AleaSoft Energy Forecasting, February 5, 2024. In the week of January 29, average prices in most major European electricity markets were similar to the previous week. Solar energy production continued to increase in most markets as the days got longer, while wind energy production was generally lower than the previous week. Demand decreased in almost all markets. CO2 futures continued to decline and gas futures halted the downward trend of recent months.

Solar photovoltaic, solar thermoelectric and wind energy production

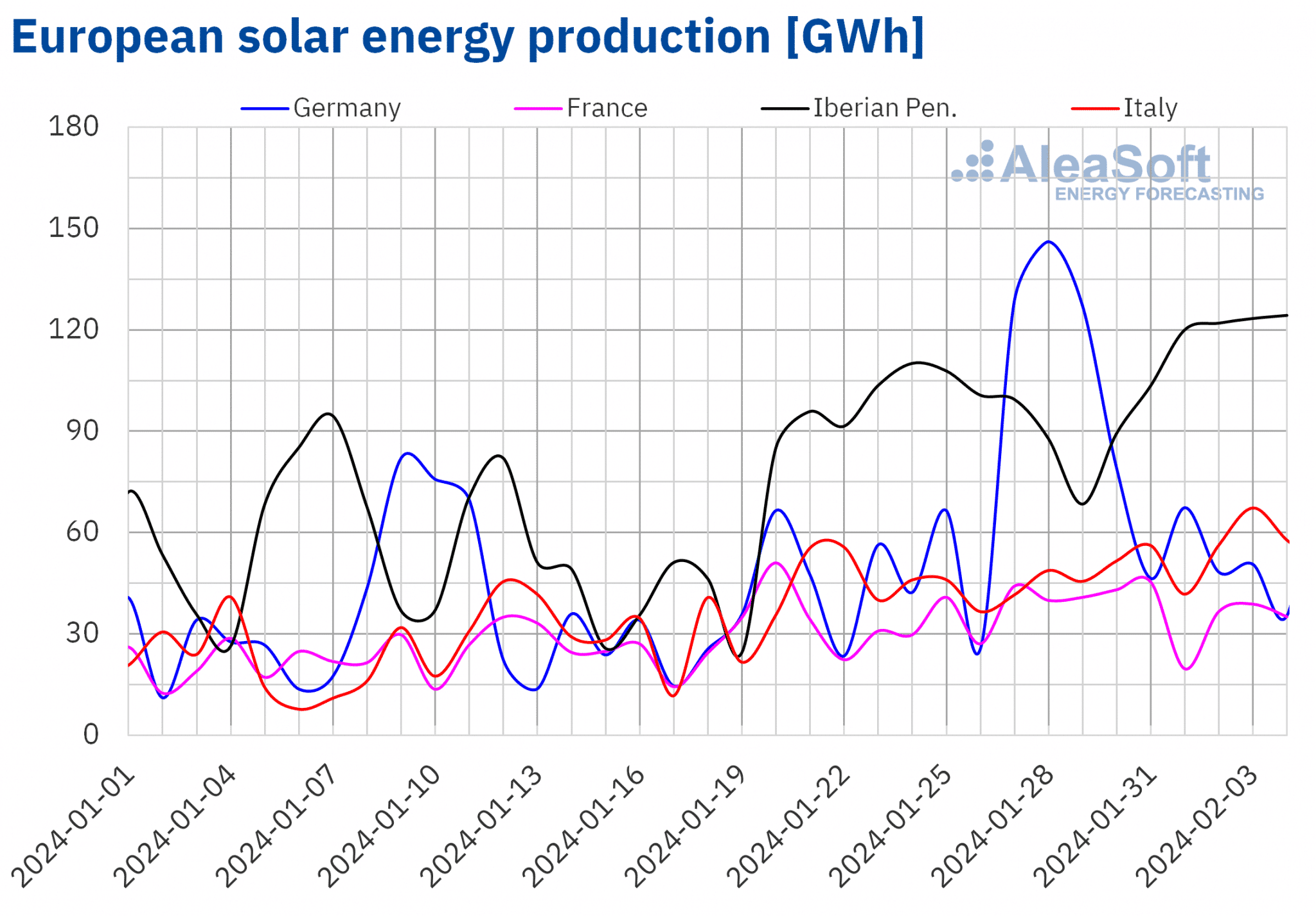

During the week of January 29, solar energy production continued to increase in the main European electricity markets, thanks to longer days. This trend has persisted since the beginning of the year in the Italian and French markets, with week‑on‑week increases of 20% and 10%, respectively, in the aforementioned week. On the Iberian Peninsula, solar energy production increased for the second consecutive week, by 16% in Portugal and 6.3% in Spain. However, the German market was the exception, registering a 7.0% decrease in solar energy production after a significant increase in the previous week.

