AleaSoft, December 21, 2020. After the price peaks in the European electricity markets during the cold snap, they settled down during the week of December 14, while prices in the Iberian market rose after a week with peaks in wind energy production. Moreover, the prices of gas, coal, oil and CO2 emission rights have ended the week with decreases after the bullish rallies that reached highs at the beginning of the week.

Photovoltaic and solar thermal energy production and wind energy production

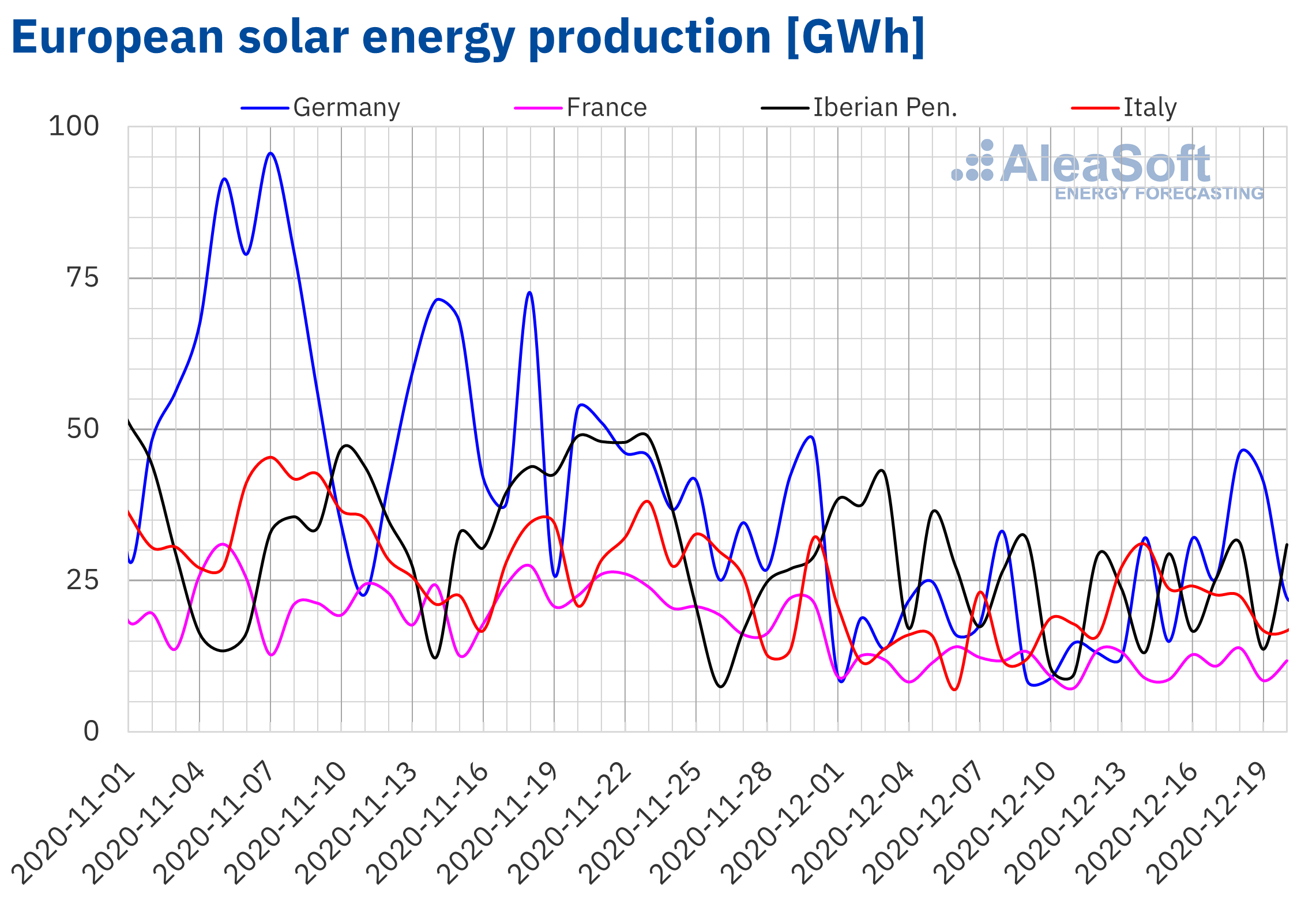

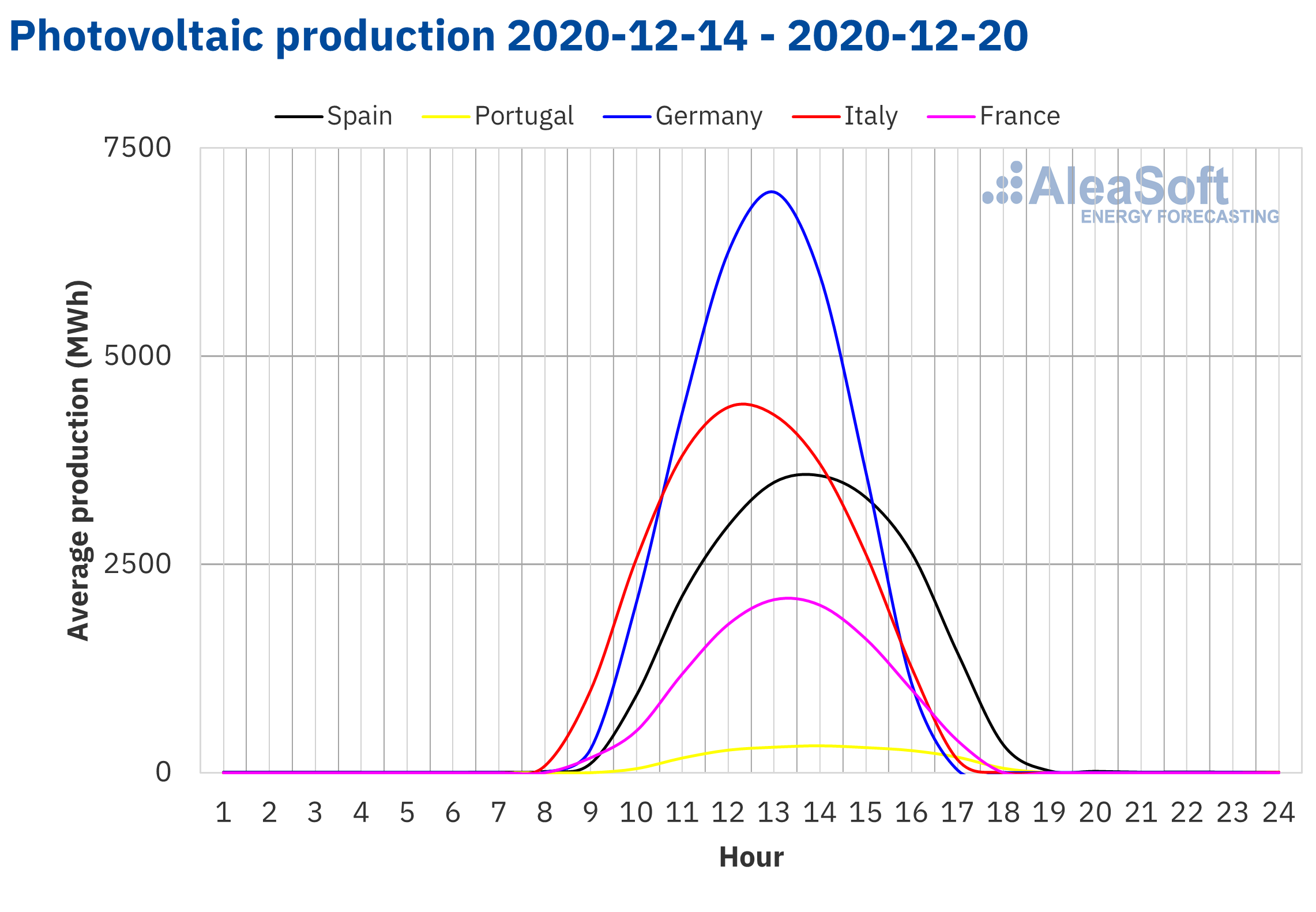

The solar energy production between Monday, December 14 and Sunday, December 20 increased compared to the previous week in most of the markets analysed at AleaSoft. In the German market, production increased by 98%, while in the Italian market it grew by 24% and in the Iberian Peninsula the increase was 7.6%. The exception was the French market where solar production decreased by 6.6% compared to the previous week.

For the fourth week of December, AleaSoft‘s solar energy production forecasting indicates that solar energy production in the Spanish market will increase compared to the third week. On the contrary, in the German and Italian markets a reduction in production is expected.

