AleaSoft, January 7, 2021. The price increases that occurred on Monday, January 4, were just the beginning. The hardening of the conditions during the cold snap, with even greater drops in temperatures, and together with the fall in wind and photovoltaic energy production, pushed the European electricity markets prices to record highs in some of the cases. On the other hand, the futures prices stop their bullish rally of the end of the year and fall slightly in most markets.

Photovoltaic and solar thermal energy production and wind energy production

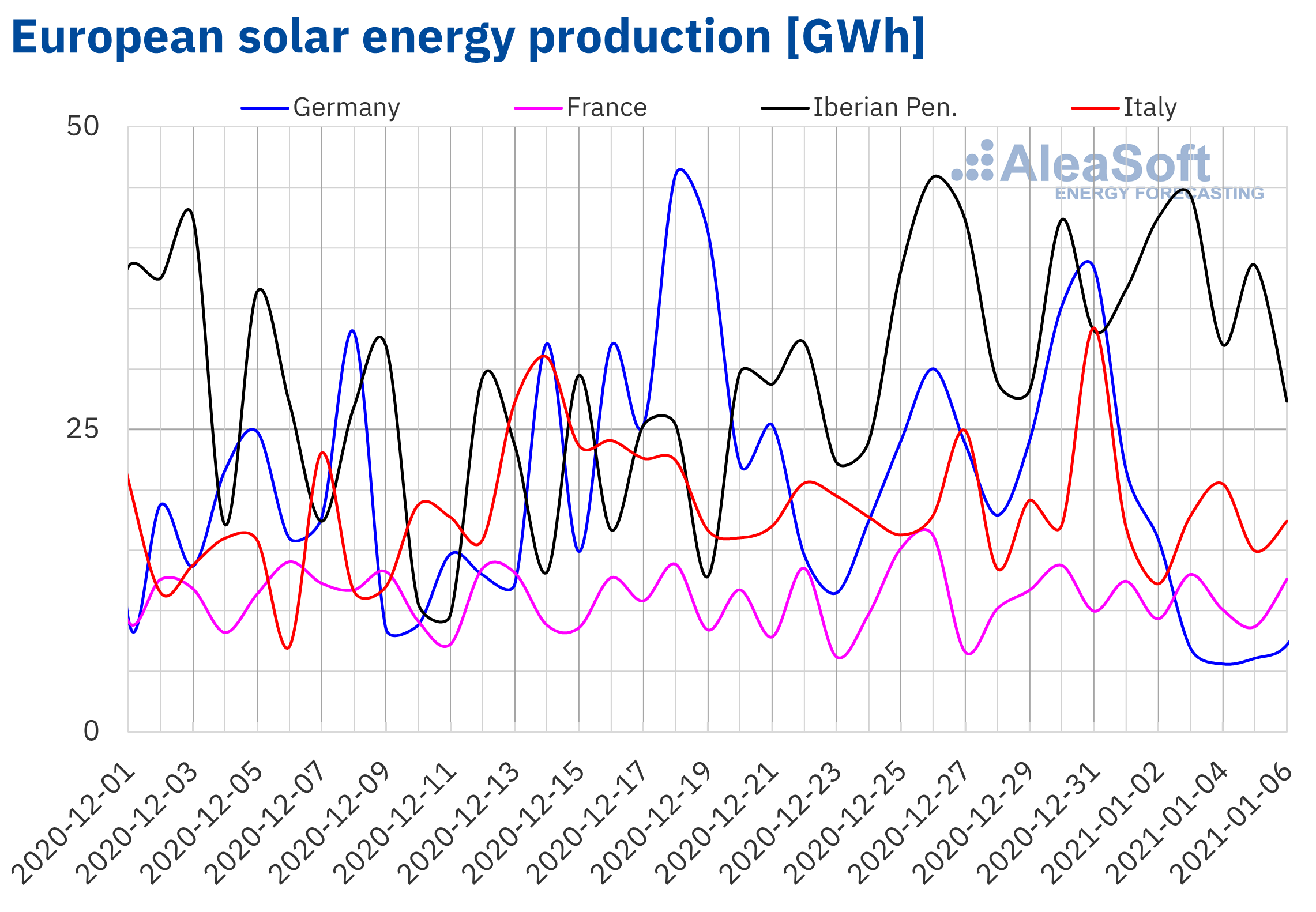

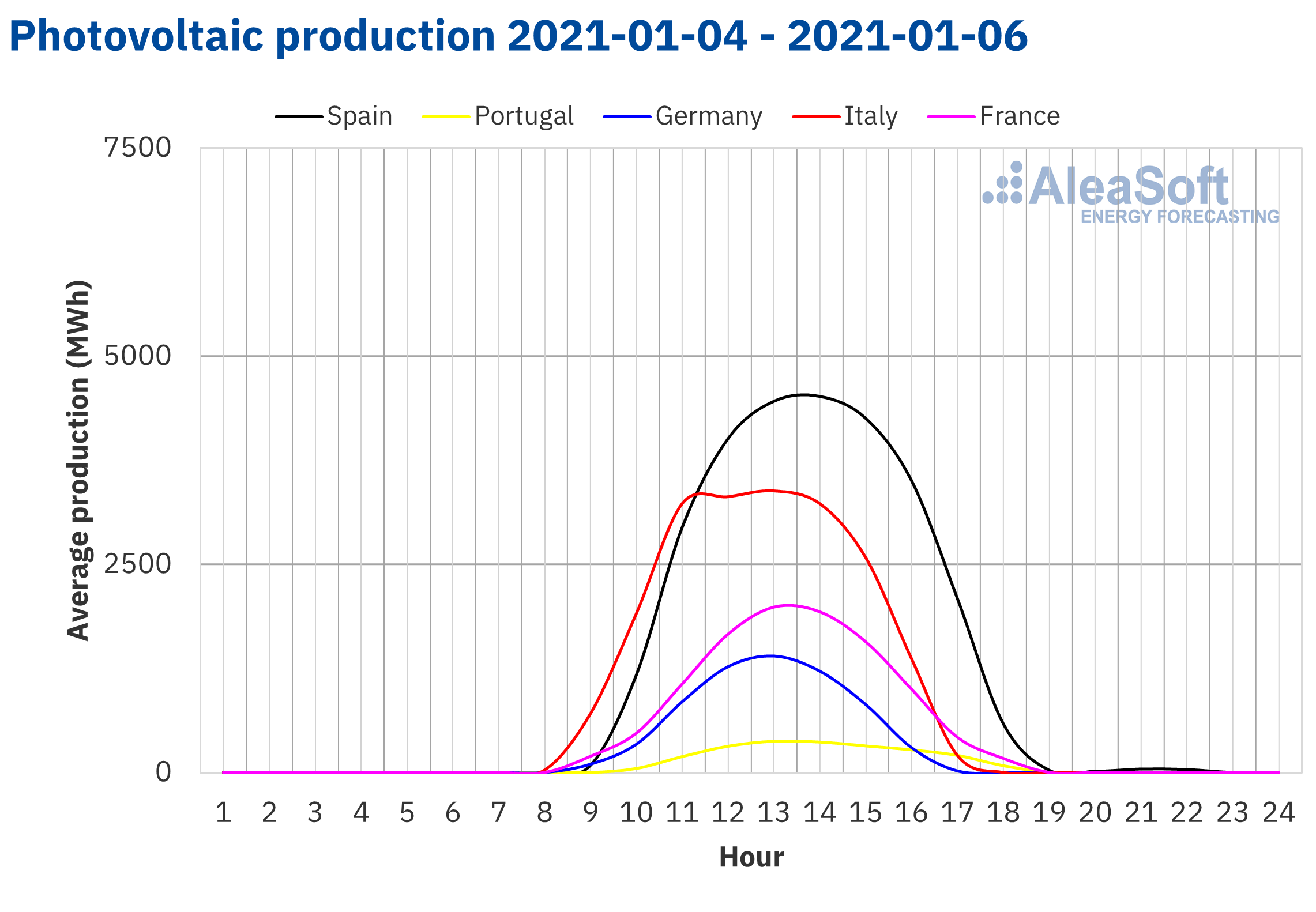

At the beginning of the first week of 2021, the week of January 4, the solar energy production registered lower values than the previous week, the last week of 2020. The drop in solar energy production was led by Germany with a drop of 72% during the first three days of the week, compared to the previous week. It is followed by Portugal with a drop of 20% and Spain, France and Italy with falls around or below 10%.

