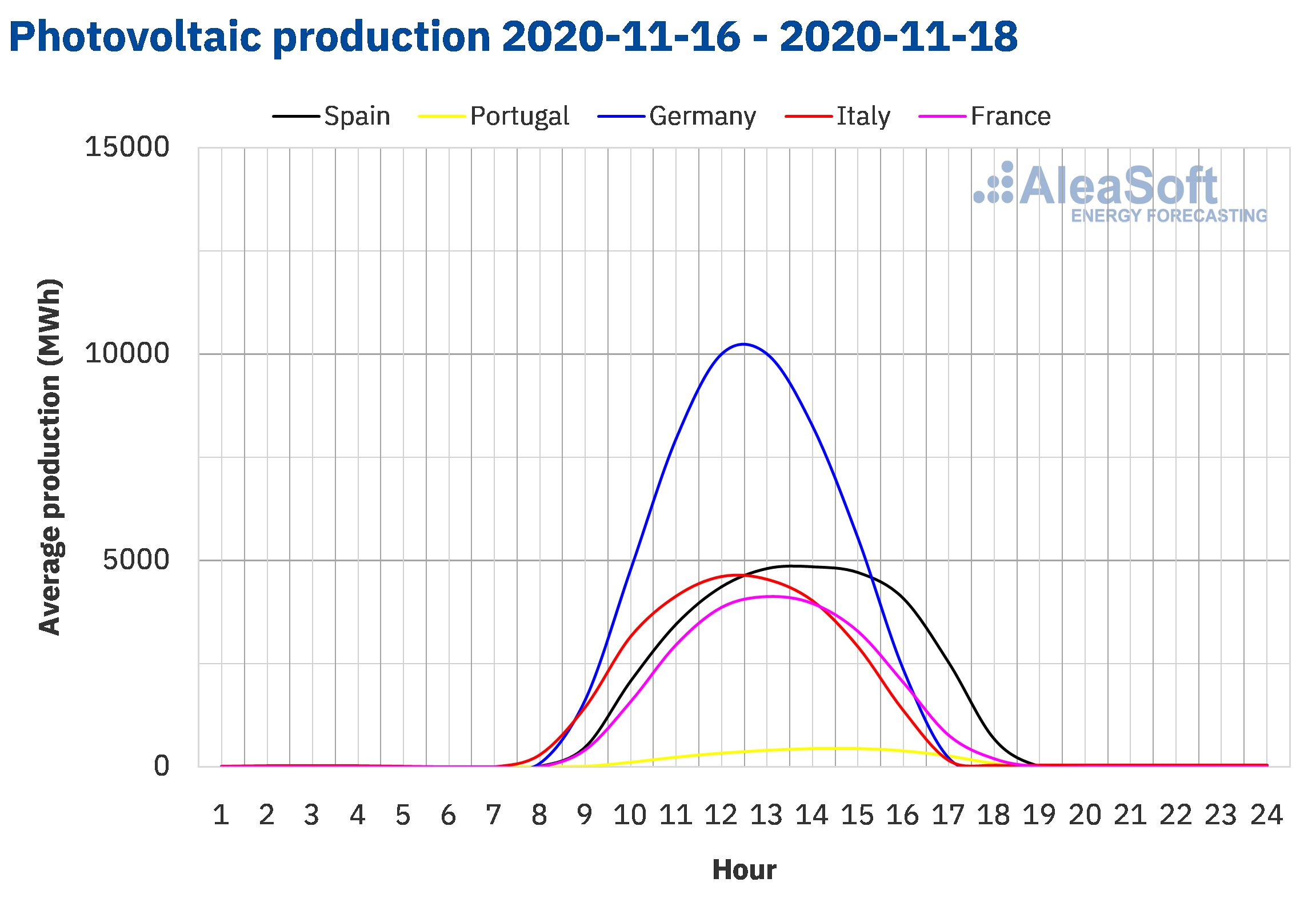

During the first three days of the week that began on Monday, November 16, the average solar energy production increased by 21% in the Iberian Peninsula compared to the average of the previous week. In the French market, the production grew by 14% while in the German market there was an increase of 1.0%. On the contrary, in the Italian market the production had a reduction of 13%.

During the first 18 days of November, the solar energy production increased in all the markets analysed at AleaSoft compared to the same period of 2019. In the Iberian Peninsula, the production grew by 34%, while in the markets of Germany, France and Italy the increases were 49%, 48% and 44% respectively.

