AleaSoft, August 20, 2020. Gas prices continue with the increasing trend that began at the end of July and already register values similar to those of mid-April, above €8/MWh. Brent remains stable around $45/bbl. The prices of most of the European electricity markets rose in the first days of the third week of August favoured by the gas and by a low renewable energy production in Germany, but this trend is expected to change and the prices to drop by the end of the week.

Solar photovoltaic and solar thermal energy production and wind energy production

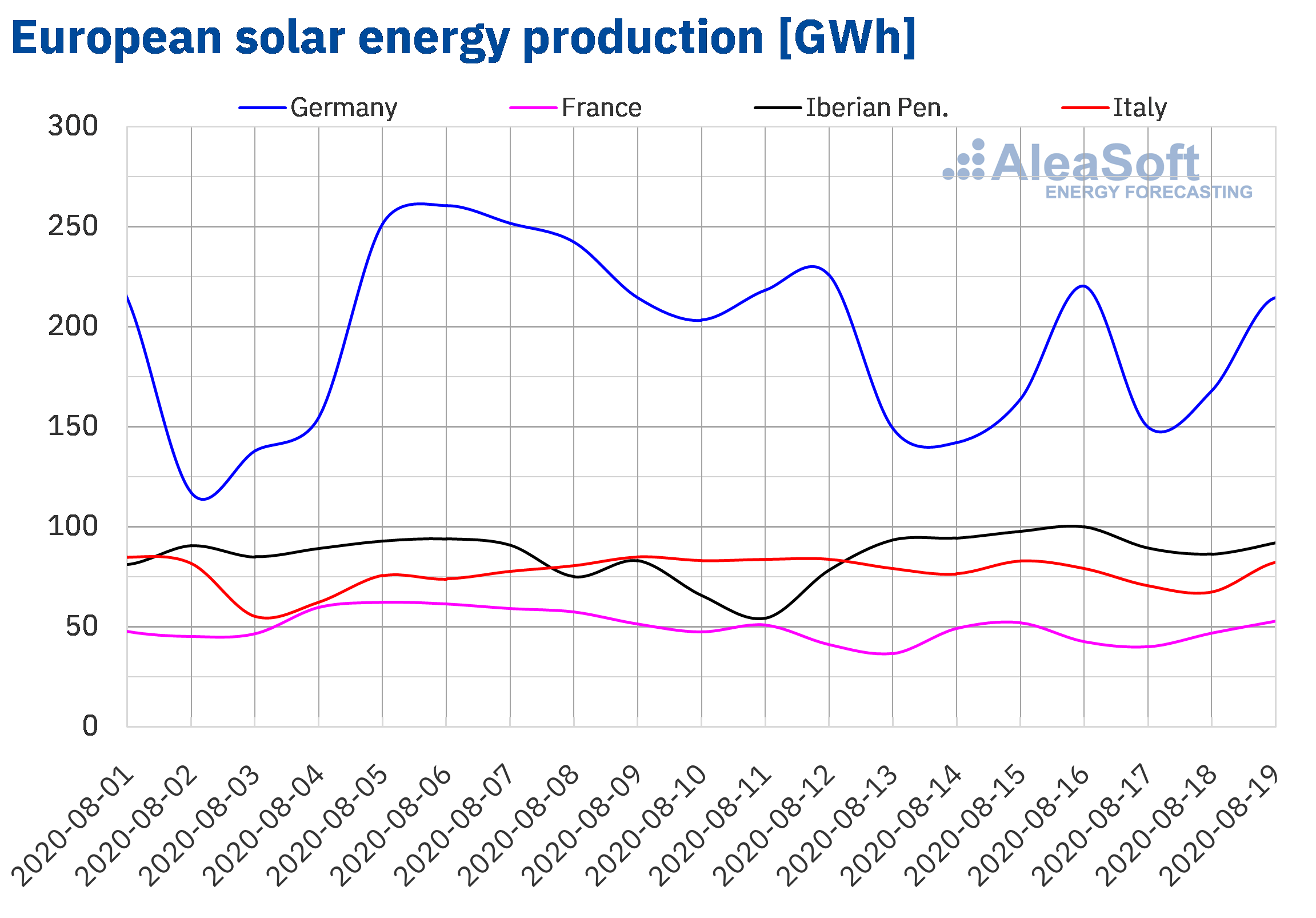

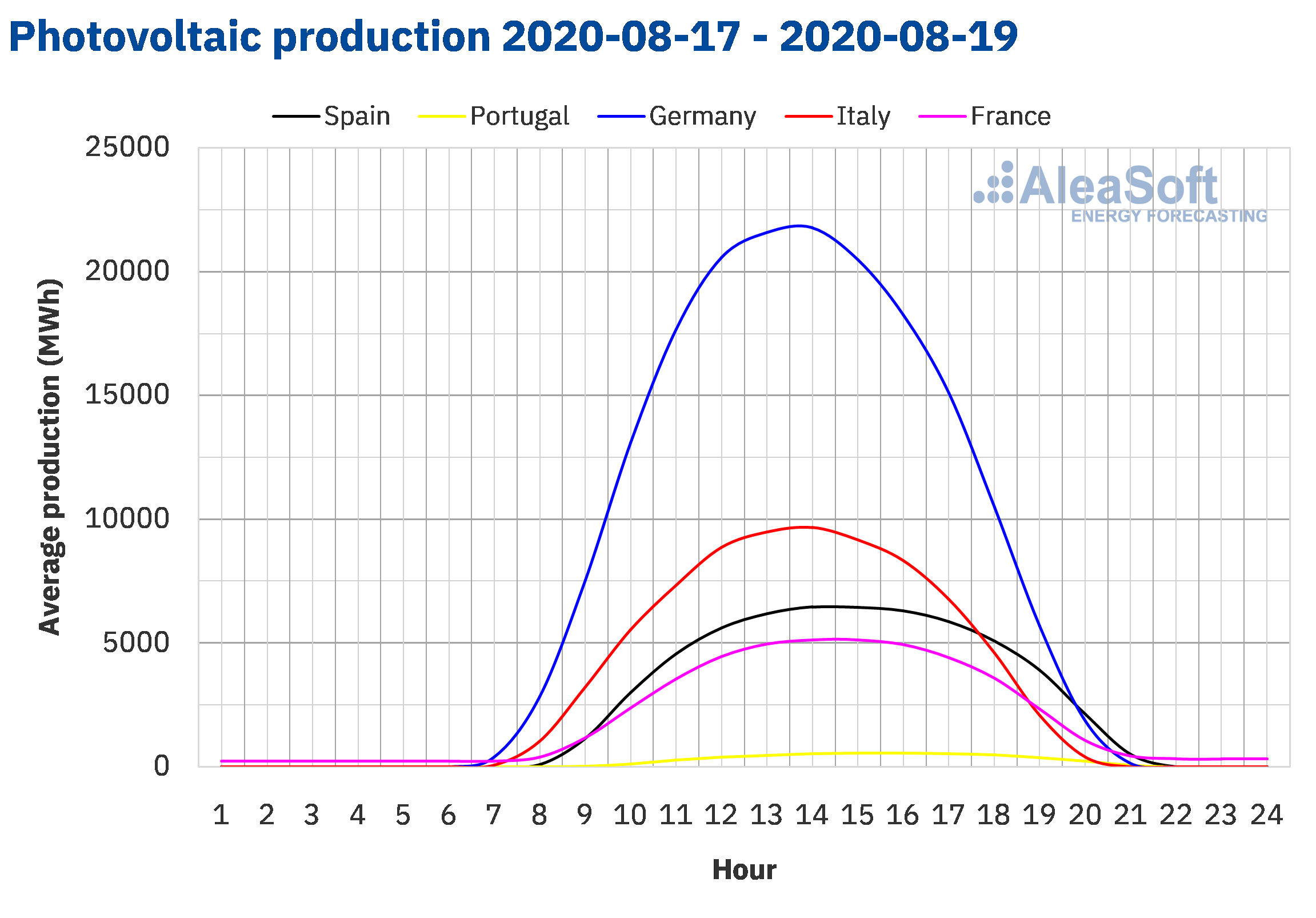

The solar energy production decreased 9.5% in the Italian market and 6.1% in the German market during the period between Monday 17 and Wednesday 19 of August compared to the average for the second week of August. On the contrary, in the Iberian Peninsula, the production increased by 7.0%, while in the French market the increase was 1.8%.

In the elapsed 19 days of August, the solar energy production was higher compared to the same period of 2019 in all the markets analysed at AleaSoft. In the Iberian Peninsula it increased by 32% and in the German market by 22%. In the Italian and French markets the increase in production was 3.6% and 13% respectively.

For the week that began on Monday, August 17, the analysis carried out at AleaSoft indicates that solar energy production will continue the same trend that was observed since the beginning of the week in all the analised European markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

