AleaSoft, September 10, 2020. In the second week of September, the prices of the main European electricity markets fell due to the increase in wind energy production compared to the first week of the month, although they remained above €40/MWh in general. Other factors that favoured this decline were the falls in the Brent oil, TTF gas and CO2 prices. However, a lower wind energy production is expected in the third week of September, so the prices will recover again.

Photovoltaic and solar thermal energy production and wind energy production

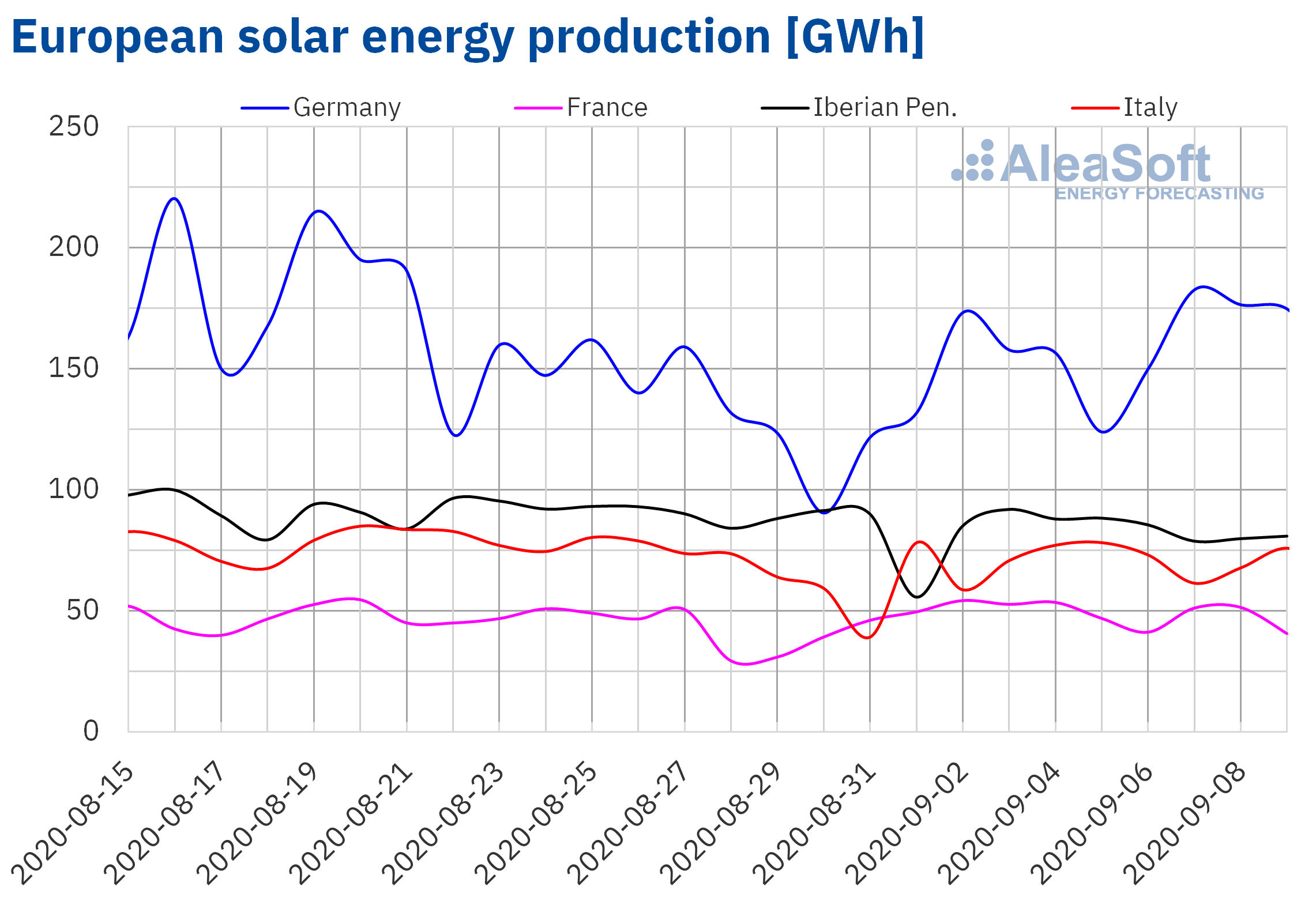

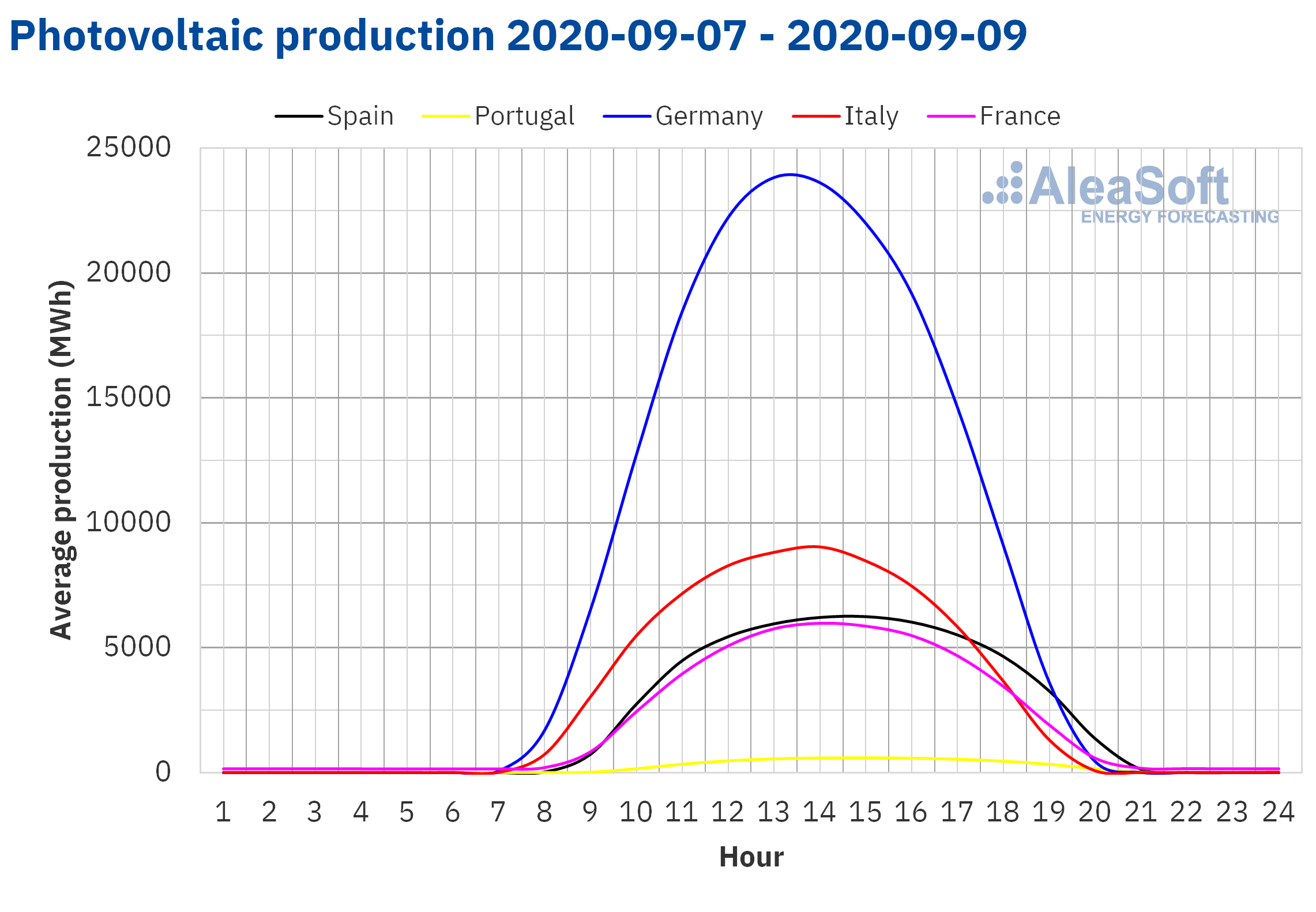

The solar energy production of the first three days of the week that began on Monday, September 7, increased by 23% in the German market compared to the average of the previous week. In the rest of the markets analysed at AleaSoft, the production decreased between 4.5% and 2.6%, except in the Italian market, which registered a variation of 0.7%.

Despite the decline in production registered at the beginning of the week, during the first nine days of September the production increased in all the markets analysed at AleaSoft compared to the same days of 2019. In the Iberian Peninsula, the production increased by 53%, while in the markets of Italy, Germany and France it increased between 16% and 23%.

At the end of the week, the analysis carried out at AleaSoft indicates that the solar energy production in the Italian market will end up being lower than that of the previous week, while on the contrary an increase is expected in the German market.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

