AleaSoft Energy Forecasting, October 25, 2021. In the third week of October, prices of most spot and futures European electricity markets fell. The decrease in gas and CO2 led to declines in electricity markets, in which wind energy production also increased in a generalised way. However, in the Italian and Iberian markets prices increased. Despite the declines, levels remain high and in almost all markets €200/MWh were exceeded some day. Brent futures continued to rise.

Photovoltaic and solar thermal energy production and wind energy production

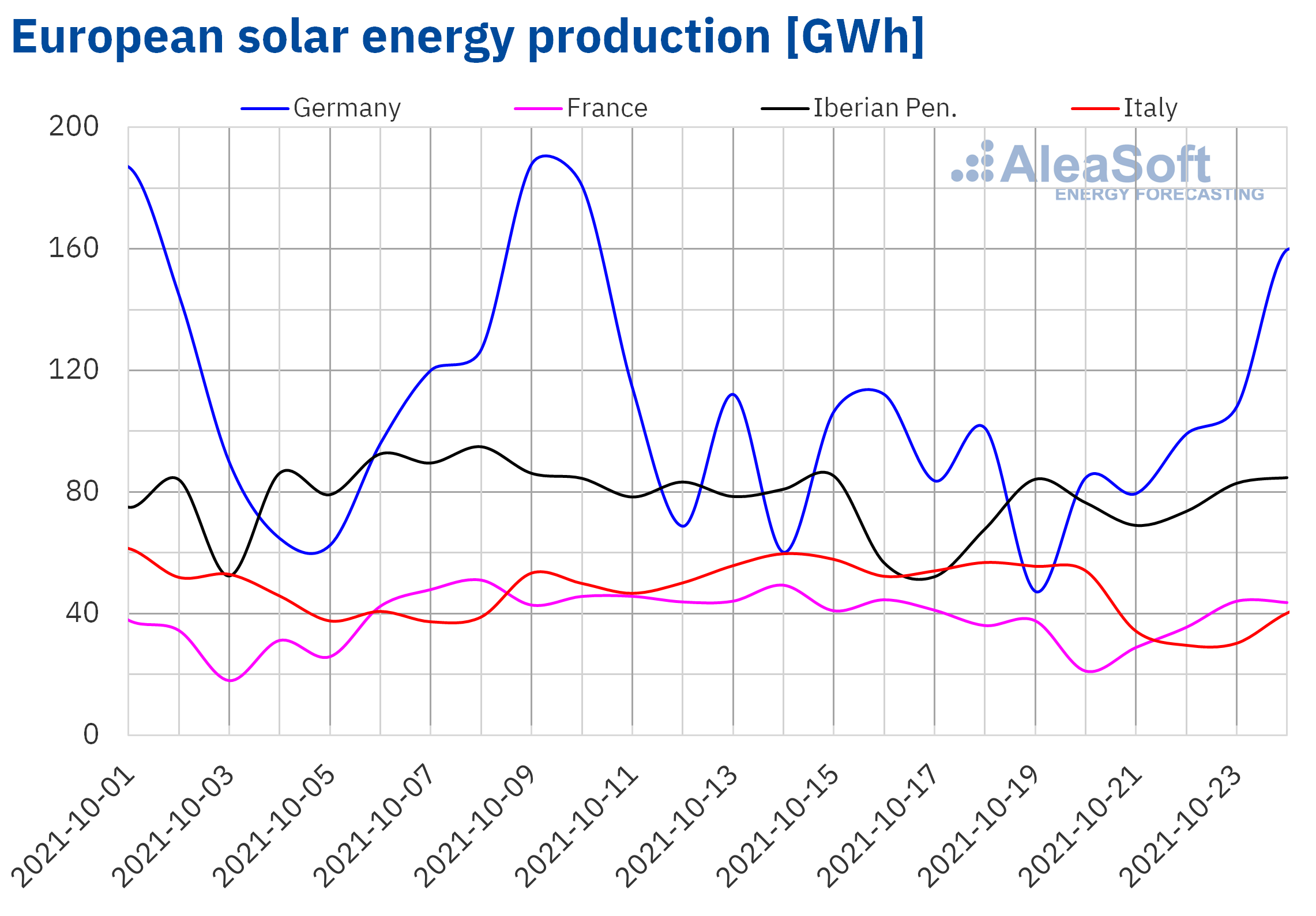

During the third week of October, the solar energy production increased by 3.4% and 4.6%, respectively, in the German and Iberian markets, compared to the production of the previous week. On the contrary, declines of around 20% were registered in the markets of Italy and France.

