AleaSoft, May 18, 2020. The second week of May began and ended with negative hourly prices in some markets, on May 11 and 17, due to the combination of high wind and photovoltaic energy production. The electricity demand rose in all markets due to the drop in temperatures and the progressive relaxation of the measures to curb COVID‑19. The gas prices remain at historical lows. In the third week of May, the electricity markets prices are expected to continue below €30/MWh.

Photovoltaic and solar thermal energy production and wind energy production

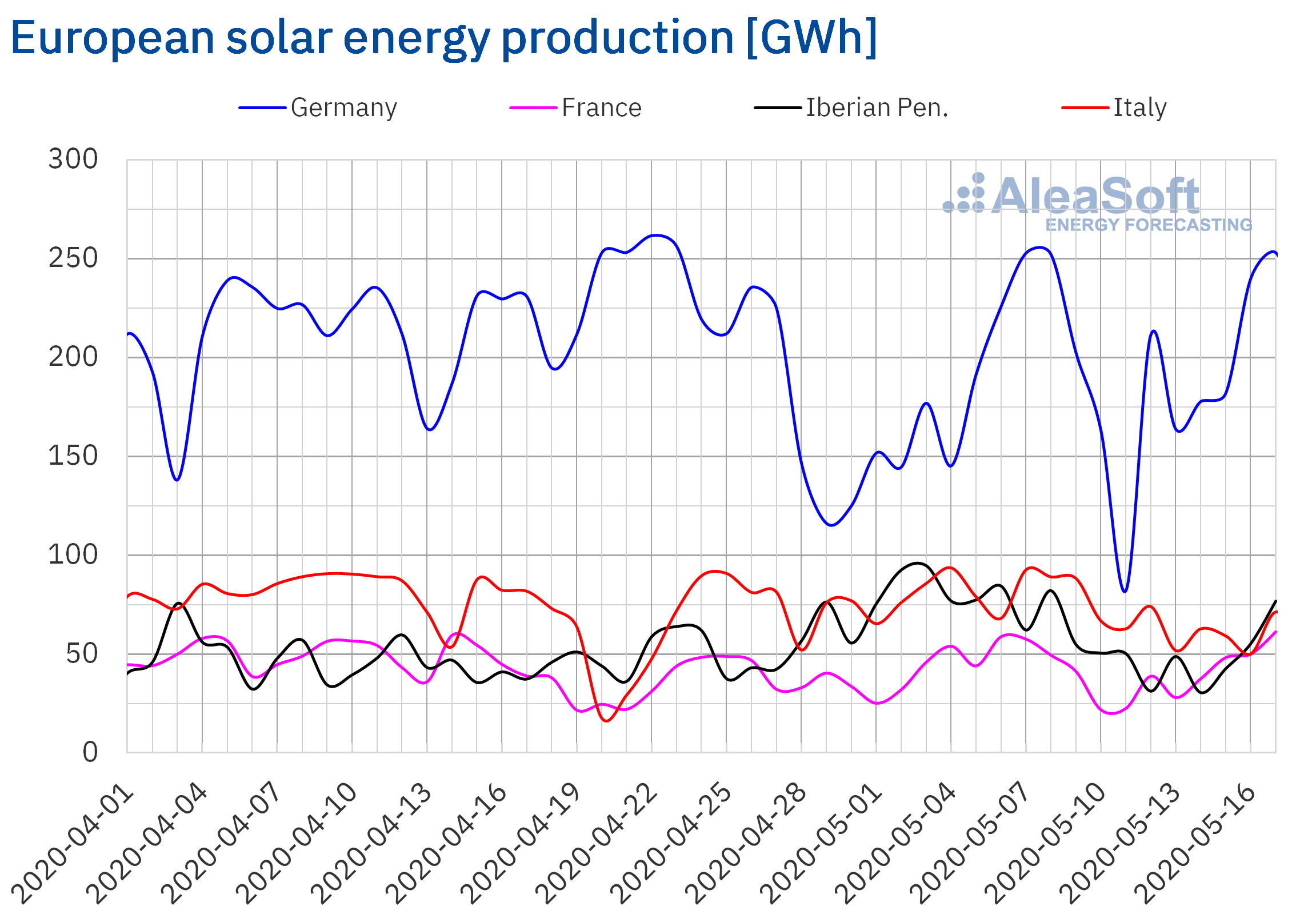

The week 20 of the year 2020 ended with a lower solar energy production than the previous week in all the markets analysed at AleaSoft. The greatest variation was in the Spanish market, with a decrease in production of 32%. The drop in production in the Italian market is also noteworthy, where it ended the week being 25% lower. In France and Germany the decreases were 12% and 8.6% respectively. However, at the end of the week, on Sunday, May 17, the production approached the maximum value of the previous week, and even exceeded it in some cases.

