AleaSoft, March 8, 2021. The European electricity markets prices rose in a generalised way during the first week of March. The increase in demand and the decrease in wind energy production were the main causes of this behaviour, which was also favoured by the decrease in solar energy production in France and Spain. The MIBEL market ceased to be the one with the lowest price on the continent, position that the Nord Pool market occupied again. The Brent futures reached their highest value in the last two years.

Photovoltaic and solar thermal energy production and wind energy production

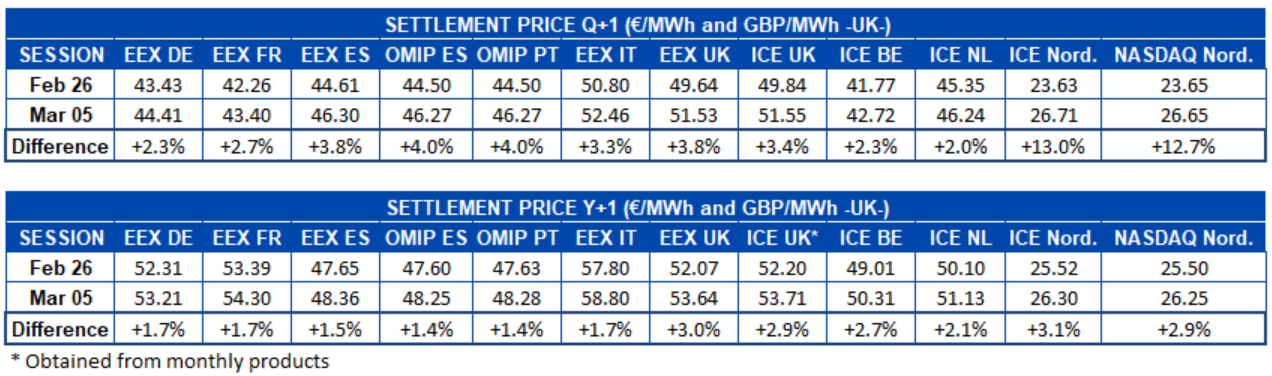

During the first week of March, the solar energy production decreased by 24% in the Iberian Peninsula and by 2.9% in the French market compared to the last week of February. On the contrary, in the Italian market, the production grew by 4.7% and in the German market by about 3.6%.

For the second week of March, the AleaSoft‘s solar energy production forecasting indicates that it will decrease in the German and Italian markets compared to the previous week. In the Spanish market, the production is expected to be higher than that registered the previous week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

