AleaSoft Energy Forecasting, February 19, 2024. In the third week of February, European electricity market prices remained stable, most of them with averages below €70/MWh. The MIBEL market registered the lowest averages for the second week in a row. Photovoltaic energy registered the highest daily production in history for a February month in Spain, Portugal and Italy. Gas and CO2 futures continued to fall and registered settlement prices not reached since June 2023 and October 2021, respectively.

Solar photovoltaic, solar thermoelectric and wind energy production

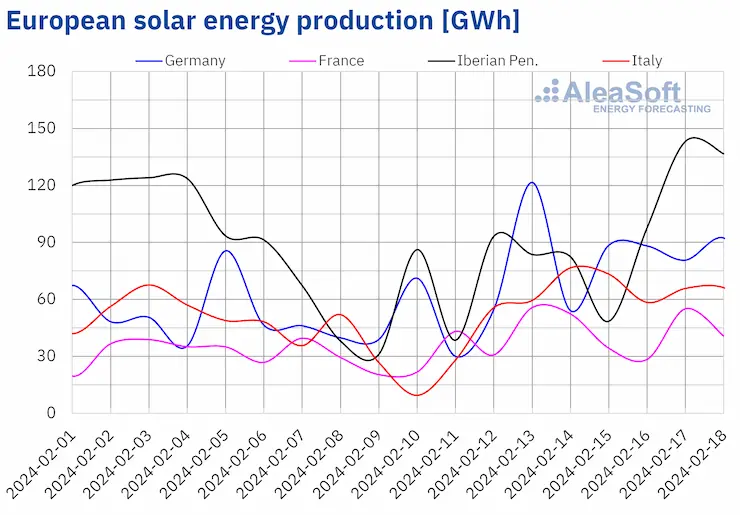

In the week of February 12, solar energy production increased in all major European electricity markets, reversing the downward trend of the previous week, in line with the forecasts done by AleaSoft Energy Forecasting at the beginning of that week. Increases ranged from 38% in France to 83% in Italy.

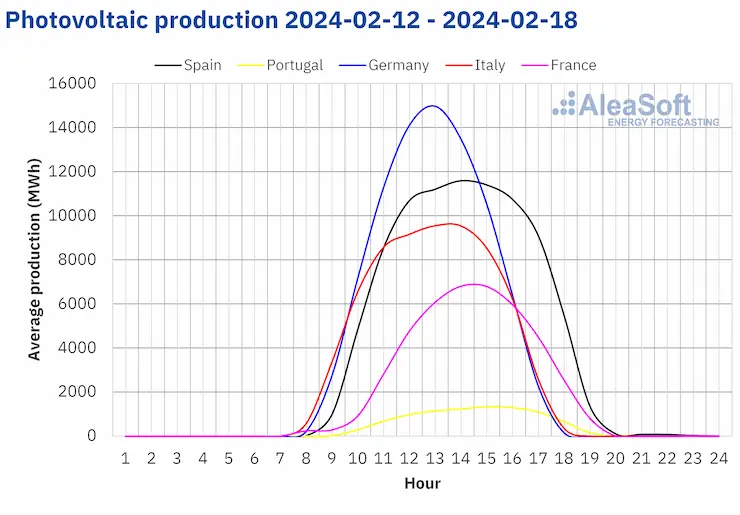

With longer days and more daylight hours, photovoltaic energy production in Southern Europe and France returned to levels last seen in the first half of October. On February 17, for example, the Spanish market generated 118 GWh, the highest value since October 11. This production is also the highest ever registered in a February month in Spain. Portugal generated 13 GWh on February 18, which is also the highest value since the beginning of October and the highest for a February month in this market. Italy reached the highest solar photovoltaic energy production for a February month in its history, 77 GWh, on February 14, which is also a level of production not registered since October 2023. France produced 56 GWh of solar energy on February 13, which is the highest value since mid‑October.

