AleaSoft, April 2, 2020. The electricity markets prices fell across Europe in the recently ended March. The decrease in demand as a result of the measures taken to contain the COVID‑19 as well as the decrease in gas and CO2 prices are the main causes of this decrease, according to the analysis carried out at AleaSoft. The decrease in prices was also favoured by the increase in renewable energy production in several markets, mainly the solar energy production.

Photovoltaic and solar thermal energy production and wind energy production

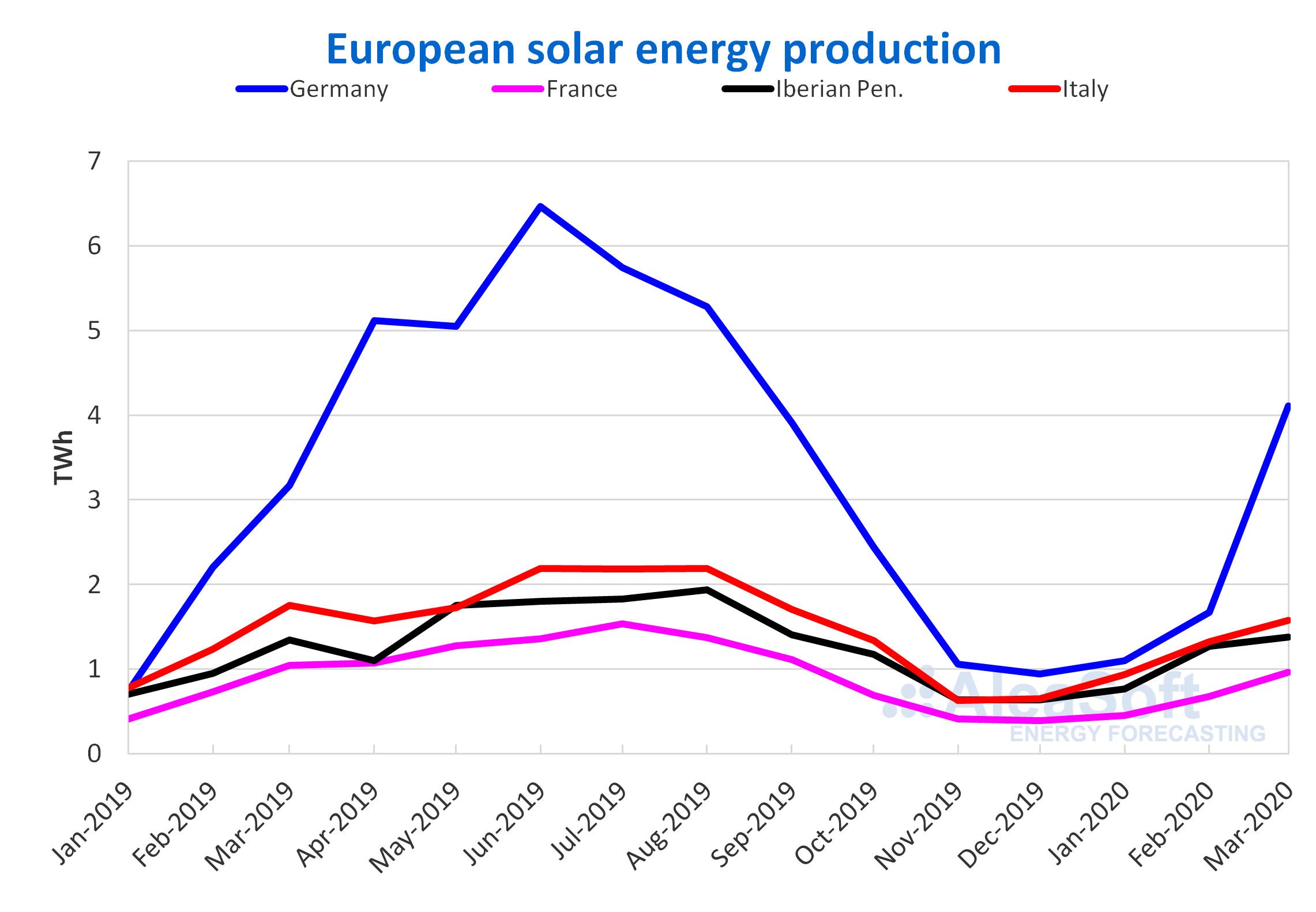

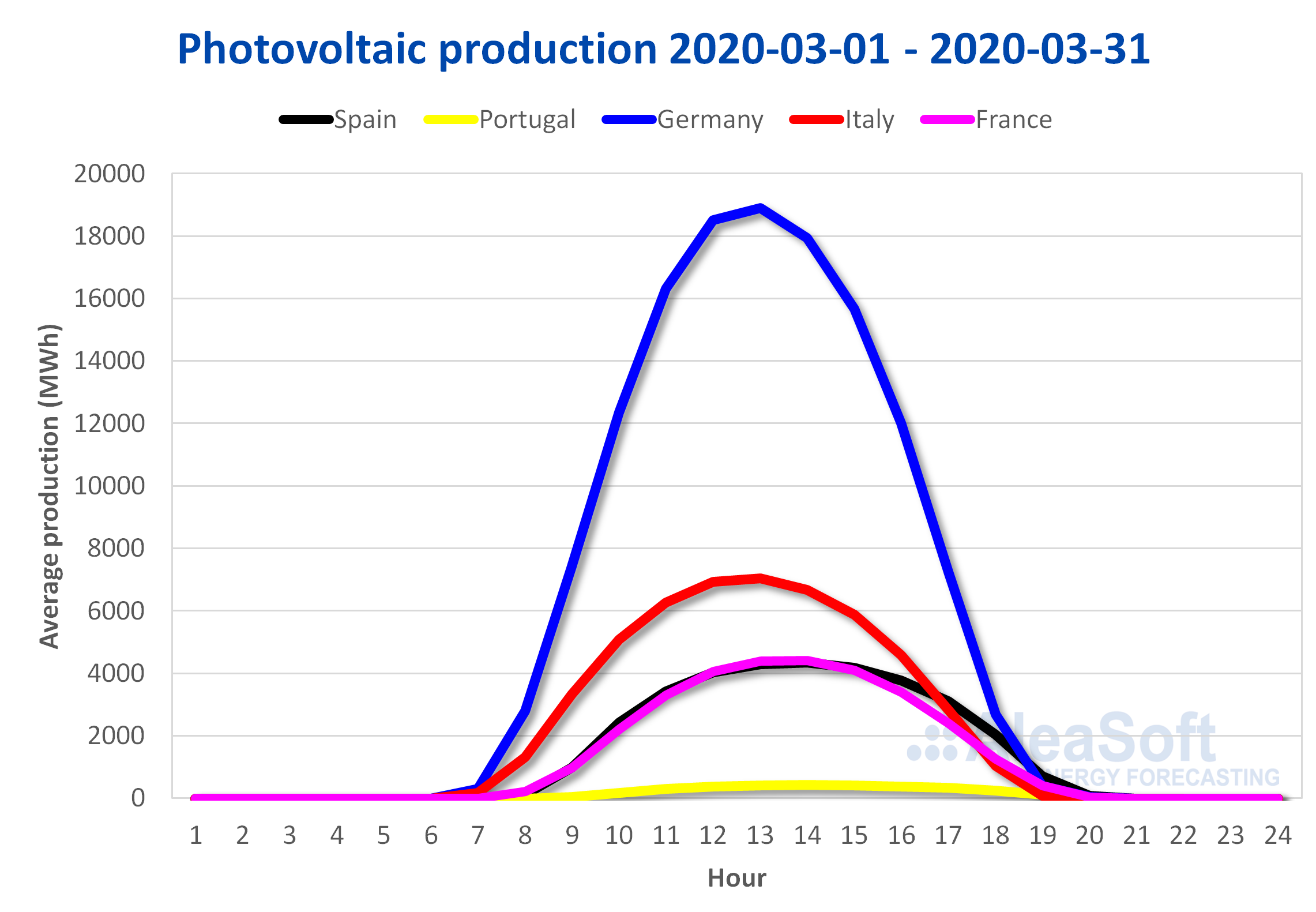

The solar energy production increased in most markets in the month of March, in year‑on‑year terms. In Germany there was an increase of 29%. In addition, in that market on March 23 the maximum daily production of the first quarter of the year in the history was registered. In Portugal the average production rose 7.3%, setting the historical record for the first quarter of the year on the 26th. In the Iberian Peninsula there was an increase of 2.8%, while in France the decrease was 7.6%.

Compared to February 2020, the solar energy production rose in all the analysed electricity markets. The most notable increases were 130% of Germany and 33% of France. Meanwhile, in Portugal and Italy the increases were 10% and 11% respectively.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