In the year‑on‑year analysis, the production with this technology during the month of May until Sunday 17 was higher in most of the markets analysed at AleaSoft. The largest increase was in the Italian market, where it increased by 30%. In the German market, the production was 22% higher, while in the Iberian Peninsula it increased by 18%. The exception was the French market, which registered a decrease in production of 0.2%.

The AleaSoft‘s solar energy production forecasting for this week indicates that the production with this technology in Germany, Spain and Italy will be higher than that of last week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

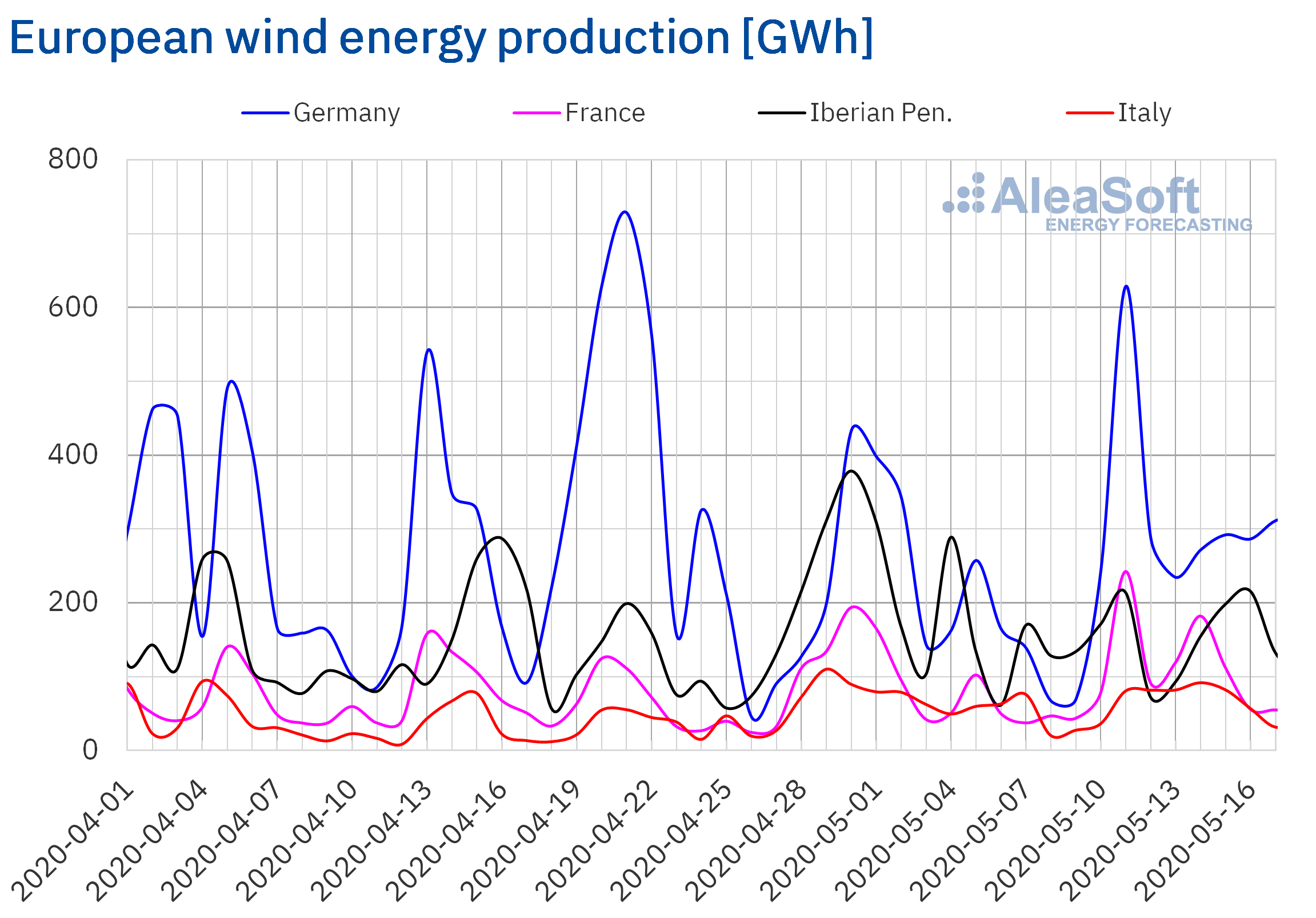

On the other hand, during the week of May 11, the wind energy production increased in most European markets and was more than double that registered the previous week in Germany and France. In the Italian market there was also a considerable increase of 53% last week, while in Spain it increased by 4.0%. Out of the markets analysed at AleaSoft, the only one that registered a decrease in production with this technology was the Portuguese market, of 23%.

From the first day of May 2020 until the 17th, the wind energy production was lower in most European markets compared to the same period of 2019. In the Iberian Peninsula and in Italy it decreased by 22%, while in Germany it fell 14%. In contrast, in France, the production with this technology was 1.2% higher.

