AleaSoft Energy Forecasting, May 22, 2023. In the third week of May, negative or zero hourly prices were registered in most of the European electricity markets, especially during the weekend. In the Nord Pool market, the value of -€5.67/MWh registered in an hour of Sunday 21 is the lowest one in history. For the week as a whole, prices decreased in every market, due to the decrease in demand and gas prices, and also to a higher solar and wind energy production than that of the previous week in several markets.

Solar photovoltaic and thermoelectric energy production and wind energy production

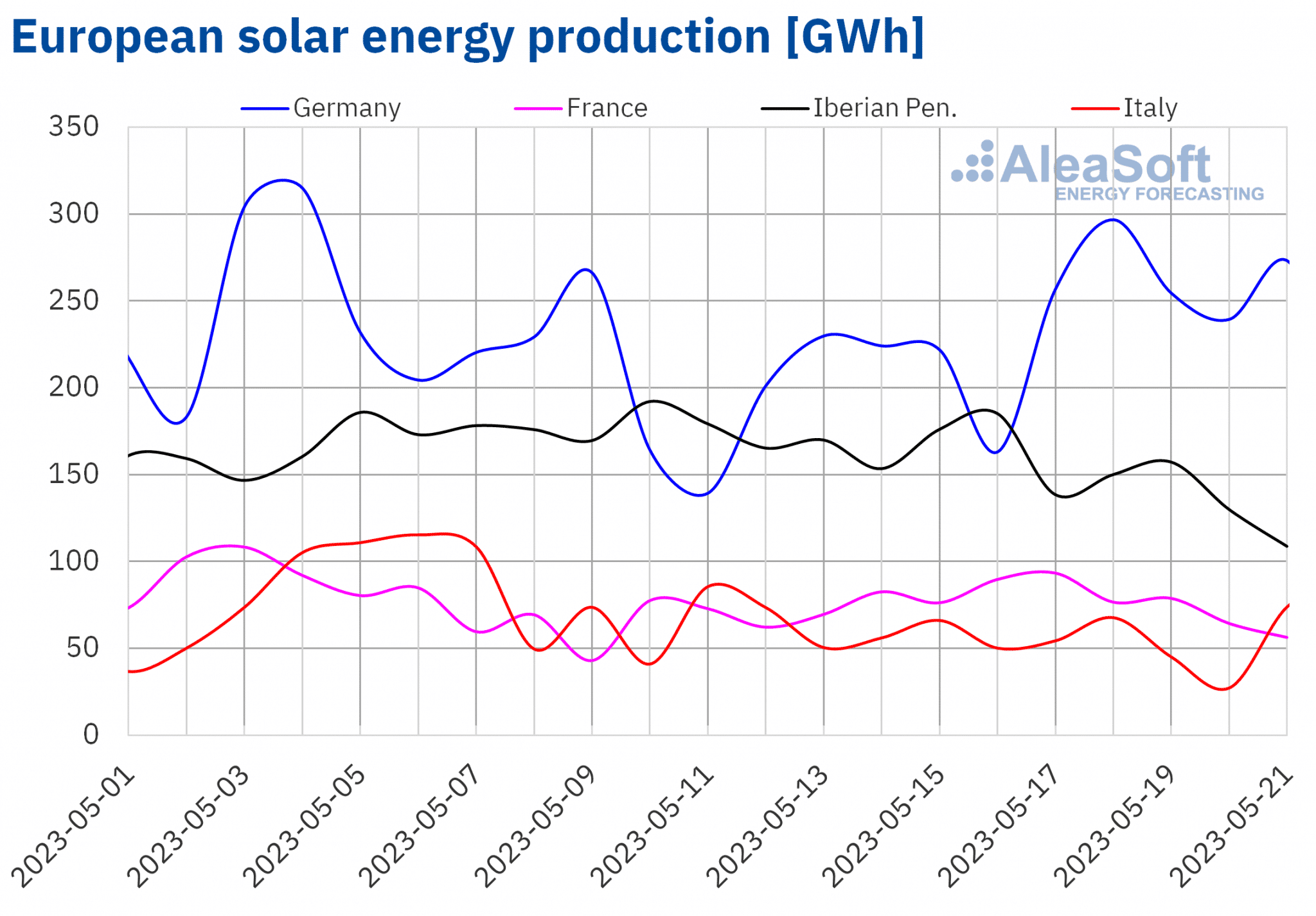

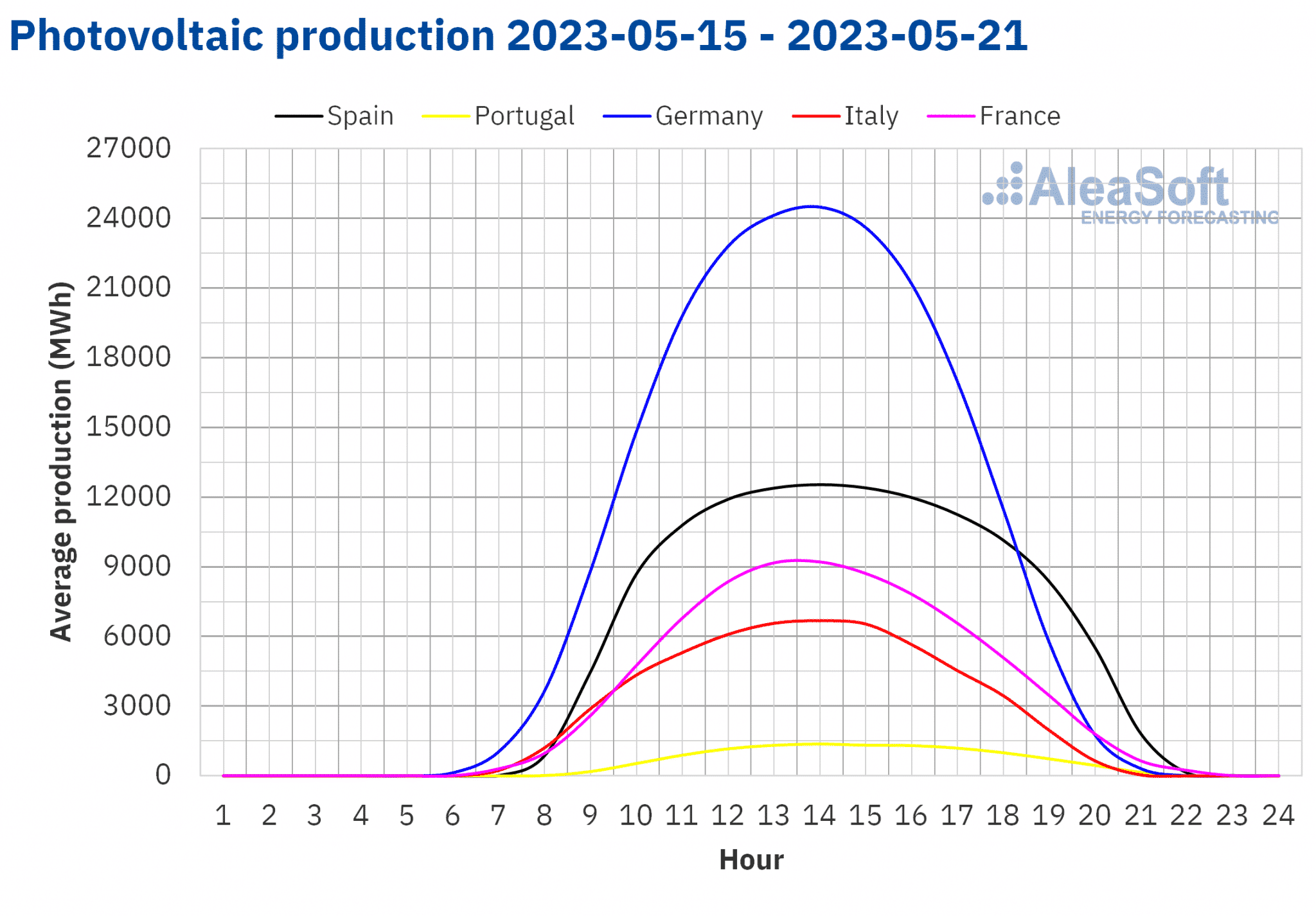

In the week of May 15, the twentieth week of the year, the solar photovoltaic energy production reached a record value in the Iberian Peninsula, with a total production of 862 GWh in Spain and 81 GWh in Portugal, if it is compared to the twentieth week of the past five years. However, compared to the previous week, when historical records were registered in these two markets, the solar energy production, including solar thermoelectric energy production in the case of Spain, fell by 13% and 16% respectively. The same trend was observed in Italy, with a decrease of 11% respect to the week of May 8. In the rest of the markets analysed at AleaSoft Energy Forecasting, increases in the solar energy production of 12% and 17% were registered in France and Germany, respectively.

