AleaSoft, December 15, 2020. Bearing in mind the importance of the risk management, both when selling and when buying energy, is always important. The current moment of economic crisis and fluctuations in the markets prices may relegate the risk management to the background, but it is precisely in situations like this when the need and the importance of a solid risk management strategy based on reliable price forecasting become obvious.

Perhaps right now, in full concern about the recovery from the global economic crisis and amid the hopeful news of the long‑awaited success of the COVID‑19 vaccines, the question of the risk management is not the current topic in the media. But at a time like this, when the energy markets prices recover, keeping in mind the need for the risk management is important.

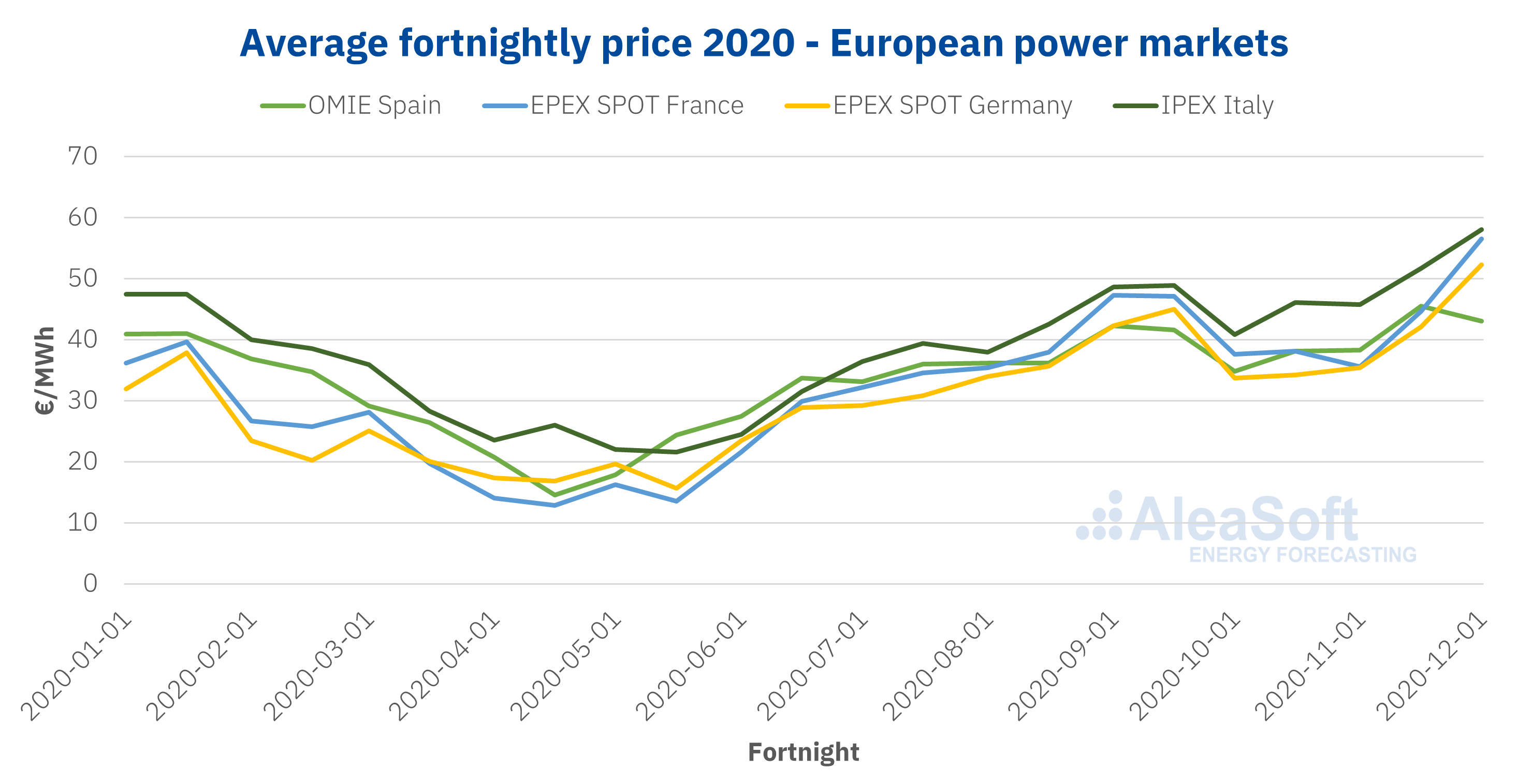

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT and GME.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT and GME.