For the week of February 19, according to AleaSoft Energy Forecasting’s solar energy production forecasts, the upward trend will continue in the Spanish and German markets, but it will reverse in the Italian market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

In contrast to solar energy production, wind energy production decreased in the week of February 12 in all major European electricity markets compared to the previous week. The German market fell for the third consecutive week, by 32%. In the other markets, declines ranged from 53% in Italy to 26% in Spain, after the increases of the previous week.

For the week of February 19, AleaSoft Energy Forecasting’s wind energy production forecasts indicate that the downward trend will reverse and wind energy production will increase in Germany, France, Italy and the Iberian Peninsula.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

In the week of February 12, electricity demand fell in all major European electricity markets compared to the previous week. The downward trend of previous weeks continued in the French market, where demand fell for the fifth consecutive week, this time by 3.9%. The German and Italian markets registered declines for the fourth consecutive week, with decreases of 4.1% and 2.0% in each case. For the rest of the markets, declines ranged from 9.4% in Portugal, which celebrated Tuesday of Carnival on February 13, to 1.6% in Belgium.

The drop in demand was related to the increase in average temperatures. During the week, average temperatures increased from 0.8 °C to 2.1 °C in most European markets. Average temperatures only fell in Italy, by 1.0 °C.

For the week of February 19, according to AleaSoft Energy Forecasting’s demand forecasts, the downward trend will reverse and demand will increase in Germany, France, Spain, Belgium, Portugal, Great Britain and the Netherlands. However, in Italy, demand will fall again.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

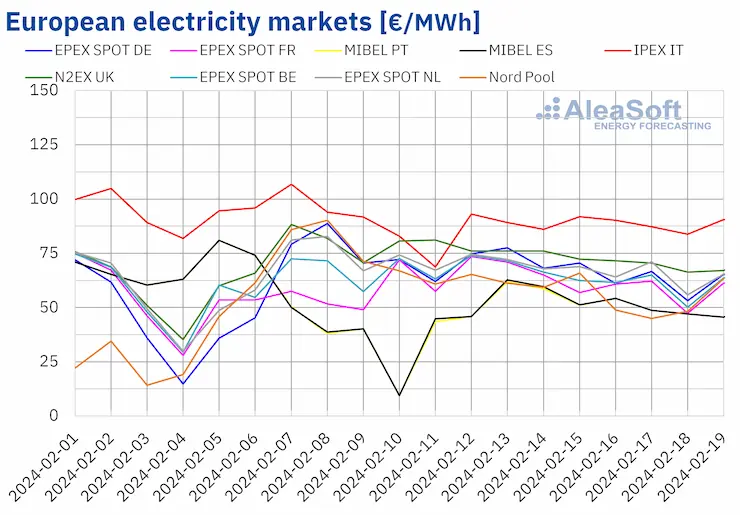

During the week of February 12, average prices of most major European electricity markets continued stable, reversing their trend again compared to the previous week. However, the EPEX SPOT market of Germany maintained its upward trend, with an increase of 4.0%. The EPEX SPOT market of Belgium and the IPEX market of Italy did not change their downward trend either, which registered decreases of 0.2% and 2.1%, respectively. Among the markets whose performance changed compared to the previous week, the MIBEL market of Spain and Portugal and the French market rose by 9.2% and 11%, respectively. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices fell between 1.0% in the EPEX SPOT market of the Netherlands and 18% in the Nord Pool market of the Nordic countries.

In the third week of February, weekly averages continued below €70/MWh in most analyzed European electricity markets. The exceptions were the IPEX market of Italy, with an average of €88.75/MWh, and the N2EX market of the United Kingdom, with a price of €72.67/MWh. In contrast, the Portuguese and Spanish markets registered the lowest weekly prices for the second week in a row, €52.51/MWh and €52.76/MWh, respectively. In the rest of the analyzed markets, prices ranged from €56.23/MWh in the Nordic market to €67.75/MWh in the Dutch market.

During the week of February 12, the fall in the average price of gas and CO2 emission rights, the drop in demand and the increase in solar energy production led to lower prices in most analyzed European electricity markets. However, the fall in wind energy production contributed to higher prices in the German, French and Iberian markets.

