AleaSoft, August 17, 2020. The prices of most of the European electricity markets rose in the second week of August due to the heat wave that suffered a large part of the continent and that caused an increase in demand in various markets. The recovery in gas prices and the decline in renewable energy production in some markets also favoured this trend. In the third week of the month, temperatures are expected to be less warm, leading to lower prices in most of the markets.

Solar photovoltaic and solar thermal energy production and wind energy production

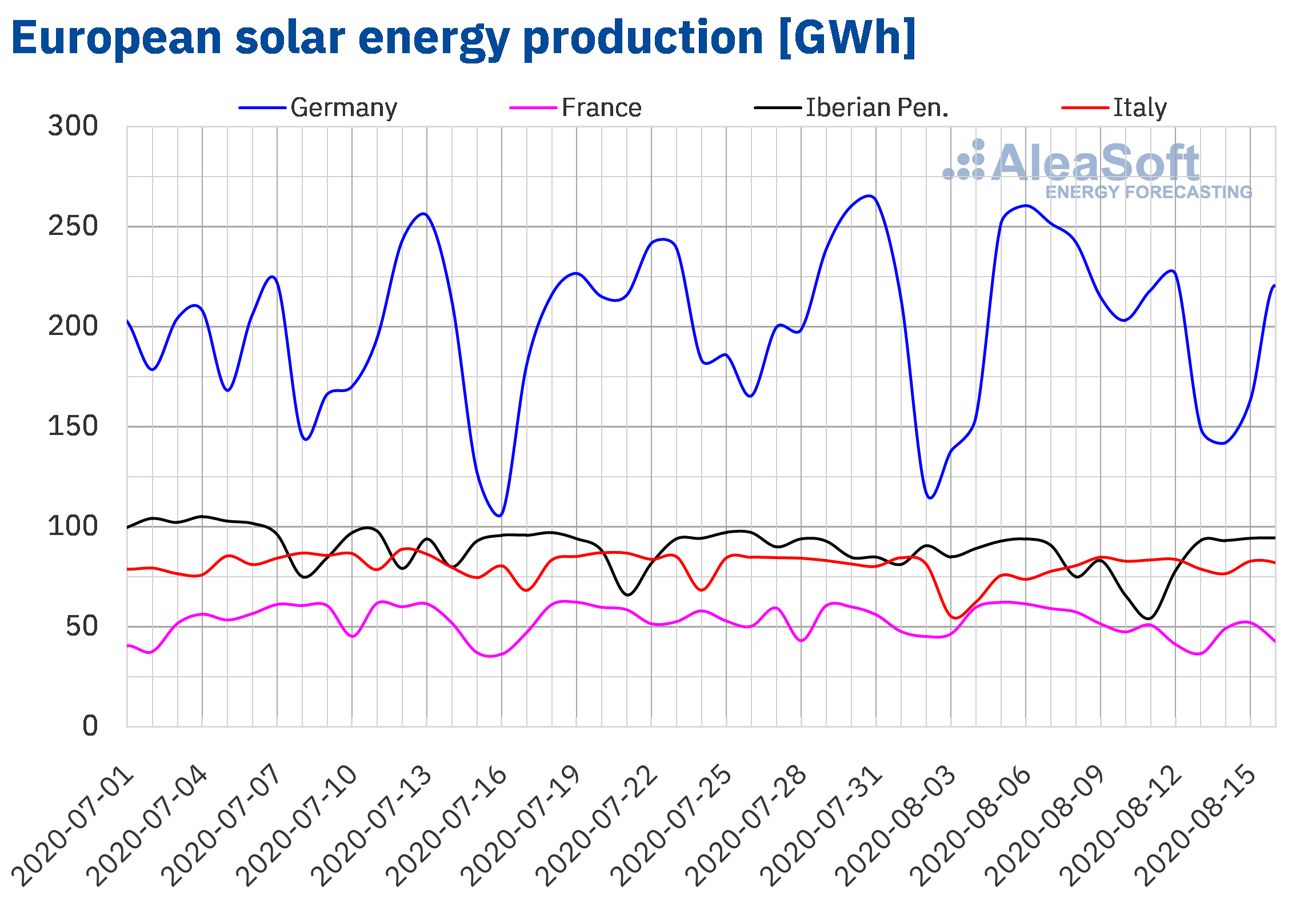

The solar energy production during the week that began on August 10 decreased in most of the markets analysed at AleaSoft. In the French market it fell by 20%, while in the German market it fell by 13% and in the Iberian Peninsula by 6.0%. The exception was the Italian market where production increased by 12%.

In the year‑on‑year analysis, during the first 16 days of August, the solar energy production was the highest in all markets. The largest increases were recorded in the Iberian Peninsula, with an increase of 31% in Spain and 26% in Portugal. On the other hand, the lowest variation was registered in the Italian market, of 5.0%. In the German market, production grew by 20% during this period and in the French by 12%.

