AleaSoft Energy Forecasting, February 2, 2024. In January 2024, prices in European electricity markets maintained the stability of recent months and registered slightly higher averages than in December 2023. Solar photovoltaic energy production reached record levels for a January month in all markets and wind energy production in Germany and Italy. Electricity demand increased in general. Average gas and CO2 prices fell for the third and sixth consecutive month, respectively.

Solar photovoltaic, solar thermoelectric and wind energy production

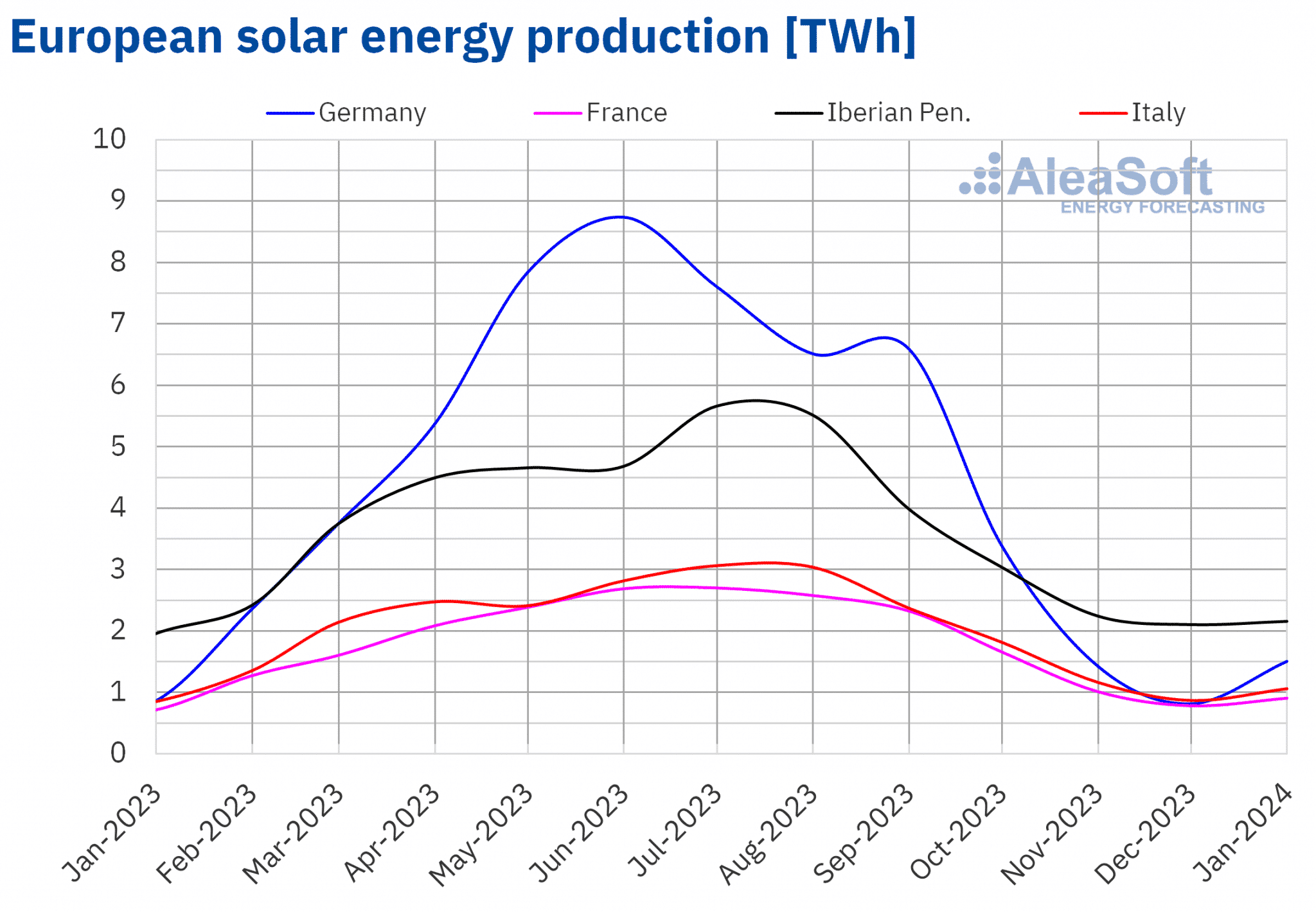

In January 2024, solar energy production increased in the main European electricity markets compared to the same month in 2023. The German market registered the largest increase, which was 75%, followed by increases in the French and Italian markets, 26% and 25% in each case. The smallest variations were registered in the Iberian market, with an increase of 5.7% in Portugal and 7.2% in Spain.

