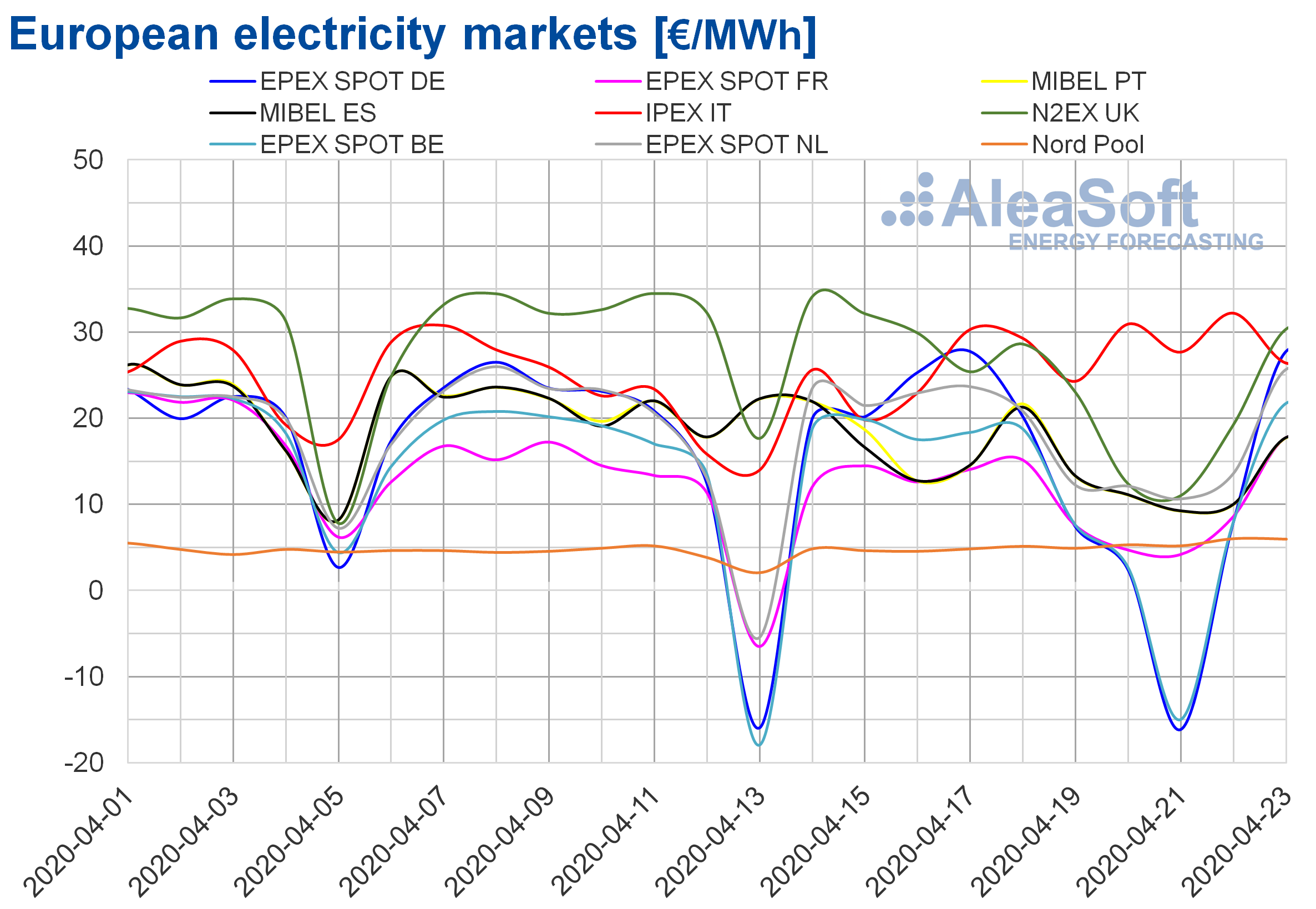

AleaSoft, April 23, 2020. This week the prices in most European electricity markets registered prices below €20/MWh. In some cases this was happening since the beginning of April. The exception was the IPEX market of Italy, which was around €30/MWh. The causes of these prices are the high renewable energy production in a context of lower demand and low gas prices. The Brent oil prices are at a minimum due to the fall in consumption, the still high production and the storage at the limit.