For the week of May 22, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that production will increase in Germany and Italy, but that it may drop in Spain

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

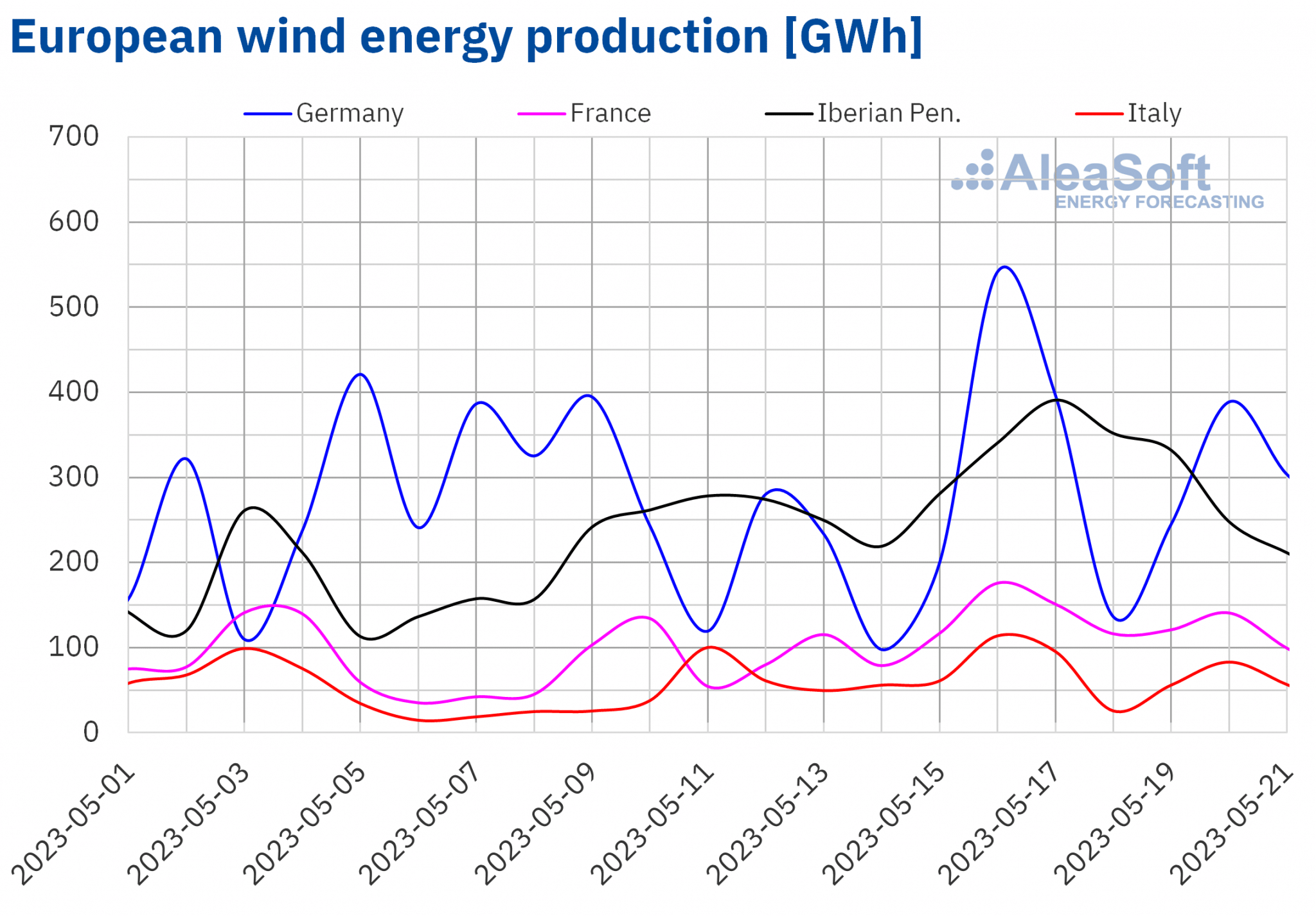

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

In the third week of may, similarly to the solar photovoltaic energy production, the wind energy production set a record in the Iberian Peninsula, with a total value of 1830 GWh in Spain and 326 GWh in Portugal, if it is compared to the twentieth week of the past five years. Compared to the previous week, an increase in almost all analysed markets was registered, between a 31% in Germany and a 51% in France. In the Spanish and Italian markets, the production with this technology also increased, 37% in Spain and 39% in Italy. However, in Portugal a drop of 6.9% was registered.