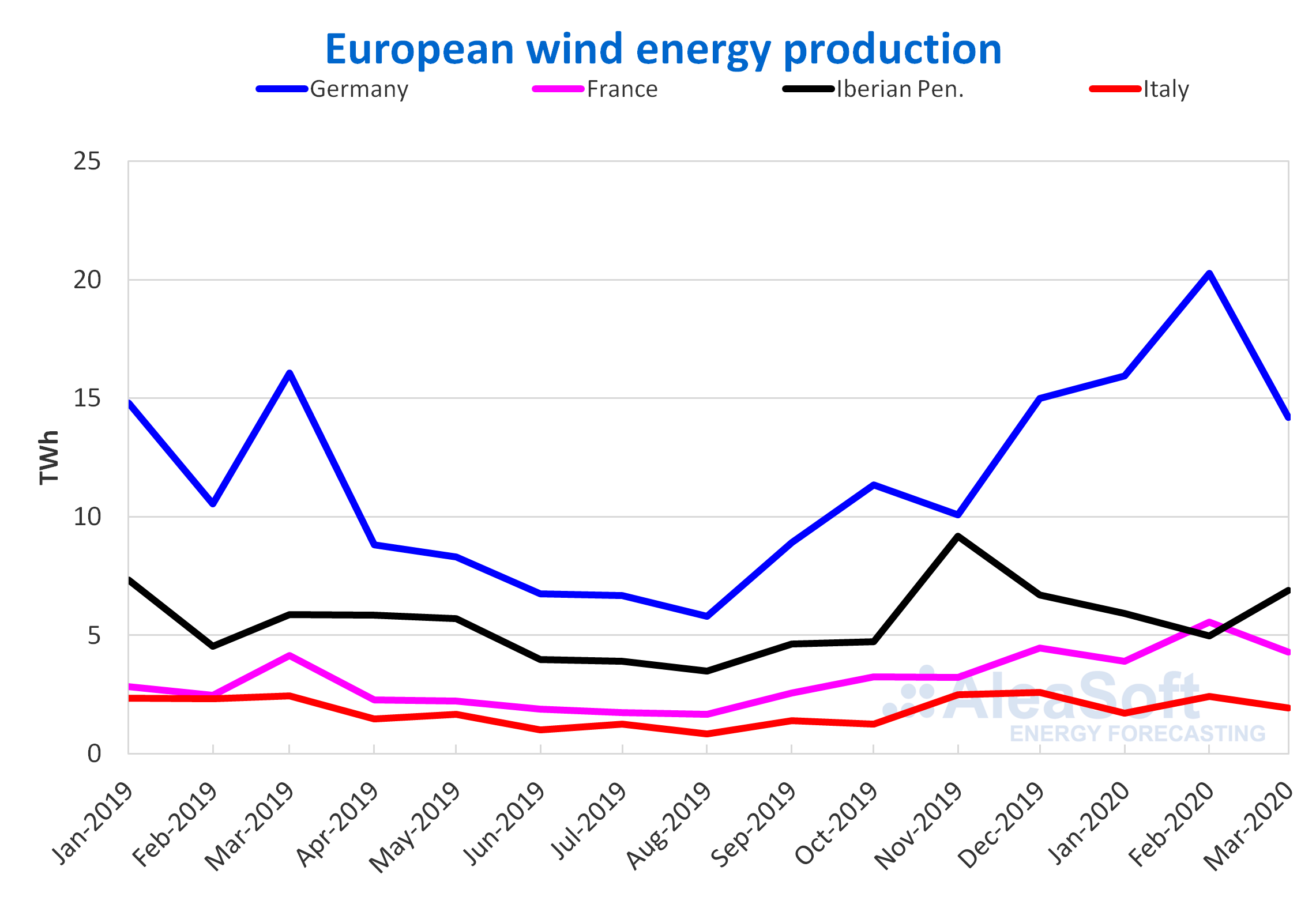

In the case of the wind energy production, the greatest variation was 25% of Portugal. Another of the registered increases occurred in France, in this case being 3.6%. In the Italian and German markets there were falls of 21% and 12% respectively.

Compared to the second month of 2020, the generation with wind technology fell significantly in several markets. In the German market the drop was 35%. In France and Italy it decreased 28% and 25% compared to the average values of February. On the other hand, in the Portuguese market there was a recovery of 56%.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