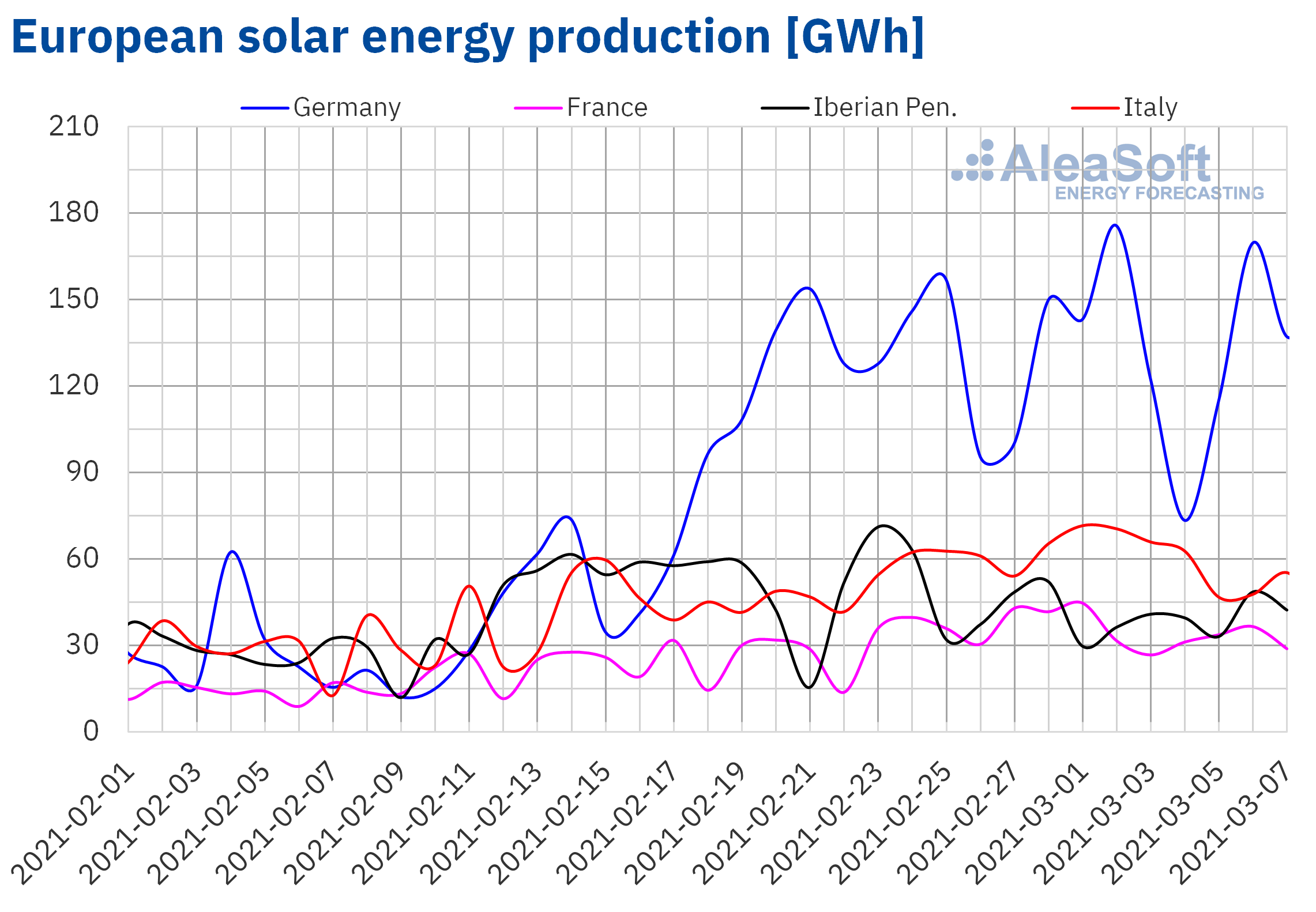

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA. Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

