AleaSoft Energy Forecasting, December 5, 2025. The first year of the “five‑year period of batteries” has confirmed both the decisive progress of renewable energy and the significant challenges that still persist in the electricity market. This was the central theme of the 61st edition of AleaSoft Energy Forecasting’s monthly webinars, in which experts from EY, Deloitte, PwC Spain and AleaSoft analysed the evolution of the sector, the key role of batteries, demand, regulation and the future of nuclear energy in the decarbonisation process.

The 61st edition of the monthly webinar series organised by AleaSoft Energy Forecasting took place on Thursday, December 4. For the second consecutive year, the webinar in Spanish featured the participation of leading consulting firms in the energy sector, represented by Antonio Hernández García, Partner of Regulated Sectors at EY, Jaume Pujol Benet, Partner, Financial Advisory at Deloitte España, Óscar Barrero Gil, Partner Responsible for Energy Sector at PwC Spain, and Oriol Saltó i Bauzà, Associate Partner at AleaSoft. Antonio Delgado Rigal, CEO of AleaSoft, moderated the webinar and the analysis table.

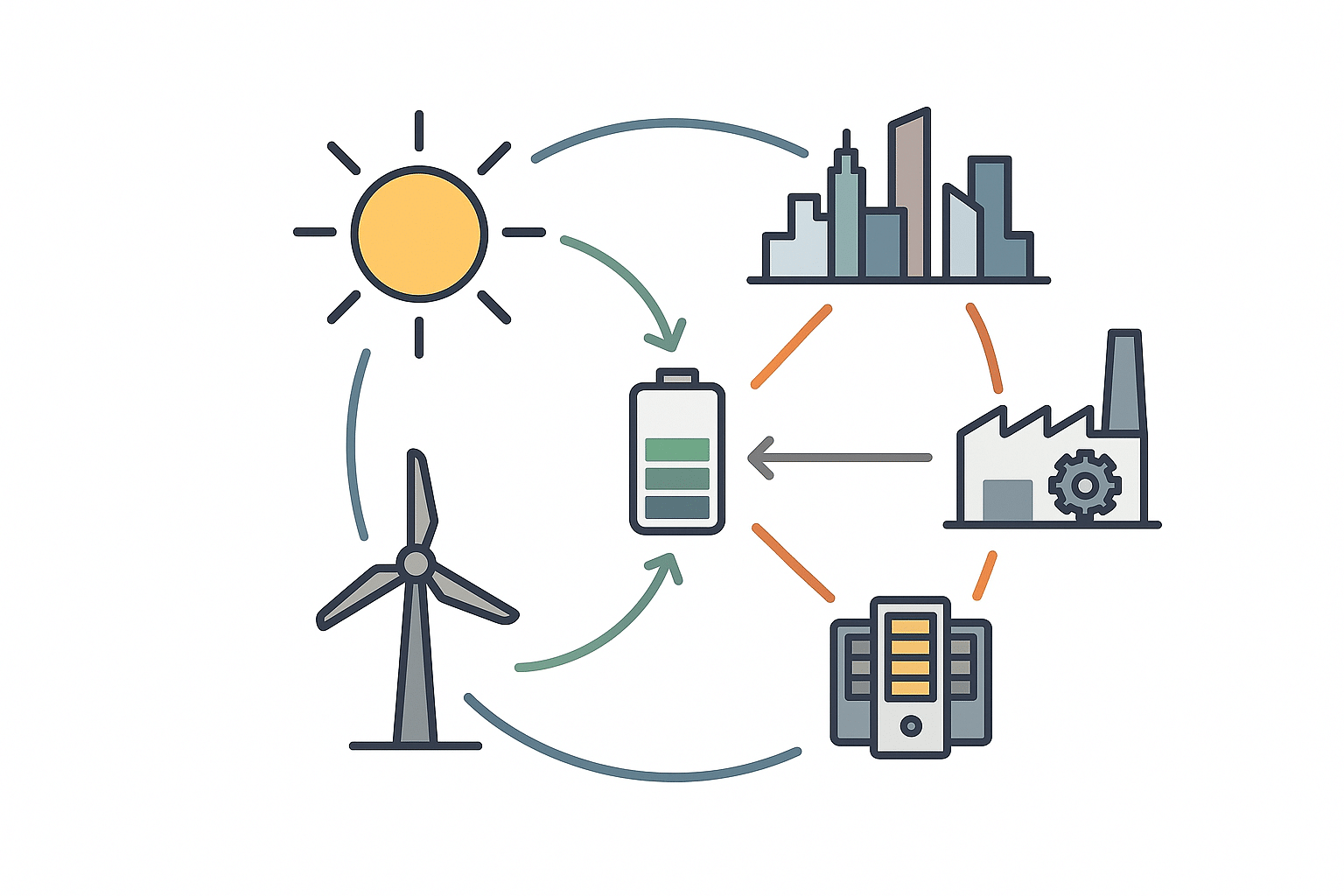

Balance of the first year of the battery five‑year period

2025 has been a turning point that has highlighted both the problems and the measures required to carry out the energy transition. Although electricity demand has shown a slight rebound this year, the renewable energy penetration has resulted in many hours with zero or negative prices, which has driven solar PPA (Power Purchase Agreement) prices to historical lows and to the lowest levels in Europe.

On the regulatory front, favourable steps have been taken this year with the approval of Royal Decree 917/2025 in October, which benefits renewable energy with hybridisation in the curtailment priority order, and Royal Decree 997/2025 in November, which also supports plants with hybridisation by simplifying and speeding up the permits and procedures associated with these facilities.

