AleaSoft Energy Forecasting, April 3, 2024. In the first quarter of 2024, prices in the main European electricity markets fell to their lowest levels since at least the second quarter of 2021 in most markets. Declines in gas and CO2 prices marked this evolution. The general increase in solar energy production combined with the increase in wind energy production in most markets also contributed to the price declines. Photovoltaic energy production was the highest ever registered in a first quarter in most markets, a record that wind energy production also reached in Italy.

Solar photovoltaic and thermoelectric energy

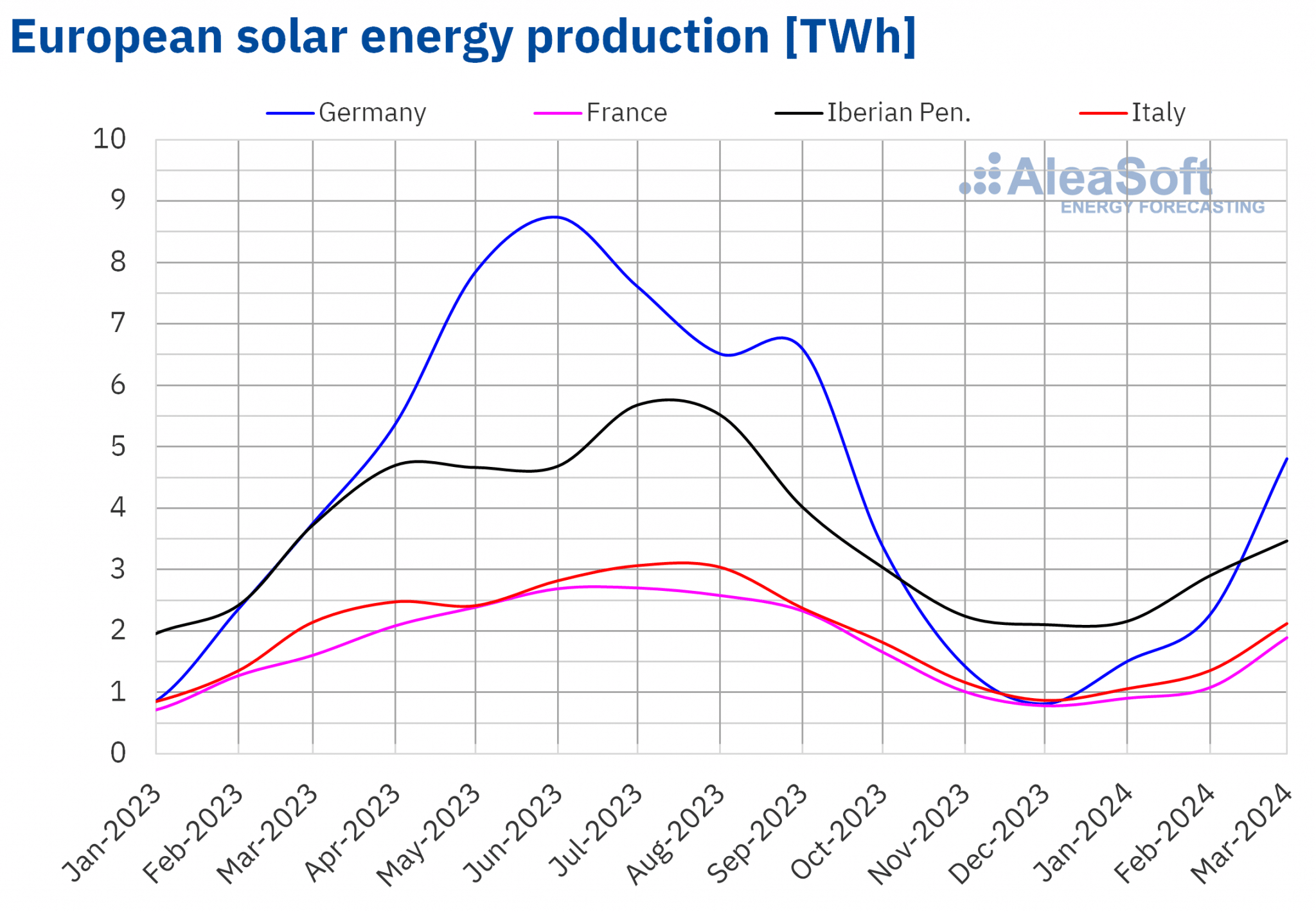

In the first quarter of 2024, solar energy production increased in all major European electricity markets compared to the same period in 2023. The German and Portuguese markets registered double‑digit percentage growth, 23% and 12%, respectively. The Spanish market had the lowest growth, 2.0%.