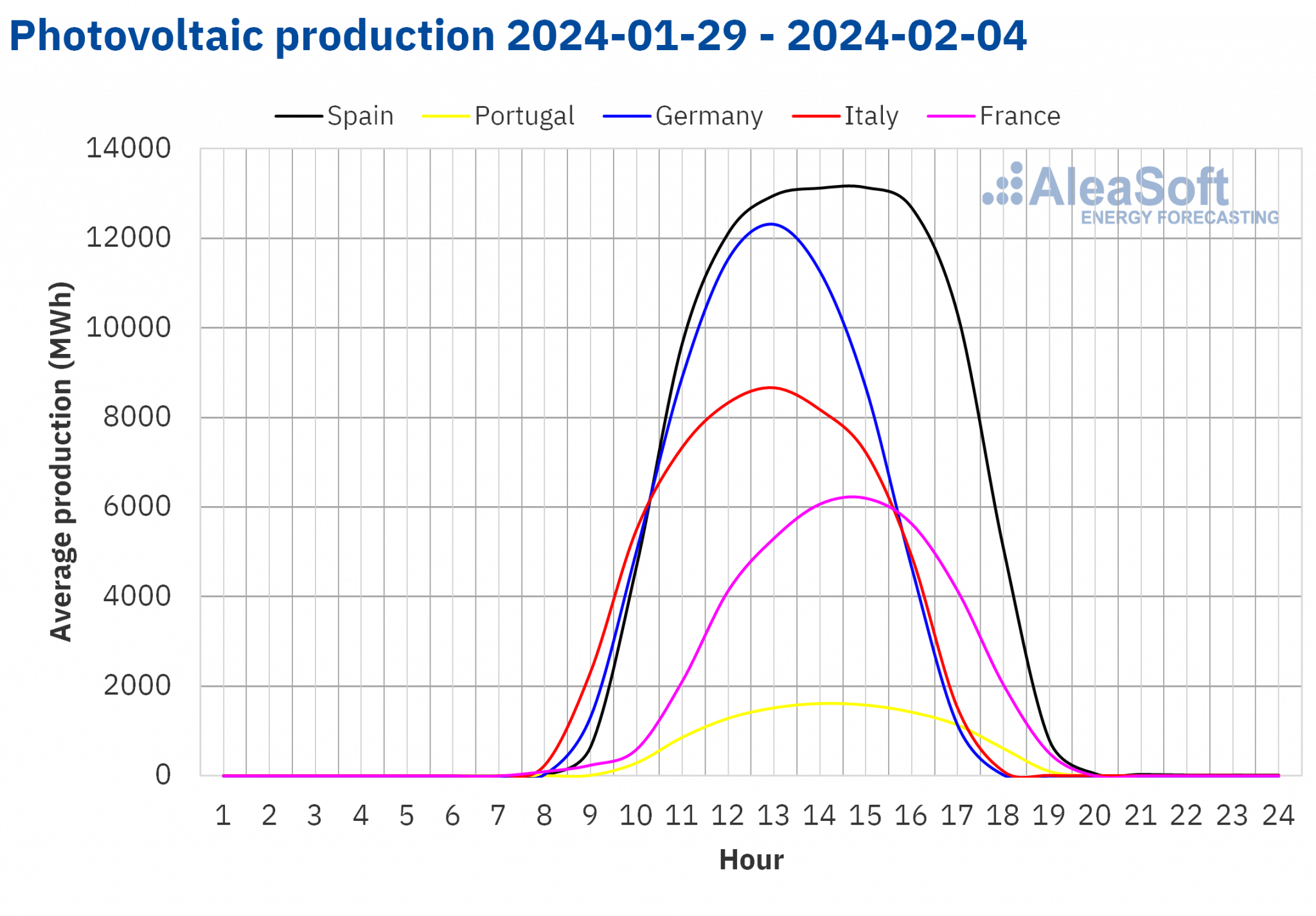

The upward trend in solar energy production was also reflected in the daily values. In Spain, solar photovoltaic energy production reached levels last seen in October, with 104 GWh generated on Sunday, February 4. Italy and Portugal registered 67 GWh and 12 GWh respectively on Saturday, February 3, marking solar energy production levels not seen since October.

