AleaSoft, June 7, 2021. In the first week of June, the prices of most of the European electricity markets rose. Although the demand fell in general, the fact that the solar and wind energy production fell in several markets in the current context of gas prices above €25/MWh and CO2 prices close to €50/t led to increases in prices. The Brent futures exceeded $71/bbl, the highest value in the last two years. In the second week of June, the electricity markets prices will continue to rise.

Photovoltaic and solar thermal energy production and wind energy production

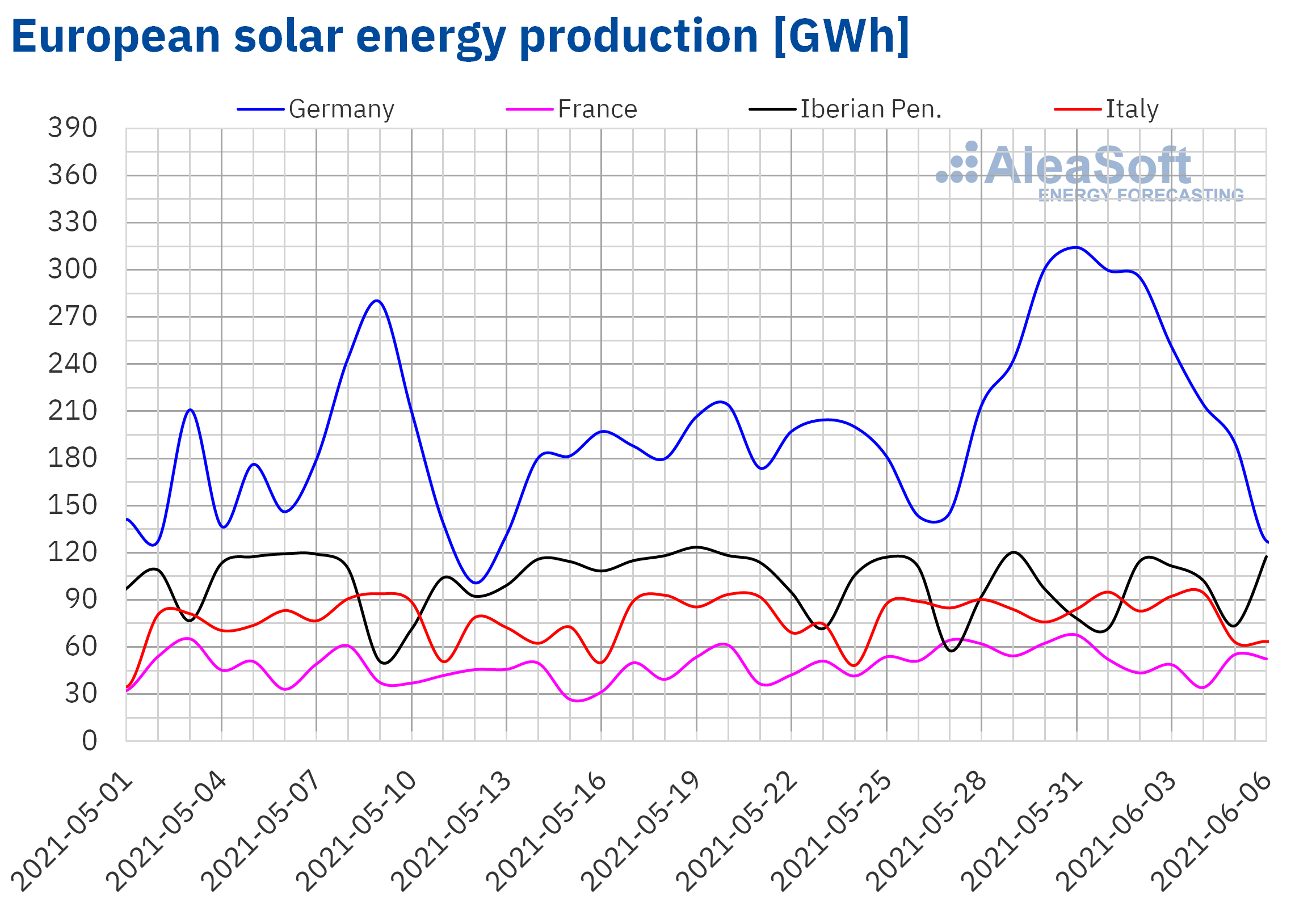

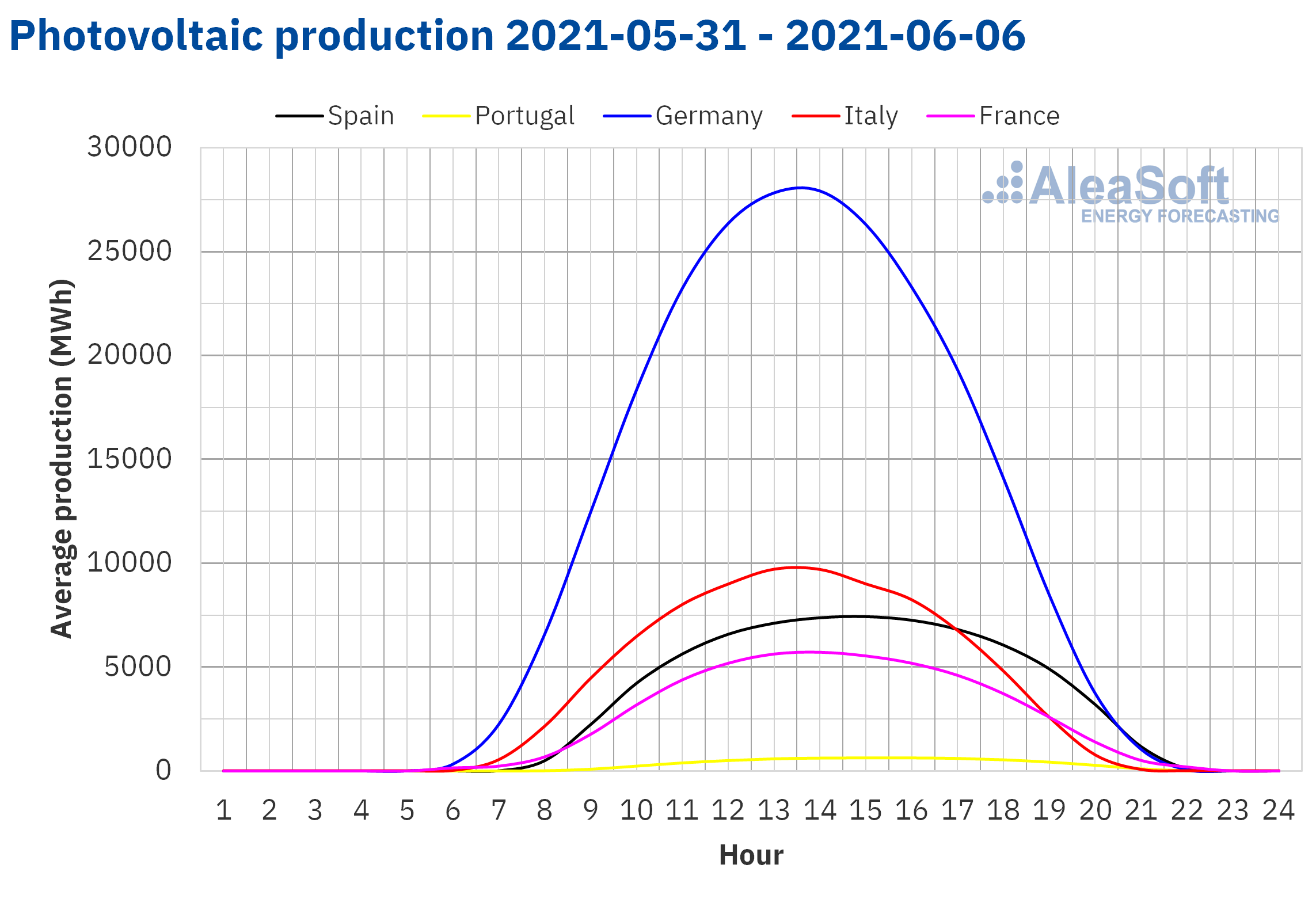

During the week of May 31, the solar energy production increased by 19% in the German market and 2.8% in the Italian market compared to the total registered in the week of May 24. However, in the French market, the production with this technology decreased by 9.1% and 4.5% in the Iberian Peninsula compared to the previous week.

