AleaSoft, December 9, 2020. A few weeks before the end of the year, it can already be assured that 2020 has been an exceptional year. If something marked this year it was, without a doubt, COVID‑19 and the global crisis that it brought. The prices and the demands in the energy markets plunged at the end of the first quarter. But, on the other hand, the renewable energies continued on their way, with more and more photovoltaic and wind energy plants, producing more and more energy and meeting a greater demand.

The electricity markets prices

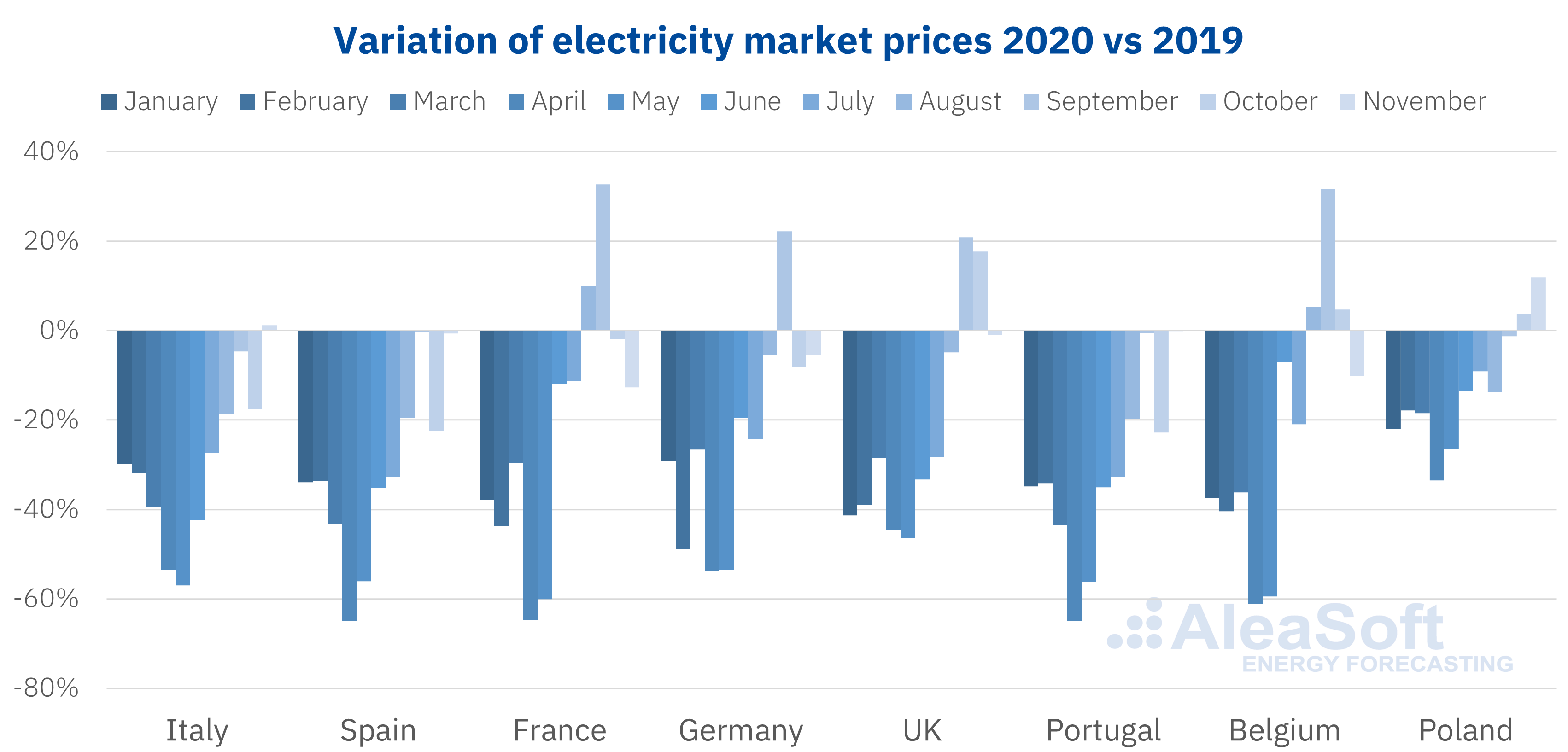

The Spanish MIBEL electricity market will end the year with an average price of around €33.50/MWh, the lowest price since 2004, sixteen years ago, before the creation of the Iberian MIBEL market in 2007. The average price in April fell to €17.65/MWh, a 65% drop compared to April 2019. Such a low monthly average was not registered since February 2014 and previously since March 2001. Outside of these three occasions, it was never registered a month with such a low price in the twenty‑three year history of the electricity market in Spain.