Compared to previous month, solar energy production in January also increased in all markets analyzed at AleaSoft Energy Forecasting. Again, the German market registered the largest change, with an 85% increase compared to the generation registered in December 2023. The Italian and French markets increased by 22% and 16%, respectively. The Iberian market registered lower growth, with an increase of 2.1% in Spain and 6.8% in Portugal.

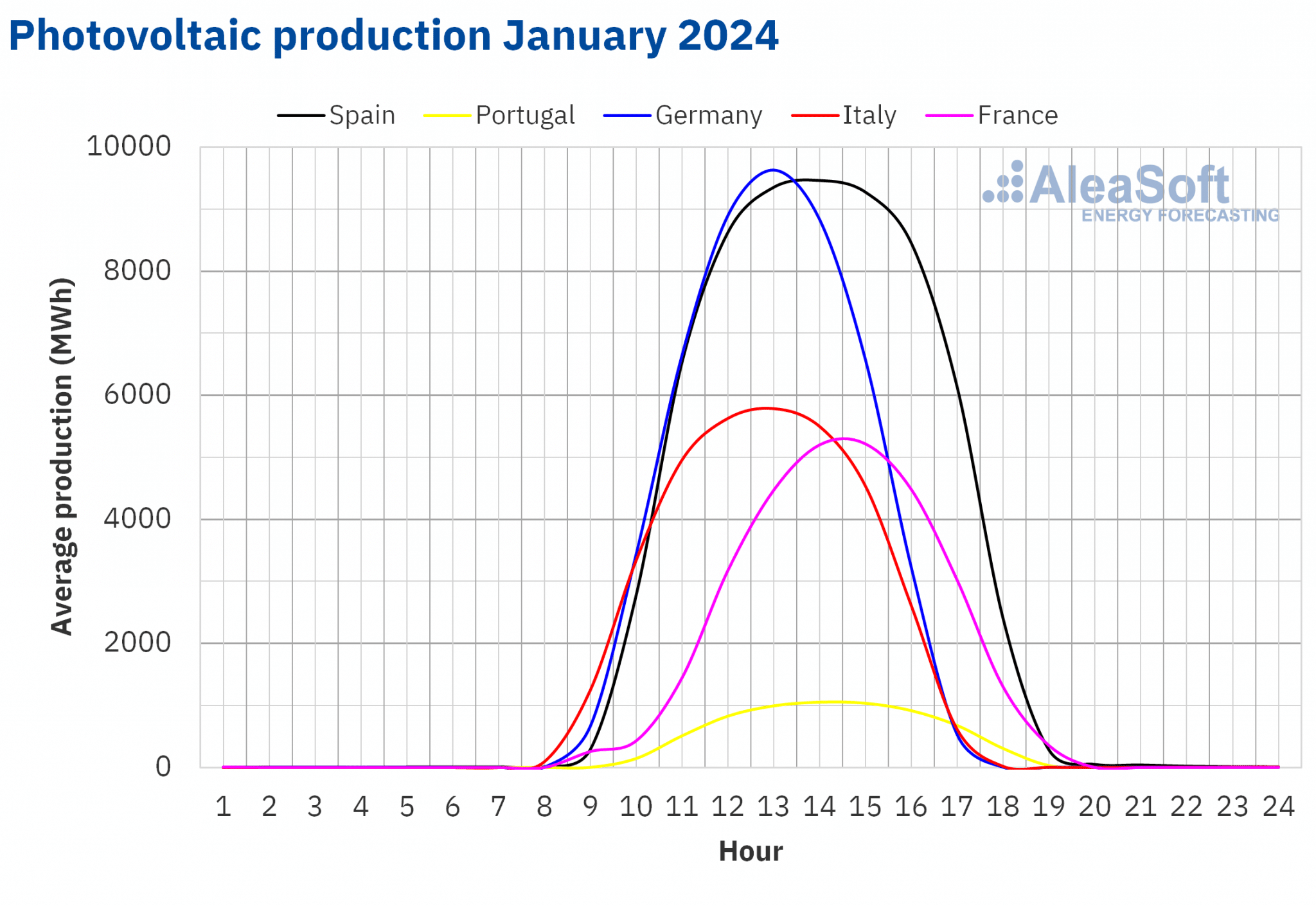

Solar photovoltaic energy production in January 2024 broke records in all analyzed markets, compared to historical January production in previous years. The Spanish market topped the list of record‑setting markets, generating 1848 GWh. The German, Italian and French markets followed with 1502 GWh, 1058 GWh and 909 GWh, respectively. In the Portuguese market, solar technology produced 201 GWh.

These production records for a January month are indicative of the overall growth in solar energy generation capacity installed in recent years. An example of this is the solar capacity installed in Portugal, which, according to REN data, increased by 128 MW between December 2023 and January 2024.