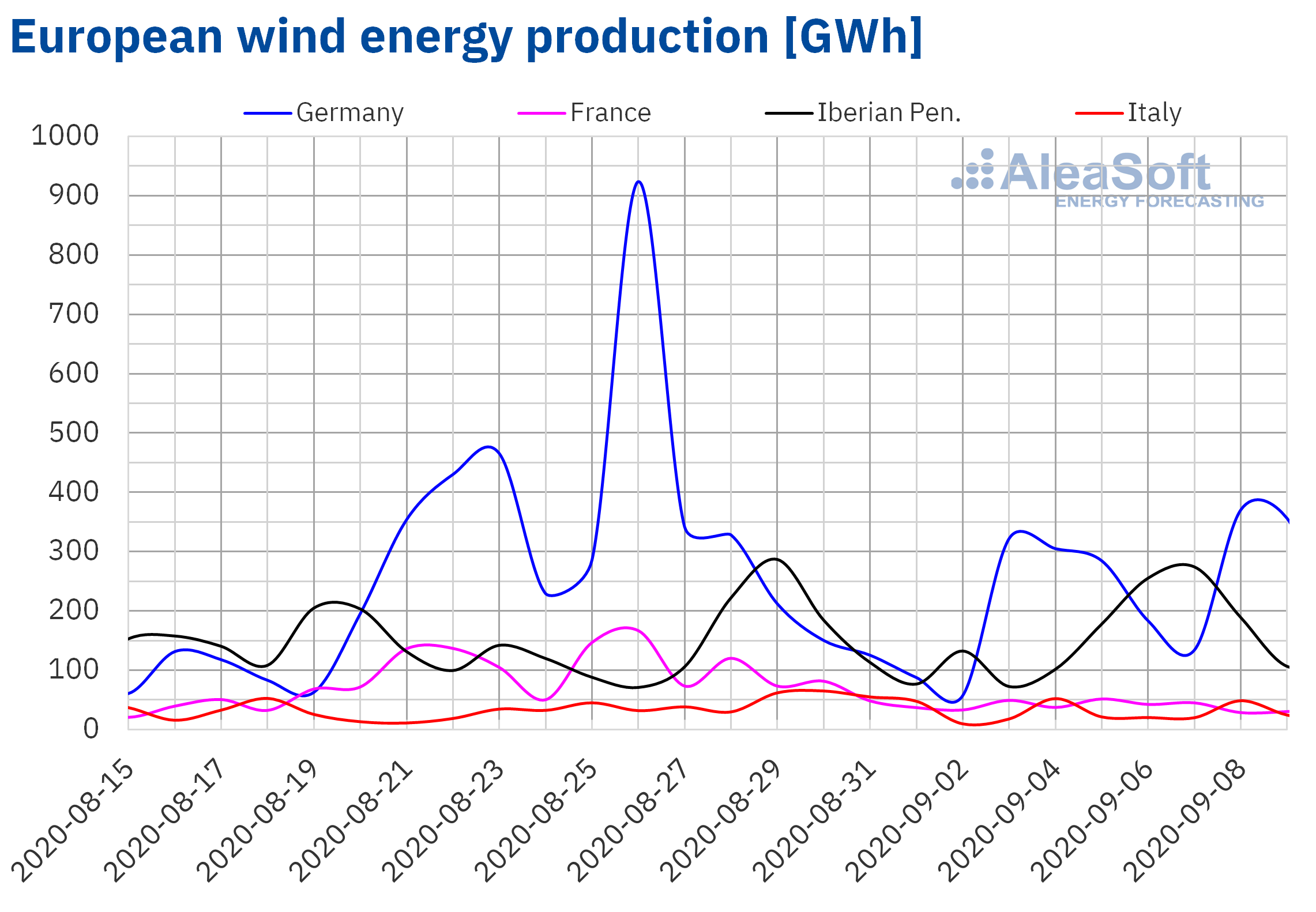

The wind energy production of the first three days of the second week of September increased by 47% in the German market and by 43% in the Iberian Peninsula compared to the average of the week of August 31. On the contrary, in the French market it decreased by 19% while in the Italian market it decreased by 3.1%.

In the year‑on‑year analysis, during the first nine days of September, the production with this technology decreased in most markets between 17% and 31%. The exception was the German market where an increase of 3.5% was registered during this period.

For the end of the week, the AleaSoft‘s analysis indicates that the total wind energy production will be lower than that of the previous week in France and Italy, while on the contrary, an increase is expected in the Iberian Peninsula and Germany.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