For this week the AleaSoft‘s wind energy production forecasting indicates that wind energy production will decrease in all the markets analysed at AleaSoft.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

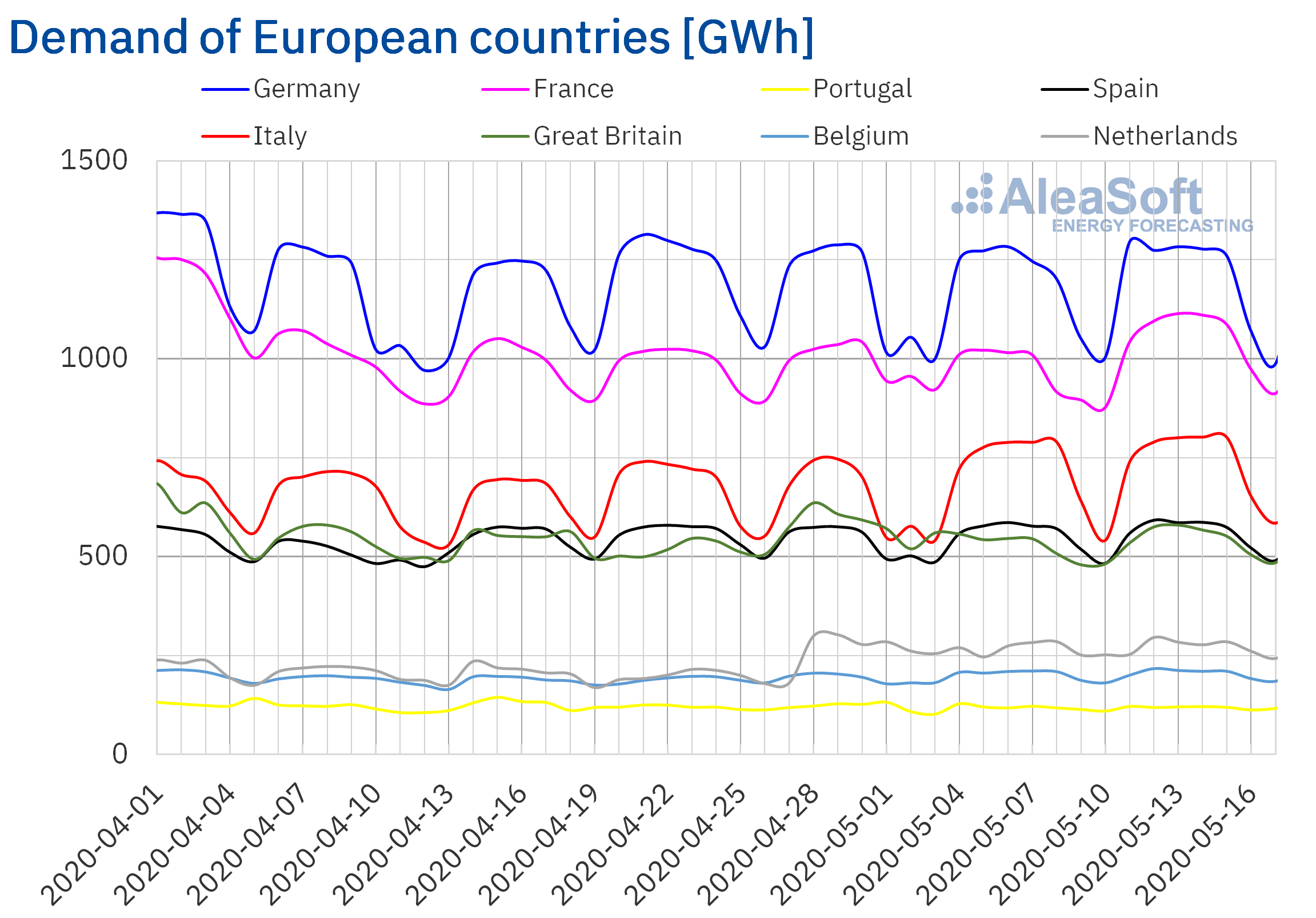

Electricity demand

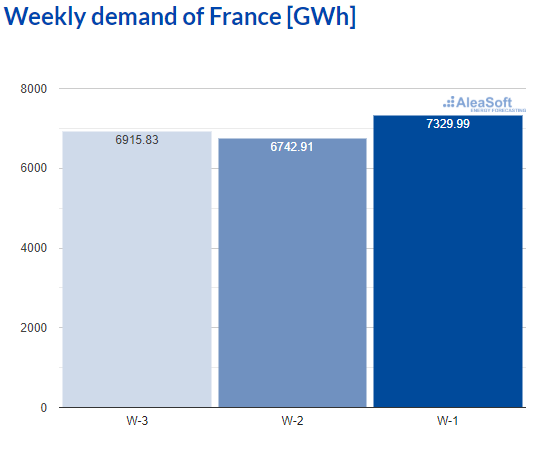

The electricity demand increased in all European markets during the past week compared to the previous week that ended on May 10, favoured by a decrease in temperatures in most of the continent. The greatest variation was 8.7% and was registered in France, a country where shops, libraries and small museums began to reopen since last Monday, May 11.