For the week that began on Monday, August 17, AleaSoft‘s solar energy production forecasting indicates that solar energy production will decrease in most of the markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

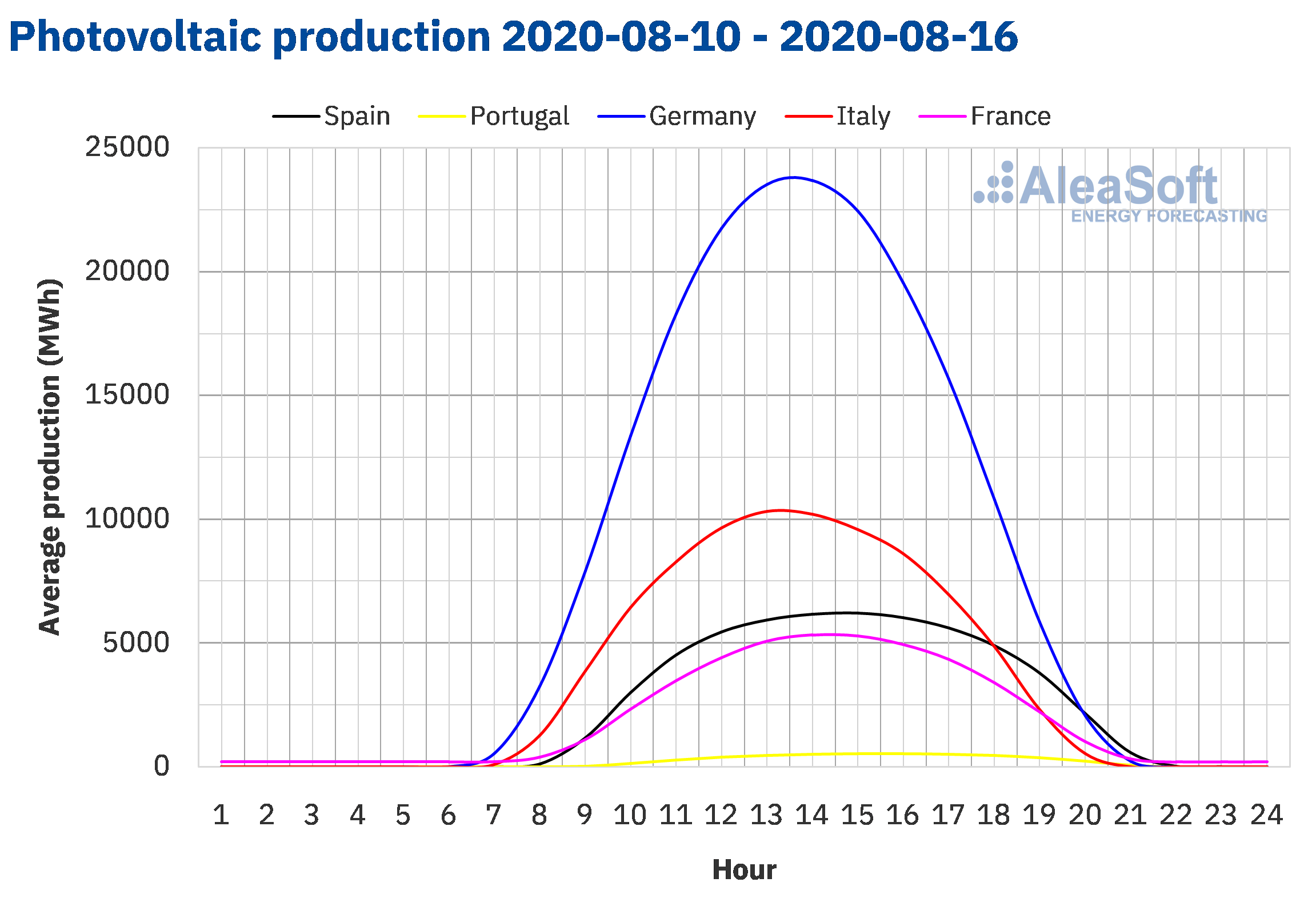

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

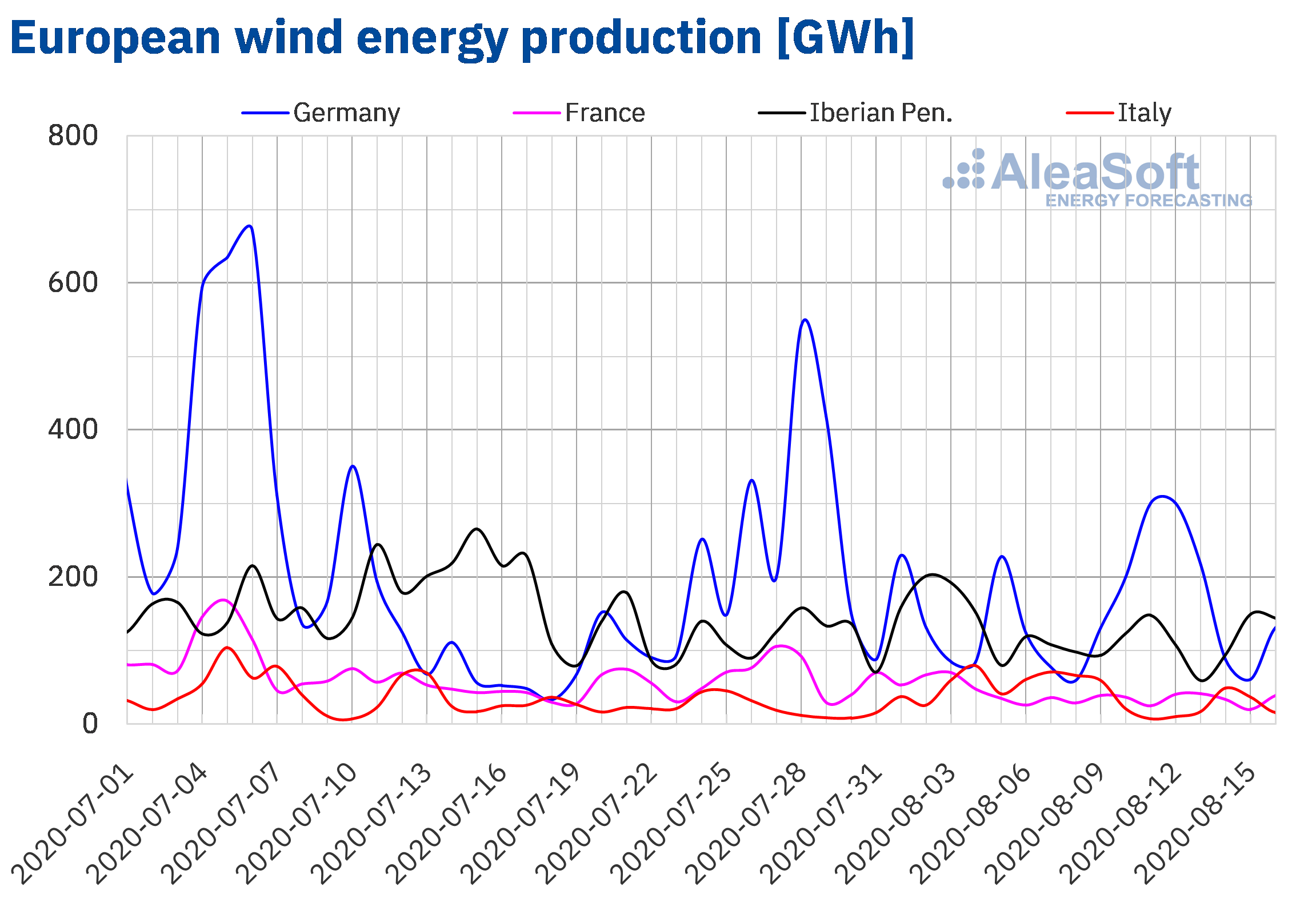

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

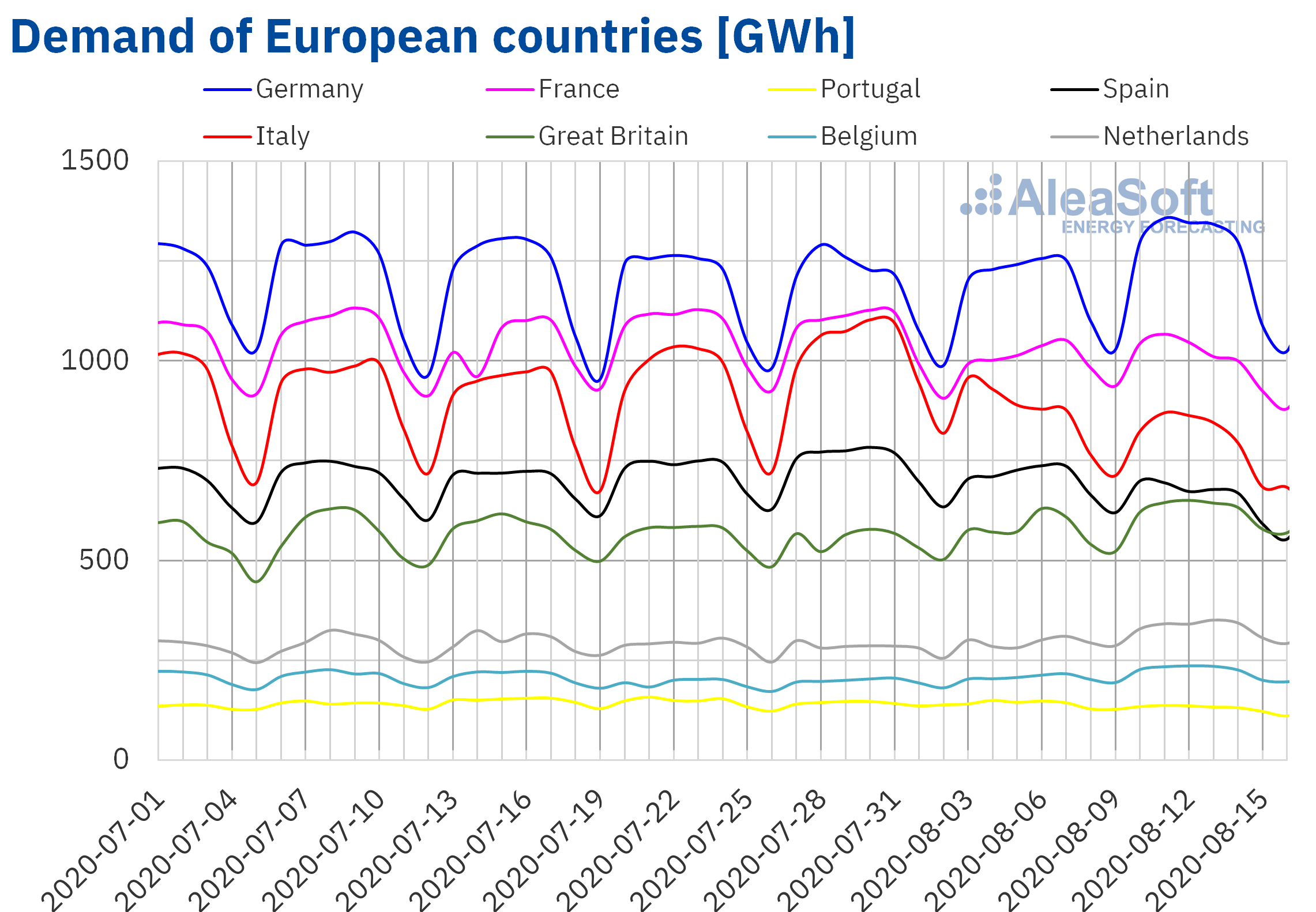

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

During the second week of August, the wind energy production increased by 64% in the German market while, on the contrary, it decreased by the same amount in the Italian market compared to the week of August 3. In the markets of France and Spain, production decreased by 16% and 5.2% respectively, while in the Portuguese market, the production with this technology increased by 14%.

From August 1 to 16, the wind energy production decreased between 36% and 28% in the markets of France, Germany and Portugal compared to the same days in 2019. On the contrary, in the Spanish market it increased by 20% and 11% on the Italian market.

For the third week of August, AleaSoft‘s wind energy production forecasting indicates an increase in production in most of the analysed markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

