AleaSoft, March 16, 2020. During the first day of the coronavirus alarm state in Spain, the demand was lower and the hourly profile changed. The Brent oil price continued to drop affected by the decrease in demand. At AleaSoft, analysis news about the consequences that the measures taken to contain the spread of the pandemic will have in the short and medium term will be published. On the other hand, in Germany the highest solar energy production so far this year was registered yesterday.

Photovoltaic and solar thermal energy production, wind energy production and electricity demand

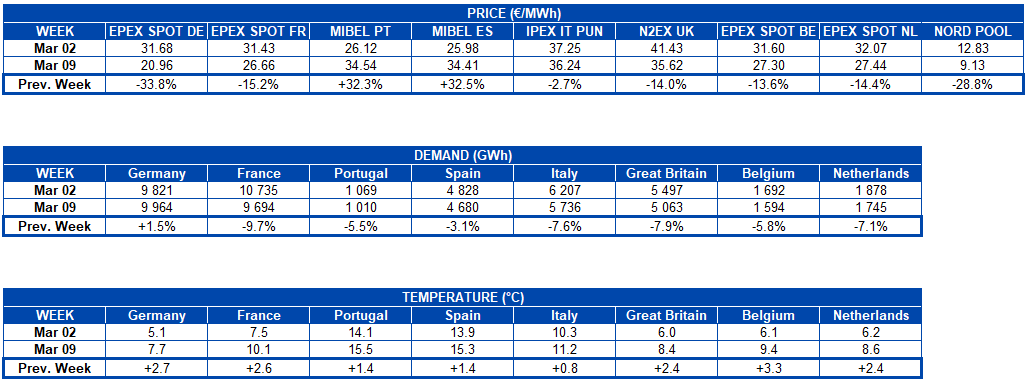

Last week of March 9, the solar energy production increased compared to the previous week in all the European markets analysed by AleaSoft. The countries with the largest increases in production were France with 50% and Germany with 37%. In the German market, the production of Sunday, March 15, of 175 GWh, is the highest of this year so far. In the Iberian Peninsula and Italy, the productions were 24% and 23% higher than the week of Monday, March 2. For this week at AleaSoft an increase of this solar energy production is expected in the German market and in the Italian market. On the contrary, a decrease in production is expected in Spain.

The year on year analysis was also favourable in most of the analysed countries last week. At the end of the first 15 days of March, the production in Germany stands out being 41% higher than that registered in the same period of the previous year. In the case of the Iberian Peninsula and France, 25% and 6.1% more energy was generated. The exception was the Italian market in which the solar energy production decreased by 9.6%.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

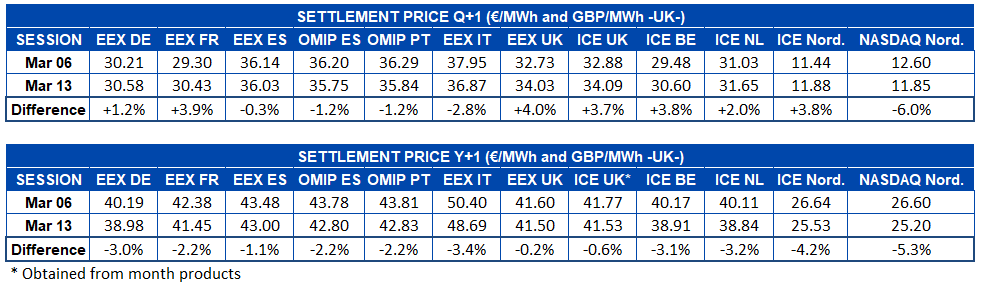

As expected at AleaSoft, last week’s wind energy production, compared to the previous week, decreased in Portugal, Spain and Italy and increased in France and Germany. Last week was very favourable for Germany as the wind energy generators produced 71% more than the previous week. In the case of France, the increase was 18%, while in the Iberian Peninsula and Italy, the production fell 60% and 48% respectively. For this week at AleaSoft an increase in wind energy production is expected in Spain and Portugal. By contrast, it is expected that in Germany, Italy and France it will decrease.

Despite the increases in wind energy production registered last week in Germany and France, so far in March, this was 24% and 22% lower, respectively, than that generated in the same period of the last year. In Spain and Portugal, the year on year production was 25% higher compared to the first 15 days of March 2019, while in Italy the production remained very similar.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