Photovoltaic and solar thermal energy production and wind energy production

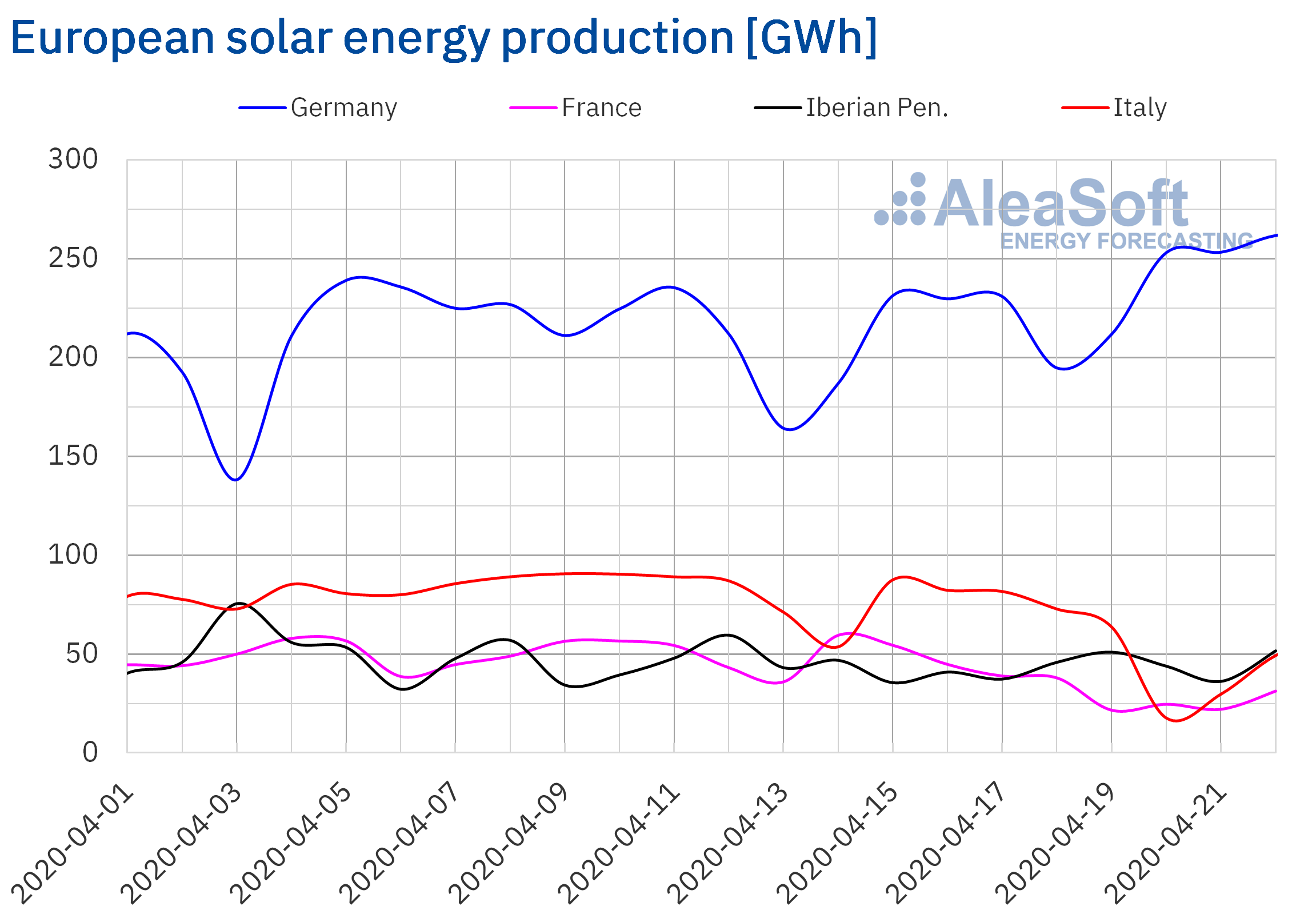

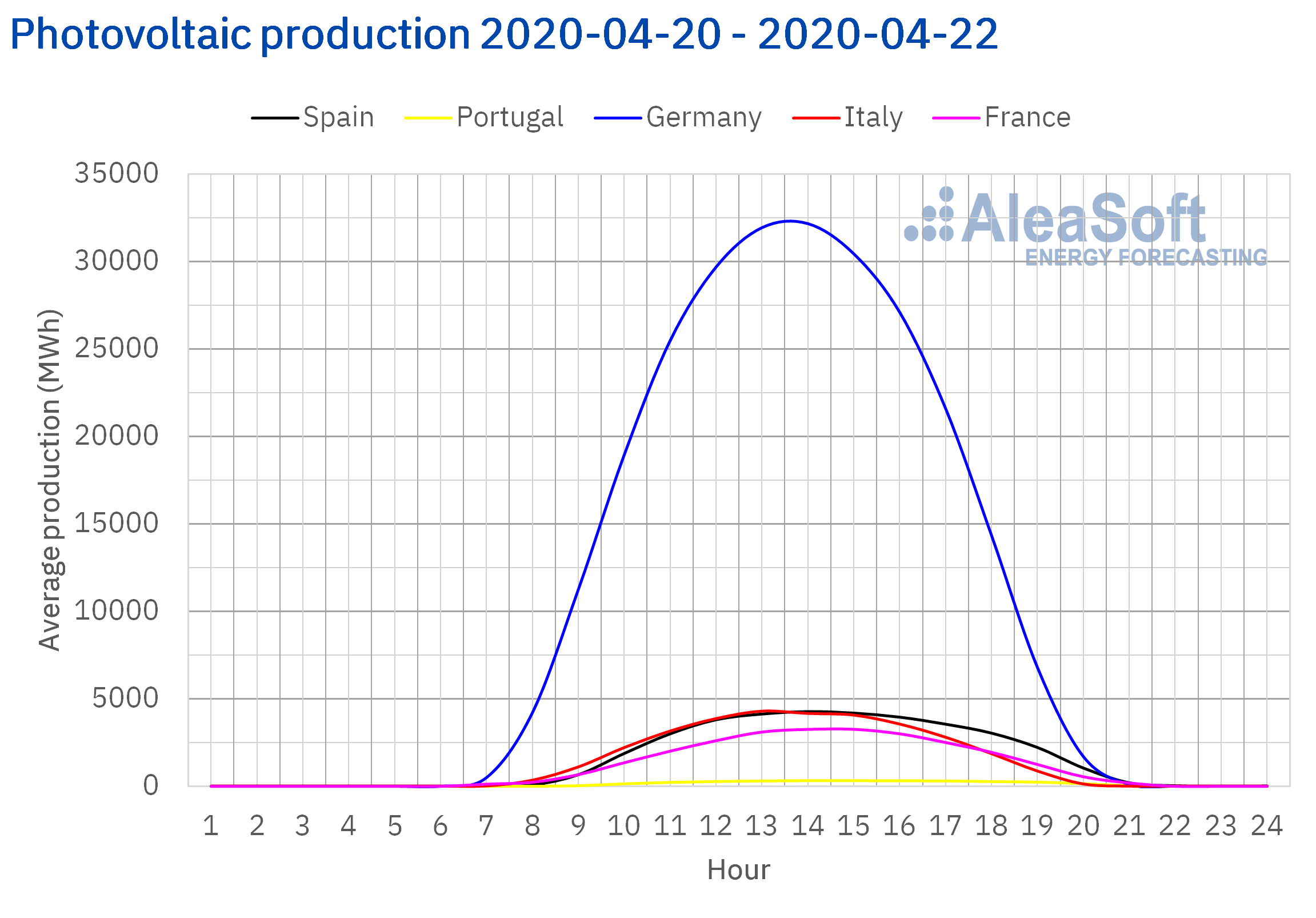

The solar energy production in Germany increased by 24% during the first three days of this week compared to the average of last week that ended last Sunday, April 19. In fact, the total production of yesterday, April 22, of 262 GWh, was the highest so far this year. In the Iberian Peninsula, the average for the first three days of this week was also higher than last week’s average, in this case 2.3%, despite the 14% decrease in the Portuguese market. In the Italian and French markets, the productions were 56% and 38%, respectively, lower than last week’s average.