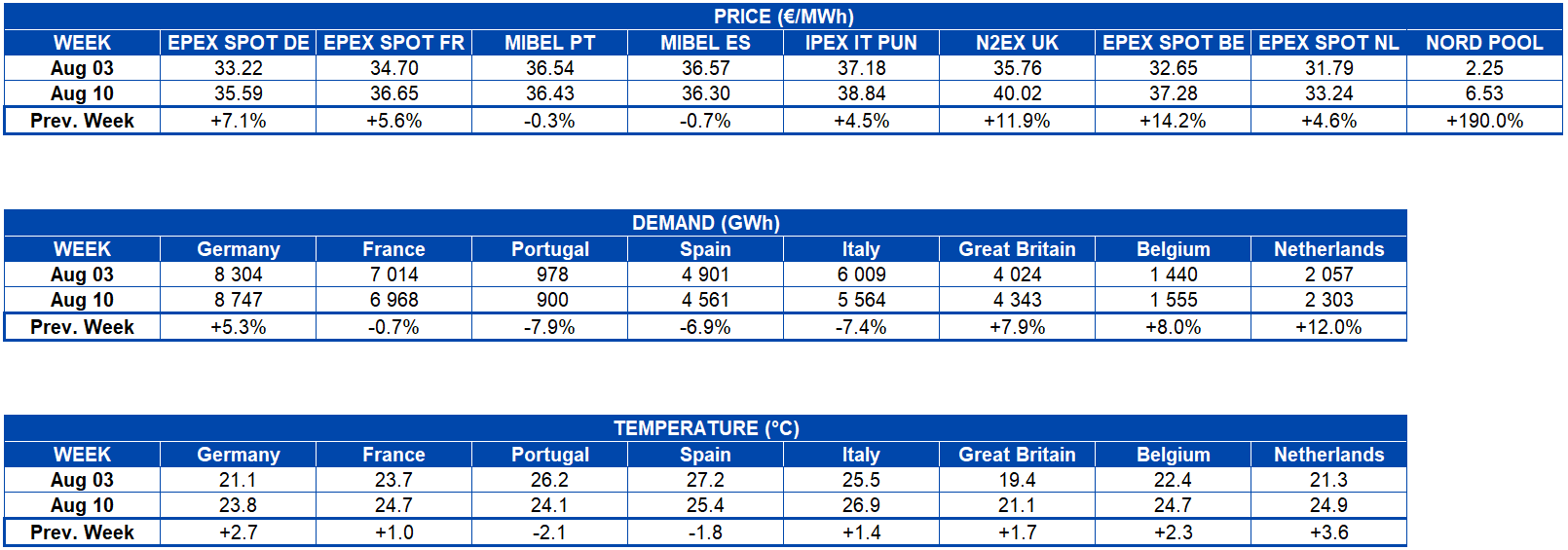

The heat wave caused significant increases in demand during the week of August 10 compared to the first week of the month in some European markets. The increases in the markets of Belgium, Great Britain and Germany were 8.0%, 7.9% and 5.3% respectively. A particular case was France which, despite high temperatures and presenting an upward trend during the first three days of the week, ended with a decrease of 0.7% compared to the week of August 3, due to the holiday of the Day of the Assumption of Mary that was celebrated on August 15. In other European markets, the decline in labour activity in the August holiday period contributed to the drop in demand. Such were the cases of Portugal, Italy and Spain, which registered decreases of 7.9%, 7.4% and 6.9% respectively.

The demand trend and other variables of interest in the European electricity markets can be analysed in the AleaSoft‘s electricity market observatories.

For the current week, AleaSoft’s energy demand forecasting predicts a decrease in demand for most of the markets due to less warm temperatures in much of Europe.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

