AleaSoft Energy Forecasting, February 12, 2024. In the week of February 5, European electricity market prices remained at levels similar to those they have registered since the second half of January. The MIBEL market registered the lowest weekly averages. Wind energy was the protagonist of the week in most markets and registered an all‑time high in Germany on the 6th. Gas and CO2 futures continued to fall and registered the lowest prices since July 2023 and October 2021, respectively.

Solar photovoltaic, solar thermoelectric and wind energy production

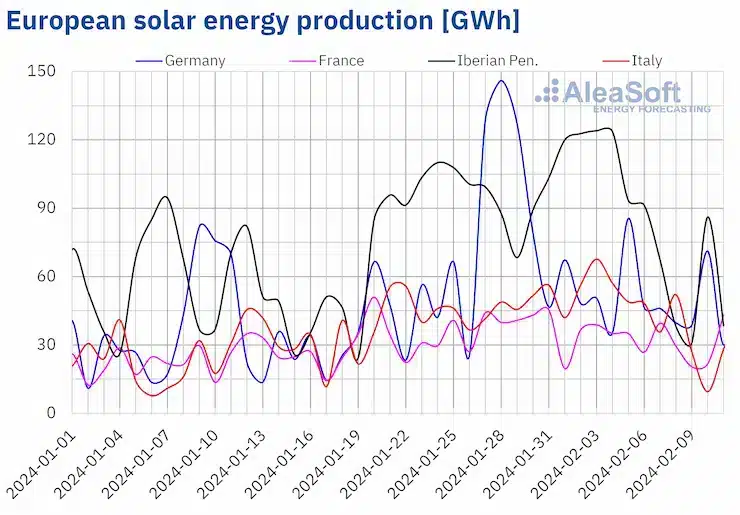

During the week of February 5, solar energy production declined in all major European electricity markets, despite increasing hours of sunshine, reversing the upward trend of previous weeks. Reductions ranged from 44% in Portugal to 17% in France.

As for the week of February 12, AleaSoft Energy Forecasting’s solar energy production forecasts indicate that Germany, Italy and Spain will register a return to the upward trend.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

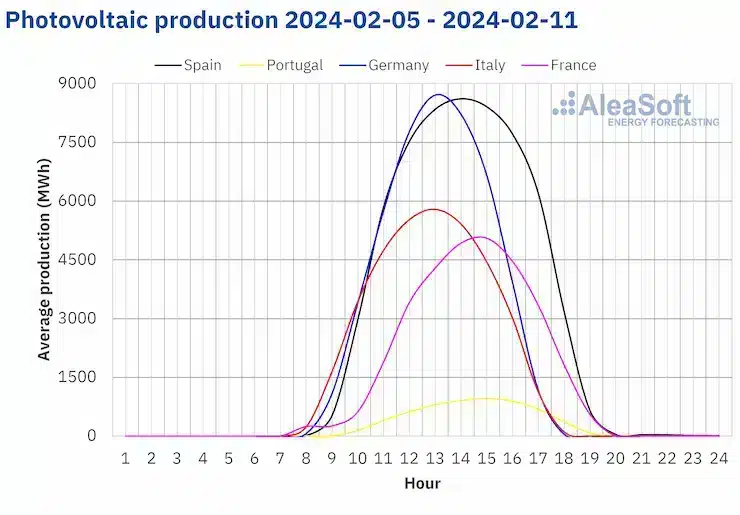

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA. Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

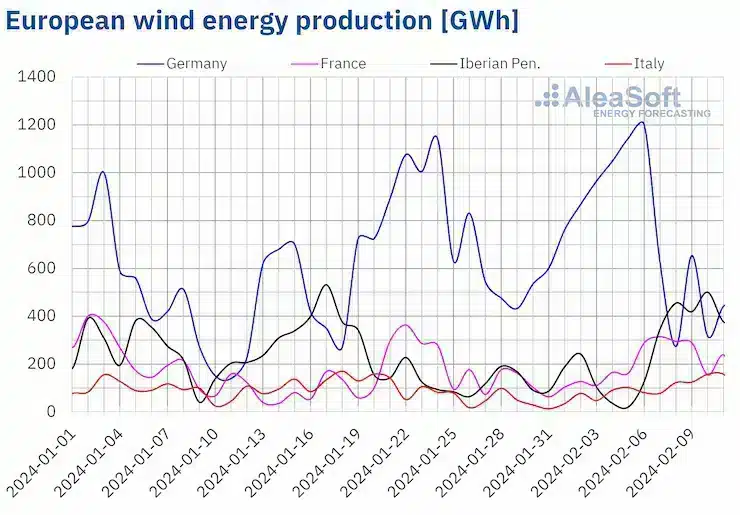

During the week of February 5, wind energy production increased in most major European electricity markets compared to the previous week. The Portuguese market registered its second consecutive increase, with a rise of 125%. In the other markets, increases ranged from 109% in France to 150% in Spain, recovering from the previous week’s declines. However, in the German market, wind energy production declined for the second consecutive week, down 11% week‑on‑week. Despite this decline, Germany reached its highest ever wind energy generation levels on Monday, February 5, and Tuesday, February 6, 1143 GWh and 1200 GWh, respectively.

