AleaSoft Energy Forecasting, May 30, 2022. In the fourth week of May, prices of most European electricity markets fell and their averages were below €175/MWh. Negative hourly prices were registered in several markets from May 26 to 28. Wind energy production increased in a generalised way, which favoured price declines, a behaviour that was also helped by lower demand, high solar energy production in the Iberian market and gas prices lower than those of the previous week.

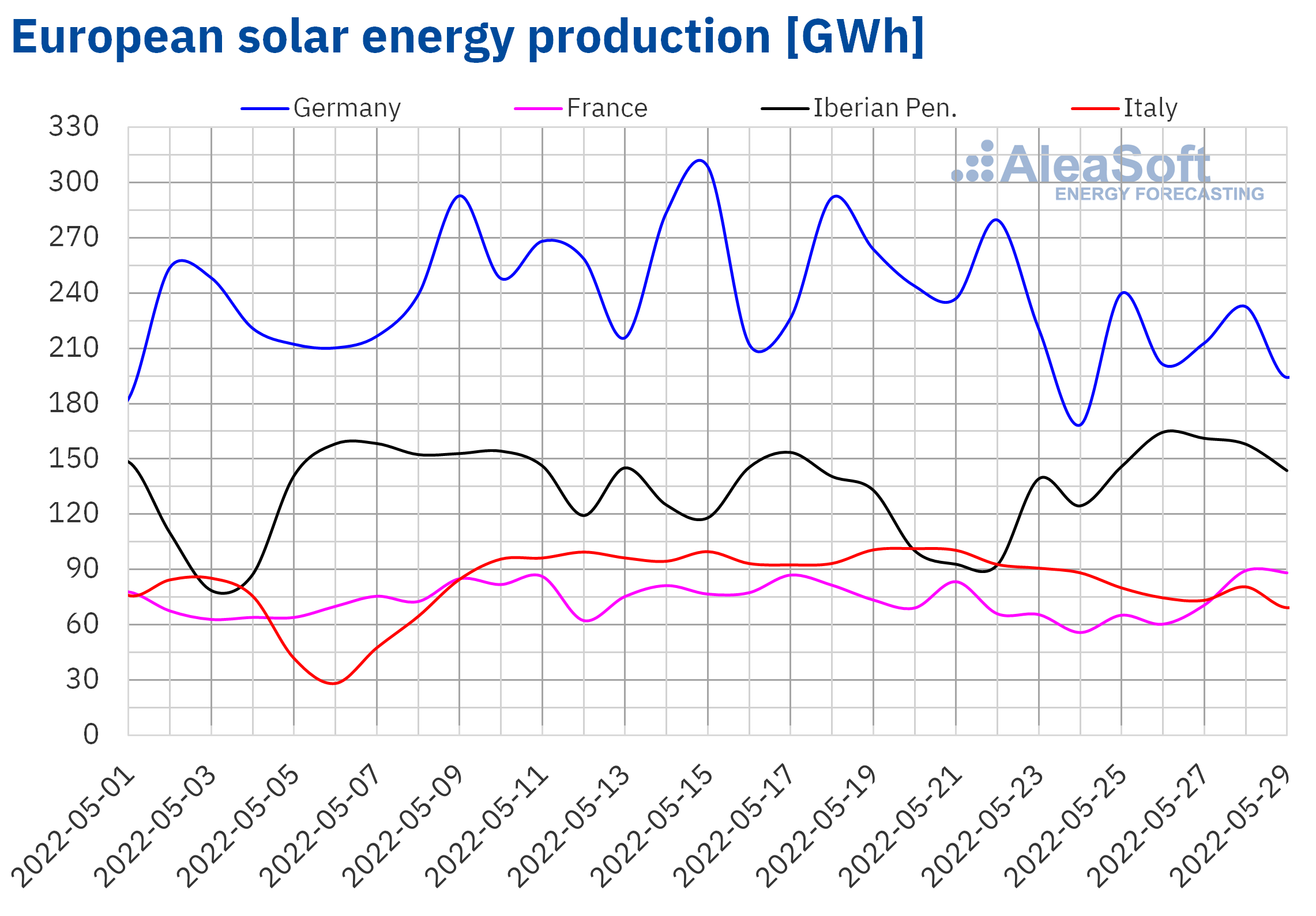

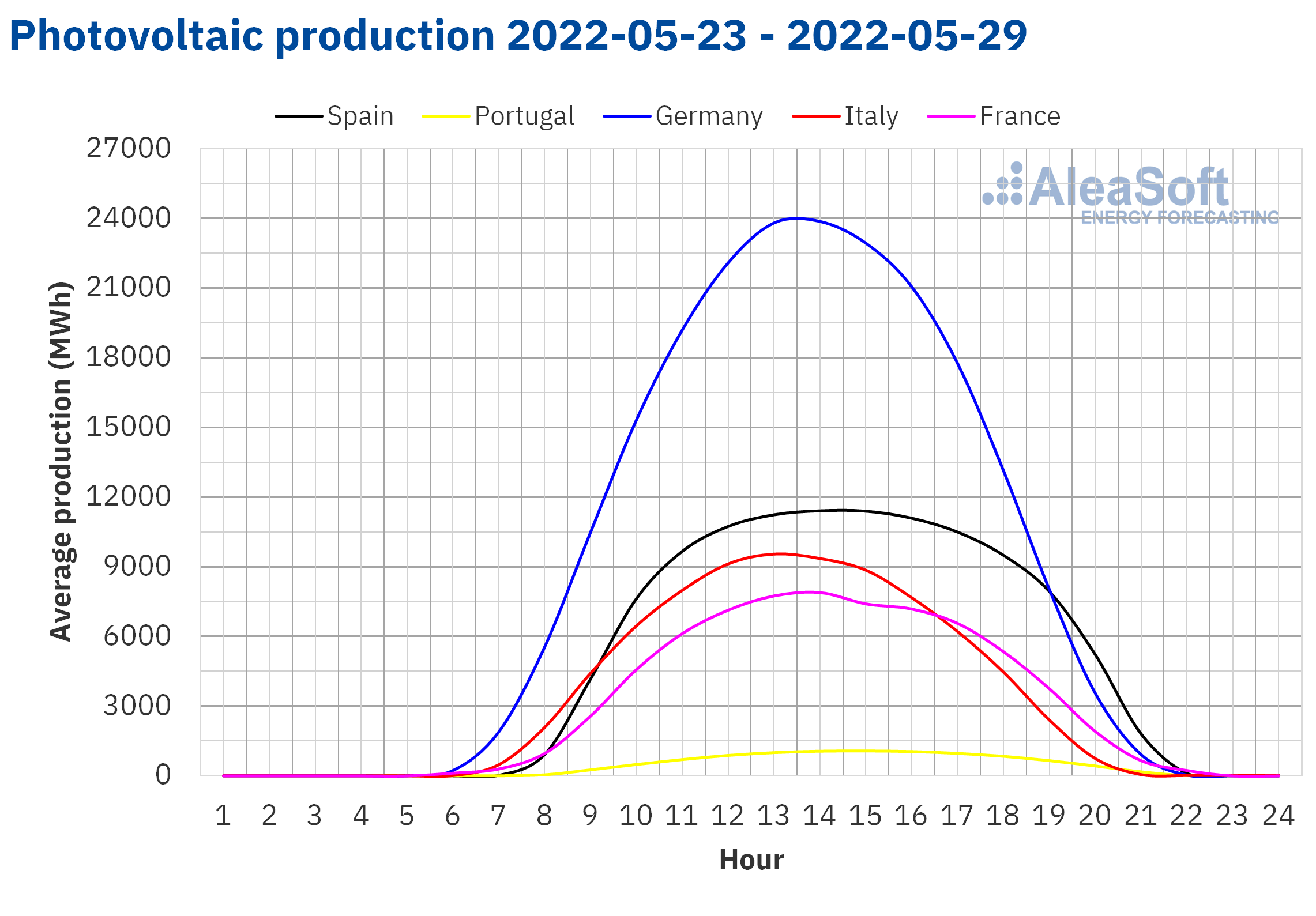

Photovoltaic and solar thermal energy production and wind energy production

During the week of May 23, the solar energy production increased by 27% in Portugal and 20% in Spain compared to the previous week. In the Spanish market, the historical record for daily solar energy production, which includes photovoltaic and solar thermal energy, was broken on Thursday, May 26, registering a production of 154 GWh for that day. The hourly record for scheduled photovoltaic energy generation was also broken on May 27 at 2 in the afternoon, with a generation of 12 024 MWh. On the other hand, a reduction of between 8.0% and 17% was registered in the solar energy production of the rest of the markets analysed at AleaSoft Energy Forecasting.

