AleaSoft, September 17, 2020. In the third week of September, the European electricity markets prices increased in a generalised way, reaching in some cases daily values higher than €70/MWh and hourly values higher than €180/MWh. This rise is caused by various factors: increased demand, decreased solar and wind energy production in some markets, and increased gas and CO2 prices. The latter registered on September 14 the highest value of at least the last eight years, above €30/t.

Photovoltaic and solar thermal energy production and wind energy production

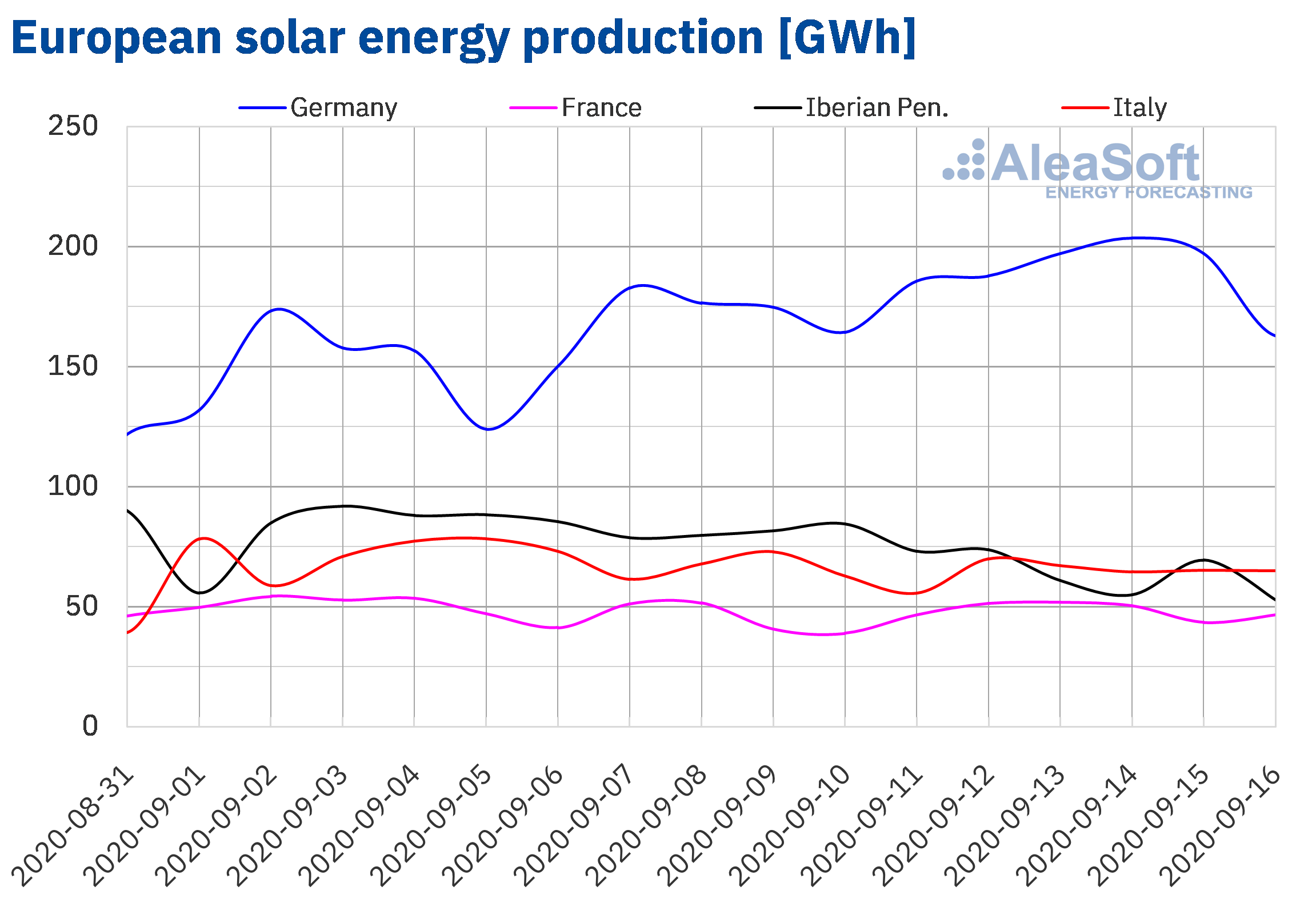

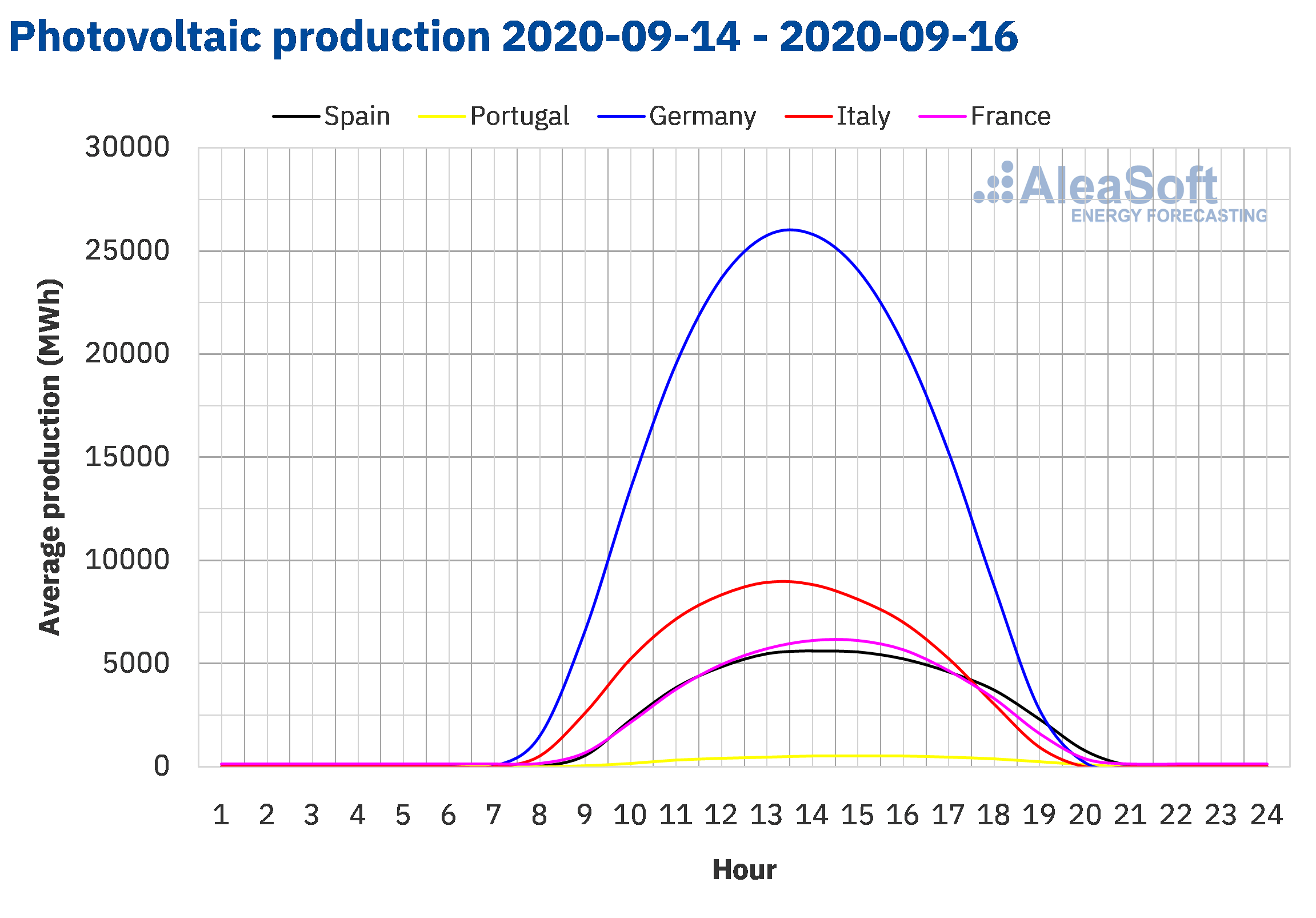

The average solar energy production between Monday, September 14, and Wednesday, September 16, decreased in all the markets analysed at AleaSoft, except in the German market, in which the production grew by 3.7% compared to the average of the previous week. In the Iberian Peninsula it decreased by 22%, while in the markets of France and Italy it fell between 1.3% and 0.8%.

The solar energy production during the first 16 days of September increased in all markets compared to the same period of 2019. The largest increase was registered in the Iberian Peninsula with a 63% higher production. In the rest of the analysed markets, the growth was between 22% and 11%.

For the week ending on Sunday, September 20, the analysis carried out at AleaSoft indicates that the solar energy production in the German market will be higher than that of the previous week, while little variation is expected in the Italian market.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