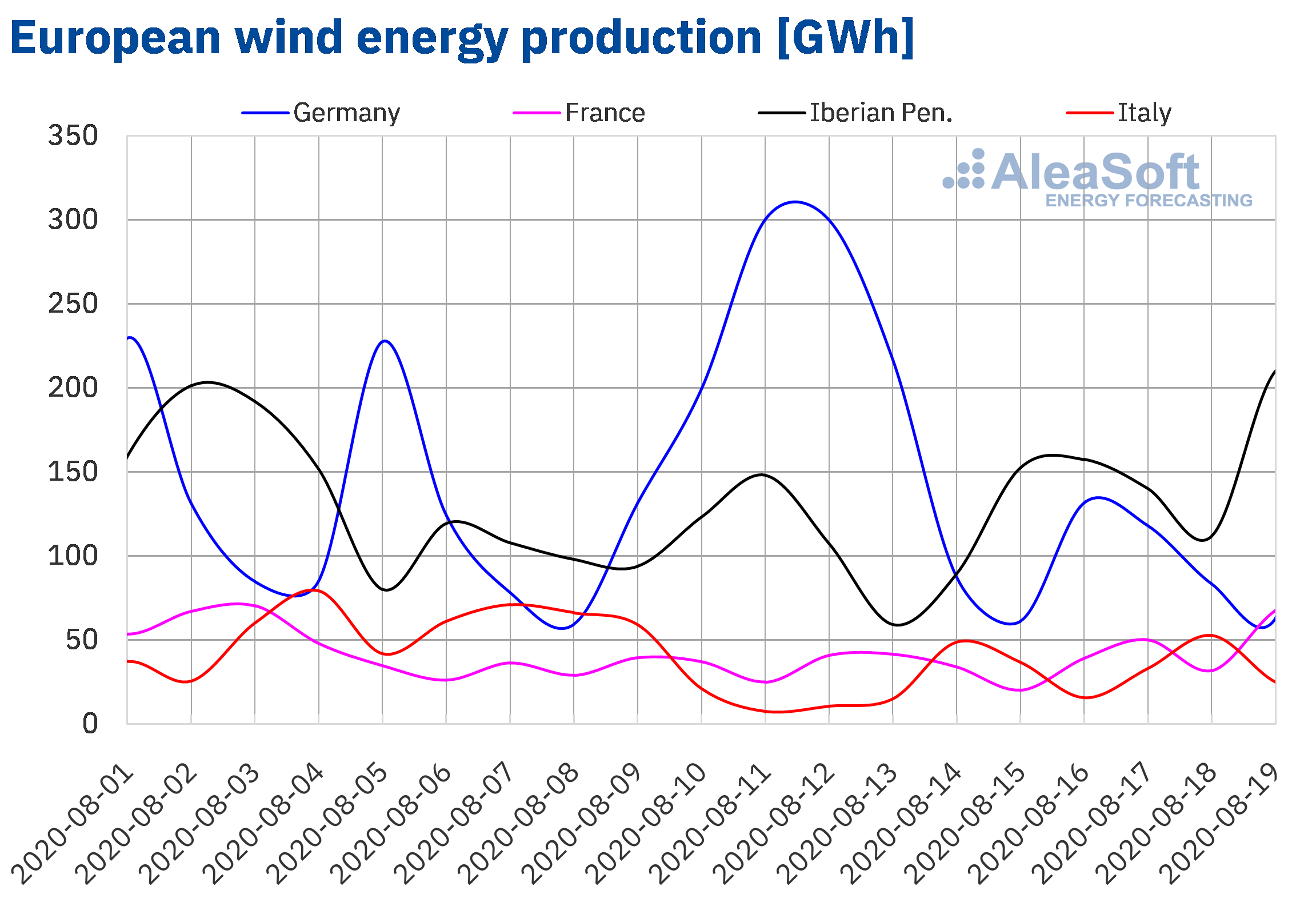

The average wind energy production for the first three days of the third week of August increased 65% in the Italian market and 47% in the French market compared to the average for the week of August 10. In the Iberian Peninsula, the production with this technology increased by 29%. The exception was the German market where a 52% drop was registered.

Between August 1 and 19, the wind energy production was 21% higher in the Italian market and 8.7% in the Iberian Peninsula compared to the same days in 2019. On the contrary, the markets of France and Germany registered a decrease of 36% and 40% respectively.

By the end of the third week of August, AleaSoft‘s analysis indicates that the total wind energy production for the week will be higher in all the markets analysed at AleaSoft.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