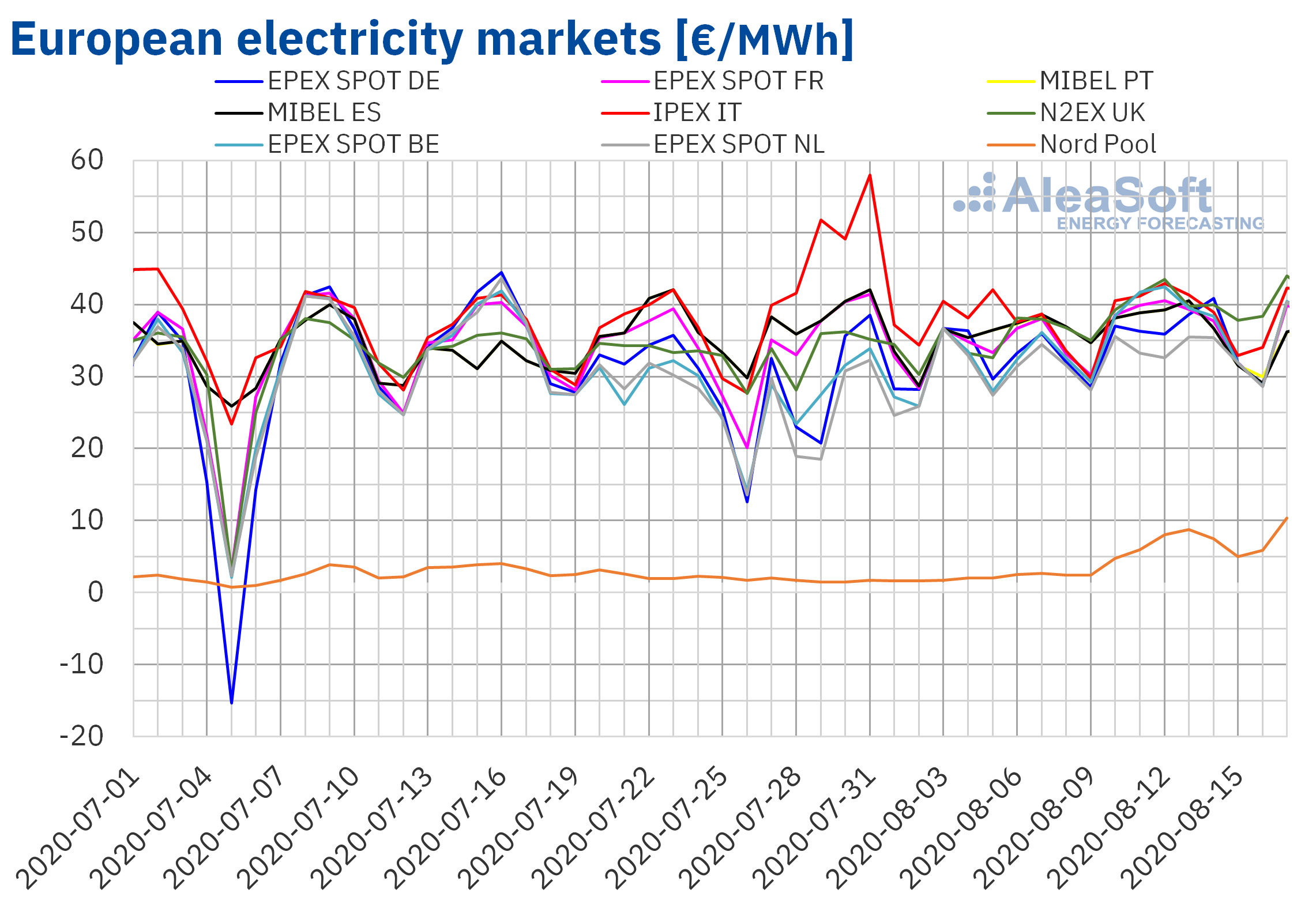

During the week of August 10, the prices of the European electricity markets maintained a relatively stable behaviour. Leaving aside the Nord Pool market of the Nordic countries, where prices remained below €10/MWh, in the rest of the markets the prices from Monday to Friday were between €34.45/MWh in the EPEX SPOT market of the Netherlands and €40.98/MWh in the IPEX market of Italy. On weekends, prices fell due to lower demand and were between €30.22/MWh in the Dutch market and €38.08/MWh in the N2EX market of Great Britain.

Regarding the weekly average price, the British market topped the list of the markets with the highest prices of the period, among which are usually the IPEX market of Italy and the MIBEL market of Spain and Portugal. With a weekly price of €40.02/MWh, this market displaced the Italian market from its usual position, which came in second place with an average price of €38.84/MWh. Belgium’s EPEX SPOT market, which usually belongs to the markets with the lowest prices, was ranked third in the list of markets with the highest prices, averaging €37.28/MWh during the second week of August. Regarding the markets with the lowest prices, where the Nord Pool market and all the EPEX SPOT markets are located, the market of the Nordic countries continued to be the one with the lowest price, although it increased to €6.53/MWh, maintained a difference of more than €15/MWh compared to the next market with the lowest prices, which in this case was the EPEX SPOT market of the Netherlands, with a weekly average price of €33.24/MWh.

During the second week of August, the prices increased in most of the European markets compared to the values of the week of August 3. The MIBEL market of Spain and Portugal was the only one that ended the week of August 10 with prices lower than those of the first week of August. The largest increase was registered in the EPEX SPOT market of Belgium, which ended the week with an average weekly price higher by €4.63/MWh than the 33rd week of the year.

This increase in prices compared to the previous week is due, among other factors, to an increase in the electricity demand, largely caused by the increase in temperatures. The Iberian region was the only geographic area where temperatures did not increase compared to the week of August 3 and it coincides with being the only market in which prices did not increase. On the other hand, in some markets the renewable energy production was lower than the previous week, favouring the increase in prices. In that case is Italy, where wind energy production decreased by 64% in this period. Gas prices continued the recovery trend, another factor that helps to increase prices.

With respect to the equivalent week of 2019, the behaviour of prices during the second week of August was a little more heterogeneous. On the one hand, the MIBEL market of Spain and Portugal, the IPEX market of Italy, the EPEX SPOT of the Netherlands and Nord Pool of the Nordic countries presented prices lower than those of the same period of the previous year. In these cases, the greatest differences were in the Nord Pool market, where prices during week 33 of 2020 were €27.90/MWh lower than those of the same week last year and in the MIBEL market where prices were different in more than €6/MWh compared to 2019. On the other hand, there is the EPEX SPOT market of Germany, France and Belgium where prices were higher than those of the same period of the previous year, in the case of France and Belgium with differences of more than €8/MWh. In the case of the N2EX market of Great Britain, the weekly average price for both periods was the same.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

During the week of August 10, it is worth highlighting the upward behaviour of prices in the Nord Pool market, which although its price continues to be the lowest in European markets, the 190% increase compared to the first week of August was notable. In addition, its price for Monday, August 17, was €10.37/MWh, a value above €10/MWh that wasn’t reach since May 21.

For the week of August 17, AleaSoft‘s price forecasting indicates that prices in some markets such as France, Germany, Belgium, Great Britain and the Iberian Peninsula will be lower than those of the previous week, while in other markets such as Italy and the Netherlands, prices will experience slight increases.

