AleaSoft Energy Forecasting, July 18, 2022. On July 17, the highest hourly solar energy production in its history was registered in Germany, exceeding 38 GWh between 13:00 and 14:00. A solar thermoelectric energy production record was also registered in Mainland Spain on July 12. These records occur in a week in which prices of all European electricity markets increased compared to the previous week, favoured by the increase in demand amid the heat wave, high gas prices and lower wind energy production.

Photovoltaic and solar thermoelectric energy production and wind energy production

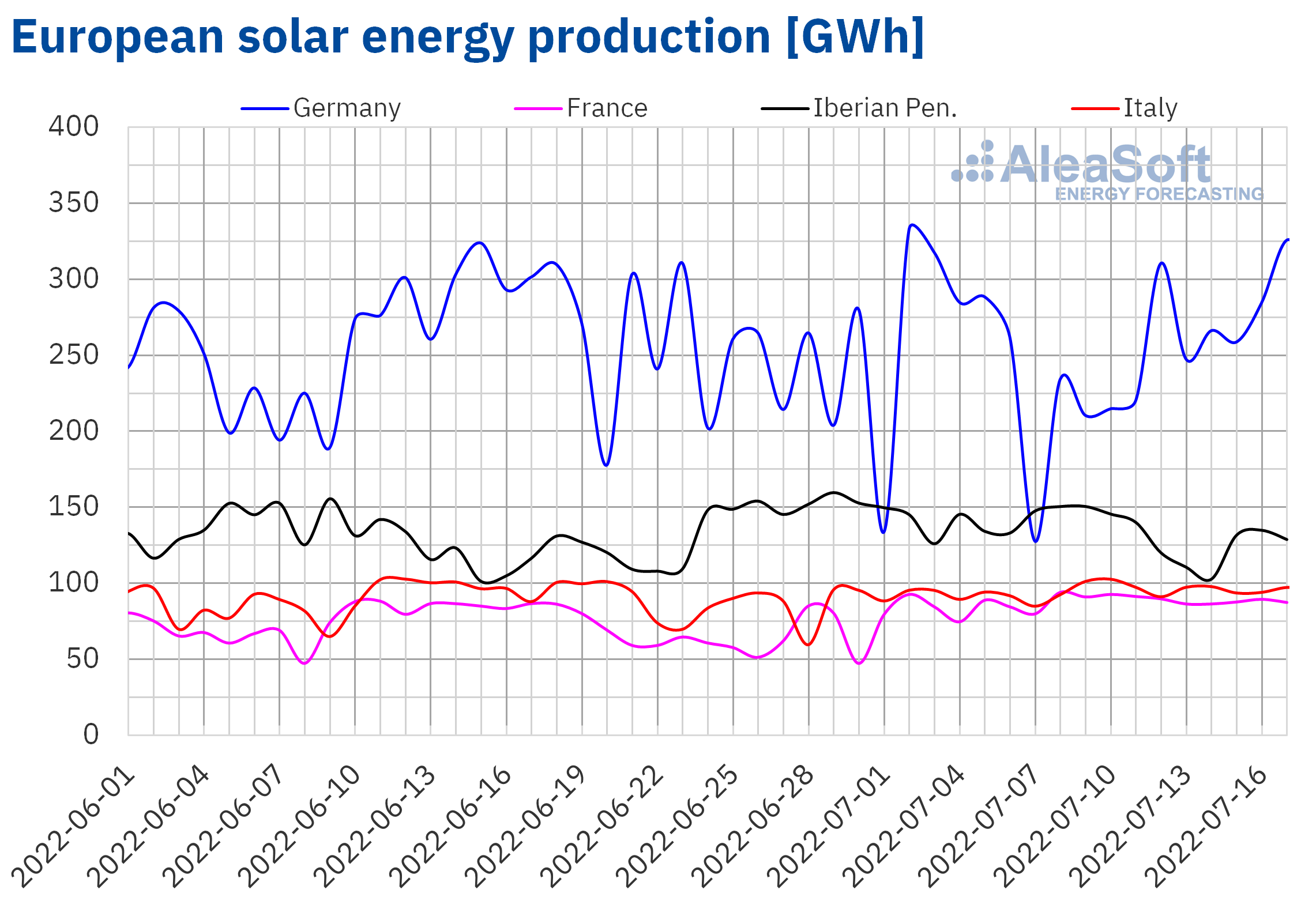

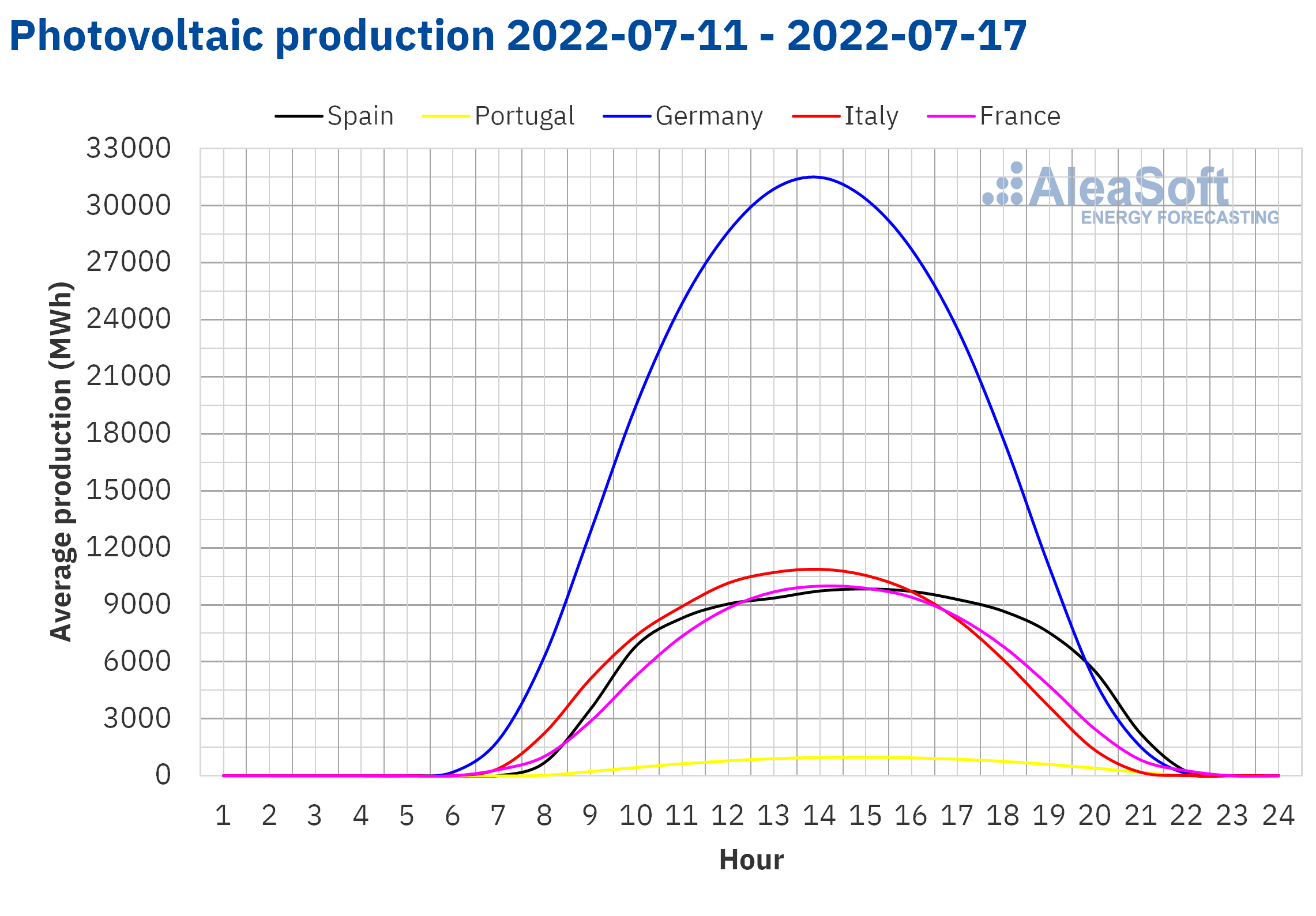

In the second week of July, the solar energy production increased by 18% in Germany compared to the previous week. In addition, on July 17, between 12:00 and 15:00, the three hours of highest solar energy production in history were registered in this market. The highest value was between 13:00 and 14:00, when 38 GWh were exceeded. The solar energy production also increased in the markets of France and Italy, by 2.1% and 1.8%, respectively.