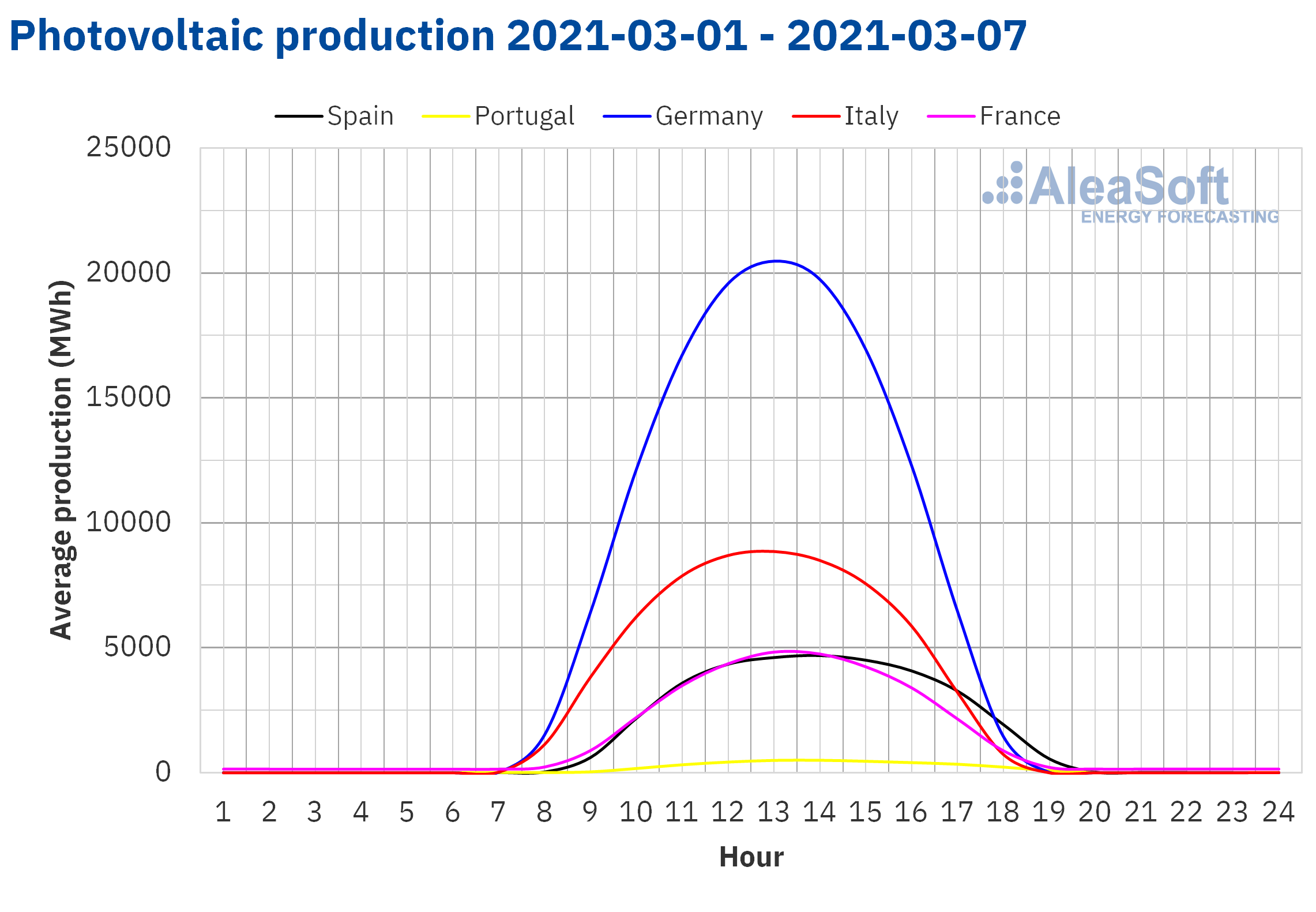

During the ninth week of 2021, the wind energy production decreased in all the markets analysed at AleaSoft compared to the previous week. In the French market it fell by 41% while in the German market and in the Iberian Peninsula it fell by 39% and 35% respectively. In the case of the Italian market, the lowest variation was registered with a reduction in production of 9.9%.

For the tenth week of 2021, the AleaSoft‘s wind energy production forecasting indicates that the production with this technology will be higher than that registered the previous week in all the markets analysed at AleaSoft.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