For the week of February 12, AleaSoft Energy Forecasting’s wind energy production forecasts indicate a decrease in production using this technology in all analyzed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Electricity demand

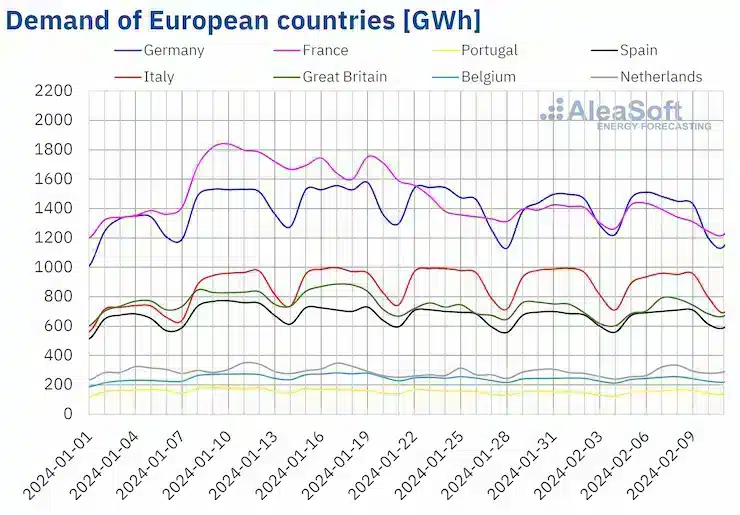

In the week of February 5, the main European electricity markets registered a heterogeneous week‑on‑week evolution in electricity demand. Demand increased in most markets, from 1.0% in Belgium to 5.9% in Portugal. However, the downward trend persisted for the fourth consecutive week in the French market, this time with a fall of 2.4%. The Italian and German markets registered declines for the third consecutive week, with falls of 3.1% and 1.0%, respectively.

At the same time, average temperatures increased in most analyzed European markets, ranging from 0.2 °C in Portugal to 3.8 °C in Italy. The only exception was Great Britain, where average temperatures decreased by 0.7 °C during the week of February 5.

AleaSoft Energy Forecasting’s demand forecasts for the week of February 12 indicate an increase in demand in Germany, Portugal, Italy, Great Britain and the Netherlands, while it will decrease in France, Spain and Belgium.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

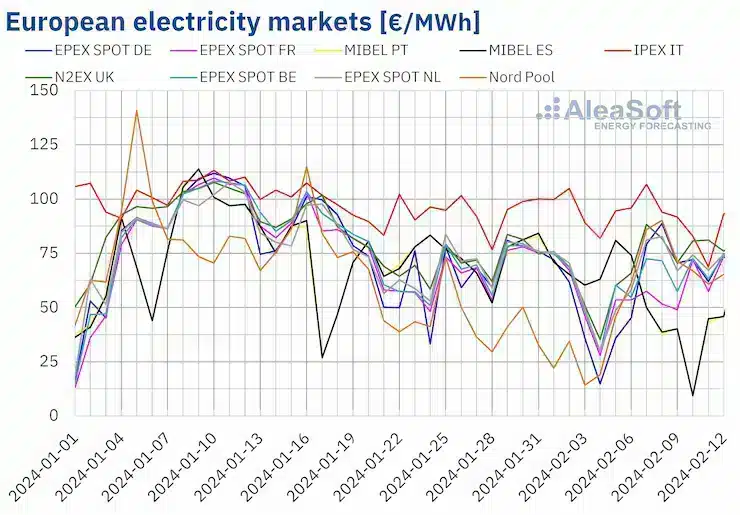

European electricity

During the week of February 5, prices in the main European electricity markets remained at a similar level to the one they have registered since the second half of January. Comparing average prices of the week with those of the week of January 29, the behavior was heterogeneous, but in general they reversed the upward or downward trend of the previous week. On the one hand, the Nord Pool market of the Nordic countries reached the highest price increase, 125%. The N2EX market of the United Kingdom and the EPEX SPOT market of Germany and the Netherlands also registered increases of 12%, 8.1% and 4.0%, respectively. On the other hand, in the rest of the markets analyzed at AleaSoft Energy Forecasting, prices declined between 0.3% in EPEX SPOT market of Belgium and 33% in MIBEL market of Spain and Portugal.

