AleaSoft Energy Forecasting, May 2, 2024. In April, prices fell in the main European electricity markets. Most of them registered their lowest monthly prices since at least June 2021. In the case of the Iberian market, April prices were the lowest in the market’s history. Photovoltaic energy production was the highest for an April month in general, while wind energy fell compared to March in most markets. Electricity demand fell in all markets compared to the previous month.

Solar photovoltaic, solar thermoelectric and wind energy production

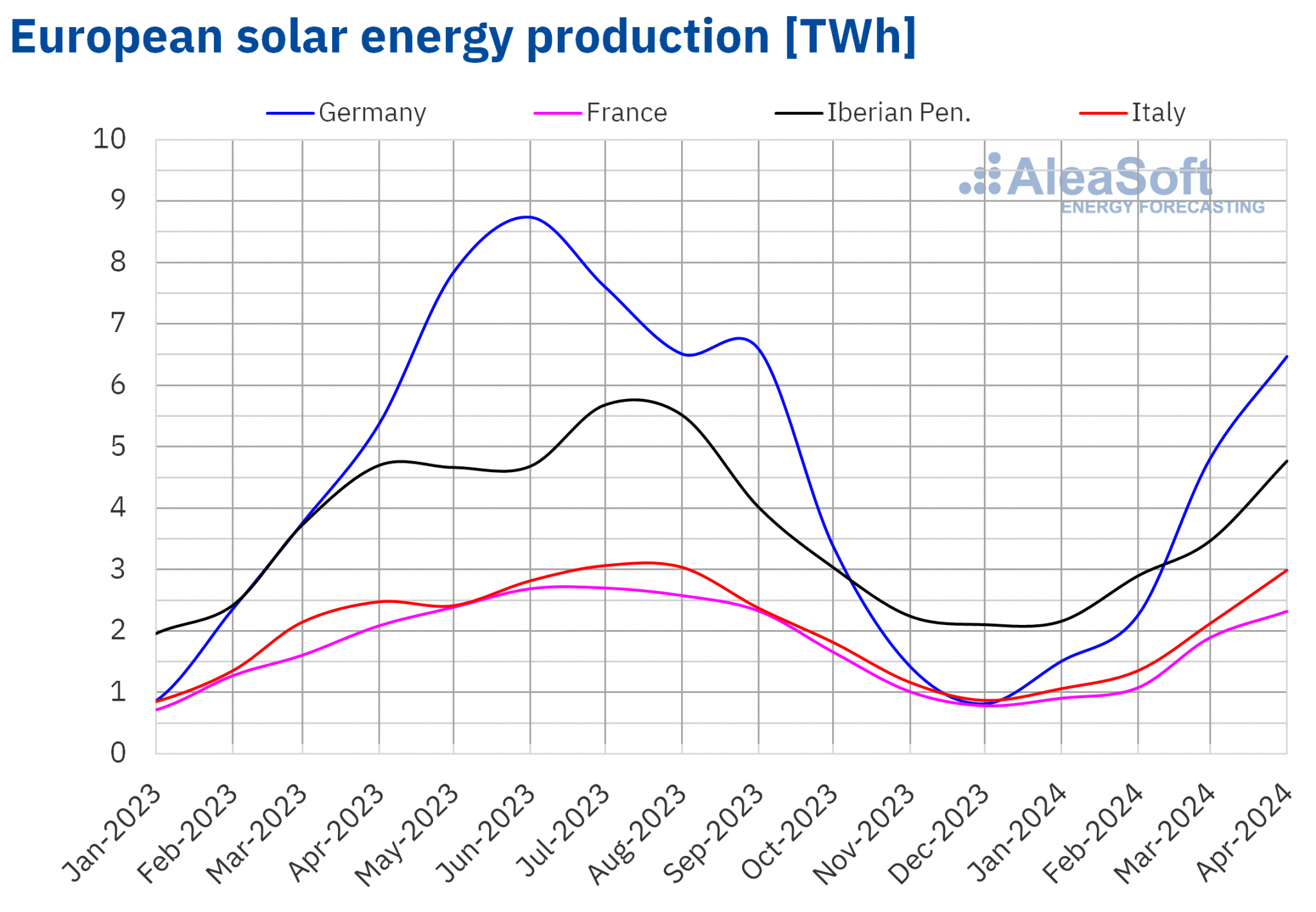

In April 2024, solar energy production increased in the main European electricity markets compared to the same month in 2023. The Italian market registered the largest increase, which was 21%. In the German, Portuguese and French markets, the rises were 20%, 15% and 11%, respectively. The Spanish market, which includes solar photovoltaic energy production and solar thermoelectric energy production, registered the smallest increase, 0.3%.