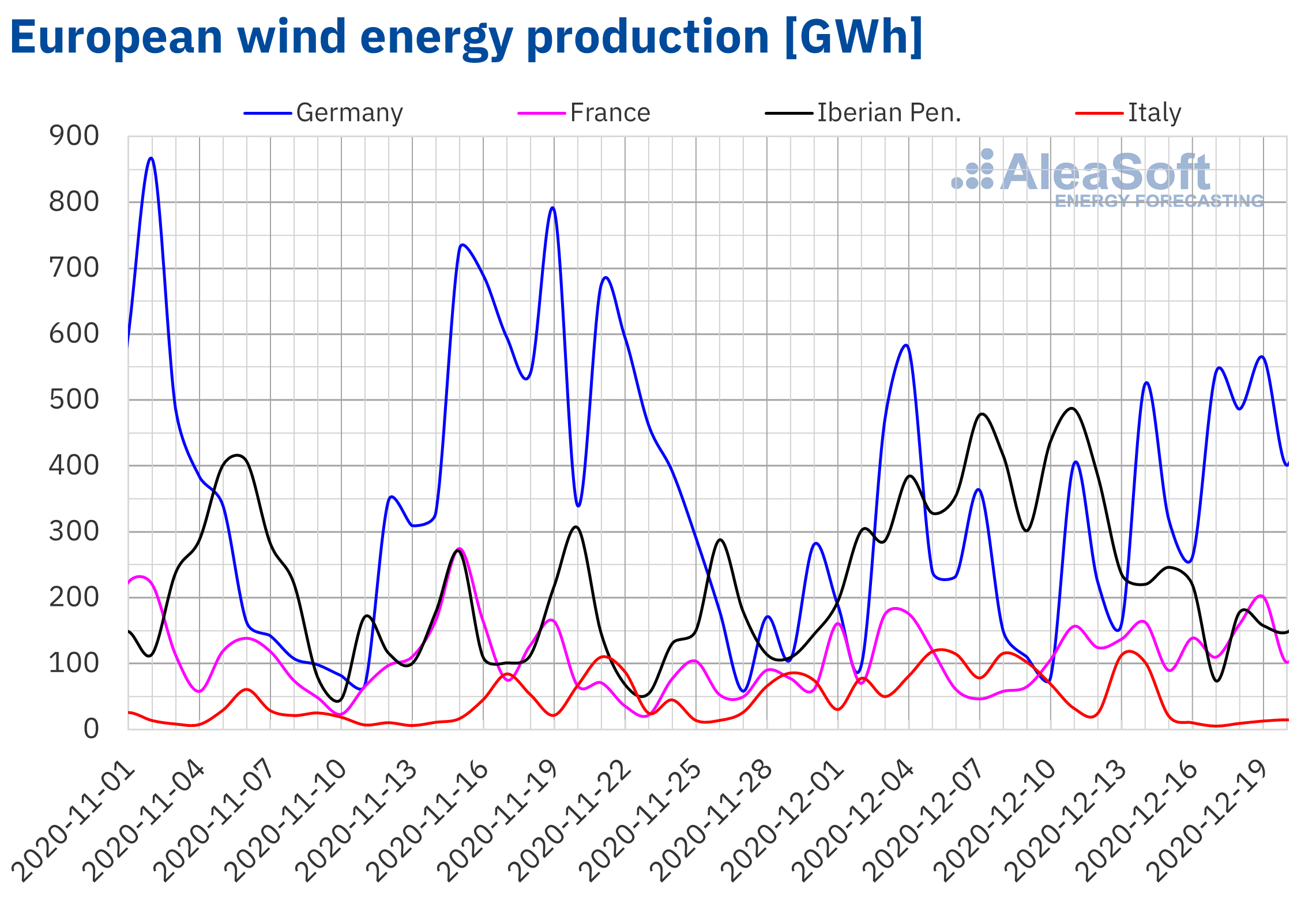

During the week that ended last Sunday, December 20, wind energy production more than doubled in the German market and increased by 39% in the French market compared to the previous week. On the contrary, in the Iberian Peninsula it decreased by 55% and in the Italian market by 67%.

For the end of the week on December 27, AleaSoft‘s wind energy production forecasting indicates an increase in wind energy production in all the markets analysed at AleaSoft except in the Portuguese market, where a reduction in production is expected with this technology compared to the third week of December.