The solar energy production forecasting carried out at AleaSoft indicates that at the end of the third week of November the generation with this technology will be lower than that registered during the previous week in the German and Italian markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

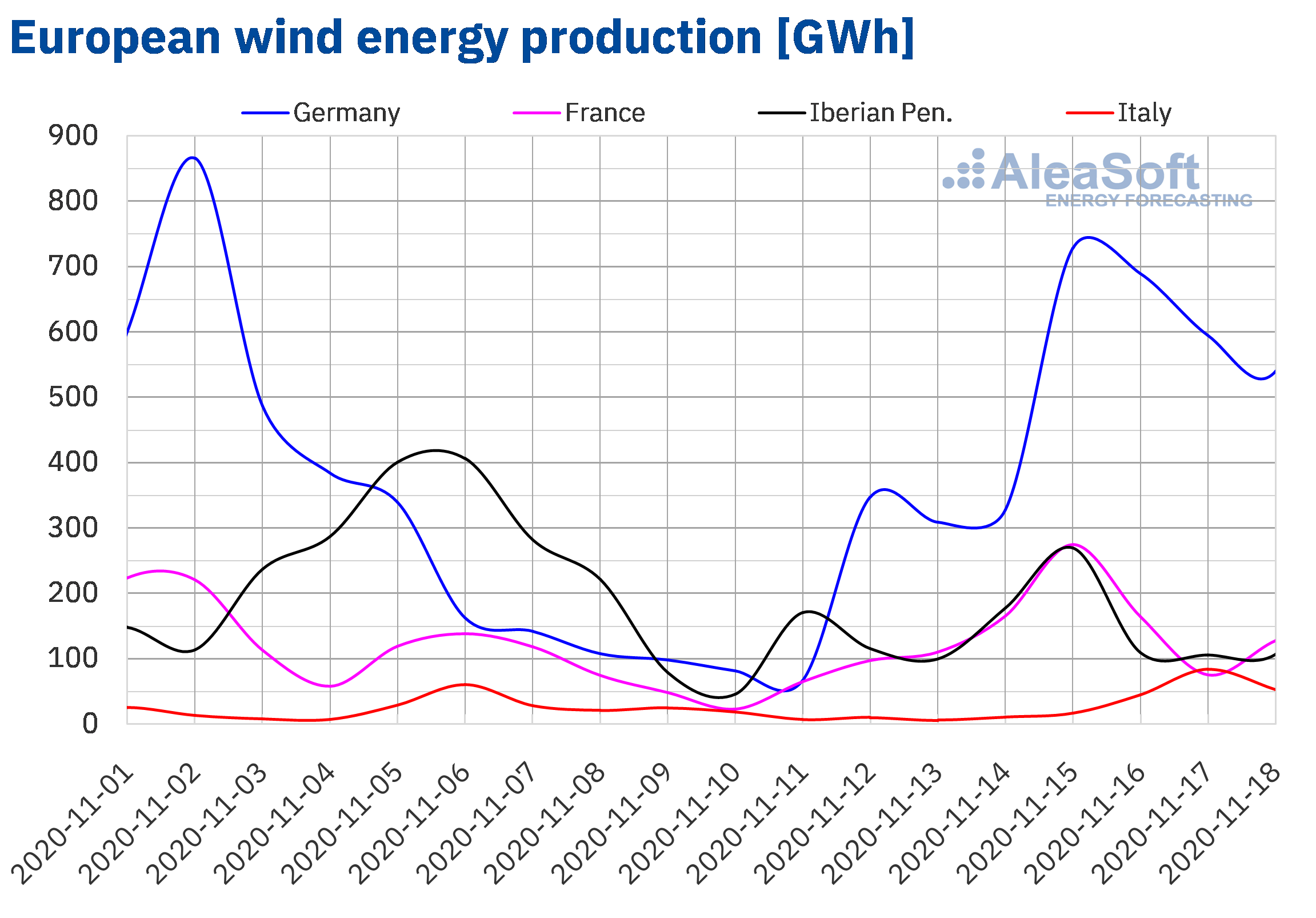

The average wind energy production of the first three days of the week of November 16 registered an increase of 344% in the Italian market compared to the average of the previous week. In the German market there was also a significant increase, in this case of 117%, while in the French market the growth was more moderate, of 9.3%. On the contrary, in the Iberian Peninsula, the production with this technology decreased by 22%. However, if the Iberian production of the first three days of the week is compared with that of the same period of the previous week, there was an increase of 9.0%.