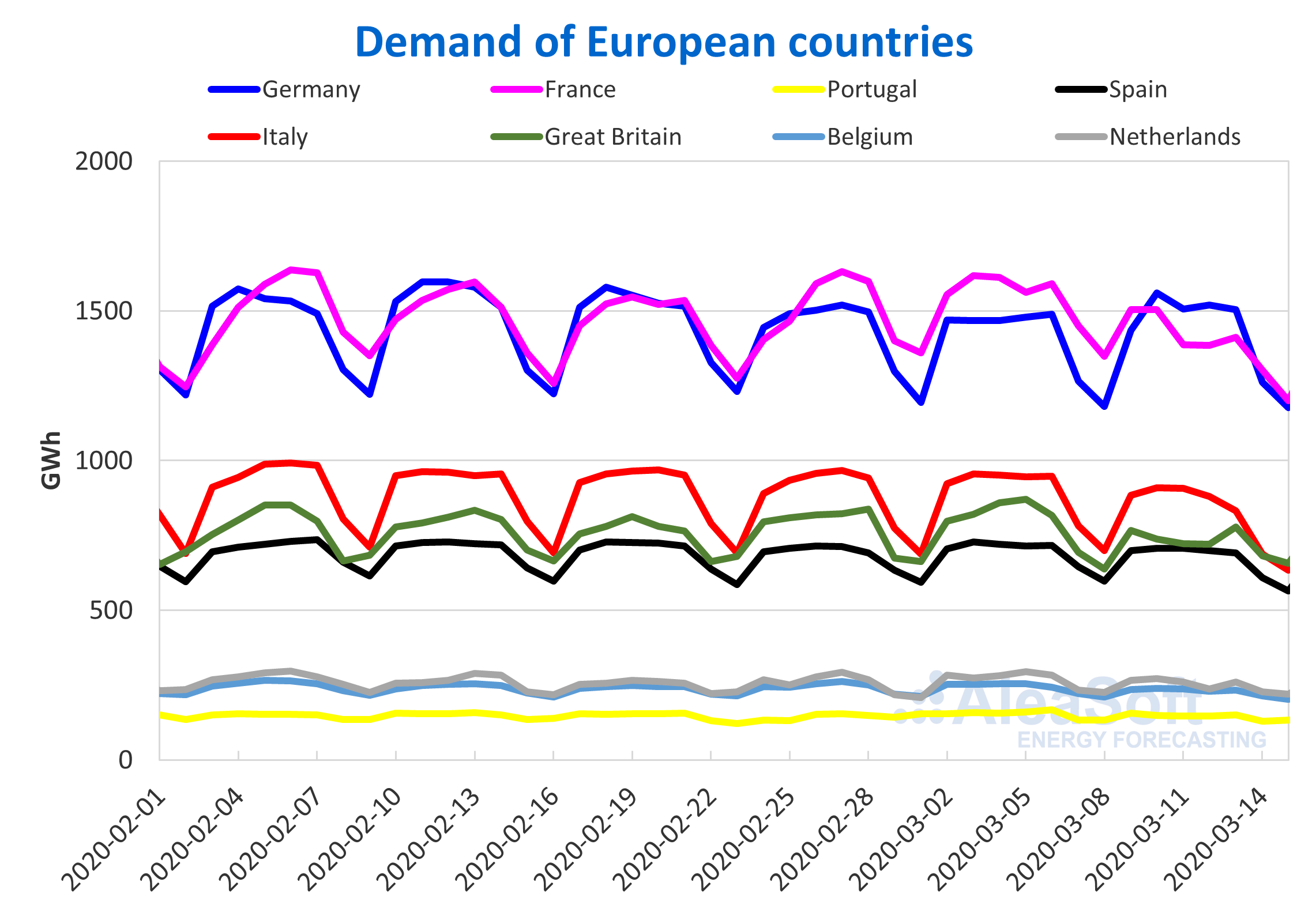

During the past week, less cold temperatures were registered in the main European markets, which, on average, were around 2 °C above the previous week’s temperatures. These milder weather conditions led to a fairly general decrease in electricity demand between 3.1% of Spain and 9.7% of France. The exception was Germany, which registered an increase in demand of 1.5% compared to the previous week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