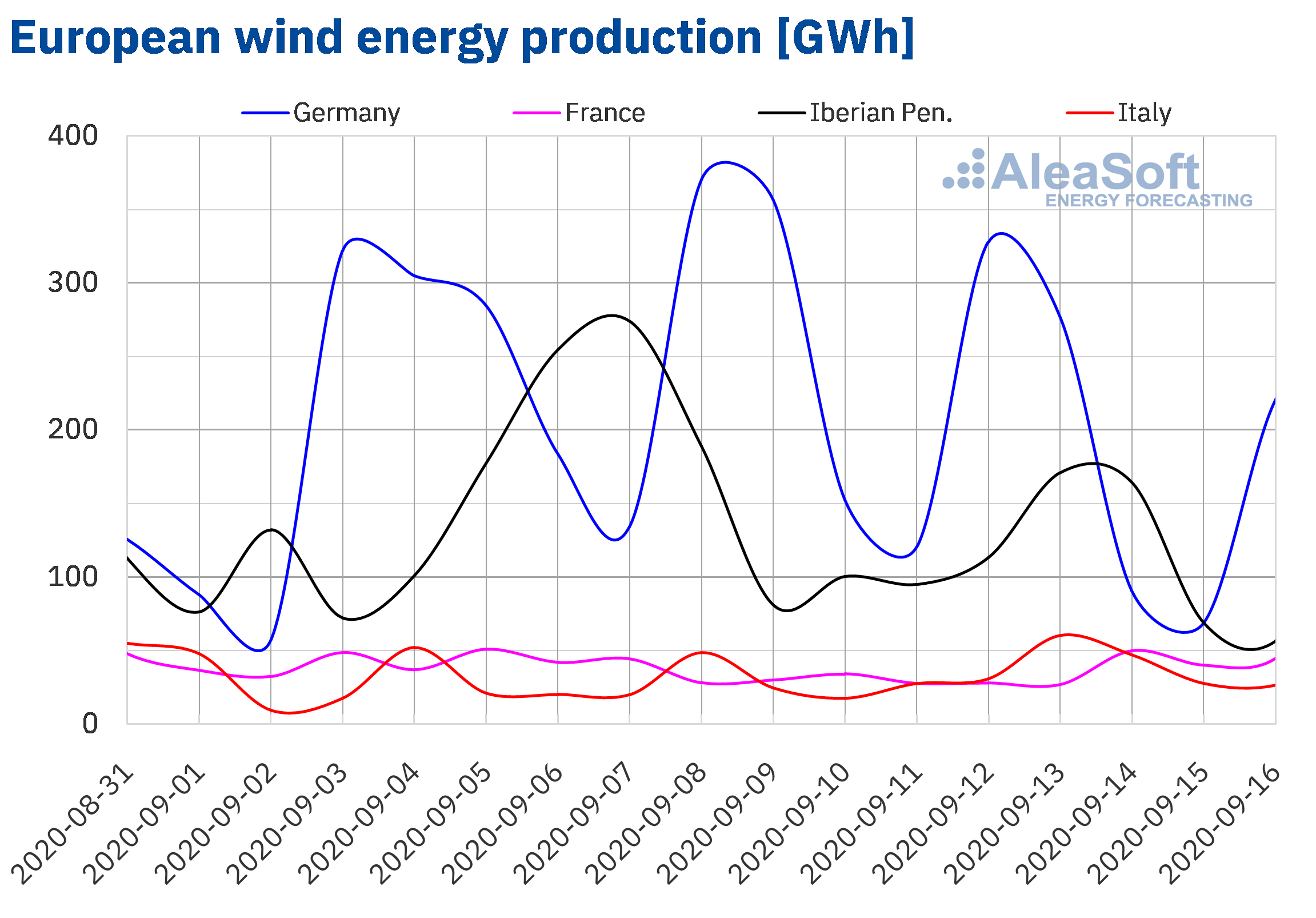

The wind energy production during the first three days of the third week of September increased by 43% in the French market and by 3.1% in the Italian market compared to the average of the week ending on Sunday, September 13. In the rest of the analysed markets, the production with this technology decreased between 32% and 49%.

In the year‑on‑year analysis, from September 1 to September 16, the wind energy production decreased in all the analysed European markets. The decreases were between 15% registered in the German market and 47% in the Portuguese market.

For the end of the third week of September, the AleaSoft’s analysis indicates that total wind energy production will be higher in France and Italy, while in the Iberian Peninsula and Germany it is expected to be lower than that registered during the second week of September.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