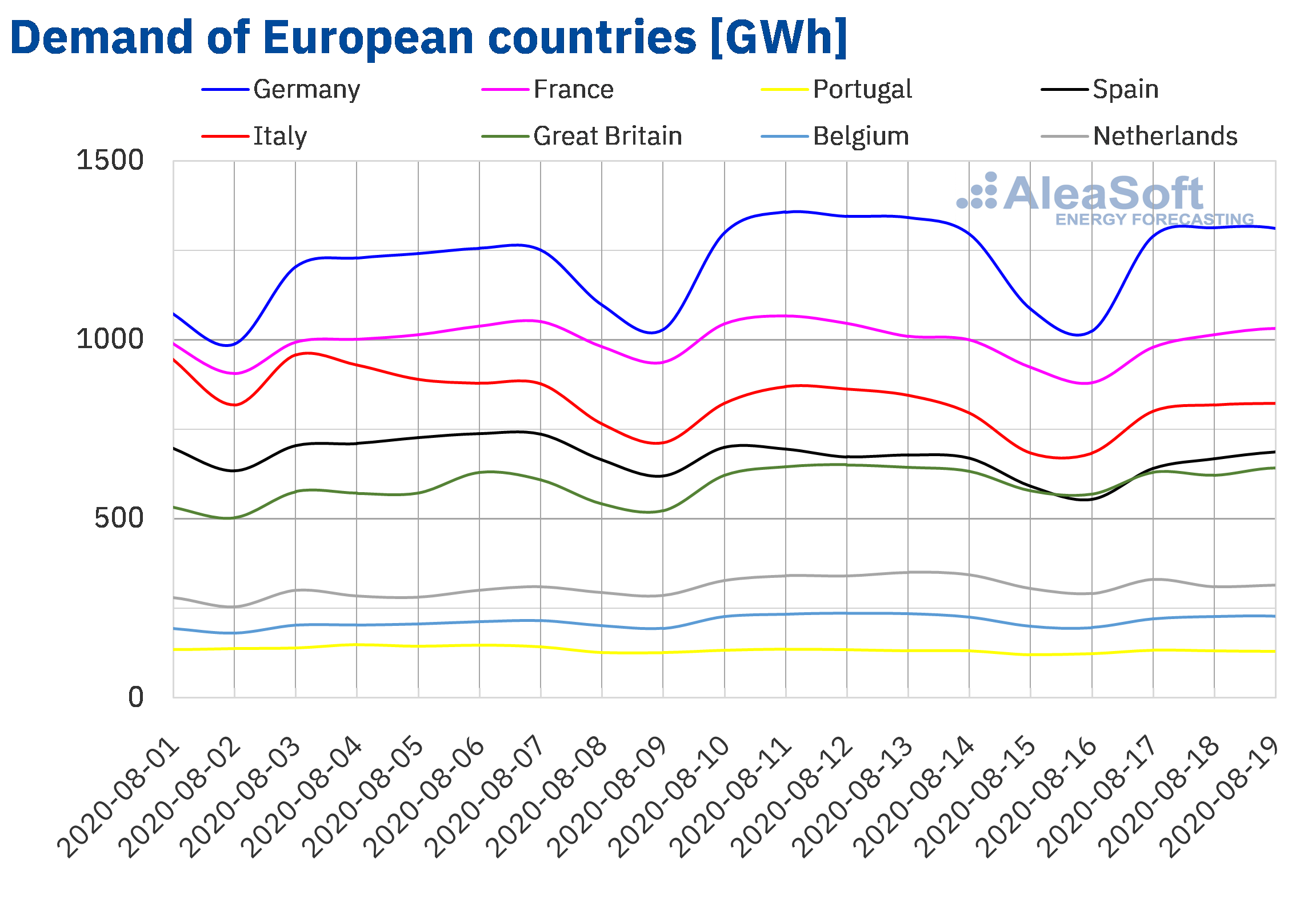

As forecasted by AleaSoft at the beginning of the week of August 17, the average temperature of the week behaved in the opposite way to that of the previous week between Monday and Wednesday, since when the effect of the heat wave of the preceding week passed, less warm temperatures were registered in all European markets except in Portugal. As a result, there was a general drop in demand in all the analised electricity markets. The lower labour activity in August also influenced these decreases. The variations in demand that stand out the most were those of Italy and France, with negative balances of 4.5% and 4.2%. These were accompanied by decreases in Belgium and Portugal, of 3.3% and 2.7% respectively. For its part, in the markets of Germany and Great Britain, the demand fell by 2.2% and 1.2%.

At AleaSoft this trend is expected to continue and the total demand at the end of the week will drop in all European markets.

The AleaSoft‘s electricity markets observatories are useful tools for hourly, daily and weekly analysis of these demand trends and other important variables of the electricity markets.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