According to AleaSoft Energy Forecasting’s solar energy production forecasts for the week of February 5, the trend will reverse, with an increase in solar energy production in Germany and a decrease in Italy and Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

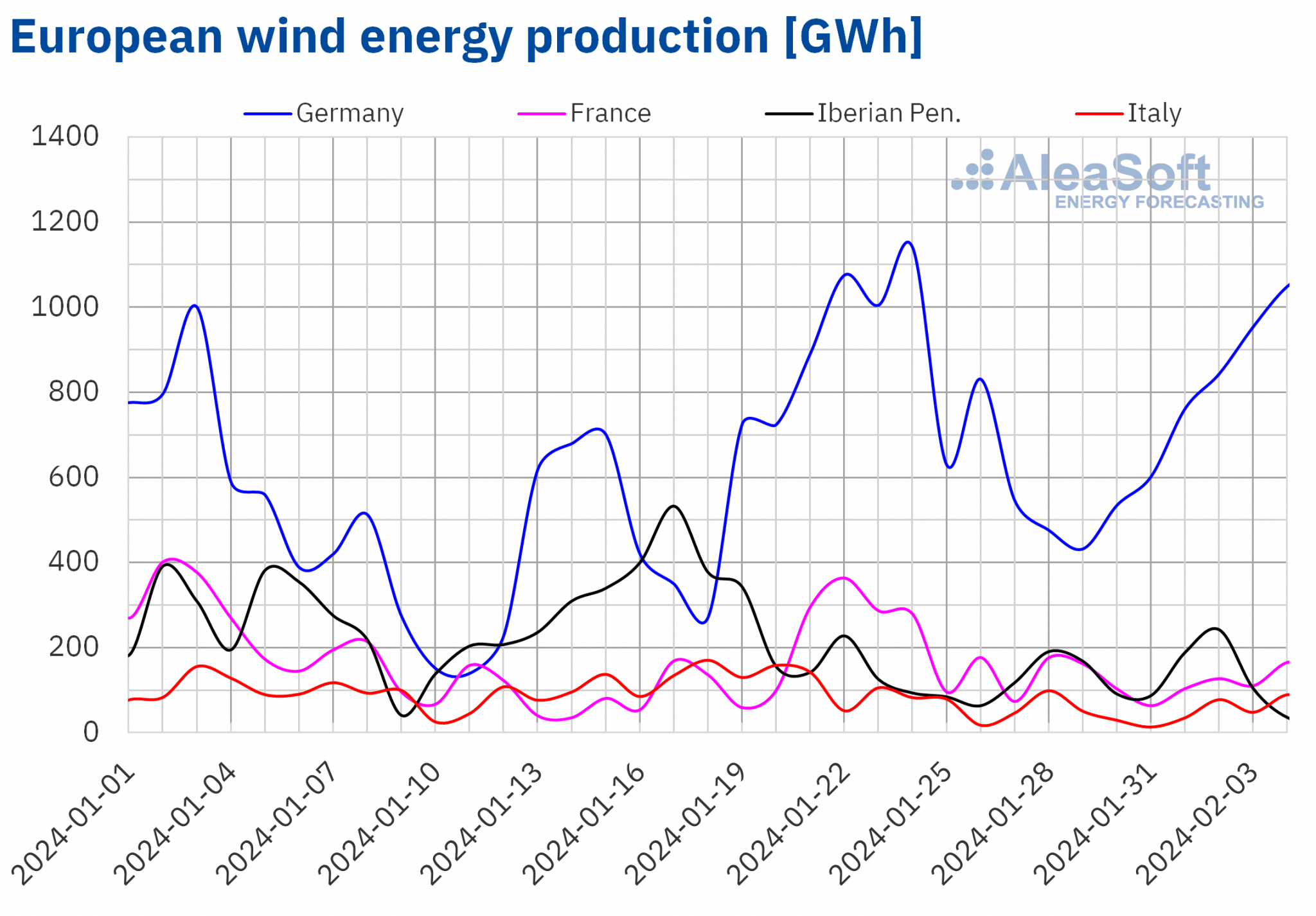

Wind energy production registered declines in most major European electricity markets in the week of January 29 compared to the previous week. Italy and Spain registered two consecutive weeks of declines, with decreases of 28% and 0.8%, respectively. In the French and German markets, wind energy production decreased by 43% and 9.2%, respectively. Only the Portuguese market registered a 12% increase in production using this technology after the previous week’s drop.