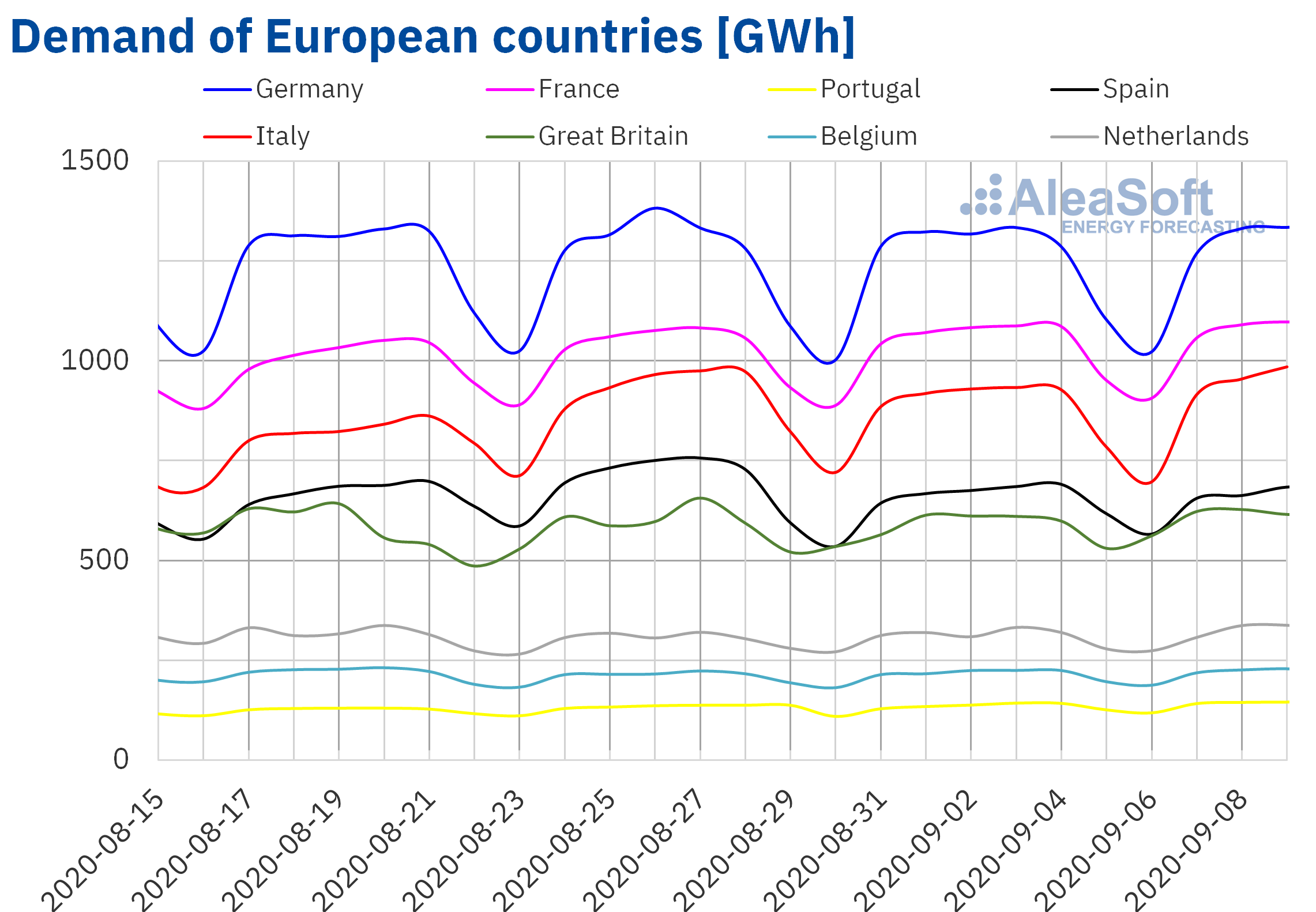

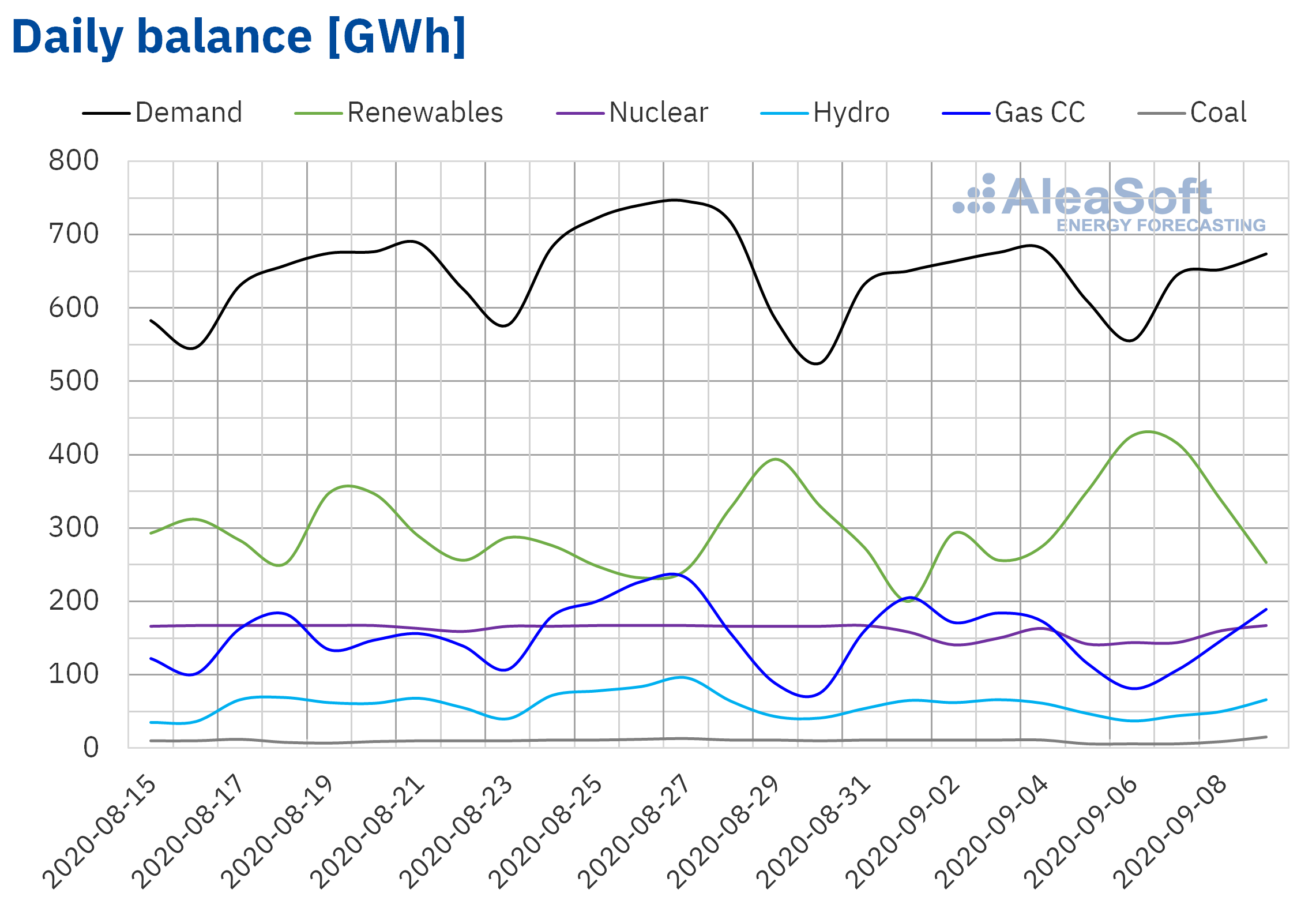

Electricity demand

The electricity demand increased in all the analysed electricity markets from Monday to Wednesday of the week of September 7 compared to the same period of the previous week. This generalised recovery, which began the previous week due to the increase in labour activity in early September, was also influenced by warmer average temperatures. The markets of Portugal, Italy and Great Britain stood out due to the increases of 7.8%, 4.5% and 4.2% respectively. On the other hand, in Belgium and France the increases were 2.8% and 1.5%. In Germany, the demand registered values similar to those of the previous week, with an increase of only 0.2%.

To analyse the evolution of the demand in more detail, at AleaSoft the electricity markets observatories are available with daily updated data from the most important markets in Europe.

At AleaSoft, the current behaviour of the demand in the different European markets is expected to continue at the end of the second week of September.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

The variation in electricity demand in Mainland Spain was 0.8% from Monday to Wednesday of the week of September 7 compared to the previous week. The increase in average temperatures of 0.6 °C favoured this rise partially. The AleaSoft‘s demand forecasting indicates that at the end of the week the total demand will conclude slightly below that registered in the week of August 31.

The average solar energy production in Mainland Spain, which includes both the photovoltaic and solar thermal technologies, decreased by 4.5% between Monday, September 7, and Wednesday, September 9, compared to the average of the first week of September. During the first nine days of September there was an increase in production with these technologies of 55% compared to the first nine days of September 2019. The total solar energy production of the second week of September will be lower than that registered the previous week according to the analysis carried out at AleaSoft.

The average level of the wind energy production in Mainland Spain for the first three days of the week that began on Monday, September 7, increased by 37% compared to the average of the previous week. In the year‑on‑year analysis, the production registered between the first day of September and the 9th of the month decreased by 17%. According to the analysis carried out at AleaSoft, for the week that began on September 7, it is expected that the total production with this technology will be higher than that registered the previous week.

After the reconnection to the grid of the Vandellós II nuclear power plant, which registered a forced shutdown on Tuesday, September 2, the nuclear energy production gradually recovered until at dawn of Saturday, September 5, the Ascó I nuclear power plant notified to the Nuclear Safety Council (CSN) an unscheduled stop to carry out the replacement of one of the safety valves in the suction of the waste heat evacuation pump of train A, according to the report of the CSN. The CSN classified the incident as level 0 on the International Nuclear and Radiological Events Scale (INES). Since Wednesday, September 9, all the plants were operating, and the nuclear energy production recovered to a level close to 167 GWh per day.

Source: Prepared by AleaSoft using data from REE.

Source: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 11 363 GWh stored, according to data from the Hydrological Bulletin of the Ministry for Ecological Transition and Demographic Challenge number 36, which represents a decrease of 363 GWh compared to bulletin number 35.