Source: Prepared by AleaSoft using data from RTE.

Source: Prepared by AleaSoft using data from RTE.

In Great Britain there was a 3.8% change in demand together with a decrease in average temperatures of 3.5 °C. Other considerable increases were those registered in Italy and Germany, of 2.4% and 1.6% respectively.

At the AleaSoft observatories it is possible to analyse the evolution of the demand in recent weeks with daily updated data.

In the coming days, the AleaSoft’s electricity demand forecasting indicates that the demand will recover as progress is made in the deconfinement in the different countries.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

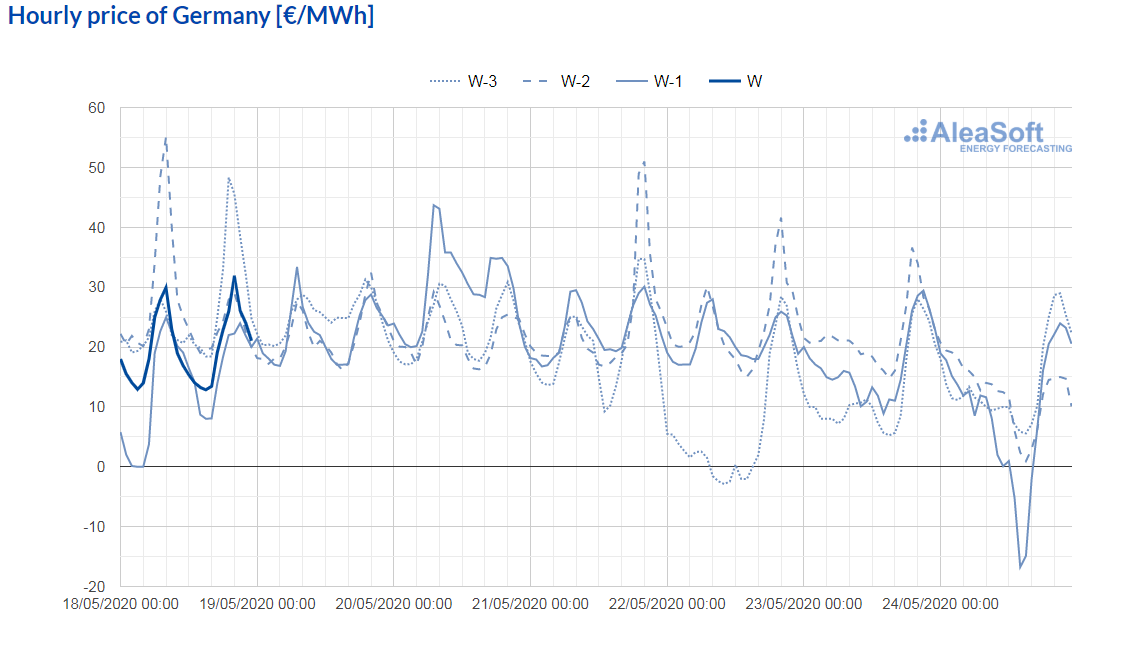

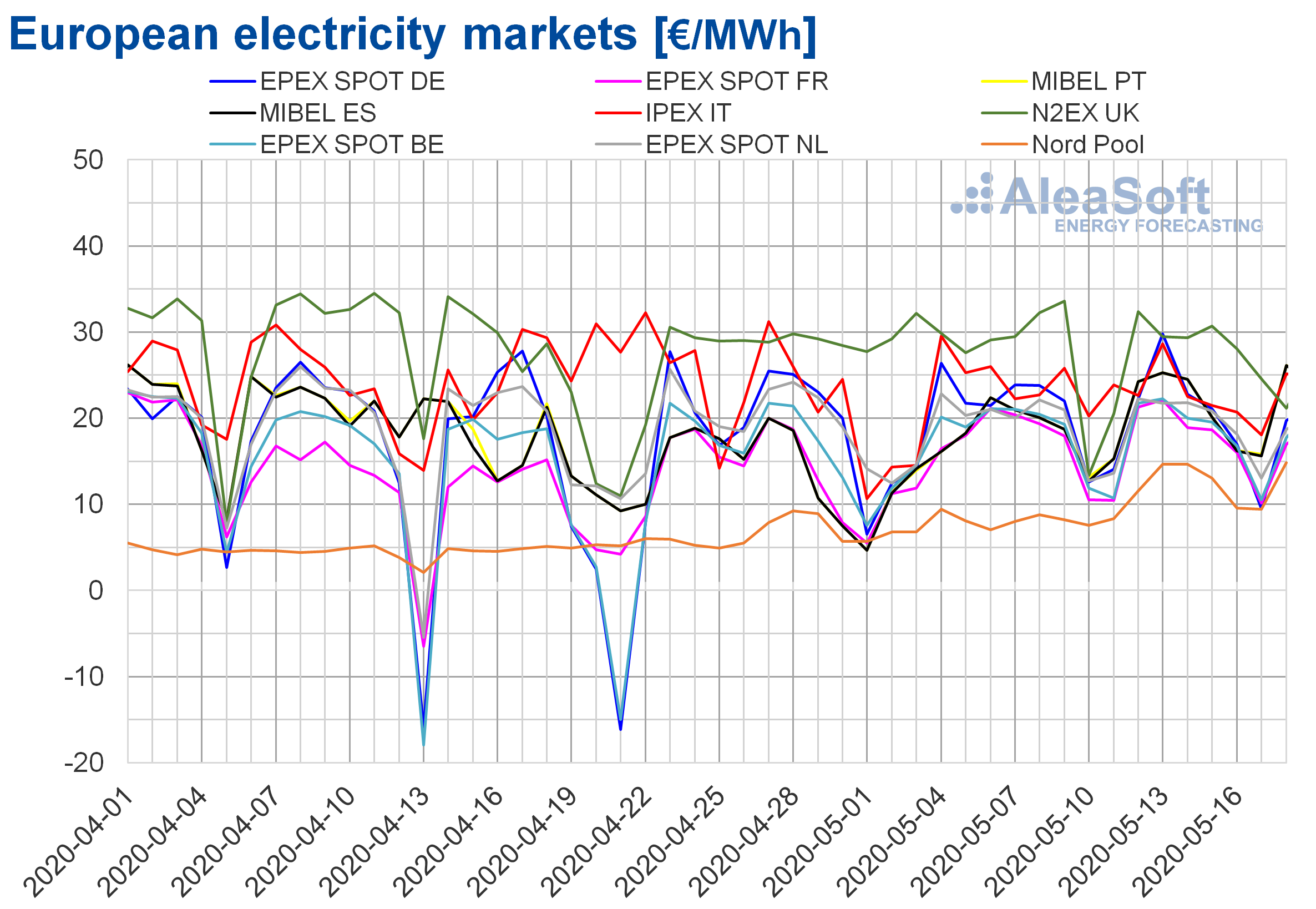

European electricity markets

The week of May 11, the prices decreased compared to those of the previous week in most of the analysed European electricity markets. The exceptions were the Nord Pool market of the Nordic countries and the MIBEL market of Spain and