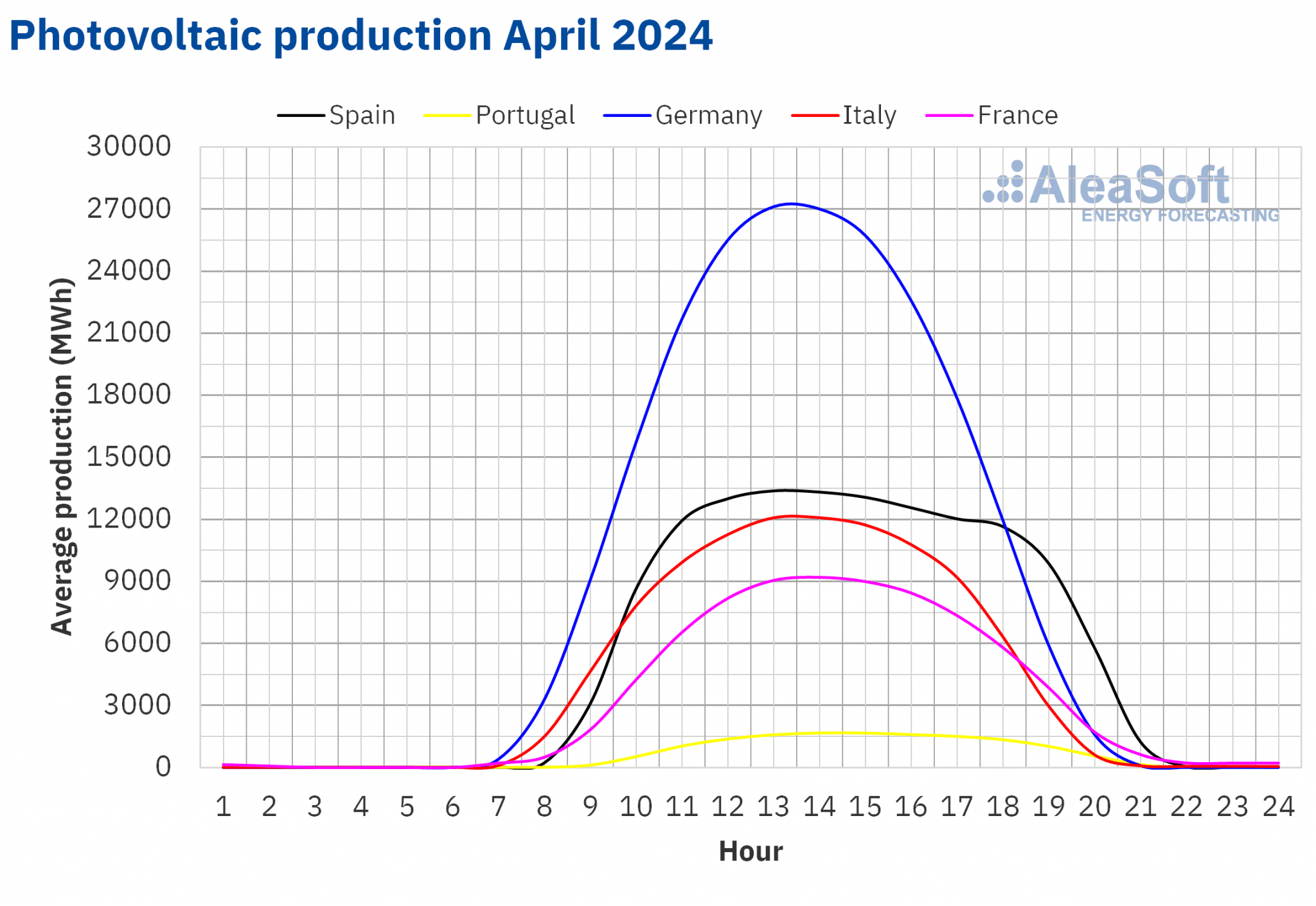

In April 2024, the analyzed European electricity markets broke historical records for photovoltaic energy production compared to the same month in previous years. The German and Spanish markets had the highest generation, 6468 GWh and 3874 GWh, respectively. The Italian market generated 2993 GWh, the French market 2321 GWh and the Portuguese market 419 GWh. The increase in installed capacity over the last twelve months led to the year‑on‑year increases in photovoltaic energy production. According to Red Eléctrica data, between April 2023 and April 2024, in Mainland Spain, the photovoltaic capacity increased by 4571 MW. During the same period, the Portuguese market added 923 MW of this technology to the system. RTE of France reported an increase in its installed capacity of 3052 MW between April 2023 and March 2024.

April solar energy production was also higher than in March in all markets analyzed at AleaSoft Energy Forecasting, corresponding to the increase in solar radiation. In this case, increases ranged from 27% in the French market to 46% in the Italian market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