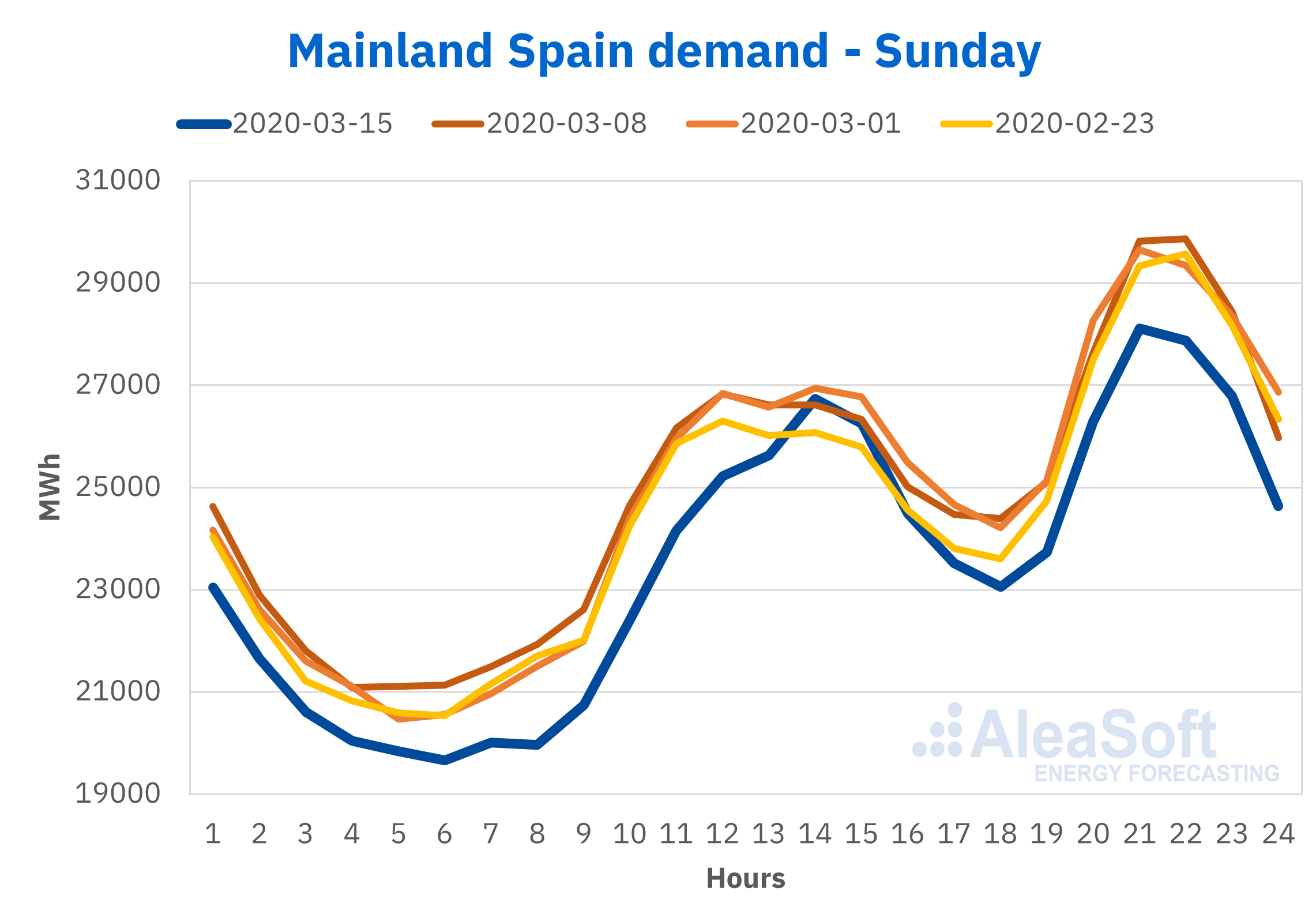

But in addition to the weather conditions, the measures taken by some states to deal with the crisis caused by the spread of the coronavirus had a clear and visible impact on electricity demand in some countries. In Spain, the declaration of the state of alarm led to the confinement of the population in their homes and the closure of schools and high schools, restaurants, premises and shops that are not of food or essential services since Saturday, March 14. These restrictions caused a decrease and a change in the hourly profile of the electricity demand over the weekend. The demand of Sunday, March 15, was clearly lower than that of the previous Sundays, some of them with less cold temperatures. There is also a smaller difference between the height of the midday and night peaks, due to the increase in domestic consumption during the mealtime.

Source: Prepared by AleaSoft using data from REE.