The highest hourly price of this 2020 is, to date, €62.57/MWh that was registered on December 3 between 8 and 9 in the morning. The lowest price, of €1.02/MWh, took place on May 1, a holiday in the confinement during the first wave of COVID‑19 that undoubtedly led to a low price and demand. There were also prices below €2/MWh in October and December.

In the French EPEX SPOT market, the year‑on‑year drop in prices stood at 65% in April and 60% in May. In the global of 2020, the price will be around €31.50/MWh and, as in the Spanish market, it will be the lowest yearly price since 2004. For the German EPEX SPOT market, the fall will be less historical. The yearly average will be around €30/MWh and will surely not fall below €28.98/MWh of 2016. In the case of the Italian IPEX market, the average price for 2020 will be around €38/MWh, which, compared to €52.32/MWh of 2019, represents a drop of about 30%.

Source: Prepared by AleaSoft using data from GME, OMIE, EPEX SPOT, N2EX and POLPX.

Source: Prepared by AleaSoft using data from GME, OMIE, EPEX SPOT, N2EX and POLPX.

The drop in electricity demand

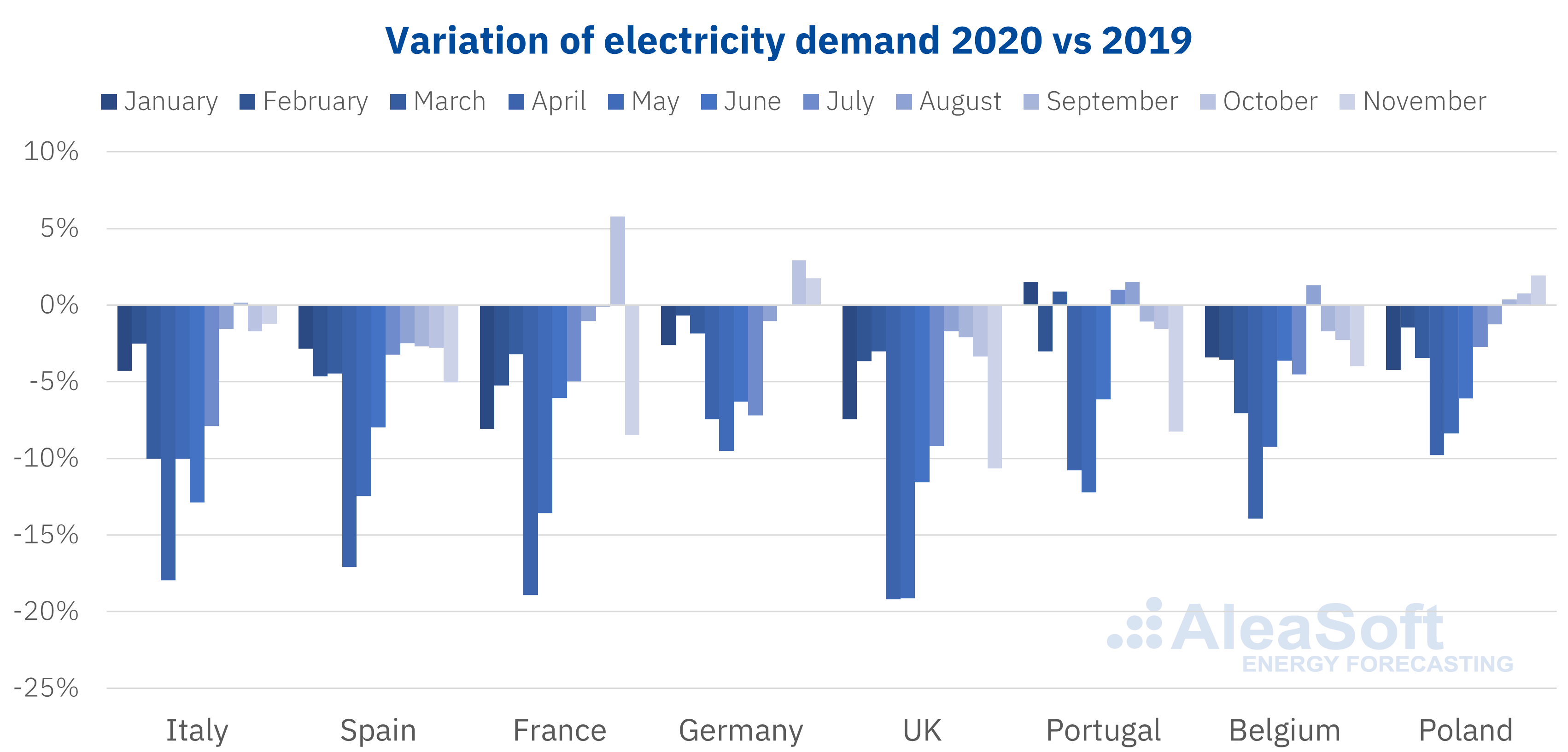

In addition to the prices, the demand was also clearly affected by the crisis caused by COVID‑19. The fall in electricity demand during the months of April and May brought it to the levels of almost two decades ago in some countries. In Spain, the demand fell by 17% in April compared to the previous April, in Italy it reached 18% and in France up to 19%. In Germany, with less severe measures of confinement and restriction of the economic activity, the fall in April was 7% and in May it did not exceed 10%.

Overall for the year, the demand will fall by around 5% in Spain, the most important drop in recent decades, even greater than in the last crisis in 2009, which was 4.5%. Similarly, in Italy the fall will be close to 6%, while in 2009 it was 4.1%. In France, the fall will exceed 6%, while in Germany it will not reach 3%.

Source: Prepared by AleaSoft using data from TERNA, REE, RTE, ENTSO-E, National Grid, REN and ELIA.

Source: Prepared by AleaSoft using data from TERNA, REE, RTE, ENTSO-E, National Grid, REN and ELIA.