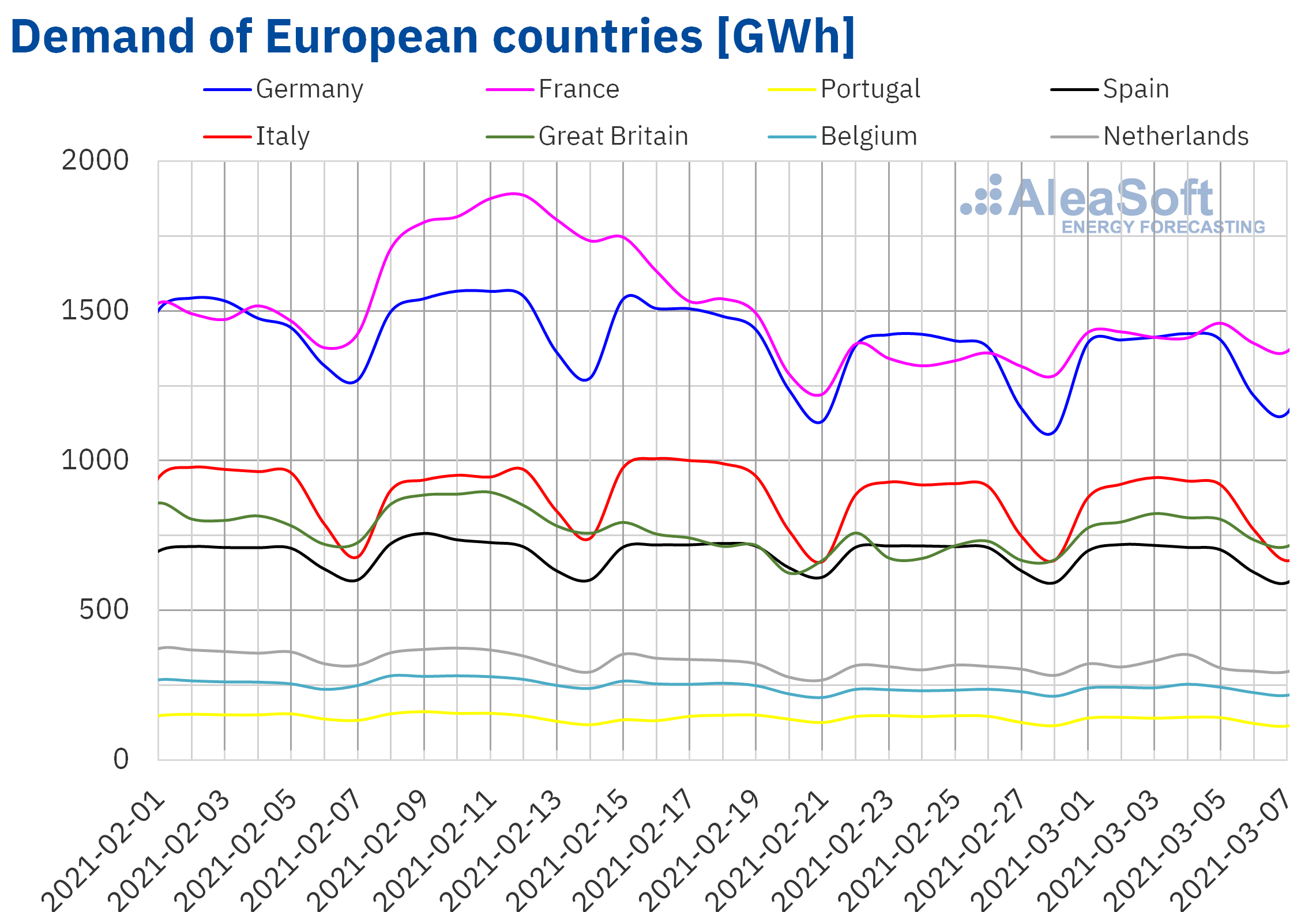

Electricity demand

From March 1 to 7, the electricity demand increased in all European markets compared to the previous week, except in the Iberian Peninsula. The drop in average temperatures was the main cause of this behaviour. In the markets of Great Britain and Belgium, the average temperatures fell by more than 4.0 °C and favoured the increases in demand of 12% and 3.0% respectively. Another important rise was the 5.9% registered in the French market. On the other hand, in Portugal and Spain there were decreases of 3.0% and 0.4% respectively.

For the week of March 8, the AleaSoft‘s demand forecasting indicates that there will be increases in most of the European markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