For the last week of October, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that generation with this technology will decrease in the markets of Italy and Spain, while in the German market it will be higher than that of the week of October 18.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

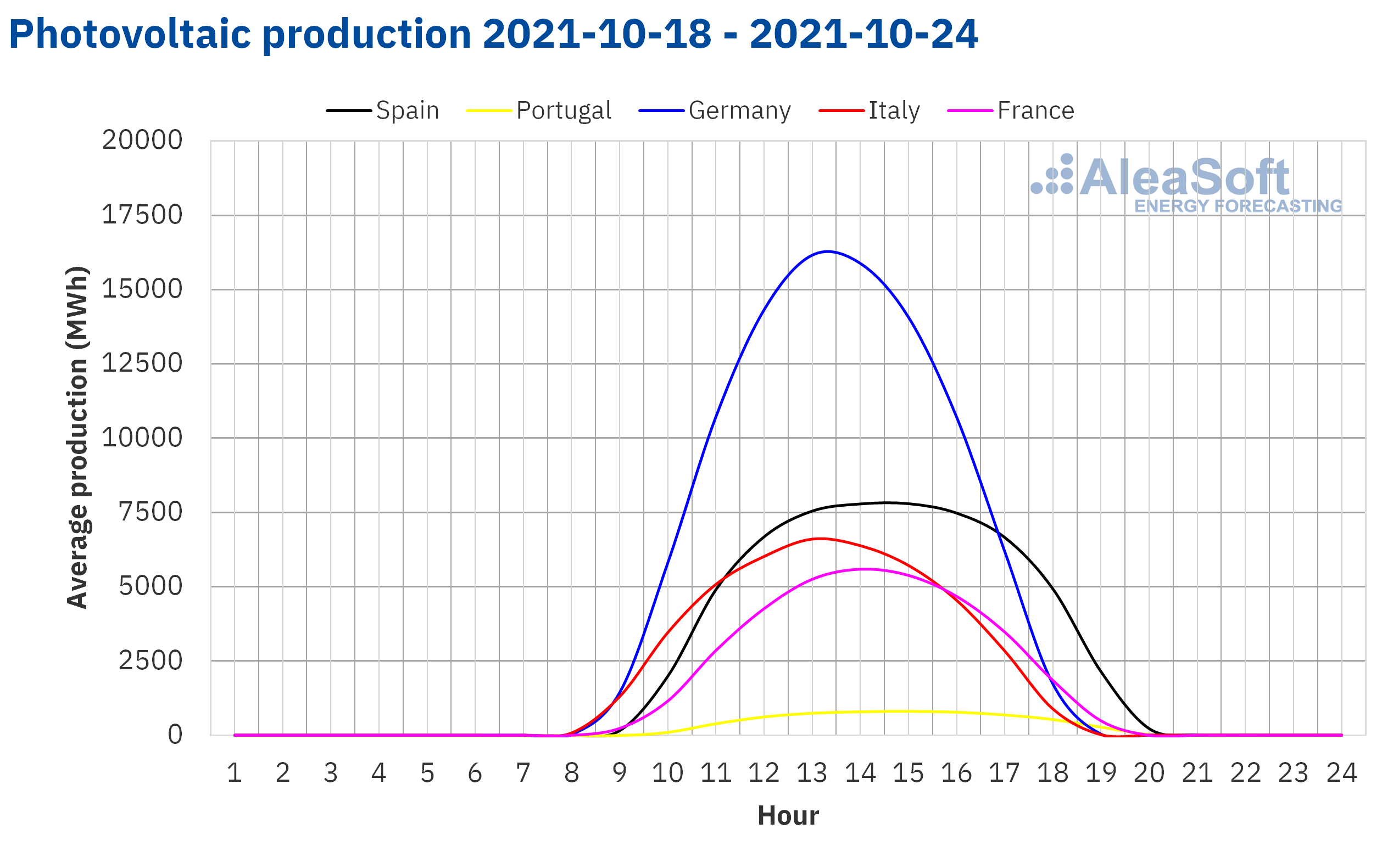

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

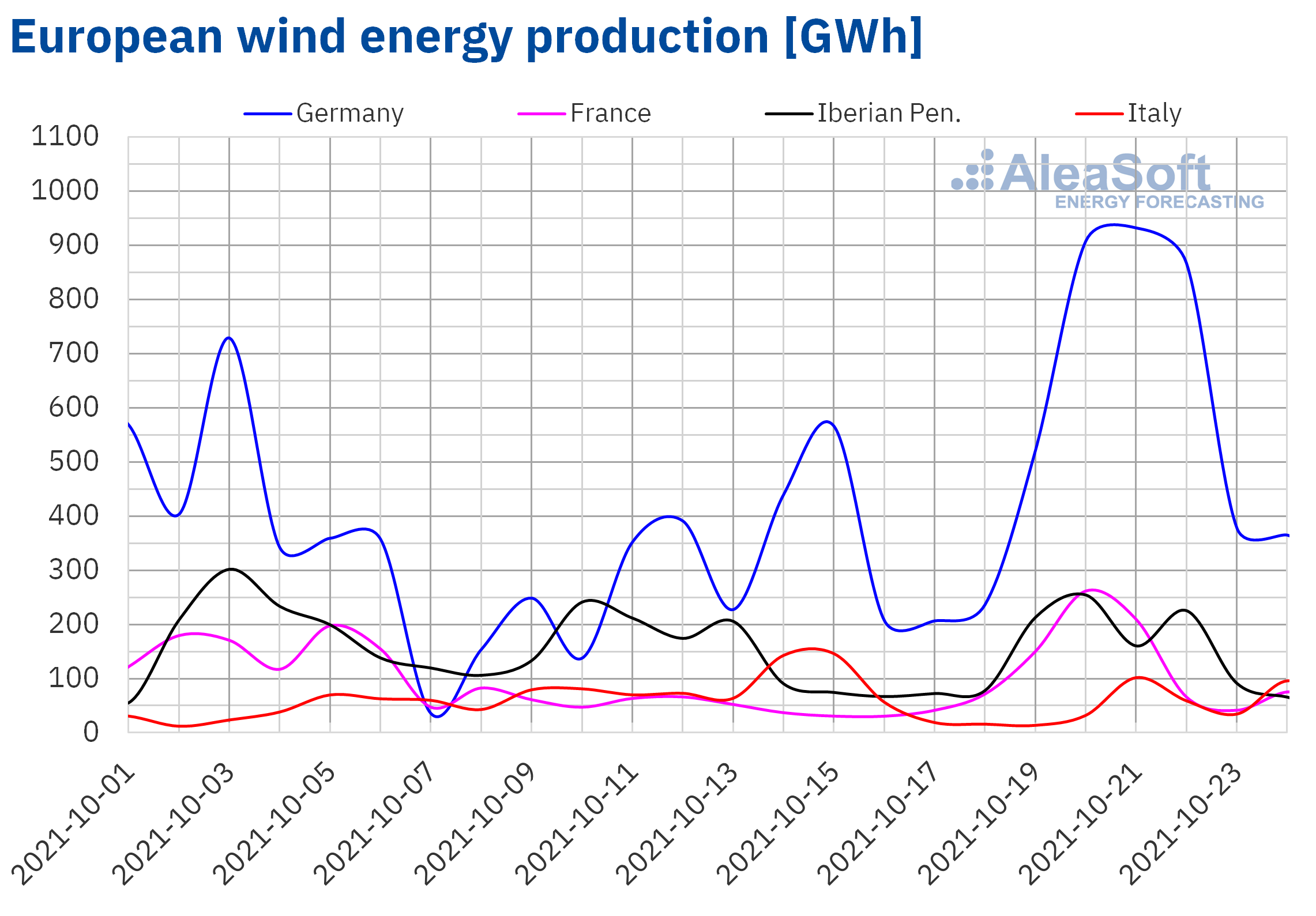

The wind energy production increased in most of the analysed markets during the week of October 18, compared to that registered during the week that began on the 11th of the same month. In the French market, the growth was 174%, followed by a 76% increase in the German market and a 22% increase in the Iberian market. However, in the Italian market, the production during this period decreased by 38%.