In Mainland Spain, the solar thermoelectric energy production registered an hourly record on July 12 at 13:00, of 2221.80 MWh. However, the combined solar photovoltaic and thermoelectric energy production decreased by 14% compared to the previous week. In Portugal there was also a 14% decrease in solar energy production.

In the third week of July, the AleaSoft Energy Forecasting’s forecasts indicate that the solar energy production will increase in Germany but it will decrease in Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

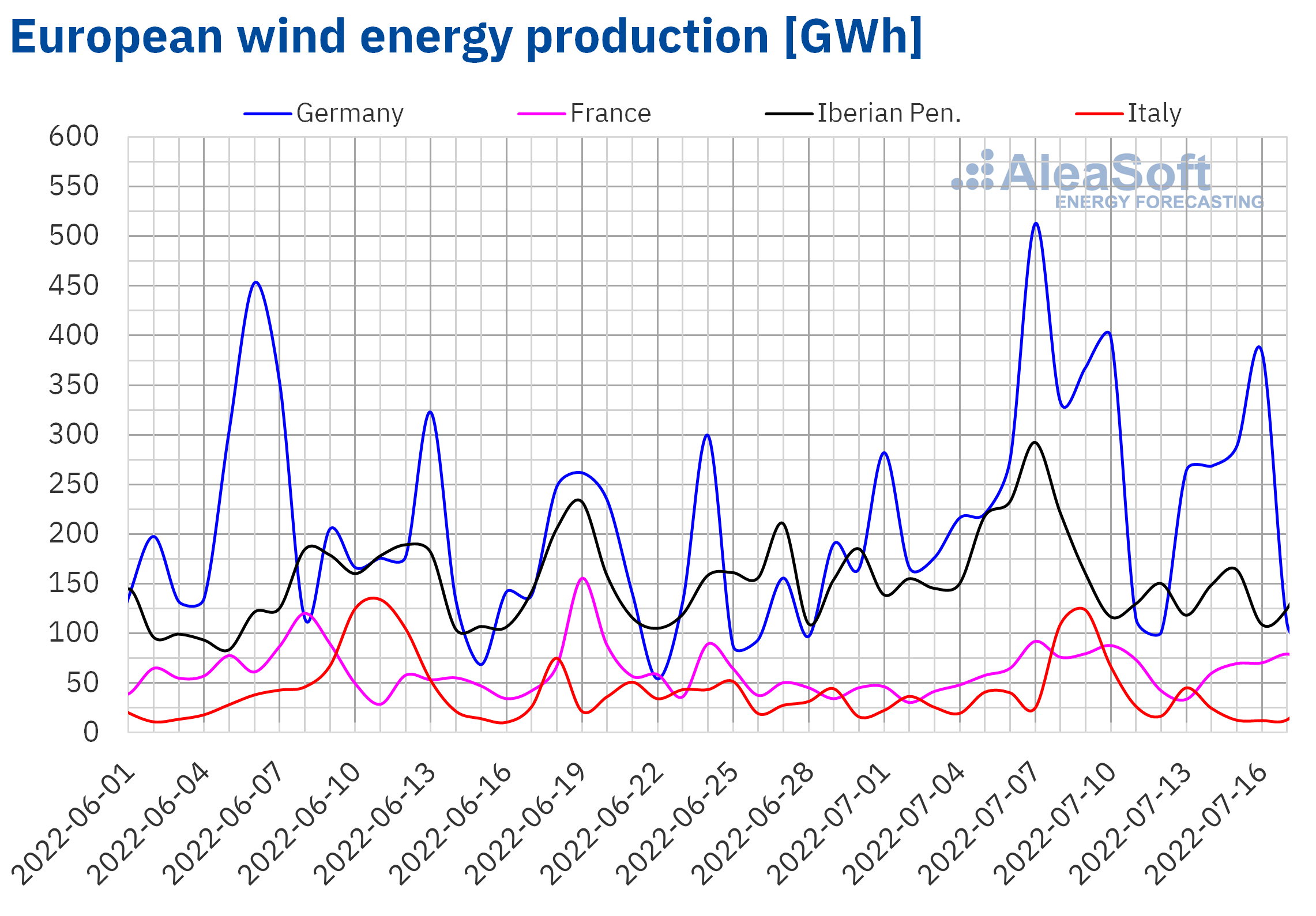

As for wind energy production, in the week of July 11 it decreased in all markets analysed at AleaSoft Energy Forecasting compared to the week that began on July 4. The decreases were between 13% of Portugal and 64% of Italy.

The AleaSoft Energy Forecasting’s forecasts indicate that in the week of July 18 the wind energy production will increase in most markets except in Germany where a slight decrease is expected.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