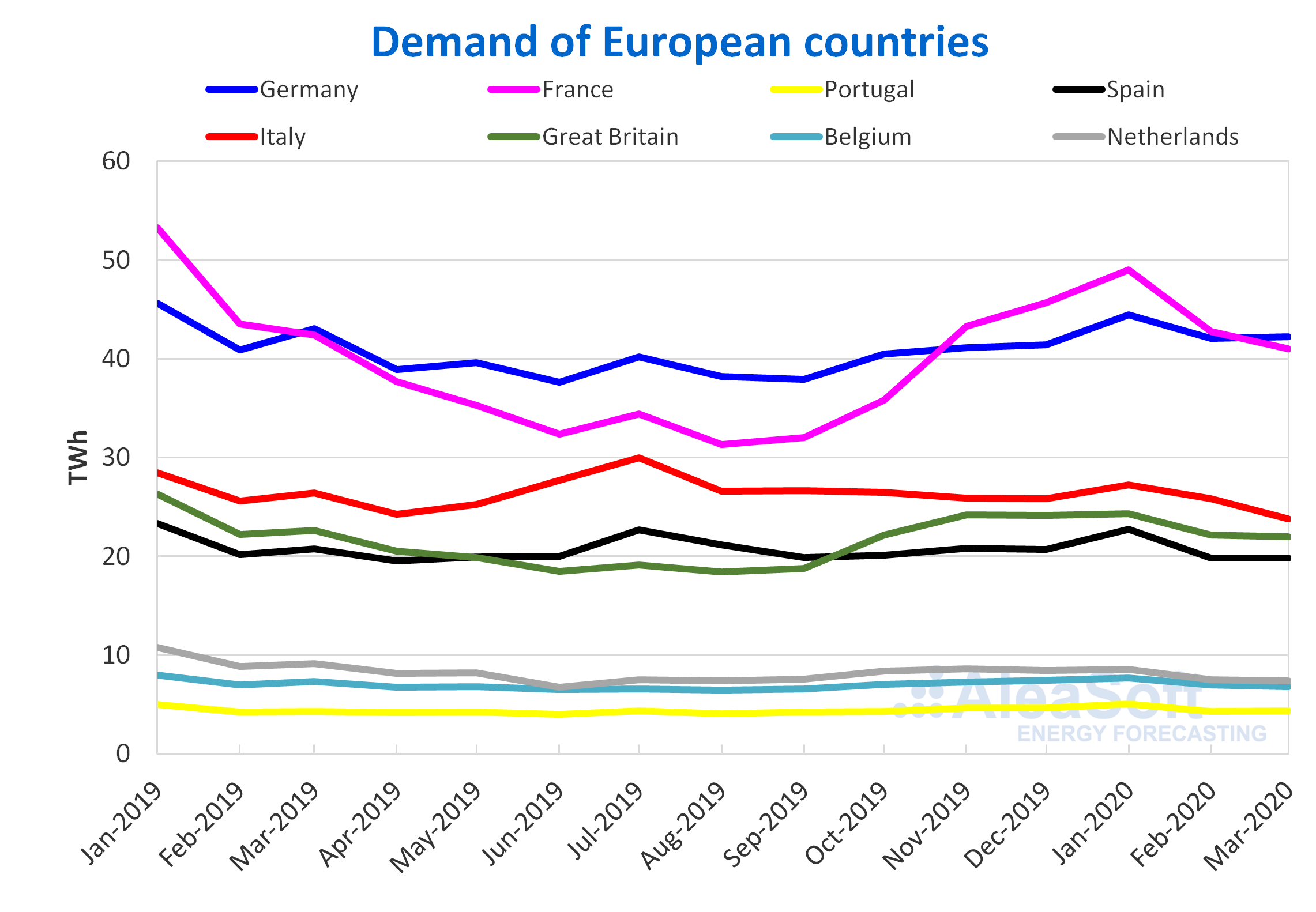

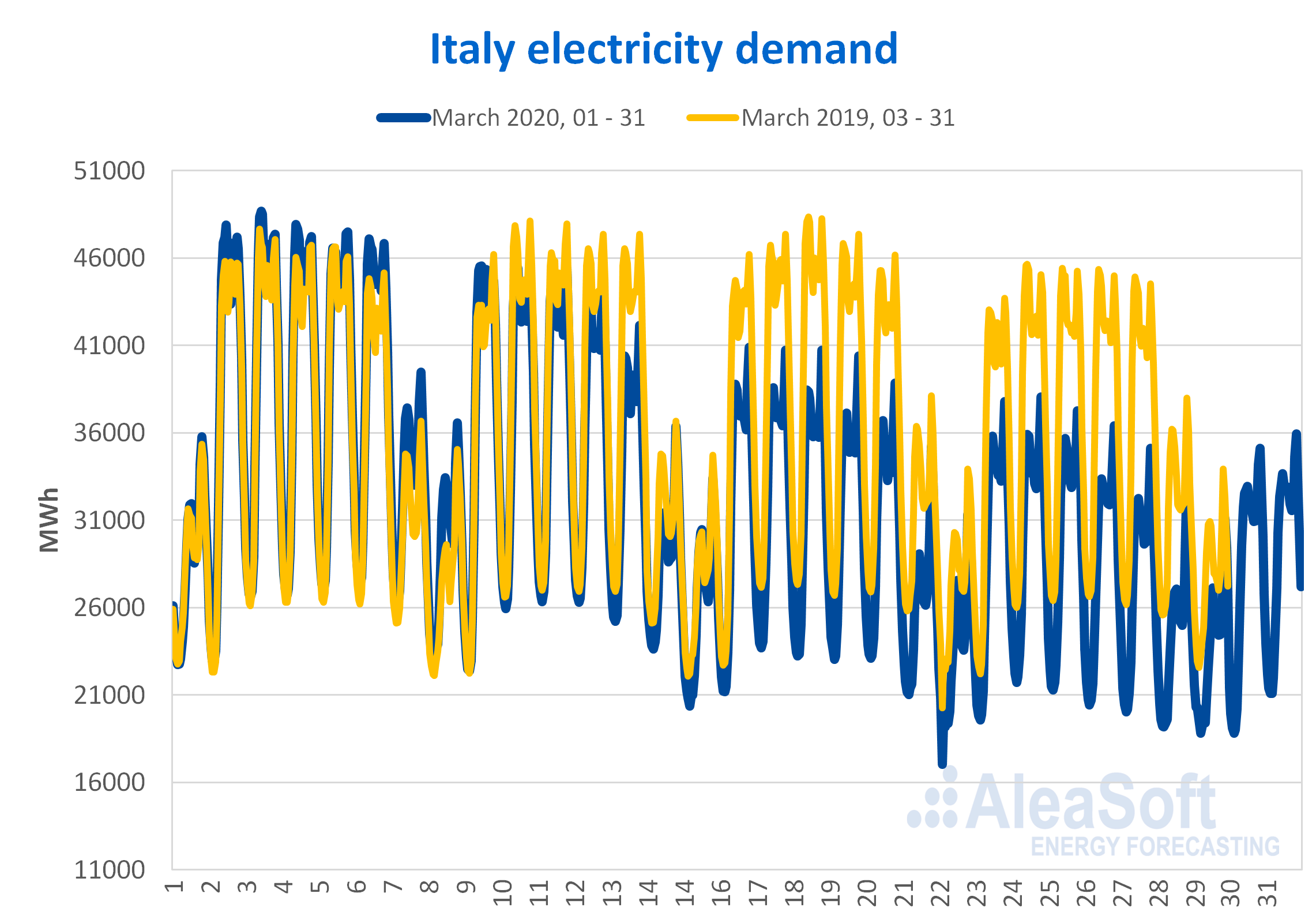

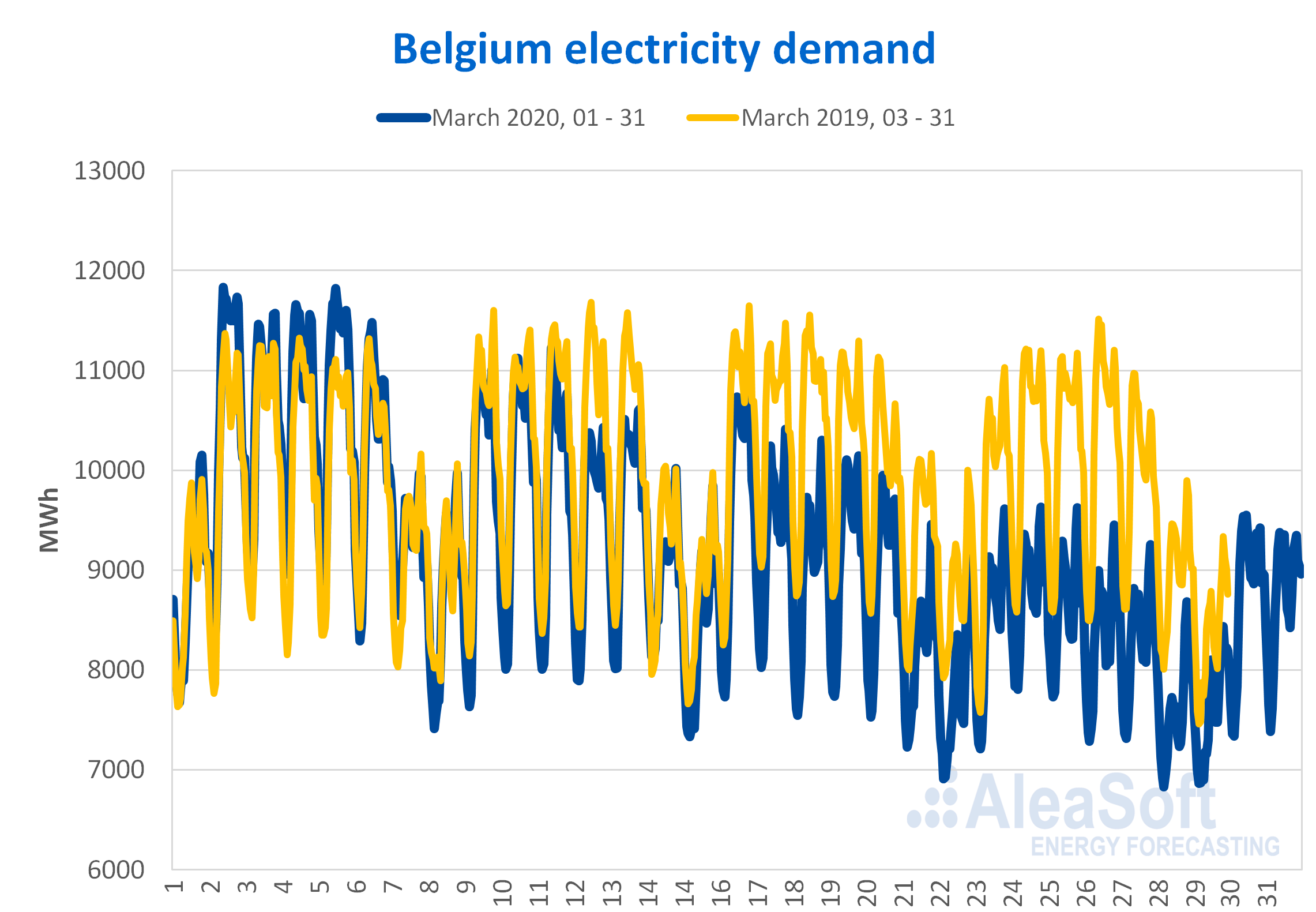

During the month of March, what marked the trend in electricity demand in the European markets was the year‑on‑year decrease in electricity consumption in the industrial and commercial sectors due to the measures established by each country to curb the spread of the coronavirus. Despite the drop in average temperatures of more than 1 °C in most markets, the demand profile fell significantly during the business hours and led to a general decrease. Among the most significant decreases are those of Italy, Belgium and Spain, which were 10%, 7.0% and 4.4% respectively. Other declines were 3.2% in France and 3.0% in Great Britain.

As for the comparison of the demand of last March with respect to that of February 2020, the fall was abrupt in many markets. The main drop occurred in Italy, where it decreased by 14%. The decreases in France and Belgium followed that of Italy, being 10% and 9.0% respectively.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

The demand of Italy followed the course of the measures taken to counteract the coronavirus infections. From the declaration of national confinement, the curve decreased.

Source: Prepared by AleaSoft using data from TERNA.

Source: Prepared by AleaSoft using data from TERNA.

In the case of the Belgian market, the evolution of the demand marks a downward trend from the measures taken on March 10, among which is the cancellation of classes in schools. Another quite marked difference with respect to the demand of the corresponding week of 2019, was the one that was evident after the confinement declared as of March 18.

Source: Prepared by AleaSoft using data from ELIA.

Source: Prepared by AleaSoft using data from ELIA.