For the week of October 25, AleaSoft Energy Forecasting’s forecasts indicate a general decline in wind energy generation in the analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

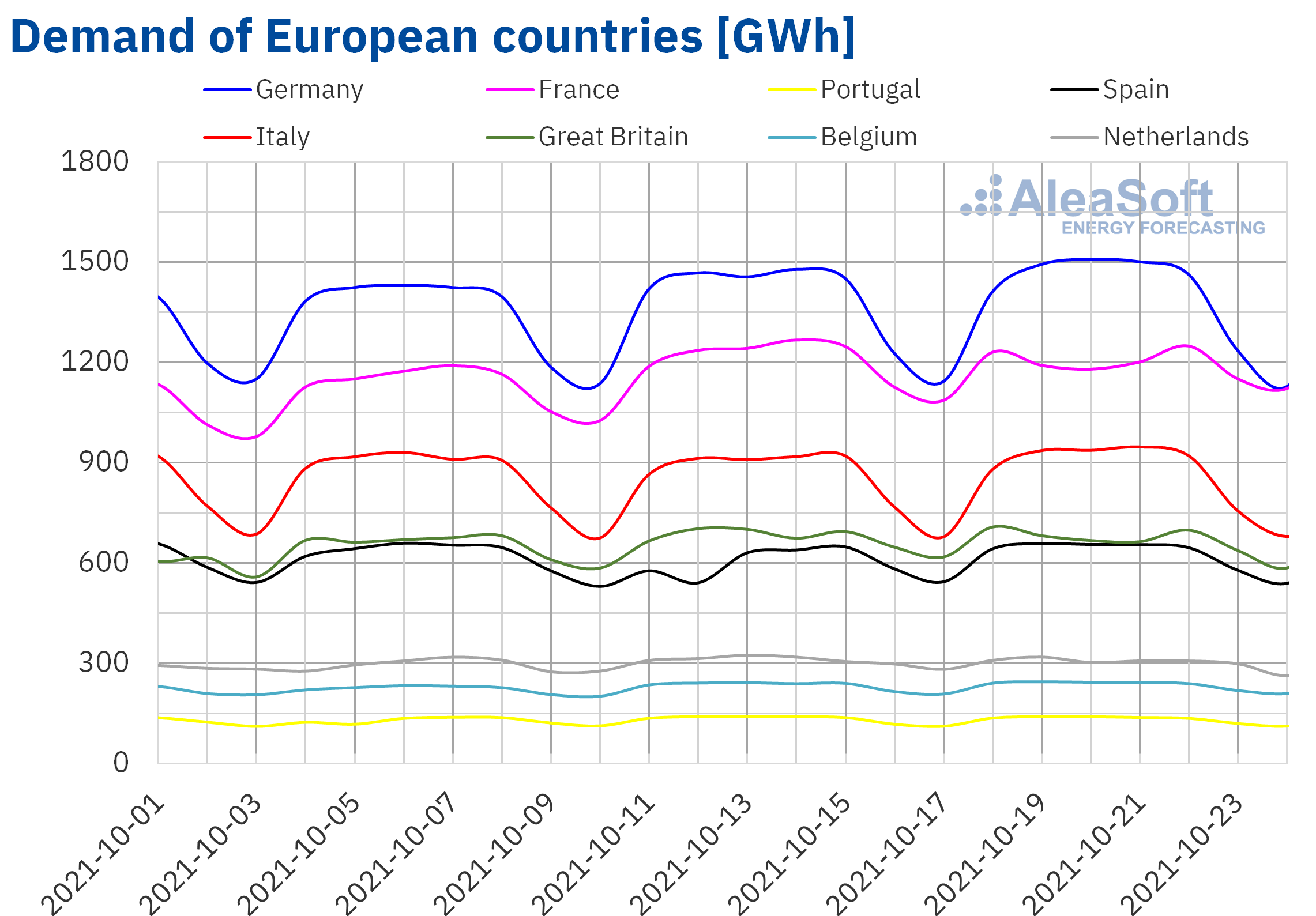

The electricity demand increased in most electricity markets of Europe during the week of October 18 compared to the previous week. In the markets of Germany and Belgium, the demand increased for the second week in a row, and this time the increases were 1.0% in both cases. The Spanish market registered a 5.1% recovery due to the influence of the Spanish National Holiday on October 12 the previous week. When correcting the effect of this holiday on demand, the increase in Spain was 1.2%.

