AleaSoft, April 16, 2021. The objectives of the NECP are ambitious, but as the installed renewable energy capacity and the demand for access permits advance, they seem acceptable. Still, everybody is aware that the amount of funding required to achieve this will be challenging. The Axpo experts who participated in the AleaSoft’s webinar analysed which are the new players that are appearing in the renewable energy landscape to face all this demand for financing.

Last Thursday, April 15, the second and last part of the series of webinars “Prospects for the energy markets in Europe. Spring 2021” was held, organised by AleaSoft and with the participation of two speakers from Axpo: Fernando de Juan Astray, Head of Origination and Long‑Term Products at Axpo Iberia, and Ana Manzano, Originator Long‑Term Products at Axpo Iberia, in addition to Oriol Saltó i Bauzà, Manager of Data Analysis and Modelling at AleaSoft. Antonio Delgado Rigal, CEO of AleaSoft, participated in the subsequent analysis table.

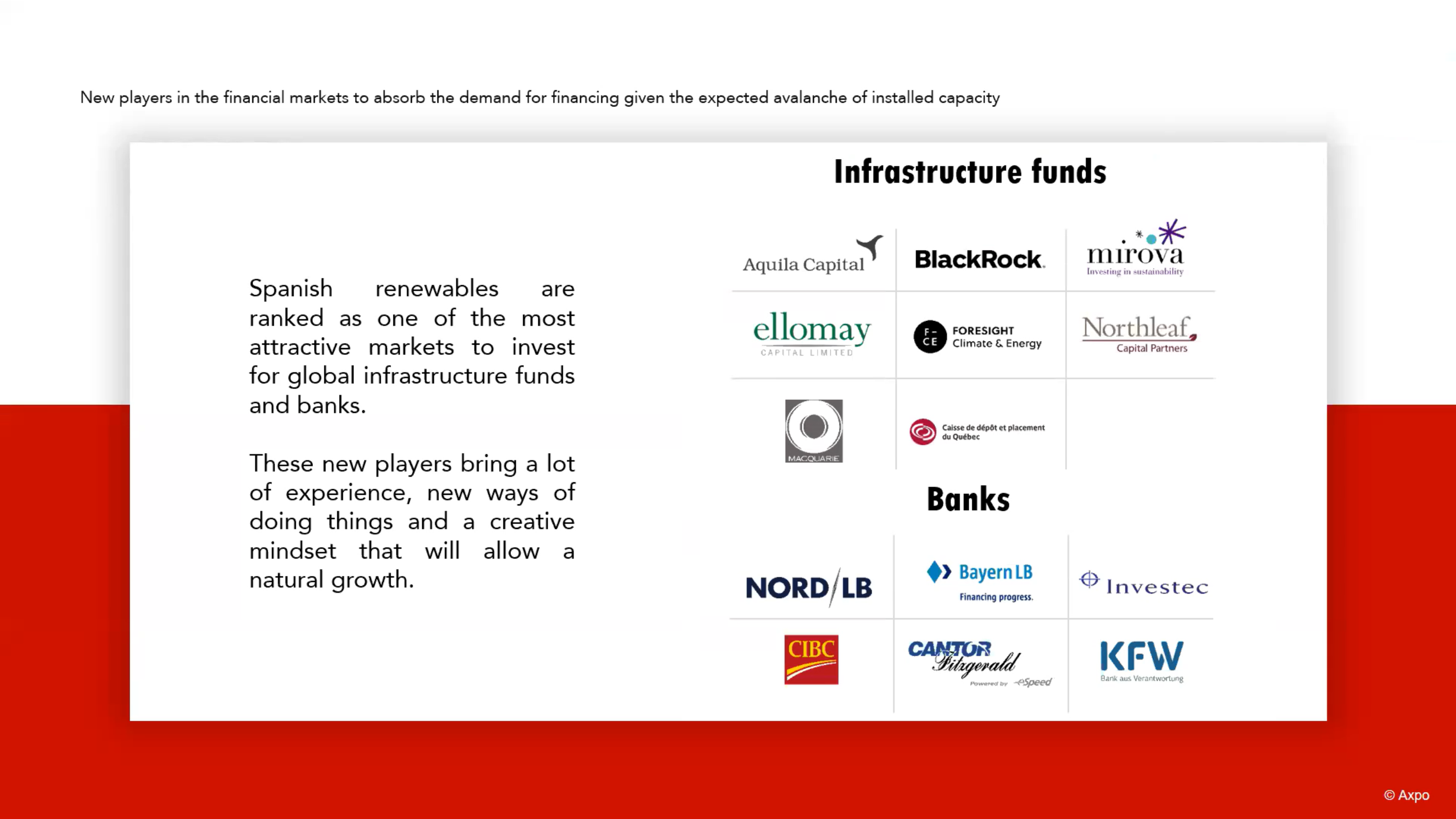

In addition to analysing which are the new players and the role that are developing in the financial markets to absorb the demand for financing given the expected avalanche of installed renewable energy capacity, it was also analysed the evolution of the energy markets and their prospects, the taking of positions regarding the climate change of the large stakeholders worldwide and the corporate PPA as solutions for the industry and for the renewable energies.

The investment necessary to meet the objectives of the NECP

The objectives of the NECP in terms of installed renewable energy capacity are ambitious. From the more than 27 GW of wind energy and almost 12 GW of photovoltaic energy currently installed in Spain, the goal is to reach more than 50 GW of wind energy and close to 40 GW of photovoltaic energy in 2030. According to the economic impact study of the NECP prepared by the Government itself, in total, to develop all this new wind and photovoltaic energy capacity an investment of more than 41 billion Euros will be required. Looking at the data from Red Eléctrica (REE), to start up all the wind and photovoltaic energy capacity that currently has a granted access permit, around 130 GW, it would take almost 100 billion Euros.

But beyond the installed capacities, there are the shortly scheduled IPOs of renewable energy companies that will amount to more than 11 billion Euros. To which must be added the corporate operations for the sale of assets that, according to the Axpo experts, are valued at around 3 billion Euros.

All this together represents around between 50 and 110 billion Euros needed to finance this avalanche of renewable energy capacity that the objectives of the NECP will mean. They are numbers of a scale difficult to conceive and it is difficult to get an idea of how all that financing can be achieved.

In Spain, the main banks active in renewable energy projects financing are not too many and they cannot provide all that necessary capital. According to the Axpo experts, the rest of the necessary capital can come from the infrastructure funds and international banks. Some of these funds and banks, among the most important globally, saw the attractiveness that Spain has for investing in renewable energies and, in fact, they have already been involved in the investments in renewable energies in our country for some time. For the experts, the presence of these new players represents an opportunity to learn from these entities with experience in financing at a global level, due to their accumulated experience and because they provide a different vision when designing and structuring the financing of the new renewable energy projects.

Source: Axpo.

Source: Axpo.

The importance of the market forecasts for the development of the renewable energies

A step prior to obtaining the financing for a project to install electricity generation from renewable energies is to design a financial model that reliably and scientifically estimates the income that will be generated from the sale of the energy. For this, it is essential that the market prices forecasts used are reliable and scientific. The AleaSoft‘s forecasting methodology is completely science based and allows obtaining reliable market prices forecasts.

The long‑term forecasting reports include the hourly prices forecasts for the 30‑year horizon, as well as confidence bands that provide a quantitative measure of the probability of all possible future scenarios, a necessary input for the risk management models.

This important role of the market prices forecasts for the development of the renewable energies will be one of the topics that will be analysed in the next webinar that AleaSoft will organise on next May 13.