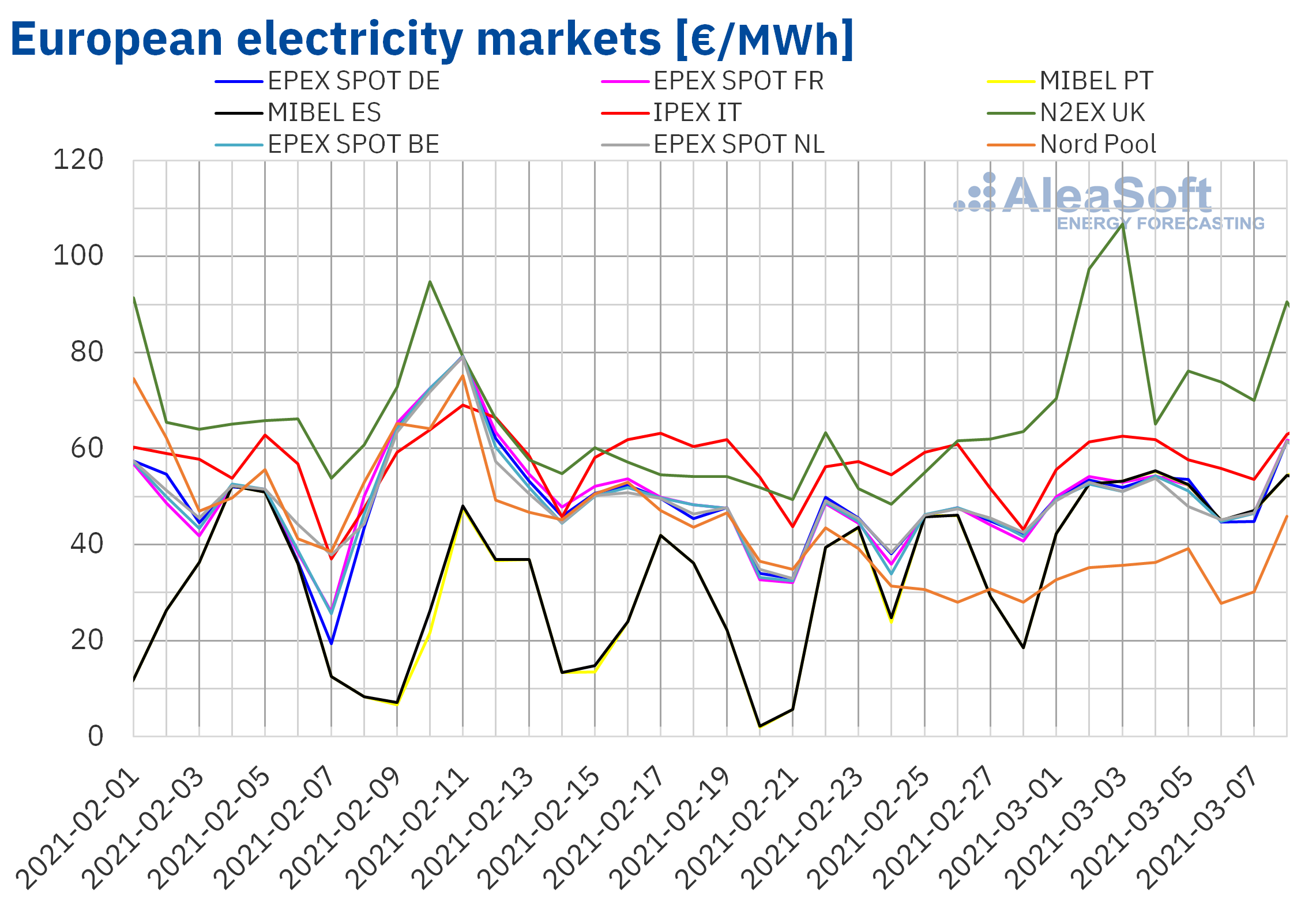

European electricity markets

The week of March 1, the prices of all the European electricity markets analysed at AleaSoft increased compared to those of the previous week. The highest price increase, of 41%, was that of the MIBEL market of Spain and Portugal, followed by that of the N2EX market of United Kingdom, of 38%. On the other hand, the lowest price increase, of 2.3%, was that of the Nord Pool market of the Nordic countries. In the rest of the markets, the price increases were between 6.6% of the IPEX market of Italy and 16% of the EPEX SPOT market of France.

In the first week of March, the highest weekly average price was that of the N2EX market, of €79.96/MWh. While the Nord Pool market registered the lowest average, of €33.86/MWh. In the rest of the markets, the prices were between €49.52/MWh of the market of the Netherlands and €58.36/MWh of the Italian market.

On the other hand, during the week of March 1, the MIBEL market stopped registering the lowest daily prices on the continent. That week, the lowest prices corresponded to the Nord Pool market, whose weekly minimum price was €27.78/MWh. On the other hand, the highest daily price in the first week of March, of €106.78/MWh, was reached on Wednesday, March 3, in the British market and it was the highest price in this market since mid‑January.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

During the first week of March, the increase in demand in most markets favoured the rise in prices. In addition, the general decline in wind energy production on the European continent and the decrease in solar energy production in countries such as France and Spain also contributed to the increase in prices in the European electricity markets.