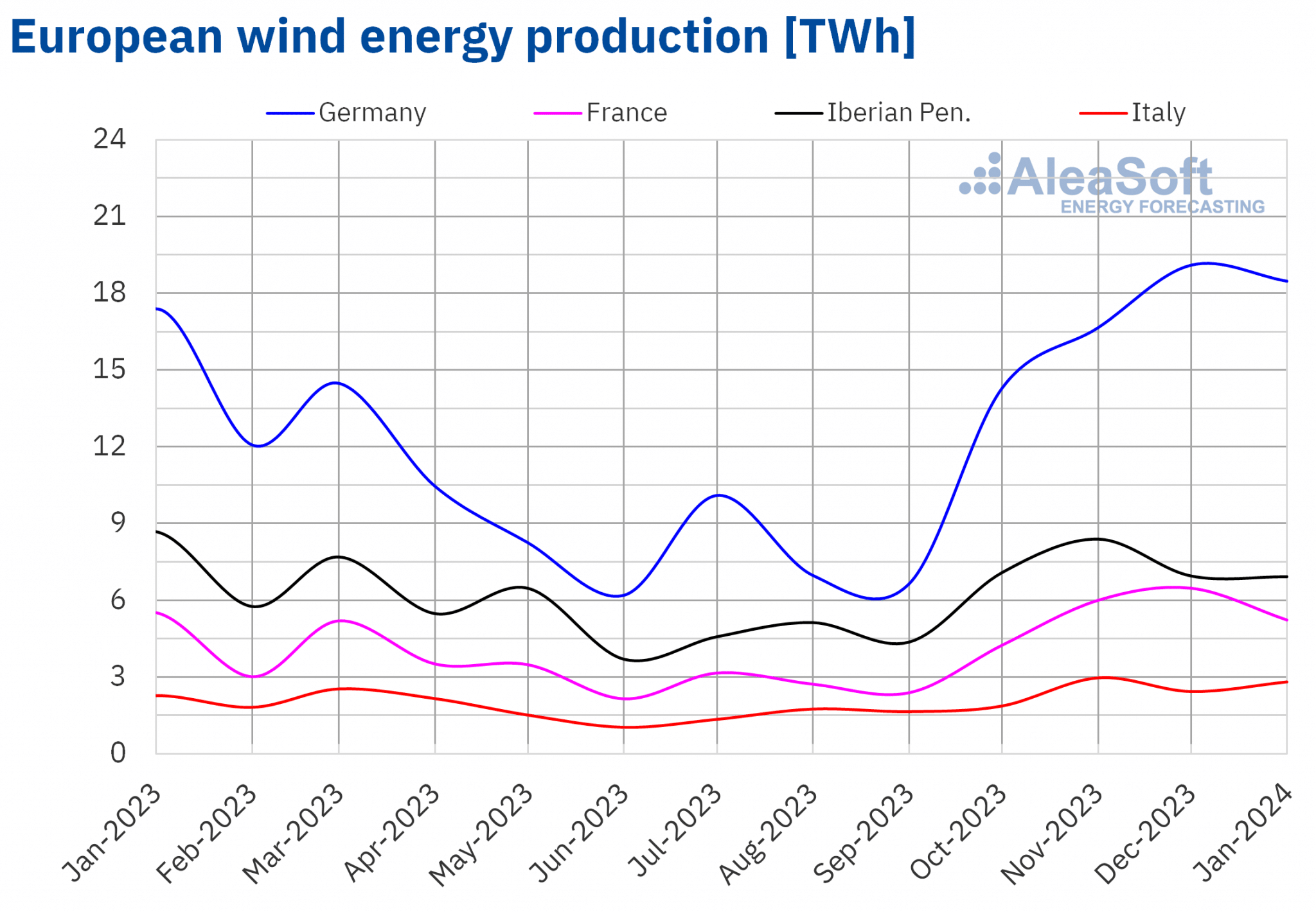

Wind energy production in the main European markets was mostly lower in January 2024 compared to the same period in 2023. The Spanish market registered the largest decline, 22%, followed by decreases in the Portuguese market, by 10%, and in the French market, by 5.2%. The Italian and German markets were the exceptions, with increases of 24% and 6.2%, respectively.

Compared to previous month, wind energy production also decreased in most European markets analyzed at AleaSoft Energy Forecasting in January. In this case, the French market registered the largest drop, 19%. The German and Spanish markets had less pronounced declines, 3.3% and 0.7%, respectively. In contrast, the Italian market registered an increase in production using this technology of 15%, while the Portuguese market registered a less pronounced increase of 0.8%.

In January 2024, the German and Italian markets broke wind energy production records when compared to the same month in previous years. The German market registered a generation of 18 473 GWh and the Italian market, 2817 GWh. The French market had the second highest wind energy generation for a January month, 5231 GWh, after the record reached in January 2023.

