AleaSoft Energy Forecasting, October 27, 2025. During the fourth week of October, the increase in wind energy production led to lower prices in most major European electricity markets, with averages below €60/MWh. Germany and France registered their highest wind energy production for a day in October. In contrast, photovoltaic energy production decreased, while electricity demand rose in most markets. CO₂ futures reached their highest settlement price since mid‑February, while Brent futures registered their lowest settlement price since early May.

Solar photovoltaic and wind energy production

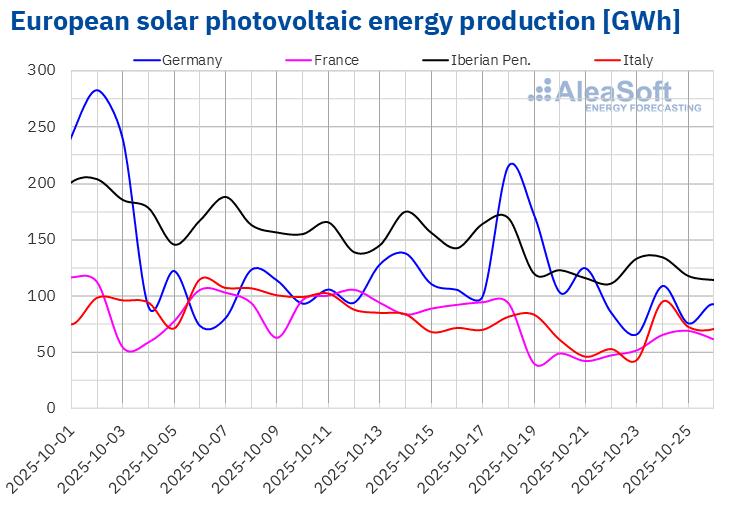

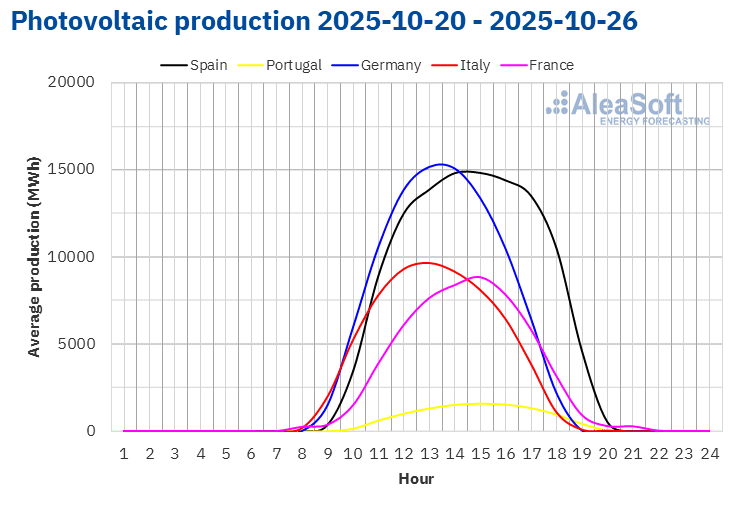

In the week of October 20, solar photovoltaic energy production decreased in the main European markets compared to the previous week. The Portuguese market registered the largest drop, 43%, continuing its downward trend for the third consecutive week. The French and German markets followed, with decreases of 34% and 32%, respectively. The Italian and Spanish markets registered the smallest declines, 19% and 18%, respectively. The downward trend in the Spanish market continued for the fifth consecutive week.

During the week of October 27, according to AleaSoft Energy Forecasting’s solar energy forecasts, the downward trend will reverse and photovoltaic energy production will increase compared to the previous week in the Italian, German and Spanish markets.

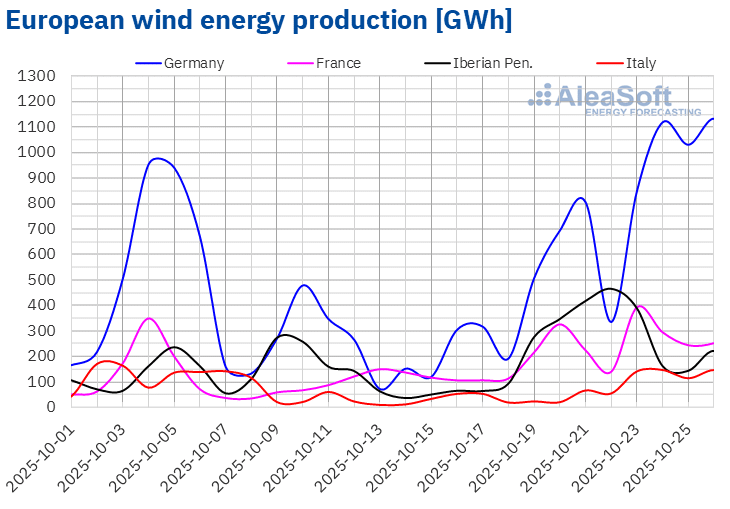

During the fourth week of October, wind energy production increased significantly in the main European markets compared to the previous week. The German market registered the largest rise, 259%, followed by the Italian, Spanish and Portuguese markets, with week‑on‑week increases of 244%, 236% and 206%, respectively. In all cases, the downward trend of the previous week reversed. The French market registered its second consecutive week of growth, with an increase of 98%.