For the week of October 25, AleaSoft Energy Forecasting’s demand forecasts indicate that there will be increases in most European markets because a decrease in average temperatures of the week is expected.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

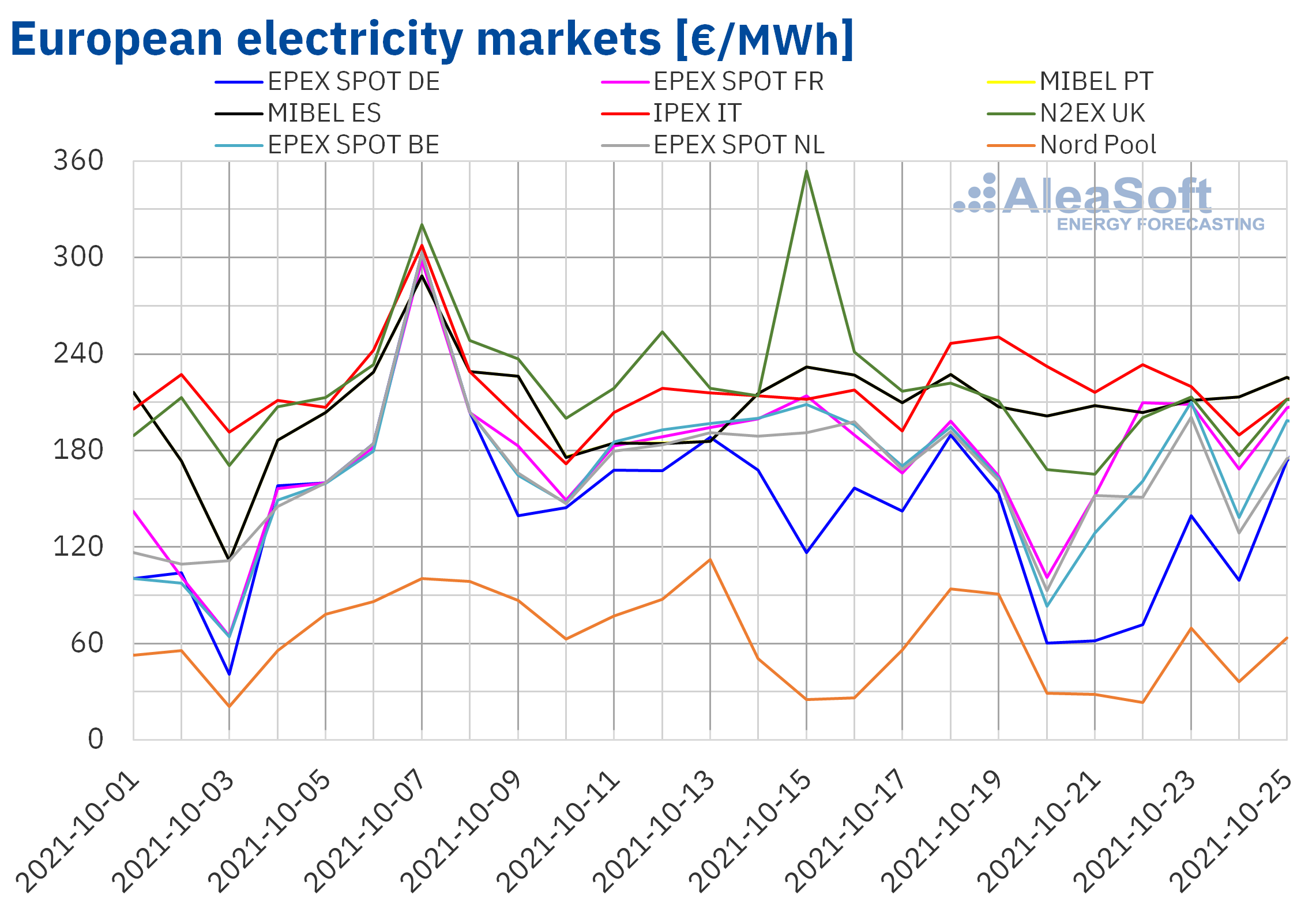

European electricity markets

In the week of October 18, the prices of most of the European electricity markets analysed at AleaSoft Energy Forecasting fell. The exceptions were the IPEX market of Italy, with a rise of 7.8%, and the MIBEL market of Spain and Portugal, with an increase of 2.3%. On the other hand, the largest drop in prices was that of the EPEX SPOT market of Germany, of 30%, while the smallest was that of the EPEX SPOT market of France, of 9.9%. In the rest of the markets, the price declines were between 15% of the Nord Pool market of the Nordic countries and 21% of the N2EX market of the United Kingdom.

In the third week of October, the highest weekly average price was that of the IPEX market, of €226.89/MWh, followed by that of the MIBEL market, of €210.28/MWh. On the other hand, the lowest average was that of the Nord Pool market, of €52.98/MWh. In the rest of the markets, prices were between €110.78/MWh of the EPEX SPOT market of Germany and €193.80/MWh of the N2EX market.