For the week of May 30, the AleaSoft Energy Forecasting’s forecasts indicate an increase in solar energy production in the German and Italian markets, while it is expected to decrease in the Spanish market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

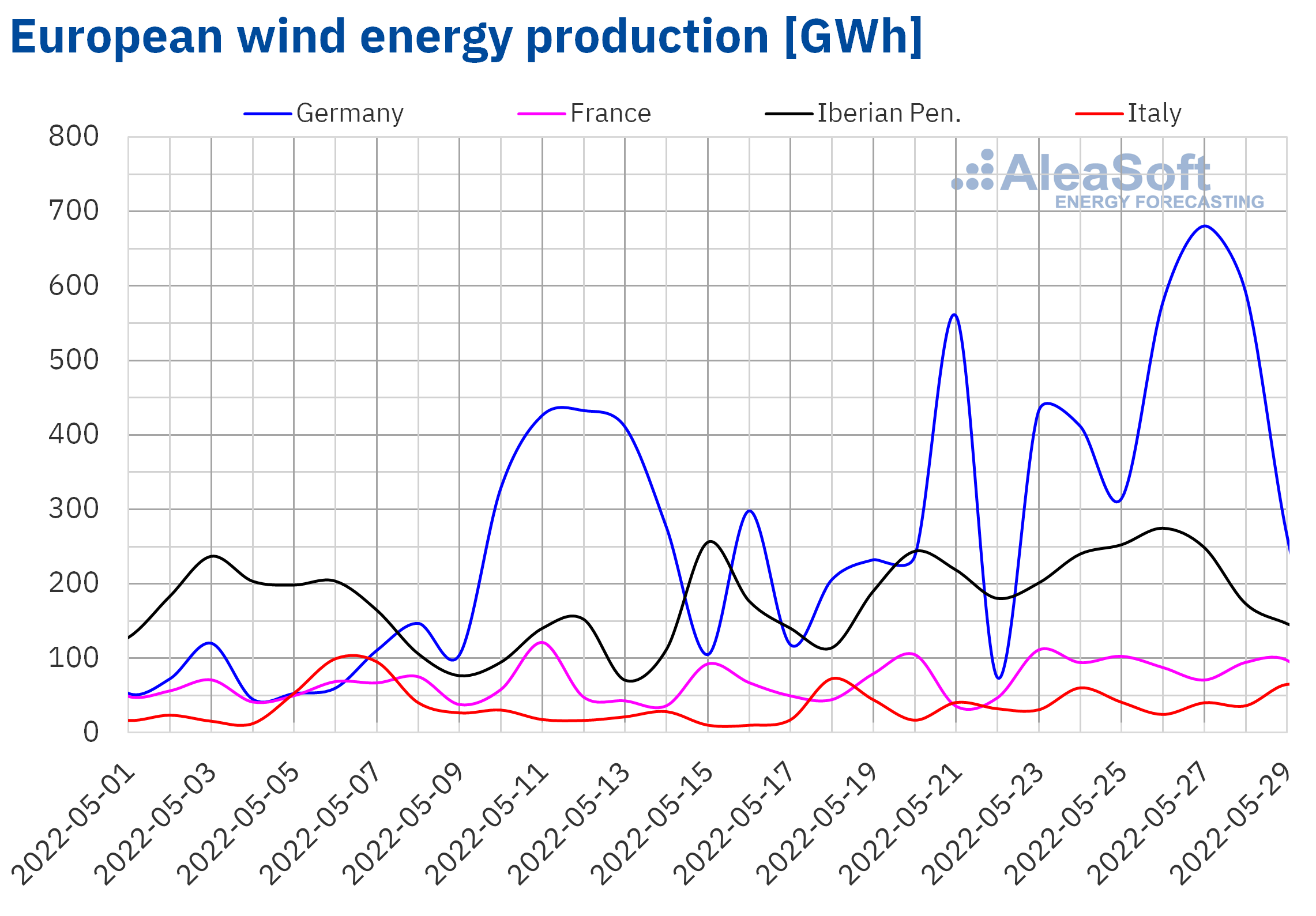

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

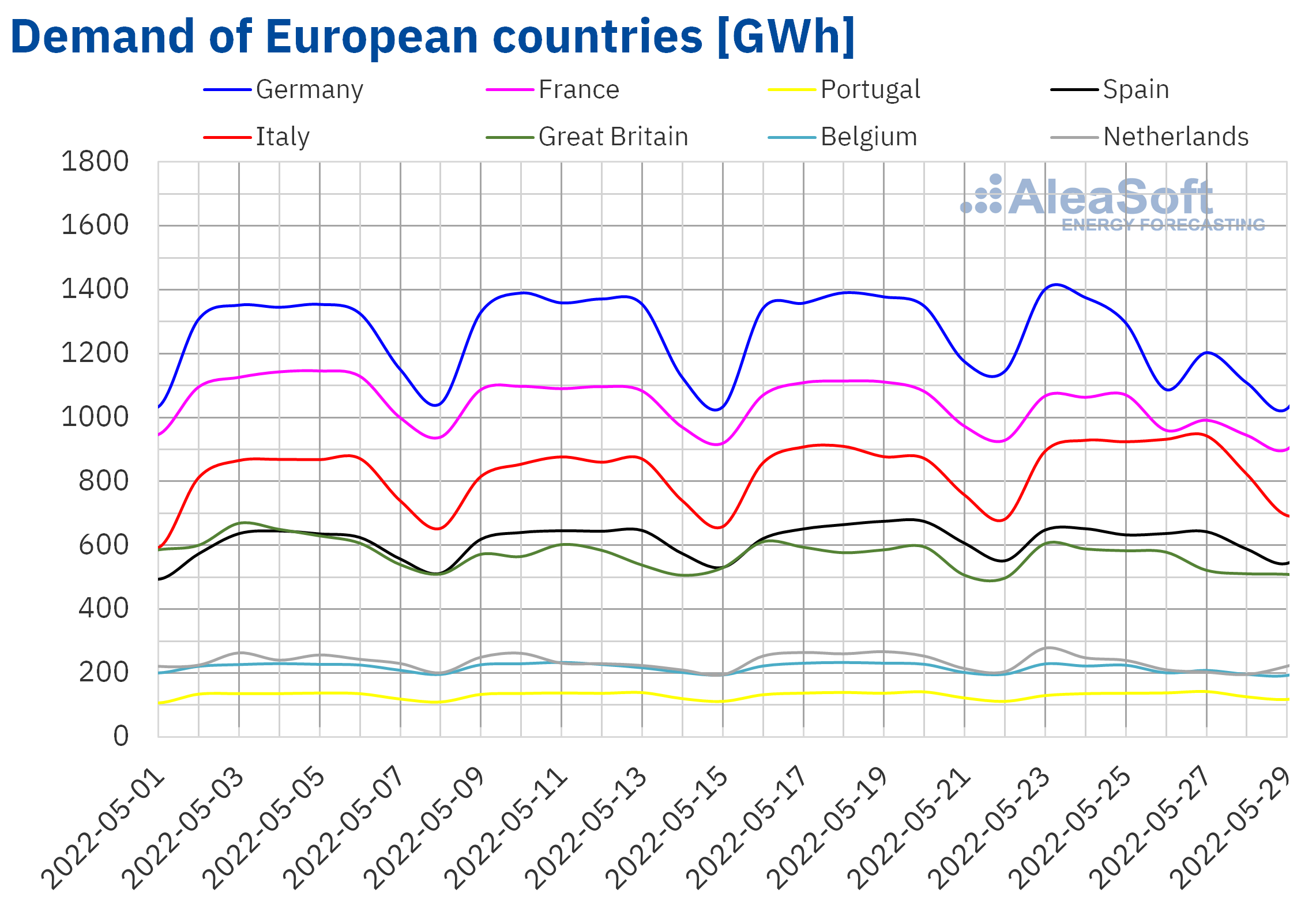

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

The fourth week of May ended with a general increase in wind energy production compared to the previous week, in the European markets analysed at AleaSoft Energy Forecasting. The largest increase was reached in the German market and was 90%. A considerable increase of 54% was also registered in the French market. In the rest of the analysed markets, the increases were between 21% and 27%.

For the week of May 30, the AleaSoft Energy Forecasting’s forecasts expect a decrease in wind energy production in all analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

In the fourth week of May, the average temperatures were less warm than those of the previous week in most European markets analysed at AleaSoft Energy Forecasting. This caused electricity demand to decrease in most markets. In Germany, France, Belgium and the Netherlands, Ascension Day was celebrated on Thursday, May 26, which also favoured the drop in demand in these markets. The decreases were between 1.8% of the United Kingdom and 7.0% of Germany and the Netherlands.

