AleaSoft, February 22, 2021. The European electricity markets prices fell in a generalised way in the third week of February, due to the fall in demand and the increase in solar and wind energy production. The MIBEL market was the one with the lowest prices throughout the week, which happened almost every day of the month. The prices of the European electricity, gas and CO2 futures also fell, but the latter remained above €37/t. However, the Brent futures exceeded $63/bbl for the first time since May 2019.

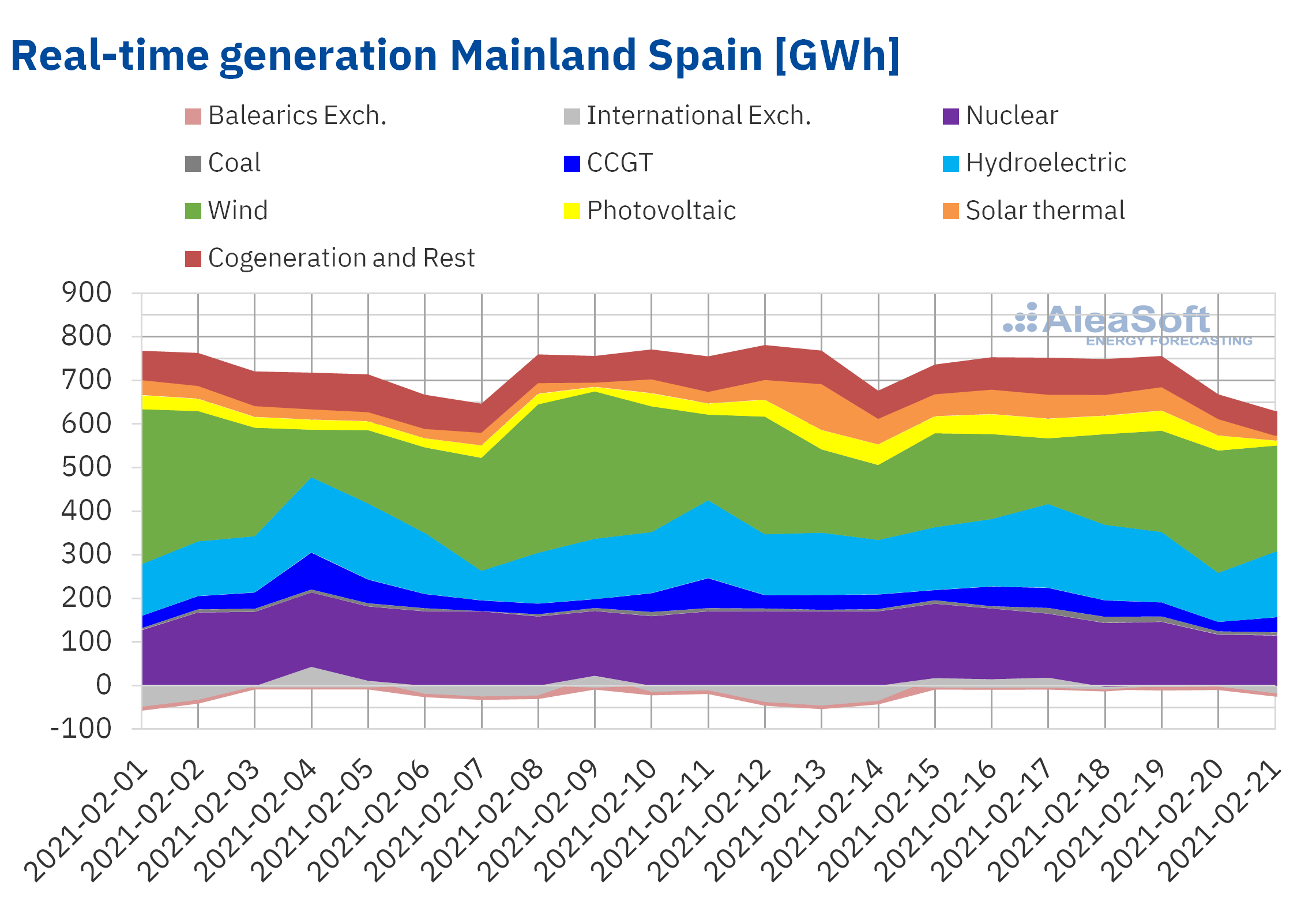

Photovoltaic and solar thermal energy production and wind energy production

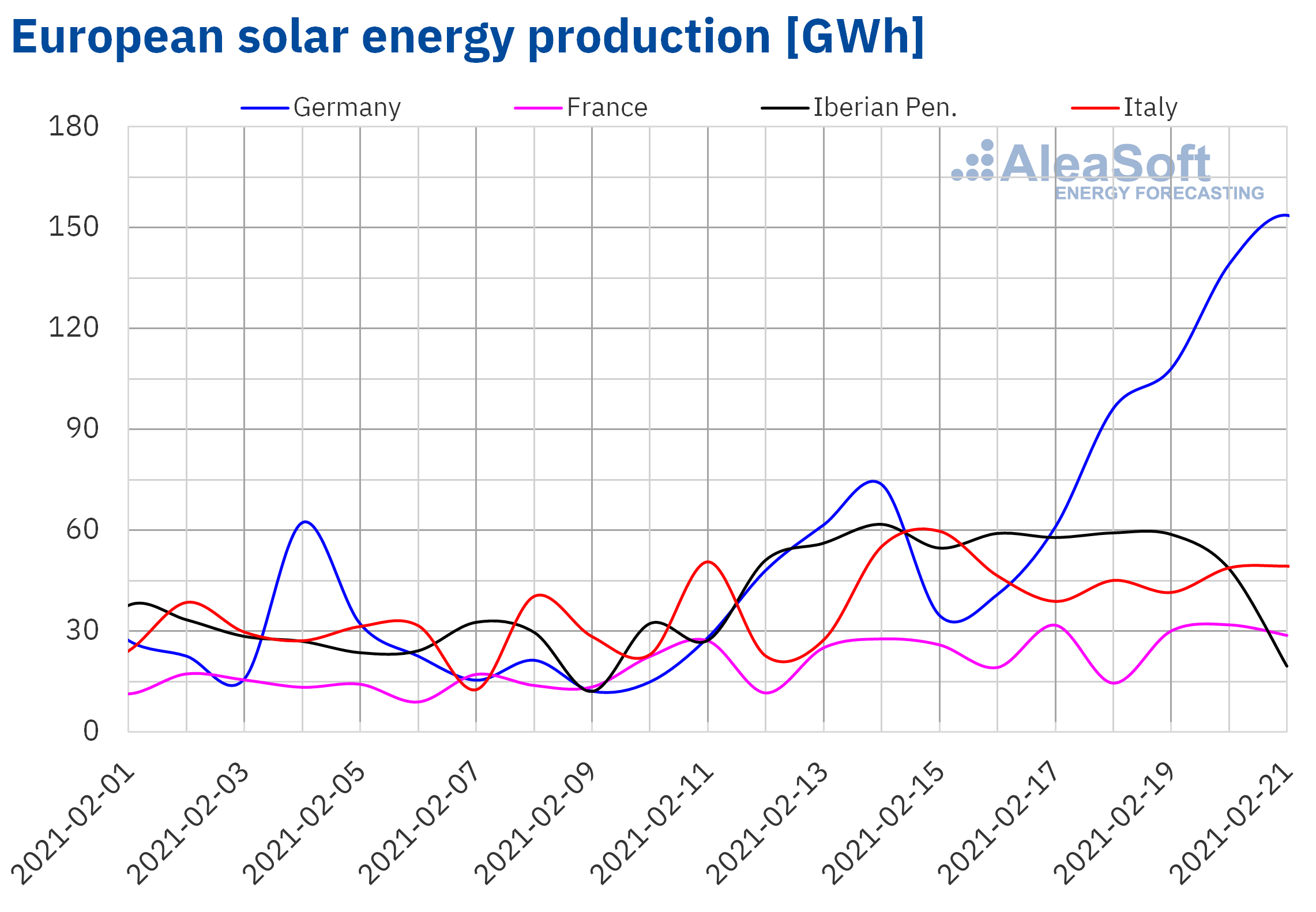

During the third week of February, the solar energy production increased in all the markets analysed at AleaSoft, compared to the previous week. In the German market, the production was more than double that registered during the previous week, while in the Italian market it was 33% higher. In the Iberian Peninsula the increase was 32% and in the French market 29%.