In the year‑on‑year analysis, between November 1 and 18, the production with this technology increased by 17% in the German market and by 21% in the French market. In the rest of the analysed markets, the production decreased compared to the same days of November 2019. In the Italian market, the production fell by 72%, while in the Iberian Peninsula, the production with this technology fell by 43%.

For the week that began on Monday, November 16, the AleaSoft‘s wind energy forecasting indicates that the total production will be higher than that registered during the second week of November in most of the analysed markets, except in the French market where little variation is expected.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

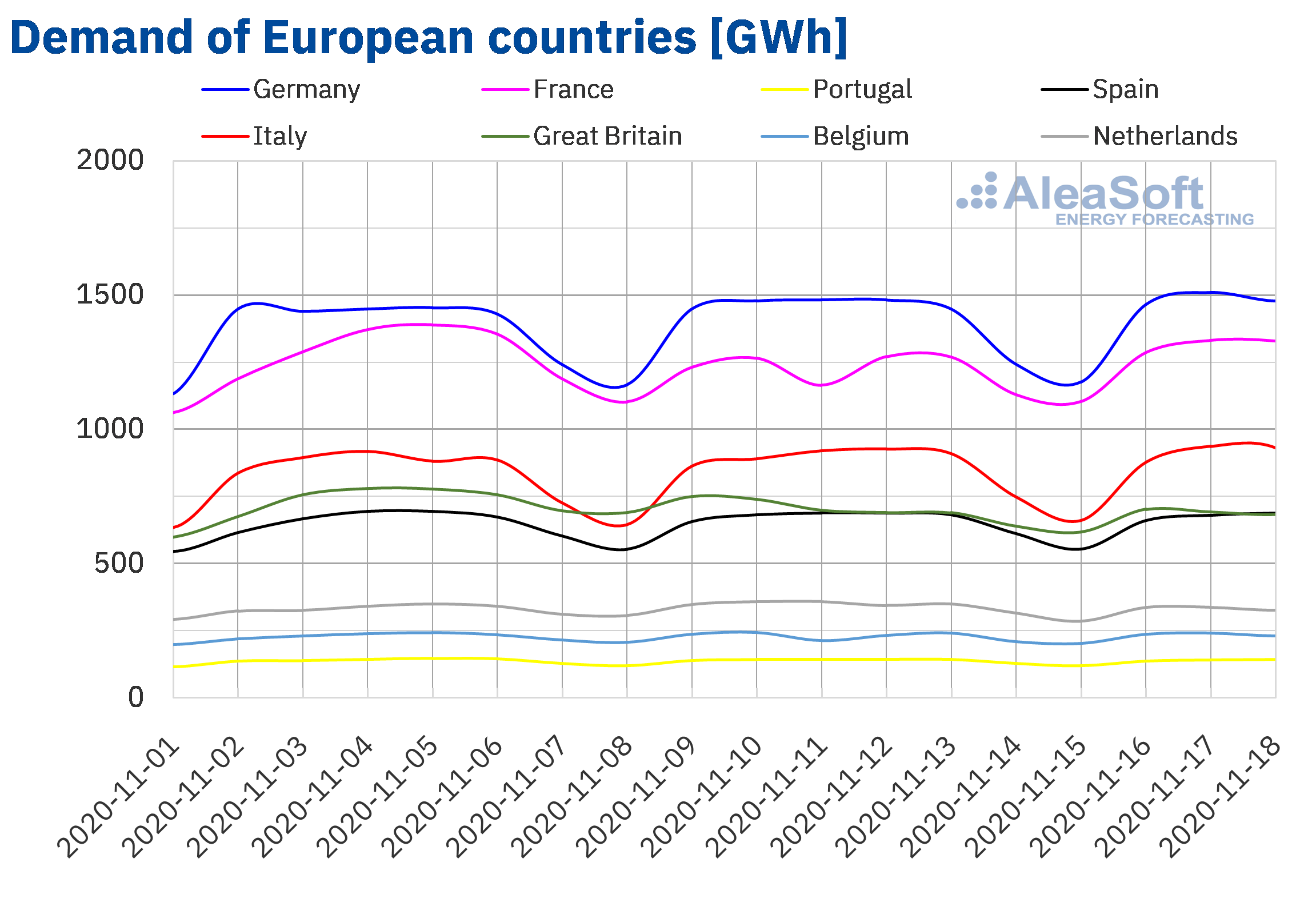

From November 16 to 18, the electricity demand recovered compared to the first three days of the previous week in most European markets. Increases of 7.8% and 1.9% were registered in the markets of France and Belgium, due to the effect that the holiday of Wednesday, November 11, Armistice Day, had on the demand of the previous week. Once this effect was corrected, the variations in demand were 4.0% and ‑2.2% respectively. In Italy there was a rise of 2.8% and in Germany of 1.0%. Regarding the decreases, in Great Britain the demand fell by 5.0%, while in Portugal the decrease was 1.0%.