The AleaSoft‘s price forecasting indicates that in the week of March 8, the prices will fall in the German, French, Iberian and British markets. The generalised increase in wind energy production and the increase in solar energy production in Spain will favour this behaviour.

Electricity futures

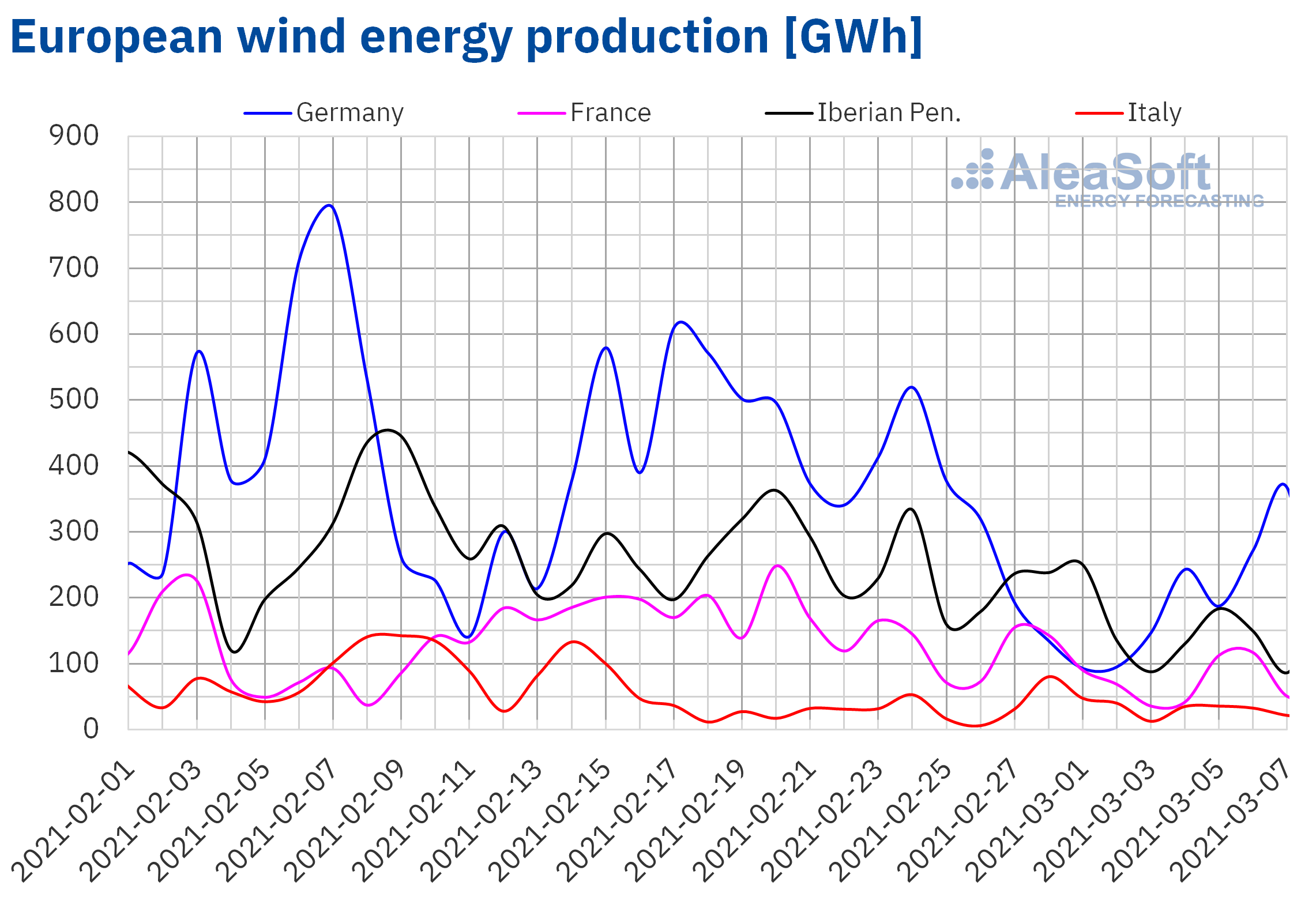

The electricity futures prices for the second quarter of 2021 registered an upward behaviour in all the markets analysed at AleaSoft if the settlement prices of the March 5 session are compared with those of the February 26 session. As usual, due to their relatively lower prices, the ICE and NASDAQ markets of the Nordic countries led these rises with increases of 13% in both cases. In the rest of the markets, the increases were between 2.0% of the ICE market of the Netherlands and 4.0% of the OMIP market of Spain and Portugal.

The same thing happened with the product of the calendar year 2022, a general increase led by the Nordic markets, in this case with increases of 3.1% and 2.9% in the ICE and NASDAQ markets respectively, but also accompanied in this case by the EEX market of the United Kingdom, with a 3.0% increase in its prices. In the rest of the markets, the increases were above 1.4%, value registered in the OMIP market of Spain and Portugal.