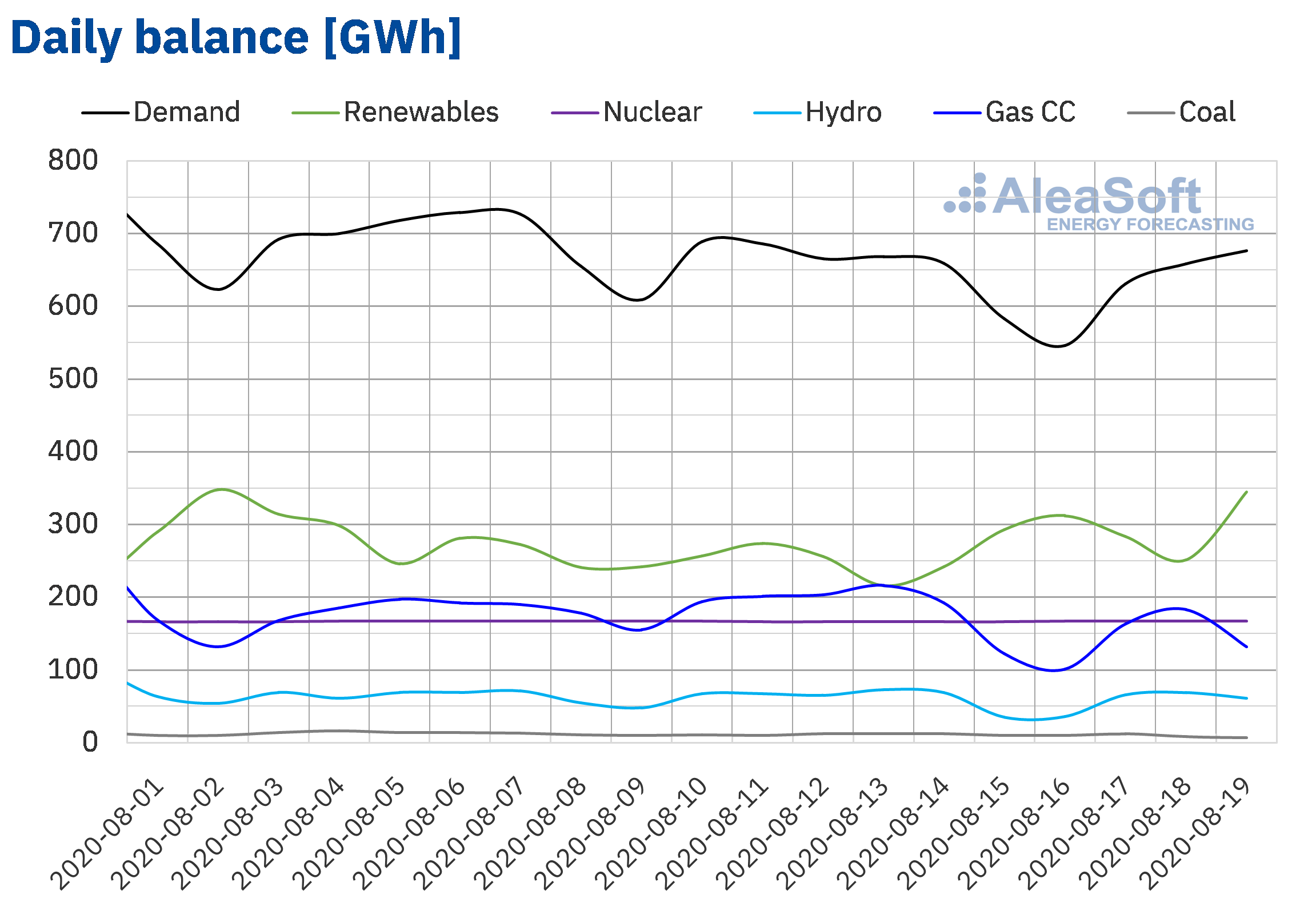

Mainland Spain, photovoltaic and solar thermal production and wind energy production

The electricity demand of Mainland Spain during the first three days of the week of August 17 was 3.6% below that of the same period of the previous week. The most influential factors in this drop were the 0.3 °C drop in average temperatures and the effect of the decline in labour activity in August. At AleaSoft, the demand from the Spanish peninsula is expected to end the third week of August with values similar or lower than those of the previous week.

The solar energy production in Mainland Spain, which includes both photovoltaic and solar thermal technologies, increased by 7.5% between Monday, August 17 and Wednesday, August 19, compared to the average for the week of August 10. In the year‑on‑year analysis, during the first 19 days of August, there was a 32% increase in production with these technologies. For the current week, the analysis carried out at AleaSoft indicates that production will remain slightly higher than that of the second week of August.

Regarding the wind energy production in Mainland Spain, in the first three days of the third week of August it increased by 27% compared to the average of the previous week. In the year‑on‑year analysis, the wind energy production during the 19 days elapsed in August was 20% higher. The analysis carried out at AleaSoft indicates that at the end of the week, production with this technology will continue to be higher compared to the second week of August.

At this moment, all the nuclear power plants are in operation and nuclear energy production maintains a level close to 167 GWh per day.

Source: Prepared by AleaSoft using data from REE.

Source: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 12 674 GWh stored, according to data from the Hydrological Bulletin of the Ministry for Ecological Transition and Demographic Challenge number 33, that represents a decrease of 321 GWh compared to bulletin number 32.