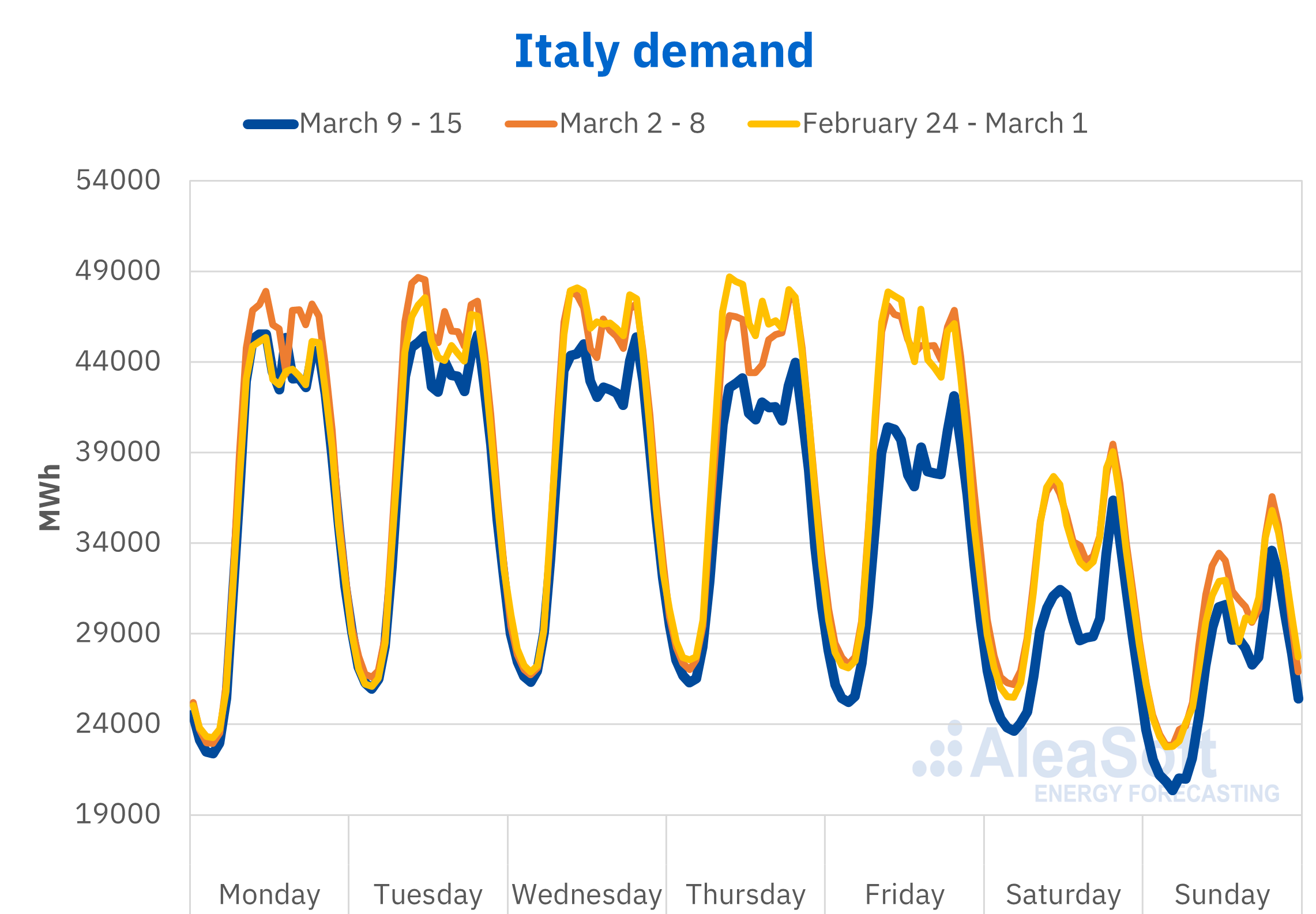

In the case of Italy, there are several provinces in isolation since March 8, and, two days later, the restrictions were extended to the entire country. Comparing the demand of this last week of March 9 to 15 with the two previous weeks, it is clear how the demand was decreasing.

Source: Prepared by AleaSoft using data from TERNA.

In the European countries, a lower temperature change than that of the previous week is expected for this week, except in the case of the Iberian Peninsula, where a steep drop in temperatures of up to 2.4 °C is expected in Spain and 1.7 °C in Portugal. But, without a doubt, what will shape the evolution of electricity demand will be the impact on the economy and transportation of the measures and restrictions that states are adopting to combat the spread of the coronavirus.