The energy markets are at a time when, after a year with historically low prices, both in the electricity markets and in the oil or gas markets, the prices are rising and setting new annual records. For the electricity producers, this year of low prices has clearly been unfavourable if they did not plan their risk management properly. For the electricity consumers, if their energy purchase strategy was adequate, they must have been able to take advantage of this opportunity offered by the low market prices.

In any case, no matter how this year was, the prices are recovering and risk management planning is necessary, both to protect against further price fluctuations and to take advantage of them if they are in the favourable sense.

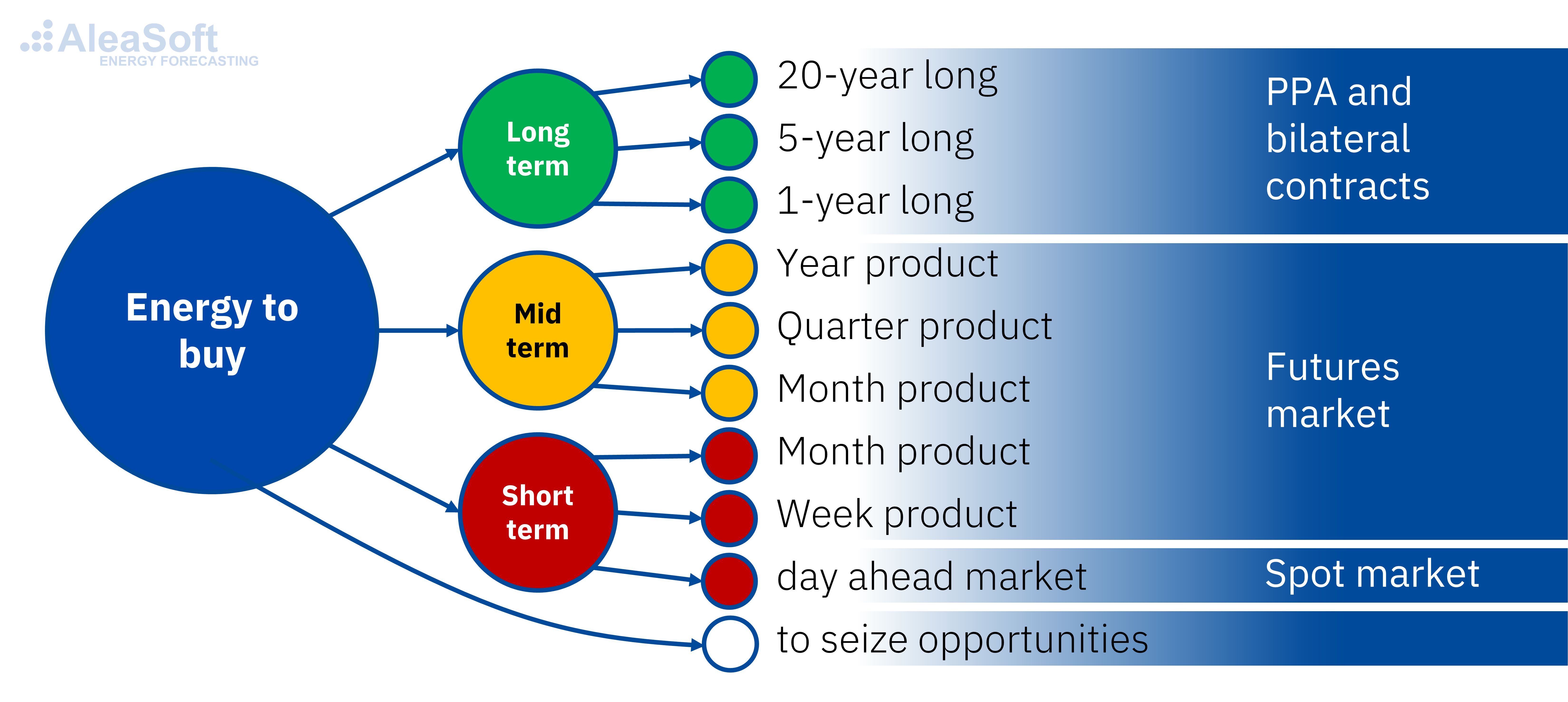

Diversification based energy purchase strategy scheme.

Diversification based energy purchase strategy scheme.

How to properly measure the market prices risk

The most widely used measure to determine the risk to which one is exposed is the Value‑at‑Risk (VaR). This measure tells us how much money “is at risk” with a certain level of confidence. It is normally used to measure how much invested money can be lost if a stock, or an asset in general, changes in value. The VaR is the measure that translates the uncertainty into Euros.

In the case of the energy markets, it can be used, for example, when signing a PPA or buying energy in the futures markets. For an electricity generation facility, the VaR will indicate the maximum amount of money that could be entered lower than the spot price with a confidence level of 95%, for example. For a consumer, the VaR will show how much more they could pay compared to the pool price with a certain level of confidence.

Calculating the VaR is relatively straightforward and is the first thing taught in any risk management course. The trickiest part is estimating the probability distribution of the pool’s future prices. This is the distribution from which the markets prices in the future with certain levels of confidence are obtained. The reliability of this probability distribution is the key for the VaR to be a realistic and accurate measure of the risk.