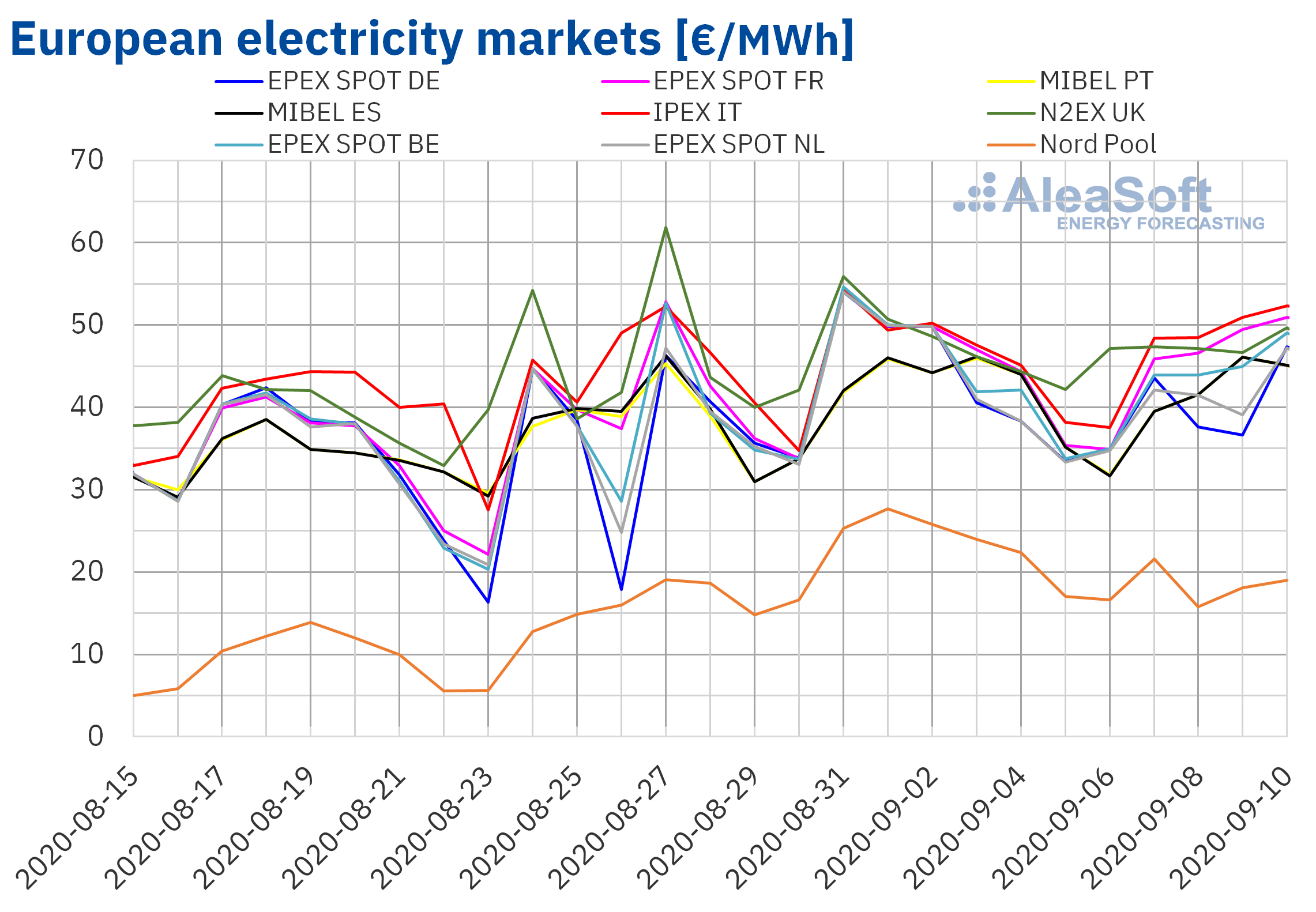

European electricity markets

In the first four days of the week of September 7, the prices fell in all the European electricity markets analysed at AleaSoft compared to the same period of the previous week. The largest price drop, 28%, was in the Nord Pool market of the Nordic countries, followed by a 15% decline in the EPEX SPOT market of Germany. On the other hand, the IPEX market of Italy had the smallest price drop, 0.7%. In the rest of the markets, the price decreases were between 3.1% of the MIBEL market of Portugal and 13% of the EPEX SPOT market of the Netherlands.

Despite the decreases, the average price for the first four days of the second week of September exceeded €40/MWh in almost all the analysed European markets, except in the Nord Pool market. The lowest average price of this period was registered in this market, of €18.62/MWh. In contrast, the highest average, €50.02/MWh, was that of the Italian market, followed by that of the French market, of €48.21/MWh. The rest of the electricity markets had average prices between €41.28/MWh in the German market and €47.70/MWh in the N2EX market of Great Britain. During the first four days of the week of September 7, the markets were less coupled than during the same period of the previous week. The market whose performance was the most distant from the rest was the Nord Pool market, with an average more than €20/MWh lower than the rest of the markets.

As for the daily prices, the first four days of the second week of September, they remained above €35/MWh in almost all European electricity markets. The exception was the Nord Pool market. In this market, the daily prices were between €15.80/MWh on Tuesday, September 8, and €21.59/MWh on Monday, September 7.

On the other hand, the highest daily price of the period was registered by the Italian market on September 10, which was €52.31/MWh.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The price drops of the first days of the week of September 7 were favoured by a significant increase in wind energy production in countries such as Germany, Spain or Portugal. Increasing solar energy production in the Iberian Peninsula, Italy and Germany also contributed to the declines.

The AleaSoft’s price forecasting indicates that the first four days of the week of September 14, the prices of the European electricity markets will be, in general, higher than those of the same period of the second week of September. The decline in renewable energy production in most markets will favour these price increases.

Iberian market

In the MIBEL market of Spain and Portugal, the average price of the first four days of the week of September 7 decreased compared to the same period of the previous week. The fall was 3.1% in Portugal and 3.4% in Spain. These were the second and third smallest price changes in the European markets, after that of the IPEX market. Due to these decreases, the average price from September 7 to 10 was €43.06/MWh both in the Portuguese market and in the Spanish market.

