AleaSoft Energy Forecasting, November 12, 2021. The situation of the energy markets in Europe is of tense calm. The increased flow of gas to the continent’s reserves slowed the rise in prices in gas and electricity markets. But prices continue at extremely high levels and very dependent on any news about the supply of gas from Russia and Algeria, which may provoke, at any moment, a new upward trend in prices.

Last Thursday, November 11, the webinar “Prospects for European energy markets in the global energy crisis” took place, organised by AleaSoft Energy Forecasting and with the participation of speakers from Engie Spain. During the webinar, current issues of the energy sector in Spain and Europe were discussed, from the evolution of European energy markets and their prospects, to PPA in renewable energy projects, through the latest Royal Decree‑laws approved in Spain in September and October, and many other issues, linked, above all, to the current situation of global energy crisis and the energy transition. Clients of Engie Spain and AleaSoft Energy Forecasting, as well as those interested in its forecasts, can request the recording of the webinar here.

The situation of the energy markets in the energy crisis

In recent weeks, the situation in the energy markets calmed down. The present situation can be considered better in the sense that, although prices are at extremely high levels, at least, they stopped rising and the volatility decreased.

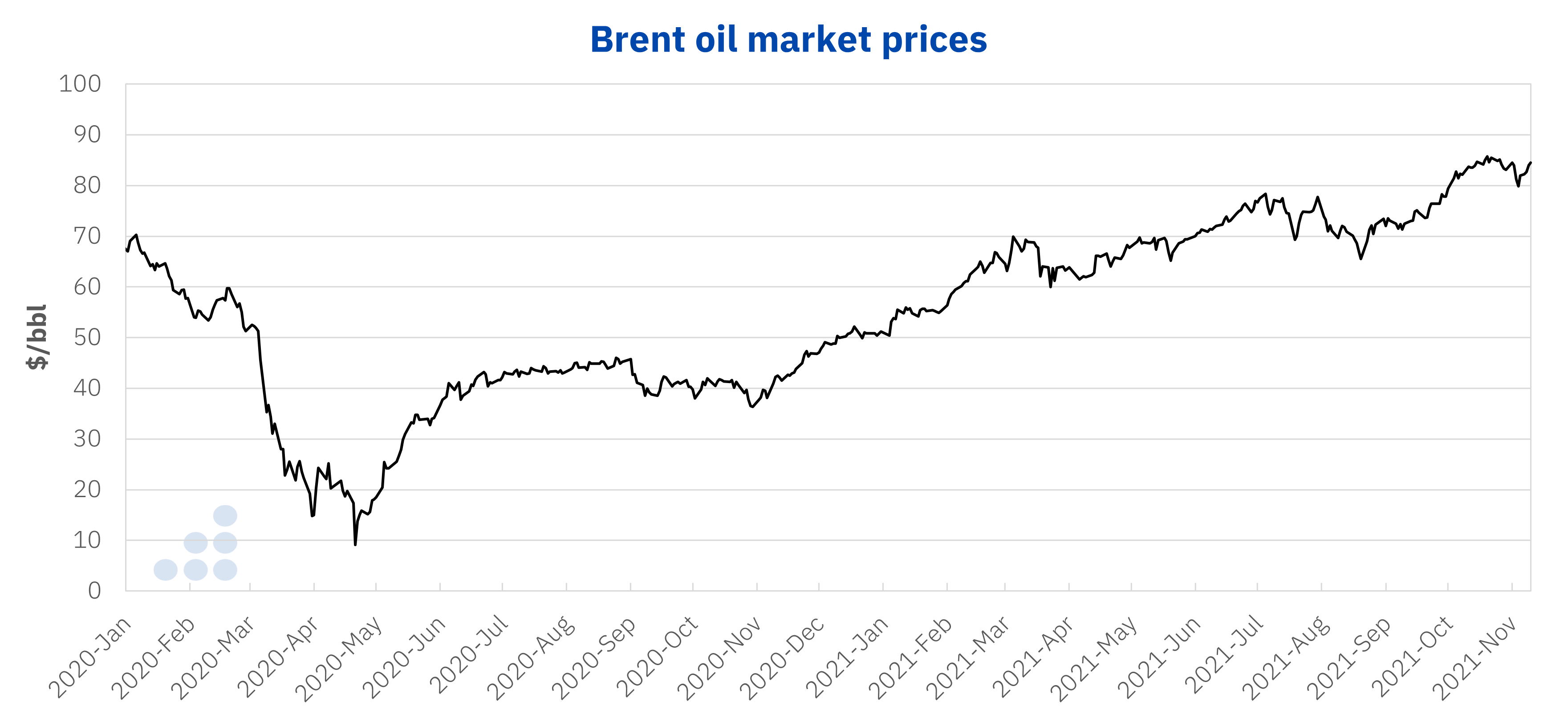

The price of a Brent oil barrel was between $80 and $85 for four weeks, since the beginning of October. On their rise since prices bottomed in April 2020, prices hit several plateaus that were sustained for several months in a row. Some forecasts suggest that $90 per barrel could be reached by the end of the year. If these levels were reached, the year 2021 might exceed the average price of 2018, the last peak in oil prices.