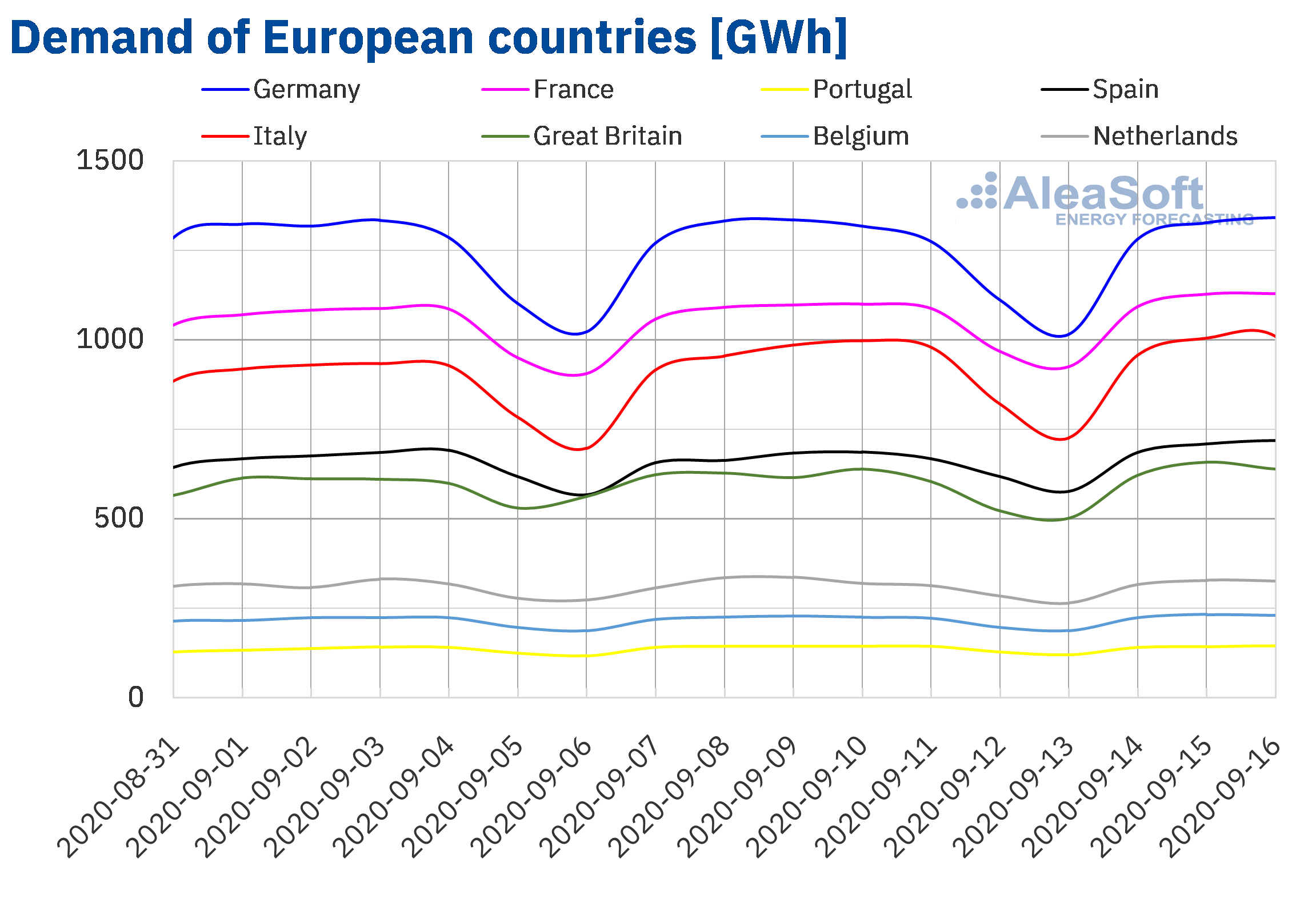

From Monday to Wednesday of the week of September 14, the average temperatures increased in most of Europe, favouring the increase in electricity demand in most electricity markets compared to the first three days the previous week. The largest increases in temperatures, of 5.1 °C in Belgium and 4.9 °C in France, influenced the increases in demand in these markets, of 2.1% and 3.2% respectively. The markets of Italy and Great Britain registered increases of 4.0% and 2.8% in that order. The level of the German market was very similar to that of the previous week, with an increase of only 0.3%. On the other hand, in the markets of the Netherlands and Portugal the demand decreased by 0.9% and 0.1% respectively.

At the AleaSoft’s demand observatories, a more detailed analysis of the evolution of the demand of Spain as well as of the stability in Germany in recent weeks can be carried out.

At AleaSoft it is expected that, at the end of the third week of September, the demand will be lower in the markets of Portugal and the Netherlands compared to that of the previous week, while in the rest of the European markets it will continue to be higher.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