For the last week of February, the AleaSoft‘s forecasting indicates that the solar energy production in the German and Italian markets will increase compared to the previous week. However, in the Spanish market it is expected to be lower.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

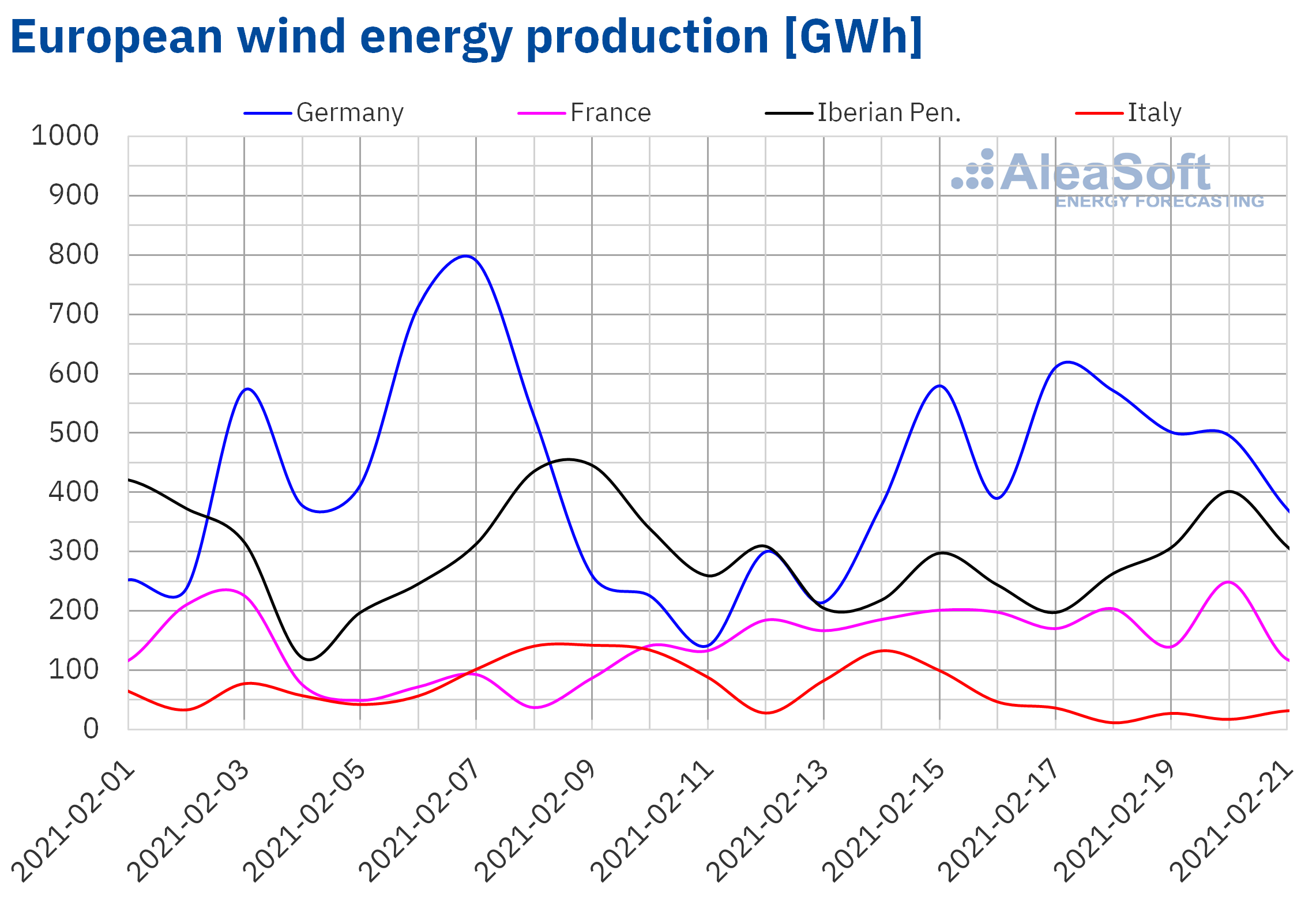

During the week that started on February 15, the wind energy production increased by 72% in the German market compared to the week of February 8. In the French market, the production was 37% higher, while in the Italian market and in the Iberian Peninsula, the production fell by 64% and 8.7% respectively. In the case of the Iberian Peninsula, the average production registered between Friday, February 19, and Sunday, February 21, was 7.3% higher than the average production of the week of February 8.