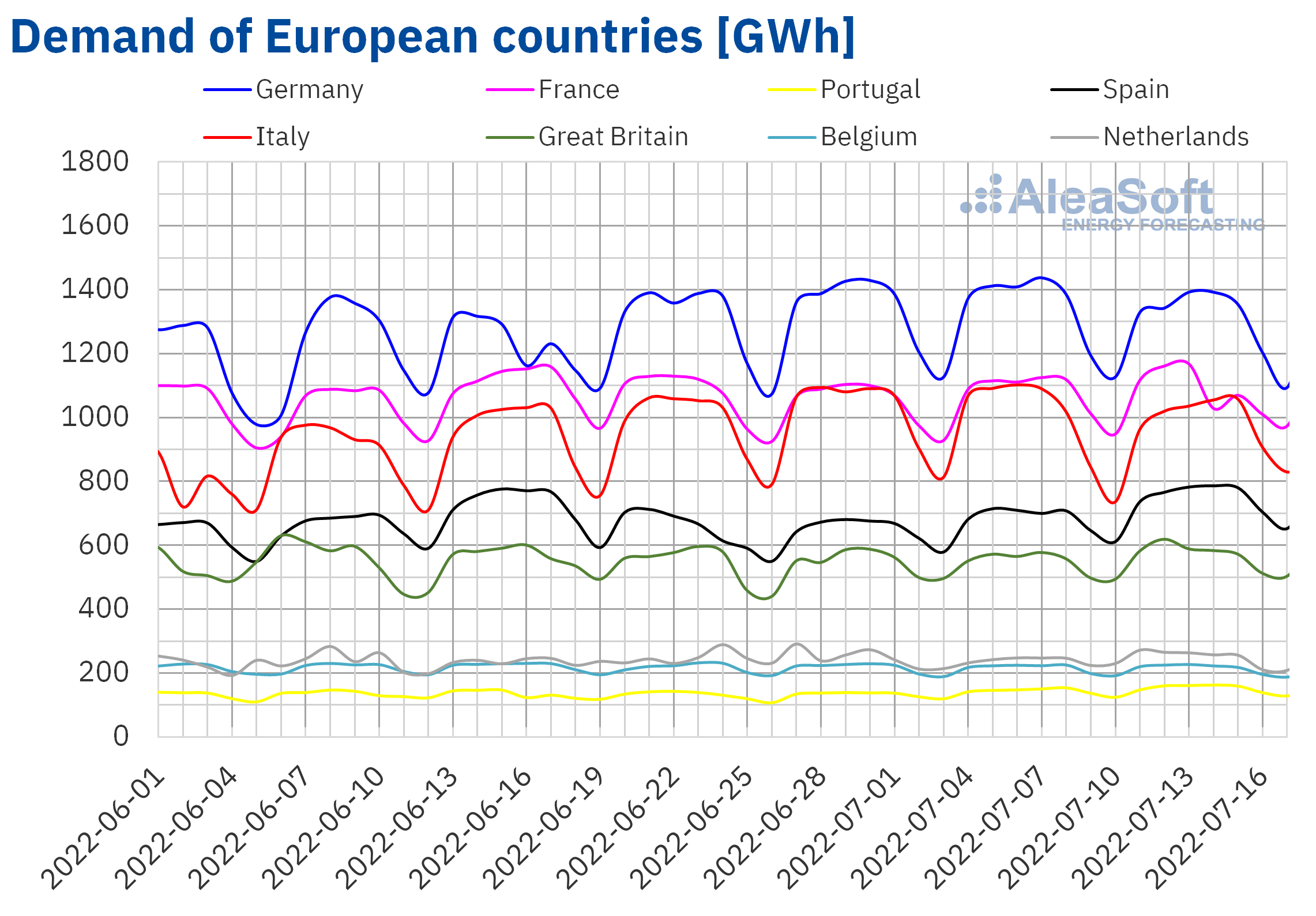

During the week of July 11, the electricity demand behaved mostly upwards in the analysed European markets compared to the previous week. The largest increases were registered in the markets of Spain and Portugal, which were 9.1% and 5.8%, respectively. In the markets of Great Britain and the Netherlands, the demand increased by 3.8% in both cases. The French market was the one with the lowest increase, of 0.1%, due to the decrease in labour hours of Thursday, July 14, national holiday of France. These increases were favoured by the rise in average temperatures, mainly in Spain, France and Portugal, where they increased by more than 3 °C during this period due to the heat wave that is affecting a large part of Western Europe.

On the other hand, the demand fell in the markets of Germany, Italy and Belgium. The largest falls were registered in the markets of Germany and Italy, and were 2.5% and 1.2% in each case. In the Belgian market the drop was 0.5%.

For the third week of July, the AleaSoft Energy Forecasting’s forecasts estimate that the demand will increase in most European markets, favoured by the increase in temperatures in most of the continent. The exceptions will be the markets of Belgium, Spain and Great Britain where the electricity demand is expected to be lower than that registered during the second week of July. In the case of Belgium, the decrease will be favoured mainly by the national holiday of Thursday, July 21, while in Spain it will be due to less warm temperatures than those registered during the week of July 11.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