Electricity futures

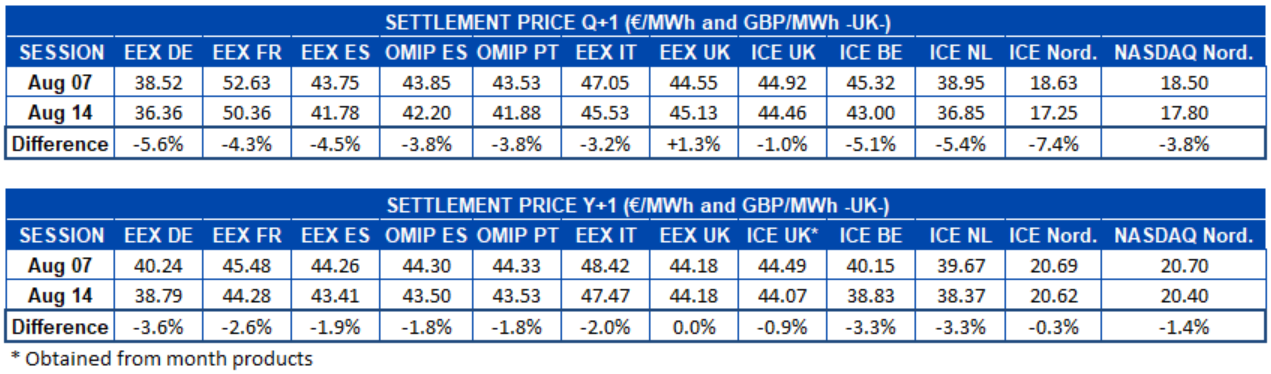

At the end of the week of August 10, most of the European electricity futures markets registered a drop in prices for the product of the last quarter of 2020. The EEX market of Great Britain was the only one in which the price was above of the settlement value for the week of August 3, by 1.3%. The rest of the markets registered decreases of between 1.0% of the ICE market in Great Britain and 7.4% of the ICE market of the Nordic countries. The EEX market of France, despite the price falling 4.3%, continued to be the one with the highest value, at €50.36/MWh, at the end of the session on August 14.

Regarding the prices of electricity futures for next year 2021, there was a general decrease in prices in all markets during the just ended week. The UK EEX market in the August 14 session registered a closing price equal to that of the August 7 session. In the rest of the markets, prices fell between 0.3% of the ICE market in the Nordic countries and 3.6% of the EEX market in Germany. In this product, unlike the quarterly product, the EEX market in Italy was the one with the highest price, at €47.47/MWh. By contrast, the NASDAQ market in the Nordic countries was the lowest priced for both products.