For the week that began on February 22, the AleaSoft‘s wind energy production forecasting indicates that this will be lower than that registered the previous week in all the markets analysed at AleaSoft.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

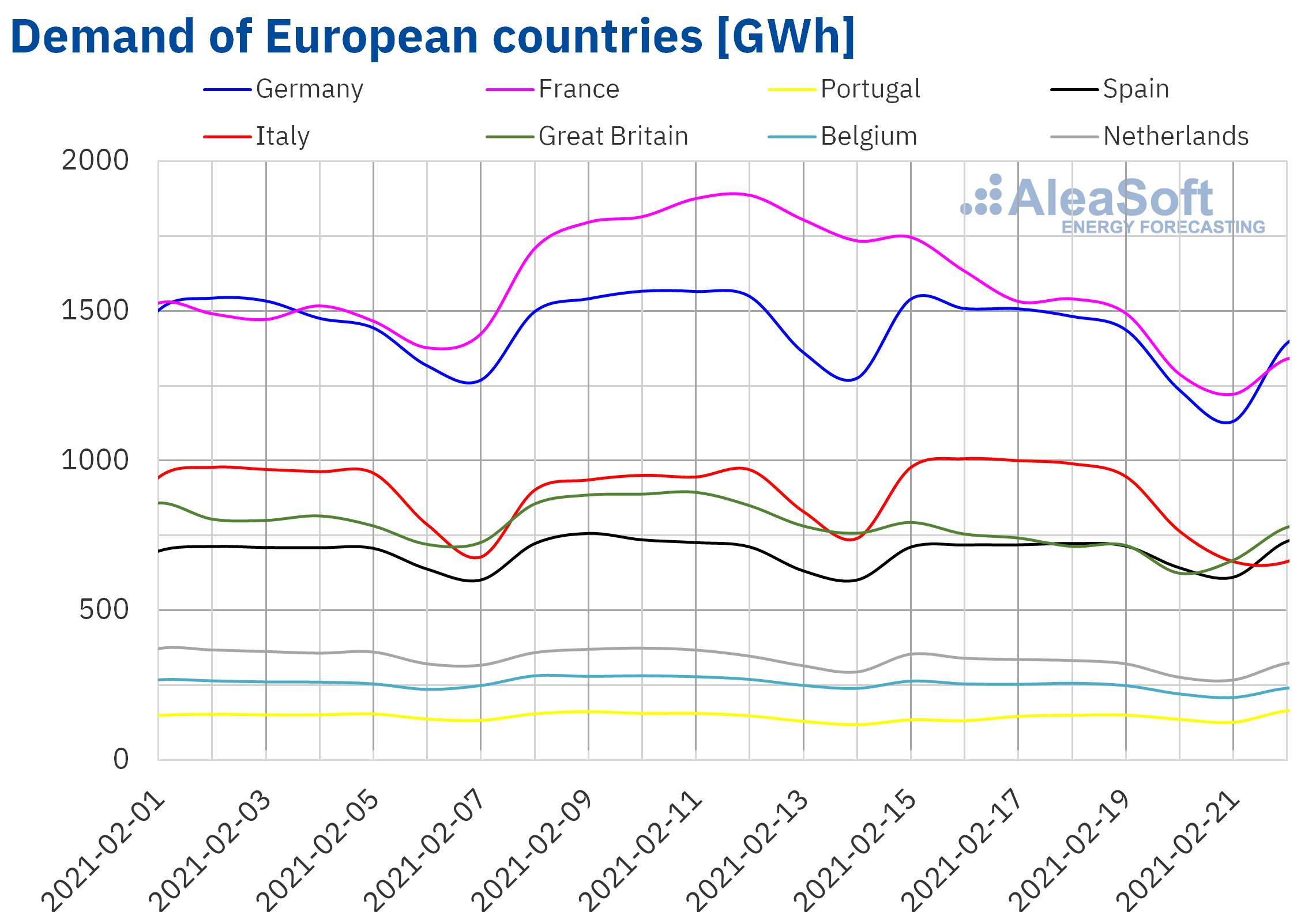

In the week of February 15, the recovery of the temperatures after the passage of the Storm Darcy through Europe was the most influential factor in the decline in demand in most European markets. The week‑on‑week average temperatures increased by more than 11 °C in the markets of Germany, the Netherlands and Belgium. Regarding the behaviour of the demand, the decreases of over 15% in France and Great Britain stand out. The exception to the decreases in demand was the Italian market, which registered an increase of 1.2%.

The AleaSoft’s forecasting indicates that the demand will decrease in most of Europe, while increases will be registered in Spain, Portugal and Great Britain.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

