AleaSoft Energy Forecasting, September 24, 2021. Consumers, both industrial and domestic, are the most affected by this price escalation in electricity markets throughout Europe. PPA, as a risk management tool, can help large consumers and retailers to protect themselves from price fluctuations in the energy markets.

PPA, as risk management tools, are the solution for producers and large consumers in the face of market prices fluctuations. For electricity generation plants with renewable energies, PPA contracts are, in most cases, the requirement to obtain financing for the construction and start‑up of the project. For large and electro‑intensive consumers, having predictability of energy costs provides the possibility of planning and the assurance of long‑term viability.

If PPA represent an advantage for both sides of the contract, why aren’t more PPA signed? The truth is that in Spain many PPA contracts are signed when compared to the rest of the European markets, but much less than in American markets. But the most complicated part in a PPA is not the price agreement, as might be thought, but the guarantees from both parties: guarantees that the producer will complete the construction and will deliver the agreed energy on time, and guarantees that the consumer will be able to consume all the energy and will be able to face the agreed price.

Guarantees by large and electro‑intensive consumers

The Royal Decree 1106/2020, of December 15, which regulates the Statute of electro‑intensive consumers, tries to alleviate the problem that the lack of guarantees represents for large consumers when signing PPA at competitive prices. According to the Statute, electro‑intensive consumers will have to contract a PPA for at least 10% of their consumption and for a minimum duration of five years. To make the price of the agreement competitive for the consumer, long‑term electricity supply contracts signed directly or indirectly with plants that generate electricity from renewable energy sources will have the endorsement and guarantee of the State. The procedure for requesting the State guarantees and the scope that these guarantees will have is not yet approved.

The recently published Royal Decree‑Law 17/2021 includes the holding of auctions between producers and large direct consumers or retailers. In the latter case, the intention is lowering the electricity price for the final consumers. One aspect to take into account is that these auctions are not yet regulated, so there is the possibility that once the procedure is defined, they will be subject to legal proceedings.

According to AleaSoft Energy Forecasting, the ideal solution to the high prices that end consumers face is that they can choose the risk they want to assume: indexed to the daily market, one‑, five‑ or ten‑year futures price. Even domestic consumers should be able to choose different flat rates based on the length of the contract. It is important that retailers, which are the companies that supply electricity to domestic consumers and smaller companies, have long‑term supply contracts to cover their risks.

Guarantees for producers

To tackle the problem that renewable energy projects developers find when it comes to finding counterparties with guarantees to sign a PPA and being eligible for financing, the Government opted for renewable energy auctions, which can be understood as a “PPA with the State” or a “PPA without offtaker”.

It is a good solution for renewable energy projects, but it does not contribute, at least in a direct and obvious way, to lower electricity prices. The energy produced by plants under the Renewable Energy Economic Regime (REER) will be sold directly to the spot market. Given that the opportunity cost of renewable energies is very low, there will be practically no difference between offers of a plant under the REER compared to those of a full merchant plant, so the impact of auctions on market prices will be very limited.

How PPA can help limit the impact of high prices for large consumers

To understand how consumers are affected by high prices that are being registered in the spot electricity market, it is necessary to think about who is not affected by this rise in pool prices. Consumers with mid‑ and long‑term contracts are those who are protected against this price increase.

On the other hand, those affected are large consumers who did not previously define an energy purchase and sale strategy that would allow them to protect themselves from fluctuations in market prices and domestic consumers and SMEs covered by rates indexed to the pool. According to AleaSoft Energy Forecasting, in the latter case the example of neighbouring countries, such as the United Kingdom, France, Italy and Portugal, should be taken, with retailers that offer prices with a horizon of months on the basis of a supply contract previously established with large producers.

Large consumers and retailers can find in PPA, as long as they can provide necessary guarantees, a tool that allows them to buy energy at a previously agreed price and minimise the market prices risk.