According to AleaSoft Energy Forecasting’s wind energy production forecasts for the week of February 5, the downward trend will persist in the German market. In contrast, wind energy production will increase in France, Italy and the Iberian Peninsula.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

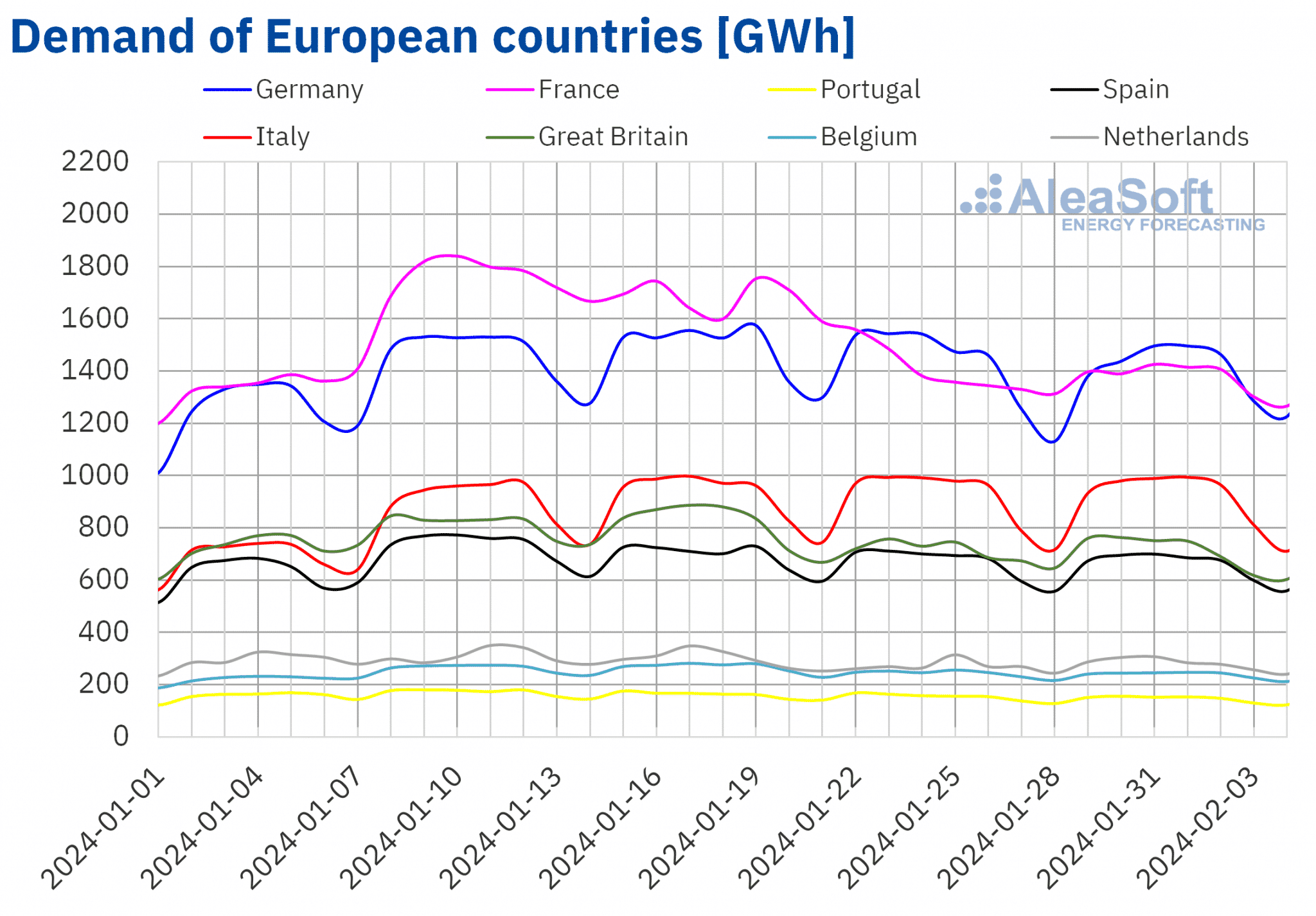

During the week of January 29, the main European electricity markets registered a decrease in electricity demand, following the downward trend of previous weeks. In Portugal, France and Spain, demand fell for the third consecutive week, with decreases of 4.9%, 1.7% and 1.3%, respectively. On the other hand, the markets of Belgium, Germany, Great Britain and Italy registered declines for the second consecutive week, with decreases ranging from 2.0% to 0.3%. The exception was the Netherlands market, which registered a 3.6% increase in electricity demand compared to the week of January 22.

At the same time, average temperatures in Great Britain, the Netherlands and Belgium increased between 0.2 °C and 0.6 °C. In contrast, the analyzed markets that are located in Southern Europe registered decreases in average temperatures that ranged between 0.9 °C and 0.1 °C. In the German market, average temperatures remained similar to those of the previous week.

AleaSoft Energy Forecasting’s demand forecasts indicate that, for the week of February 5, the downward trend will persist in France and Italy. In contrast, demand will increase in Germany, Spain, Portugal, Belgium, the Netherlands and Great Britain compared to the week of January 29.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

