AleaSoft Energy Forecasting, February 23, 2024. Activity in the battery market in Spain is frenetic and investor appetite is high. Although current regulation is considered sufficient for battery projects, there are challenges in obtaining local and regional permits due to the lack of experience in energy storage projects. The expected capacity market is the missing piece of the revenue stack for financial institutions to be willing to provide non‑recourse financing for battery projects.

The 41st edition of the monthly webinar series organized by AleaSoft Energy Forecasting was held on February 15. On this occasion, in addition to the usual review of European energy markets and the evolution of futures markets, the event featured the participation of Tomás García, Senior Director, Energy & Infrastructure Advisory at JLL, who analyzed the context and market trends of battery energy storage systems in Spain. The recording of the webinar can be requested on the AleaSoft Energy Forecasting website.

NECP objectives for batteries

The publication of the Integrated National Energy and Climate Plan (NECP) in 2021 set a target of 2.5 GW of batteries by 2030. The draft update of the plan presented in 2023 revised this target sharply upwards to 9.0 GW. For Tomás García, the market will determine how much storage will finally fit or be needed in the Spanish electricity system, but, in his opinion, the installed capacity in 2030 will exceed this 9.0 GW target.

But is there regulation for large-scale battery installations?

One aspect that JLL receives many queries about is the regulation in the Spanish market for the installation of batteries. The answer of Tomás García was very clear on this aspect: the existing regulation is sufficient to allow and make viable battery projects in Spain. Regulation should not be a problem.

However, he qualifies that there is uncertainty and lack of experience, especially on the part of the administrations, when it comes to processing permits for storage projects. Some clarifications and nuances are also necessary and, perhaps, some small modifications of the operation procedures and some technical details. But all of this is due to the lack of background for this type of projects.

Capacity market: key for battery projects

“The capacity market is not there yet, but it is expected”, said Tomás García. The Spanish government’s latest proposal is being reviewed by the European Union’s competition authorities. The outlook is to be able to publish a new draft in the summer of 2024 and to be able to hold the first capacity auctions in 2025.

This market is a key market for the implementation of batteries in Spain. “It will improve the business case” as it will provide a fixed and secure long‑term income, which will improve the conditions for obtaining non‑recourse financing for battery projects.

Battery market trends in Spain: a lot of development activity and investor appetite

Tomás García commented that they are seeing “frenetic and very intense activity” in battery project development in the last two years. Much of this activity is coming from small developers trying to position themselves in a growing market. There are already many projects with grid connection points and land already acquired or contracted, and some could reach the ready‑to‑build status as early as this year.

The most important challenges that the projects are currently facing are obtaining permits at local and regional level, due to the lack of experience in the processing of this type of projects. This lack of experience comes from both the administrations and the developers.

In terms of project transactions, they are starting to see the first operations. What they are seeing is a lot of appetite from both local and international investors, especially from other markets, such as the United Kingdom, with a much more mature battery market. The investor appetite is so great that many investors are willing to invest in green field projects, assuming the risk of development.

As for financing, debt providers are interested in battery projects, because they see that it is a very growing market, but they consider that the conditions are not yet in place to apply non‑recourse financing to these projects. In this regard, during the webinar, the importance of having reliable long‑term price forecasts for a robust financial model was highlighted. For a type of asset such as batteries, simulations of hourly prices in the long‑term allow estimating project revenues and sizing it appropriately for possible operating strategies.

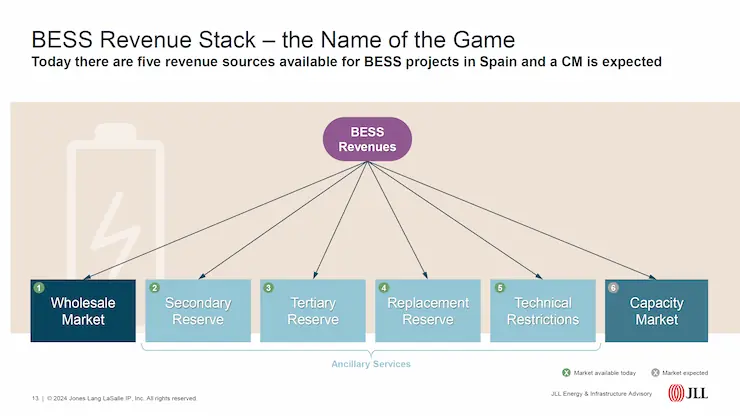

How to reduce uncertainties in the battery revenue stack?

Uncertainty in the revenues that battery facilities will receive during their lifetime is the main obstacle to get non‑recourse financing. According to Tomás García, the uncertainties in the revenue stack for battery projects have three dimensions.

Uncertainty in the level of revenues, the composition of the revenue stack and how it will evolve over the life of the projects have a direct impact on the rate of return (IRR) of the project. In this regard, long‑term hourly price simulations allow estimating revenues from price arbitrage in the wholesale markets and from the participation in the ancillary services in the long term. But, until the capacity market is completely defined (term, de‑rating factors…), it will not be possible to complete the estimation of all pieces of the revenue stack.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

The next edition of the monthly webinar series organized by AleaSoft Energy Forecasting will take place on Thursday, March 14. On this occasion, EY will participate for the fourth consecutive year in this webinar series. In addition to the usual review of the energy markets, the regulation of renewable energy in Spain and its prospects, the financing of renewable energy projects, PPA, portfolio valuation and green hydrogen auctions will be analyzed.

Source: AleaSoft Energy Forecasting.