Comparing the past 22 days of April with the same period of 2019, the generation from this renewable source was higher in all the markets analysed at AleaSoft. The largest increase was in the Italian market, with a 45% higher production. In the rest of the markets, the production increased between 24% of the German market and 37% in the Iberian Peninsula.

For the end of the current week, the AleaSoft‘s forecasting indicates that the solar energy production in Germany will rise compared to the last week’s total. On the contrary, it is expected that the solar energy production in the Italian market will end up being lower than that registered last week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

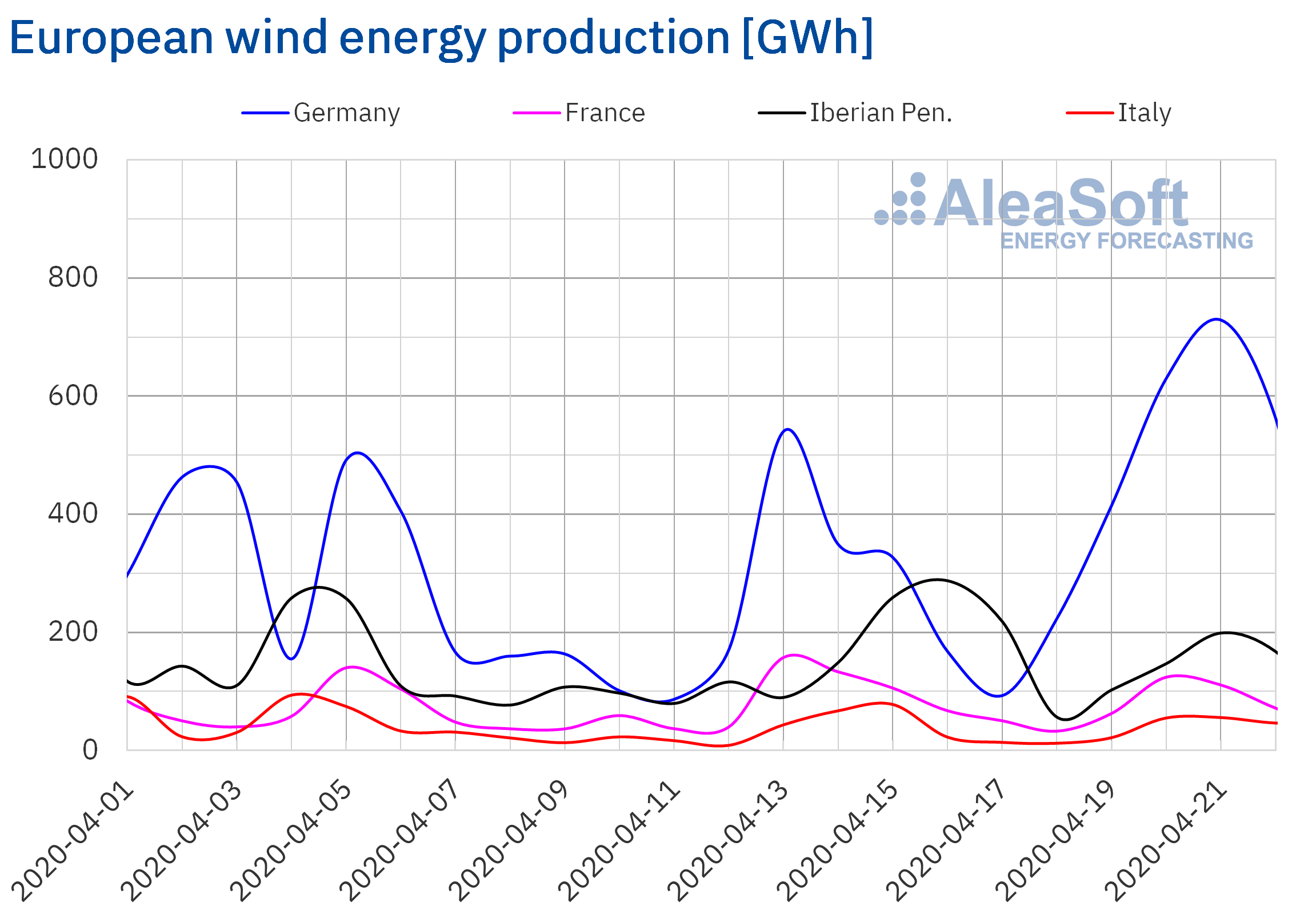

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

The wind energy production of the first three days of this week in the German market was 112% higher than last week’s average. In the rest of the markets analysed at AleaSoft it also increased between 3.0% of the Iberian Peninsula and 42% of the Italian market. It should be noted that despite the increase in the Iberian peninsula, in the Portuguese market the average wind energy production of these first three days decreased by 45%.

The production with this technology during the current month until April 22, compared to the same period of 2019, fell 24% in the Iberian Peninsula and 17% in the Italian market. On the contrary, in the German market and in the French market the productions increased by 14% and 13% respectively.

The AleaSoft‘s forecasting indicates that the total wind energy production of the week in Germany and Italy will increase compared to last week’s total. On the contrary, it is expected that in the Iberian Peninsula and France it will be lower.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