For the week of June 7, the AleaSoft’s solar energy production forecasting indicates that it will decrease in the markets of Spain, Germany and Italy compared to the previous week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

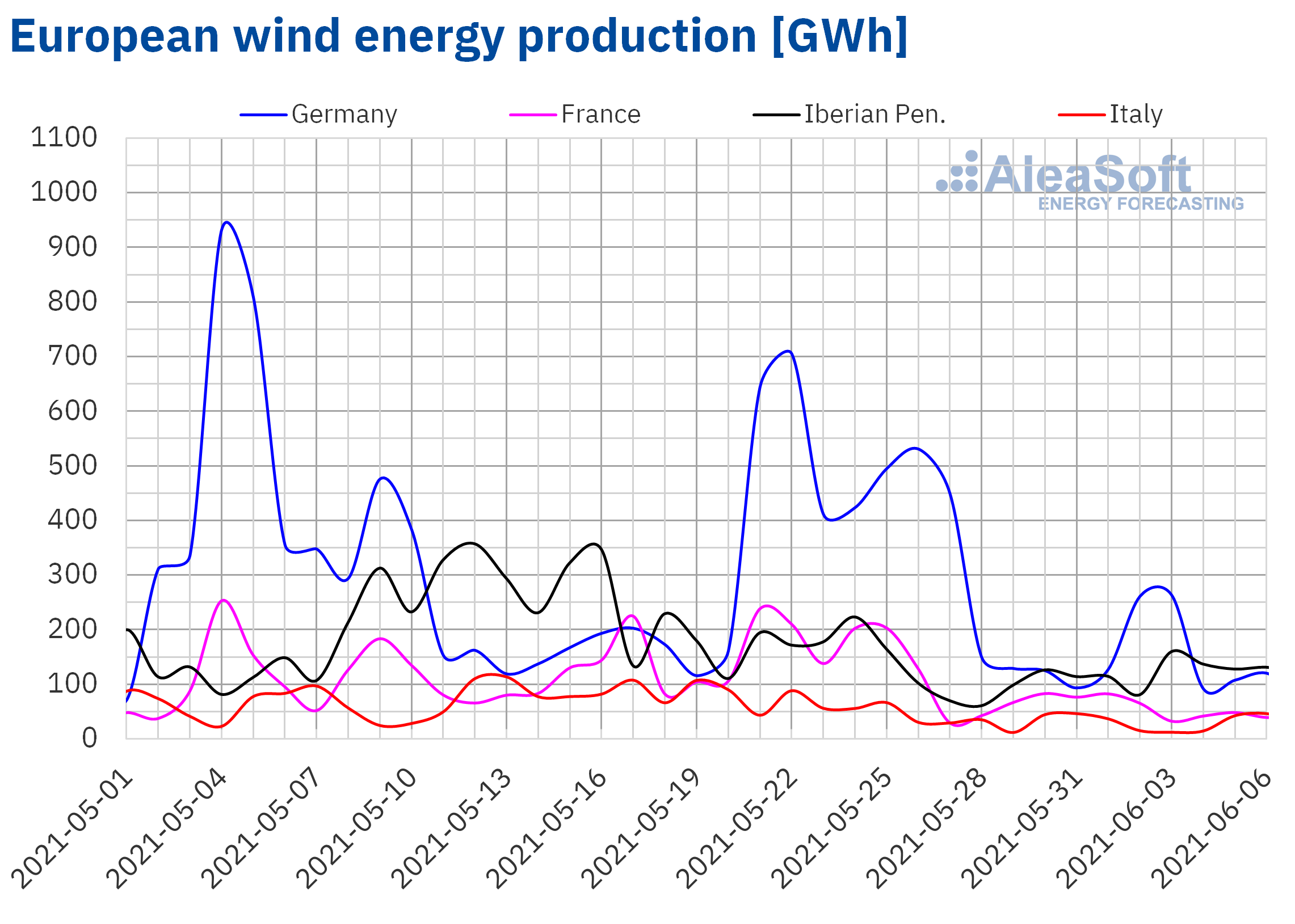

During the first week of June, the wind energy production decreased in most of the continent except in the Iberian Peninsula where it increased by 2.3% compared to the production registered in the last week of May. The largest drop was that of the German market, of 54%, followed by those of the French and Italian markets, of 49% and 22% respectively.