Regarding daily prices, in almost all analysed electricity markets they exceeded €200/MWh on some day of the week of October 18. In the case of the MIBEL market, this happened every day of the third week of October. Although the highest daily price of the week, of €250.54/MWh, was reached on Tuesday, October 19, in the Italian market. In fact, the Italian market had the highest daily prices of all the European electricity markets almost every day of the week, except for Sunday, when the MIBEL market occupied this position, and repeated it on October 25. On the other hand, the lowest daily price of the week, of €23.32/MWh, was registered on Friday, October 22, in the Nord Pool market. This was the only market whose prices remained below €100/MWh throughout the third week of October.

During the week of October 18, the general increase in wind energy production allowed prices to fall in most of the analysed electricity markets. Furthermore, although gas and CO2 prices remain high, in the third week of October they were on average lower than those of the previous week. However, in Italy, the wind and solar energy production fell, which favoured that this market reached the highest average price of the third week of October. On the other hand, despite the fact that in the Iberian Peninsula there was an increase in wind and solar energy production, the MIBEL market registered the second highest weekly price, influenced by the decrease in nuclear energy production in Spain due to the recharging works of the Ascó I nuclear power plant.

The AleaSoft Energy Forecasting’s price forecasts indicate that in the week of October 25, prices might increase in most markets, influenced by the increase in demand and the general decrease in wind energy production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

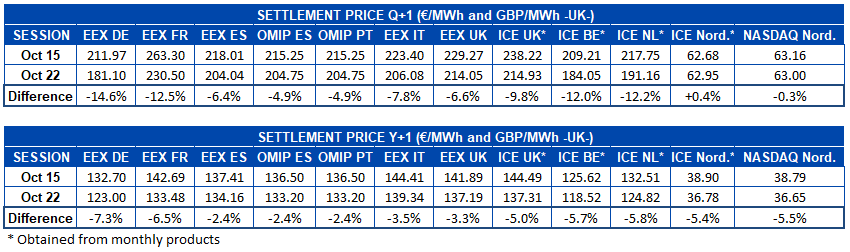

Electricity futures

In the third week of October, electricity futures prices for the first quarter of 2022 fell in most European futures markets. The exception was the ICE market of the Nordic countries, where prices increased by 0.4% between the sessions of October 15 and 22. The NASDAQ market of the Nordic region was, in turn, the one in which prices changed the least, with a decrease of €0.16/MWh, which represented 0.3%. In the rest of the markets, the decreases were between 4.9% registered in the OMIP market of Spain and Portugal and 15% of the EEX market of Germany.

During the same period, the price decrease for the product of the year 2022 was generalised in all markets. The EEX market of Germany was also in this case the market in which the largest declines were registered, with a decrease of 7.3%. Meanwhile, for the Iberian Peninsula, both in the EEX market of Spain and in the OMIP market of Spain and Portugal, the smallest change in this product was registered, with a decrease of 2.4%.