Electricity demand

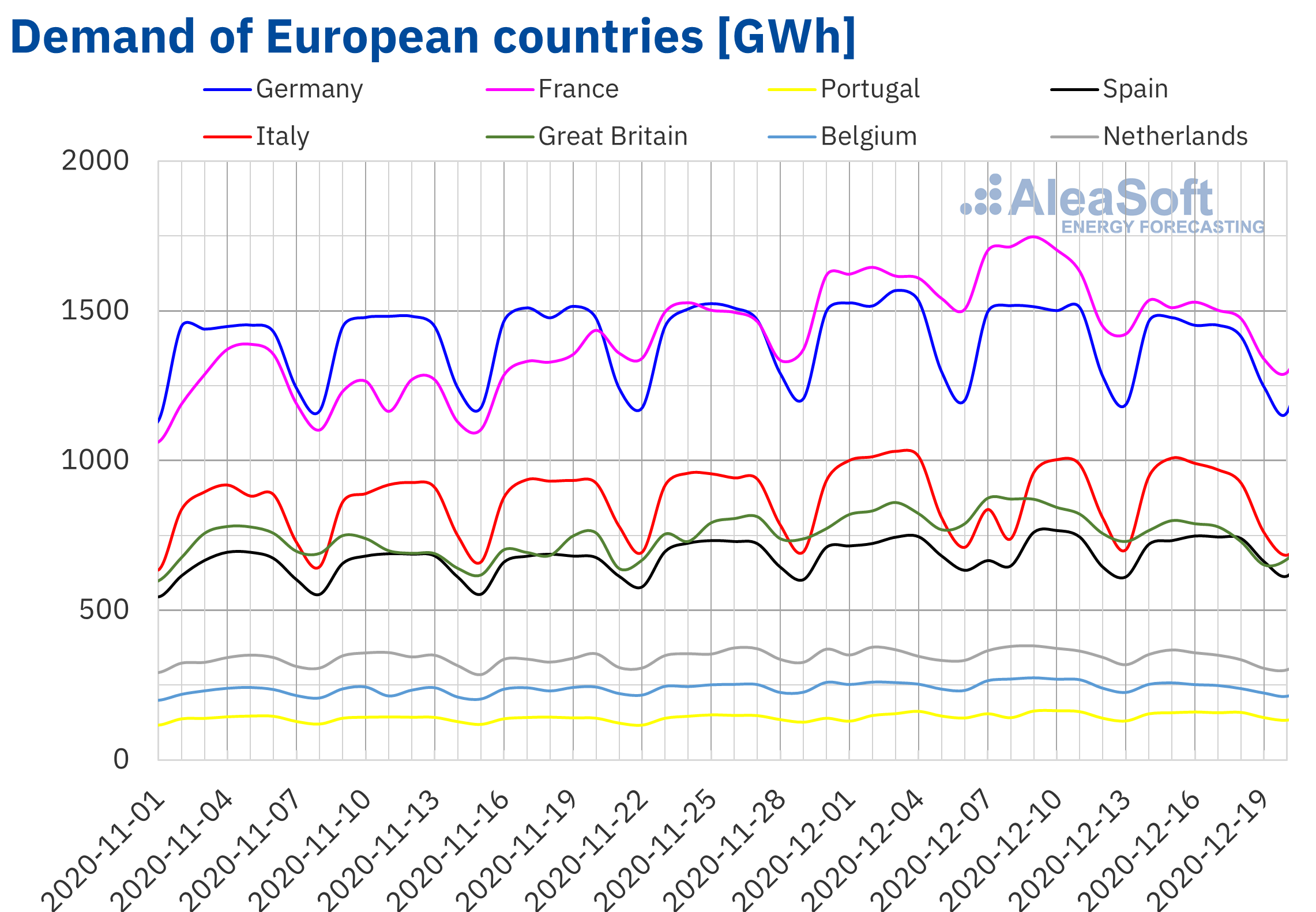

Electricity demand fell during the week of December 14 compared to the previous week, in Germany, France, Great Britain and Belgium, due to the increase in average temperatures that was up to 5 °C in the latter country. In the rest of the markets there were increases in demand of up to 4.0%.

For the week of December 21, drops in average temperatures are expected, which will favour a decrease in demand in the European markets.