According to the AleaSoft‘s solar energy production forecasting, the total for this first week of the year will register significant drops in production in all markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

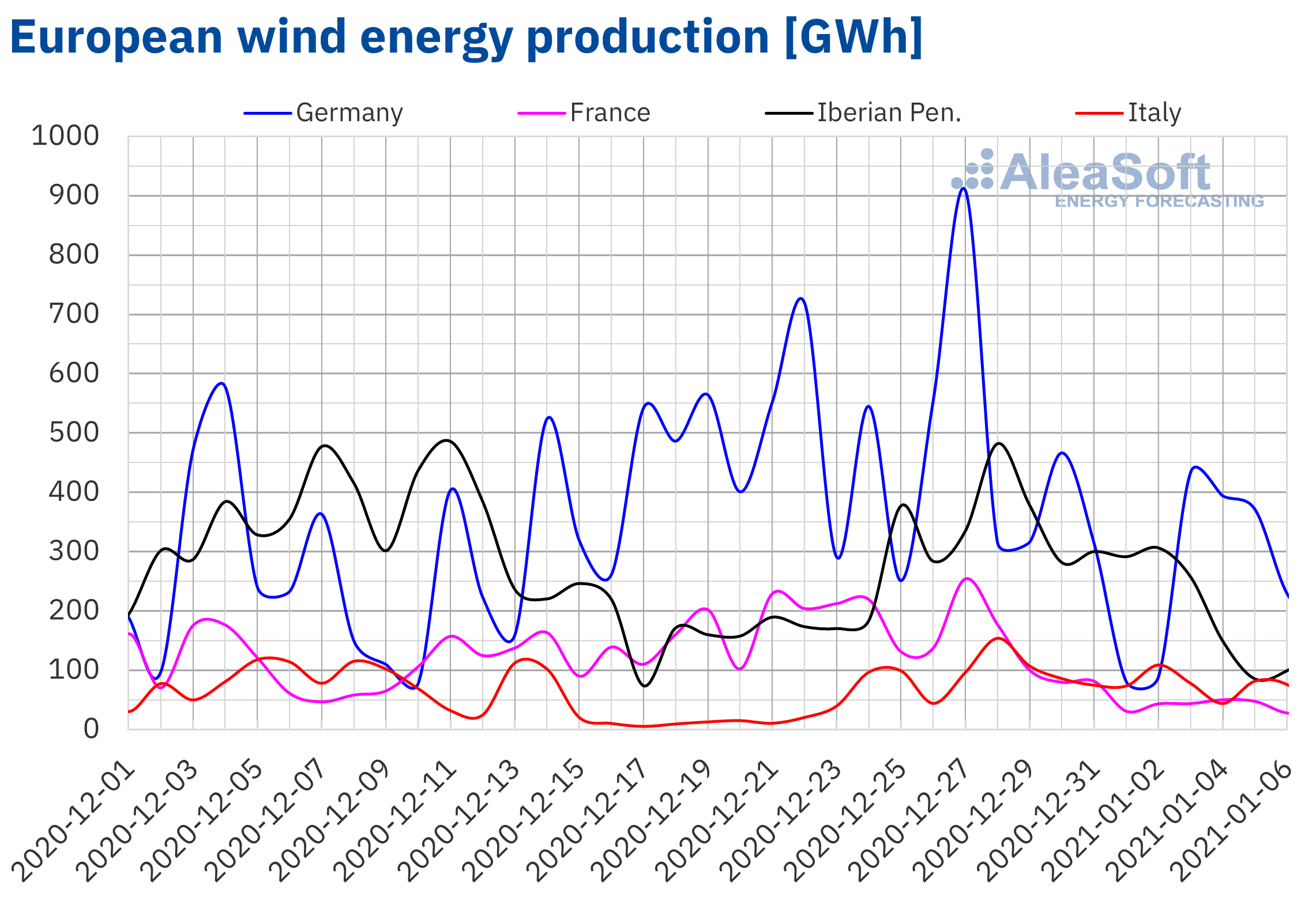

For the wind energy production even more important falls were registered during these first days of the first week of January. In the Iberian Peninsula, the drop in production reached 66% during the first three days of the week, followed by France and Italy with drops of 47% and 31%, respectively. The exception was Germany with an increase of 15% during the beginning of the week.

For the end of the week, on January 10, the AleaSoft‘s wind energy production forecasting points to very significant drops in wind energy production, also in Germany.