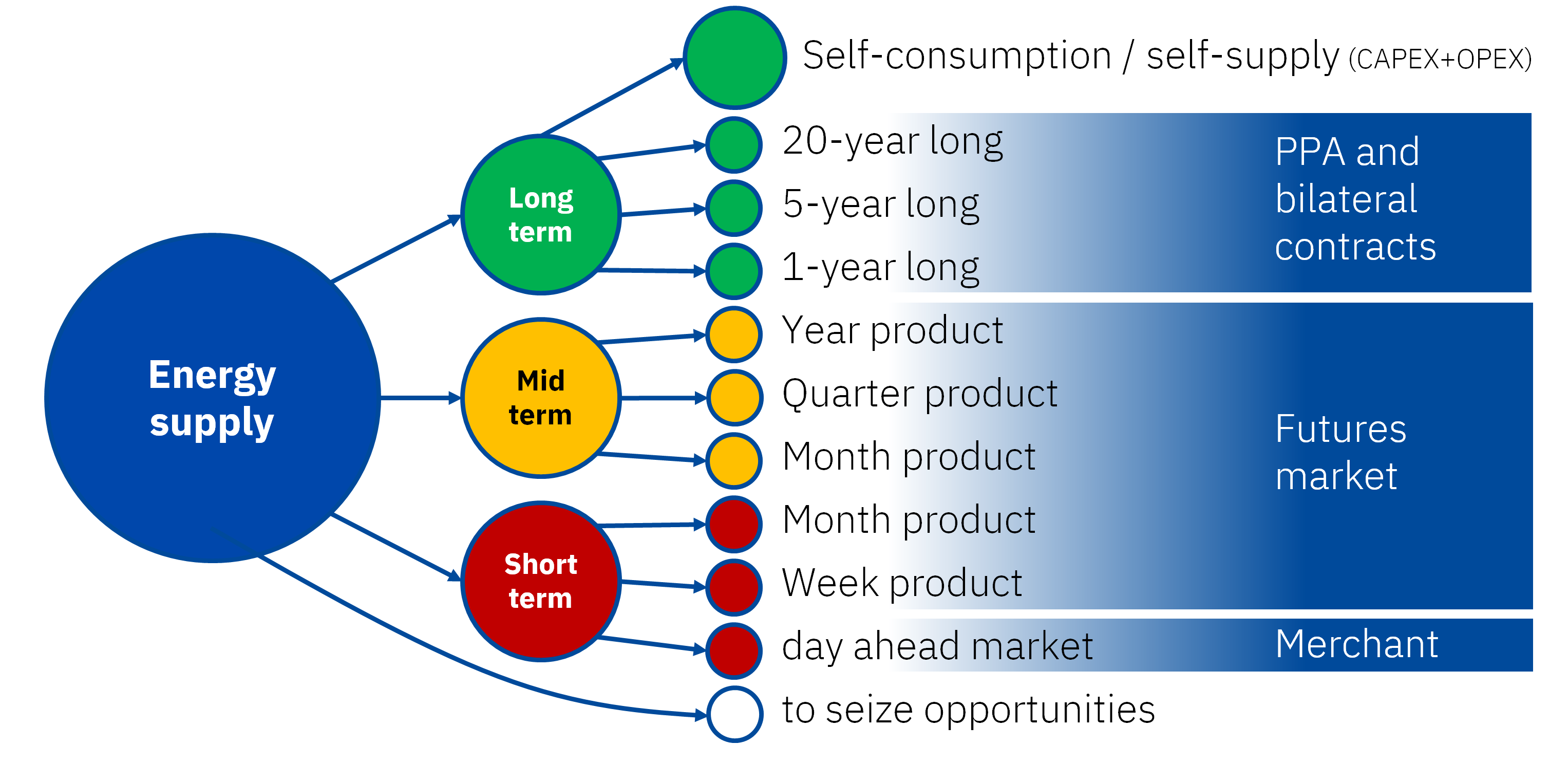

A PPA is a key piece in an energy buying and selling strategy based on diversification, in which part of the energy is bought or sold through these long‑term contracts and another part in the spot and futures markets, taking advantage of opportunities that arise. Short‑, mid‑ and long‑term electricity markets prices forecasts are a fundamental input in this process of detecting opportunities and defining the strategy.

Energy buying and selling strategy based on diversification.

Energy buying and selling strategy based on diversification.Source: AleaSoft.

When signing a PPA contract, it is important to have 30‑year market hourly prices forecasts to cover the entire lifetime of the generation plant, even beyond the duration of the PPA. The hourly granularity of forecasts is necessary to the correct income estimation during the operation of the facility.

The extensive experience of AleaSoft Energy Forecasting as a provider of forecasts, optimisation tools and reports of the energy sector for different market players: generators, system operators, traders, large and electro‑intensive consumers, retailers, banks and investment funds, turned the company into a hub of connections and contacts between companies of the sector to address opportunities and synergies in the energy markets, for example, in the negotiation of PPA contracts.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The need for long‑term forecasting for PPA, for the renewable energy projects financing and in audits and portfolio valuation will be one of the topics that will be covered in the next webinar organised at AleaSoft Energy Forecasting for the 7th of October. This webinar is part of the series of monthly webinars, which with this edition launches a new course, where AleaSoft Energy Forecasting, together with the most important companies in the energy sector in Europe, analyse the energy markets, their evolution and long‑term prospects. On this occasion, there will be the participation of two speakers from the consulting firm Deloitte, almost a year after the interesting webinar held in October 2020 with the same speakers.