AleaSoft, May 12, 2021. The European energy markets are facing the spring with great rises. The escalation in CO2 and gas prices pushed the electricity futures prices for next year to record highs. On the other hand, the annual products that are being traded in the OMIP market in the longer term have low prices. The electricity markets are in balance and in the mid‑term they will tend to stabilise.

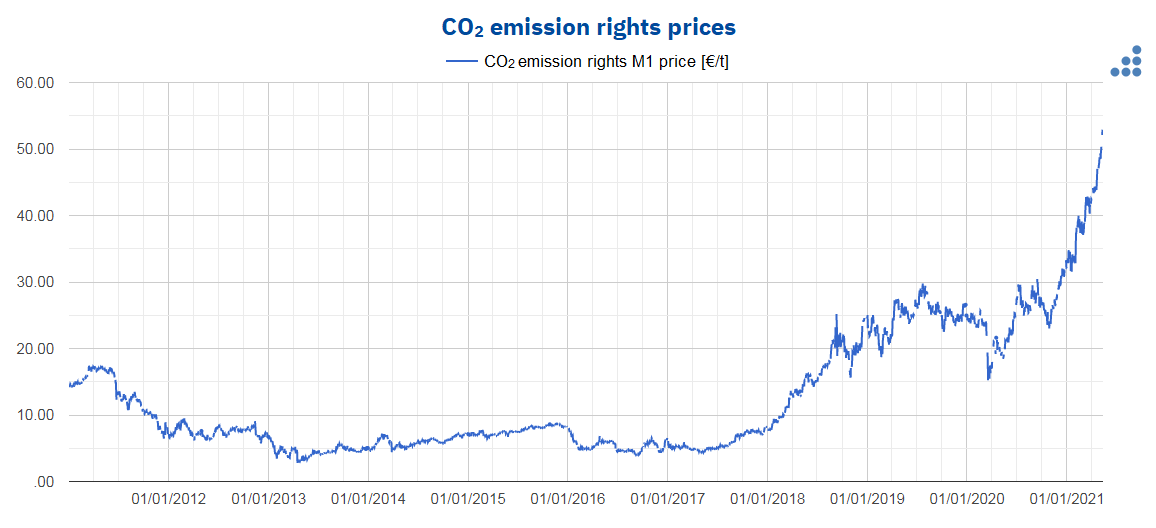

Since the beginning of April there was a general escalation in prices in the European energy markets. Among the most significant increases is that of the CO2 emission rights, which reached historical maximum prices of around €53/t after increasing by more than €10/t with respect to the values at which they were traded at end of March and double compared to those of the beginning of November 2020.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from EEX.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from EEX.

The CO2 emission rights market is a mechanism that was implemented to favour the energy transition. The expectations of an increase in CO2 prices increased after the publication of several articles of investment funds that pointed to the increase in prices in this market in the short term. This caused the agents to maintain their positions and not to sell.