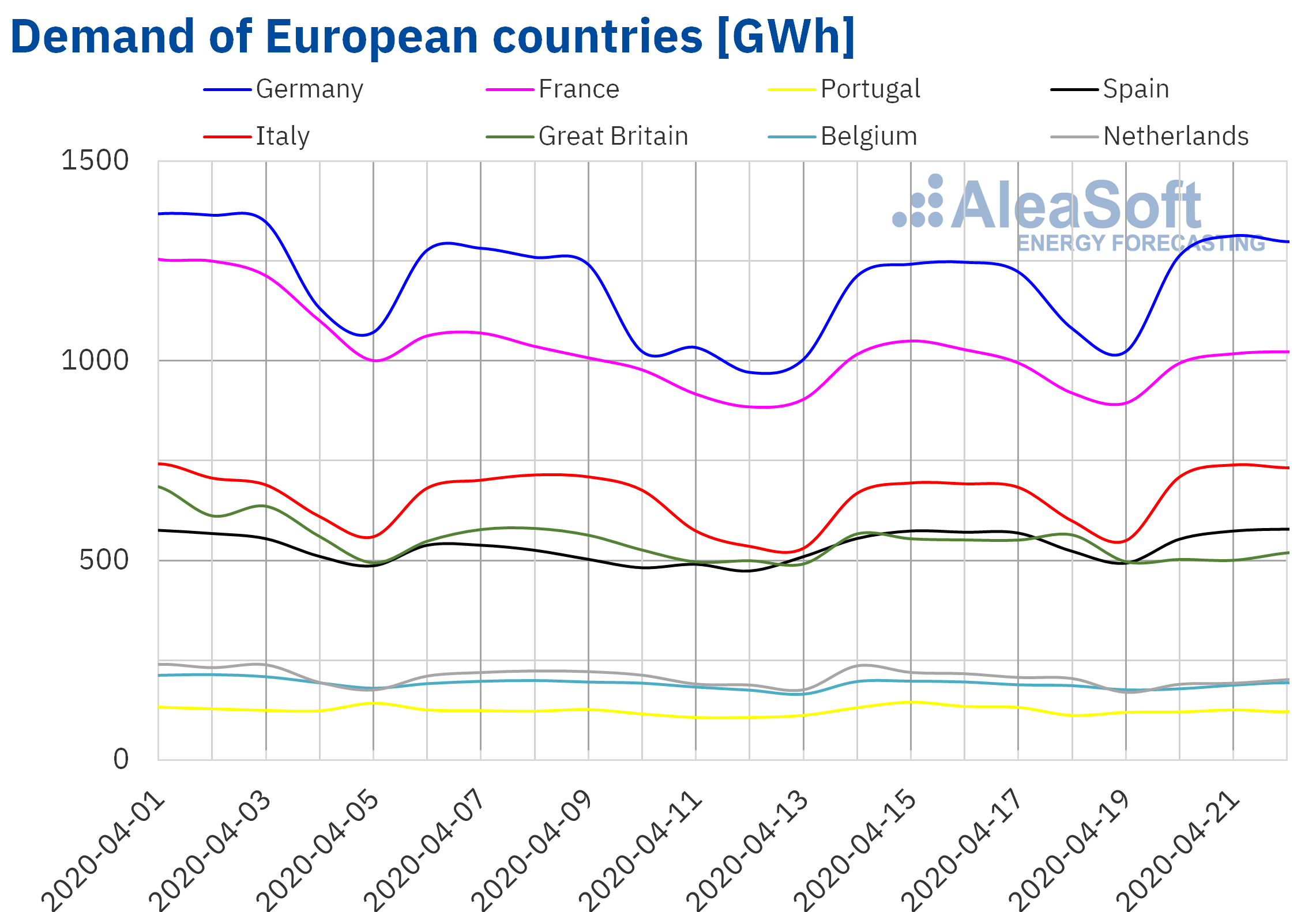

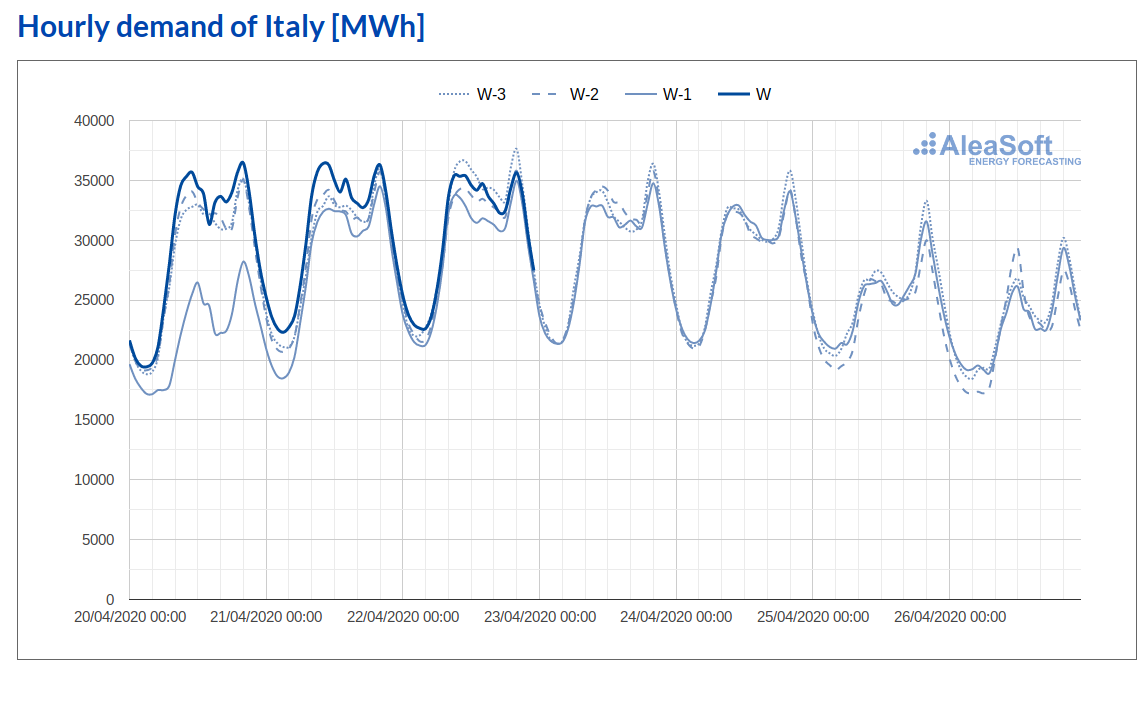

Electricity demand

This week the electricity demand increased from Monday to Wednesday in most of the analysed European markets, compared to the same period the previous week. At AleaSoft last week the increase in demand for this week of April 20 was forecasted, the main causes of this increase being the effect of the holiday of Easter Monday on April 13 and, in some cases, the decrease in restrictions to combat the spread of COVID‑19.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

The variation of greater magnitude was the 15% increase in Italy, maintaining until yesterday, Wednesday, a level above that of the last three weeks. In Germany there was a considerable increase of 12%, another of the influential factors being the fact that part of the commercial and industrial sectors resumed their activities on Monday, April 20. The recovery in demand in the French market was 2.2%, although it maintained a similar level to that of last week so far this week. In the case of Great Britain, the level was 5.6% lower. In Portugal and Spain the differences were ‑5.0% and 4.1% respectively. The behaviour of demand in Belgium was practically unchanged, with an increase of only 0.1%.