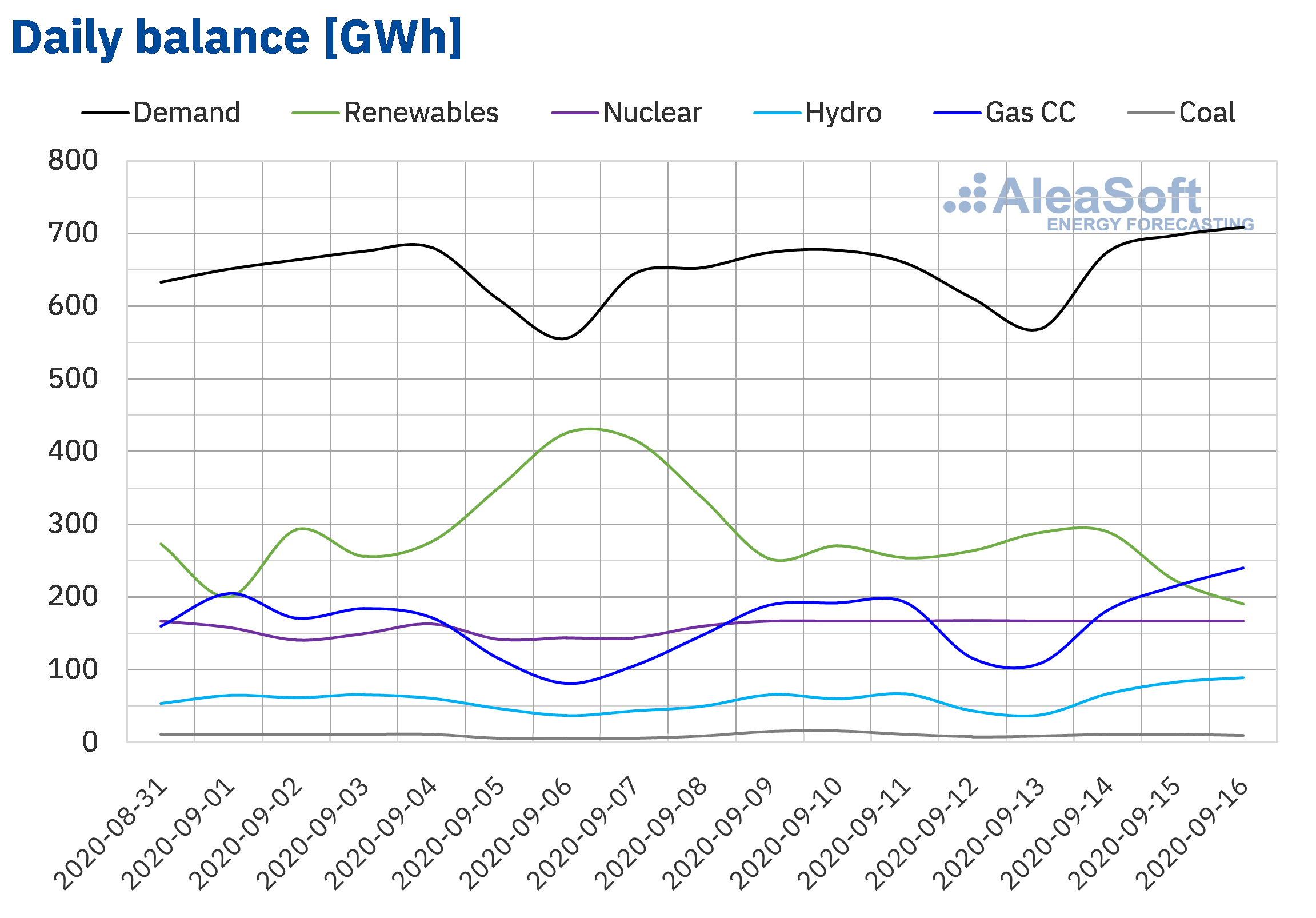

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

The electricity demand increased by 5.5% in Mainland Spain from September 14 to 16 compared to the first three days of the previous week. The average temperatures played a fundamental role in this rise, increasing by 2.5 °C. The AleaSoft’s demand forecasting indicates that this recovery will continue until the end of the week.

The average of the solar energy production in Mainland Spain, which includes the photovoltaic and solar thermal technologies, decreased by 24% between Monday, September 14, and Wednesday, September 16, compared to the average of the second week of September. During the first 16 days of September there was an increase in production with these technologies of 66% compared to the same days of 2019. For the third week of September the analysis carried out at AleaSoft indicates that the production will be lower than the total registered during the week of September 7.

The average level of the wind energy production in Mainland Spain of the first three days of the third week of September, decreased by 32% compared to the average of the previous week. In the year‑on‑year analysis, the production registered between September 1 and 16 was 29% lower than that of the first 16 days of September 2019. According to the analysis carried out at AleaSoft, for the week that began on September 14, it is expected that the production with this technology will be lower than that registered in the second week of September.

At the moment all nuclear power plants are in operation and the nuclear energy production maintains a level close to 167 GWh per day.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 10 964 GWh stored, according to data from the Hydrological Bulletin of the Ministry for Ecological Transition and Demographic Challenge number 37, which represents a decrease of 398 GWh compared to bulletin number 36.