Portugal, with increases of 42%, 9.4% and 9.2% respectively. The market with the largest drop in prices, of 10%, was the EPEX SPOT market of Germany, followed by the EPEX SPOT market of Belgium and the IPEX market of Italy, with declines of 8.5% and 8.1%, respectively. While the market where the price fell the least, 0.1%, was the N2EX of Great Britain.

The market with the lowest average price of last week of May 11, of €11.61/MWh, was once again the Nord Pool market, followed by the EPEX SPOT market of France, with €16.79/MWh. While the market with the highest average price, of €27.87/MWh, was the N2EX. In the rest of the markets, average prices were reached between €17.36/MWh of the EPEX SPOT market of Belgium and €22.55/MWh of the IPEX market of Italy.

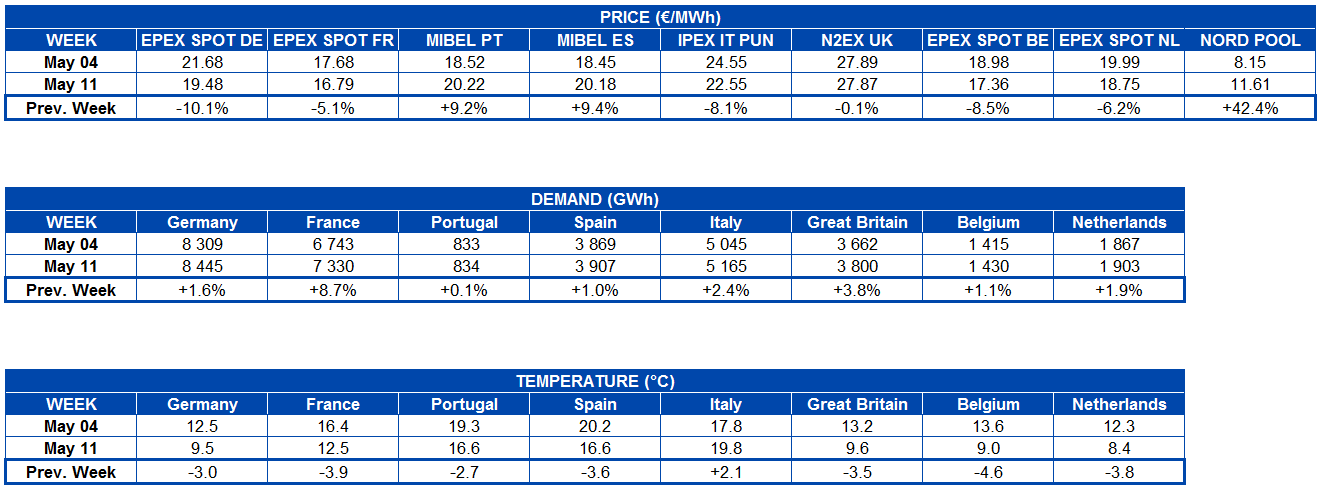

On the other hand, during the past week there were no negative daily prices in the analysed electricity markets. However, both Monday, May 11, and Sunday, May 17, negative hourly prices were reached in some markets.