Electricity demand

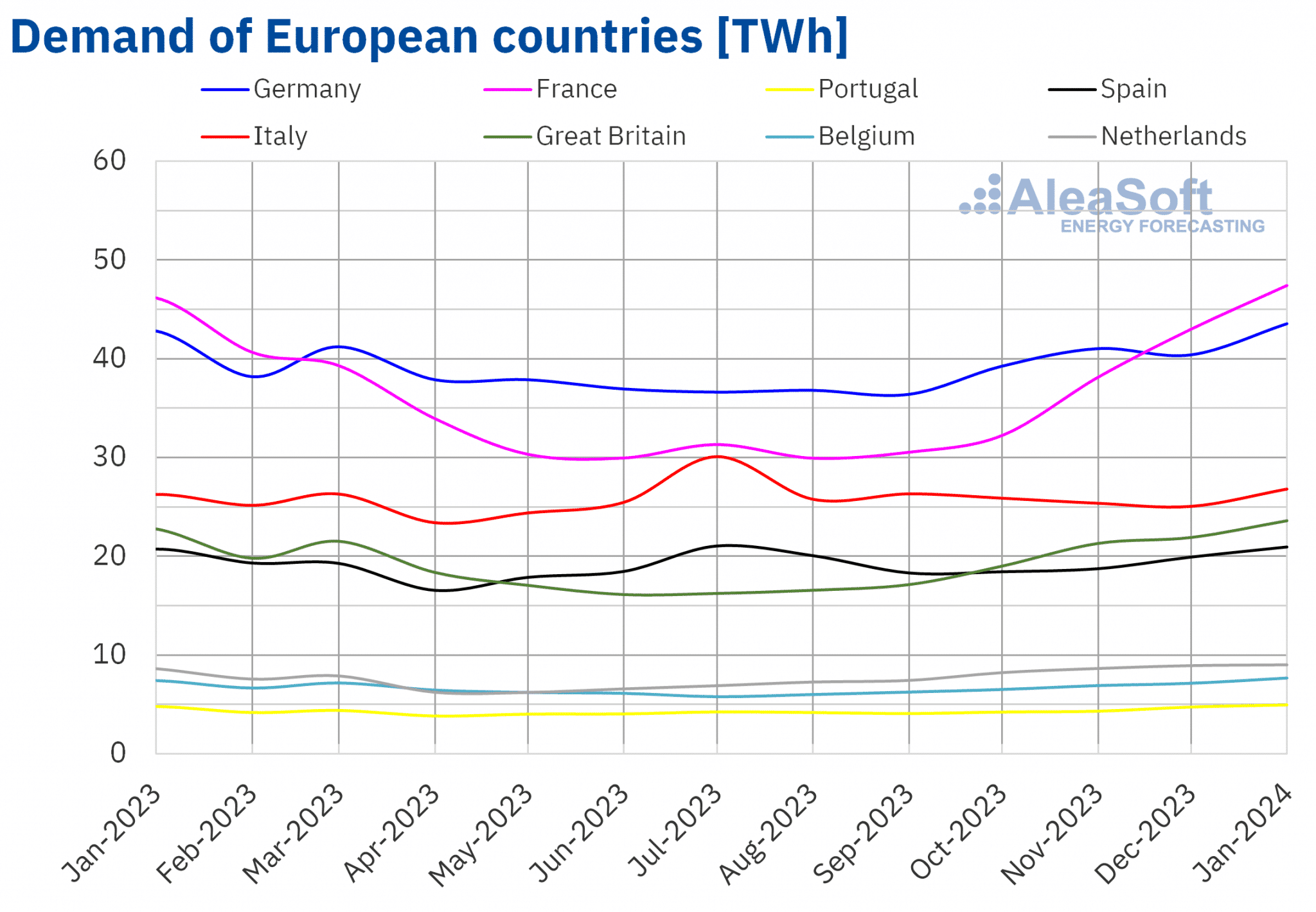

In January 2024, all European markets registered an increase in electricity demand compared to the same period in 2023. The Netherlands market registered the largest increase, 4.5%, followed by increases of 3.6%, 3.4% and 3.3% in the markets of Great Britain, Belgium and Portugal, respectively. In the other markets, increases ranged from 0.8% in the Spanish market to 2.7% in the French market. In Portugal, electricity demand for the ended month was 4934 GWh, the second highest, at least since 2009, after that registered in January 2021.

Compared to the previous month, electricity demand in January 2024 also increased in all European markets analyzed at AleaSoft Energy Forecasting. In this case, the French market registered the largest increase, reaching 10%. The Italian, Belgian, British and German markets registered increases between 7.0% and 7.8%. In the Iberian market, demand increased by 4.6% in Portugal and 5.2% in Spain. On the other hand, the Dutch market registered the smallest increase, 0.9%.

January 2024 was colder than the same month in 2023 in most markets. The decrease in average temperatures compared to the same period of the previous year ranged from 0.5 °C in Great Britain to 1.8 °C in the Netherlands. Italy, Portugal and Spain were the exceptions. In these markets, average temperatures were higher than in January 2023 by 0.3 °C, 2.0 °C and 1.8 °C, respectively.

Compared to December 2023, in January average temperatures were lower in most analyzed markets. Belgium registered the largest temperature drop, 3.3 °C. In the remaining markets, temperature decreases ranged from 1.3 °C in Italy to 2.7 °C in the Netherlands. In this case, the Iberian market was also the exception, with temperatures 0.6 °C higher in Spain and 0.8 °C higher in Portugal than in the previous month.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.European electricity markets