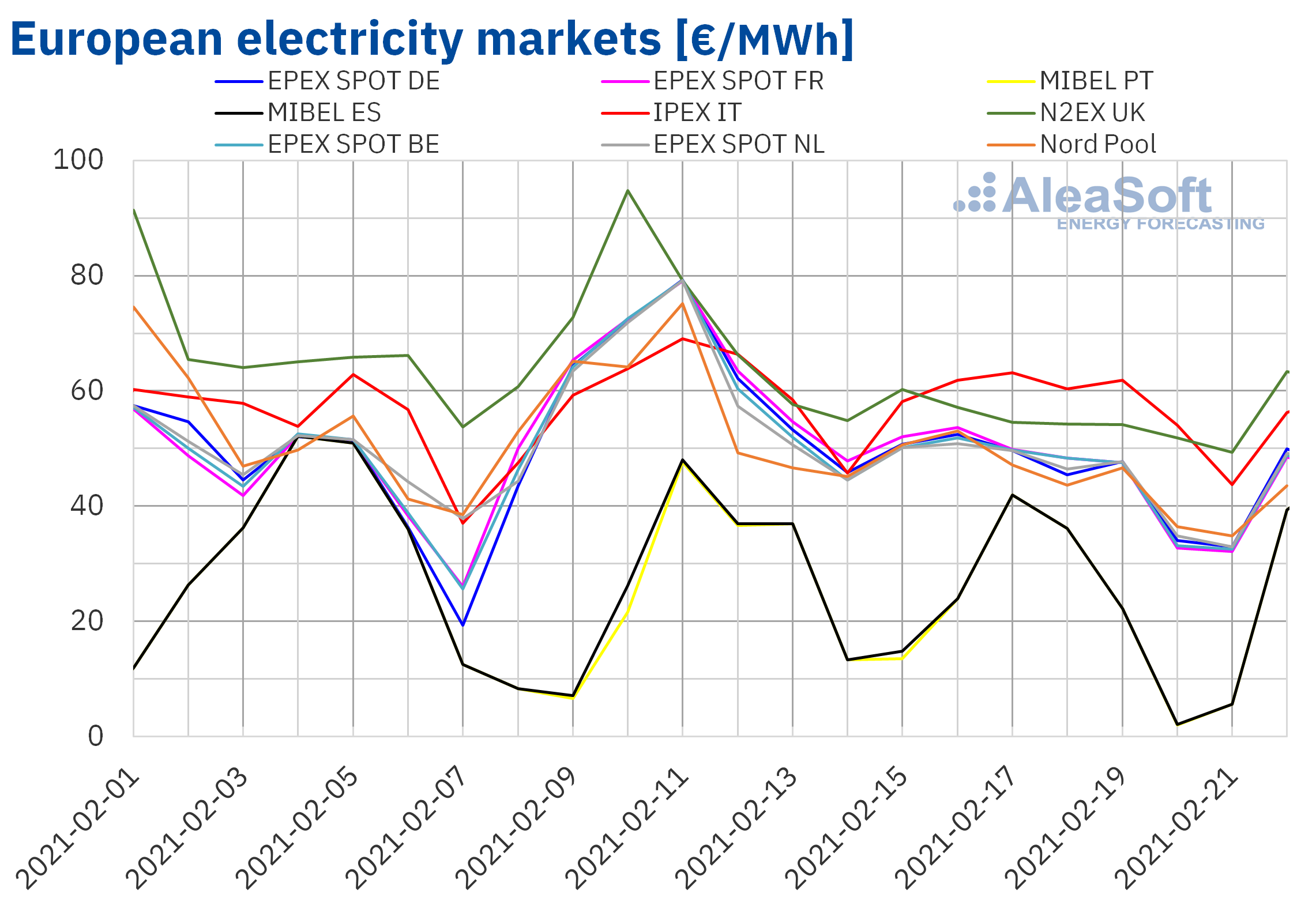

The week of February 15, the prices of all European electricity markets analysed at AleaSoft decreased compared to those of the previous week. The largest drop in prices, of 27%, was that of the EPEX SPOT market of France, followed by that of the EPEX SPOT market of Germany, of 26%. On the other hand, the lowest price decrease, of 1.7%, was that of the IPEX market of Italy. In the rest of the markets, the price drops were between 15% of the MIBEL market of Portugal and 25% of the EPEX SPOT market of Belgium.

In the third week of February, the highest weekly average price was that of the Italian market, of €57.60/MWh, followed by that of the N2EX market of UK, of €54.50/MWh. While in the MIBEL market of Portugal and Spain the lowest averages were registered, of €20.78/MWh and €21.01/MWh, respectively. In the rest of the markets, the prices were between €44.63/MWh of the Nord Pool market of the Nordic countries and €45.20/MWh of the French market.

On the other hand, the week of February 15, the MIBEL market continued to present the lowest daily prices in the analysed markets. On Saturday, February 20, the lowest daily prices so far this month were registered, of €2.19/MWh in Spain and €2.02/MWh in Portugal. On that day, hourly prices below €1/MWh were reached for twelve hours in Spain and for thirteen hours in Portugal. The minimum hourly price of the week in these markets was €0.16/MWh, which corresponded to two hours of Monday, February 15, and seven hours of Saturday, February 20.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

During the third week of February, the decrease in demand in most markets favoured the fall in prices. In addition, the general increase in solar energy production and the increase in wind energy production in countries such as Germany, France and Portugal also contributed to the decrease in prices in the European electricity markets.

The AleaSoft‘s price forecasting indicates that during the week of February 22, the prices will recover in most markets, favoured by the general decrease in wind energy production and the increase in demand in some markets.

Iberian market

Between February 1 and 22, the MIBEL market of Spain and Portugal was the one with the lowest price in Europe almost every day, except February 4. The lowest prices of the month so far were registered during the last weekend, on February 20 and 21. On February 20 the price of the Portuguese market was €2.02/MWh and that of the Spanish market was €2.19/MWh, and on February 21 both markets reached €5.67/MWh. On Saturday, February 20, seven hours had a price of €0.16/MWh in the two markets.

The low prices of February 20 and 21 were caused by the increase in wind energy production, to which was added the decrease in demand during the weekend. In Spain, the Ascó I, Ascó II, Cofrentes and Vandellós II nuclear power plants had to reduce their power to help absorb the increase in wind energy production. However, the production continued with cogeneration, combined cycle gas turbines and coal. During that weekend, Spain positioned itself as a net exporter of electricity.

Source: Prepared by AleaSoft using data from E.SIOS.

Source: Prepared by AleaSoft using data from E.SIOS.