For the current week, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that the production may fall in all analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

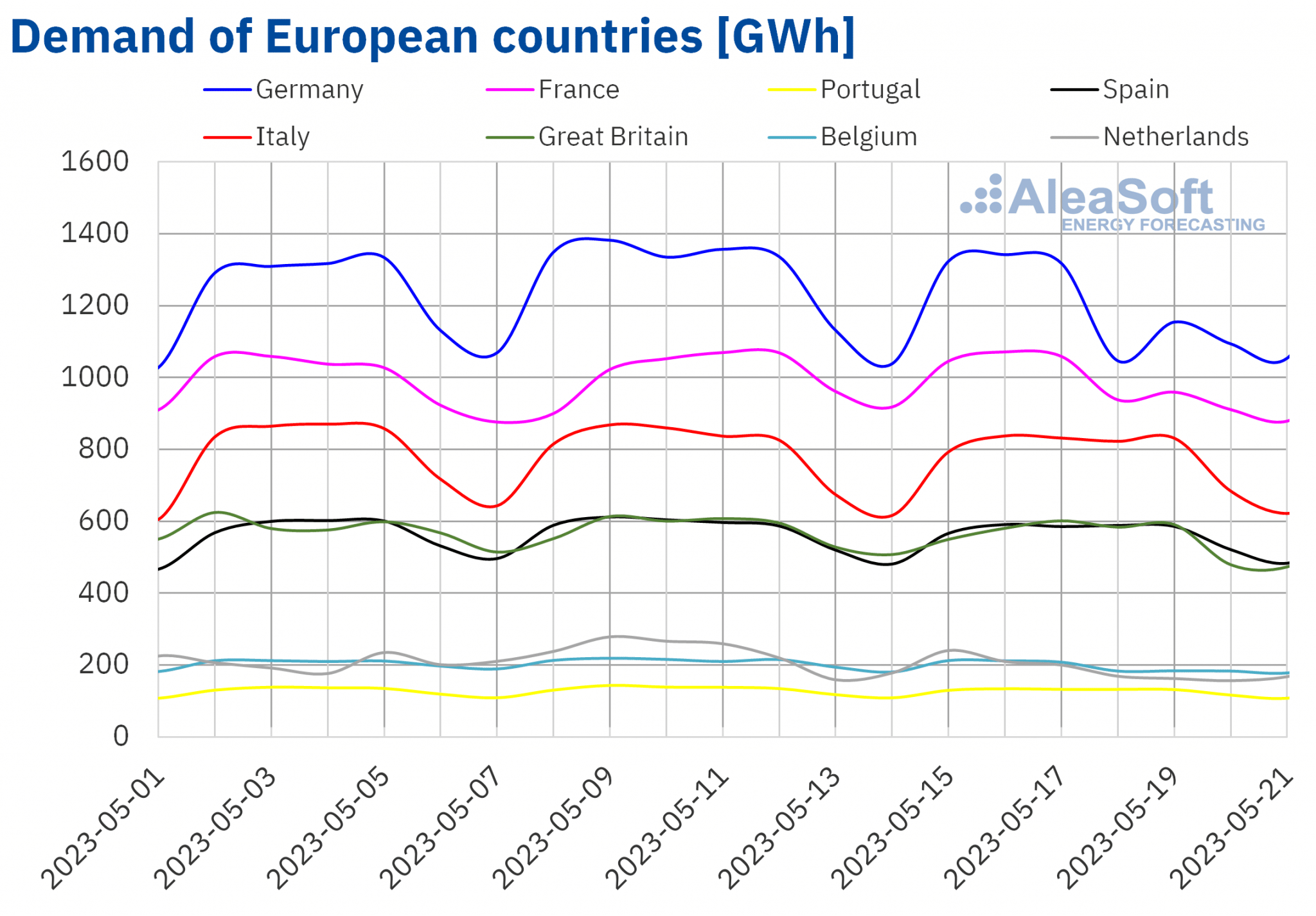

The third week of May finished with a drop in the electricity demand in all European markets analysed respect to the previous week. This behaviour is related to the celebration of the Day of Ascension on May 18 in several of the main European markets. The largest fall, of 18%, was observed in the Netherlands. On the other hand, the smallest decreases were registered in Italy, of 1.4% and in Spain, with a drop of 1.7%. In these two markets, the day May 18 was not a holiday.