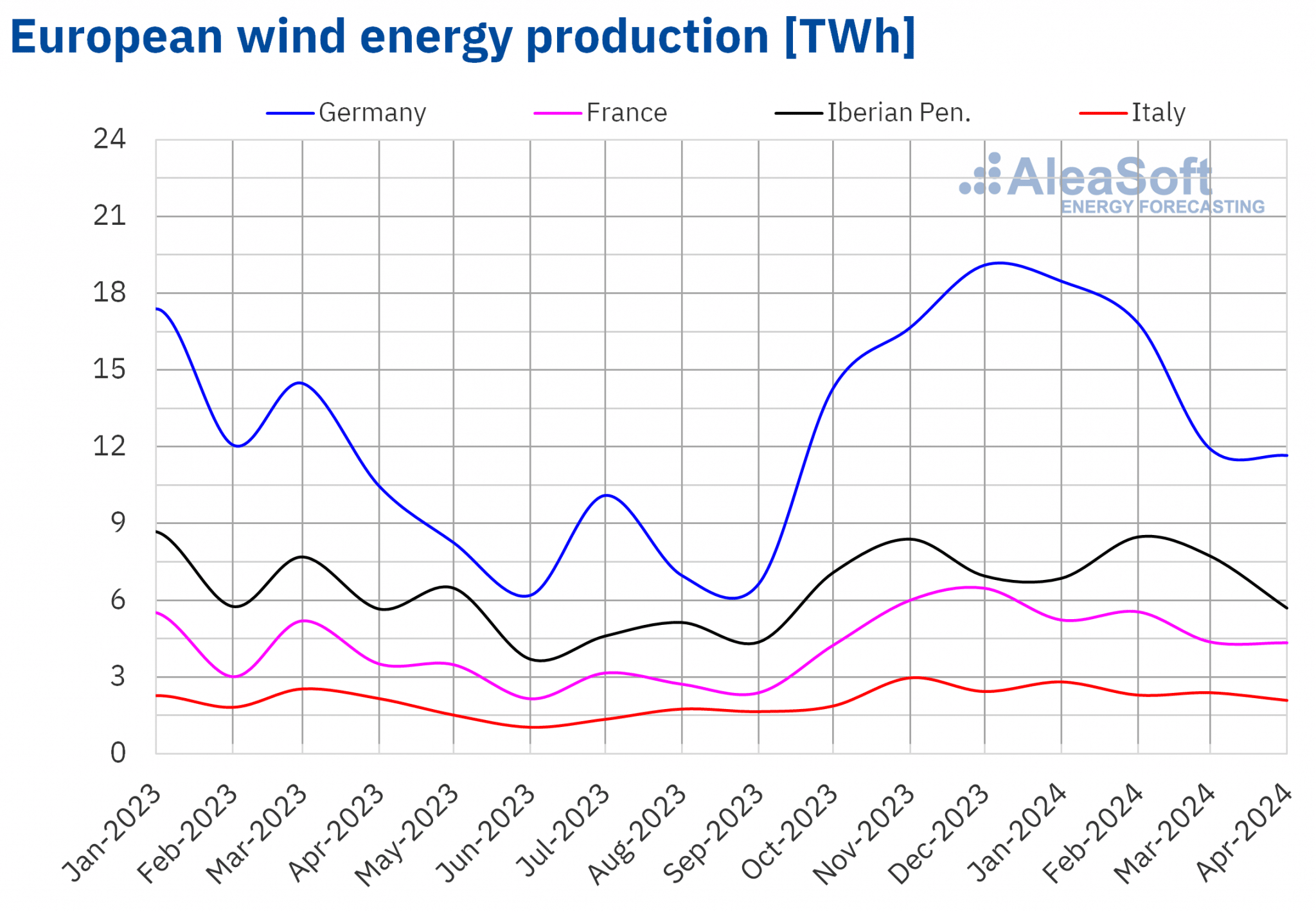

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Wind energy production increased year‑on‑year in most major European electricity markets in April 2024. The Portuguese market registered the largest increase, 33%. In France and Germany, increases were 23% and 11%, respectively. On the other hand, the Spanish and Italian markets registered decreases compared to the same period in 2023. In Spain, the decline was 5.2%, while in Italy it was 3.3%.

According to data from Red Eléctrica, between April 2023 and April 2024, 620 MW of wind energy were installed in Mainland Spain. On the other hand, according to RTE, installed capacity in France increased by 1497 MW between April 2023 and March 2024.

Compared to March 2024, April wind energy production declined in most analyzed markets. The Portuguese, Spanish and Italian markets registered decreases of 25%, 22% and 11%, respectively. The exceptions were the German and French markets, with corresponding increases of 1.1% and 2.5%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.Electricity demand