The markets in which the demand rose were those of Portugal and Italy, by 0.5% and 4.7%, respectively. Italy was the only analysed market in which the average temperatures of the fourth week of May increased compared to the previous week.

In the week of May 30, the electricity demand is expected to increase in most European markets, except in Italy and the United Kingdom, according to the AleaSoft Energy Forecasting’s forecasts.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In the week of May 23, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The exception was the N2EX market of the United Kingdom, with a 9.6% rise. On the other hand, the largest drop in prices was that of the Nord Pool market of the Nordic countries, of 56%, while the smallest decrease, of 5.2%, was that of the IPEX market of Italy. In the rest of the markets, the price decreases were between 8.1% of the MIBEL market of Portugal and 37% of the EPEX SPOT market of Germany.

In the fourth week of May, average prices were lower than €175/MWh in almost all analysed electricity markets. The exception was the Italian market with a weekly average of €217.27/MWh. On the other hand, the lowest weekly average, of €64.74/MWh, was registered in the Nord Pool market. In the rest of the markets, prices were between €119.49/MWh of the German market and €174.95/MWh of the Iberian market.

Regarding hourly prices, from May 26 to 28, negative prices were registered in several markets. In the Belgian market, in those three days, a total of seventeen hours with negative prices were registered. The lowest price was that of Friday, May 27, at 13:00, of ‑€88.56/MWh, the lowest value since April 24. In those days, fourteen hours with negative prices and one hour with a price equal to zero were registered in the German market. The lowest hourly price, of ‑€13.85/MWh, was reached on May 28 at 13:00 and it was the lowest since March 20. In the case of the Dutch market, there were also seventeen hours with negative prices on those days and one hour with a price equal to zero on May 27. The minimum price was that of Friday, May 27, at 13:00, of ‑€100.09/MWh, the lowest since April 24. Regarding the Nord Pool market, there were no negative hourly prices, but fourteen hours with prices below €2/MWh were registered from May 26 to 28. The lowest hourly price, of €1.13/MWh, was that of May 28 at 8:00, the lowest since October 2021.

During the week of May 23, the general increase in wind energy production and the decrease in gas prices compared to the previous week favoured the price drops in the European electricity markets. The decrease in demand in most markets also contributed to the drop in prices.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of May 30 the European electricity markets prices might increase influenced by the general decrease in wind energy production and the increase in demand in most markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Electricity futures

