AleaSoft Energy Forecasting, October 19, 2021. PPA are essential hedging tools for achieving renewable energy capacity targets for the energy transition. But, although they became common in the news of the electricity sector, their accounting is very complex and, as it is a long‑term hedging contract, it requires periodic estimates of the asset’s value and of long‑term electricity market prices. From Deloitte Spain they review the key aspects of PPA accounting.

On October 7, the monthly webinar organised by AleaSoft Energy Forecasting took place, with the participation of two speakers from Deloitte Spain, Carlos Milans del Bosch, Partner of Financial Advisory and Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services. On behalf of AleaSoft Energy Forecasting, Antonio Delgado Rigal, CEO, and Oriol Saltó i Bauzà, Head of Data Analysis and Modelling, took part. AleaSoft Energy Forecasting and Deloitte Spain clients can request the recording of the webinar here.

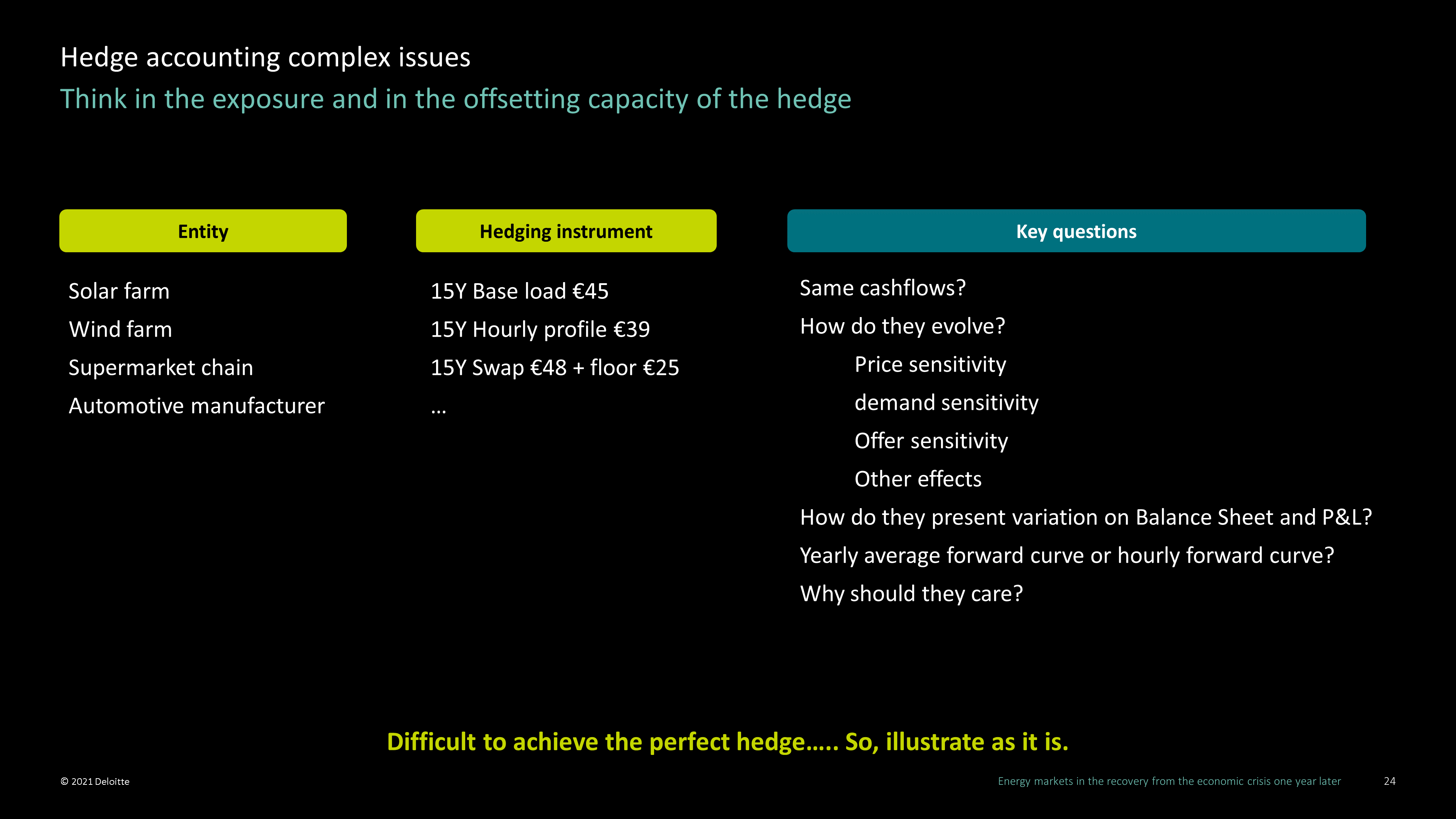

In the webinar, in addition to analysing the evolution and current situation of energy crisis and the current situation of the renewable energy projects financing, the complexities when preparing the financial information of a PPA, both for the producer and for the offtaker, and the importance of markets prices forecasting with hourly detail were exposed.

How is a PPA classified for accounting purposes?

The answer to this question is not unique. The diversity of PPA types does not help their accounting. PPA can be physical or financial, also called virtual, they can be with or without options, they can be in base load or outlined. In accounting terms, PPA can be classified as derivatives or as embedded derivatives, either as contracts pending execution, concessions or leases.

That diversity makes it very difficult, for example, for an investor to compare two PPA opportunities or decide which one is the best to invest in. According to Deloitte, transparency and common sense in the preparation of information is the way to go.

The need for long‑term hourly prices forecasting

The market prices forecasting is necessary, among others, when making cash flow forecasts in impairment tests, mergers and acquisitions and hedge accounting. For these cash flow projections to be valid and coherent, markets prices forecasts must meet important requirements.

Source: Deloitte Spain.

Source: Deloitte Spain.

On the one hand, price forecasts must be coherent. For the accounting to be robust, forecasts used in each evaluation must be coherent with the previous ones and continue to be coherent in the future so that the value of the asset is not distorted by the simple fact of not being able to trust the forecasts that are used as inputs.

On the other hand, if it is necessary to present the change in the value of an asset or assess the exposure to the risk of market prices volatility, with prices of a very volatile market, such as electricity markets, price estimates are needed with as much granularity as possible. Because if prices can fluctuate a lot, then it is not enough to have an estimate of the yearly or monthly average, price forecasts with hourly granularity are necessary.

AleaSoft’s analysis on the prospects for energy markets in Europe

The evolution of the markets in this global energy crisis will continue to be analysed in the next AleaSoft Energy Forecasting’s webinar that will be held on November 11. The webinar will also have the participation of invited speakers from Engie Spain to analyse and debate the situation of renewable energy projects financing.