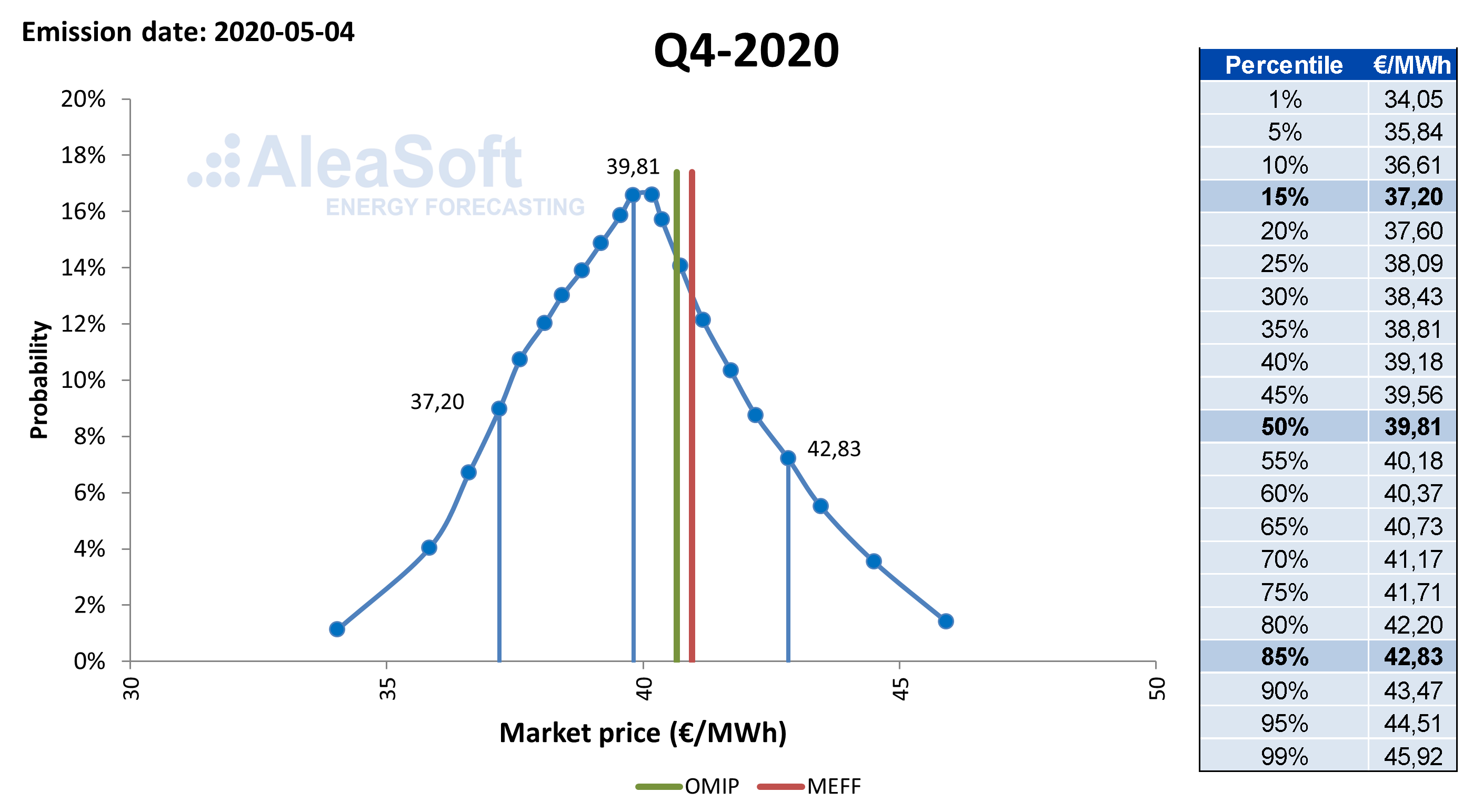

Probability distribution of the average price of the Iberian electricity market OMIE Spain for the fourth quarter of 2020 carried out on May 4, 2020.

Probability distribution of the average price of the Iberian electricity market OMIE Spain for the fourth quarter of 2020 carried out on May 4, 2020.

The probabilistic prices forecasts

To estimate the VaR, two or three prices scenarios, normally labelled high, mid and low, which do not provide any numerical or scientific information on the probability associated with each of them, are not enough. In order to calculate the VaR, complete probabilistic distributions are necessary, where each percentile indicates the probability that the real final price exceeds or is below a certain value.

To obtain the complete probabilistic distributions, reliable and robust prices forecasting models are necessary that allow the generation of a large number of simulations that represent all possible market prices in the future, each with the weight corresponding to the probability of that price occurring.