In the early hours of Monday, May 11, there were negative hourly prices in the N2EX market and the EPEX SPOT market of France and Belgium. The Belgian market price at hour 5, of ‑€4.98/MWh, was the lowest of that day.

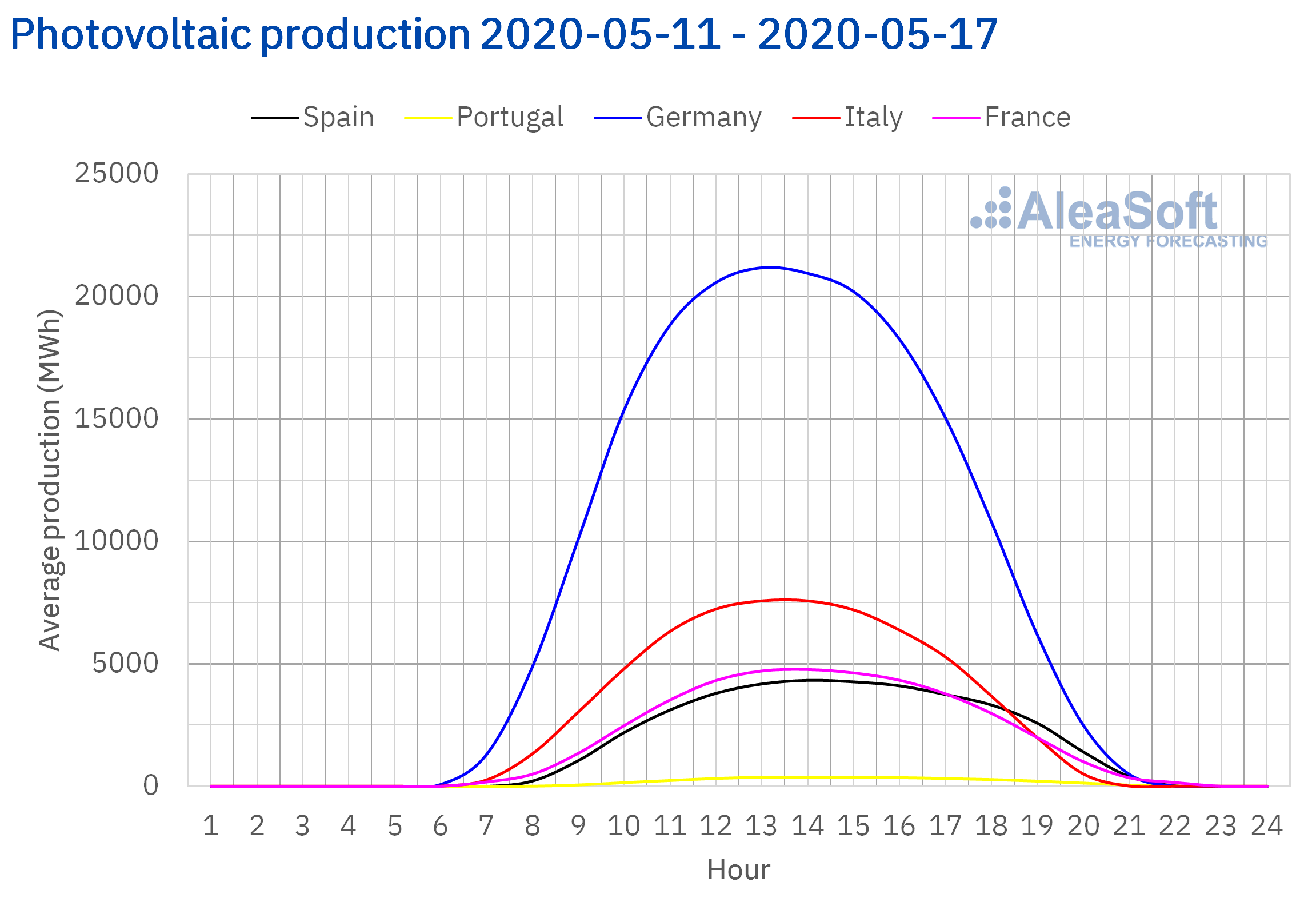

On Sunday, May 17, in the afternoon, negative hourly prices were reached in the EPEX SPOT market of Germany, Austria, Belgium, France and Switzerland and in the market of Denmark, belonging to the Nord Pool. The lowest hourly price was that of the German market at hour 15, of ‑€16.76/MWh. In these hours in Germany the photovoltaic energy production was between 20 GWh and 30 GWh and the wind energy production was above 16 GWh, which was added to a lower demand since it was Sunday, reaching exports above 10 GWh.