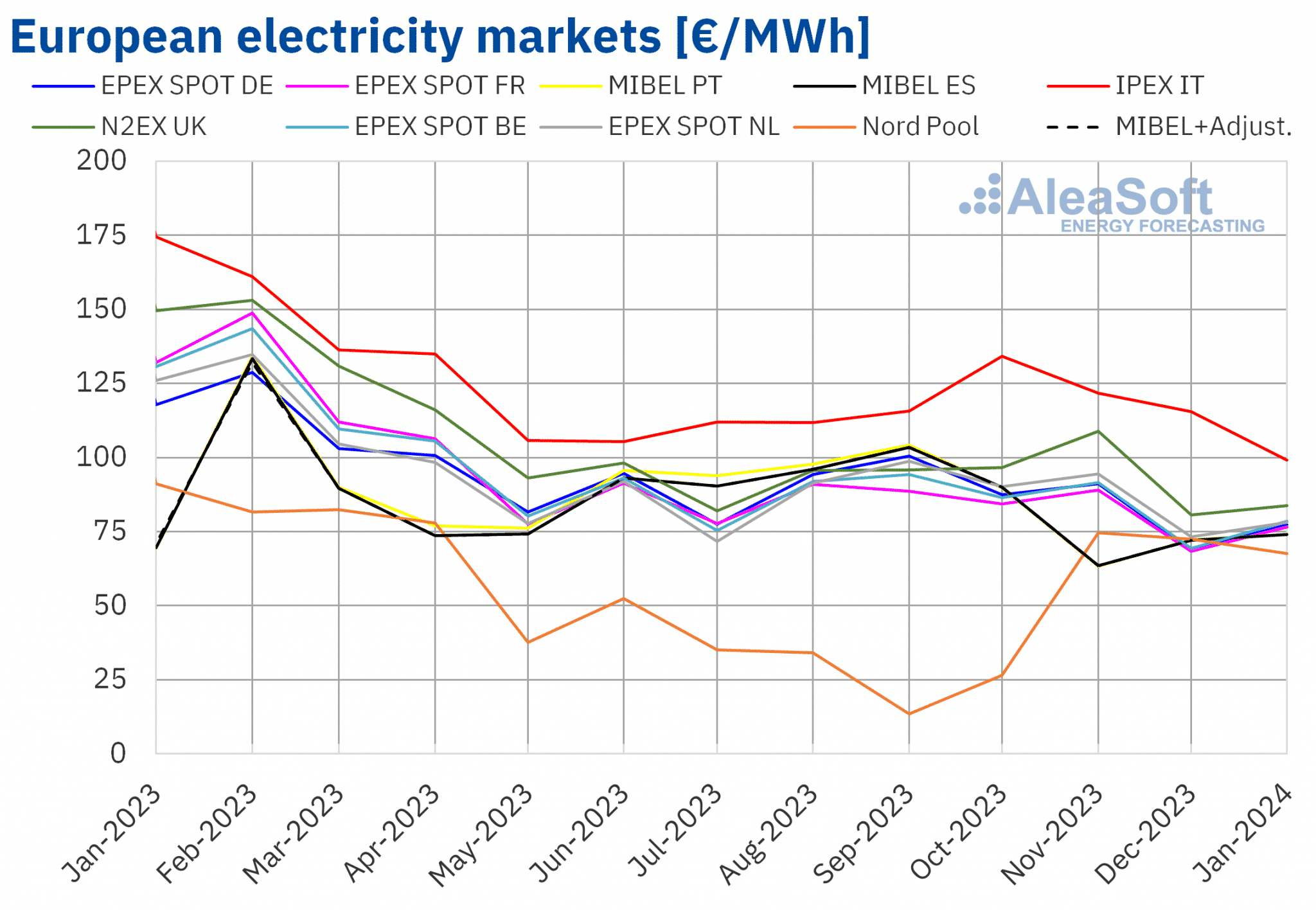

In the month of January 2024, the monthly average price was below €80/MWh in most major European electricity markets. The exceptions were the averages of the N2EX market of the United Kingdom and the IPEX market of Italy, which were €83.76/MWh and €99.16/MWh, respectively. In contrast, the Nord Pool market of the Nordic countries registered the lowest monthly price, €67.64/MWh. In the rest of European electricity markets analyzed at AleaSoft Energy Forecasting, averages ranged from €74.08/MWh in the MIBEL market of Portugal to €78.56/MWh in EPEX SPOT market of Belgium.

Monthly prices in most European electricity markets have remained stable over the past few months, with some downward trend. However, compared to December, average prices increased slightly in January in most European electricity markets analyzed at AleaSoft Energy Forecasting. The exceptions were the Nordic market, with a 6.6% decrease, and the Italian market, with a 14% decrease. On the other hand, the German and Belgian markets registered the largest increase, 13% in both cases. In the other markets, prices rose between 2.6% in the Portuguese market and 12% in the French market.