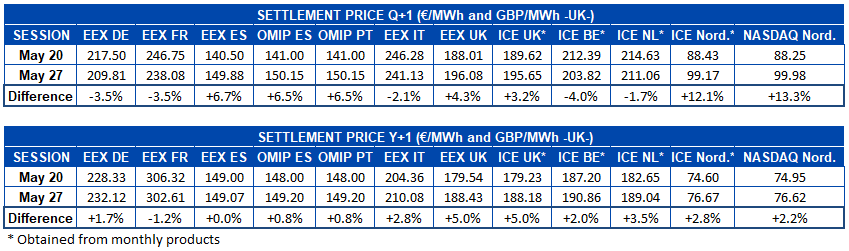

In the fourth week of May, electricity futures prices for the next quarter registered heterogeneous behaviours in the European markets analysed at AleaSoft Energy Forecasting. On the one hand, the settlement prices fell in the EEX market of Germany, France and Italy and in the ICE market of Belgium and the Netherlands in the session of May 27, compared to those of the session of May 20. The largest decrease in percentage terms was that of Belgium, with a 4.0% decrease. However, in absolute terms, where prices fell the most was in the EEX market of France, which settled on Friday, May 27, with a price €8.67/MWh below the settlement price of the previous Friday, May 20. On the other hand, in the EEX market of Spain and the United Kingdom, the OMIP market of Spain and Portugal, the ICE market of the United Kingdom and the Nordic countries and in the NASDAQ market also of the Nordic countries, prices rose in this same period of time. In this case, the largest increase, both in absolute and relative terms, was that registered in the NASDAQ market, with an increase of €11.73/MWh, which represents a rise of 13%.

As for electricity futures for the next year 2023, the behaviour of the European markets between the sessions of May 20 and 27 was more inclined to rise. Only the price in the EEX market of France reduced, with a decrease of 1.2%. In the EEX market of Spain, the price hardly changed, with an increase of €0.07/MWh and in the rest of the markets the increases were between 0.8% registered in the OMIP market for Spain and Portugal and the 5.0% rise that was registered in the EEX and ICE markets of the United Kingdom.