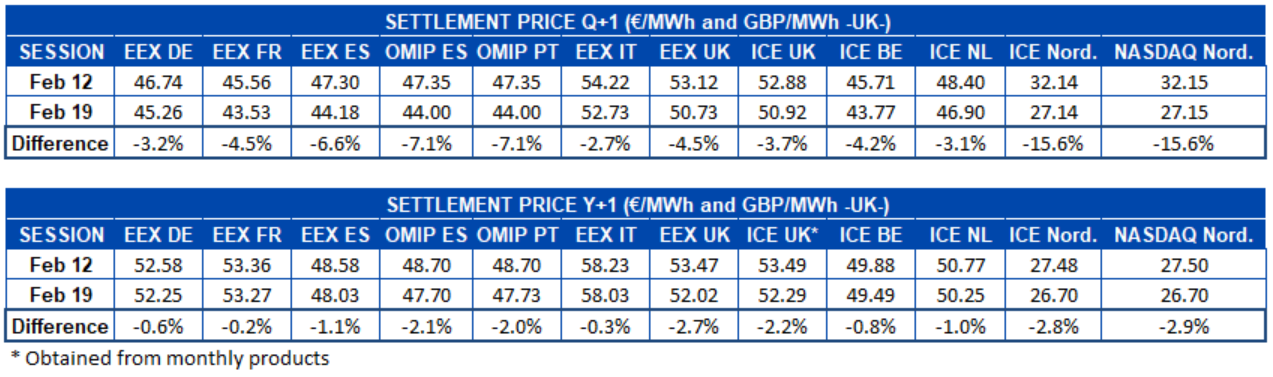

Electricity futures

During the third week of February, the electricity futures prices for the second quarter of 2021 had a downward behaviour in all the European markets analysed at AleaSoft. The Nordic region, both in the ICE market and in the NASDAQ market, was the one that presented the steepest decreases, in both cases close to 16%. In the rest of the markets, the decreases were between 2.7% of the EEX market of Italy and 7.1% of the OMIP market of Spain and Portugal, value registered for both countries.

A similar behaviour but on a smaller scale was registered for the product of the calendar year 2022. The prices fell in all markets. Again, the ICE and NASDAQ markets of the Nordic countries led the falls, with decreases of 2.8% and 2.9% respectively. Also in this product, the EEX market of Italy was the one with the lowest variation, with a decrease of 0.3%.