At the AleaSoft’s electricity demand observatories, the behaviour of the demand during the week of November 16 compared to the previous weeks can be analysed in more detail.

The AleaSoft’s forecasting indicates that at the end of the week of November 16, the demand of the European markets will continue the same behaviour registered during the first three days of the week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

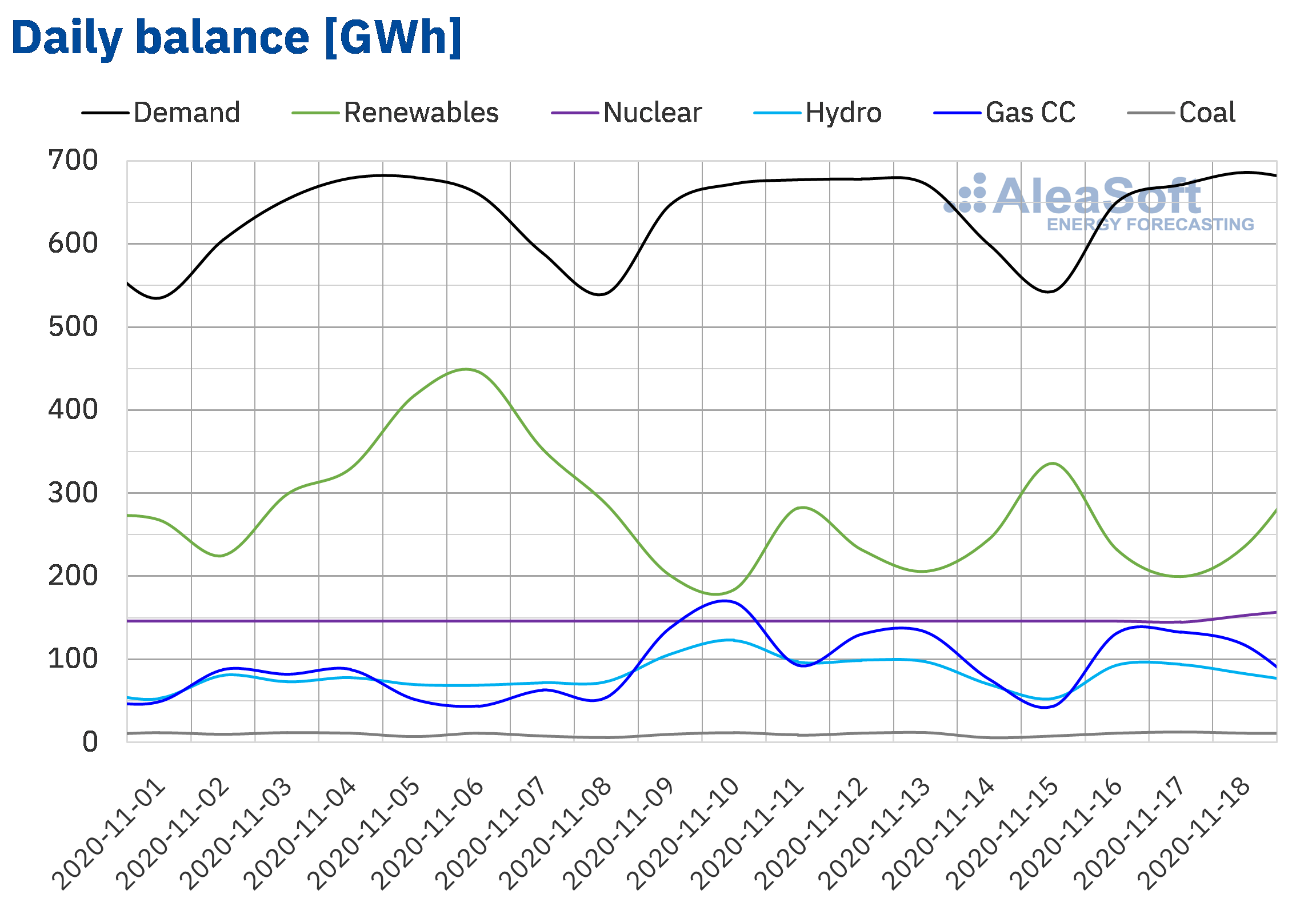

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

The electricity demand of Mainland Spain registered a slight increase of 0.1% from Monday to Wednesday of the third week of November compared to the same days of the previous week. For the end of the week of November 16, at AleaSoft it is expected that the demand will be slightly higher than that of the previous week.

