AleaSoft, May 14, 2021. The current situation of high prices in the markets of energy, gas, CO2, electricity… causes concern among the large consumers and even among the domestic consumers. But it also has an impact on the development of the renewable energies and the financing of new projects. The analysis of the current situation and the vision on the future of the European energy system were the main topics discussed in the May webinar of AleaSoft.

Last Thursday, May 13, the first part of a series of webinars organised by AleaSoft was held with the intention of analysing the behaviour and the current situation of the energy markets in Europe, highlighting the importance of the price forecasting in the management of the purchase and sale of energy and describing the long‑term vision of the future for the European energy system. The webinar, entitled “Prospects for the energy markets in Europe. The price forecasting and its importance for the development of the renewable energies. Vision of the future”, had the participation of the AleaSoft’s experts Oriol Saltó i Bauzà, Head of Data Analysis and Modeling, Antonio Delgado Rigal, CEO, and Alejandro Delgado, CTO. The recording of the session can be requested at this link.

A heart‑stopping spring

As soon as the webinar began, Antonio Delgado Rigal described the current situation of the energy markets as “a heart‑stopping spring”. And no wonder, the upward trend in practically all markets is creating concern for both consumers and investors in renewable energies. The concern for the large consumers and electrointensives is clear, at higher electricity prices, the more their production costs increase and the less competitive they are. The high electricity futures prices make it very expensive to cover their consumption for the next quarters and for the year 2022. While, waiting to buy the energy in the spot market is very risky seeing the upward trend of all markets.

For the renewable energies the situation is not entirely favourable either. In principle, high energy prices mean more income from the sale of the electricity. However, the situation of tension and instability that is being experienced makes it more difficult to find good conditions for the new projects financing.