Source: Prepared by AleaSoft Energy Forecasting using data from the EIA.

Source: Prepared by AleaSoft Energy Forecasting using data from the EIA.

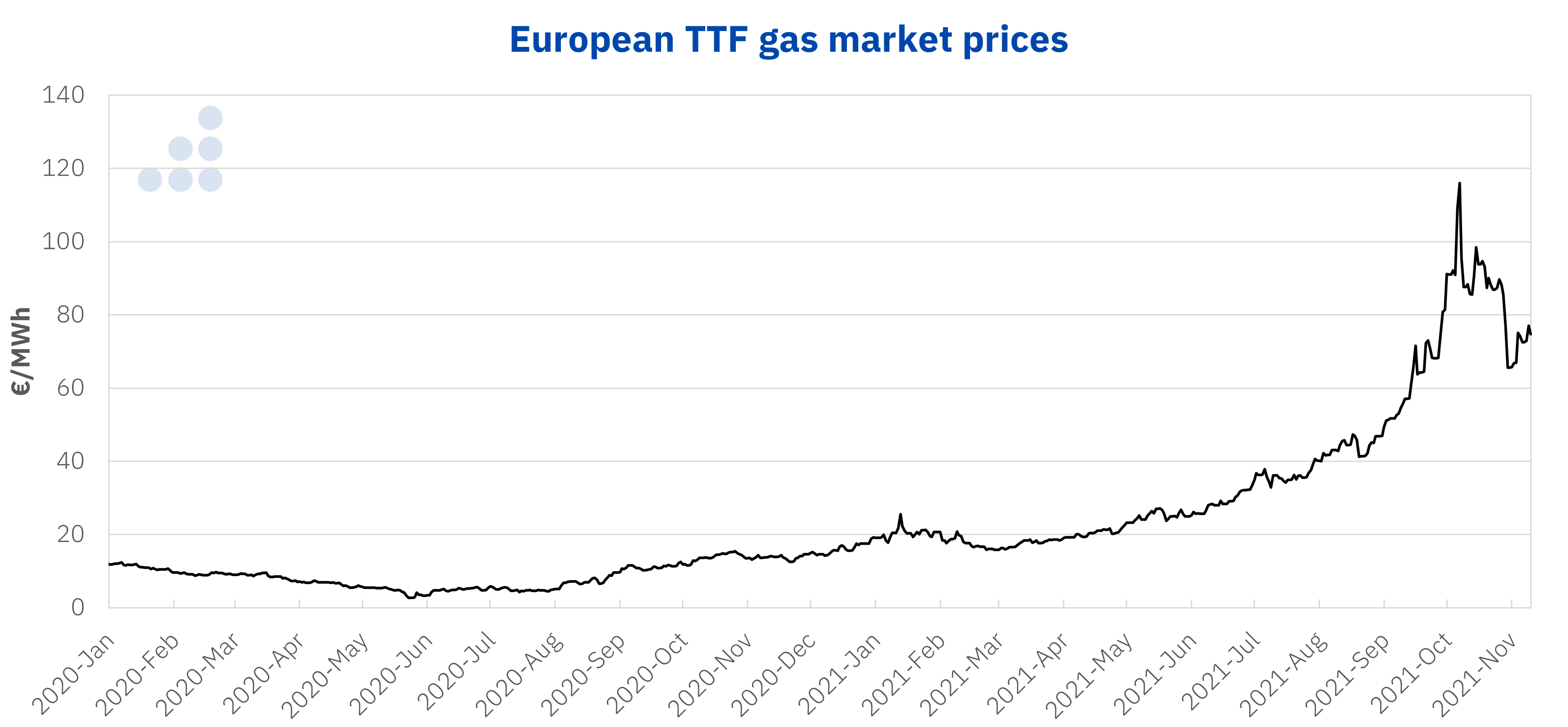

TTF gas prices, the benchmark in Europe, are those that registered the most pronounced exponential growth and were positioned as the main responsible for the rise in electricity spot and futures markets prices. This rise in gas and electricity markets prices was what created the situation of social alarm and energy crisis. A crisis with a global reach, since similar increases were registered in the gas markets in Asia and America.