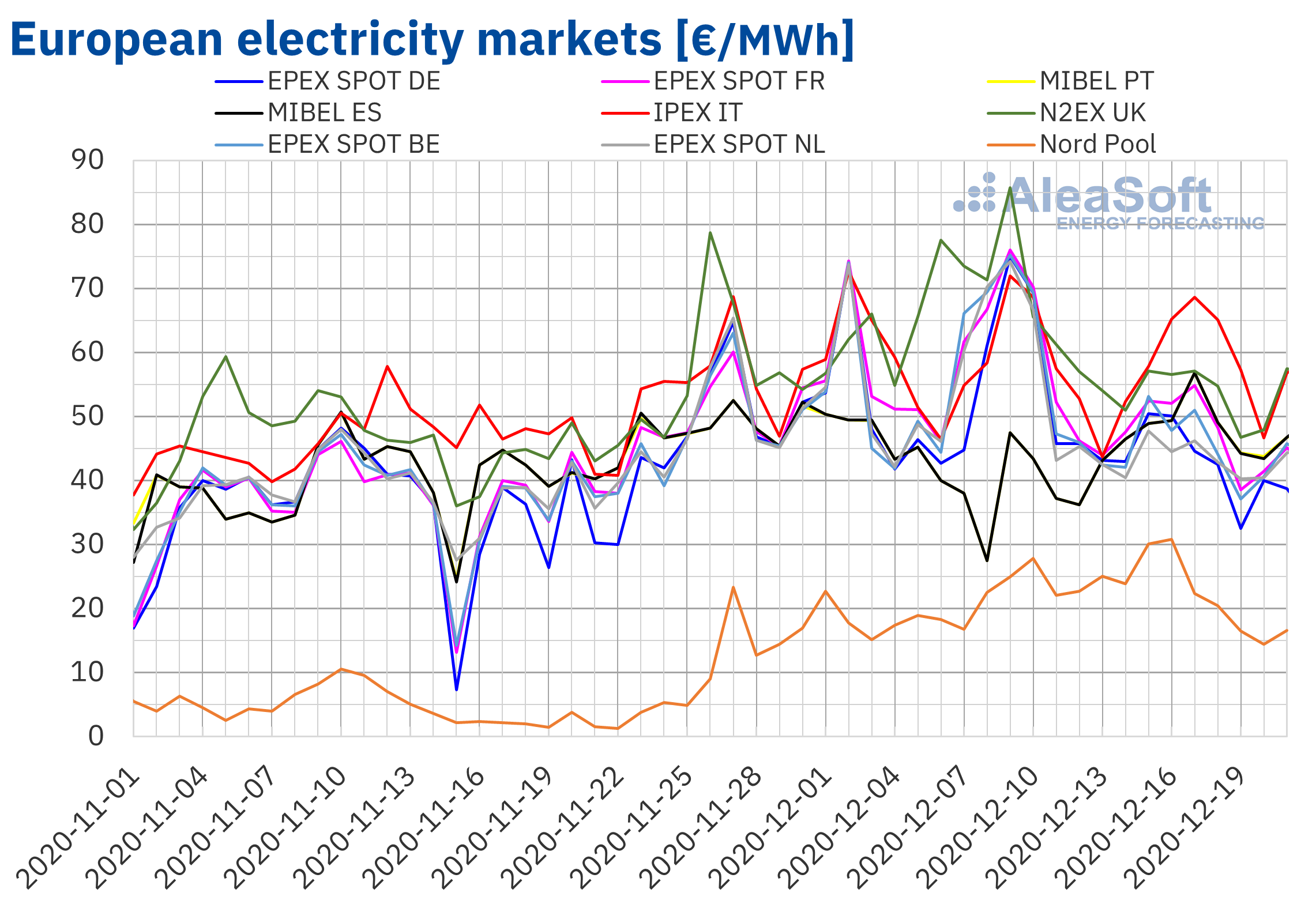

European electricity markets

Prices in the electricity markets of central and northern Europe fell after the records registered during the week of December 7 due to the cold snap that hit the continent. The price drops were around 20% in the EPEX SPOT market of France and Germany and in the British N2EX, while in the EPEX SPOT markets of Belgium and the Netherlands they were around 25%. The recovery of temperatures and the increase in wind and solar energy production were the keys to this relaxation in prices.

In the south of the continent, the situation was the reverse and prices recovered after the peaks in wind energy production during the previous week, of December 7. In the Iberian market MIBEL, prices increased by 25%, while in the Italian market IPEX, they did so by just over 1%.