Regarding average temperatures, decreases were registered compared to the previous week in almost all analysed markets except in Great Britain and Italy, where they remained quite similar to the previous week.

For the week of May 22, according to the demand forecasting made by AleaSoft Energy Forecasting, the demand is expected to increase in all the main European markets except in Spain and Great Britain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

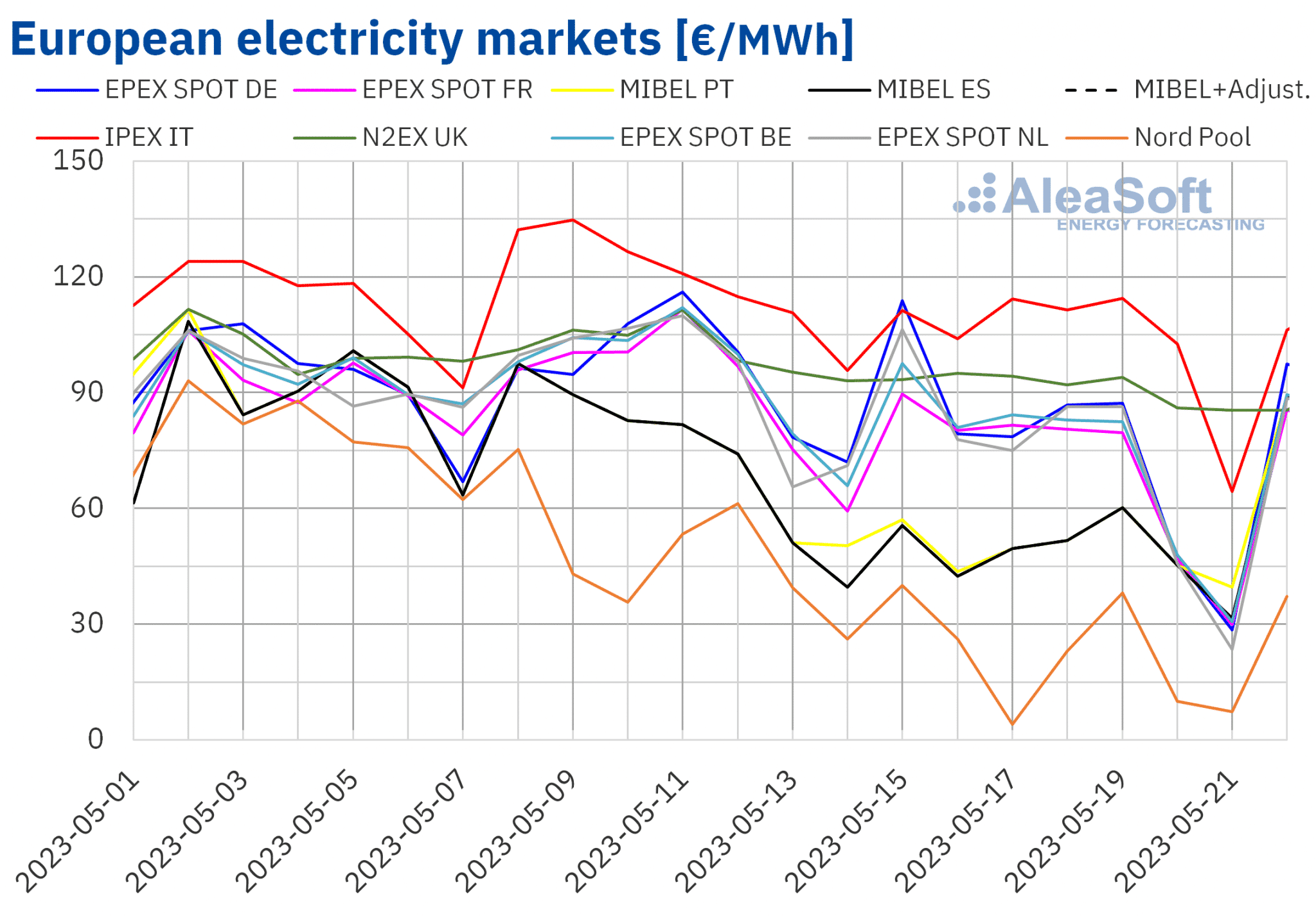

European electricity markets

In the week of May 15, prices in all European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The largest fall, of 56%, was registered in the Nord Pool market of the Nordic countries. On the other hand, the smallest price decrease, of 9.9%, was that of the N2EX market of United Kingdom. In the rest of the markets, the decreases were between 14% of the IPEX market of Italy and 35% of the MIBEL market of Spain.

In the second week of May, the highest average price, of €103.21/MWh, was that of the Italian market, followed by the average of the N2EX market of United Kingdom, of €91.46/MWh. On the other hand, the lowest weekly average price was that of the Nordic market, of €21.23/MWh. In the rest of the analysed markets, prices set between the €48.07/MWh of the Spanish market and the €74.43/MWh of the EPEX SPOT market of Germany.

Regarding hourly prices, in the Spanish market, on Sunday, May 21, a zero-price value was registered between 10:00 and 11:00. In the German, Belgian, French and Dutch markets, besides zero-price hours, negative prices were registered during the weekend of May 20 and 21. This also happened on Wednesday, May 17, in Netherlands. In the case of the Nordic market, negative prices were registered the days May 20 and 21. In this market, a historical minimum was reached, at least since 2011, of –€5.67/MWh on Sunday, May 21, between 13:00 and 14:00. On the other hand, the lowest hourly price of the third week of May, of ‑€76.00/MWh, was registered on that same day, from 12:00 to 13:00, in the Dutch market.

During the week of May 15, the decrease in the average gas price and the generalised drop in demand led to price decreases in European electricity markets. These drops were also affected by the increase in the wind energy production in most of the markets and the increase of the solar energy production in France and Germany.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the fourth week of May prices may increase in most of the European electricity markets, influenced by the recovery in demand and the decrease in wind energy production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