Comparing average prices in January with those registered in the same month of 2023, prices decreased in most analyzed markets. The exceptions were the Spanish and Portuguese markets, with increases of 6.5% and 6.8%, respectively. On the contrary, the largest price drop was that of the British market, 44%. In the other markets, price declines ranged from 26% in the Nordic market to 43% in the Italian market.

In January 2023, under the influence of the Iberian exception mechanism, MIBEL market prices were the lowest of all analyzed markets. When taking into account the adjustment that some consumers had to pay for the gas price cap in this market, the January 2023 average was €70.90/MWh, also lower than the January 2024 average.

In January 2024, monthly prices of the MIBEL market of Spain and Portugal were the highest in the last three months. In contrast, the Nordic market registered the lowest average in the last three months. In the case of the Italian market, despite reaching the highest average of all analyzed markets in January 2024, it was the lowest in the last 31 months in the IPEX market.

The fall in the average price of gas and CO2 emission rights and the general increase in solar energy production led to a year‑on‑year decrease in European electricity market prices in January 2024, despite the recovery in demand. In addition, wind energy production increased in some markets, such as Germany and Italy, but it decreased in the Iberian Peninsula, which contributed to the year‑on‑year price increase in the MIBEL market.

On the other hand, in January 2024, the average price of gas and CO2 emission rights also fell compared to the previous month, although to a lesser extent. In addition, demand increased and wind energy production decreased in most analyzed markets. This led to higher prices in European electricity markets, despite the general increase in solar energy production compared to the previous month. In the case of the Italian market, wind energy production also increased compared to December, contributing to the price decrease in this market.