Source: Prepared by AleaSoft using data from TERNA.

Source: Prepared by AleaSoft using data from TERNA.

At the AleaSoft’s electricity demand observatories all the changes occurred in recent weeks can be observed, with values that are updated daily.

At the end of this week, the demand is expected to remain higher than that of last week, according to the AleaSoft’s electricity demand forecasting.

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

In Mainland Spain, the electricity demand rose 4.1% during the first three days of this week compared to the same period of the previous week, due to the effect of the Easter Monday holiday, celebrated on April 13 of last week. According to AleaSoft calculations, when correcting this effect, the increase was 0.4%. At the end of this week, the Spain’s electricity demand is expected to be higher than that of last week.

The solar energy production in Mainland Spain, which includes the photovoltaic and solar thermal energy, increased by 3.6% so far this week compared to the average values of the previous week. Comparing the past 22 days of April with the same period of 2019, the solar energy production increased by 37%. The analysis carried out at AleaSoft indicates that this week the solar energy production will be higher than the last week’s total.

On the other hand, the wind energy production of the first three days of this week increased by 20% compared to the last week’s average. From the first day of this month of April until the 22nd, the wind energy production decreased by 24% compared to the same period of 2019. For this week, the production with this technology is expected to end being less than that of last week.

The nuclear energy production between April 20 and 22 of this week decreased by 6.0% compared to the same period of the week. The unit 1 of the Almaraz Nuclear Power Plant continues to be disconnected from the electricity grid since April 14 to carry out the refuelling work. This recharge is scheduled to last until the second week of June, the duration is longer than usual to guarantee protection against COVID‑19 for all workers, according to the informative note from the Almaraz‑Trillo Nuclear Power Plants.

Sources: Prepared by AleaSoft using data from REE.

Sources: Prepared by AleaSoft using data from REE.

The hydroelectric reserves currently have 14 985 GWh stored, according to data from the last Hydrological Bulletin of the Ministry for the Ecological Transition and the Demographic Challenge, which represents an increase of 659 GWh compared to the previous bulletin.