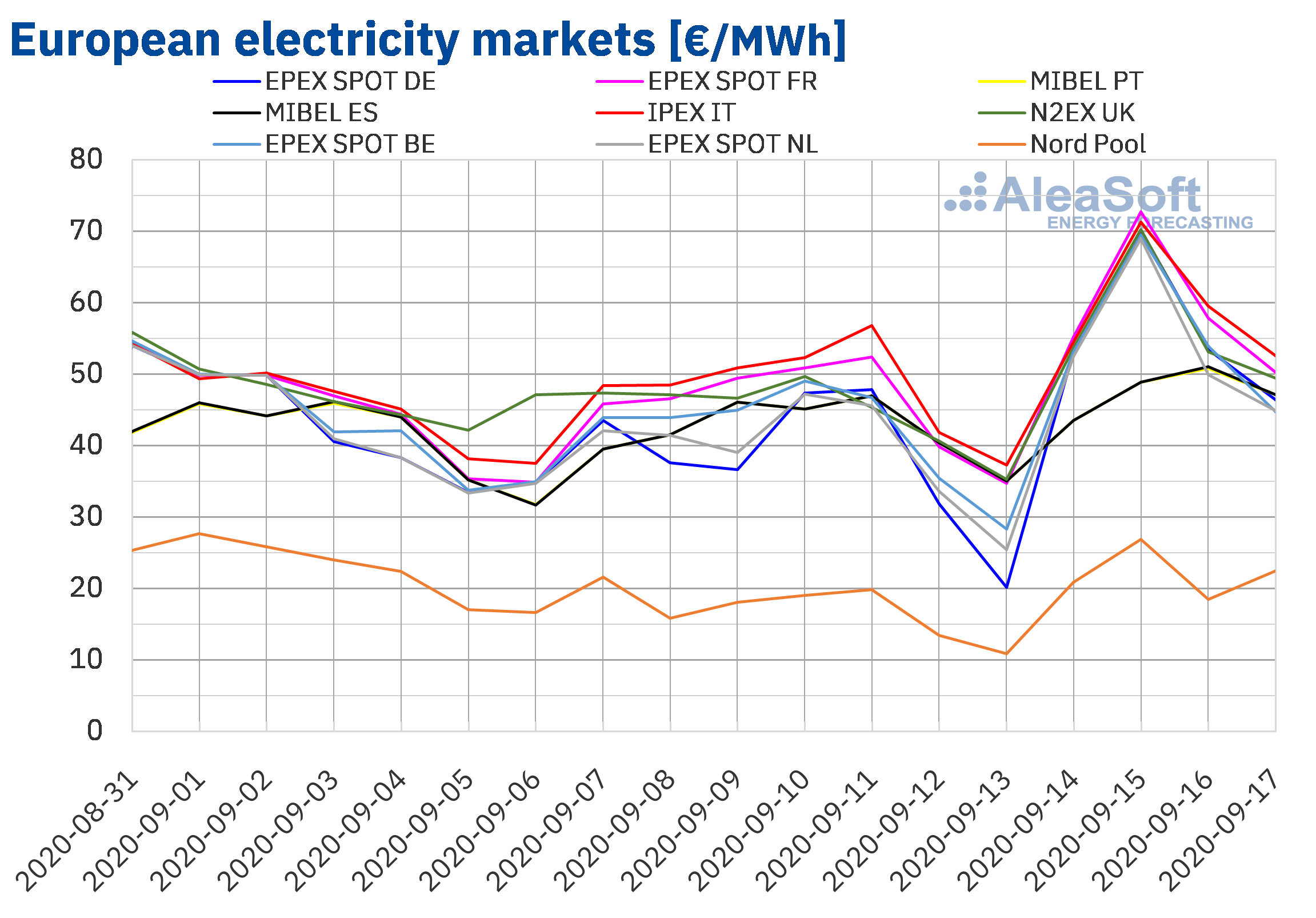

European electricity markets

The first four days of the week of September 14, the prices increased in all the European electricity markets analysed at AleaSoft compared to the same period of the previous week. The largest price increase, of 35%, was that of the EPEX SPOT market of Germany, followed by the 27% increase of the EPEX SPOT market of the Netherlands. In contrast, in the MIBEL market of Portugal and Spain, there were the lowest price increases, of 10% and 11% respectively. On the other hand, in the IPEX market of Italy, the N2EX market of Great Britain and the Nord Pool market of the Nordic countries, the price increase was 19%. While, in the French and Belgian markets, the increase was 22%.

As a consequence of these price increases, the average of the first four days of the third week of September exceeded €50/MWh in almost all the analysed European markets, except in the MIBEL and Nord Pool markets. In this last market, the lowest average price of this period, of €22.18/MWh, was reached. In contrast, the highest average, of €59.47/MWh, was that of the Italian market, followed by that of the French market, of €59.02/MWh.

On September 14 and 15, the European electricity markets were quite coupled. The exceptions were the MIBEL and Nord Pool markets, with prices lower than those of the rest of the markets. However, the prices of these two markets were also far apart, with those of the Nord Pool market being more than €20/MWh lower. On the other hand, on September 16 and 17, the coupling decreased, but the MIBEL market prices were closer to those of the rest of the markets.

From Monday, September 14, to Thursday, September 17, the daily prices remained above €40/MWh in almost all European electricity markets. The exception was the Nord Pool market. In this market, the daily prices were between €18.51/MWh of Wednesday, September 16, and €26.87/MWh of Tuesday, September 15.

In addition, on September 15, the daily prices exceeded €70/MWh in the markets of Germany, France, Great Britain and Italy. The highest daily price, of €72.76/MWh, was reached in the French market.

On the other hand, at the hour 20 of September 15, the hourly prices exceeded €180/MWh in the German, Belgian, British and French markets. The prices reached a value of €189.25/MWh in Germany, Belgium and France and of €184.87/MWh in Great Britain. In the case of the British market, the reached hourly price was the highest since June 2019. In Belgium and France, it was the highest since November 2018. While, in the case of Germany, it was the highest hourly price since February 2012.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The price increases of the first days of the week of September 14 were favoured by higher demand in most of the markets and by a significant reduction in wind energy production in countries such as Germany, Spain and Portugal. The decline in solar energy production in the Iberian Peninsula, Italy and France, as well as the recovery in gas prices and the high CO2 prices also contributed to these increases.

The AleaSoft’s price forecasting indicates that at the end of the third week of September the weekly average prices will be higher than those of the previous week in the European electricity markets. But, for the fourth week of September, the prices are expected to fall in a generalised way, favoured by the recovery of the wind energy production in some countries.

Iberian market

In the MIBEL market of Spain and Portugal, the average price of the first four days of the week of September 14 increased compared to the same period of the previous week. The rise was 10% in Portugal and 11% in Spain. These price variations were the lowest compared to those of the rest of the European markets, which were mostly around 20%.