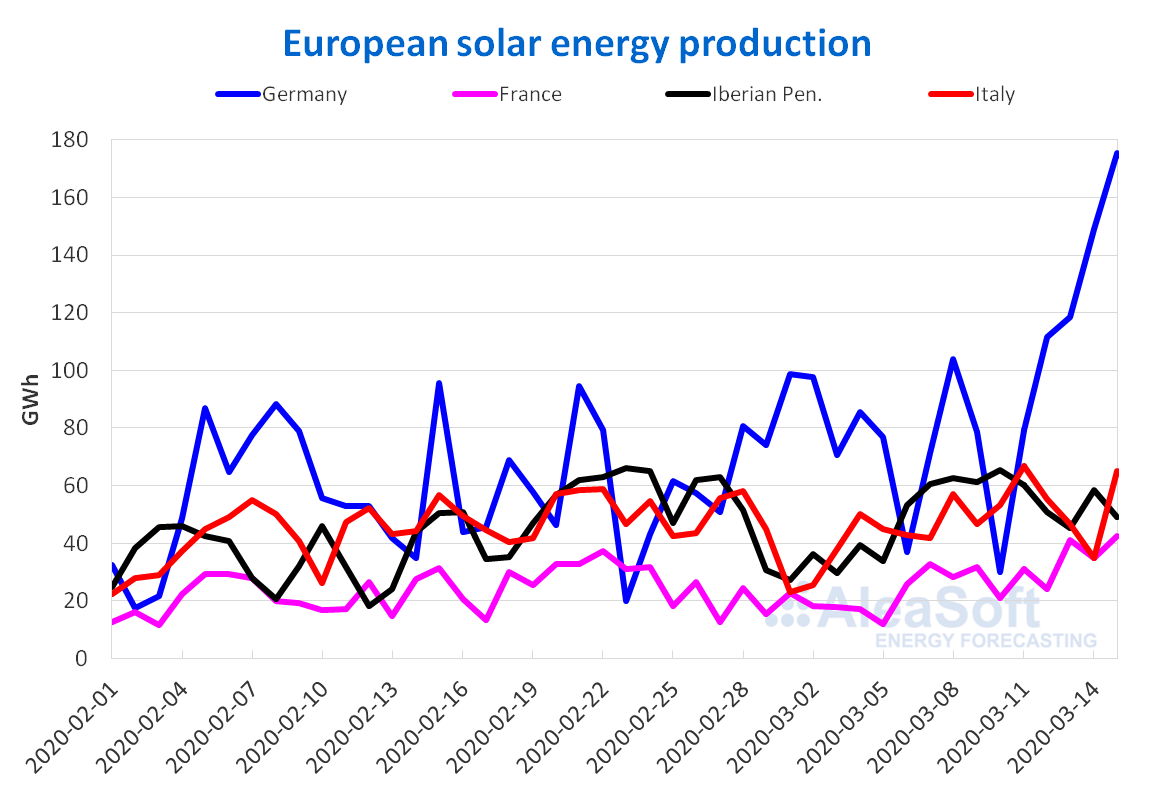

European electricity markets

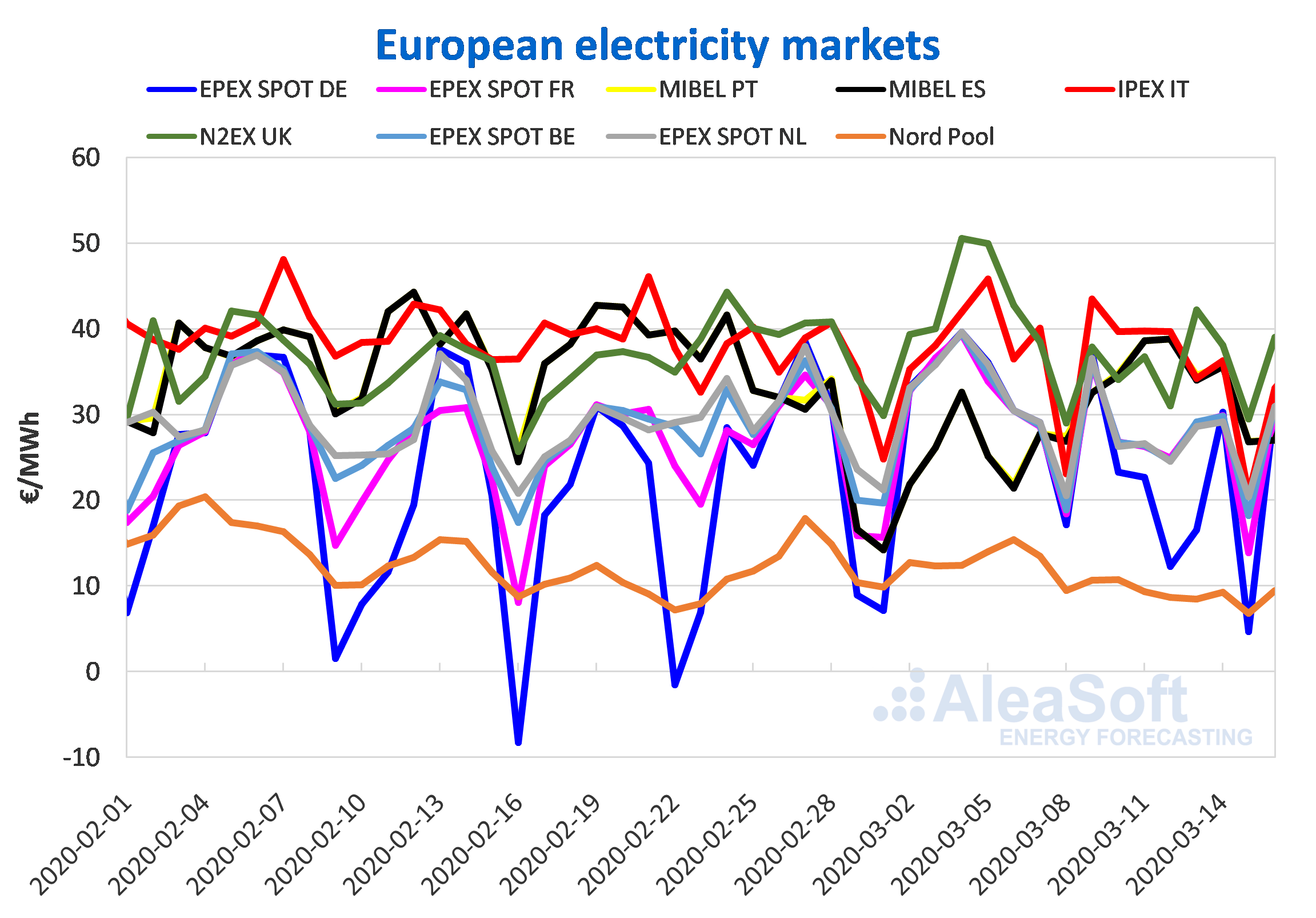

During last week, of March 9, the average prices of most of the European markets analysed by AleaSoft decreased with respect to those of the week of March 2. The greatest decrease occurred in the EPEX SPOT market of Germany, where the average price of the week fell 34% compared to the previous week. This market registered negative prices for some hours on several days of last week due to the high production with renewable sources of those days. For example, this Sunday, March 15, the German market registered negative prices from 9 a.m. to 4 p.m. (CET) and reached the lowest hourly price since the start of the year, of €33.80/MWh at 1 p.m., closing with an average price for that day of €4.65/MWh. The Nord Pool market was the second market with the greatest decrease in prices during the past week, of 29%, and it was also the market with the lowest average price, of €9.13/MWh. In the EPEX SPOT markets of France, Belgium and the Netherlands the variations were between 15% and 14%, with prices quite coupled during the week. The Italian IPEX market was the one with the lowest decrease, of 2.7%, which represents a difference close to €1/MWh, and in turn it was the market with the highest price in Europe for almost all of last week, which made it be the market with the highest average price for the week, while the N2EX market of Great Britain, with a decrease of 14%, was the second market with the highest prices and as of Friday, March 13, it replaced the Italian market as the market with the highest prices.

The less cold temperatures and the influence of the measures applied to combat the spread of the coronavirus during the past week in some European markets favoured the decrease in electricity demand, which together with an increase in solar energy production in all markets led to the decrease in the prices of a large part of the electricity markets of the European continent.