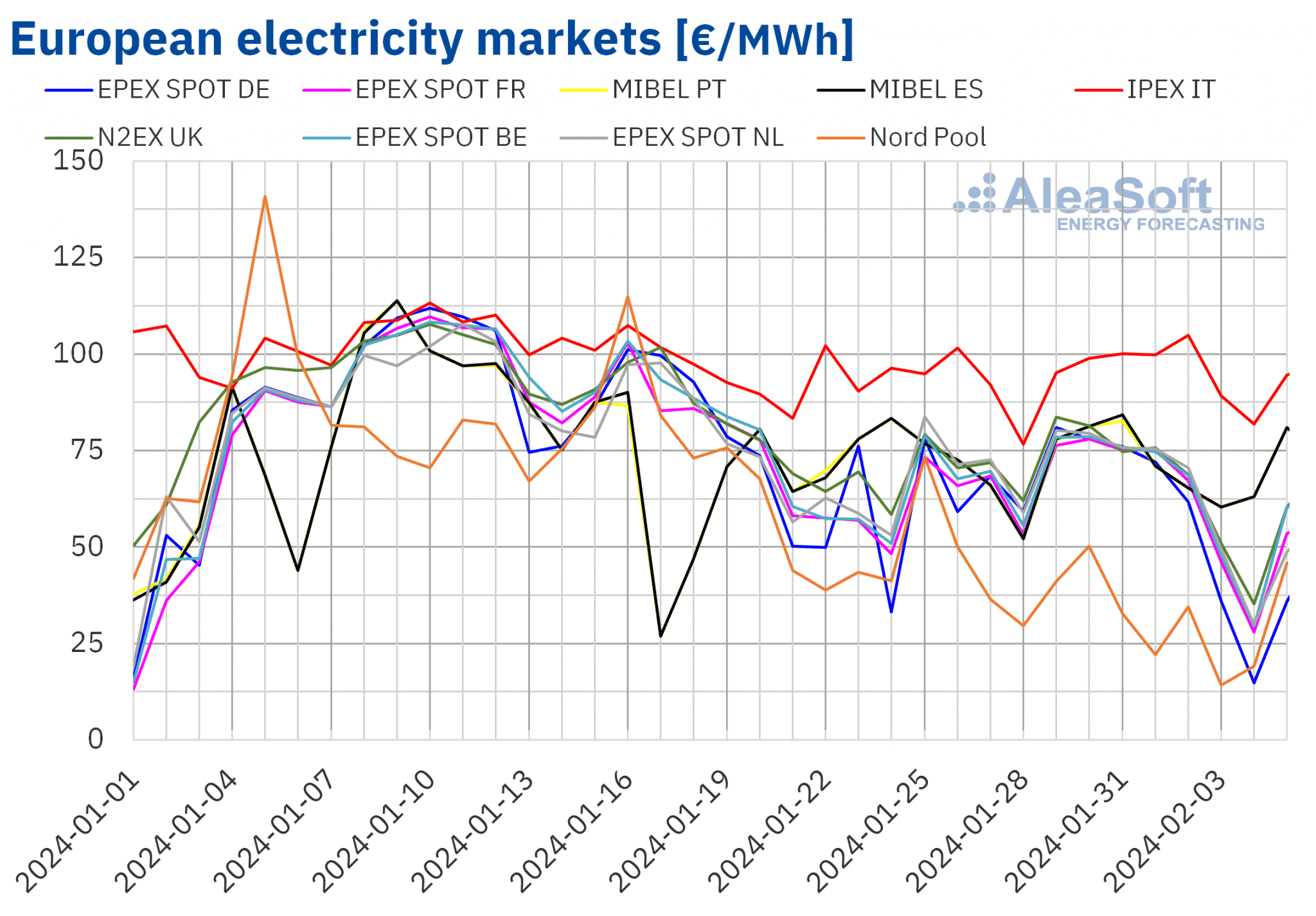

European electricity markets

In the week of January 29, average prices of most major European electricity markets remained similar to those of the previous week. The exception was the Nord Pool market of the Nordic countries, which registered a drop of 32%. On the other hand, the slight variations registered were also downward in the EPEX SPOT market of the Netherlands and Germany and in the N2EX market of the United Kingdom, which were ‑0.1%, ‑1.1% and ‑1.1%, respectively. In contrast, in the rest of the markets analyzed at AleaSoft Energy Forecasting, prices increased between 0.6% in the MIBEL market of Portugal and 5.3% in the EPEX SPOT market of France.

In the first week of February, weekly averages continued to be below €75/MWh in almost all analyzed European electricity markets. The exception was IPEX market of Italy, which again registered the highest average, €95.68/MWh. On the other hand, the Nordic market reached the lowest weekly price, €30.56/MWh. In the rest of the analyzed markets, prices ranged from €59.92/MWh in the German market to €71.89/MWh in the Spanish market.

Also, in the first five days of February, several markets registered hourly prices below €1/MWh. In the German, Belgian, British, British, Dutch and Nordic markets, the number of hours with prices below €1/MWh was 11, 3, 2, 8 and 6, respectively.

During the week of January 29, weekly gas prices registered a slight recovery. This led to the slight increase in prices registered in most analyzed markets. The decline in wind energy production in markets such as France, Spain and Italy also contributed to this behavior. However, the decline in demand limited the increases and in some cases contributed to the decline in prices.

AleaSoft Energy Forecasting’s price forecasts indicate that in the second week of February, they might decrease in most European electricity markets. Increased wind energy production in most markets will favor this behavior. In addition, demand might decrease in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