On the other hand, the first four days of the second week of September, there was a 100% coupling in the markets of Spain and Portugal. On Monday, September 7, the lowest daily price was reached, of €39.53/MWh. The rest of the days of the period considered, the prices exceeded €40/MWh. The highest daily price, €46.08/MWh, was that of September 9.

During the first days of the second week of September, the increase in renewable energy production, mainly wind energy, in the Iberian Peninsula favoured the decline in prices in the MIBEL market.

However, AleaSoft‘s price forecasting indicates that the average price for the first four days of the week of September 14 will increase, influenced by a drop in wind and solar energy production in the Iberian Peninsula.

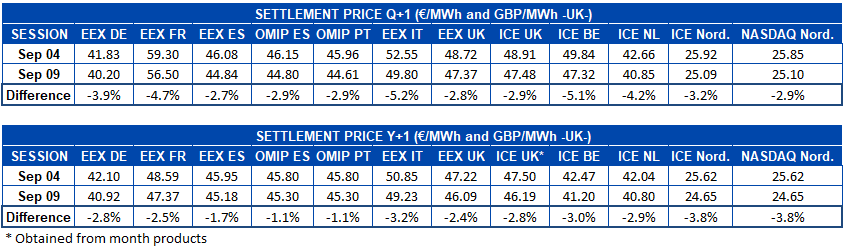

Electricity futures

In the days of the week of September 7, the European electricity futures markets registered a general drop in prices for Q4-20. The decreases in settlement prices on Wednesday, September 9, compared to Friday, September 4, were in the range of 2.7% to 5.2%. The EEX market of Spain was the one with the smallest decline, closely followed by the OMIP market of Spain and Portugal with a 2.9% decrease, a position it shares with the NASDAQ market of the Nordic countries. On the other hand, the EEX market in Italy was the one with the greatest decrease, 5.2%, also closely followed by the ICE market of Belgium with a difference of -5.1% compared to the settlement price of the trading session of September 4.

The drop in prices was also present in the product of next year 2021. In this case with slightly lower values, which were between 1.1% and 3.8% decrease. Also, in this case, the Iberian region was the one with the least change. However, the Nordic countries, both in the NASDAQ and in the ICE markets, led the greatest drop for this product. Although, as usual, this prominence in the percentage variation is based on its low prices. If the absolute decreases are taken into account, the market with the greatest decrease was the ICE of Great Britain with a difference of €1.31/MWh, but in this case it is an estimate based on monthly products, since in that market British annual products are not traded. The next greatest decrease was that of the Belgian pole of the ICE market itself, with a decrease of €1.27/MWh.