The average solar energy production of Mainland Spain, which includes the photovoltaic and solar thermal technologies, increased by 23% between Monday and Wednesday of the third week of November compared to the average of the week of November 9. In the year‑on‑year comparison, the production with these technologies during the first 18 days of November registered an increase of 35%. At AleaSoft, it is expected that at the end of the week of November 16 the total solar energy production will be higher than that registered the previous week.

The average level of the wind energy production in Mainland Spain of the first three days of the week that began on Monday, November 16, decreased by 23% compared to the average of the previous week, although if compared with the same period of the previous week, it was 4.6% higher. In the year‑on‑year analysis, the production registered between November 1 and 18 was 43% lower. According to the analysis carried out at AleaSoft, for the week of November 16 to 22, the production with this technology is expected to increase compared to that registered in the second week of November.

The nuclear energy production increased to a daily average of close to 148 GWh as the unit II of the Ascó nuclear power plant was reconnected at 6:04 p.m. on Tuesday, November 17.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 10 717 GWh stored, according to data from the Hydrological Bulletin of the Ministry for Ecological Transition and Demographic Challenge number 46, which represents an increase of 19 GWh compared to the bulletin number 45.

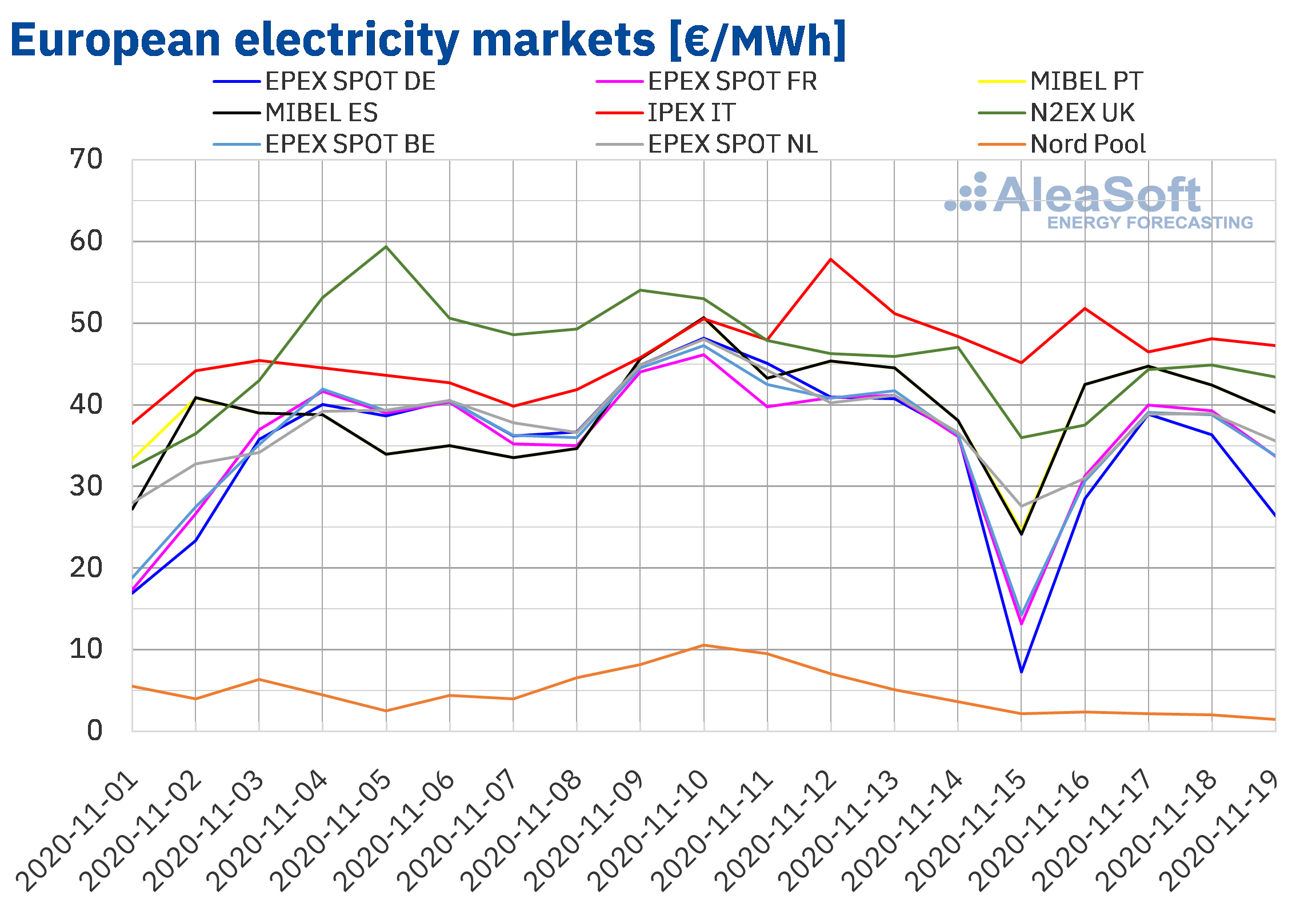

European electricity markets

The first four days of the week of November 16, the prices fell in all the European electricity markets analysed at AleaSoft compared to the same period of the previous week. The largest drop in prices, of 77%, was that of the Nord Pool market of the Nordic countries, followed by the 27% drop of the EPEX SPOT market of Germany. On the other hand, the IPEX market of Italy had the lowest price decrease, of 4.2%. In the rest of the markets, the price variations were between ‑8.7% of the MIBEL market of Spain and ‑19% of the EPEX SPOT markets of Belgium and the Netherlands.

During the first four days of the third week of November, the market with the lowest average price, of €2.00/MWh, was the Nord Pool market of the Nordic countries. On the other hand, the highest average price in this period, of €48.42/MWh, was that of the IPEX market of Italy, followed by that of the N2EX market of Great Britain, of €42.53/MWh. The average prices in the rest of the markets were between €32.53/MWh of the German market and €42.19/MWh of the Spanish market.

Between Monday and Thursday of the third week of November, the European electricity markets prices were in general loosely coupled. The markets with the highest coupling were those of France, Belgium and the Netherlands. On the other hand, the highest daily prices were reached in the Italian market, while the Nord Pool market registered the lowest daily prices. The differences between the prices of both markets exceeded €40/MWh.