The fall in renewable energy production, together with the increase in demand, is among the main factors behind the rise in prices in the electricity markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

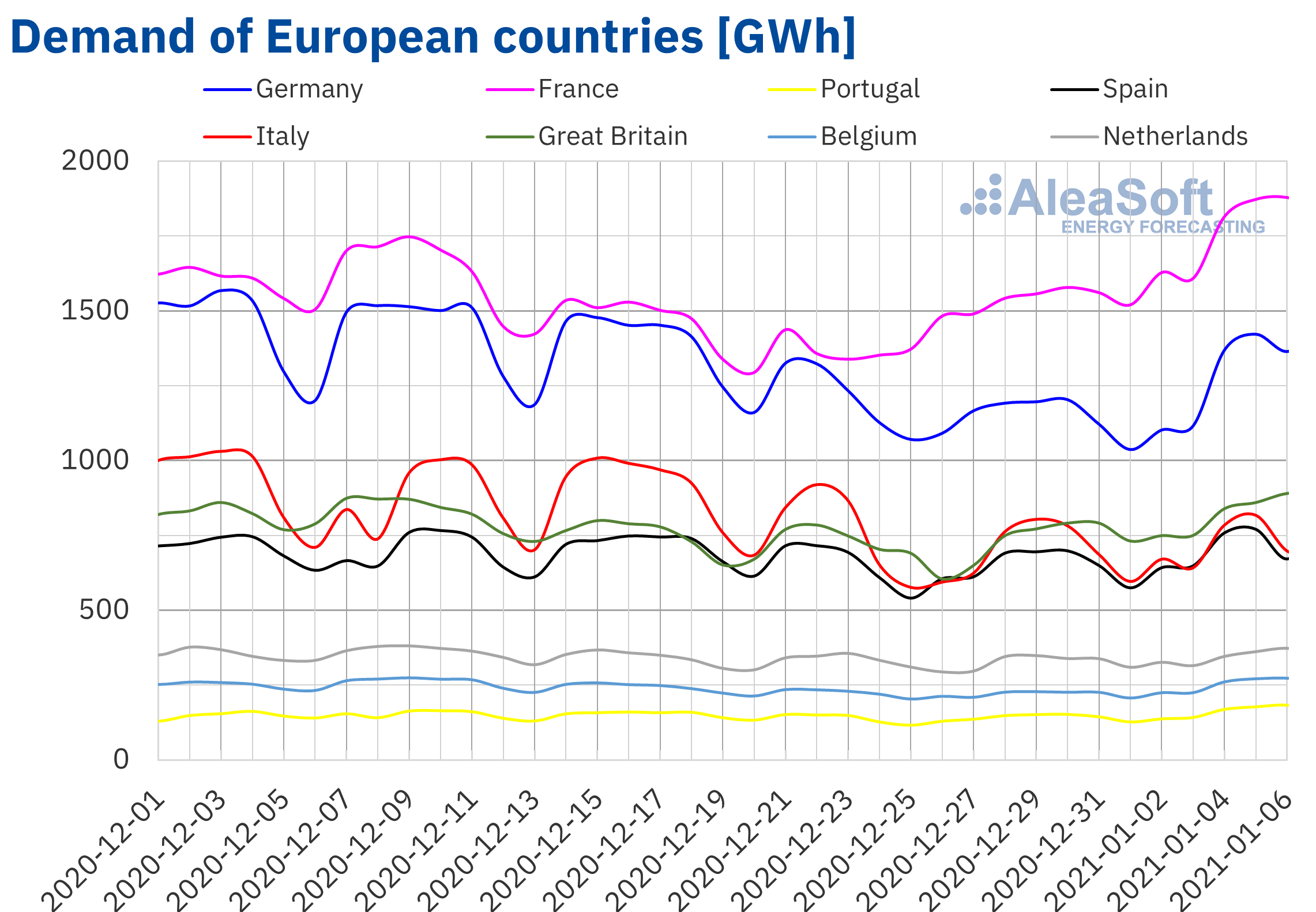

The hardening of the meteorological conditions during the cold snap that hits most of the continent led to additional drops in temperature of up to 3.5 °C in Spain. In other countries such as Portugal, France, Germany and the Netherlands, the temperature drops exceeded 1 °C, and in Italy and Belgium the drops stayed below 1 °C. The exception is the United Kingdom with temperatures 1.1 °C above those of the last week of 2020.

These colder conditions led the electricity demand to escalate again, also favoured by the return of the Christmas holidays in most countries. The consumption increases far exceeded 10% in France, Belgium, Portugal, Germany and the United Kingdom. On the other hand, there are the Netherlands, where the rise did not reach 5%, and Italy, where the demand fell by 2.1%.