AleaSoft Energy Forecasting’s price forecasts indicate that in the fourth week of February European electricity market prices might fall. Increased wind energy production will lead to this behavior. Increased solar energy production will also contribute to lower prices in markets such as Germany and Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

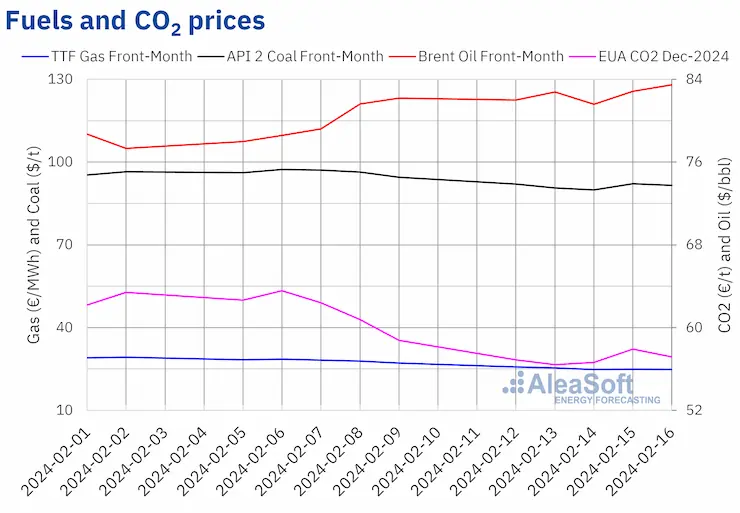

In the third week of February, settlement prices of Brent oil futures for the Front‑Month in the ICE market were above $80/bbl. These futures reached their weekly minimum settlement price, $81.60/bbl, on Wednesday, February 14. In the later sessions of the week, prices increased. As a result, on Friday, February 16, these futures registered their weekly maximum settlement price, $83.47/bbl. This price was 1.6% higher than the previous Friday and the highest since late January.

Instability in the Middle East continued to exert its upward influence on the evolution of Brent oil futures prices in the third week of February. On the other hand, while OPEC+ maintained its demand growth forecasts for 2024, the International Energy Agency corrected its forecasts downwards. Despite this decline in the forecasts, Brent oil futures prices remained above $80/bbl.

As for settlement prices of TTF gas futures in the ICE market for the Front‑Month, in the third week of February they continued the downward trend of the previous week. As a result, on Friday, February 16, these futures reached their weekly minimum settlement price, €24.82/MWh. According to data analyzed at AleaSoft Energy Forecasting, this settlement price was 8.5% lower than the previous Friday and the lowest since early June 2023.

Abundant supply and high European reserve levels offset the effect of gas supply disruptions from Norway in the third week of February. Forecasts of above‑normal temperatures and increases in wind energy production also exerted a downward influence on TTF gas futures prices during that week.

As for the settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2024, during the third week of February, they remained below €60/t. These futures continued the downward trend of the previous week to reach their weekly minimum settlement price, €56.43/t, on Tuesday, February 13. According to data analyzed at AleaSoft Energy Forecasting, this settlement price was 11% lower than the previous Tuesday and the lowest since October 2021. On Wednesday and Thursday prices recovered slightly, but on Friday, February 16, they declined again. On that day, the settlement price was €57.17/t, 2.7% lower than the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe, the energy storage and the renewable energy projects financing

On Thursday, February 15, AleaSoft Energy Forecasting and AleaGreen held their second webinar of 2024, year of the 25th anniversary of the foundation of AleaSoft Energy Forecasting. On this occasion, JLL participated for the third time in the monthly webinar series. The webinar analyzed the evolution and prospects of European energy markets, the context and trends of the energy storage market in Spain, the revenue stack and technical aspects of battery energy storage systems, as well as financing considerations.

The next webinar in the series will take place on March 14. This webinar will feature guest speakers from EY for the fourth year in a row. The content of the webinar will include the prospects for European energy markets, regulation, financing of renewable energy projects, PPA, self‑consumption, portfolio valuation, the green hydrogen auction and the Innovation fund.

Source: AleaSoft Energy Forecasting.