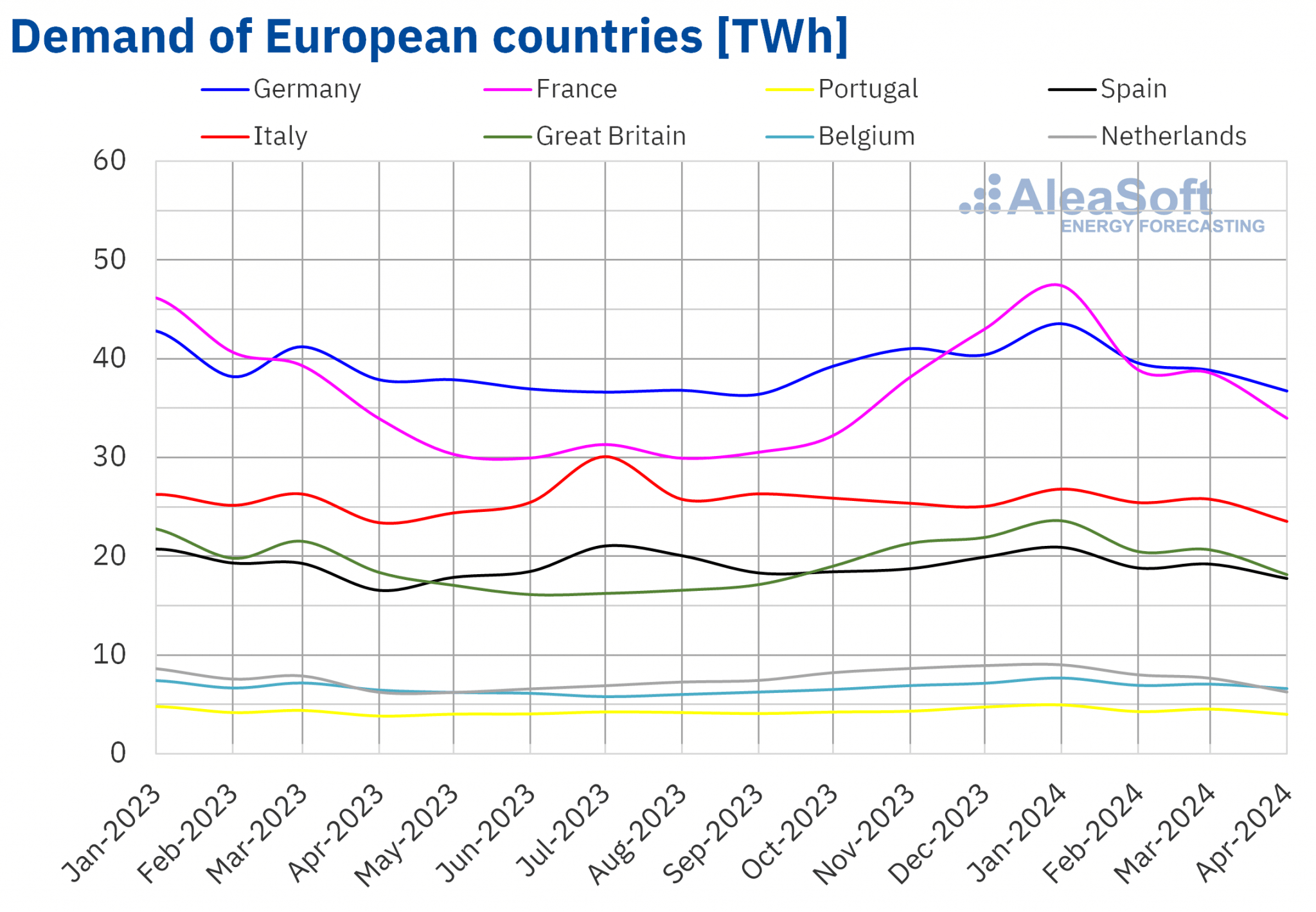

In April 2024, electricity demand exceeded that registered in the same period of 2023 in most major European electricity markets. This behavior was favored by the fact that in 2023 Easter was celebrated in April while in 2024 it was mainly celebrated in March. The Portuguese market registered the largest increase, 4.5%, followed by the Spanish market’s increase, 4.0%. The French market had the smallest increase in demand, 0.1%. In the Dutch, Italian and Belgian markets, increases ranged from 0.5% to 2.3%, respectively. On the other hand, the German and British markets registered year‑on‑year declines in demand of 3.0% and 1.2%, respectively.

In April 2024, average temperatures were higher than in the same month in 2023 across much of Europe, with increases ranging from 0.6 °C in Great Britain to 2.9 °C in Germany. The exceptions were Spain and Portugal, where average temperatures were 1.4 °C and 1.2 °C lower, respectively.

Comparing the electricity demand of April 2024 with that of March of the same year, there was a general decrease. In this case, the Dutch market registered the largest decrease, 15%, followed by drops of 9.2% in Great Britain and 9.0% in France. In the rest of the analyzed markets, the falls ranged between 8.6% in Portugal and 2.3% in Germany.