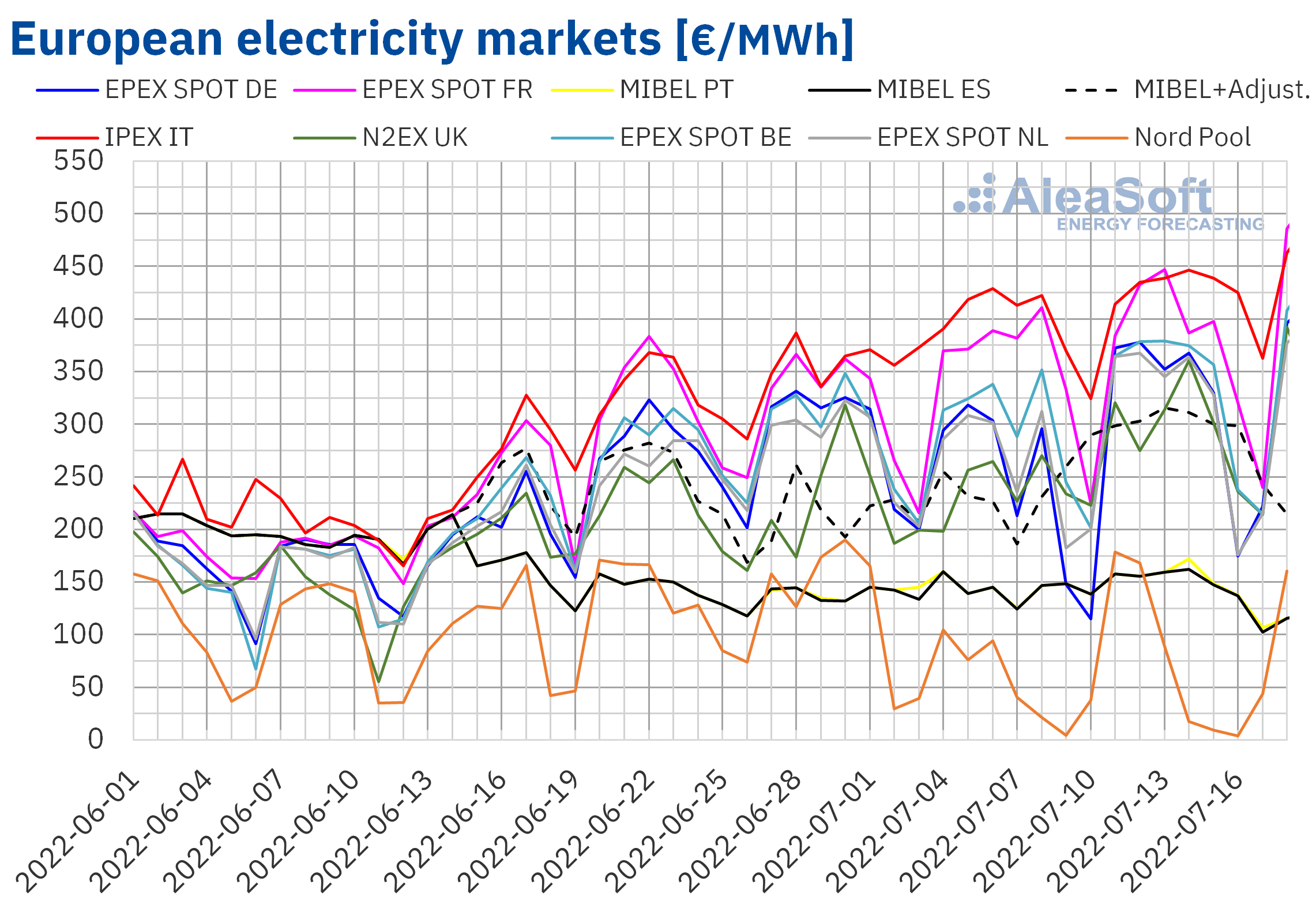

European electricity markets

In the week of July 11, prices of all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The largest price rise was that of the Nord Pool market of the Nordic countries, of 34%, followed by the 30% rise of the EPEX SPOT market of Germany. On the other hand, the smallest increase, of 1.9%, was that of the MIBEL market of Spain. In the rest of the markets, the price increases were between 3.4% of the MIBEL market of Portugal and 21% of the N2EX market of the United Kingdom.

In the second week of July, the highest average, of €422.93/MWh was reached in the IPEX market of Italy. On the other hand, the lowest weekly average, of €72.89/MWh, was that of the Nord Pool market. In the rest of the markets, prices were between €145.92/MWh of the Spanish market and €372.55/MWh of the French market.

Regarding hourly prices, negative hourly prices were registered in the markets of Germany, Belgium and the Netherlands in the second week of July. Two hours with negative prices were registered in the German market on July 16, while one hour was registered in the Belgian market on the 17th. In both cases, negative prices had not been registered since the first half of June. In the case of the Dutch market, five hours with prices below zero were registered on July 16. The lowest hourly price, of ‑€77.43/MWh, was reached in this market at 14:00. This price was the lowest in this market since the end of May.

In contrast, on July 18, hourly prices above €600/MWh were reached in the markets of Germany, Belgium, France, Italy and the Netherlands. Also in the British market, £600/MWh was exceeded.

During the week of July 11, the high gas prices and the general decrease in wind energy production compared to the previous week led to an increase in European electricity markets prices, despite the increase in solar energy production in some markets.

On the other hand, the limit on gas prices applied in the MIBEL market allowed its prices to be the lowest after those of the Nord Pool market. However, part of the consumers must pay a higher price as compensation for the limitation of the gas price. In the Spanish market, the average of this price was €295.63/MWh in the week of July 11, 23% higher than that of the previous week.

The AleaSoft Energy Forecasting’s price forecasts indicate that in the week of July 18 prices of most European electricity markets might continue to increase, despite the increase in wind energy production in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