Source: Prepared by AleaSoft using data from EPEX SPOT

Source: Prepared by AleaSoft using data from EPEX SPOT

The price declines of the week of May 11 are related to a significant increase in wind energy production in countries such as Germany, France or Italy. Although that week in the Iberian Peninsula the renewable energy production decreased, which favoured the price increases in the MIBEL market.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The AleaSoft‘s price forecasting indicates that this week of May 18, prices will increase in most of the analysed European electricity markets, mainly due to a general decrease in wind energy production. However, the daily average prices will continue below €30/MWh.

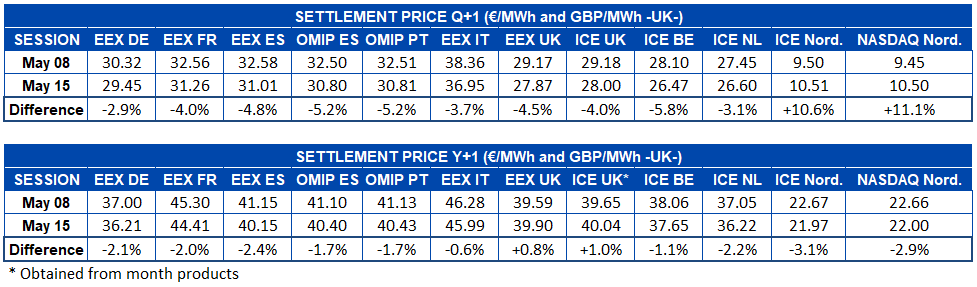

Electricity futures

Decreases were registered in the main European futures markets during the last week of May 11 for the product of the third quarter of the current year. Out of the markets analysed at AleaSoft, only the Nordic countries were left out of these declines, with increases in the ICE and NASDAQ markets of 10% and 11% respectively. In the rest of the markets the falls were between ‑2.9% of the EEX market of Germany and ‑5.8% of the ICE market of Belgium. The Belgian market is, therefore, the market with the greatest decline, although closely followed by the OMIP market of Spain and Portugal, with a 5.2% decrease, but where in absolute terms the decline was greater.

Something similar happened in the electricity futures for the next 2021. Almost general decline, but in this case the British region was the one where the prices increased, contrary to the rest of the markets. Both in the EEX market and in the ICE market, Great Britain registered price increases for this product of around 1%. Meanwhile, in the rest of the markets the decreases were between 1.7% of the OMIP market of the Iberian region and 3.1% of the ICE market of the Nordic countries, which being the only region in which the prices increased in the product of the next quarter, was also the one that fell the most for the product of the next year.