The German and French markets set a record for daily wind energy production for an October month. In the German market, this occurred on October 24, with a generation of 1119 GWh, and in France, the day before, on October 23, with a generation of 393 GWh.

In the week of October 27, according to AleaSoft Energy Forecasting’s wind energy forecasts, the upward trend will reverse and wind energy production will decrease in the Italian, German, French, Spanish and Portuguese markets.

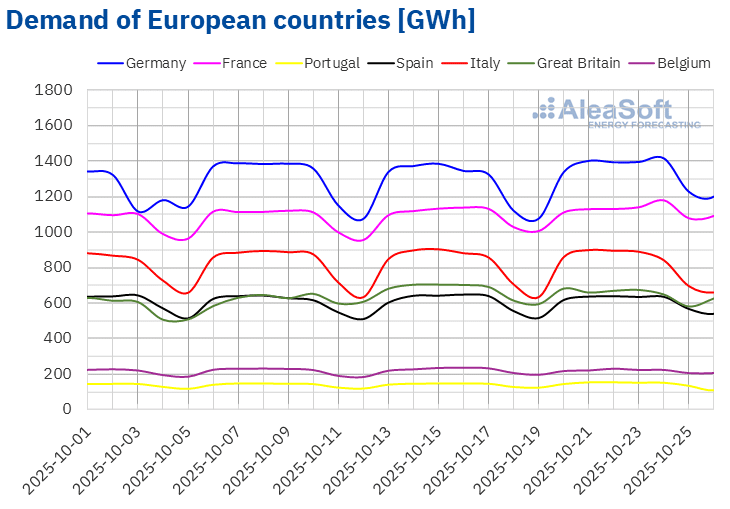

Electricity demand

In the week of October 20, electricity demand increased in most major European markets compared to the previous week. The German and Italian markets reversed the downward trend of the previous week, registering the largest and smallest increases in demand, respectively. In Germany, demand rose by 4.6%, while in Italy it increased by 0.2%. Meanwhile, the French, Portuguese and Spanish markets continued the upward trend of recent weeks, with increases of 2.7%, 2.1% and 0.6%, respectively. The exceptions were the British and Belgian markets, where demand fell by 3.2% and 1.6%, respectively, after two consecutive weeks of increases.

During the week, average temperatures rose by 0.3 °C in Spain and 0.4 °C in Germany, while remaining similar to the previous week in Italy. In the rest of the analyzed markets, average temperatures fell, with decreases ranging from 0.2 °C in Belgium to 1.4 °C in Great Britain.

According to AleaSoft Energy Forecasting’s demand forecasts, during the week of October 27, demand will increase in Great Britain, France and Belgium, while it will decrease in the rest of the main European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

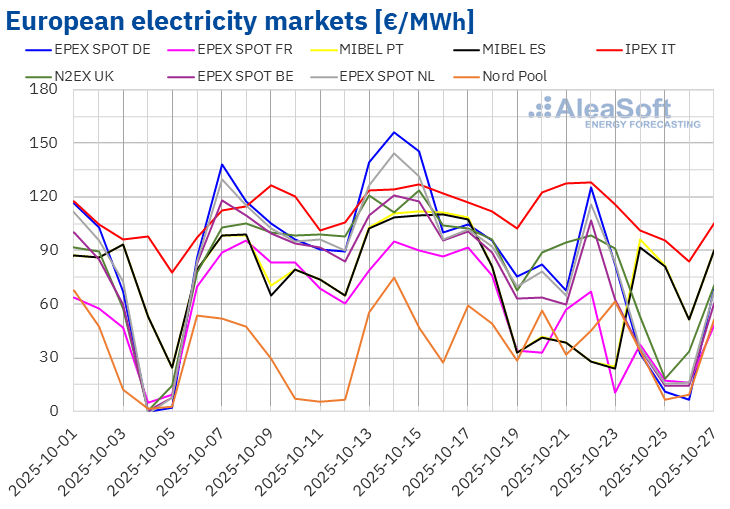

In the fourth week of October, average prices in the main European electricity markets fell compared to the previous week. The IPEX market of Italy registered the smallest decrease, 6.5%, while the EPEX SPOT market of France registered the largest percentage price drop, 57%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices fell between 28% in the Nord Pool market of the Nordic countries and 50% in the EPEX SPOT market of Germany.