Between November 16 and 19, the daily prices only exceeded €50/MWh on one occasion. This happened on Monday, November 16, when a price of €51.82/MWh was reached in the Italian market. On the other hand, the daily prices of the Nord Pool market remained below €2.50/MWh during the first four days of the third week of November. The lowest daily price, of €1.44/MWh, was reached on Thursday, November 19, in this market.

Regarding the hourly prices, in the early hours of Monday, November 16, there were negative hourly prices in Germany, Belgium, France, Great Britain and the Netherlands. The lowest hourly price, of ‑€5.29/MWh, was reached at hour 4 of Monday in the German market. On the other hand, the highest hourly price of the first four days of the third week of November, of €106.19/MWh, was reached at the hour 19 of Thursday, November 19, in the British market.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The general increase in wind energy production in Europe and the increase in solar energy production in countries such as Germany and France compared to the first three days of the previous week, favoured the price decreases during the first days of the week of November 16.

The AleaSoft‘s price forecasting indicates that once the third week of November is over, the prices will continue to be lower than those registered during the week of November 9. On the other hand, for the week of November 23, the prices are expected to recover in most markets as a result of decreases in wind energy production.

Iberian market

In the MIBEL market of Spain and Portugal, the average price of the first four days of the week of November 16 decreased compared to that of the same period of the previous week. The decrease was 8.7% in Spain and 8.8% in Portugal. These were among the smallest price declines in the European electricity markets, after the fall of the Italian market.

The average price from November 16 to 19 was €42.19/MWh in the Spanish market and €42.17/MWh in the Portuguese market. These were the third and fourth highest prices in the European markets, after the averages of the Italian market and the British market.

The daily prices of the MIBEL market were the same in both Spain and Portugal during most of the period between Monday and Thursday, except for Wednesday, when the Spanish market price was €0.07/MWh higher than that of the Portuguese market. On the other hand, the maximum daily price, of €44.75/MWh, was reached on Tuesday, November 17. Meanwhile the minimum daily price, of €39.08/MWh, was reached on Thursday, November 19.

During the first days of the week of November 16, the increase in wind energy production in the Iberian Peninsula compared to the same days of the second week of November favoured the decrease in prices in the MIBEL market.

The AleaSoft‘s price forecasting indicates that this behaviour will continue the rest of the week.