For the week of June 7, the AleaSoft’s wind energy production forecasting indicates that the production with this technology will be lower than that registered the previous week in the markets of Germany and France. For the rest of the markets the rise is expected to be moderate.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

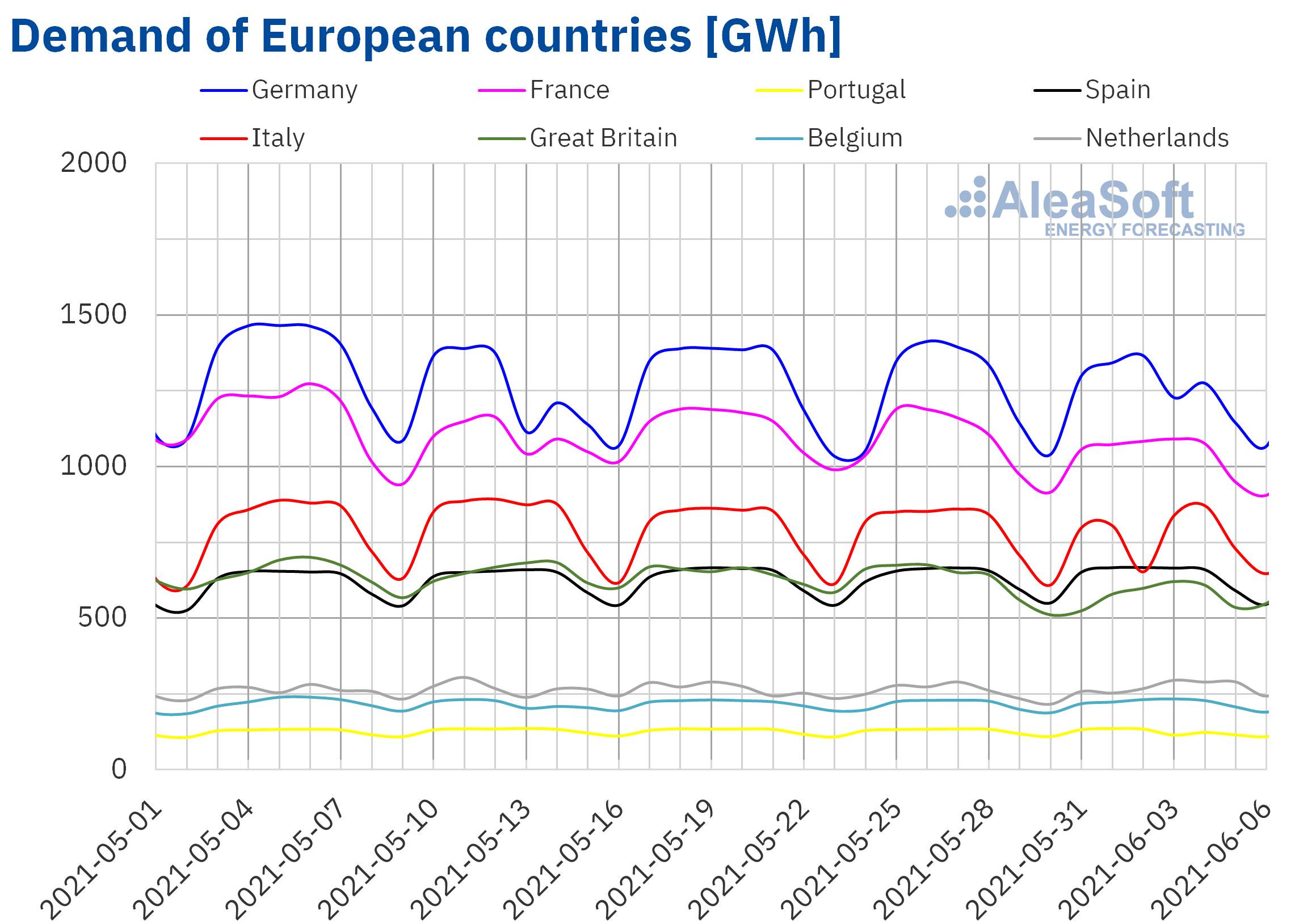

Electricity demand

The electricity demand of the week of May 31 decreased compared to the previous week in most European markets. These decreases were mainly associated with the effects of the holidays celebrated during that week in various countries of the continent. In the British market, the effect of the Spring Bank Holiday, celebrated on May 31, influenced the weekly drop of 8.3%. In Italy the Day of the Italian Republic was commemorated on June 2, while a day later Corpus Christi was celebrated in Portugal and in some regions of Germany. The falls were around 3.5% in the first two markets but in the third the demand remained with values similar to those of the week of May 24. Correcting the effect of these holidays, the variations were ‑6.9%, ‑0.7% and 0.3% in the United Kingdom, Portugal and Italy respectively. On the other hand, in the markets of Spain and Belgium, increases were reported below 3.0%.

The analysis of the demand can be carried out in the AleaSoft’s electricity markets observatories, through graphs with hourly, daily and weekly data.

For the week of June 7, the AleaSoft’s demand forecasting indicates that there will be increases in most electricity markets of Europe.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