The upward trend of the markets

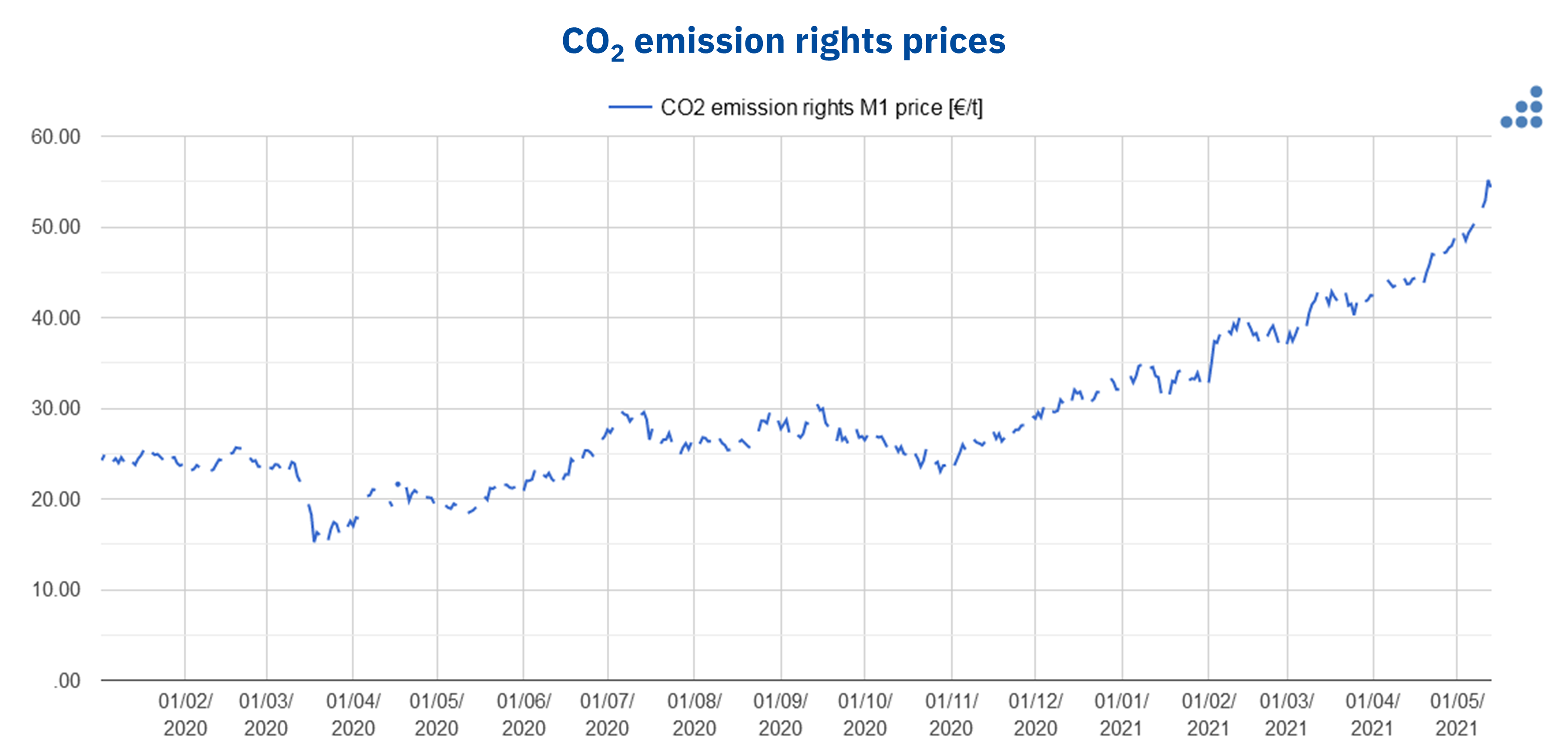

The star market that is grabbing the most headlines is that of the CO2 emission rights. The upward trend of their prices, practically without truce since October 2020, registered a notable acceleration in recent weeks, registering historical maximum prices beyond €55 per ton emitted. During the webinar, it was analysed which factors can make us think that this behaviour is structural, and that therefore it will continue with higher prices, and those that point to a temporary situation.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from EEX.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from EEX.

The TTF gas prices are following a similar trend and, although they are not at historical highs, they are reaching values beyond €26/MWh, prices that were not registered since the last episode of high gas prices in November 2018.

The rise in CO2 and gas prices is pushing the electricity futures prices up. The most affected products are those with the closest expiration dates, for the months of the third and fourth quarters of 2021 and the annual product for 2022. The latter is already close to €68/MWh in the OMIP market for Spain, annual prices never seen in the Spanish electricity market.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from OMIP.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from OMIP.