Brent, oil and CO2

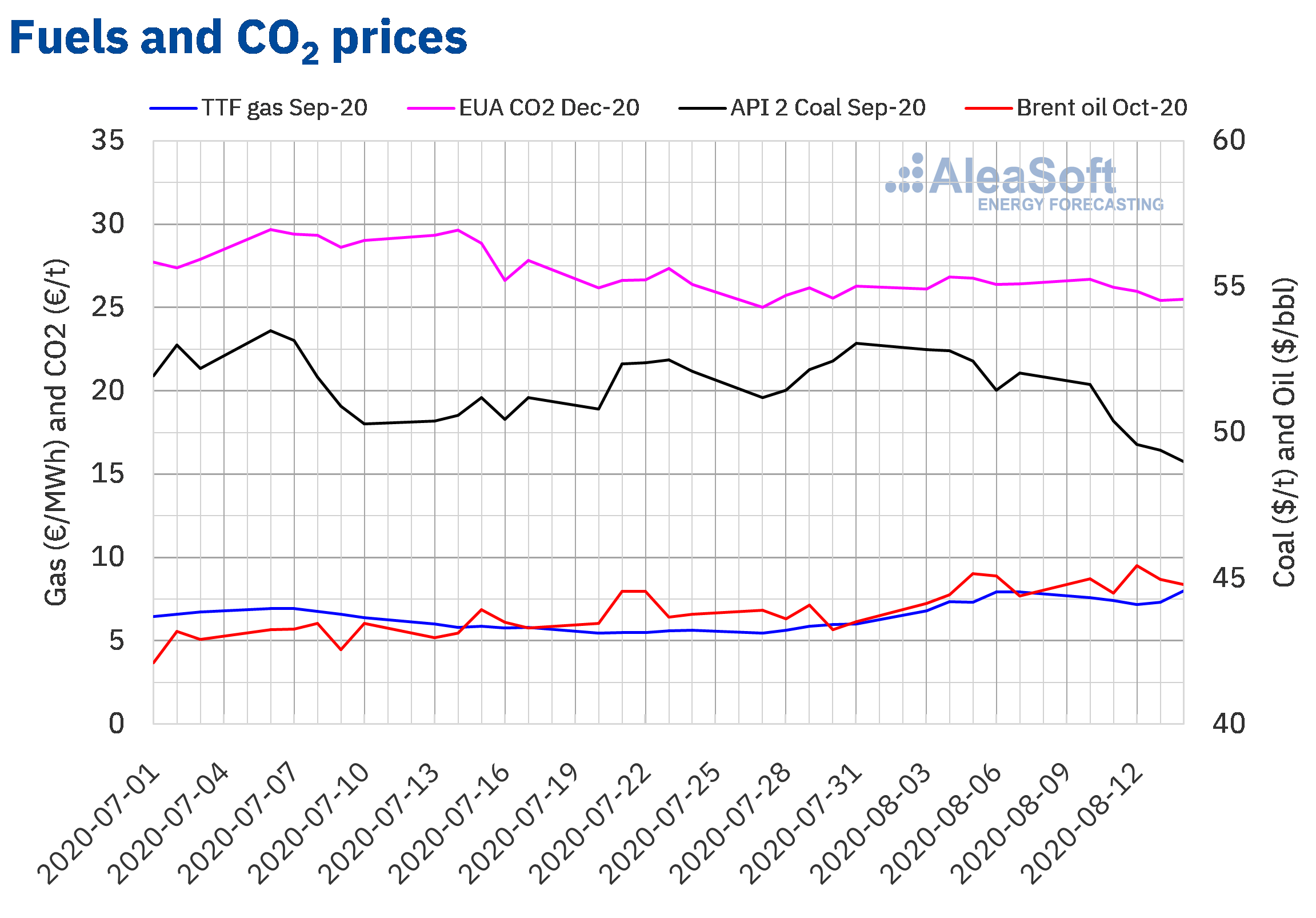

During the second week of August, the prices of Brent oil futures for the month of October 2020 in the ICE market remained close to $45/bbl. For much of the week, settlement prices were higher than those of the first week of August, except for Thursday 13, when it was 0.3% lower than that of August 6. Prices began the week with an increase of 1.3% compared to Friday, August 7, and on Tuesday, August 11, they fell 1.1% to $44.50/bbl, the lowest value of the week. On Wednesday, August 12, prices increased again, with a settlement value of $45.43/bbl, the highest since March 9. Subsequently, on Thursday and Friday, the settlement prices fell again by 1.0% and 0.4% compared to the previous day, to $ 44.80/bbl on Friday, August 14.

Prices were generally stable in the week that recently ended due to stagnant demand as a result of spikes in the number of COVID‑19 infections that caused a slowdown in the lifting of restrictions in the United States and Europe.

Regarding the TTF gas futures in the ICE market, the prices for the month of September 2020 began on Monday, August 10 with a downward trend, settling that day with a price of €7.59/MWh, lower that of Friday, August 7, by 4.3%. This trend continued until Wednesday, August 12, when the lowest price of the week of € 7.17 / MWh was reached. During the two following days, prices recovered, increasing by 2.0% on Thursday and 9.7% on Friday compared to the previous day. On Friday, August 14, a settlement price of €8.02/MWh was reached, the highest since April 22. The price rise at the end of the week was mainly due to stronger global LNG prices and expectations of higher gas demand in September.

Regarding the TTF gas spot market, the week started with an index price of €7.23/MWh on Monday, August 10, the highest in this period. The following days, prices fell to reach the lowest price of the week, €6.39/MWh, on Thursday, August 13. Later, during Friday and the weekend, prices began to recover to €6.92/MWh on Saturday and Sunday. On Monday, August 17, prices continued to rise to €6.98/MWh, 0.8% higher than at the weekend.