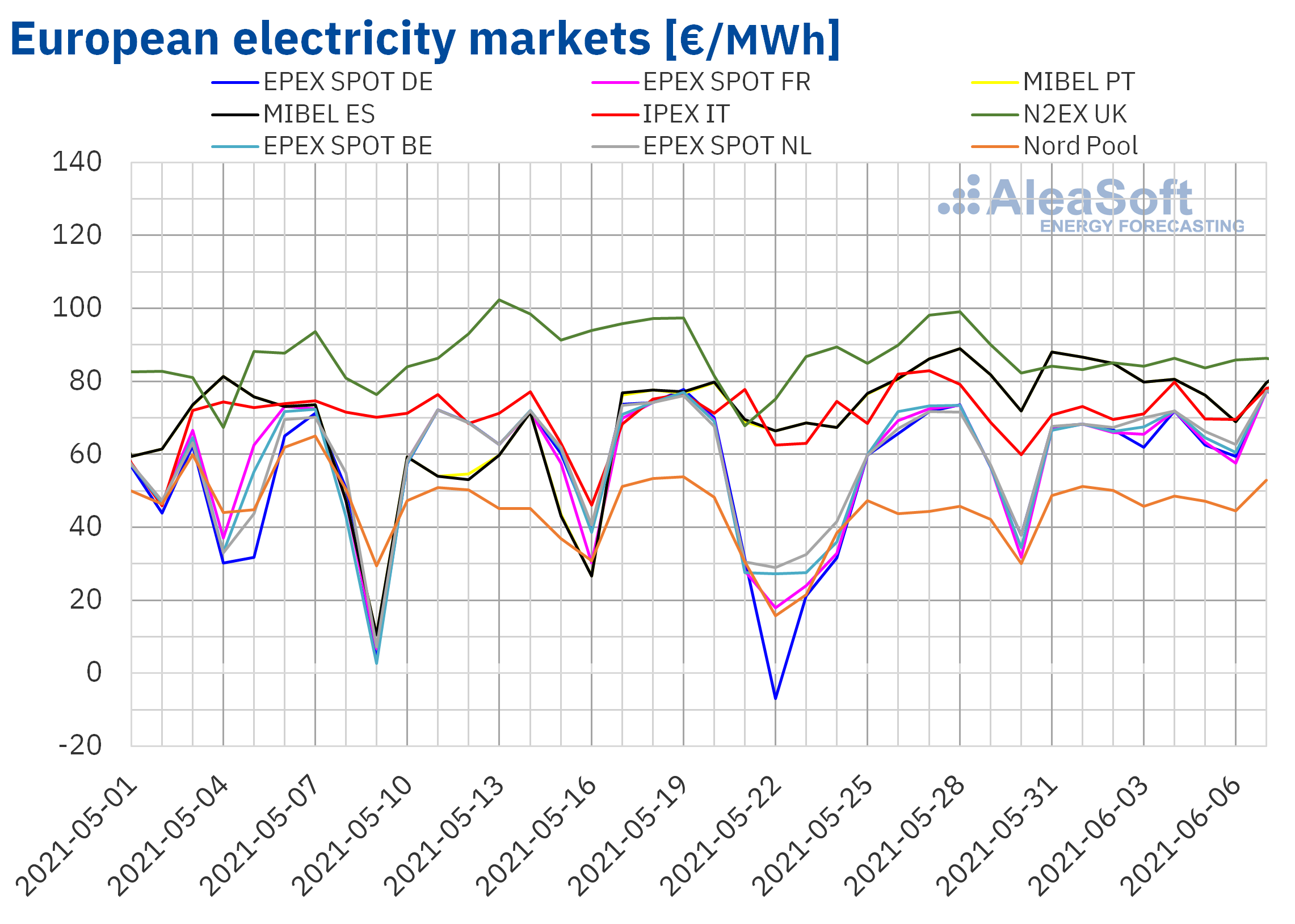

European electricity markets

The week of May 31, the prices increased in almost all the European electricity markets analysed at AleaSoft. The exceptions were the IPEX market of Italy and the N2EX market of the United Kingdom, with decreases of 2.3% and 6.5% respectively. Regarding the price increases, the largest was that of the EPEX SPOT market of the Netherlands, of 17%, followed by that of the EPEX SPOT market of France, of 16%. On the other hand, the smallest increases were those of the MIBEL market of Spain and Portugal, of 2.0% and 2.1% respectively. In the rest of the markets, the increases were around 15%.

In the first week of June, the highest weekly average price was that of the N2EX market, of €84.64/MWh, followed by the averages of the MIBEL market of Spain and Portugal, of €80.70/MWh and €80.68/MWh respectively. While the lowest average was that of the Nord Pool market of the Nordic countries, of €48.00/MWh, in the rest of the markets the prices were between €65.45/MWh of the EPEX SPOT market of Germany and €71.94/MWh of the IPEX market.

The gas prices remain high and the CO2 prices, although they fell in the first week of June, remain around €50/t. To this was added the decrease in wind energy production in the German, French and Italian markets and in solar energy production in markets such as Spain and France, favouring the increase in prices in the European electricity markets. However, the decrease in demand allowed the prices to fall in the British and Italian markets.

The AleaSoft’s price forecasting indicates that during the week of June 7, the prices will increase in most markets. This behaviour will be influenced by the increase in demand, the decrease in wind energy production in the German and French markets and a decrease in solar energy production in markets such as Germany, Spain or Italy. In addition, in the coming days, the gas and CO2 prices are expected to continue high.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, Nord Pool and GME.