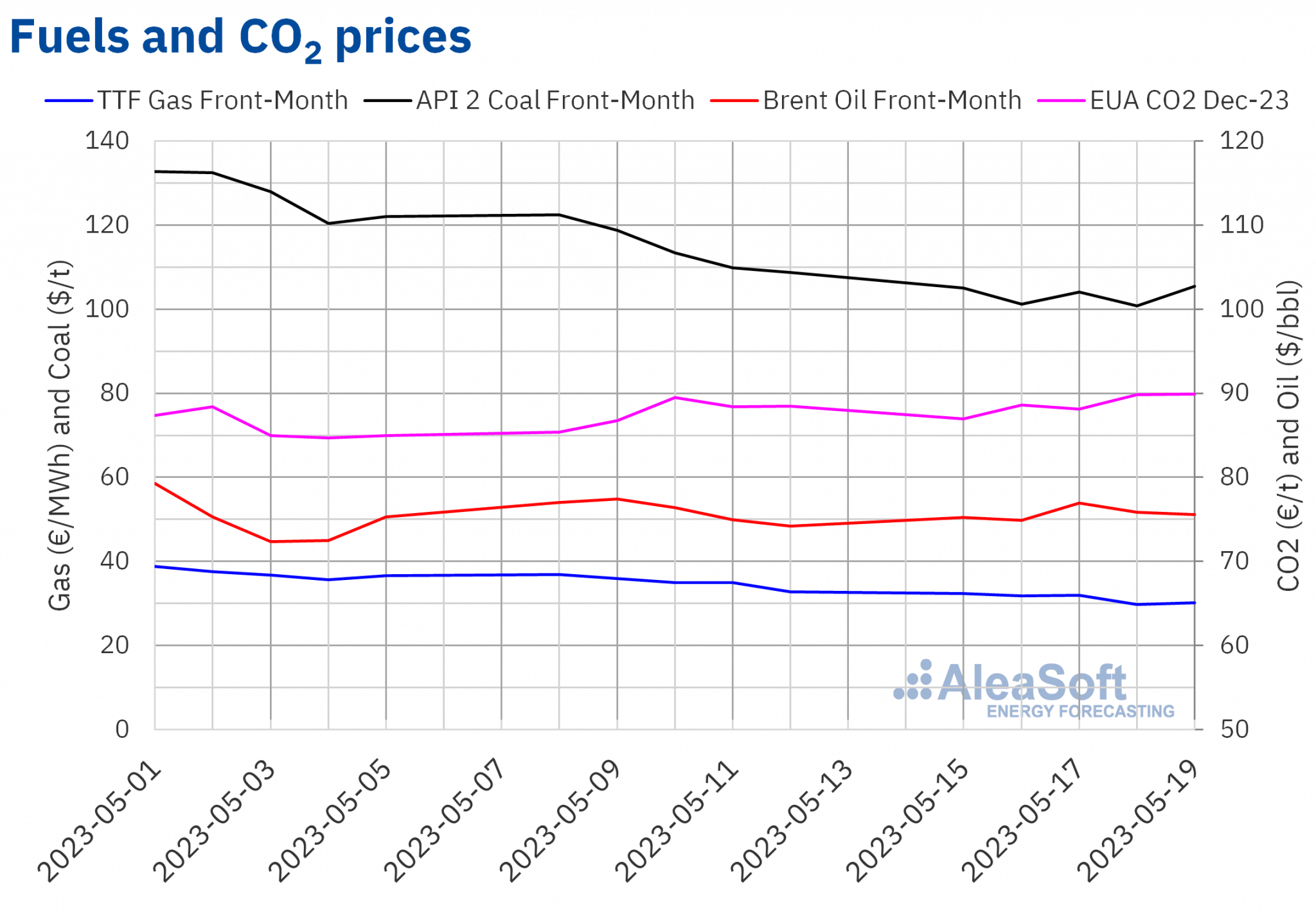

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered their weekly minimum settlement price, of $74.91/bbl, on Tuesday, May 16. This price was a 3.3% lower than that of the previous Tuesday. However, on Wednesday, May 17, prices increased and the weekly maximum settlement price, of $76.96/bbl was reached, which was a 0.7% higher than that of the previous Wednesday. Subsequently, prices decreased till a settlement price of $75.58/bbl was registered on Friday, May 19. This price still was 1.9% higher than that of the previous Friday.

Negotiations on the US debt ceiling influenced Brent oil futures prices in the third week of May. On the other hand, fears of further interest rate hikes due to US inflation levels and their effect on demand exerted a downward influence on prices. The release of data on rising oil stocks in the United States also contributed to this effect.

As for TTF gas futures in the ICE market for the Front‑Month, on Monday, May 15, they reached the weekly maximum settlement price, of €32.31/MWh, although this price was 12% lower than that of the previous Monday. During all the third week of May, settlement prices were lower than that of the same days in the previous week. On Thursday, May 18, the weekly minimum settlement price, of €29.78/MWh, was reached. This price was 15% lower than that of the previous Thursday and the lowest since June 2021.