Since the peak in gas prices at the beginning of October, when they exceeded €115/MWh, prices fell by two notches. The first, on October 9, after the Russian president assured that Europe would have the necessary gas to get through the winter and that caused prices to fall by 18% to the level of €90/MWh. This level was maintained until October 28, when Gazprom‘s announcement that it would start replenishing reserves in Europe once Russian reserves were full, caused prices to fall to the level of €70/MWh, a level at which has been since then.

Source: Prepared by AleaSoft Energy Forecasting using data from PEGAS.

Source: Prepared by AleaSoft Energy Forecasting using data from PEGAS.

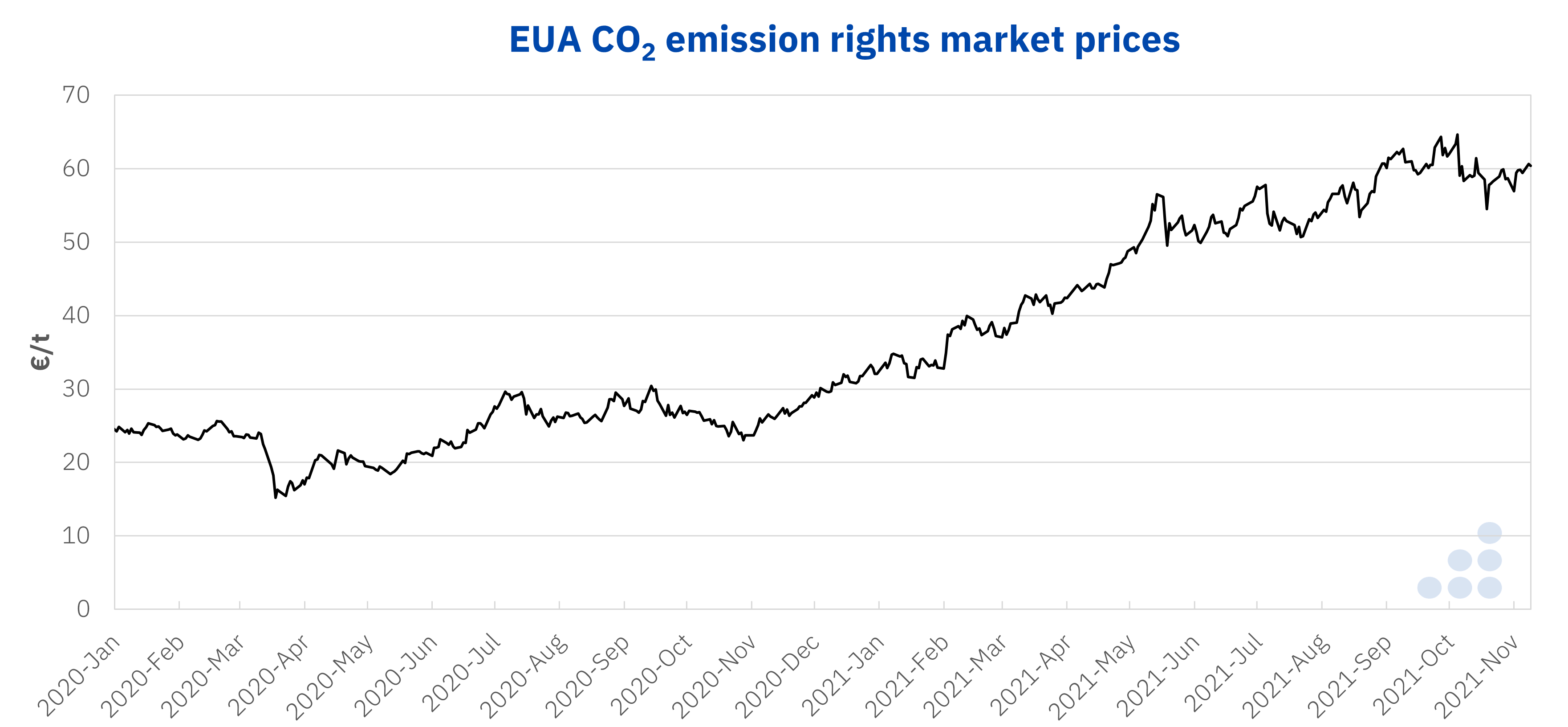

The other factor that contributed to the increase in European electricity markets prices, especially at the start of the bullish rally at the end of 2020, was the CO2 emission rights prices. Once fully recovered from the fall in March 2020, CO2 prices began an escalation in November that took them from €25/t to €60/t in ten months. Since the beginning of September, prices have remained relatively stable around that price of €60/t.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX.