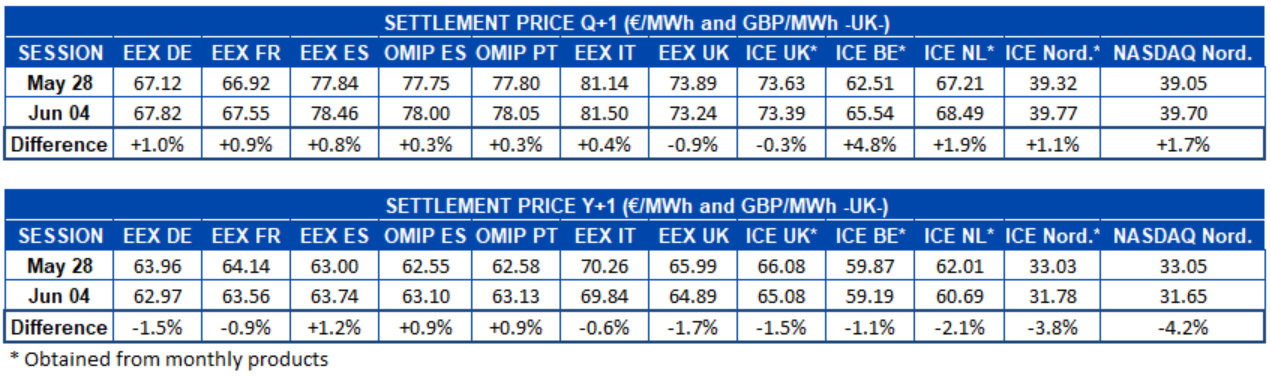

Electricity futures

The electricity futures prices for the next quarter registered increases in almost all the European markets analysed at AleaSoft, if the settlement prices of the sessions of May 28 and June 4 are compared. The United Kingdom, both in the EEX market and in the ICE market, was the exception, with decreases in these markets of 0.9% and 0.3% respectively. In the rest of the markets, the increases were between 0.3% and 4.8%, the latter being the case of the ICE market of Belgium, which was where the prices for the Q3‑2021 product increased the most.

However, the electricity futures prices for the next year had a more heterogeneous behaviour. The price increases were concentrated in the Iberian Peninsula region. The EEX market of Spain and the OMIP market of Spain and Portugal were the markets that registered rises, with increases of 1.2 and 0.9% respectively. In the rest of the markets, the prices fell between 0.6% and 4.2%. This last value is that of the NASDAQ market of the Nordic countries, which was the one in which the prices fell the most between the two analysed sessions.