In the Nord Pool market of the Nordic countries, the average price for the week of December 11 was €22.64/MWh, 2% less than the previous week.

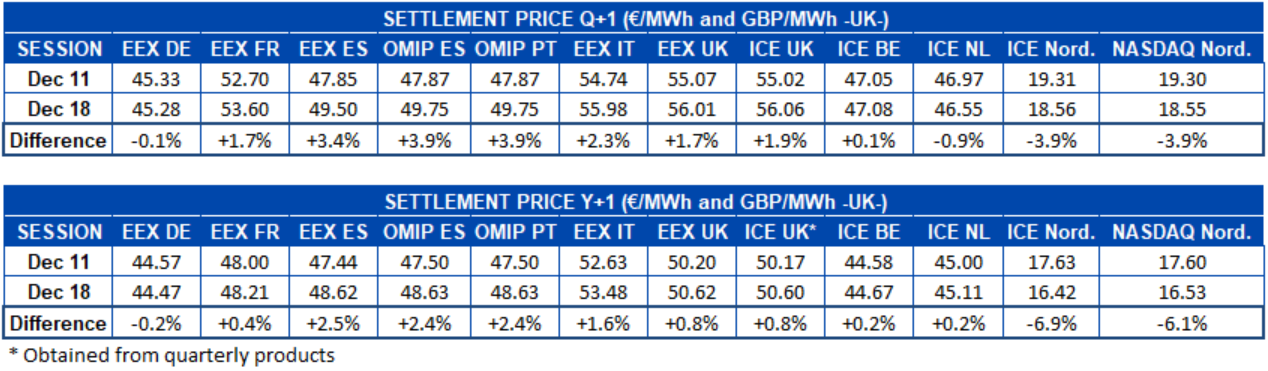

Electricity futures

During the third week of December, the behaviour of the prices for the next quarter in the European electricity futures markets analysed at AleaSoft was heterogeneous, although the upward behaviour predominated. The EEX market of Germany, the ICE market of the Netherlands and the Nordic countries and the NASDAQ market of the Nordic countries were the markets in which there were decreases in price compared to the end of the previous week, on Friday, December 11. In the rest of the markets, the increases were between 0.1% of the ICE market in Belgium and 3.9% of the OMIP market in Spain and Portugal.

Regarding the prices of electricity futures for the year 2021, the behaviour was very similar, a rise in the prices of most of the markets. The Nordic countries, both in the ICE market and in the NASDAQ, were left out, registering falls of 6.9% and 6.1% respectively. It also happened in the EEX market of Germany, with a decrease of 0.2%. The EEX market in Spain was where the largest increases were registered for this product, with a 2.5% increase. The OMIP market in Spain and Portugal followed closely with an increase of 2.4%. In the rest of the markets the increases were between 0.2% and 1.6%.