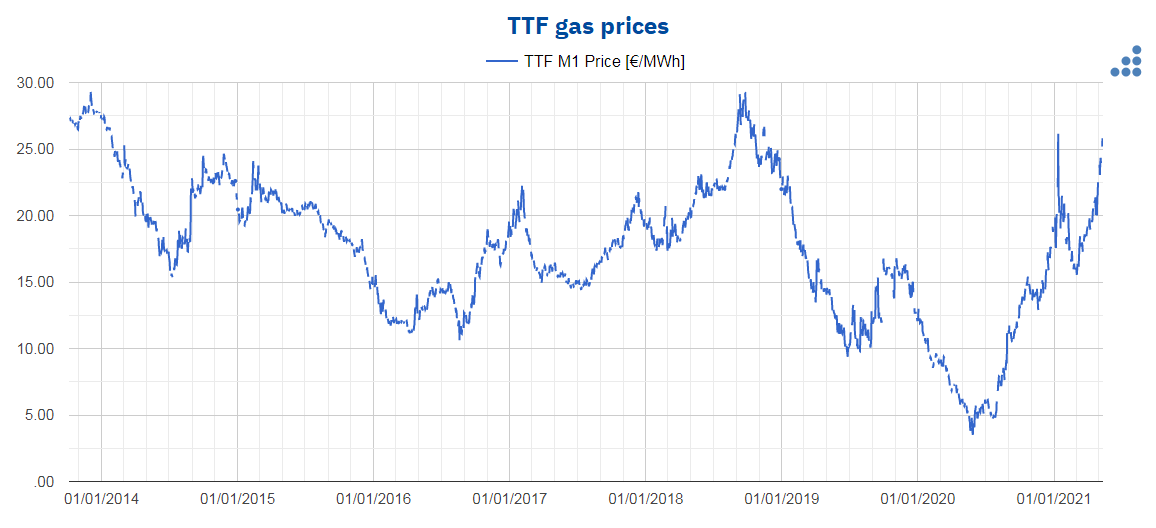

The TTF gas prices rose considerably since the beginning of the second quarter of 2021, around €7/MWh, and currently exceed €25/MWh. These values are double those of the beginning of October 2020 and were not reached since the end of 2018, with the exception of the one‑off increase of January 12 of this year, when it was around €26/MWh during the cold snap in Europe that accompanied the Storm Filomena.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from ICE.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from ICE.

The gas prices were influenced by the low temperatures on the continent, the low levels of the reserves and the increase in demand in China and the increase in gas prices in Asia. In addition, there was a shortage of gas supplies and the supply from Russia is lower than usual. Maintenance work was also carried out in early April on Norway’s main oil and gas fields.

Historical maximum prices in the European electricity markets

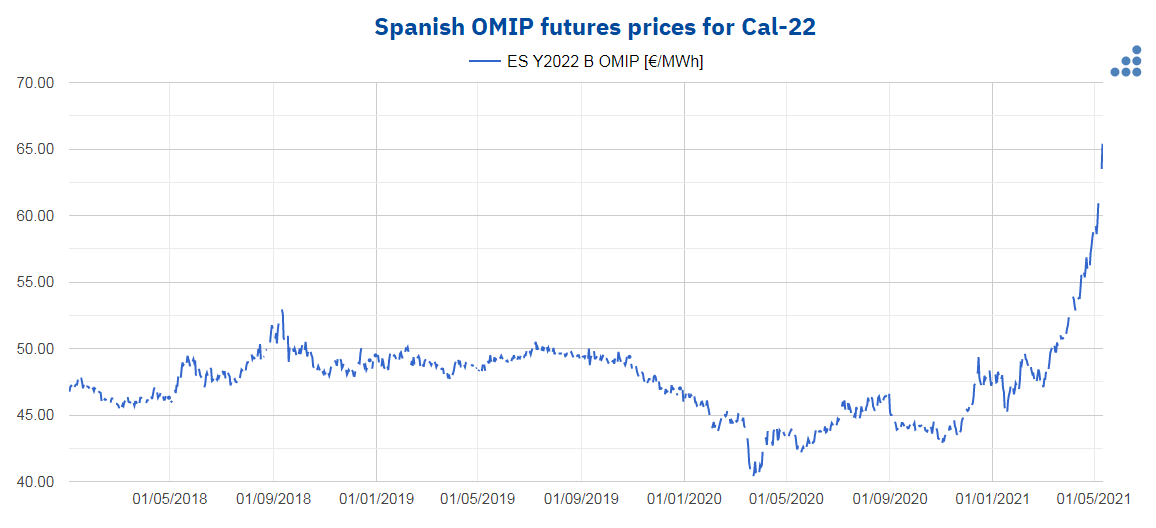

In this context, the electricity futures for Cal‑22 reacted with increases in the range of €8/MWh to €14/MWh between the sessions of March 31 and May 11 of this year, reaching historical maximum prices that exceed €64/MWh in most markets and €72/MWh in some cases, such as the EEX market of Italy. This situation is generating concern among the large consumers and electrointensives who see their competitiveness in danger due to the increase in the price of one of their main supplies.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from OMIP.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from OMIP.

In the European spot electricity markets, historical maximum prices were also reached in the spring of 2021. The monthly average for April was the highest since October 2018 in the Iberian MIBEL market, in addition to being the month of April with the highest price of all its history. Likewise, last April was the highest of the months of April since at least 2013 in the N2EX market of the United Kingdom, the EPEX SPOT market of Germany, France, Belgium and the Netherlands and the IPEX market of Italy.