The advance of spring meant that average temperatures in April were higher than those in March in all analyzed markets. The Portuguese market registered the largest increase, 2.7 °C. In the rest of the markets, variations in average temperatures ranged between 1.5 °C in Great Britain and 2.4 °C in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.European electricity markets

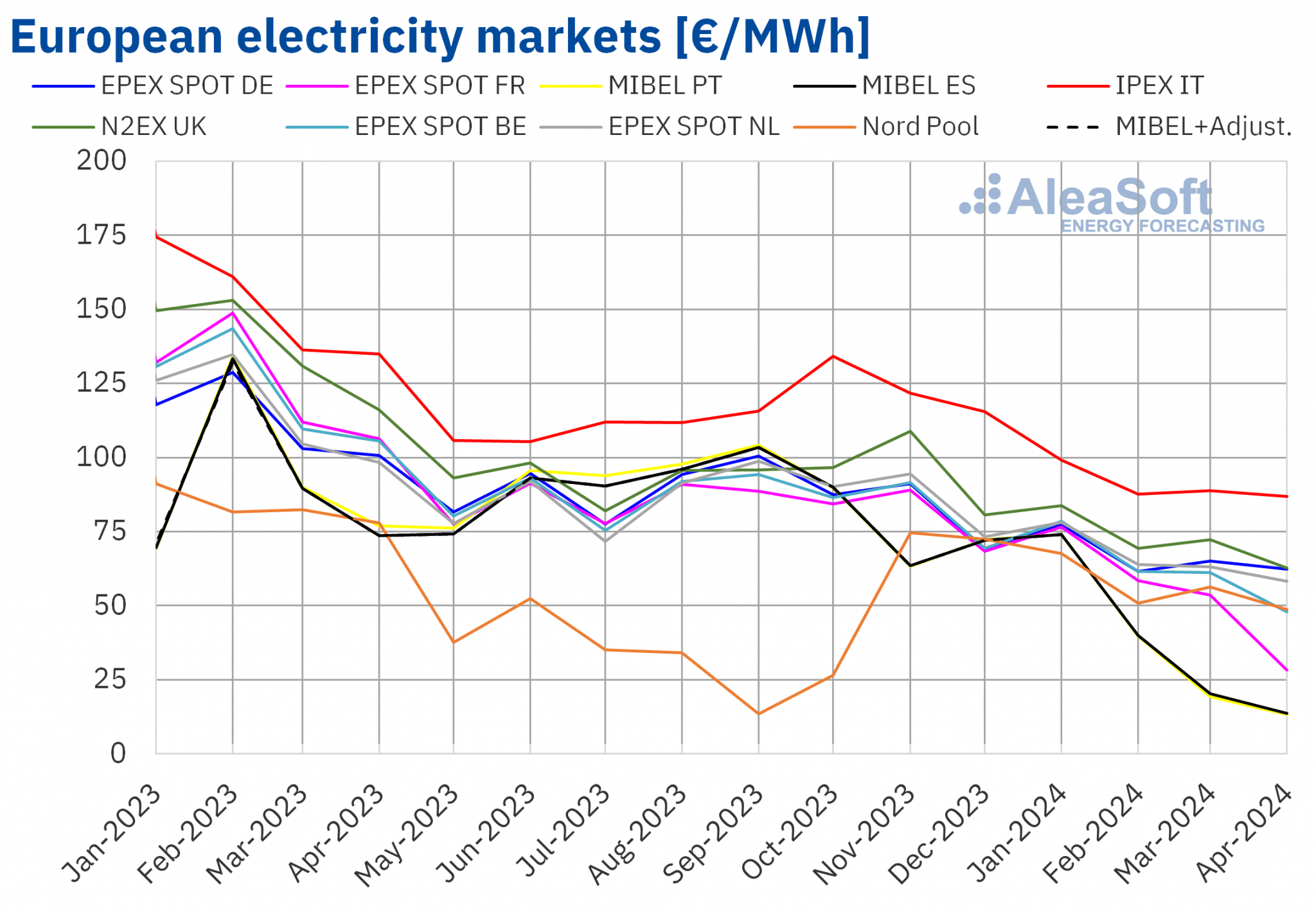

In April 2024, the monthly average price was less than €65/MWh in most major European electricity markets. The exception was the IPEX market of Italy, with an average of €86.80/MWh. The MIBEL market of Portugal and Spain and the EPEX SPOT market of France registered the lowest monthly prices, €13.23/MWh, €13.67/MWh and €28.23/MWh, respectively. In the rest of European electricity markets analyzed at AleaSoft Energy Forecasting, the averages were between €48.01/MWh in the EPEX SPOT market of Belgium and €62.71/MWh in the N2EX market of the United Kingdom.