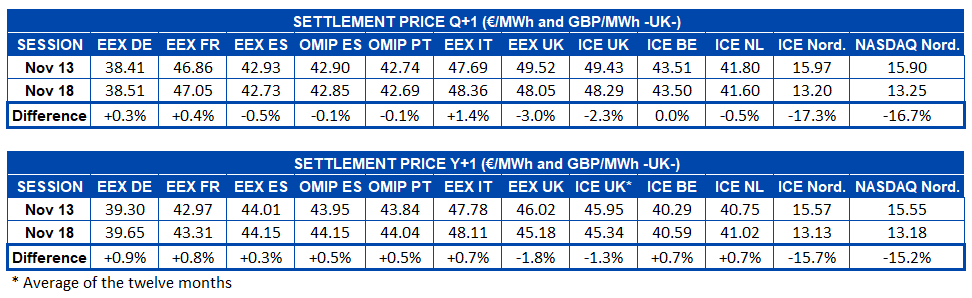

Electricity futures

The electricity futures prices for the first quarter of 2021 behaved mostly downward in the session on Wednesday, November 18, compared to the last session of the previous week, of November 13. The prices of the ICE market and the NASDAQ market of the Nordic countries were those with the greatest reduction, of 17%. In the rest of the markets where the prices fell, the variations were between ‑0.1% of the OMIP market of Spain and Portugal and ‑3.0% of the EEX market of Great Britain. The ICE market of Belgium was the one with the smallest decrease, with a difference of €0.01/MWh. On the other hand, the EEX markets of Germany, France and Italy registered increases of between 0.3% and 1.4%.

Regarding the electricity futures prices for the calendar year 2021, increases were registered in the session of November 18 for most of the analysed markets compared to those of the session of Friday, November 13. In this case, the registered increases were less than 1.0%. On the other hand, in the decreases the reduction of between 15% and 16% in the prices of the NASDAQ and ICE markets of the Nordic countries also stands out. The other markets where the prices fell were EEX and ICE of Great Britain, with decreases of 1.8% and 1.3% respectively.