In the third week of May, the abundance of liquefied natural gas supplies in a scenario where demand has decreased, continued to drive prices down.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, on Monday, May 15, they decreased 1.7% compared to the last session of the previous week. That day, the weekly minimum settlement price, of €86.97/t, was reached. But, later, prices increased and they kept above €88/t the rest of the third week of May. On Friday, May 19, the weekly maximum settlement price, of €89.88/t, was reached, which was 1.6% higher than that of the previous Friday and the highest since April 20.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

On June 8 will take place the edition number 34 of the monthly webinars of AleaSoft Energy Forecasting and AleaGreen. This edition will have the participation of speakers from Engie Spain again, who will analyse the fundaments of the financing of renewable energy projects and PPA as well as the main regulatory issues of the Spanish electricity sector, based on their experience in these areas. In addition, the usual analysis of the evolution and prospects of the European energy markets will be carried out, with a view to the second half of 2023 and the coming winter.

To obtain coherent, quality long-term energy market price forecasts, it is necessary to use a scientific methodology as well as experience in the sector and in each country’s markets. A poor long-term forecast can come at a high cost to those selling or buying renewable assets. AleaSoft Energy Forecasting, with 24 years of experience, is trusted by its clients as a provider of forecasts for the energy sector. A promotion of long-term price curves is available in May. The curves are based on a scientific method and are characterised by robustness and consistency, with no major variations in each quarterly update.

Source: AleaSoft Energy Forecasting.