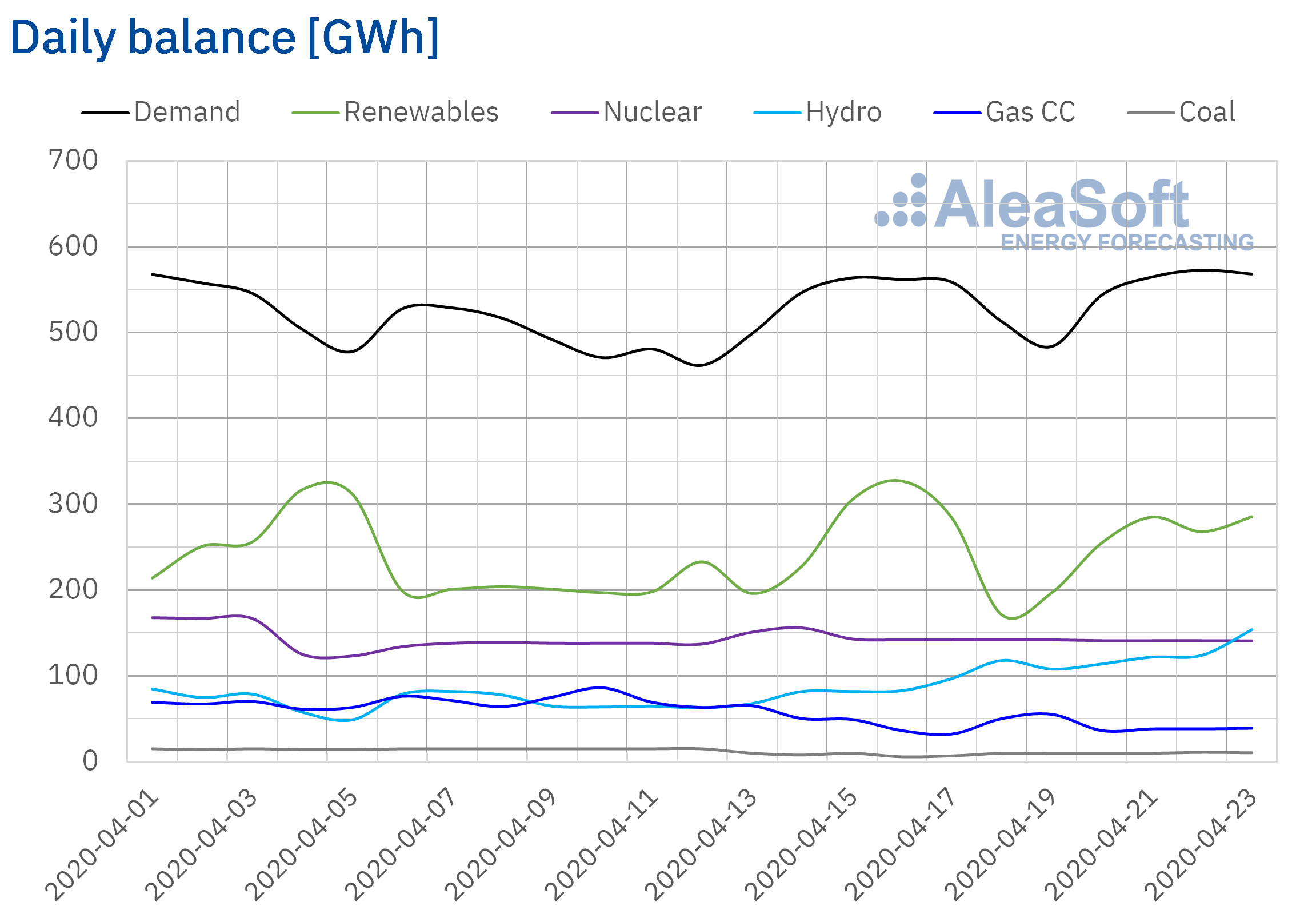

European electricity markets

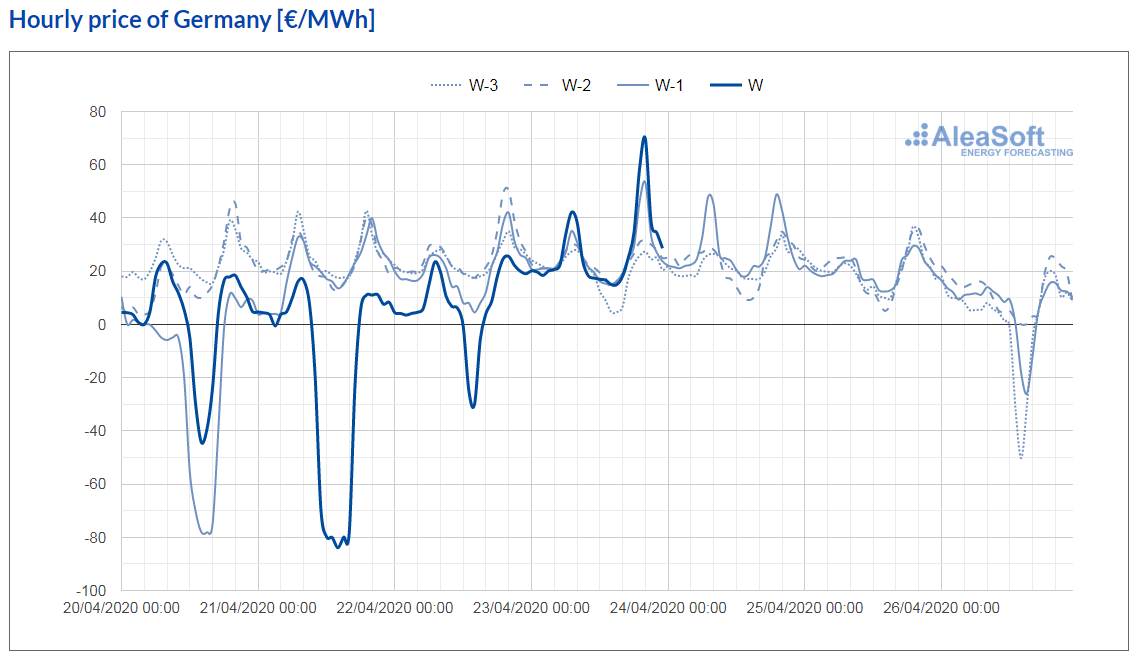

In the first four days of this week of April 20, the prices fell in most European electricity markets compared to those registered the same days of last week. The largest declines, of 56% and 54%, occurred in the EPEX SPOT markets of Germany and Belgium, respectively. While in the EPEX SPOT market of the Netherlands there was the smallest drop in prices, of 0.6%. On the other hand, the IPEX market of Italy, the Nord Pool market of the Nordic countries and the EPEX SPOT market of France presented price increases of 42%, 40% and 8.0%, respectively.

In most markets, the daily average prices between April 20 and 23 were below €20/MWh. The market with the lowest average price so far this week, of €4.34/MWh, was the EPEX SPOT of Belgium, followed by the EPEX SPOT of Germany and the Nord Pool, with prices of €5.48/MWh and €5.61/MWh, respectively. In contrast, the market with the highest average price, of €29.32/MWh, was the IPEX. The rest of the markets, in the first four days of this week, registered average prices between €8.80/MWh of the EPEX SPOT market of France and €18.23/MWh of the N2EX market of Great Britain.

On the other hand, in the first three days of this week, negative hourly prices were registered in the EPEX SPOT markets of Germany, Belgium and France. Furthermore, on Monday and Tuesday, there were also negative hourly prices in Great Britain. However, in the first four days of this week, negative daily average prices were reached only in the EPEX SPOT markets of Germany and Belgium, of ‑€16.15/MWh and ‑€14.99/MWh, respectively, for Tuesday, April 21. In the case of the German market, on April 21 at the hour 15, an hourly price of ‑€83.94/MWh was registered, which is the lowest since June 2019.

Source: Prepared by AleaSoft using data from EPEX SPOT.

Source: Prepared by AleaSoft using data from EPEX SPOT.

The drop in prices registered in most European electricity markets the first days of this week is related to higher production with renewable energy in most of the markets in the current context of low gas and coal prices and lower electricity demand.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

The AleaSoft‘s price forecasting indicates that at the end of this week the weekly average prices of most European markets will be lower than that of the previous week. Although, in general, they will be higher than the averages for the first days of the week, as a decline in renewable energy production is expected in some markets during the rest of the days of the week.