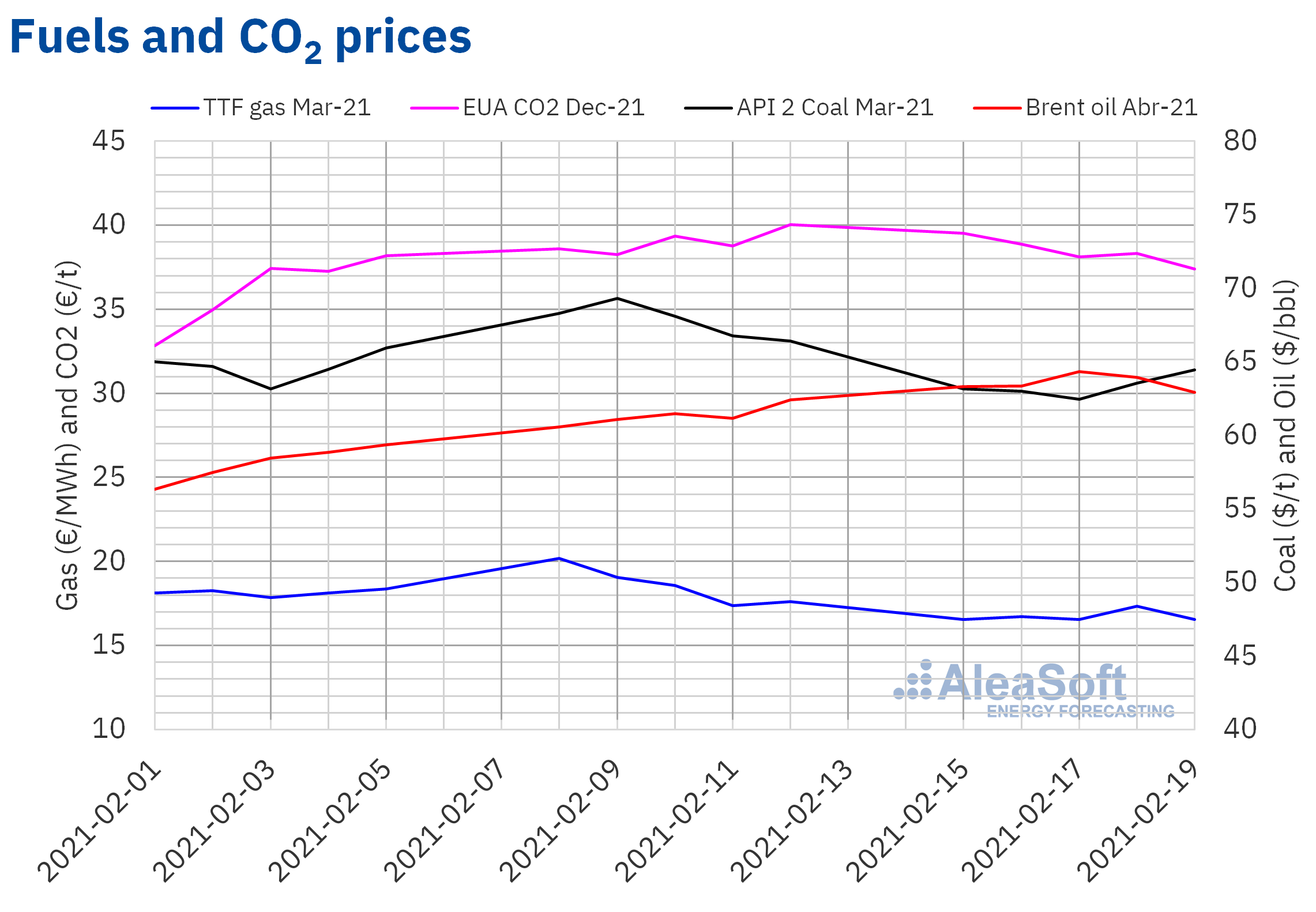

Brent, fuels and CO2

The Brent oil futures prices for the month of April 2021 in the ICE market, the third week of February, continued with the upward trend until reaching a settlement price of $64.34/bbl on Wednesday, February 17. This price was 4.7% higher than that of the same day of the previous week and the highest since the beginning of May 2019. But on Thursday the prices began to fall. The settlement price of Friday, February 19, was $62.91/bbl, the lowest of the week, but still 0.8% higher than that of the previous Friday.

The cold temperatures registered during the third week of February in the United States caused a reduction in the country’s production, favouring the increase in Brent prices. However, the refineries were also affected by the cold snap, causing a decrease in demand that ended up exerting its influence on the evolution of the prices.

On the other hand, the expectations about the improvement in the economy and the demand at the world level, together with the OPEC+ production cuts, will continue to exert their upward influence on the prices. But the recovery of the activity in the US refineries is expected to be slow, which may lead to an increase in the country’s crude reserves in the coming weeks.

As for the TTF gas futures in the ICE market for the month of March 2021, the third week of February registered prices lower than those of the same days of the previous week. On Monday, February 15, a settlement price of €16.54/MWh was reached, 18% lower than that of the previous Monday and the lowest since December 2020. This price was repeated again on Wednesday, February 17. On the other hand, on Thursday, February 18, the highest settlement price of the week, of €17.33/MWh, was registered. Less cold temperatures in Europe and greater availability favoured the drops in gas prices. However, the reserves levels are low, which may curb these declines.