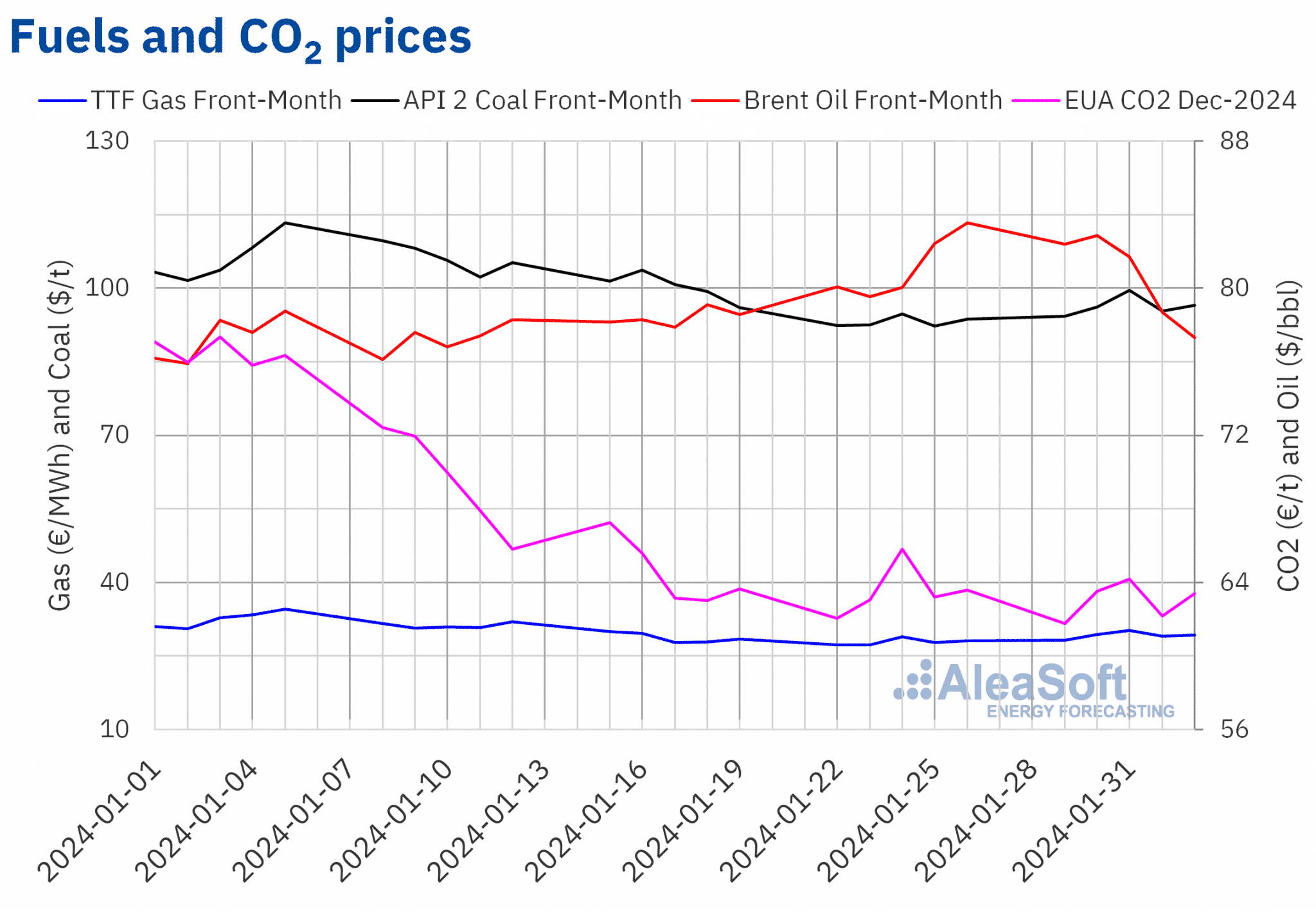

Brent oil futures prices for the Front‑Month in the ICE market registered a downward trend during the first week of February. As a result, on Friday, February 2, these futures registered their weekly minimum settlement price, $77.33/bbl. This price was 7.4% lower than the previous Friday and the lowest in the last three weeks.

Concerns about economic and demand evolution in China exerted a downward influence on Brent oil futures prices in the first week of February. The lack of expectations about a cut in interest rates in the United States also contributed to these declines. In addition, oil stocks increased in this country. On the other hand, on February 1, OPEC+ decided to maintain the agreed production levels.

As for the settlement prices of TTF gas futures in the ICE market for the Front‑Month, in the first sessions of the week of January 29, they continued the upward trend started at the end of the previous week. As a result, on Wednesday, January 31, these futures reached their weekly maximum settlement price, €30.24/MWh. According to data analyzed at AleaSoft Energy Forecasting, this was the only time that settlement prices for this product exceeded €30/MWh during the second half of January. In the first sessions of February, settlement prices were below €30/MWh again. On Friday, February 2, the settlement price was €29.30/MWh. This price was 4.2% higher than the previous Friday.

Instability in the Middle East contributed to the increase in TTF gas futures prices in the last sessions of January. However, still high European stock levels and abundant supply continued to exert a downward influence on prices.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2024, on Monday, January 29, they registered the weekly minimum settlement price, €61.78/t. According to data analyzed at AleaSoft Energy Forecasting, this settlement price was the lowest since the first half of November 2021. Thereafter, prices increased until Wednesday, January 31. On that day, emission rights futures registered their weekly maximum settlement price, €64.17/t. In the last session of the week, on Friday, February 2, the settlement price was €63.40/t, down 0.3% from the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

On Thursday, February 15, AleaSoft Energy Forecasting and AleaGreen will hold their second webinar of 2024, the year of the 25th anniversary of AleaSoft Energy Forecasting’s foundation. This webinar will feature JLL for the third time in the monthly webinar series. The discussed topics will be the evolution and prospects of European energy markets, the context and trends of the energy storage market in Spain, the revenue stack and technical aspects of battery energy storage systems, as well as financing considerations.

Source: AleaSoft Energy Forecasting.