On the other hand, the MIBEL market of Spain and Portugal was the exception, as the prices during the past week increased compared to the week of March 2, with an increase of 32% for both poles. The average prices of €34.54/MWh in Portugal and €34.41/MWh in Spain made them the third and fourth markets with the highest prices for the week on the continent. Due to the low wind energy production for most of last week, the prices of these markets remained above €32.52/MWh of Monday, March 9. However, this Sunday, March 15, they fell to €26.80/MWh in the Spanish market and €26.88/MWh in the Portuguese market due to a slight increase in wind energy generation and a decrease in demand during the weekend and due to the measures adopted by the Spanish government to combat the expansion of the coronavirus, a factor that will lower demand for the next few days.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

For this Monday, March 16, the prices decreased in most markets compared to Monday, March 9. The British market was the exception, as it increased the price by 3.0%, remaining as the one with the highest prices on the continent, averaging €38.99/MWh. The EPEX SPOT markets continued quite coupled for this day, with variations of between 16% and 15% compared to Monday of last week, and prices close to €31/MWh. The Iberian market, with a daily average price of €27.02/MWh and a variation of 17%, moved away from the group of markets with the highest prices and was the second market with the lowest prices behind the Nord Pool for this day. The Italian market, with a drop of 24% and an average price of €33.10/MWh, was the one with the greatest decrease for this day, but still positioned itself as the second market with the highest price, after the N2EX market. While the Nord Pool market with an average price of €9.45/MWh continues to be the market with the lowest prices for this Monday.

In general, at AleaSoft, the prices of the markets of the European continent are expected to be a little more coupled at the beginning of the week. In the EPEX SPOT markets of Germany, France, Belgium and the Netherlands, the N2EX market and the Nord Pool market, the prices will increase, with the increase in the German market being the most significant due to a decrease in expected wind energy production. On the other hand, in the MIBEL market of Spain and Portugal and the IPEX market of Italy, the prices are expected to fall.