Compared to March, average prices decreased in all European electricity markets analyzed at AleaSoft Energy Forecasting. The French market registered the largest drop, 47%. In contrast, the smallest decline, 2.3%, corresponded to the Italian market. In the other markets, prices fell between 4.2% in the German market and 33% in the Spanish market.

Comparing average prices of April with those registered in the same month of 2023, prices also fell in all analyzed markets and drops were larger. In this case, the Spanish and Portuguese markets had the largest declines, 81% and 83%, respectively. The smallest drop, 36%, was in the Italian market. In the rest of markets, price declines ranged from 38% in the German market and the Nord Pool market of the Nordic countries to 73% in the French market.

As a result of these declines, April prices in the British, Belgian, Dutch and Italian markets were the lowest since February, March, May and June 2021, respectively. The French market reached the lowest monthly average since June 2020. In the case of the MIBEL market of Spain and Portugal, April’s monthly prices were the lowest in its history. Precisely in the Iberian market, there were negative hourly prices for the first time in April 2024.

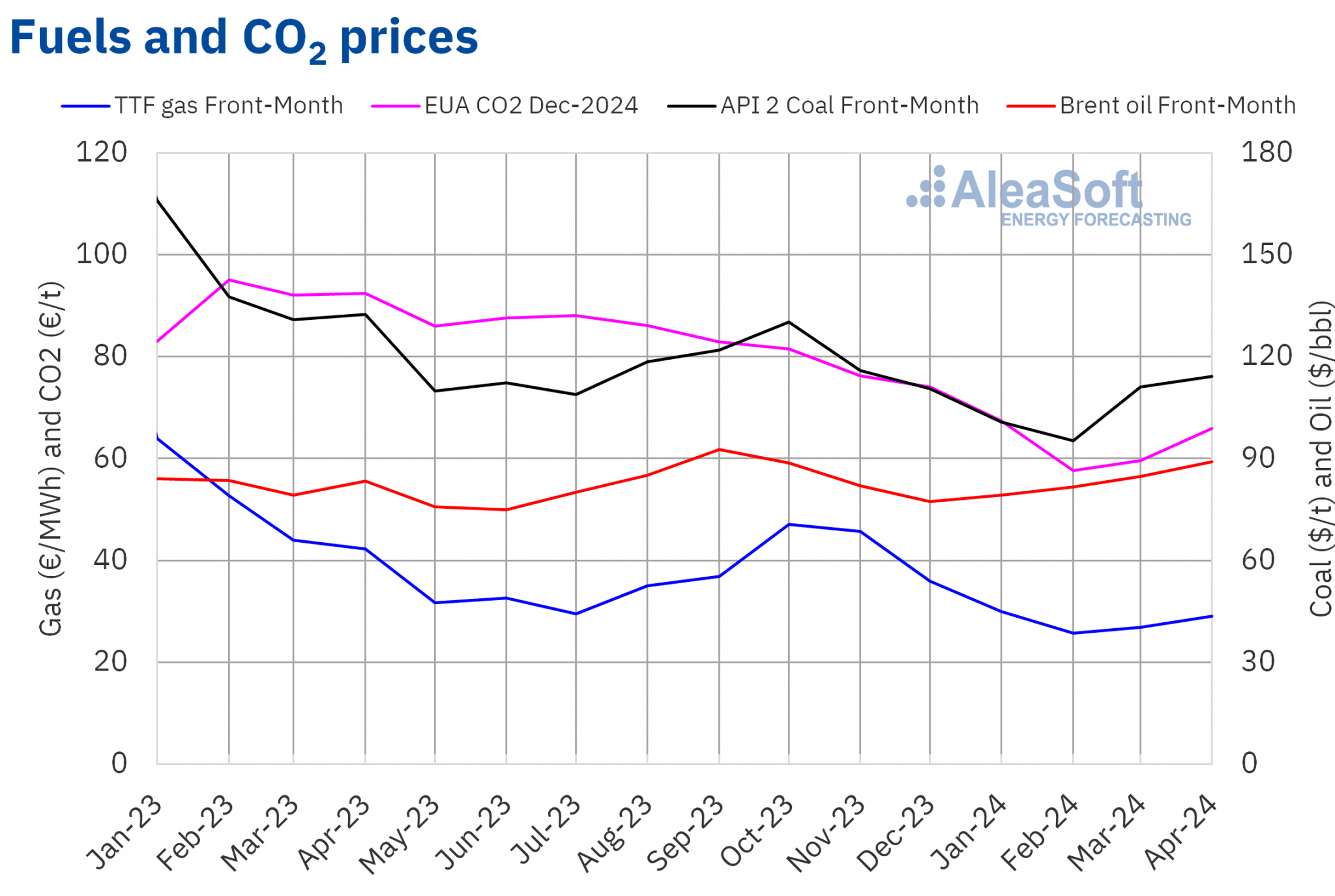

In the fourth month of 2024, the fall in the average price of gas and CO2 emission allowances, the generalized increase in solar energy production and the increase in wind energy production in most markets led to a year‑on‑year decrease in European electricity market prices.

On the other hand, the general drop in demand in April 2024 compared to the previous month and the increase in solar energy production contributed to the decrease in European electricity market prices compared to March. However, gas and CO2 emission allowance prices increased slightly compared to the previous month and wind energy production decreased in most analyzed markets, limiting price decreases.

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered a monthly average price of $89.00/bbl in the month of April. This value was 5.1% higher than the March Front‑Month futures price, $84.67/bbl. It was also 6.8% higher than the April 2023 Front‑Month futures price, $83.37/bbl.