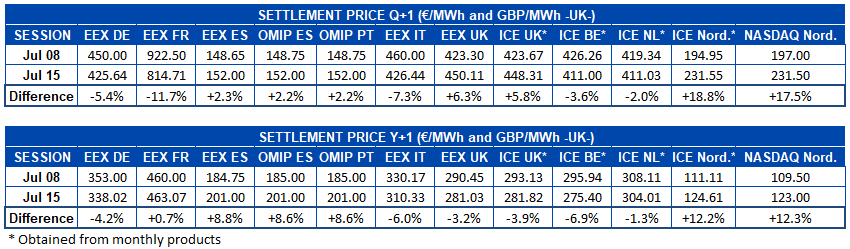

Electricity futures

During the second week of July, electricity futures prices for the next quarter showed a heterogeneous behaviour in the markets analysed at AleaSoft Energy Forecasting. In the EEX market of Germany, France and Italy and in the ICE market of Belgium and the Netherlands, prices fell between the sessions of July 8 and 15. The most pronounced of the decreases was that of the French market, whose settlement price fell by 12%, which, being the market with the highest prices, in absolute terms is a decrease of €107.79/MWh. In the rest of the markets, the prices rose, with the largest increase being that registered in the ICE market of the Nordic countries, with a 19% increase, reaching a settlement price of €231.55/MWh in the session of July 15, figure that is quite high for the usual prices of the markets of the Nordic region.

The behaviour of electricity futures prices for the year 2023 was also uneven. The most pronounced drop occurred in the ICE market of Belgium and prices of the ICE market of the United Kingdom and the Netherlands and the EEX market of Germany, Italy and the United Kingdom also fell. On the other hand, the largest increase in this case was that of the NASDAQ market of the Nordic countries, with a 12% rise and closely followed by the ICE market of the same region. Prices also rose in the OMIP market of Spain and Portugal and in the EEX market of Spain and France, although in the latter case the rise was only 0.7%.