Due to these price increases, the average price from September 14 to 17 was €47.58/MWh in the Portuguese market and €47.64/MWh in the Spanish market. These were the second and third lowest prices in the European markets after the Nord Pool market average.

On the other hand, the first four days of the third week of September, the daily prices of Spain and Portugal were above €40/MWh. Furthermore, on Wednesday, September 16, the prices exceeded €50/MWh in both markets. The highest daily price, of €51.05/MWh, was reached in the Spanish market.

During the first days of the week of September 14, the decrease in wind and solar renewable energy production in the Iberian Peninsula favoured the increase in prices in the MIBEL market. These factors were added to the increase in electricity demand, in gas and CO2 prices.

However, the AleaSoft’s price forecasting indicates that prices will fall next week of September 21, favoured by a decrease in demand and the recovery of the wind energy production in the Iberian Peninsula.

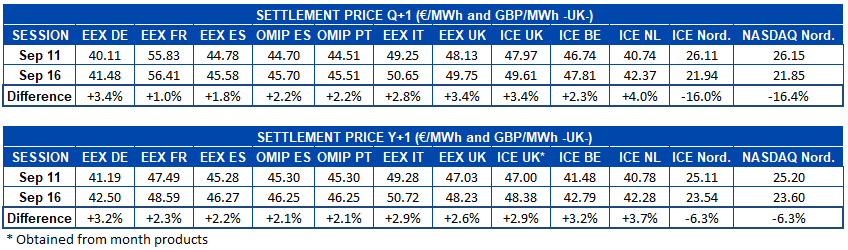

Electricity futures

In the elapsed days of the week of September 14, most of the European electricity futures markets analysed at AleaSoft registered increases in prices of the product for the next quarter when comparing the values of the last session of the previous week, on September 11, with those of the session of September 16. Only the prices of the Nordic countries region decreased, both in the ICE market and in the NASDAQ market, where the drops were 16%, a value that, as was already analysed on other occasions, is due more to the low prices of this region, than to great variations. In the rest of the markets, the increases ranged from 1.0% of the EEX market of France to 4.0% of the ICE market of the Netherlands.

As for the electricity futures for the calendar year 2021, exactly the same happened, the Nordic markets fell by 6.3% in both cases, while the prices increased in the rest of the markets. The market with the greatest increase, of 3.7%, was again the Netherlander ICE. However, in this case the OMIP market of Spain and Portugal was the one with the lowest increase, with a variation of 2.1% for both countries.