In the second week of February, weekly averages were below €70/MWh in most analyzed European electricity markets. The exceptions were the IPEX market of Italy, which averaged €90.66/MWh, and the British market, with a price of €75.52/MWh. In contrast, the Portuguese and Spanish markets reached the lowest weekly prices, €48.07/MWh and €48.31/MWh, respectively. In the rest of the analyzed markets, prices ranged from €56.37/MWh in the French market to €68.92/MWh in the Nordic market.

In addition, in the early hours of Monday, February 5, the German, Belgian and Dutch markets registered hourly prices below €1/MWh. The German market registered the highest number of hours, a total of six, of which four had negative prices. The MIBEL market also reached prices below €1/MWh for eight consecutive hours on Saturday, February 10. Specifically, between 11:00 and 17:00, the Iberian market price was €0/MWh. High levels of renewable energy production in hours with lower demand led to these prices.

During the week of February 5, the drop in solar energy production had an upward influence on prices in the German market. In markets such as the United Kingdom and the Netherlands, increased demand also contributed to higher prices. However, the significant increase in wind energy production in the French, Iberian and Italian markets led to lower prices in these markets.

AleaSoft Energy Forecasting’s price forecasts indicate that in the third week of February, prices in European electricity markets might increase. The drop in wind energy production will favor this behavior. In addition, demand might increase in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

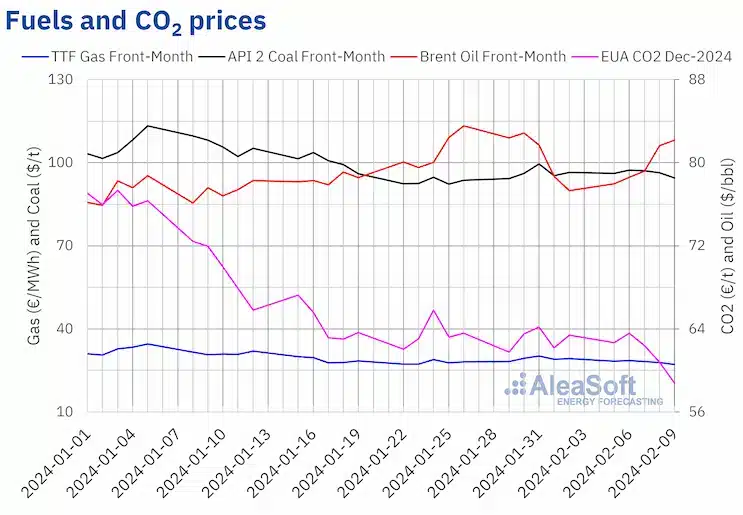

Brent, fuels and CO2

After the previous week’s declines, Brent oil futures prices for the Front‑Month in the ICE market registered an upward trend during the second week of February. As a result, on Friday, February 9, these futures registered their weekly maximum settlement price, $82.19/bbl. This price was 6.3% higher than the previous Friday, although it was still lower than the previous week’s maximum settlement price, $82.87/bbl, reached on Tuesday, January 30.

During the second week of February, instability in the Middle East drove Brent oil futures prices higher. Evolution of the conflict will continue to influence prices, but economic data from Europe and the United States to be released in the third week of February might also influence them.

As for settlement prices of TTF gas futures in the ICE market for the Front‑Month, they decreased in most sessions of the second week of February. As a result, on Friday, February 9, these futures reached their weekly minimum settlement price, €27.12/MWh. This settlement price was 7.5% lower than the previous Friday. Moreover, according to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since the end of July 2023.

Abundant supply, high European reserve levels and forecasts of less cold temperatures had a downward influence on prices of these futures during the second week of February.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2024, settlement prices declined during the second week of February. On Friday, February 9, these futures reached their weekly minimum settlement price, €58.78/t. According to data analyzed at AleaSoft Energy Forecasting, this settlement price was 7.3% lower than that of the previous Friday and the lowest since October 2021.

Lower gas prices are favoring its use instead of coal, leading to lower demand for CO2 emission rights.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy storage

Next Thursday, February 15, at 10:00 CET, AleaSoft Energy Forecasting and AleaGreen will hold a webinar with the participation of Tomás García, Senior Director, Energy & Infrastructure Advisory at JLL for the third time in the monthly webinar series. This will be the second webinar of 2024, year of the 25th anniversary of the foundation of AleaSoft Energy Forecasting. In addition to the evolution and prospects of European energy markets, the webinar will analyze the context and trends of the energy storage market in Spain, the revenue stack and technical aspects of battery energy storage systems, as well as financing considerations.

Source: AleaSoft Energy Forecasting.