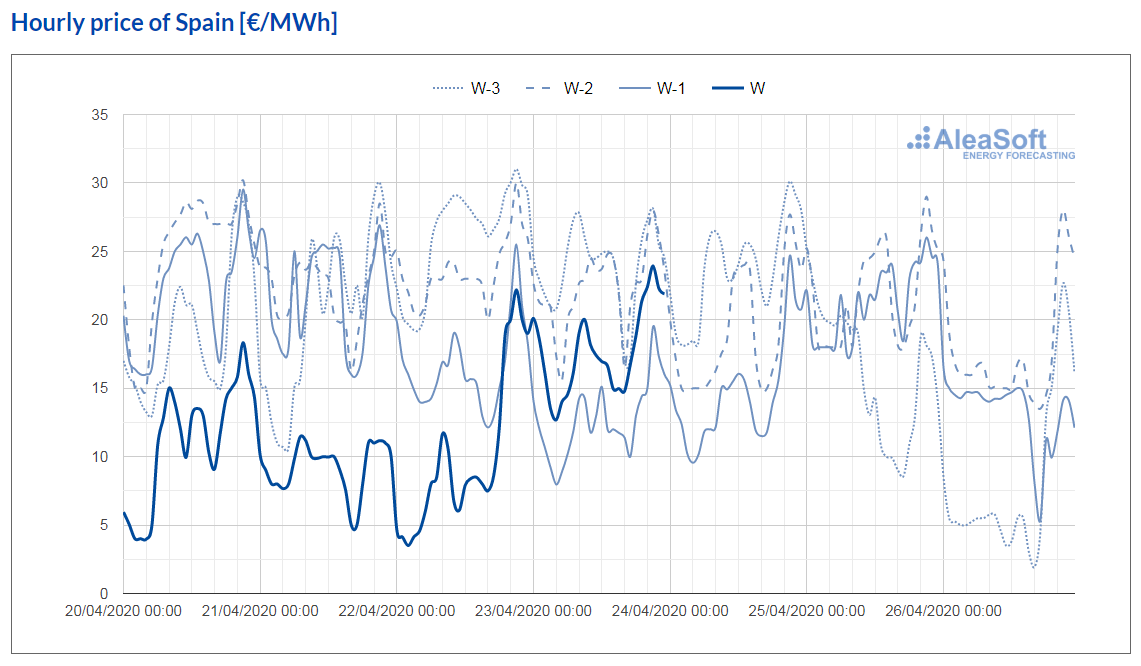

Iberian market

The prices of the first four days of this week in the MIBEL market of Spain and Portugal fell by 35% and 36%, respectively, compared to those registered the same days of last week. In both cases, the average price from April 20 to 23 was €12.02/MWh. The price declines of the last days are mainly related to the weather conditions that allowed an increase in renewable energy production in the Iberian Peninsula. The low prices of the rest of the interconnected markets of Europe also favoured the decrease in prices of the MIBEL market. Most of the hours of the first four days of this week, Spain was a net importer of electricity from France.

The AleaSoft‘s price forecasting indicates that at the end of the week the weekly average price will be higher than that of the first four days of the week in both Spain and Portugal, but without reaching the average of the previous week.

Source: Prepared by AleaSoft using data from OMIE.

Source: Prepared by AleaSoft using data from OMIE.

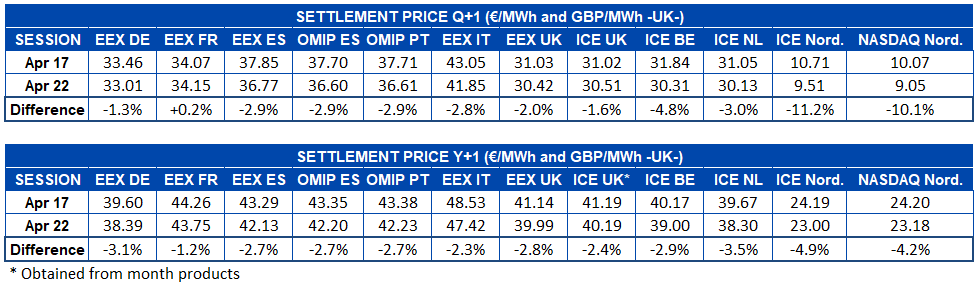

Electricity futures

The electricity futures prices for the third quarter of 2020 registered an almost general drop in the elapsed days of this week compared to Friday, April 17. The EEX market of France was the exception with a slight rise of 0.2%. In the rest of the markets, the falls were between 1.3% and 3.0%, with the exceptions being the ICE market of Belgium, which stood out with a drop of 4.8%, and the ICE and NASDAQ markets of the Nordic region where, because of the lower price, the absolute differences represented a greater percentage change, and between the sessions of April 17 and 22 they registered a change of ‑11% and ‑10% respectively.

In the case of the futures for the calendar year 2021, the decline was general in all the markets analysed at AleaSoft. As usual, the markets with the greatest variation were ICE and NASDAQ of the Nordic countries, with drops of 4.9% and 4.2%, respectively. Meanwhile, the EEX market of France was the one with the smallest change with a difference in yesterday’s session compared to last week’s settlement of ‑1.2%.

In most markets, the behaviour of the prices so far this week was decreasing until the session of Tuesday, April 21. This day the lowest prices were registered, which were related to the fall in Brent oil and gas prices. In the session of Wednesday, April 22, the prices recovered after EDF extended the maintenance shutdowns at its nuclear reactors due to the uncertainties related to the COVID‑19 health crisis. However, in most cases, the settlement prices continued to be below those of the session of Friday, April 17.