European electricity markets

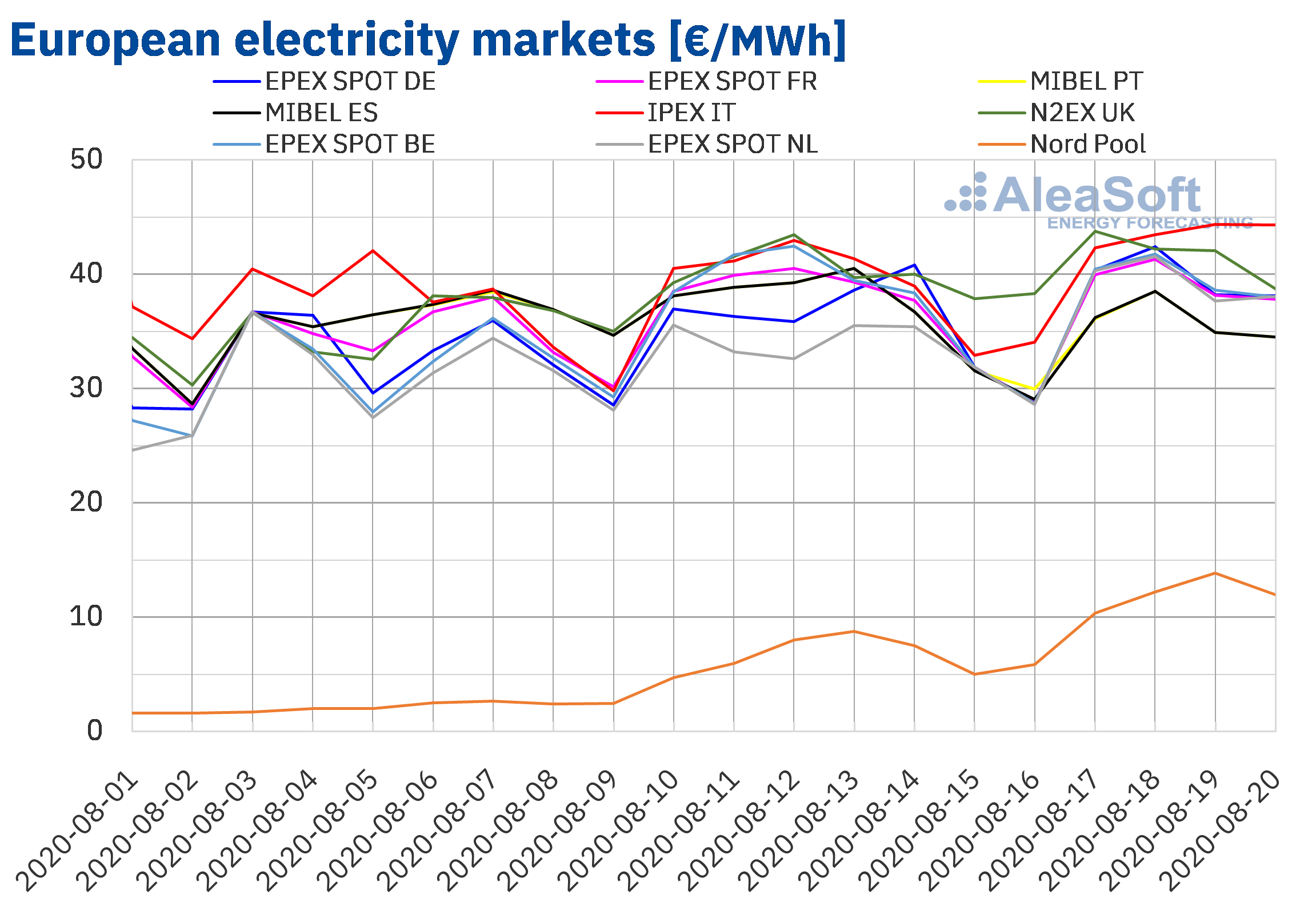

In the first four days of the week of August 17, the prices of the European electricity markets, excluding the Nord Pool market, remained between €35/MWh and €45/MWh. The upper end was marked by the IPEX market of Italy, which resumed its position as the market with the highest prices in Europe since Tuesday, August 18 and in the session of August 20, it reaffirmed in this position with a difference of more of €5/MWh compared to the N2EX market in Great Britain, which was the one that occupied the second position. At the other extreme, there was the MIBEL market in Spain and Portugal, which throughout the week remained the second with the lowest price and settled on August 19 and 20 with a price of €34.90/MWh and €34.50/MWh respectively for both countries. For its part, the Nord Pool market continues its marked upward trend, but is still well below the rest of the markets.

The analysed countries of the EPEX SPOT market maintained a high coupling during the days of the week. On August 20, their prices converged near €38.00/MWh with a deviation of just €0.14/MWh. Specifically, for this day, the N2EX market in Great Britain also joined, which fell to €38.75/MWh.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

During the analysed period, a heterogeneous behaviour of prices is observed. On the one hand, in the EPEX SPOT of Germany and the Netherlands, IPEX, N2EX and Nord Pool markets increased prices compared to the equivalent period of the previous week of August 10. Mainly in the Nordic market, where prices increased by more than 75%. On the other hand, there are the EPEX SPOT market of France and Belgium and MIBEL in which prices fell compared to the previous week, with the Iberian market being the one with the greatest drop, approximately 8%.

A similar situation occurs if we compare the prices of the first four days of the week of August 17, 2020 with respect to the same days of the third week of August 2019. On the one hand, the EPEX SPOT markets of Germany, France, Belgium and the Netherlands and N2EX increased their prices. The one that did it the most was the French market, with an 18% increase. On the other hand, the MIBEL, IPEX and Nord Pool markets of the Nordic countries presented prices lower than those of 2019. The Nord Pool market is the one with the greatest decrease in this comparison. Despite the upward trend that has been exhibiting for two weeks, its price is still 65% lower than the equivalent days of the previous year.

Among the fundamental causes that led to this market behaviour is a decline in renewable energy production in Germany that forced the prices up. This scenario changed on August 20 and therefore a drop in prices in Germany is expected to spread to the rest of the interconnected markets. Another important factor that has led to the increase in the prices of the electricity markets is the increase that gas prices are experiencing.

The AleaSoft‘s electricity market price forecasting indicates that their evolution in the remaining days of the week will cause some markets to end up being lower than those of the previous week, except in the Italian, Dutch and Nordic markets.

Iberian market

The MIBEL market between August 17 and 20 presented an unusual behaviour, being every day below the prices of the EPEX SPOT market of the analysed countries. During these days, the Iberian market was about €3/MWh below its neighbour, the French market. With respect to the equivalent days of the year 2019, the prices during the analysed period were 12% lower. Regarding the week of August 10, 2020, there were also decreases in prices, of more than €3/MWh on average. This behaviour of the Iberian market occurred despite high temperatures, thanks to an increase in renewable energy production, mainly wind power.

At AleaSoft, it is expected that in the remaining days of the week this distribution of market prices will change and MIBEL will take on values higher than those of the EPEX SPOT market.