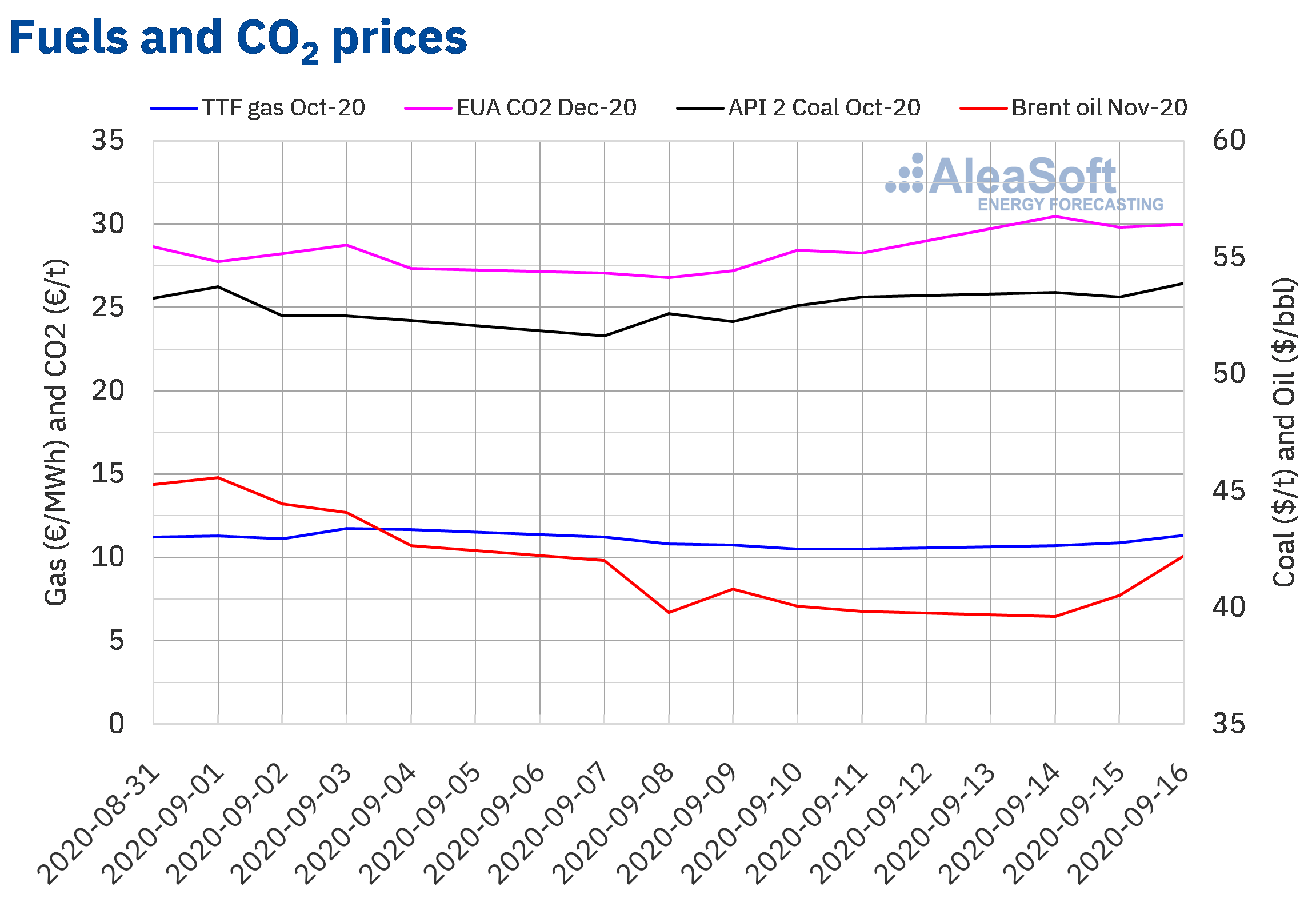

Brent, fuels and CO2

The Brent oil futures for the month of November 2020 in the ICE market began the third week of September with price increases. As a result, on Wednesday, September 16, the settlement price was $42.22/bbl, 3.5% higher than that of the previous Wednesday, but still 5.0% lower than that of the first Wednesday of September.

The price increases in the first days of the third week of September are related to the interruptions in production in America due to the Hurricane Sally and to the decrease in crude reserves in the United States.

However, on Tuesday the International Energy Agency revised down its demand forecasting for 2020. Furthermore, the outcome of the OPEC+ meeting of Thursday, 17 September, about its production cuts may have an influence on prices in the coming days.

On the other hand, the TTF gas futures prices in the ICE market for the month of October 2020, the first three days of the third week of September, recovered their upward trend. This allowed the prices to once again exceed €11/MWh on Wednesday, September 16. That day, the settlement price was €11.32/MWh, 5.4% higher than that of the previous Wednesday.

Regarding the TTF gas prices in the spot market, they also started the third week of September with increases. However, the first three days of the week of September 14, the index prices were still below €11/MWh. In contrast, on Thursday, September 17, the index price was €11.15/MWh.

As for the API 2 coal futures prices in the ICE market for the month of October 2020, the first three days of the third week of September, they remained above $53/t. The maximum settlement price for this period, of $53.90/t, was reached on Wednesday, September 16. This price was 3.2% higher than that of the same day of the previous week and the highest since the beginning of August.

Regarding the CO2 emission rights futures in the EEX market for the reference contract of December 2020, the first three days of the third week of September, they had settlement prices at least 10% higher than those of the same days of the previous week. On Monday, September 14, a settlement price of €30.47/t was reached. This price was 13% higher than that of the previous Monday and the highest since at least the end of March 2012. On the other hand, on Tuesday there was a small decline to settle at €29.80/t. But, on Wednesday, September 16, the settlement price rose to €29.99/t. This week’s high prices are related to the European Commission’s proposal to increase the emission cut targets for 2030 known on Monday, September 14.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis of the recovery of the energy markets at the end of the economic crisis

On September 17, the first part of the webinar “Energy markets in the recovery from the economic crisis” organised by AleaSoft was held with great success of participation. In the webinar and the subsequent analysis table, it was commented that the prices of the main European electricity markets recovered relatively quickly after the most critical part of the health crisis caused by the coronavirus, although there is still uncertainty in the medium term considering that the pandemic is still present and that we must wait to see how the economy evolves. In the long term, the AleaSoft’s models indicate that the market balance that was anticipated before the coronacrisis will recover. Other topics discussed were the financing of the renewable energy projects and the importance of the forecasting in the audits and in the portfolio valuation. The speakers were Oriol Saltó, Manager of Data Analysis and Modelling at AleaSoft, Daniel Fernández Alonso, Head of Energy Management at ENGIE Spain and Roger Font, Projects, Assets and Specialised Businesses Global Manager at Banco Sabadell. On October 29, the second part of the webinar will be held, in which there will be the presence of two invited speakers from the consulting firm Deloitte: Pablo Castillo Lekuona, Senior Manager of Global IFRS & Offerings Services, and Carlos Milans del Bosch, Partner of Financial Advisory.

The price curves of the main European electricity markets in the medium and long term are periodically updated at AleaSoft, taking into account the latest published economic data, as well as the exit scenarios from the economic crisis.

At the AleaSoft’s observatories, the main European electricity, fuels and CO2 markets can be monitored. This tool includes graphs of the fundamental variables of the markets with the data of the last weeks, which are updated daily.

Source: AleaSoft Energy Forecasting.