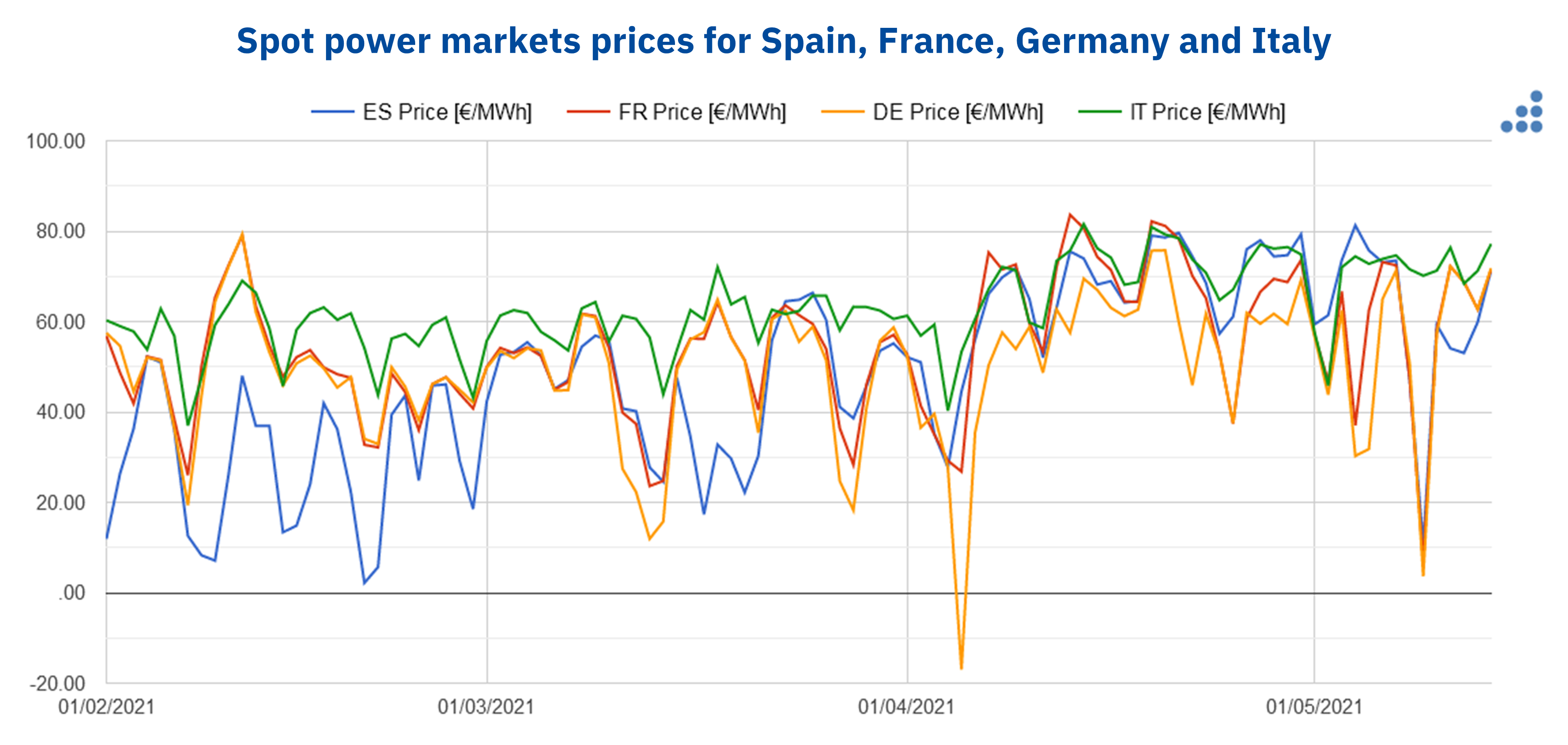

The spot electricity markets are also noticing this upward pressure of the gas and CO2 prices and relatively high prices for April are being registered. However, in the spot markets, the variability of the renewable energies, especially the wind energy, is causing significant fluctuations in prices, with values close to zero for the Spanish market and negative values for other markets.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from OMIE, EPEX SPOT and IPEX.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from OMIE, EPEX SPOT and IPEX.

A message of optimism and calm

Despite the current situation of tension and instability, from AleaSoft a message of “calm for the present and optimism for the future” was sent. As explained, the AleaSoft’s models show that the current prices are above the market balance prices and that the situation should be reversed at the mid‑ and long‑term.

They also highlighted the importance of having a strategy for the purchase or sale of energy, planned based on coherent and reliable markets prices forecasts in all horizons, which allows mitigating the market prices risk associated with situations such as the current one.

The second part of the webinar: the price forecasting for the large consumers, the decarbonisation of the industry and the role of the green hydrogen

As mentioned at the beginning, this webinar was the first part of a series that, for now, has a second part scheduled for June 10. In this new session, how the energy markets evolved so far will be analysed and the importance of the price forecasting will be discussed, this time focusing more on the large consumers. In the part of the vision of the future, it will focus on the decarbonisation of the industrial sector and the role that the green hydrogen will play in the energy transition.

Source: AleaSoft Energy Forecasting.