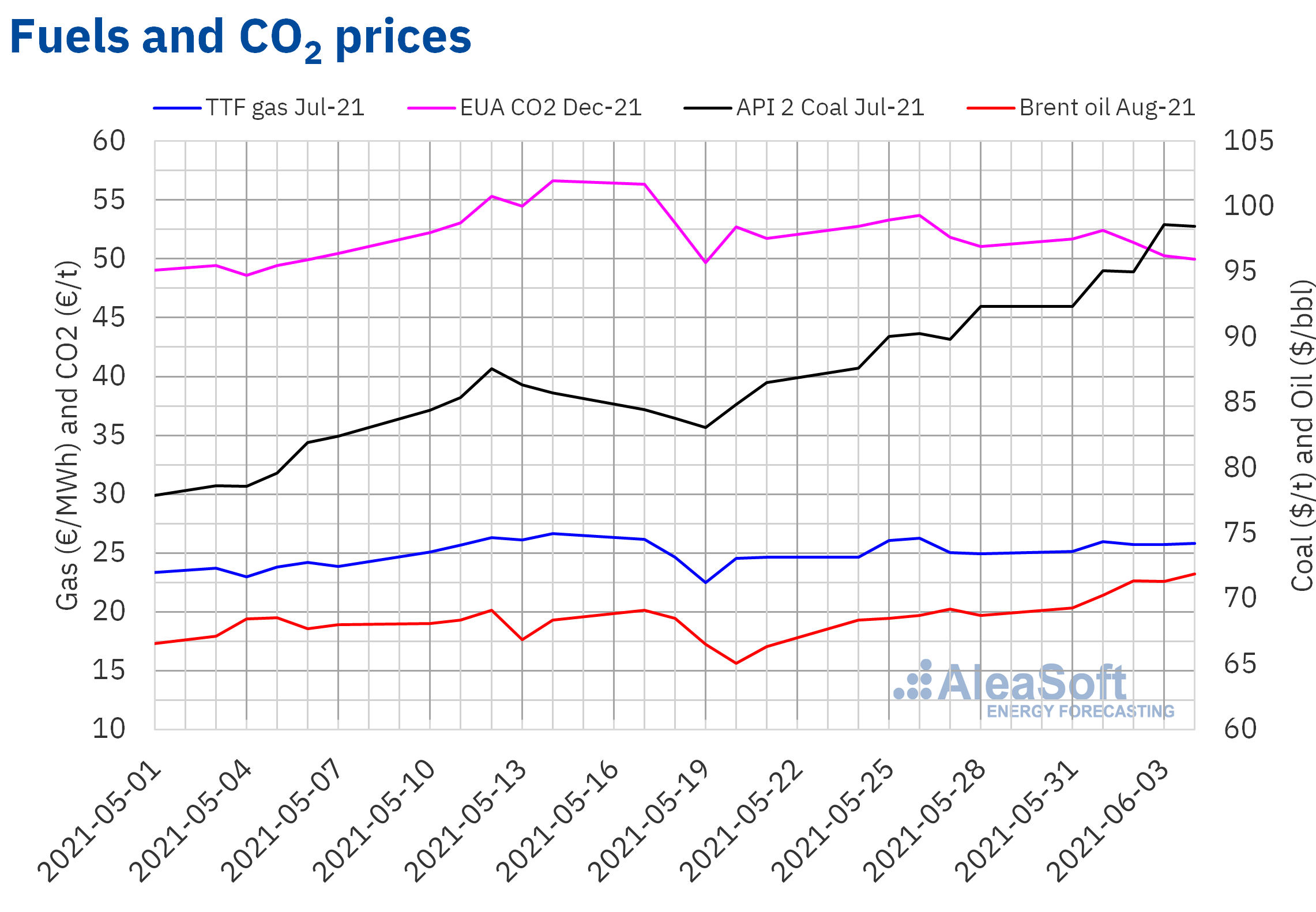

Brent, fuels and CO2

The Brent oil futures prices for the month of August 2021 in the ICE market followed an upward trend during the first week of June. As a result, on Friday, June 4, a settlement price of $71.89/bbl was reached, which was 4.6% higher than that of the previous Friday and the highest in the last two years.

The advance in vaccination against COVID‑19 in the United States and Europe is favouring the recovery in demand. In addition, a weaker dollar and the news about the decrease in US crude reserves also contributed to the increase in prices at the end of the first week of June.

On the other hand, the OPEC+ agreed at its meeting of Tuesday, June 1, to continue increasing its production this month according to plan. Regarding the negotiations on the Iranian nuclear program, the lack of an agreement still does not allow the lifting of sanctions on crude exports from this country.

As for the TTF gas futures prices in the ICE market for the month of July 2021, the first week of June they were higher than €25/MWh. After a daily price increase of 3.4%, on Tuesday, June 1, the maximum settlement price of the week, of €25.97/MWh, was reached. However, this price was 0.3% lower than that of the same day of the previous week, when a settlement price of €26.04/MWh was registered.

The reserves levels remain low and maintenance work is scheduled in Norway that will affect the gas flow to the rest of Europe.

Regarding the CO2 emission rights futures in the EEX market for the reference contract of December 2021, the first week of June they registered prices lower than those of the same days of the previous week. The settlement price of Friday, June 4, was €49.97/t, 2.1% lower than that of the previous Friday and it was below €50/t for the first time since May 19.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