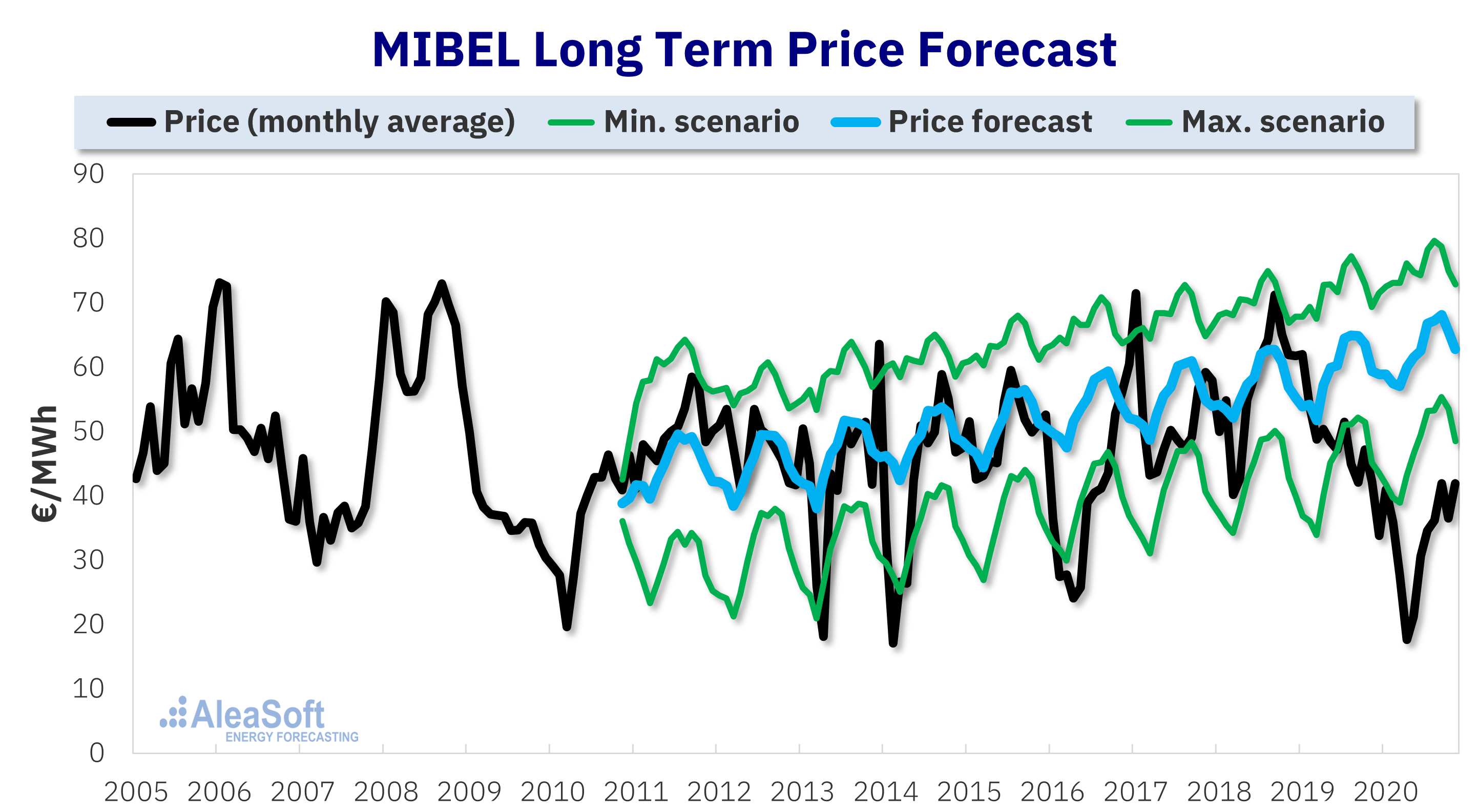

The AleaSoft‘s price forecasts provide the complete probability distributions for all months, quarters and years in a mid‑term horizon up to three years ahead. For the long term, up to a 30‑year horizon, confidence bands with the 15th and 85th percentiles are included, a probabilistic metric necessary for the risk management. In addition, the forecasts, even in the long term, have hourly granularity that allows, for example, estimating the price captured by a certain production or consumption profile.

The long‑term forecasts provide a different vision of the future about the renewable energies in the next 30 years, made by experts in the European electricity markets, mainly in the Spanish electricity market, with more than 20 years of experience making forecasts in all horizons. The Alea methodology, a hybrid model based on classic statistical techniques and Artificial Intelligence, is an alternative, and can be complementary to the most commonly used forecasting models based on the dispatch of units.

Long term price forecast for the Iberian electricity market made in November 2010.

Long term price forecast for the Iberian electricity market made in November 2010.

The future and the evolution of the energy markets in Europe

In addition to forecasts for the risk management, detailed analyses on the evolution of the energy markets in Europe are available, which provide a clear vision of the future of the European energy system, contributing knowledge, intelligence and opportunities.

Webinars that disseminate useful information and knowledge to the professionals of the energy sector are also regularly organised at AleaSoft. The next webinar will be held on January 14 and will feature the participation of speakers from the consulting firm PwC Spain, to analyse the status and the vision of the PPA contracts market for large consumers, its impacts and requirements, and the need for future electricity market prices estimates.

Source: AleaSoft Energy Forecasting.