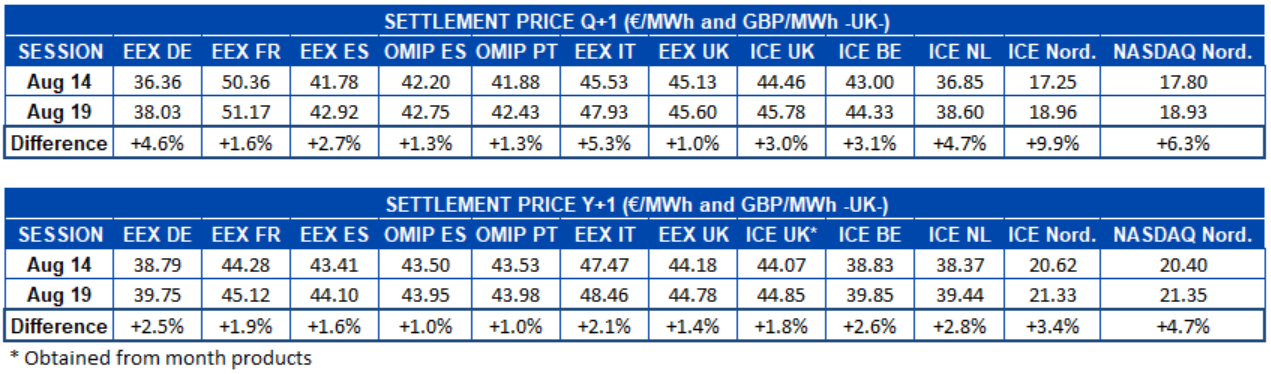

Electricity futures

In the days elapsed during the week of August 17, the European electricity futures markets analysed in AleaSoft registered a general increase in their prices. When analysing the product Q4‑20, in relative terms with respect to the session on Friday, August 14, the ICE market of the Nordic countries was the one that registered the greatest variation, of 9.9%. However, this is due to the low prices in this market. In absolute terms, the EEX market of Italy was the one with the highest increase with a rise of €2.70/MWh between the sessions of August 14 and 19. The EEX market of Great Britain was the one with the lowest variation, with a rise of €0.47/MWh which represented an increase of 1.0%.

In the case of the product for the next calendar year, 2021, the behaviour was very similar. Prices rose in all markets. In this case, the NASDAQ market in the Nordic countries was the one with the greatest variation, with the settlement price of the August 19 session being 4.7% higher than the August 14 session price. However, in absolute terms, the ICE market in the Netherlands was the one with the highest increase, closely followed by the ICE market of Belgium. On the other hand, the OMIP market of Spain and Portugal was the one with the lowest variation, with an increase of 1.0% in both cases.