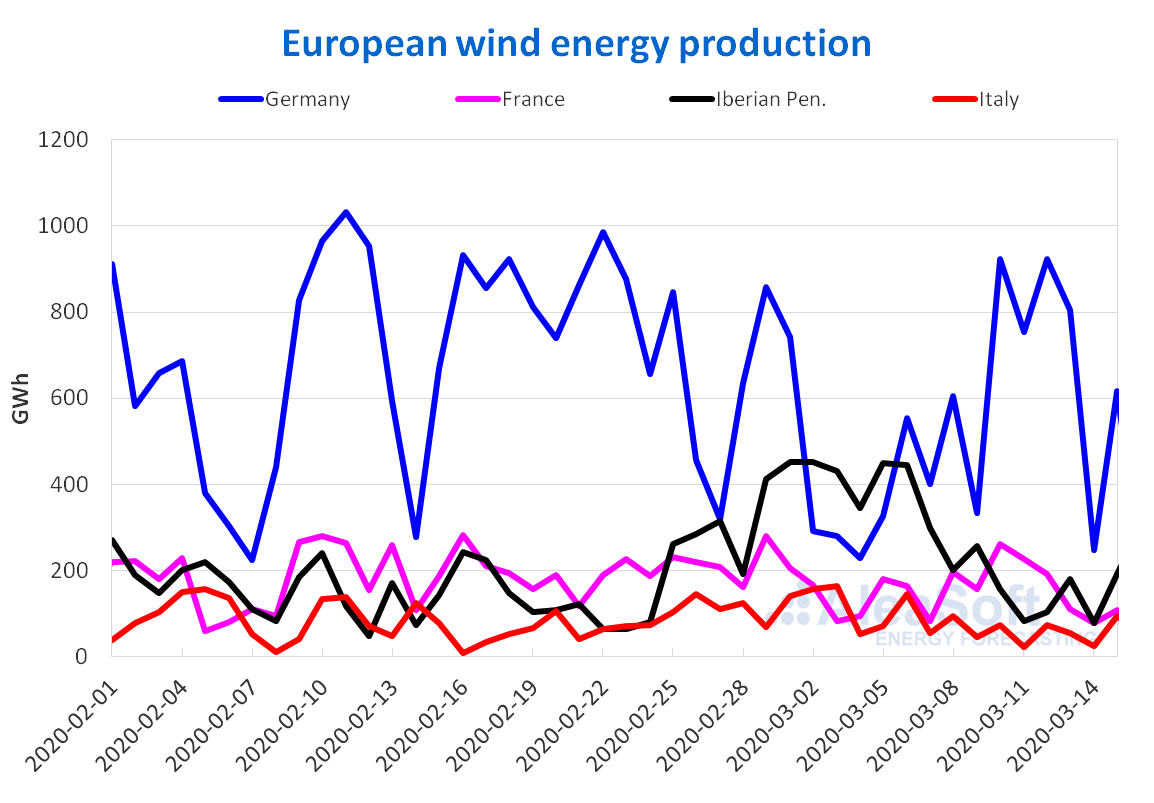

Electricity futures

The electricity futures prices for the next quarter behaved downwards in the last market sessions of the week of March 9. After starting the week with price increases, as of March 11, most markets reduced their price. However, the decline in most markets was not comparable with the increase in the first days and the final net balance between weeks continued to be positive. Such is the case of the ICE market of Great Britain, Belgium, the Netherlands and the Nordic countries, in addition to the EEX market of Great Britain, France and Germany. Finally, the EEX market of Spain, the OMIP market of Spain and Portugal and the NASDAQ market of the Nordic countries registered negative balances between the close of Friday, March 6, and Friday, March 13.

In the futures for next year there was a general decrease in all the markets analysed in AleaSoft. The declines range from €0.10/MWh of the EEX market of Great Britain, which represents 0.2%, to €1.71/MWh of the EEX market of Italy, which accounted for 3.4%. In percentage terms, the greatest drop was in the ICE market of the Nordic countries, with a 4.2% difference compared to the settlement of Friday, March 6.