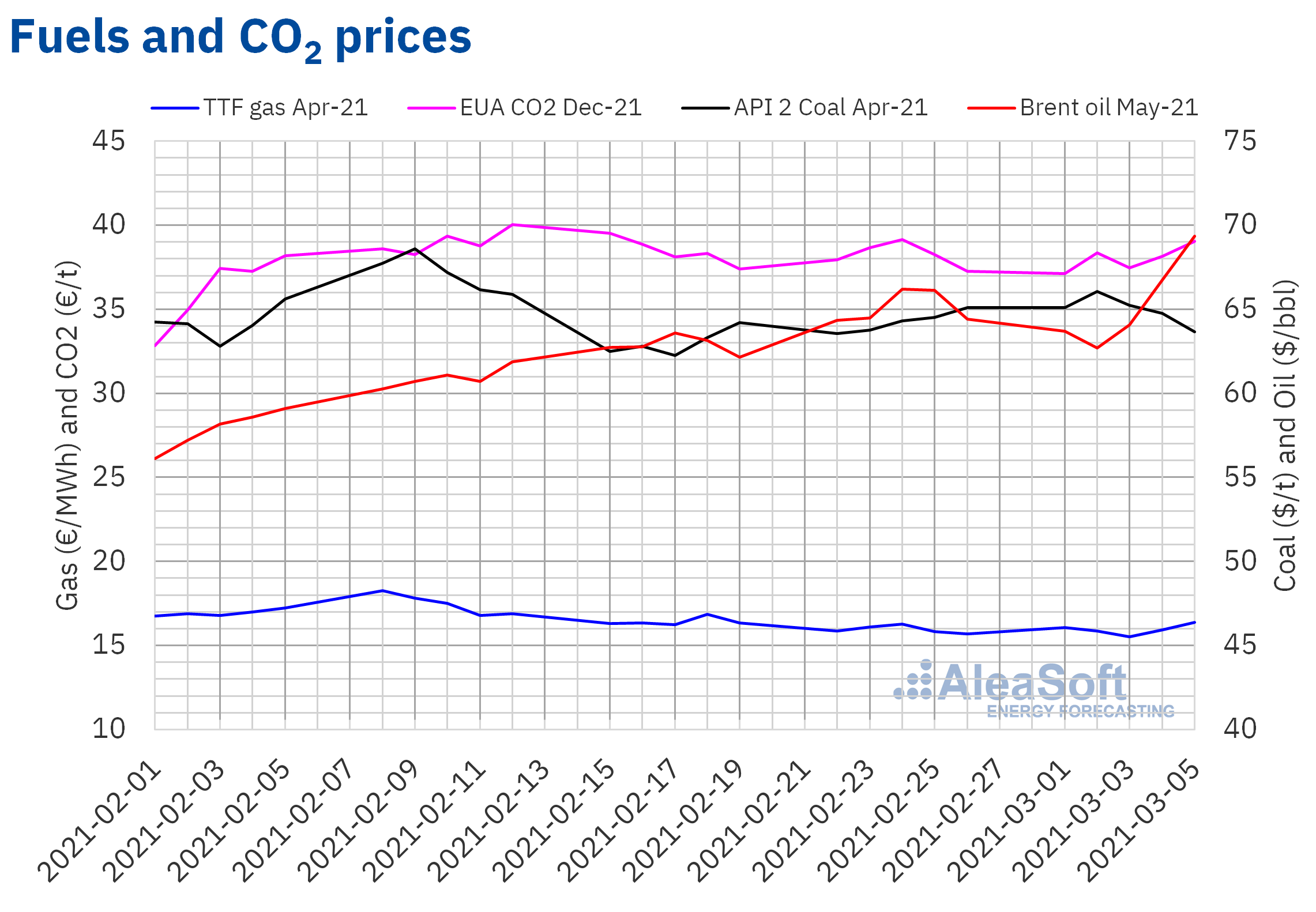

Brent, fuels and CO2

The Brent oil futures prices for the month of May 2021 in the ICE market began the first week of March with decreases. But as of Wednesday the prices began to recover. As a result of these increases, on Friday, March 5, a settlement price of $69.36/bbl was reached, 7.7% higher than that of the previous Friday and the highest in the last two years.

The evolution of the Brent oil futures prices during the first week of March was influenced by the meeting of the OPEC+ member countries. Last Thursday, March 4, despite the progressive recovery of the world demand in recent months, the OPEC+ agreed to maintain its current production levels in April due to the possibility that new coronavirus outbreaks affect the recovery of the demand.

On the other hand, in the session on Monday, March 8, the prices reached over $71/bbl, after Saudi oil facilities were attacked on Sunday. Although the attack was neutralised and did not cause any losses, the fear of supply interruptions due to hostilities in the region also exerts its upward influence on the Brent prices.

As for the TTF gas futures in the ICE market for the month of April 2021, the first week of March, the prices remained around €16/MWh. On Tuesday and Wednesday, the prices fell to reach the minimum settlement price of the week, of €15.53/MWh, on Wednesday, March 3. This price was the lowest since December 2020. However, on Thursday and Friday the prices recovered. The settlement price of Friday, March 5, of €16.37 MWh, was the highest of the week. The evolution of the oil prices and the forecast of lower temperatures favoured the recovery of the prices in the last sessions of the week.