The PPA and their importance for the large and electro‑intensive consumers

In the webinars that AleaSoft conducts monthly, one of the topics that was most analysed is the PPA, their characteristics and their importance in the market prices risks management as well as their role in the energy transition process. For this, the webinars had the participation of important companies of the European and global energy sector, consulting and service companies and financial entities such as Deloitte, PwC Spain, EY, JLL, Vector Renewables, Engie, Axpo, Banco Sabadell and Triodos Bank. Given the great interest that this issue continues to arouse in the sector and taking into account that the Statute of the electro‑intensive consumers obliges these consumers to contract renewable energy PPA for at least five years for, at least, 10% of their annual consumption, in the next AleaSoft’s webinar the importance of the PPA for the large and electro‑intensive consumers will be discussed. The webinar will be held on Thursday, June 10, and will include the participation at the analysis table of Fernando Soto, Director‑General of AEGE, to discuss this issue. In the webinar, the usual analysis of the evolution of the energy markets in recent weeks will also be carried out, and the AleaSoft’s vision of the future on the decarbonisation of the industry and the role that green hydrogen will have will be discussed.

In all these webinars, it was agreed on the importance of having quality market prices forecasts that cover, at least, the entire horizon of the PPA and that are bankable in order to obtain the project financing. It is important that the forecasts are hourly to estimate the income of the plant and also to define the prices structure of the PPA.

Source: AleaSoft Energy Forecasting.