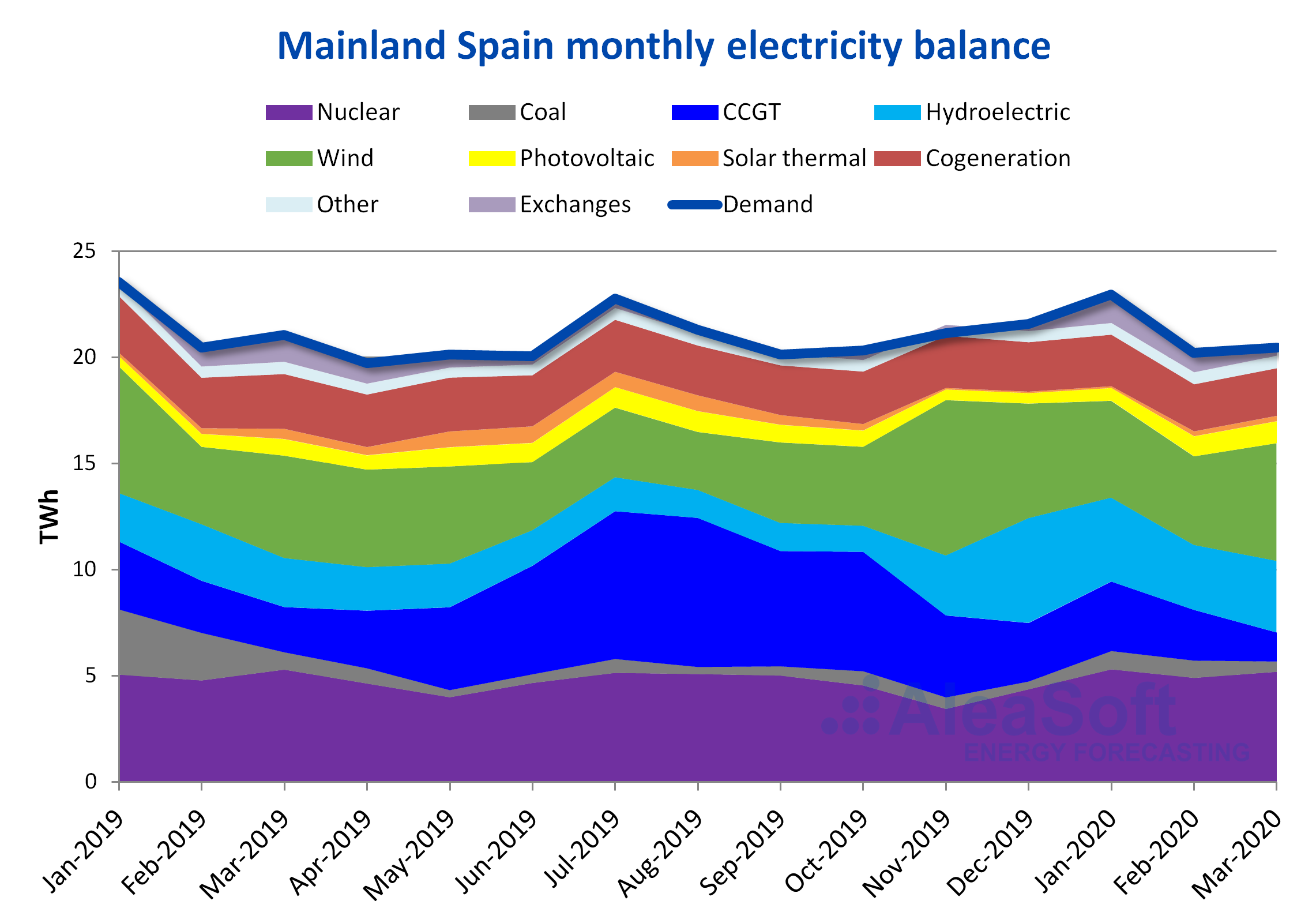

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

In March, the electricity demand of Mainland Spain fell 4.4% compared to March 2019. According to REE, once the effects of temperature and labour were corrected, the variation was ‑6.1%. Comparing the demand of March with that of February of this year, there was a decrease of 6.4%. The average temperatures of March 2020 were similar to those of February and those of March of last year, so the main cause of the decrease is the measures that were adopted to stop the expansion of the coronavirus, mainly in the second half of the month, after the Government decreed the state of alarm on March 14. An observatory was set up on the AleaSoft website where it is possible to track the impact on the demand for this reason.

The solar energy production as a whole increased 2.0% year‑on‑year in March 2020. However, if each component is analysed separately, the solar photovoltaic energy production increased 33%, while the solar thermal energy production decreased 48%. Compared to February 2020, both technologies had a similar increase, of 2.8% in the case of the photovoltaic energy and of 2.7% in the case of the solar thermal energy.

The wind energy production registered increases with respect to February and also with respect to March of last year, of 24% and 15% respectively.

The nuclear energy production fell 0.8% in March compared to March 2019. One of the factors that influenced this decrease was the high wind energy production between February 29 and March 2 that caused that less energy was produced with nuclear technology during those days. On the other hand, the Almaraz I nuclear power plant postponed its 27th recharge due to the state of alarm in which Spain is currently. The recharging is delayed until the time when the country’s sanitary conditions allow it. A shorter‑range stop was scheduled to refuel on April 14.

The production with combined cycle gas turbines fell 36% compared to March of last year and 46% compared to February of this year. The production with coal also fell in the two comparatives, 40% compared to March 2019 and 44% compared to February.

On the other hand, the hydroelectric energy production recovered 48% compared to that of the same month of last year. Compared to February, the increase was 4.2%.