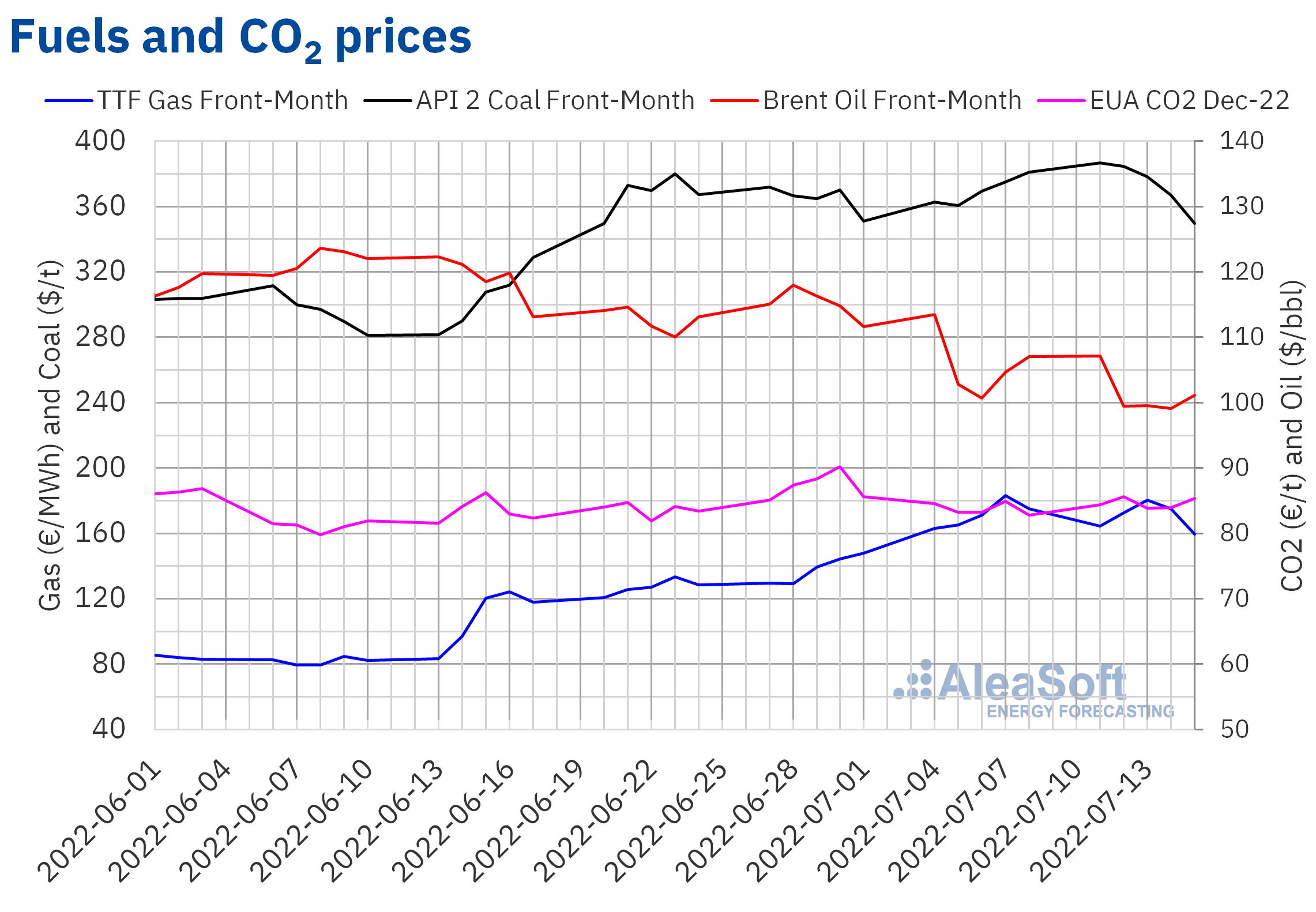

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market began the second week of July with a settlement price of $107.10/bbl on Monday, July 11, which was the maximum of the week. However, from Tuesday to Thursday, settlement prices remained below $100/bbl. The weekly minimum settlement price, of $99.10/bbl, was registered on Thursday, July 14, and was 5.3% lower than that of the previous Thursday. It was also the lowest settlement price since the first half of April. But on Friday, prices recovered to reach a settlement price of $101.16/bbl, which was 5.5% lower than that of the previous Friday.

Concern about the evolution of the economy favoured the fact that in the second week of July prices below $100/bbl were registered. Although the demand remains high, the International Energy Agency lowered its growth forecasts for the years 2022 and 2023.

As for TTF gas futures in the ICE market for the Front‑Month, they began the second week of July with a settlement price of €164.52/MWh, more than €10/MWh lower than that of the last session of the previous week, of €175.21/MWh. Subsequently, prices recovered and on Wednesday, July 13, the weekly maximum settlement price, of €180.50/MWh, was reached, which was 5.6% higher than that of the same day of the previous week. However, during the last days of the week, prices fell again. As a result, the settlement price of Friday, July 15, was €159.57/MWh, 8.9% lower than that of the previous Friday.

In the second week of July, the interruption of supply through the Nord Stream 1 gas pipeline due to maintenance work exerted its upward influence on prices. In addition, a decrease in the flow of gas from Norway also led to higher prices on Tuesday. Although the increase in supply from this country had the opposite effect on prices on Friday. On the other hand, there is concern about whether the flow of gas from Russia through Nord Stream 1 will be restored after maintenance work. Meanwhile, the heat wave might cause an increase in demand for electricity generation in the week of July 18.