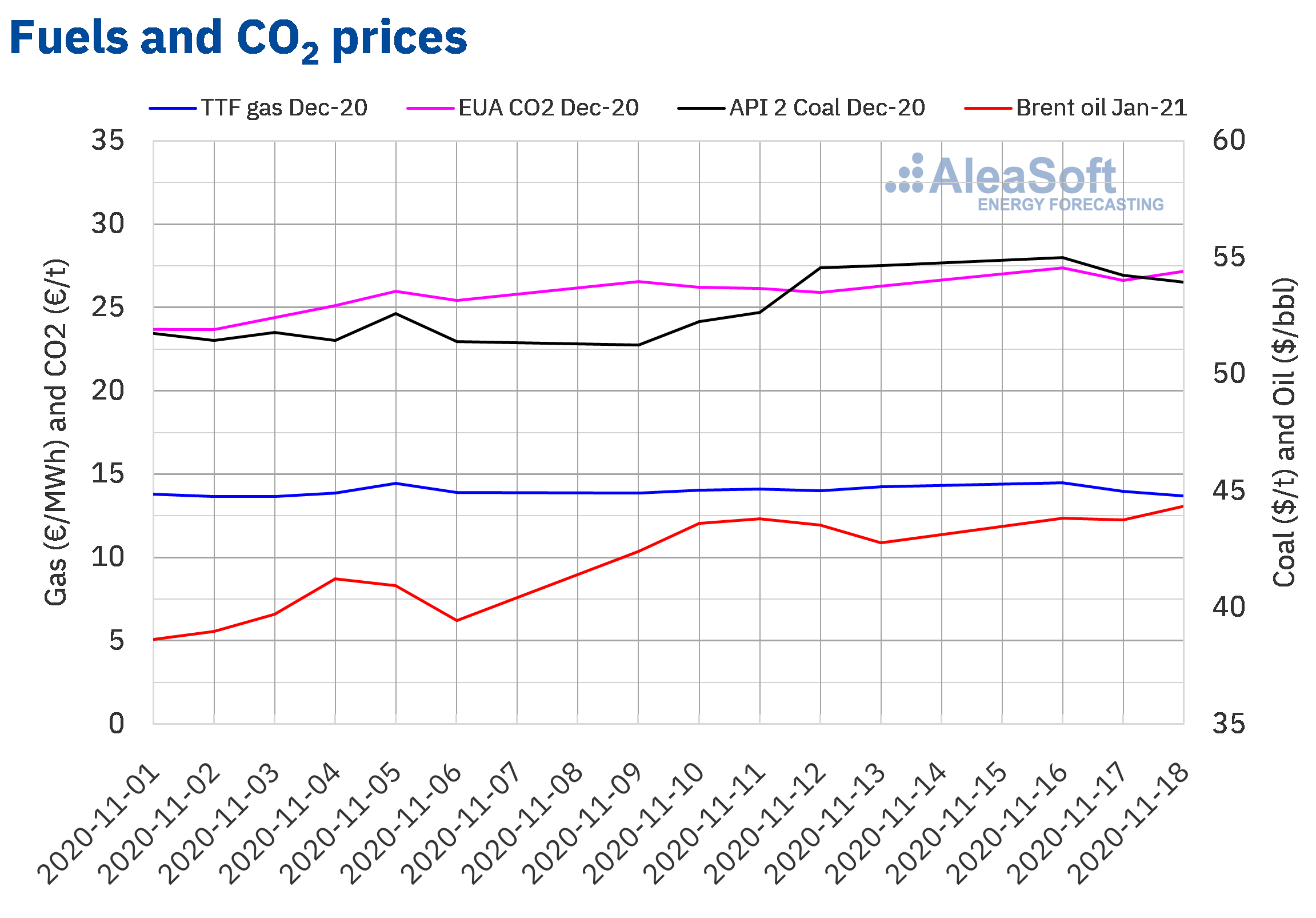

Brent, fuels and CO2

The settlement prices of the Brent oil futures for the month of January 2021 in the ICE market, the first three days of the week of November 16, remained above $43.50/bbl, with higher values than those of the same days of the previous week. The maximum settlement price, of $44.34/bbl, was reached on Wednesday, November 18. This price was 1.2% higher than that of the previous Wednesday and the highest since the beginning of September.

The recent news about the COVID‑19 vaccine development progress favoured higher prices than those of the previous week. However, there are still concerns about the levels of infections and the effects on the economy of the measures taken to contain the disease. In addition, the increase in crude oil reserves of the United States may also contribute to slowing the recovery of the Brent oil futures prices in the coming days.

On the other hand, the TTF gas futures in the ICE market for the month of December 2020, on Monday, November 16, reached a settlement price of €14.49/MWh. This price was 4.6% higher than that of the previous Monday and the highest since the end of October. However, on Tuesday and Wednesday the prices fell. On Wednesday, November 18, the settlement price was €13.68/MWh, 2.9% lower than that of the same day of the previous week.

Regarding the TTF gas in the spot market, on Tuesday, November 17, the maximum price of the first four days of the third week of November was reached, of €14.32/MWh. But, subsequently, the prices began to fall until reaching an index price of €13.51/MWh on Thursday, November 19.

As for the API 2 coal futures in the ICE market for the month of December 2020, on Monday, November 16, they registered a settlement price of $55.00/t, which was 7.3% higher than that of the previous Monday and the highest since late October. But on Tuesday the prices began to decline. On Wednesday, November 18, a settlement price of $53.95/t was reached. This price was 1.9% lower than that of Monday, but still 2.5% higher than that of the previous Wednesday.

Regarding the settlement prices of the CO2 emission rights futures in the EEX market for the reference contract of December 2020, the first days of the third week of November, they remained above €26.50/t. The highest settlement price, of €27.39/t, was that of Monday, November 16. This price was 3.2% higher than that of the previous Monday and the highest since the end of September.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the evolution of the energy markets and prospects from 2021

On November 26, the AleaSoft webinar “Prospects for the energy markets in Europe from 2021 (I)” will be held. On this occasion, three speakers from Vector Renewables will participate, Javier Asensio Marín, CEO, Hugo Alvarez López, Global Head of Technical Advisory, and Carlos Almodóvar Almaraz, Principal M&A and Financial Advisory, in addition to Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling at AleaSoft. The topics to be addressed will be the prospects for the evolution of the European energy markets from 2021, the renewable energy auctions and their effect on the market and the technical Due Diligence and their importance in the projects financing.

At AleaSoft, tailor‑made reports on energy markets issues are carried out, including the analysis of the prospects of recovery from the crisis caused by the COVID‑19 pandemic. Other examples of issues addressed in these reports of interest to the sector are the impact of the 7% tax on the market prices, the PPAs, the renewable energy auctions, the storage, the hydrogen and the self‑consumption. Expert reports are also made for breaches of contracts, which are necessary in lawsuits and arbitrations.

At the AleaSoft‘s observatories, the evolution of the energy markets can be analysed with daily updated data. These observatories include information of the main European electricity, fuels and CO2 emission rights markets that are displayed through graphs with hourly, daily and weekly data.

Source: AleaSoft Energy Forecasting.