On the other hand, the API 2 coal futures prices in the ICE market for the month of September 2020, during the second week of August, continued with the downward trend that they have been presenting since August 3. On Monday, August 10, a price of $51.65/t was reached, the highest of the week although 2.3% lower than that of Monday of the first week of the month. The rest of the days, prices continued to fall until reaching $49.00/t on Friday, August 14, the lowest price of the week and since June 23.

Regarding the futures of CO2 emission rights in the EEX market for the reference contract of December 2020, the prices of Monday, August 10, recovered 2.2% compared to Monday of the first week of August and 1.0% compared to Friday, August 7. That day a price of €26.70/t was reached, the highest of the week. During the rest of the week, prices were lower than those of the same days of the week of August 3. In this sense, from Tuesday to Thursday, prices fell to €25.43/t on August 13, the lowest value since July 28. On Friday 14, prices recovered 0.2% compared to the previous day, to €25.49/t. The decrease in prices during the second week of August was linked to a lower volume of operations due to the holiday period, where demand has decreased compared to a higher supply.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft’s analysis on the energy markets recovery after the economic crisis

The outbreaks of COVID‑19 that are occurring at the European level, which are expected to increase from September when the school year begins in person, continue to generate a lot of uncertainty regarding the exit from the economic crisis that has generated the pandemic. AleaSoft is organising a series of webinars “The energy markets in the end of the economic crisis” that will be held in two parts, on September 17 and October 29. These webinars will analyse the evolution of the markets during the coronavirus crisis and future prospects, as well as the financing of renewable energy projects and the importance of electricity market price forecasting in audits and portfolio valuation. To date, the participation of speakers from Deloitte, Engie, Banco Sabadell and AleaSoft has been confirmed.

At AleaSoft, the long-term price curves of the main European electricity markets were updated, taking into account the latest data and forecasts published on the growth of the economy.

To track the evolution of the main European electricity, fuel and CO2 markets, AleaSoft’s observatories are available. This tool includes comparative graphs of the fundamental variables of the markets corresponding to the last weeks.

Source: AleaSoft Energy Forecasting.