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2022, in the second week of July they remained below €86/t. The week began with increases and on Tuesday, July 12, the weekly maximum settlement price, of €85.65/t, was reached, which was 2.9% higher than that of the previous Tuesday. But on Wednesday the price fell by 2.1% to €83.87/t, which was the weekly minimum settlement price. The rest of the days of the week, prices recovered and the settlement price of Friday, July 15, was €85.38/t, 3.1% higher than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

On July 14, the 24th edition of the webinars of AleaSoft Energy Forecasting and AleaGreen was held, which focused on green hydrogen as a strategic vector in the energy transition. The guest speakers from H2B2, Africa Castro, Business Development, and Anselmo Andrade, Integrated Product Director, highlighted the need for aid and regulation for the development of renewable hydrogen. In the webinar, Oriol Saltó i Bauzà, Associate Partner at AleaGreen, analysed the European energy markets in recent weeks and the prospects for the coming months. The recording of the webinar can be requested here.

The next webinar will be held on September 15, with the participation of Jorge Simão, COO at OMIP, and Pablo Villaplana, COO at OMIClear, who will analyse the importance of forward markets and hedging for the development of renewable energy. Fernando Soto, Director‑General of AEGE, will participate in the analysis table of the Spanish version of the webinar to talk about the auction of renewable PPA with electro‑intensive consumers. As usual, Oriol Saltó i Bauzà will analyse the evolution and prospects of the energy markets.

Source: AleaSoft Energy Forecasting.