Source: Prepared by AleaSoft using data from REE.

Source: Prepared by AleaSoft using data from REE.

In March, the hydroelectric reserves rose 21% year‑on‑year and during these first three months of 2020 they remained above the level accumulated in the same months of 2019. On the other hand, they suffered a fall of 0.8% compared to that accumulated in February 2020.

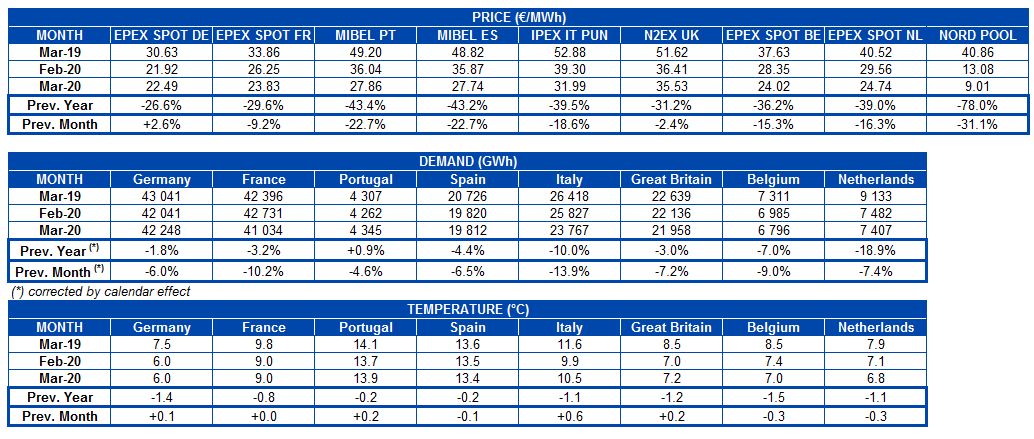

European electricity markets

In the recently concluded month of March, the prices of the European electricity markets fell generally compared to the average values in March 2019. According to the analysis carried out by AleaSoft, the main cause of this decrease is the drop in demand. Despite the fact that the temperatures were colder in all markets, the electricity demand decreased year‑on‑year in most markets, due to the expansion of the coronavirus in Europe and the containment measures approved by the different European governments. The decrease in gas, coal and CO2 emission rights prices also favoured the fall in prices. The average price of TTF gas in the spot market was 45% lower in March of this year than in March of last year. In the case of coal, the decrease was 29% when comparing the average value of March 2020 compared to March 2019. While the year‑on‑year drop in the case of the CO2 emission rights was 10%. In some markets the fall in prices was also driven by increased production with renewable energy.

The greatest year‑on‑year decline was in the Nord Pool market of the Nordic countries, of 78%. This market was also the one with the lowest average price during the month of March, with a value of €9.01/MWh. The low prices in this market are also a product of the high availability of hydroelectric energy. While the smallest year‑on‑year decline was in the EPEX SPOT market of Germany, of 27%. However, this market had the second lowest average price of the month, of €22.49/MWh. On the other hand, the N2EX market of Great Britain, with an average of €35.53/MWh, was the market with the highest average price in Europe in March 2020. The second market with the highest price was the IPEX market of Italy, with a price of €31.99/MWh. The largest decreases occurred in this market, of 21% and 10%, respectively, in wind and solar energy production.