During the month of April, instability in the Middle East continued to exert its upward influence on Brent oil futures prices. Furthermore, at the beginning of the month, OPEC+ agreed to continue its production cuts. On the other hand, expectations of demand evolution also exerted their influence on prices. In April, the International Energy Agency lowered its forecasts for global demand growth.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the month of April was €29.04/MWh. According to data analyzed at AleaSoft Energy Forecasting, compared to the average of Front‑Month futures traded in the month of March, €26.85/MWh, the April average increased by 8.1%. When compared to the Front‑Month futures traded in April 2023, when the average price was €42.21/MWh, there was a drop of 31%.

In the fourth month of 2024, declines in supply from Norway, conflicts in the Middle East and Ukraine and the European project to allow states to limit Russian gas imports, including liquefied natural gas, exerted their upward influence on TTF gas futures prices. In addition, demand for liquefied natural gas from Asia increased, causing a decline in supply to Europe. As a result, the average price for the month of April increased compared to the previous month. However, abundant gas supplies from Algeria, high European reserves levels and milder temperatures limited the price increase so that the average remained lower than in the same month last year.

As for CO2 emission allowance futures in the EEX market for the reference contract of December 2024, they reached an average price in April of €66.07/t. According to data analyzed at AleaSoft Energy Forecasting, this represents an increase of 11% compared to the previous month’s average, €59.62/t. In contrast, when compared to the April 2023 average, €97.14/t, the April 2024 average was 32% lower.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

The next webinar of AleaSoft Energy Forecasting and AleaGreen will take place on Thursday, May 9. This will be the 44th edition of the monthly series. The webinar will analyze the evolution and prospects of European energy markets, low, zero and negative prices in European electricity markets, the vision of the future of the energy sector and the energy transition vectors, such as renewable energy, demand, energy storage and green hydrogen. Luis Atienza Serna, who was Minister of Agriculture, Fisheries and Food of the Government of Spain between 1994 and 1996 and president of Red Eléctrica de España between 2004 and 2012, will participate for the second time in the analysis table of the Spanish version of the webinar.

Source: AleaSoft Energy Forecasting.