In the week of October 20, weekly averages were below €60/MWh in most European electricity markets. The exceptions were the N2EX market of the United Kingdom and the Italian market, with averages of €68.05/MWh and €110.57/MWh, respectively. In contrast, the French and Nordic markets registered the lowest weekly averages, €33.97/MWh and €34.83/MWh, respectively. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices ranged from €50.64/MWh in the MIBEL market of Spain to €58.50/MWh in the Dutch market.

Regarding daily prices, the German market registered the lowest average of the week among the analyzed markets, €6.52/MWh, on Sunday, October 26. The Nordic market also registered daily prices below €10/MWh during the weekend. In the Spanish market, on Thursday, October 23, the price was €23.59/MWh. This was its lowest price since June 16.

On the other hand, despite the drop in the weekly average, daily prices remained above €100/MWh from Monday to Friday in the Italian market. The German, Belgian and Dutch markets also registered prices above €100/MWh on October 22. That same day, the Italian market reached the highest daily average of the week, €128.01/MWh. This was its highest price since July 2.

In the week of October 20, the significant increase in wind energy production led to a decline in prices in the European electricity markets. In addition, electricity demand fell in the Belgian, British and Dutch markets.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the last week of October, prices will rise in most major European electricity markets, influenced by the drop in wind energy production. In some markets, the increase in demand will also contribute to this behavior.

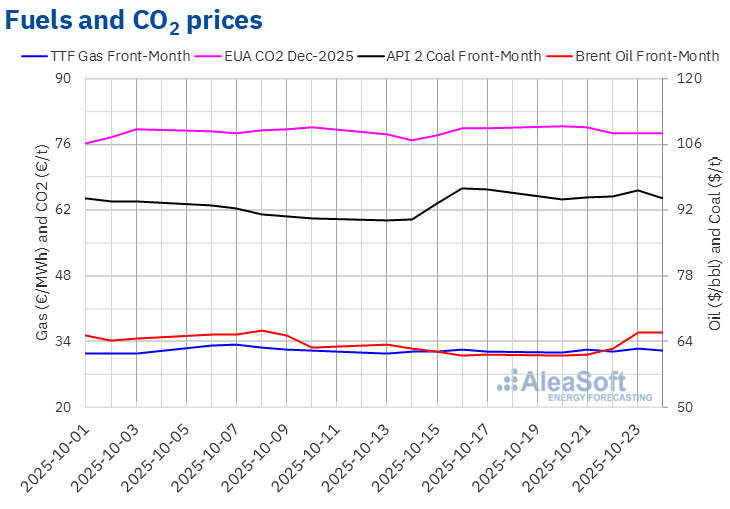

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered their weekly minimum settlement price, $61.01/bbl, on Monday, October 20. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since May 6. Subsequently, these futures registered an upward trend. As a result, on Thursday, October 23, these futures reached their weekly maximum settlement price, $65.99/bbl. On Friday, October 24, the settlement price was slightly lower, $65.94/bbl, but it was still 7.6% higher than the previous Friday.

In the fourth week of October, the announcement of US sanctions on Russian oil companies, as well as the approval of a new package of sanctions on Russia by the European Union, contributed to the increase in Brent oil futures prices. The announcement by the US Energy Department of its intention to increase the country’s strategic oil reserve also favored the price increase.

As for TTF gas futures in the ICE market for the Front‑Month, on Monday, October 20, they registered their weekly minimum settlement price, €31.74/MWh. In contrast, on Thursday, October 23, these futures reached their weekly maximum settlement price, €32.45/MWh. On Friday, October 24, after a 1.3% drop from the previous day, the settlement price was €32.02/MWh. However, according to data analyzed at AleaSoft Energy Forecasting, this price was still 0.6% higher than the previous Friday.

The European Union’s approval of a package of sanctions against Russia, which includes a ban on imports of Russian liquefied natural gas from 2027, exerted upward pressure on TTF gas futures prices. However, high European storage levels and abundant supply allowed prices to remain below €33/MWh during the fourth week of October.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2025, on Monday, October 20, they reached their weekly maximum settlement price, €79.83/t. According to data analyzed at AleaSoft Energy Forecasting, this was their highest price since February 13. Prices fell during the rest of the week’s sessions. As a result, on Friday, October 24, these futures registered their weekly minimum settlement price, €78.34/t. This price was 1.4% lower than the previous Friday.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and energy storage

On Thursday, November 13, AleaSoft Energy Forecasting will hold the 60th edition of its monthly webinar series. In addition to the evolution and prospects of European energy markets for the winter 2025‑2026, the webinar will analyze the prospects for batteries, hybridization and energy storage, as well as AleaSoft services for battery and hybridization projects. On this occasion, in the webinar in Spanish, the guest speaker will be Luis Marquina de Soto, president of AEPIBAL, the Business Association of Batteries and Energy Storage.

Source: AleaSoft Energy Forecasting.