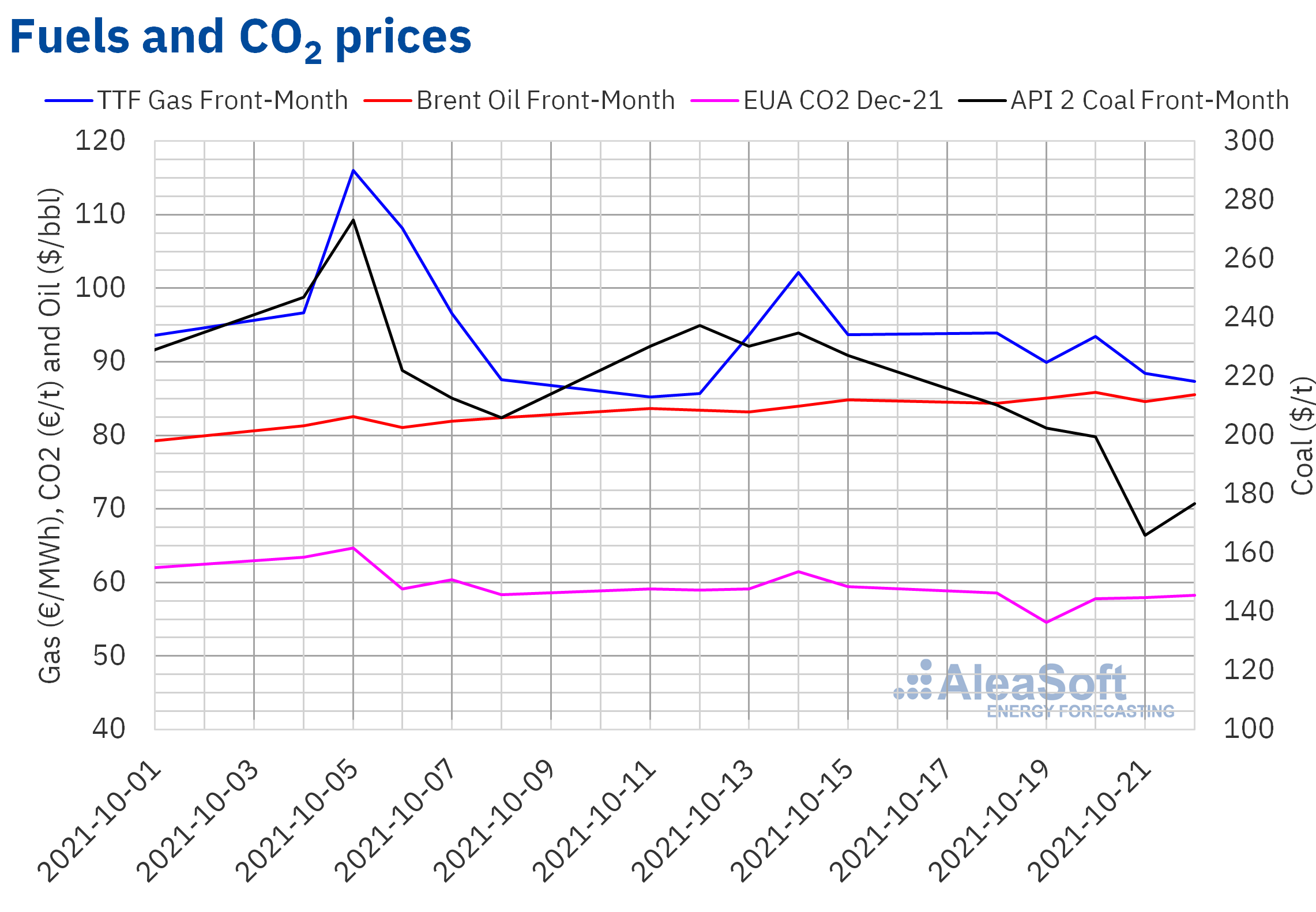

Brent, fuels and CO2

Brent oil futures prices for the Front‑Month in the ICE market, the third week of October continued their upward trend. The maximum settlement price of the week, of $85.82/bbl, was reached on Wednesday, October 20. This price was 3.2% higher than that of the previous Wednesday and the highest since October 2018. However, on Thursday there was a slight setback and, despite recovering the upward trend on Friday, the settlement price of the last session of the week was $85.53/bbl.

The recovery in demand continues to favour the increase in Brent oil futures prices. In addition, some OPEC+ member countries are having difficulties to meet their production targets due to the lack of investment. But, on the other hand, the expansion of the new Delta Plus variant of COVID‑19 and the restrictions that will be adopted to try to avoid contagions create concern about their effects on the evolution of the demand.

As for settlement prices of TTF gas futures in the ICE market for the Front‑Month, the third week of October they remained below €94/MWh. For most of the week, prices fell. As a result, on Friday, October 22, a settlement price of €87.34/MWh was reached, 6.7% lower than that of the previous Friday.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2021, the third week of October they remained below €59/t. The minimum settlement price of the week, of €54.55/t, was reached on Tuesday, October 19. This price was 7.4% lower than that of the previous Tuesday and the lowest since August.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

AleaSoft Energy Forecasting is organising the next monthly webinar, which will be held on November 11, in which the evolution and prospects for energy markets in the current context of global energy crisis will be analysed. The webinar will also feature invited speakers from Engie Spain to talk about the renewable energy projects financing in the current context of high prices in the markets and in the shadow of Royal Decree‑law 17/2021 and the regulatory insecurity.

With these monthly webinars and with market price forecasting services in all horizons, AleaSoft Energy Forecasting aspires to continue helping companies of the energy sector during the energy transition, and thus continue being witnesses and participants of this process over the next years.

Source: AleaSoft Energy Forecasting.