The forecasting indicates that the rise in demand will ease throughout the rest of this week of January 4 in most markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

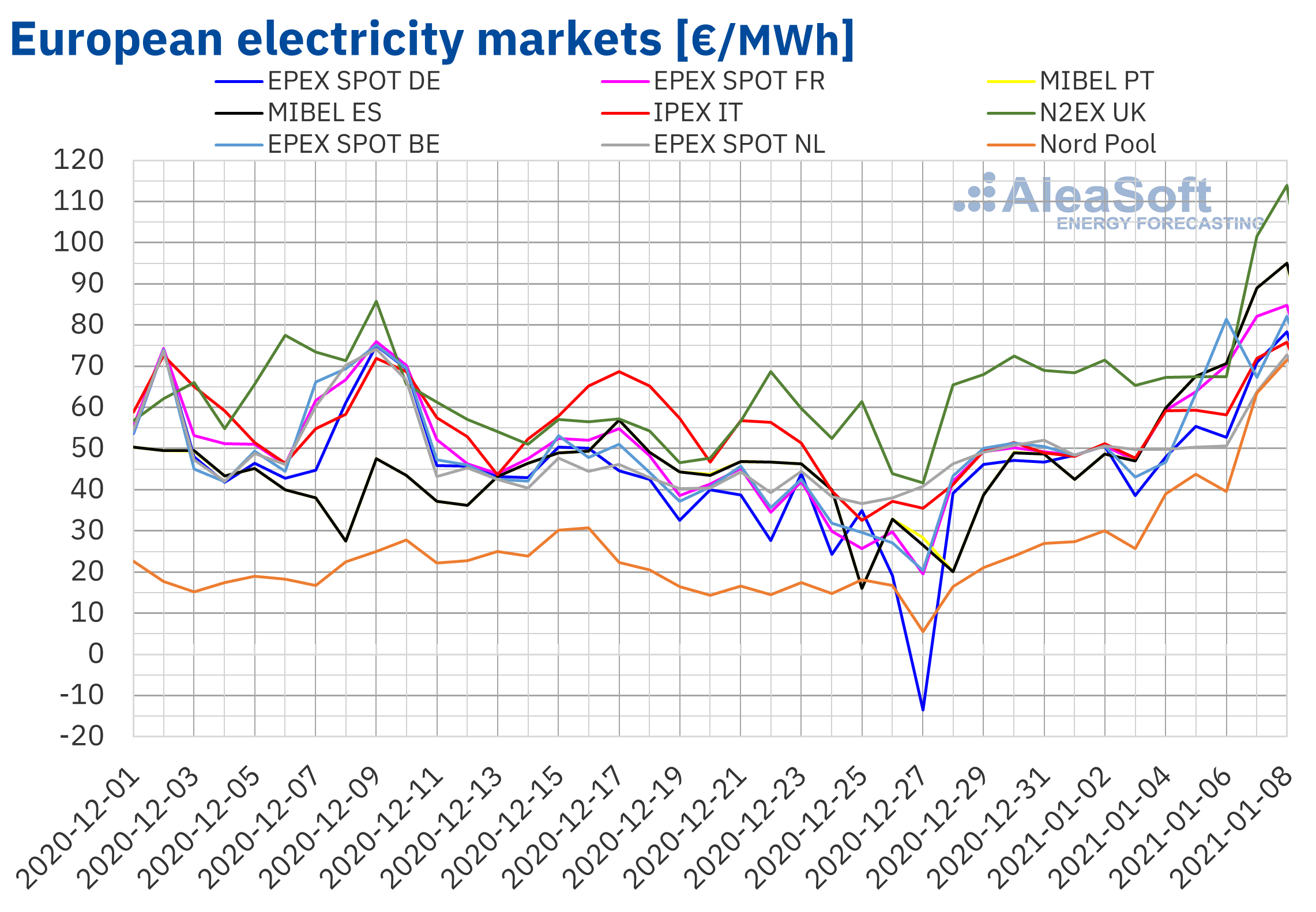

The prices in the European markets registered record values in most markets on Friday, January 8, driven by an increase in demand due to the drop in temperatures during the cold snap and a significant reduction in renewable energy production, mainly the wind energy production.

The price ranking is led by the N2EX market of Great Britain with a price of £104.06/MWh (€113.95/MWh) and which reached an hourly price of £670.39/MWh (€734.08/MWh) at the hour 19. Closely followed by the Iberian MIBEL market with €94.99/MWh, the base price record in the history of the market, and hourly price peaks above €100/MWh, and the EPEX SPOT market of France with €84.85/MWh, record price of the last two years and also with hourly prices above €100/MWh. The rest of the markets with prices around or below €80/MWh follow.