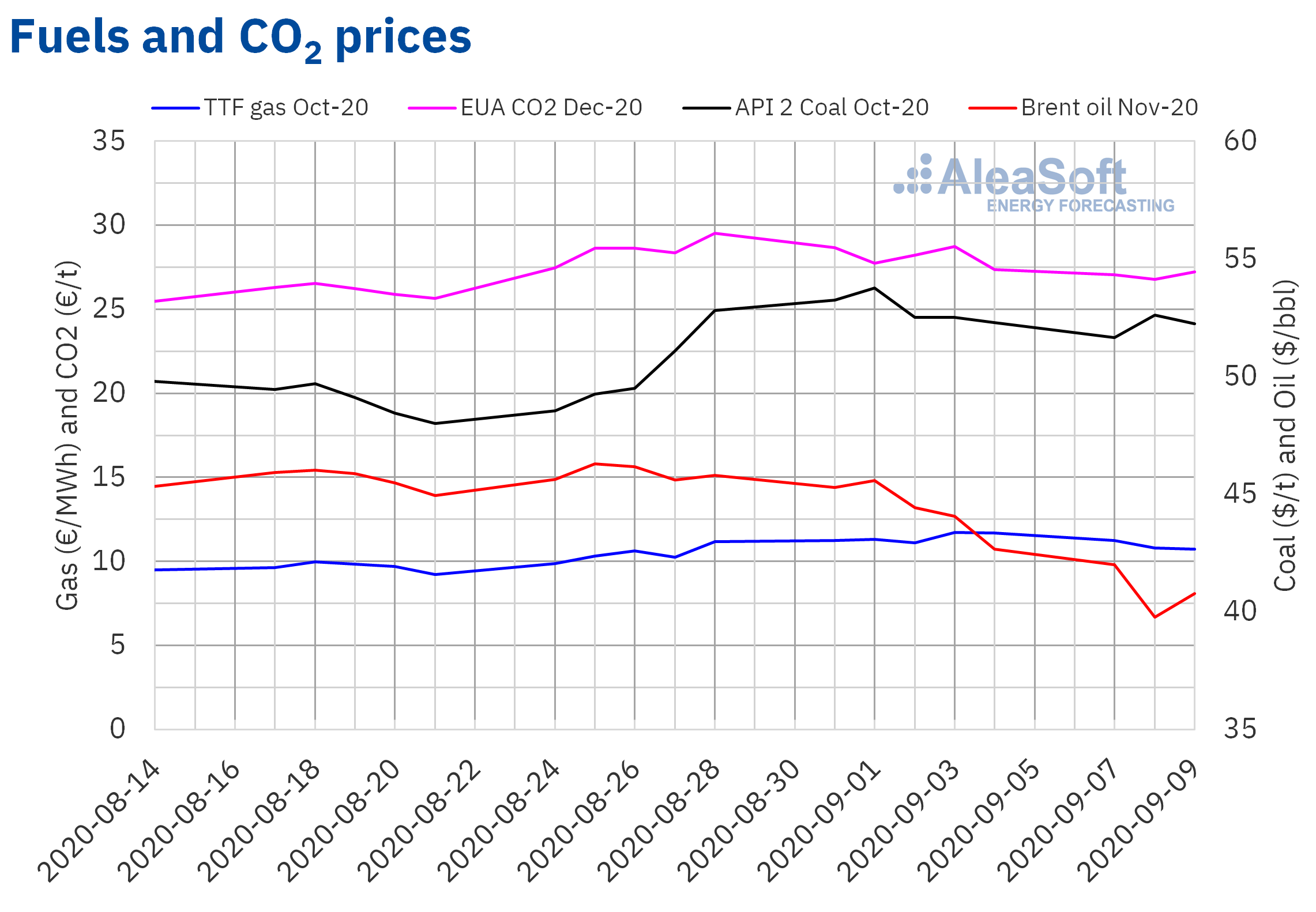

Brent, fuels and CO2

The Brent oil futures prices for the month of November 2020 in the ICE market began the second week of September with decreases. On Tuesday, September 8, a settlement price of $39.78/bbl was registered. This price was 13% lower than the previous Tuesday, September 1, and the lowest since the first half of June. On Wednesday, September 9, there was a 2.5% recovery until reaching a settlement price of $40.79/bbl. But this value was still 8.2% lower than on the same day of the previous week.

In a context in which the OPEC+ reduced its production cuts and in which the reserve levels are still high, the concerns about the evolution of the demand continue to exert its downward influence on the Brent oil futures prices. In this sense, the US Energy Information Administration published its latest forecasts on global oil consumption on Wednesday, September 9, which are lower than those made in August.

On the other hand, the TTF gas futures prices in the ICE market for the month of October 2020, the first three days of the second week of September, registered decreases. On Monday, September 7, the settlement price was €11.23/MWh. But the following days the prices were already below €11/MWh. The settlement price on Wednesday, September 9, was €10.73/MWh, 3.4% lower than the previous Wednesday.

Regarding the TTF gas prices in the spot market, on Monday, September 7, they reached an index price of €11.58/MWh, the highest since the first fortnight of January. However, the following days, the prices fell to an index price of €10.78/MWh on Thursday, September 10.

As for the API 2 coal futures prices in the ICE market for the month of October 2020, after remaining above $52/t during the week of August 31, on Monday, September 7, they registered a settlement price of $51.65/t. But on Tuesday there was a 1.8% recovery and a settlement price of $52.60/t was reached. On Wednesday, September 9, despite a slight drop of 0.7%, the settlement price remained above $52/t, specifically at $52.25/t.

Regarding the CO2 emission rights futures in the EEX market for the reference contract of December 2020, the first three days of the second week of September, had lower settlement prices than those of the same days of the previous week. The prices oscillated around €27/t and reached their lowest value for this period, €26.79/t, on Tuesday, September 8.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the energy markets recovery at the end of the economic crisis

Next Thursday, September 17, the first part of the series of webinars being organised at AleaSoft on “Energy markets in the recovery from the economic crisis” will take place. At this meeting, an analysis on the evolution of the energy markets and the renewable energy projects financing, once the most critical part of the pandemic, in which containment measures were implemented at a global level, was overcome, will be carried out. In addition, the perspectives in the medium and long term will be analysed, taking into account the outbreaks that are taking place and the uncertainty generated by the beginning of the in-person academic year and the upcoming arrival of autumn in the northern hemisphere. Another topic that will be discussed is the importance of the forecasting in portfolio valuation and audits. In this series of webinars there will be speakers from Deloitte, Engie, Banco Sabadell and AleaSoft. On the other hand, the second part of the series is already being organised, which will take place on October 29.

During the most critical part of the pandemic, AleaSoft held a series of webinars “Influence of coronavirus on electricity demand and the European electricity markets” in which it was commented that the impact of the pandemic on European electricity markets it would be more noticeable in the short- and mid-term, while in the long term the market equilibrium would be maintained with few variations. At AleaSoft, the short-, mid- and long-term price curves are periodically updated taking into account the economic evolution as well as the scenarios of the exit from the coronacrisis.

The monitoring of the main European electricity, fuel and CO2 markets can be carried out in the markets observatories available on the AleaSoft website. This tool includes comparative charts with hourly, daily and weekly data for the main market variables.

Source: AleaSoft Energy Forecasting.