When comparing the prices of the month of March with those of the month of February of this year, the monthly average decreased in all European markets except the EPEX SPOT market of Germany, where it increased by 2.6%. In this comparison, the Nord Pool market of the Nordic countries was also the one with the greatest decrease, with a decrease of 31%. While the market with the lowest decline was the N2EX market of Great Britain, of 2.4%.

Iberian market

In the month of March 2020, the average price in the MIBEL market of Spain and Portugal decreased by 43% compared to the same month in 2019. As a result of these decreases, the average price in the MIBEL market of Portugal was €27.86/MWh, while in the case of Spain the price was lower, of €27.74/MWh.

This behaviour is related to the increases of 17% and 2.7% registered in the wind and solar energy production of the Iberian Peninsula, respectively. But the main cause of the decrease in prices in the case of Spain is the state of alarm decreed by the Spanish Government on March 14 to stop the spread of the coronavirus, causing a year‑on‑year decrease in electricity demand of 4.4%, in addition to the fall in gas and coal prices.

On the other hand, last March, the MIBEL market of Spain and Portugal was the second European market with the largest decrease in prices, of 23%, compared to February 2019.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

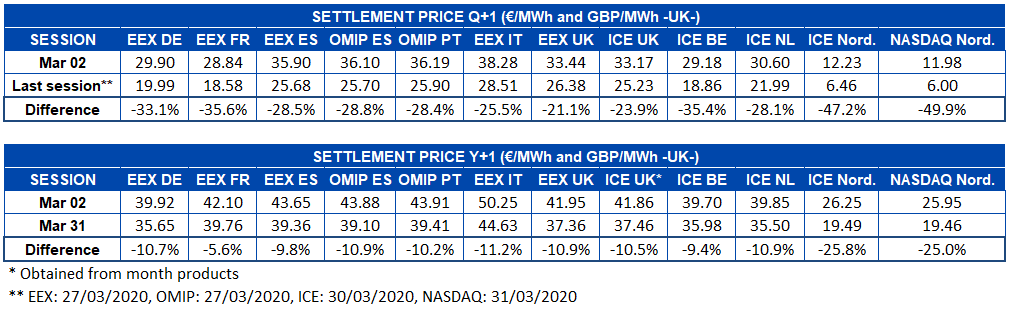

Electricity futures

The month of March in the European electricity futures markets was characterised by marked price drops. In the case of the product of the second quarter of 2020, in relative terms, the most notable drop was that of the ICE and NASDAQ markets of the Nordic countries, which between the beginning and the end of the month reduced their price by almost half. This product ended up being traded in the last market session of March at €6.00/MWh and €6.46/MWh respectively. In the rest of the markets the decreases in absolute terms were between €7.06/MWh and €10.40/MWh, which represented decreases of between 21% and 36%. The least‑changing market was Great Britain’s EEX.

In the case of the electricity futures for the 2021 calendar year, a situation very similar to that of the Q2‑2020 product occurred during the month of March. A general decline was observed where the Nordic region had the highest difference percentages. While the markets of the Nordic countries reduced their price by a quarter during the month, the rest of the markets registered decreases that are around 10%. The EEX market of France is the one that registered the least change with a decrease of 5.6%.

It is noteworthy that one of the most influential factors in these declines is the impact on electricity demand that the countries registered due to the effect of the confinement measures aimed at slowing down the spread of the coronavirus.