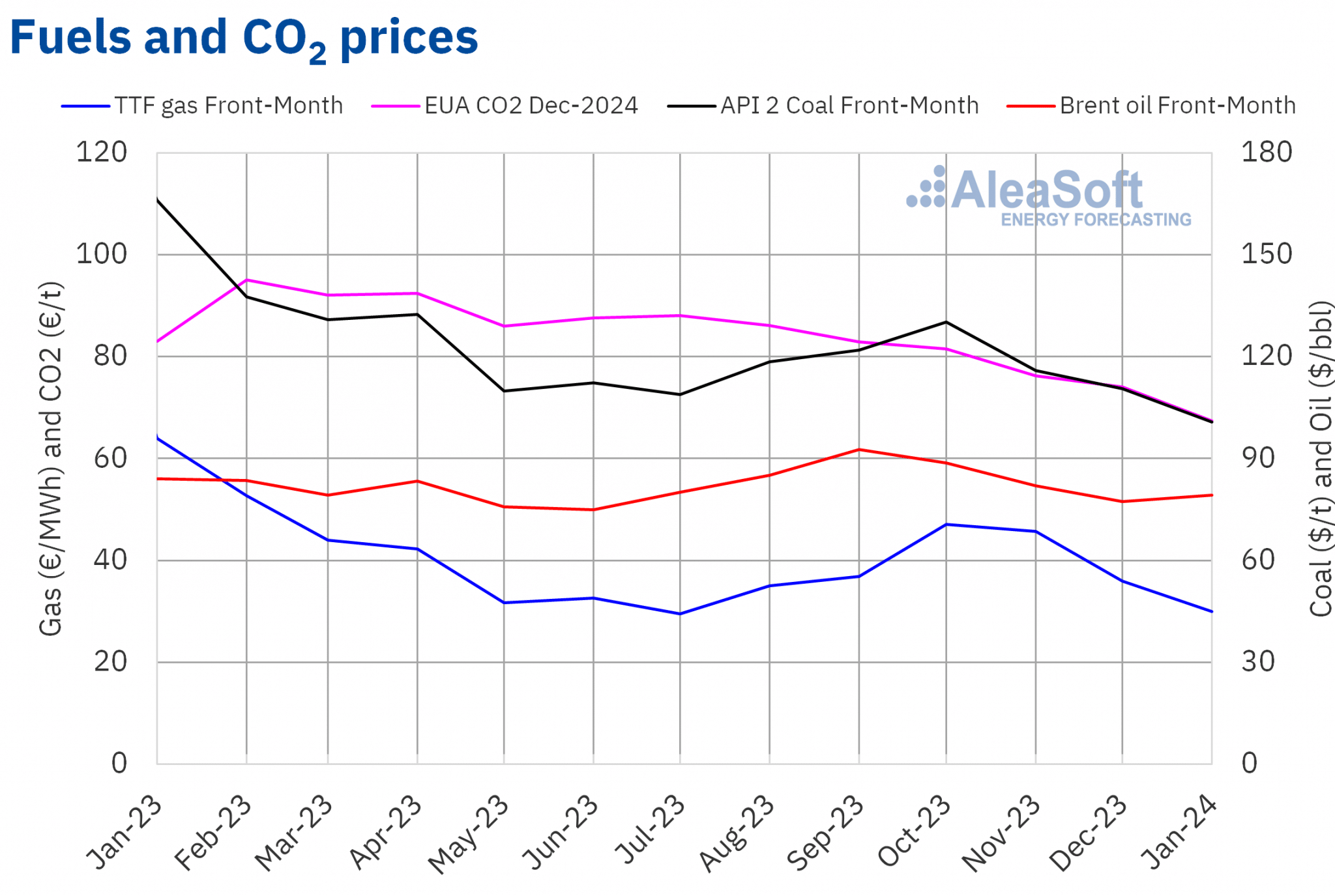

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered a monthly average price of $79.15/bbl in January. This value was 2.4% higher than that reached by the December 2023 Front‑Month futures, which was $77.32/bbl. However, it was 5.8% lower than that of the January 2023 Front‑Month futures, which was $84.04/bbl.

During the month of January, concerns about the evolution of demand and instability in the Middle East exerted their influence on the evolution of Brent oil futures prices. At the beginning of the month, production outages in Libya and the announcement of price cuts by Saudi Arabia also conditioned prices. In the second half of the month, the effects of cold temperatures on US production, the increase in the International Energy Agency’s demand forecast, news about the US economy and the announcement of stimulus measures for the Chinese economy contributed to the price increase. As a result, on Friday, January 26, the settlement price was $83.55/bbl, the highest since the first half of November 2023.

As for TTF gas futures for the Front‑Month in the ICE market, they continued the downward trend they have been maintaining since mid‑October. The average value registered during the month of January was €29.91/MWh. According to data analyzed at AleaSoft Energy Forecasting, compared to the average Front‑Month futures traded in the month of December 2023, which was €35.97/MWh, the January average decreased by 17%. When compared to the Front‑Month futures traded in January 2023, when the average price was €63.92/MWh, there was a 53% drop.