Regarding the settlement prices of the CO2 emission rights futures in the EEX market for the reference contract of December 2021, the first week of March they oscillated around €38/t. The minimum settlement price of the week, of €37.13/t, was registered on Monday, March 1, and it was the lowest since the beginning of February. While the maximum settlement price of the week, of €39.03/t, was reached on Friday, March 5.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the evolution of the energy markets in the spring of 2021

At AleaSoft, a series of webinars are being held to analyse the evolution of the European energy markets and the financing of renewable energy projects, delving into topics such as the PPA, both from the point of view of the consumer and the renewable energy producer, the renewable energy auctions, the account audits and the due diligence. Speakers from important companies of the energy sector in Europe such as Deloitte, Vector Renewables, PwC Spain and Engie participated in these webinars and it was always stressed that to develop renewable energy and obtain financing or pass an audit it is necessary to have long‑term quality forecasts, scientifically based, with a horizon of up to 30 years and hourly breakdown. For the risk management scientifically, the outputs based on a probabilistic metric are essential, which can be those corresponding to the P15 and P85 or P10 and P90 percentiles.

The next webinar will be held on March 18 and it will feature the participation of speakers from EY (Ernst & Young). In this webinar, in addition to continuing to delve into the importance of the PPA, the main novelties in the regulation of the energy sector and the opportunities for the Spanish players in international markets will be discussed, offering an outlook of the trends and returns by region.

To analyse the evolution of the energy markets, the Alea Energy DataBase (AleaApp) is very useful. This tool compiles the data of the main variables of the European energy markets automatically and includes functionalities to facilitate their visualisation and analysis.