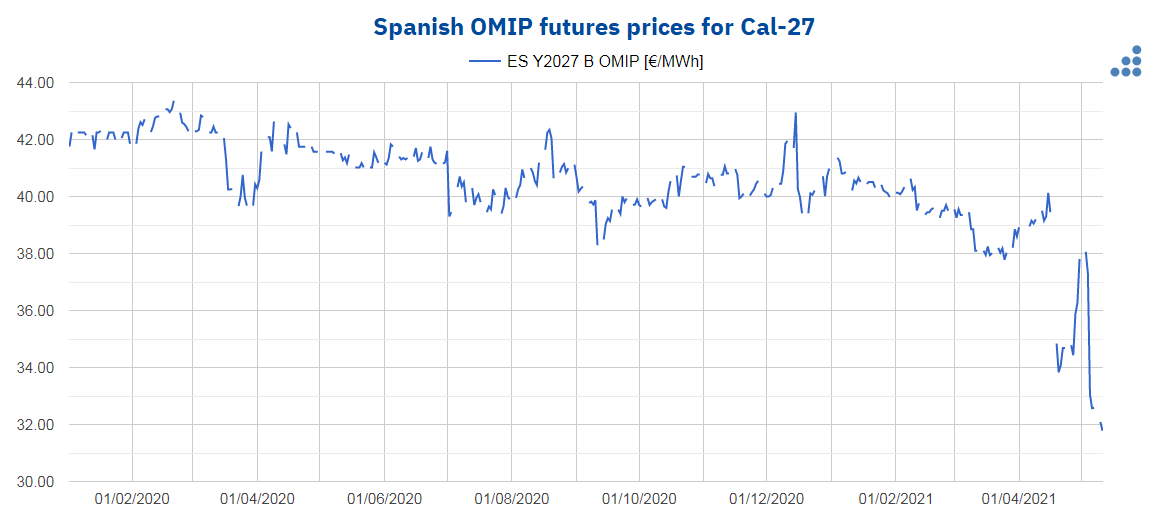

The other side of the story: low prices for the OMIP annual futures starting at Cal‑27

However, in the OMIP market of Spain, the long‑term annual products futures prices, starting at Cal‑27, registered falls in recent weeks. Since mid‑April they fell below €35/MWh, approaching €30/MWh, and for the year 2029 onwards they are even lower than that value. These products so long term have very little liquidity, so they are prone to large fluctuations when a sale or purchase transaction or bilateral contract is registered.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from OMIP.

Source: Prepared by AleaSoft with the Alea Energy DataBase (AleaApp) using data from OMIP.

The electricity markets are in balance

However, if the entire history of the electricity markets is analysed, it can be seen that there were other periods with high or low prices but that the market is in balance. The episodes of high and low prices will continue to occur, but the trend in the mid‑term is towards the stability. In the long term, although the increase in renewable energy capacity raises concerns about the prices cannibalisation, the increase in electricity demand and in the international interconnections, the pumping and the rise of other technologies, such as the electric vehicles, the storage with batteries, the green hydrogen used as a raw material in the industries, as fuel for automobiles or in the seasonal storage, will allow the market to remain in balance.

The importance of the price forecasting for the development of the renewable energies and for the large consumers

At AleaSoft a series of webinars is being organised in which all these topics will be analysed. The first will be held on Thursday, May 13, and will focus on the development of the renewable energies and how to manage the markets prices risk using mid- and long‑term electricity markets prices forecasts. The webinar will convey a message of optimism, away from the more pessimistic vision that the low prices in OMIP beyond 2027 may be transmitting. A vision of the future on the decarbonisation of the transport will also be given. Later, on June 10, an analysis will be made of the prospects and the vision of the future of the energy markets from the point of view of the large consumers and electrointensives, who are among the most affected by the high prices of the markets. The webinar will propose strategies for purchasing energy based on the diversification that allow them to mitigate the effects of the periods of high prices. In addition, on this occasion the AleaSoft‘s vision of the future on the decarbonisation of the industry and the role of the green hydrogen will be explained.