The Nord Pool market of the Nordic countries continued to set the lowest price on the continent, but this time very close to the rest of the countries with €71.56/MWh, the highest in the last five years.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The main causes of these high prices in the electricity markets point to colder weather conditions, with an increase in electricity and heating gas demand, and significantly low wind energy production.

The AleaSoft‘s prices forecasting indicates that during the rest of this week of January 4, the markets prices will moderate as weather conditions return to the seasonal levels starting at the weekend.

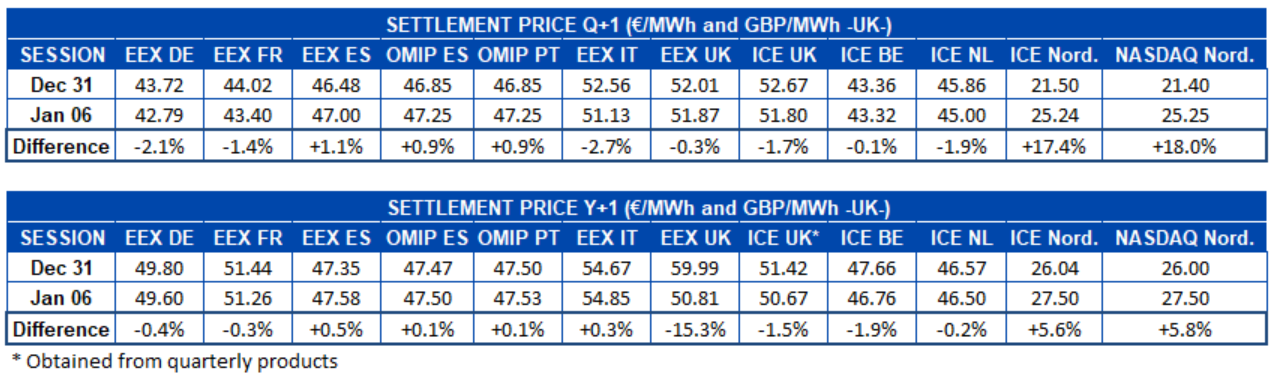

Electricity futures

After the bullish rally of the last week of 2020, the prices in the electricity futures markets moderated and most markets registered setbacks, due to the forecasts of a recovery in temperatures from the second week of January. For the Q2 futures, the only exceptions were the EEX and OMIP markets of Spain and Portugal with slight increases of around 1% and the ICE and NASDAQ markets of the Nordic countries with increases of close to 20% although they started from the lowest prices in Europe.

In the case of the Cal22 futures, the EEX market of Italy also registered a rise of 0.3% compared to the previous Friday. The 15% drop in futures in the UK EEX market stands out for this product.

Brent, fuels and CO2

The little activity in the futures markets and the prospects for a recovery in temperatures from the second week of January pushed the prices back in the gas and coal futures markets. The futures prices for the month of February of TTF gas fell by 11% on Wednesday, January 6, after the maximum of €19.84/MWh of Monday 4. Similarly, the futures for the next month of API 2 coal fell by 8.5%.

On the contrary, the Brent oil futures continue their upward run and reached $54.30 per barrel this Wednesday, January 6, the highest price since February 2020. The latest news only reinforces this upward trend in the crude oil prices. On the one hand, the announcement by Saudi Arabia of cutting the production during February and March and, on the other, the hopes of the economic recovery in the United States and worldwide.

Regarding the CO2 emission rights prices, they continue at very high levels, but they slowed their rise in the first half of the first week of January. On Wednesday, January 6, the futures for December settled at €33.63/MWh, a level very similar to that of Monday, January 4.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

The financing of renewable energy projects and the evolution of energy markets in Europe in 2021

The first AleaSoft webinar of this year 2021 will be held on January 14, where the evolution of the energy markets in Europe in recent months and its prospects from this year will be analysed. In addition, with the collaboration of several speakers from the consulting firm PwC Spain, the state and the vision of the PPA contracts market for large consumers, their impacts and requirements, and the need for estimates of future electricity market prices will be analysed.

At AleaSoft, a wide variety of reports for the energy sector are available, which include detailed analysis on the evolution of the energy markets in Europe and all the aspects that had or may have an influence on their prices and demands. The objective of these reports is to provide a clear vision of the future of the European energy system by providing knowledge, intelligence and opportunities.

Source: AleaSoft Energy Forecasting.