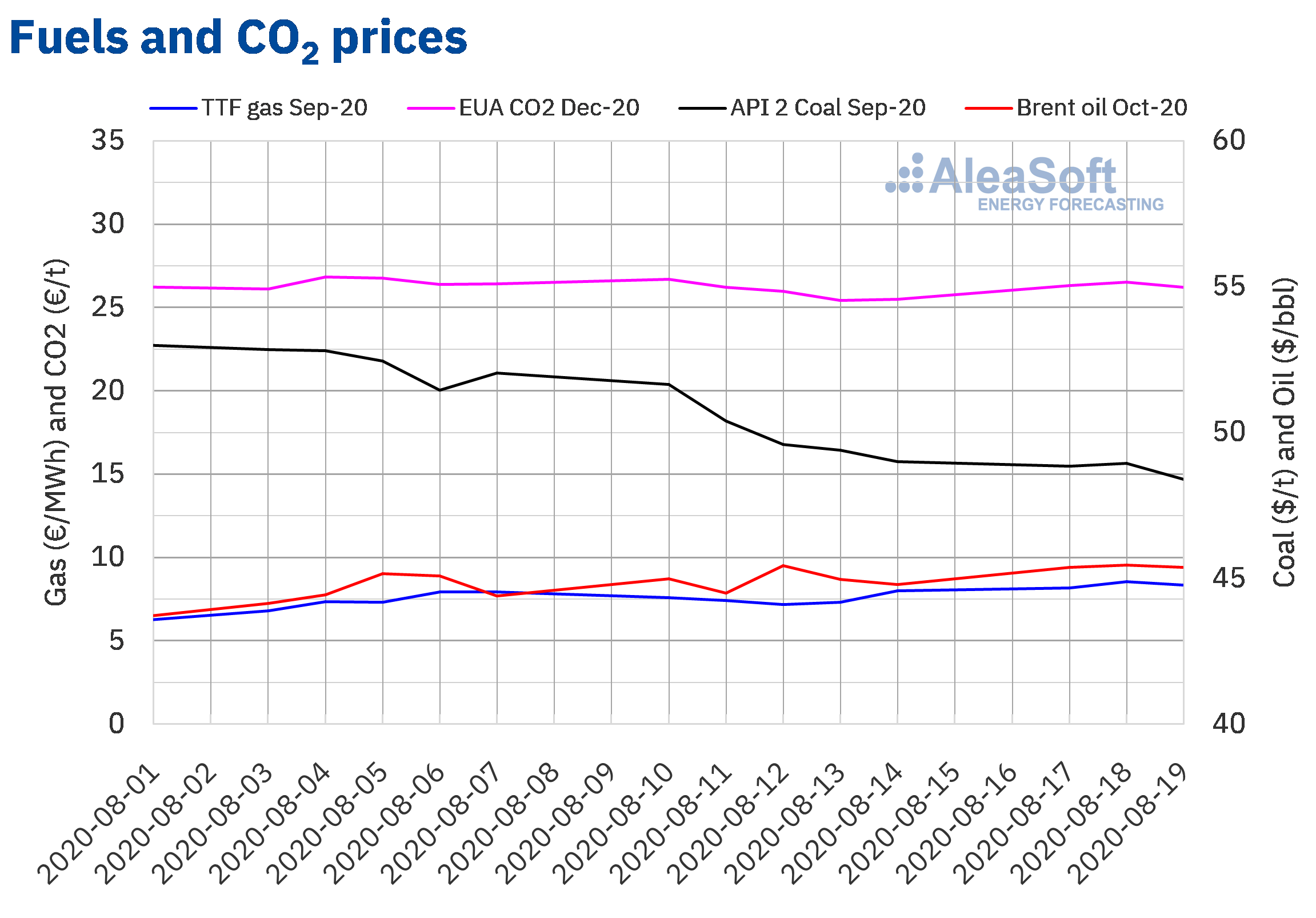

Brent, fuels and CO2

The prices of Brent oil futures for the month of October 2020 in the ICE market remained stable above $45/bbl during the three days elapsed in the third week of August. During the first two days of the week, prices were higher than those of the same days in the second week of August. On Monday, August 17, a price of $45.37/bbl was reached, 0.8% higher than that of August 10. On Tuesday 18, prices increased by 0.2% compared to the previous day, reaching $45.46/bbl, the highest value so far this week. Later on Wednesday, prices fell 0.2% compared to the previous day, settling with the same value registered in Monday’s session, of $45.37/bbl, which in turn represented a decrease of 0.1% compared to Wednesday, August 12.

The stability in crude oil prices during the analysed period was related to the decision to halt the increase in production by the OPEC+ members, for fear that the increase in cases of COVID‑19 could reduce demand.

On the other hand, the prices of the TTF gas futures in the ICE market for the month of September 2020, from Monday to Wednesday, remained above €8/MWh. The first two days continued the upward trend that they had been registering since August 13. On Monday, August 17, prices increased to €8.18/MWh, 2.0% higher than those of Friday, August 14. On Tuesday they continued to increase compared to the previous day to €8.55/MWh, which represented an increase of 4.5% and the highest price since April 20 of this year. Subsequently, on Wednesday the prices fell by 2.3% compared to the previous day to stand at €8.35/MWh.

Regarding the TTF gas prices in the spot market, since the beginning of the third week of August they have shown an upward trend. On Monday, August 17, a price of €6.98/MWh was reached, 0.8% higher than the reference prices for the weekend. In the following days, prices continued to increase until they exceeded €8/MWh on Wednesday, August 19. Already on Thursday, August 20, a price of €8.18/MWh was reached, the highest since March 23, 2020. The increase in cost of LNG deliveries due to the increase in gas prices in the United States, in conjunction with the drop in Norwegian gas supply, it supported the increase in TTF gas prices during this period.

Regarding the API 2 coal futures prices in the ICE market for the month of September 2020, on Monday, August 17, the downward trend that they were registering since August 10 continued. That day, the prices fell 0.3% compared to Friday, August 14, standing at $8.85/t. On Tuesday 18, the prices recovered 0.2% compared to the previous day to $48.95/t, this price was the highest this week, although 2.9% lower than the same day of the second week of August. Subsequently, on Wednesday the settlement price fell again to $48.40/t, 1.1% lower than in the previous session and in turn the lowest in the last two months. Larger coal stocks and lower demand due to the economic slowdown resulting from the pandemic are the ones influencing these lower prices.

The CO2 emission rights futures in the EEX market for the reference contract of December 2020, from Monday to Wednesday of the third week of August, were above €26/t. During Monday and Tuesday, they presented increases of 3.2% and 0.9% compared to the previous day, reaching a settlement price of €26.31/t and €26.54/t respectively, the latter value being the highest in so far this week. But on Wednesday the prices fell 1.2% to €26.22/t. This price and that of Tuesday, August 18, were higher than those of the same days of the week of August 10, registering increases of 1.0% and 1.3% respectively.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis on the energy markets recovery from the economic crisis

The economic crisis generated by the COVID‑19 pandemic is generating a lot of uncertainty and the increase in the outbreaks of the disease makes it difficult to predict its termination. In order to analyse the impact of this crisis on the energy markets as well as the possible exit scenarios, AleaSoft is organising the series of webinars “The energy markets at the end of the economic crisis” which will consist of two parts , on September 17 and October 29. Other topics to be analysed are the renewable energy projects financing and the importance of forecasts in audits and in portfolio valuation. At the moment, the participation of speakers from Deloitte, Engie, Banco Sabadell and AleaSoft is confirmed.

At AleaSoft, the long‑term price forecasts of the main European electricity markets were recently updated, taking into account the fall registered by the economies of the different countries in the second quarter of the year and the recovery scenarios.

AleaSoft observatories are available to monitor the main variables of the European electricity, fuel and CO2 markets, which include charts with the data of the last weeks updated daily.

Source: AleaSoft Energy Forecasting.