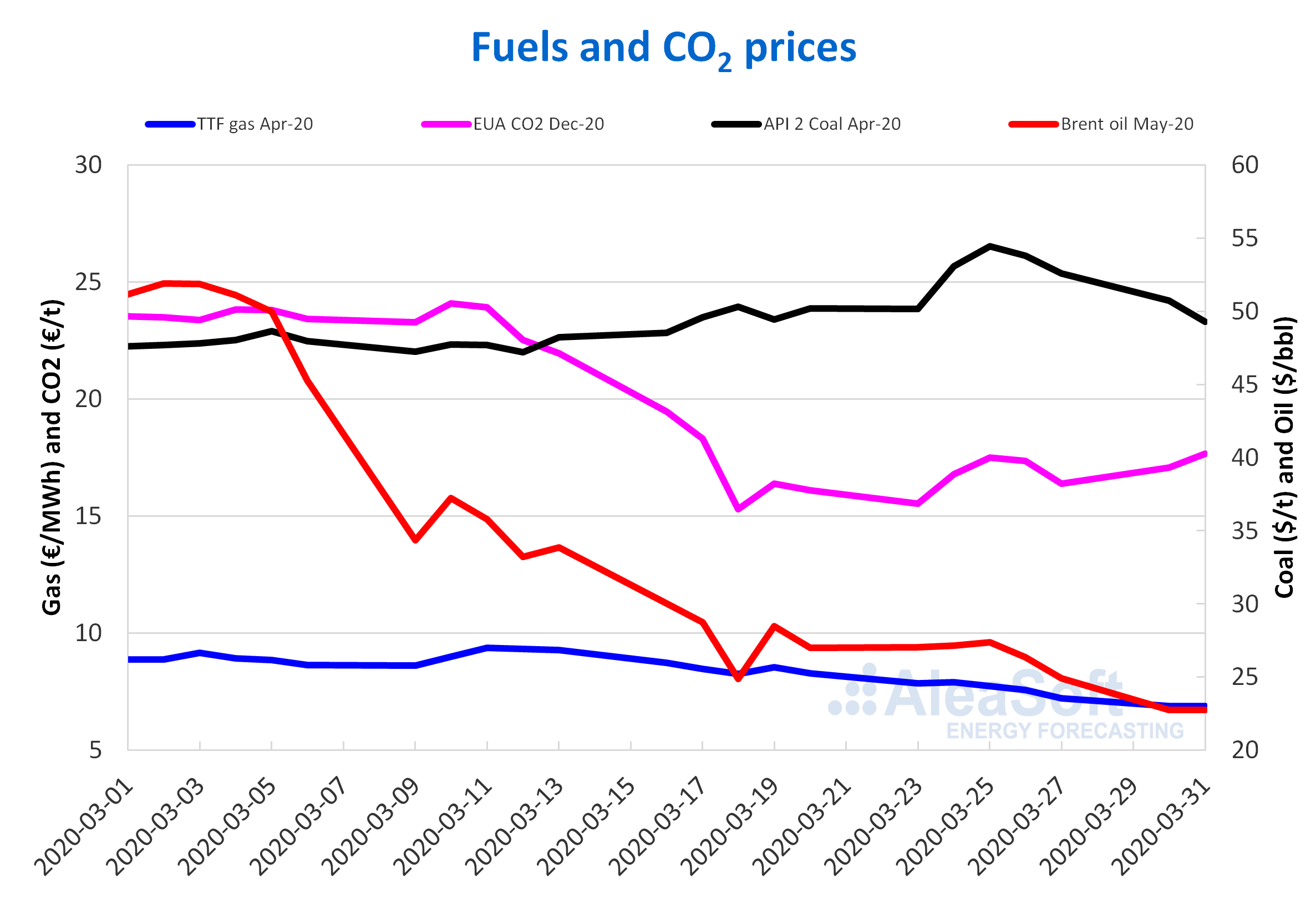

Brent, fuels and CO2

The Brent oil futures prices for the month of May 2020 in the ICE market started last month registering the monthly maximum settlement price, of $51.90/bbl, on March 2. But the prices fell throughout the month to reach the monthly minimum settlement price of $22.74/bbl on March 31. This represents a decrease of 56%. Furthermore, this settlement price is the lowest registered for this product at least since spring 2014. On the other hand, the monthly average price was $33.73/bbl. This value is 39% lower than that reached by the futures for the month M+2 in February 2020, of $55.48/bbl, and 50% lower than that corresponding to March 2019, of $67.03/bbl.

In March, the evolution of Brent oil futures prices was mainly influenced by the expansion of the coronavirus globally and the measures adopted by the different governments to try to stop the pandemic.

On the other hand, after the failure of the OPEC+ meeting of March 6, not only the expectations that further cuts in production might rebalance the market were frustrated, but a trade war between Russia and Saudi Arabia was also declared. Both countries announced their intention to significantly increase their production in April, which in a context in which demand is low and the storage capacity is very limited, may further lower the Brent oil futures prices in the month of April. In fact, the futures for M+2 started this month with a 6.1% drop compared to the settlement price of the previous day, positioning at $24.74/bbl. At the moment in today’s session, April 2, they recovered and are being negotiated above $25/bbl.

The TTF gas futures in the ICE market for the month of April 2020 reached their monthly maximum settlement price of €9.37/MWh on March 11. Subsequently, the prices fell until the monthly minimum value of €6.90/MWh was registered on March 30. This settlement price is the lowest in the last five years. Compared to the futures for the month M+1 of February 2020, the average settlement price in March, of €8.46/MWh, decreased 7.1% with respect to the average for the month of February, of €9.11/MWh. When compared to M+1 futures traded in March 2019, when the average price was €15.70/MWh, the decrease was 46%.

In the case of the spot market, last month TTF gas prices reached their maximum index price of €9.56/MWh on March 16. But during the second half of the month, the prices fell to an index price of €7.12/MWh on March 31. On the other hand, the average price for this month of March was €8.62/MWh, 6.9% lower than that of February 2020, €9.26/MWh, and 45% lower than that of March 2019, of €15.73/MWh. The prices in April continued to drop and on April 2 they settled at €6.94/MWh, the historic low since at least October 2008.

The declining demand due to the COVID‑19 crisis further lowered gas prices that, before the pandemic was declared, were already low due to oversupply.

The API 2 coal futures prices in the ICE market for the month of April 2020 remained stable at around $47.78/t in the first twelve days of the month. Later, the prices rose to reach the monthly maximum settlement price of $54.45/t on March 25. But in the last days there was a downward trend and the settlement price of March 31 was $49.30/t. The monthly average price was $49.57/t, 1.2% higher than the average price of API 2 coal futures for the month M+1 of February 2020, of $48.99/t, but 28% lower than that of March 2019, of $69.32/t.

The price increases registered in the second half of March were due, on the one hand, to fears that the expansion of the coronavirus caused mine and port closures that would lead to supply problems and, on the other hand, to the reactivation of industrial production in China. However, the supply was maintained and the prices fell again.

The CO2 emission rights futures prices in the EEX market for the reference contract of December 2020 started the month of March with values around €23.62/t and reached the monthly maximum value of €24.09/t on March 10. Subsequently, the prices began to drop until reaching the monthly minimum settlement price of €15.30/t on March 18. The average price in March was €19.89/t, 18% lower than that of February, of €24.18/t. When compared to the average for the month of March 2019 for the same product, of €22.43/t, the average for March 2020 is 11% lower.

The decreases registered in the CO2 emission rights futures prices during the past month of March are related to the spread of COVID‑19 across Europe and the containment measures approved by the European governments, which limited the mobility and the industrial production.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

Coronavirus energy crisis: follow‑up and recommendations

Given the repercussion that the coronavirus crisis is having, AleaSoft developed an observatory on the Mainland Spain electricity demand with data updated daily.

This global crisis caused falls in the consumption of electricity and gas and consequently in the prices of the energy markets. Faced with this uncertainty, the need for reliable forecasting of demand and prices that are systematically adapted to the changing situation is reinforced.

On the other hand, at AleaSoft it is considered that a measure that the Government of Spain may take to alleviate the effects of the coronavirus crisis is the elimination of the Tax on the Value of the Production of Electric Power (IVPEE for its acronym in Spanish), better known as the 7% tax to the electricity generation. In this way, in addition to favouring the consumers and generators, the export of electricity would be stimulated.

Source: AleaSoft Energy Forecasting.