Regarding the settlement prices of the CO2 emission rights futures in the EEX market for the reference contract of December 2021, they registered decreases during most of the third week of February. As a result, on Friday, February 19, the lowest settlement price of the week, of €37.41/t, was reached, which was 6.5% lower than that of the previous Friday.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the evolution of the energy markets and prospects from 2021

On February 18, the webinar “Prospects for the energy markets in Europe from 2021 (III)” was held, organised by AleaSoft and in which speakers from Engie participated. In the webinar, the PPA were analysed and it was said that they are much more than getting a good price. The most important thing is that they are a tool for the risk management, both for the consumers and for the producers. In addition, it allows the developers to obtain financing with greater leverage. In the webinar the need and importance of having long‑term market prices curves with hourly breakdown as a fundamental input in the financial models to estimate costs or income during the duration of the contract or the lifetime of the facility were also analysed. The recording of the webinar can be requested through this link or by writing to webinar@aleasoft.com.

The evolution of the European energy markets and the financing of the renewable energy projects will continue to be discussed in the webinar that AleaSoft is organising for March 18. This time the analysis will focus on the prospects for the spring 2021 and there will be the collaboration of speakers from EY (Ernst & Young). The importance of the PPA will continue to be discussed and the main novelties in the regulation of the energy sector and the business opportunities abroad will also be commented.

Source: AleaSoft Energy Forecasting