Brent, fuels and CO2

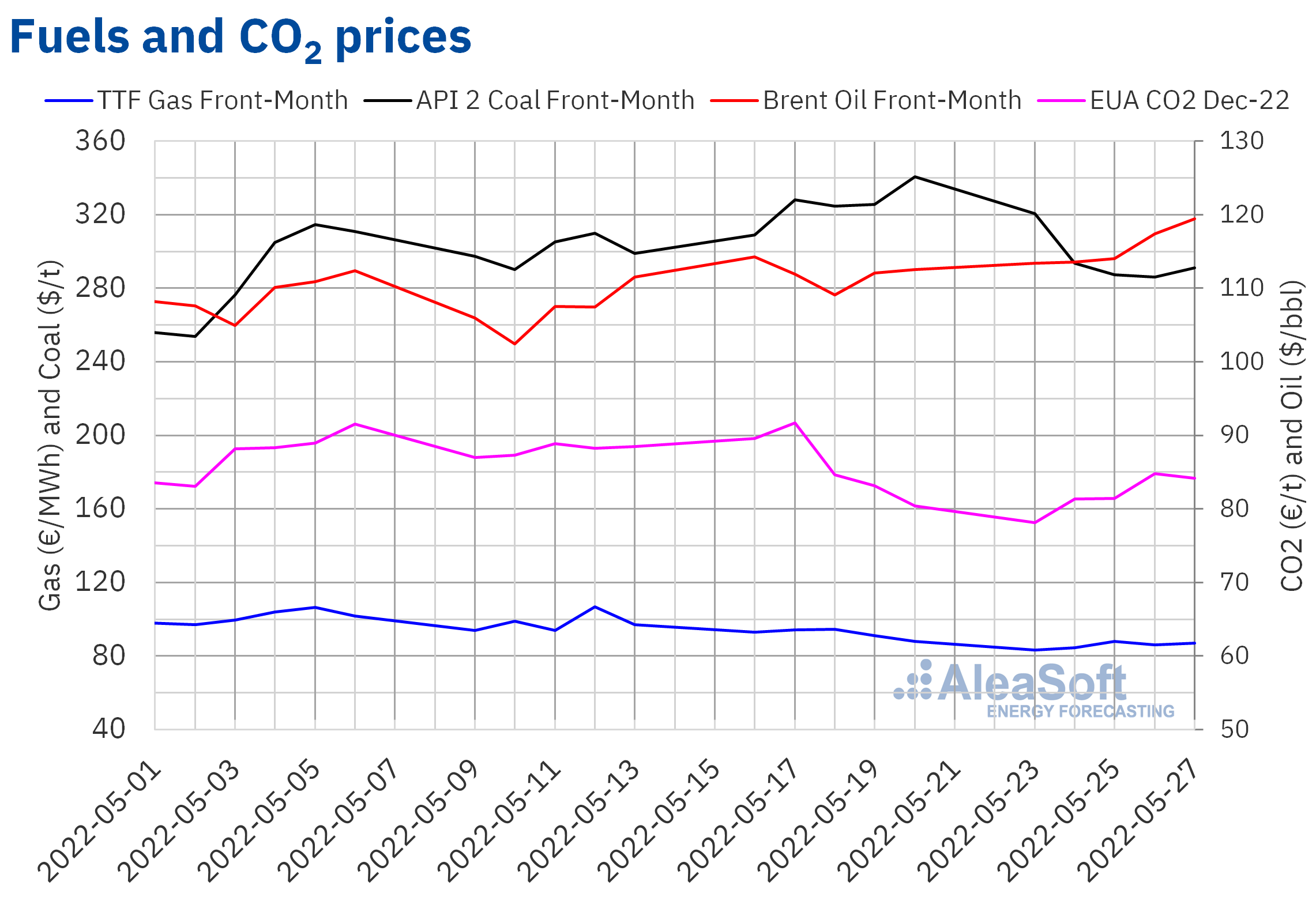

Settlement prices of Brent oil futures for the Front‑Month in the ICE market, during the fourth week of May, maintained an upward trend. As a result, on Friday, May 27, a settlement price of $119.43/bbl was reached. This price was 6.1% higher than that of the previous Friday and the highest since the end of March.

The evolution of the situation of the COVID‑19 pandemic in China and the possibility that the European Union agrees to sanctions on Russian oil contributed to the upward trend in prices and may continue to influence them in the coming days. On the other hand, the next OPEC+ meeting is scheduled for Thursday, June 2, which will also exert its influence on prices in the coming days.

As for settlement prices of TTF gas futures in the ICE market for the Front‑Month, the entire fourth week of May remained below €90/MWh. The minimum settlement price of the week, of €83.29/MWh, was registered on Monday, May 23. This price was 10% lower than that of the previous Monday and the lowest since February. Instead, the weekly maximum settlement price, of €88.08/MWh, was reached on Wednesday, May 25, but it was still 6.8% lower than that of the previous Wednesday.

The levels of gas supplies allowed prices to decline in the fourth week of May. However, the European Union is preparing contingency plans in the event of a total interruption of gas supply from Russia.

Regarding CO2 emission rights futures prices in the EEX market for the reference contract of December 2022, they began the fourth week of May with a settlement price of €78.15/t. This price was 13% lower than that of the previous Monday and the lowest since the first half of April. Subsequently, prices increased until reaching the weekly maximum settlement price, of €84.76/t, on Thursday, May 26, which was 1.9% higher than that of the previous Thursday.

In the next week of June 6, the European Parliament has to debate various proposals for the reform of this market. The news published on this subject may exert its influence on the evolution of prices.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

Next week, on June 9, a new edition of the AleaSoft Energy Forecasting’s monthly webinars will be held, in which the evolution and prospects of the European energy markets are analysed. On this occasion, invited speakers from Engie Spain will participate again, who will contribute their first‑hand knowledge and experience in the renewable energy projects financing and PPA and in the regulatory novelties of the Spanish electricity sector.

The Governments of Spain and Portugal are waiting for the European Union’s approval to launch the temporary mechanism for adjusting production costs to reduce the electricity price in the MIBEL wholesale market, established in the Royal Decree‑law 10/2022. This measure is one of the most important regulatory changes in recent years in the energy markets, and during the webinar its impact on the markets and companies of the sector will be analysed. AleaGreen’s long‑term price curves forecasts already include the effect of this mechanism on prices and their hourly granularity. These hourly forecasts are necessary for PPA, renewable energy assets valuation, cogeneration and for the development of batteries.

Source: AleaSoft Energy Forecasting.