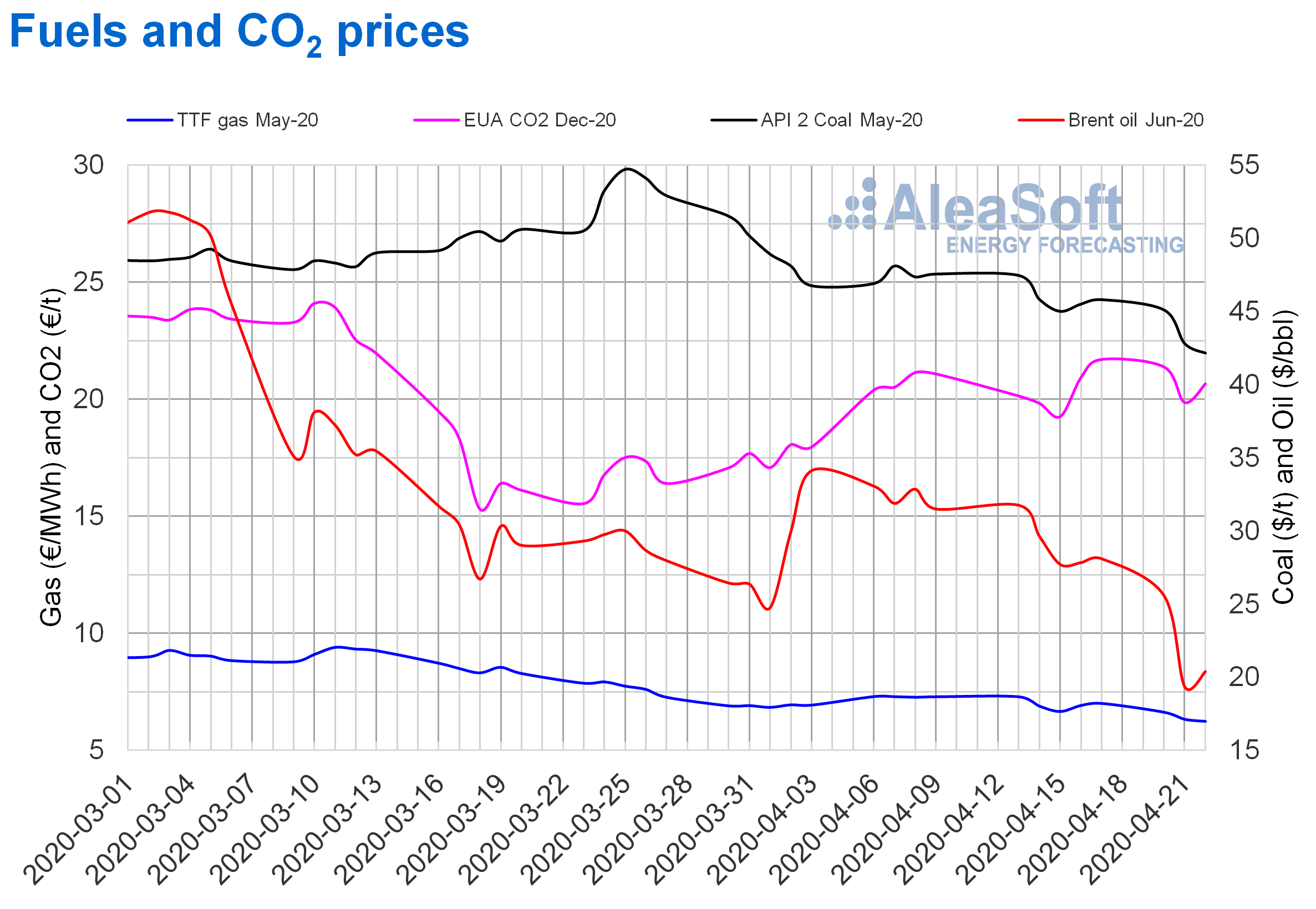

Brent, fuels and CO2

The Brent oil futures prices for the month of June 2020 in the ICE market sank the first days of this week. On Tuesday, April 21, the decrease was 24% compared to the previous day, reaching a settlement price of $19.33/bbl, the historical low to date. However, on Wednesday, it recovered 5.4% and returned to above $20/bbl, settling at $20.37/bbl. In most of the session of today, April 23, prices exceeded $21.50/bbl, exceeding $23.00/bbl in several occasions.

The price declines registered earlier in this week followed the behaviour of the oil in the United States. In the session of Monday, April 20, a negative settlement price was registered for the first time in history for the reference crude oil of the United States, the West Texas Intermediate oil, for the month of May. That day, with a settlement price of ‑$37.63/bbl, there was a decrease of $55.90/bbl from the price of last Friday. These prices are due to the fact that, in the current situation in which the demand collapsed due to the coronavirus crisis while the production levels remain high, it was added that on Tuesday, April 21, it was the expiration day of the contracts for May and the storage capacity was practically non‑existent, forcing the sale.

On the other hand, the current price levels are not just due to the unforeseen outbreak of the coronavirus pandemic. Previously, some international organisations had already predicted a decrease in demand in 2020 associated with a slowdown in the world economy.

However, at the beginning of April, already in the midst of the pandemic, with the decrease in demand aggravated by the measures adopted to stop the expansion of COVID‑19, major oil producers, such as Saudi Arabia and Russia, notably increased their production. At that time the margin to store the production awaiting a price increase was already reduced. Finally, the OPEC+ agreed to reduce its production from May. In the case of the United States, it also showed the intention to reduce its production. But these reductions may not be sufficient considering that the demand will still take time to recover and that the reserves are at the limit of their capacity.

In the coming weeks, the start of the end of the confinement in some European countries will increase the demand. But the production levels are still high and the storage capacity is depleting. Therefore, further declines could be registered before the end of April.

The TTF gas futures prices in the ICE market for the month of May 2020 fell the first days of this week until reaching a settlement price of €6.23/MWh on Wednesday, April 22. This price is 6.4% lower than that of the previous Wednesday and the lowest in the last two years. Today, April 23, the prices remained below this value.

Regarding the TTF gas in the spot market, the first days of this week, they fell to register, on Wednesday, April 22, an index price of €5.91/MWh, 15% lower than that of the previous Wednesday and the lowest in the last 11 years. But on Thursday, April 23, the price recovered to €6.01/MWh.

On the other hand, the API 2 coal futures prices in the ICE market for the month of May 2020, the first days of this week, showed a downward trend. On Wednesday, April 22, a settlement price of $42.15/t was reached, 6.3% lower than that of the previous Wednesday and the lowest in the last two years.

The evolution of the gas and coal prices was influenced by the behaviour of the oil prices. But the expected reductions in French nuclear energy production in the coming months may partially offset the downward trend of gas and coal. Although, in the case of gas, as in the case of oil, the levels of supply and reserves are high, which already kept the prices low before the start of the coronavirus pandemic. On the other hand, the recovery of the emission rights prices favours the use of gas in the electricity generation compared to the use of coal. In addition, in the case of coal, the new import restrictions of the Chinese government to support the local production will also affect the evolution of the prices.

As for the CO2 emission rights futures prices in the EEX market for the reference contract of December 2020, on Monday and Tuesday of this week they fell to register a settlement price of €19.86/t on Tuesday, April 21. This price, despite being the lowest so far this week, was still €0.04/t and €0.60/t higher than the prices of Tuesday and Wednesday of last week respectively. Yesterday, Wednesday, April 22, the prices recovered and the settlement price was €20.66/t, 7.3% higher than that of last week’s Wednesday and 4.0% higher than that of the previous day.The EDF’s announcement of the extension of the scheduled shutdowns at the French nuclear power plants favoured the registered price increase. The decrease in nuclear energy production in the coming months could partially offset the effect of the coronavirus pandemic in this market.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis on the effects on the electricity markets due to the coronavirus crisis

On the AleaSoft website an observatory of the main European electricity markets was created where it is possible to analyse the behaviour of the demand and the prices during the coronavirus crisis with daily updated data.

On the other hand, the next May 21, a Webinar on the “Influence of coronavirus on electricity demand and the European electricity markets. (II)” will be imparted, in which the evolution of the European energy markets will be analysed and the financing of the renewable energy projects will be discussed. This Webinar will be the second part of the one held on the last April 16, which addressed the consequences of the economic crisis of the COVID‑19 on the energy markets and their opportunities.

Source: AleaSoft Energy Forecasting.