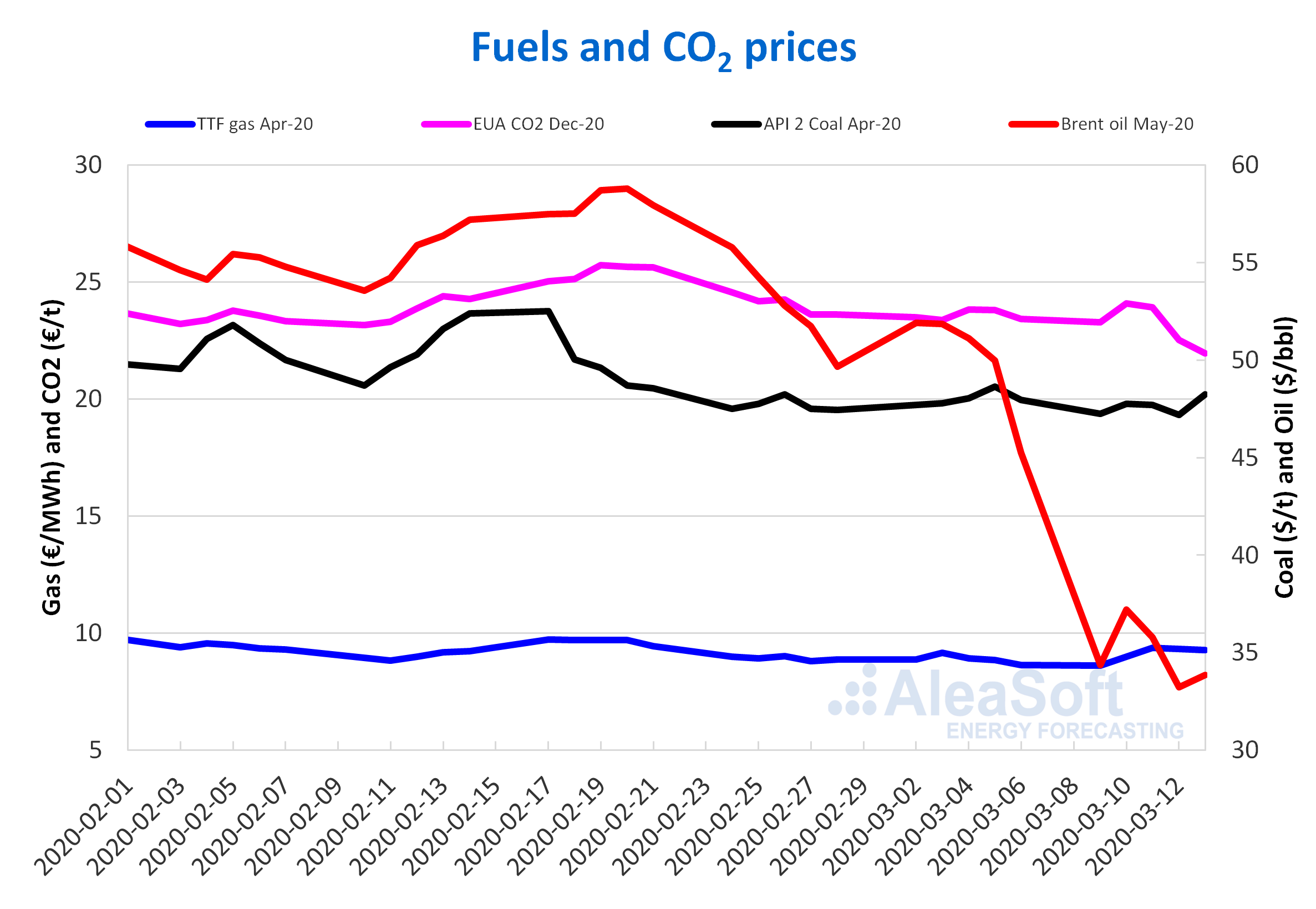

Brent, fuels and CO2

The Brent oil futures prices for the month of May 2020 in the ICE market started last week, of Monday, March 9, with a settlement price of $34.36/bbl, 24% lower than the price of the previous Friday and 34% lower than that of Monday, March 2. On Tuesday, the prices recovered by rising 8.3%, but declined again on Wednesday and Thursday until a settlement price of $33.22/bbl was registered on Thursday, representing a new historical low for the last four years. On Friday, March 13, the prices recovered to $33.85/bbl, this settlement price being 25% lower than that of Friday of the previous week. But, during the session of this Monday, March 16, prices were registered below 30$/bbl.

The effects on the economy of the expansion of the coronavirus worldwide are affecting the Brent oil futures prices. The containment measures against the coronavirus that are being implemented in more and more countries and the consequences of these on the economy are affecting the demand. This was in addition to the announcement of the drop in prices by Saudi Arabia in response to Russia’s refusal to agree to further cuts in the production of OPEC+ countries with the aim of containing the drop in prices due to the fall of the demand caused by the coronavirus. Given the prospects of declines in demand and the intentions of some oil countries to significantly increase their production from April, the prices could continue to decline.

The TTF gas futures in the ICE market for the month of April 2020 started last week with a settlement price of €8.63/MWh, €0.02/MWh lower than that of the previous Friday and the lowest of the last two years. But on Tuesday and Wednesday, the prices rose and the settlement price of Wednesday, March 11, was €9.37/MWh, the highest so far this month. In contrast, on Thursday and Friday prices fell slightly. Despite this, the settlement price of Friday, March 13, was €9.28/MWh, 7.4% higher than that of Friday, March 6.

Regarding the TTF gas in the spot market, the lowest index price since the first half of October 2019, of €8.70/MWh, was registered on Tuesday, March 10. Subsequently, an upward trend began. As a consequence, the index price for this past weekend was €9.46/MWh, 5.8% higher than that of the previous weekend. The index price for this Monday, March 16, of €9.56/MWh, is the highest so far this month.

The increases registered in gas prices are related to the weather conditions that temporarily lead to greater gas consumption for electricity generation. However, the high levels of supply and the expansion of the coronavirus will limit these increases.

On the other hand, the settlement prices of the API 2 coal futures in the ICE market for the month of April 2020, the first four days of last week, remained around $47.48/t, with values ranging from $47.20/t on Thursday, March 12, to $47.75/t on Tuesday, March 10. Thursday’s settlement price, in addition to being the lowest for the week, was also the lowest in the last two years. However, on Friday, March 13, there was a rise of 2.2% and the settlement price was $48.25/t, the highest of last week.

Source: Prepared by AleaSoft using data from ICE and EEX.

Influence of the coronavirus on the demand and the electricity markets

At AleaSoft, the medium and long term forecasts are being updated with more pessimistic GDP growth scenarios taking into account the effects that the measures being taken to contain the coronavirus are expected to have on the economy. In addition, in the coming days, news will be published analysing the impact of this pandemic on the demand and the European electricity markets. On the other hand, at AleaSoft the Webinar “Influence of the coronavirus on the energy demand and the electricity markets in Europe” is being organised for next April 16, where an analysis of gas and Brent prices will be carried out for the main European electricity markets and the future prospects.

Source: AleaSoft Energy Forecasting