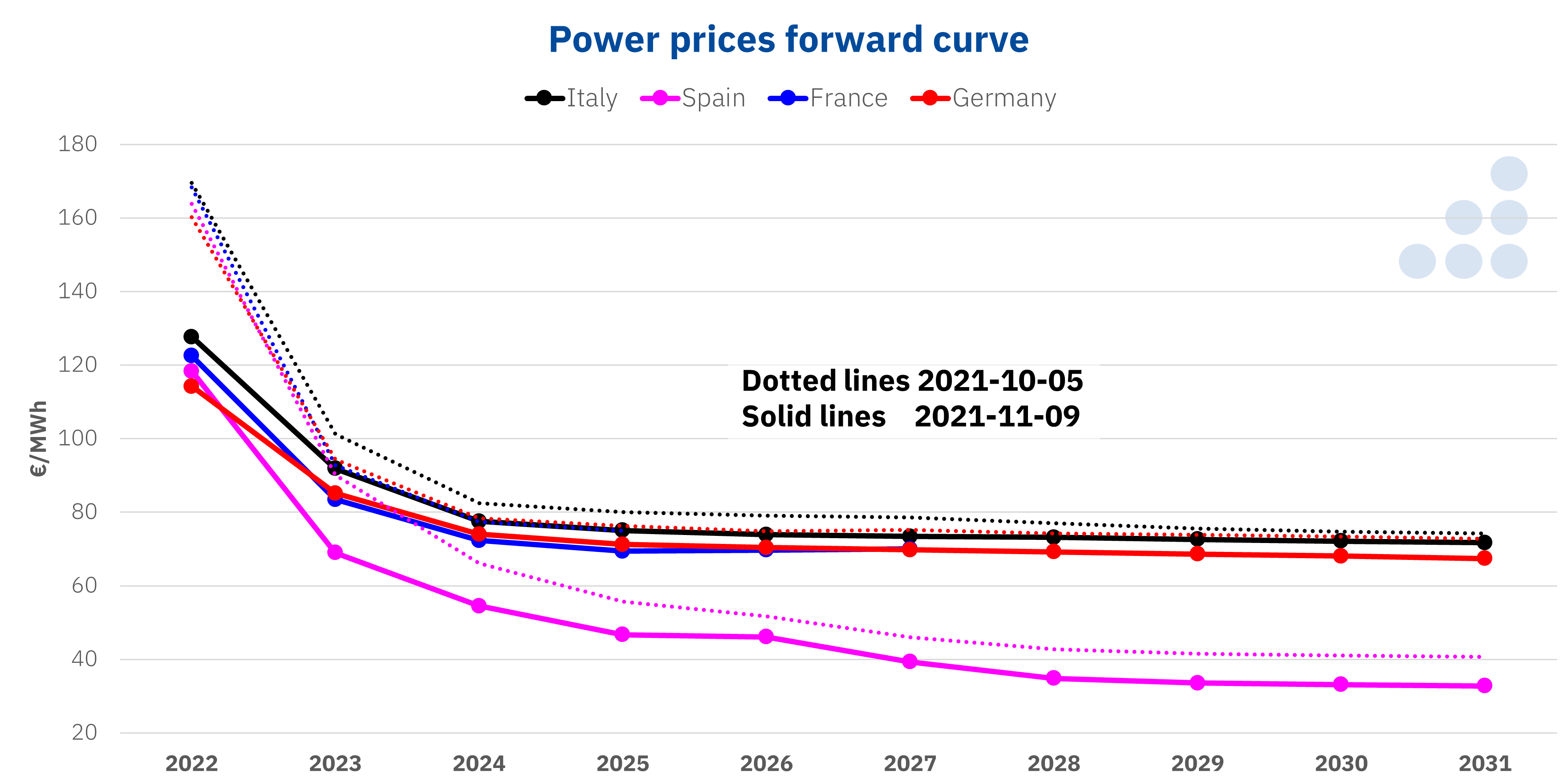

The impact on electricity futures prices

This entire situation of high prices, but of relative stability, led to electricity futures prices for the year 2022 to a decline of 25% from the highs of early October. The situation improved, but price levels remain exorbitantly high and large consumers who must cover their consumption for next year find these prices, unaffordable in many cases.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The next webinar organised by AleaSoft Energy Forecasting to follow the evolution and prospects of the energy markets in Europe will take place on January 13, 2022. This first webinar of the year will feature the participation of speakers from PwC Spain, who will analyse how the regulatory and electricity market situations impact on the PPA development, both off‑site and on‑site.

Source: AleaSoft Energy Forecasting.