The unstoppable rise of the renewable energy

If something surprised during 2020, it was how the renewable capacity in Europe continued to increase, apparently unaffected by the crisis in which the global economy was submerged. Until October, the photovoltaic capacity installed in Mainland Spain increased by 17%, exceeding 10 GW installed. The growth of the wind capacity to the same date was 4% with more than 26 GW installed in the peninsular territory.

The fall in demand due to COVID‑19 led to an increase in demand coverage by the renewable energies. During the afternoon of Sunday, May 3, the solar energy, both photovoltaic and solar thermal energy, got to meet 37% of the peninsular demand.

The wind energy production will increase by about 14% in France this year 2020, a notable growth, but the lowest in the last four years. The same situation occurs in Germany, where the wind energy generation will increase around 4%, but it will be far from the growth of recent years that reached 33% in 2017. But this is not the case of the German photovoltaic energy, which this year will have an increase in production of 15%, well above the 3% registered the previous year. In Italy, the photovoltaic energy production will increase by around 17% this year, while the wind energy will fall by around 7%.

Analysis of the evolution of the energy markets in Europe

Detailed analyses of the evolution of the energy markets in Europe with those keys that allow having a vision of the past and, above all, of the future of the European energy system and that provide knowledge, intelligence and opportunities are available in a set of reports for the energy sector of AleaSoft .

At AleaSoft webinars that provide information and useful knowledge to the professionals in the energy sector are also organised. The next webinar is scheduled for January 14 and will feature the participation of speakers from the consulting firm PwC Spain, to analyse the vision of the PPA contracts market for large consumers, its impacts and requirements, and the need for future electricity market prices estimates.

Source: AleaSoft Energy Forecasting.