The blackout of April 28 has influenced the operation of the electricity system, highlighting its weak points. In 2024, the price of energy had already increased due to the ancillary markets, and this price has doubled this year after the blackout due to the reinforcement measures taken to guarantee the security and stability of the grid.

There is also a need to boost financing for batteries, the capacity market and the need to increase the number and capacity of grid connections. Low renewable energy prices are attracting investment and connection requests, representing an extra demand of 100% of installed capacity, which cannot be met.

Regarding batteries, investment appetite is high, with 37 GW of applications with guarantees already registered in Spain, which will materialise progressively. The CAPEX associated with investment is evolving favourably and is expected to follow this trend.

Gas prices are now below €30/MWh during these winter months, when they are usually above the annual average. This downward trend is expected to continue after the peak caused by the Ukraine War and could stabilise in the coming months. However, gas reserves remain below optimal levels and risks persist due to geopolitical conflicts that could disrupt the supply of liquefied natural gas (LNG) or weather‑related events such as cold waves that would significantly increase gas consumption.

Prospects for the coming years of the five‑year period

All experts agreed that markets in 2026 will behave very similarly to this year, although with a moderate increase in some trends that emerged during the first year of the five‑year period. Demand will continue to grow slowly, and this rate should increase in subsequent years. Even with low captured prices, photovoltaic capacity will continue to expand due to investment inertia, leading to very low prices again in spring, albeit with additional costs due to reinforced ancillary markets following the blackout. Regulatory measures will continue progressing, with new capacity market regulation expected. The first hydrogen‑related projects will also appear, bringing major investments that will impact demand towards the end of the five‑year period.

The increase in zero or negative price hours has made banks more reluctant to finance merchant renewable energy projects and PPA are becoming less attractive, unless plants include hybridisation. Investment in storage will be essential for renewable energy projects in the coming years. As AleaSoft Energy Forecasting had already anticipated, the future of renewable energy will inevitably be linked to hybridisation. Currently, hybridisation can generate additional revenues split roughly 70% from participation in ancillary services and 30% from price arbitrage in the day‑ahead and intraday markets. Potential revenues from ancillary services will decrease due to cannibalisation once around 6 GW of storage systems enter the market, reducing the share to 25‑30%. The NECP targets for 2030 are 16 GW of batteries, which would further increase cannibalisation.

Demand will also take centre stage in the coming years, provided it is integrated appropriately. Together with batteries, it will lay the foundations for changing the structure of the market and prices.

The role of nuclear power plants

The lifetime of nuclear power plants was a key topic in the webinar, following the recent debate on extending the lifetime of the Almaraz plant. Speakers agreed that nuclear energy will be crucial as an accompanying technology in the decarbonisation process. Closing these facilities prematurely, given that batteries will still be at an early stage of deployment, would result only in the replacement of nuclear generation with combined cycle gas turbines, which emit greenhouse gases.

Nuclear power plants may play a significant role in ancillary services as renewable energy and storage increasingly penetrate the day‑ahead market and can sustain the weight of more demand. Their participation in ancillary services will reduce costs during hours of lower solar energy production—those with the highest ancillary service costs—and will support system stability during hours of high renewable energy production. Their contribution to security of supply, decarbonisation and price stability are the main factors supporting their continued relevance in the coming decades.

Strategic vectors of the energy transition: renewable energy, demand, grids and storage

The NECP targets for 2030 set renewable energy production at 81%, which requires long‑duration storage systems, providing inertia and stability to the grid. Investment in solar energy, which has a certain amount of inertia, is not slowing despite the number of zero‑price hours. Wind energy is growing more slowly than needed to meet the targets. Without demand growth, this excess supply would cause curtailment and a considerable number of zero or negative prices; and without a balanced evolution of all energy producers to meet NECP projections, the market will face imbalances and instability.

Demand must be promoted to advance decarbonisation and electrification of the economy. Grid upgrades are also essential, as 80% of grid nodes are currently saturated for new demand connections. Many connection requests cannot be met. New systems that will drive demand growth, including batteries and Data Centers, require enabled access and connection to the grid.

Batteries are a key vector that will stabilise the market, accelerate decarbonisation, reduce zero‑price events, strengthen the grid and provide necessary value when securing financing for renewable energy projects and PPA. With 20 GW already permitted and a further 16 GW awaiting approval, the trend in investment and deployment in renewable systems, Data Centers and other projects will continue upwards.

Spain has significantly more charges and taxes on the energy sector than other EU countries. A tax reduction would boost demand and electrification, as well as attract foreign investment. Spain can take advantage of its competitive edge thanks to the low prices generated by its abundant renewable resources.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe from 2026 onwards

On January 15, 2026, AleaSoft Energy Forecasting will hold the 62nd webinar of its monthly series. The session will focus on the evolution of the regulatory framework for renewable PPA contracts, including virtual PPA, updating the analysis presented in the January 2025 webinar.

The first AleaSoft webinar of 2026 will again feature speakers from PwC Spain for the sixth consecutive year to provide an updated analysis of recent evolution and prospects of European energy markets from 2026.

At the start of the second year of the battery five‑year period, the session will examine the prospects for energy storage and hybridisation, as well as their impact on business models and on reducing market volatility. There will also be an analysis of the evolution of FPA (Flexibility Purchase Agreements), which continue to gain relevance driven by the integration of batteries and the growing value of energy flexibility.

Another topic will be the growth of electricity demand, driven by Data Centers and industry electrification, a key element of decarbonisation. Increased demand is necessary to reduce the frequency of zero or negative prices and mitigate cannibalisation caused by high renewable energy penetration.

Source: AleaSoft Energy Forecasting.