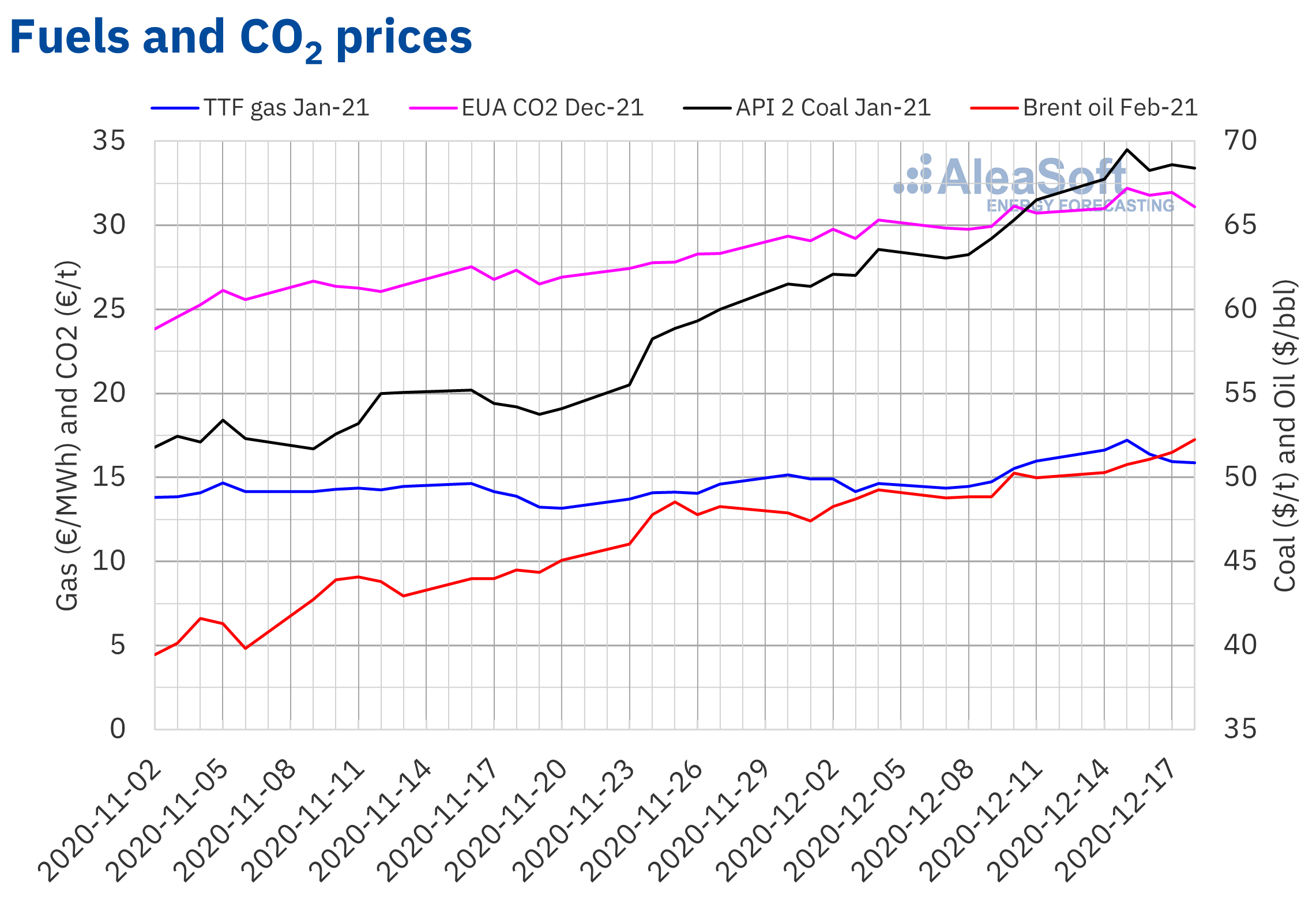

Brent, fuels and CO2

The Brent oil futures prices continued their rally during the week of December 14 to $52.26 per barrel reached on Friday the 18th, a price not registered since the end of February. However, the news of new confinements in some European countries and of the new mutations of the coronavirus are drawing a scenario of uncertainty regarding the consumption of petroleum derivatives in transport. The prices of Monday, December 21, have started to fall, falling beyond $50 per barrel.

The week of December 14 started very optimistic for TTF gas prices, which on Tuesday 15 reached €17.23/MWh. But the prospects for windier weather and warmer temperatures, lower holiday demand and enough reserves for winter slowed the uptrend in futures prices.

In the same way, API 2 coal prices registered a maximum of $69.50 per ton on Tuesday, December 15. But the outlook for coal in the coming years looks very pessimistic due to the global crisis caused by COVID‑19 and the CO2 emission reduction targets that put this fuel in the spotlight of all environmental policies.

The prices of CO2 emission rights also reached a maximum on Tuesday, December 15, with a price of €32.19/t, and the outlook still shows room for new highs to be reached, especially if a good agreement for Brexit is reached. On the other hand, the auctions of emission rights have already been completed for this year 2020, and the first ones in 2021 have been delayed a couple of weeks. This fact, together with the new Phase IV supply restrictions starting in January, should keep prices high for a few weeks.

The future and evolution of the electricity markets in Europe

At AleaSoft, there are multiple reports for the energy sector that include detailed analyses on the evolution of energy markets in Europe and any aspect that may have an influence on their prices. These reports provide a clear vision of the future of the European energy system by providing knowledge, intelligence and opportunities.

The next webinar organised by AleaSoft will be held on January 14 and will feature the participation of speakers from the consulting firm PwC Spain, to analyse the status and vision of the PPA contract market for large consumers, its impacts and requirements, and the need for estimates of future electricity market prices.

Source: AleaSoft Energy Forecasting.