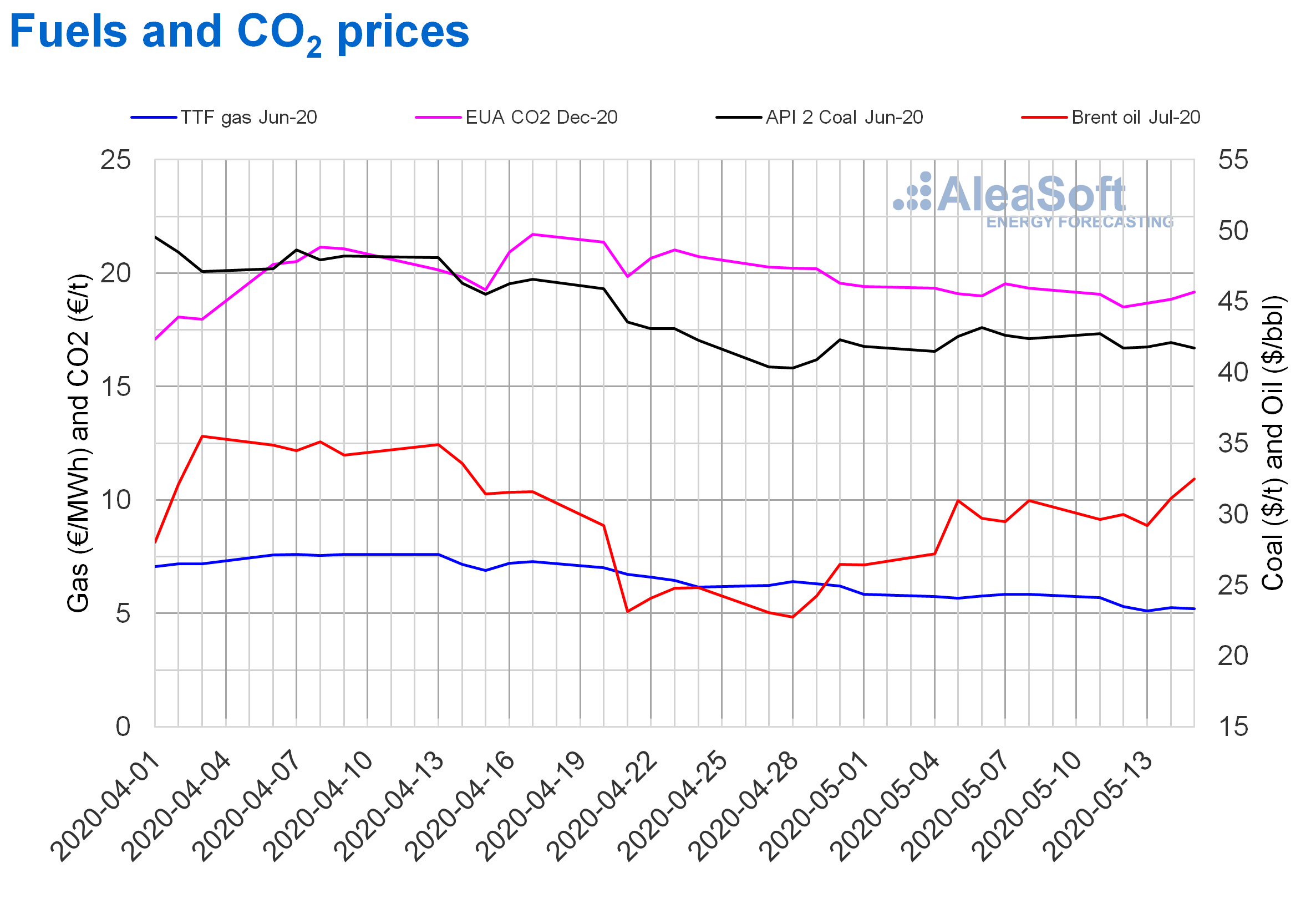

Brent, fuels and CO2

The Brent oil futures for the month of July 2020 in the ICE market during the first days of the week of May 11 remained below $30/bbl. On Wednesday, May 13, the minimum settlement price of last week was reached, of $29.19/bbl, 1.8% lower than that of the previous Wednesday. But on Thursday and Friday the prices started to recover, with daily increases of 6.6% and 4.4% respectively. Thus, on Friday, May 15, a settlement price of $32.50/bbl was reached, 4.9% higher than that of Friday of the previous week and the highest since April 15. In the session of today, May 18, the prices were above $33/bbl most of the time.

The upward revision of the demand forecast for 2020 by the International Energy Agency and the decrease in supply due to the OPEC+ production cuts favoured the recovery of the prices. However, despite the fact that the demand is recovering as more and more countries are relaxing the confinement measures, it is still low and the reserves levels remain high. In addition, the fears of new outbreaks of COVID‑19 and the concern about the evolution of the economy in the coming months persist. With this scenario, the prices are expected to continue low in the coming days.

The TTF gas futures prices in the ICE market for the month of June 2020 last week of May 11 continued below €6/MWh. On Wednesday, May 13, a settlement price of €5.12/MWh was reached, 11% lower than that of the previous Wednesday and the lowest in the last two years. On Thursday and Friday the settlement prices were higher than that of Wednesday, but they did not reach €5.30/MWh and were 10% lower than those of the same days of the previous week.

Regarding the TTF gas in the spot market, on Tuesday, May 12, it reached the maximum index price of last week, of €5.65/MWh, which was 2.9% higher than that of the previous Tuesday. But the following days, the prices fell until registering a value of €4.80/MWh for the weekend, which was lower than the lows registered in October 2009. Today, Monday, May 18, the price recovered to €4.87/MWh.

On the other hand, the API 2 coal futures in the ICE market for the month of June 2020 last week of May 11 registered settlement prices between $41.70/t of Tuesday and Friday and $42.75/t of Monday, May 11. This price of Monday was 3.0% higher than that of the previous Monday, but $0.40/t lower than the maximum price of the week of May 4.

As for the CO2 emission rights futures prices in the EEX market for the reference contract of December 2020, they started last week with decreases until reaching a settlement price of €18.52/t on Tuesday, May 12, which was 3.0% lower than that of the previous Wednesday and the lowest since April 6. Subsequently, the prices recovered to register a settlement price of €19.17/t on Friday, May 15, which was the highest of the week.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis on the effects on the electricity markets due to the coronavirus crisis

An observatory was created on the AleaSoft website where the evolution of the main variables of the European electricity markets can be monitored. Comparative charts with hourly, daily and weekly data are included in the observatory.

This Thursday, May 21, the Webinar “Influence of coronavirus on electricity demand and the European electricity markets (II)” will be held, in which the evolution of the electricity markets during the coronavirus crisis will be analysed and the topic of the renewable energy projects financing will be explored further. At the end, an analysis table will be held to discuss both issues.

Source: AleaSoft Energy Forecasting.