In January, high European reserve levels and abundant supplies of liquefied natural gas led to lower TTF gas futures prices. Temperature evolution also influenced prices in January. The increase in demand due to the low temperatures, which affected Europe in the first weeks of the month, and the effects of these on the supply of liquefied natural gas from the United States exerted an upward influence on prices, limiting their fall. Even so, on January 23, the settlement price was €27.23/MWh, the lowest since the beginning of August 2023.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2024, they reached an average price of €67.43/t in January. According to data analyzed at AleaSoft Energy Forecasting, this represents a decrease of 8.9% compared to the previous month’s average, which was €74.01/t. When compared to the January 2023 average, which was €86.92 €/t, the January 2024 average was 22% lower. The monthly average of CO2 futures for this product accumulates six consecutive months of declines.

Low levels of demand at the start of the 2024 emission rights auctions exerted a downward influence on prices in January. On January 29, the settlement price was €61.78/t, the lowest since the first half of March 2022.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

The next webinar in the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen will focus on energy storage. This webinar will take place on February 15 and will feature Tomás García, Senior Director, Energy & Infrastructure Advisory at JLL. The main aspects addressed in the webinar will be the context and trends of the energy storage market in Spain, the revenue stack and technical aspects of battery energy storage systems, as well as financing considerations. In addition, the webinar will include the usual analysis of the evolution and prospects of European energy markets.

Source: AleaSoft Energy Forecasting.