Solar energy production in the first quarter of 2024 was also higher than in the last quarter of 2023 in all major European markets. Increases ranged from 12% in France to 52% in Germany.

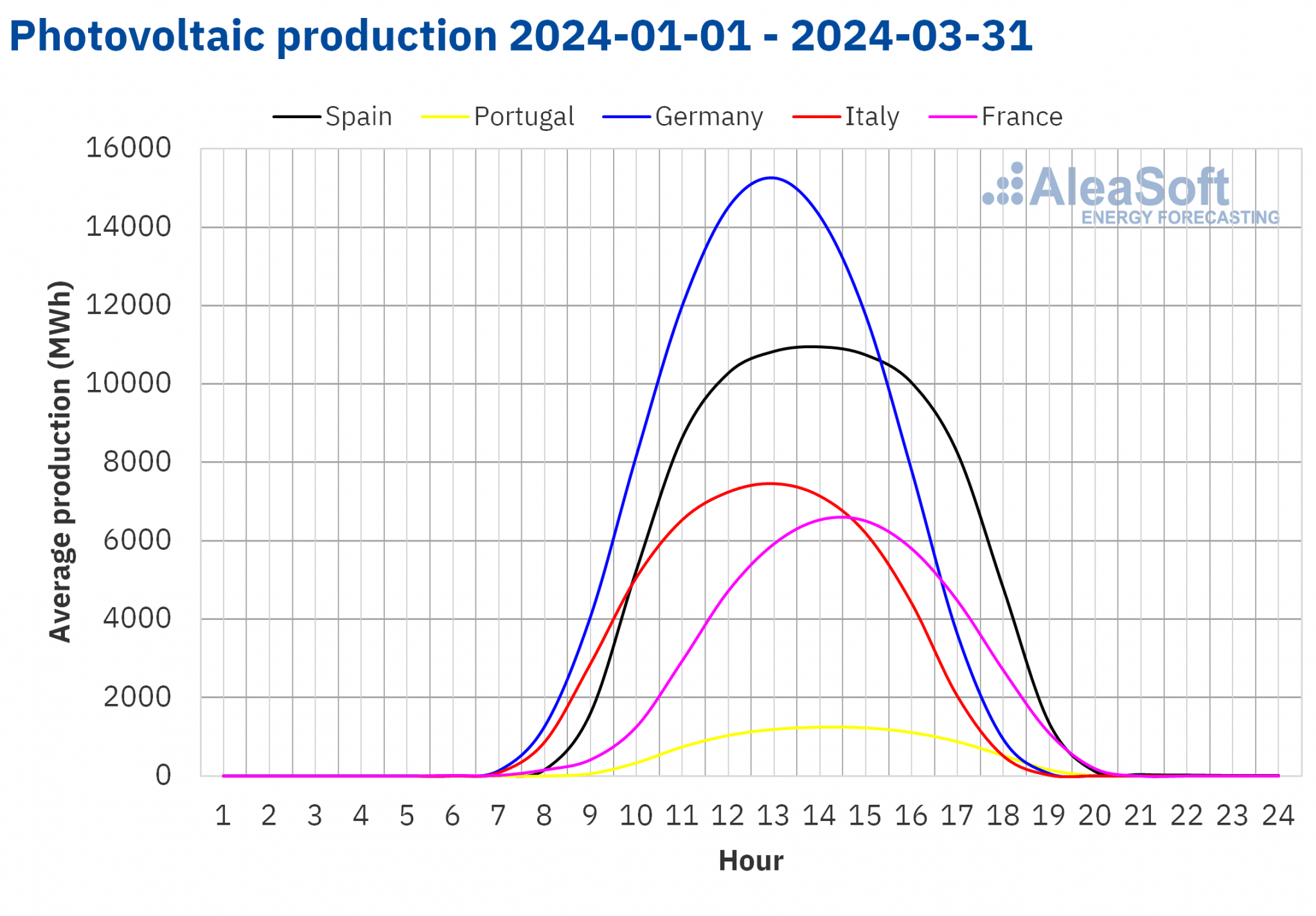

In most of the markets analysed at AleaSoft Energy Forecasting, solar photovoltaic energy production in the first quarter of 2024 was higher than in the first quarter of the previous years of the historical series. The Spanish market topped the list with a production of 7258 GWh, followed by the Italian market with 4532 GWh and the French market with 3883 GWh. The Portuguese market closed the list with a production of 776 GWh.

The above‑mentioned record productions reflect the increase in installed photovoltaic capacity. In Mainland Spain, between March 2023 and March 2024, installed photovoltaic capacity increased by 4472 MW, according to data from Red Eléctrica. Similarly, in Portugal, according to REN data, installed photovoltaic capacity increased by 772 MW in the same period.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

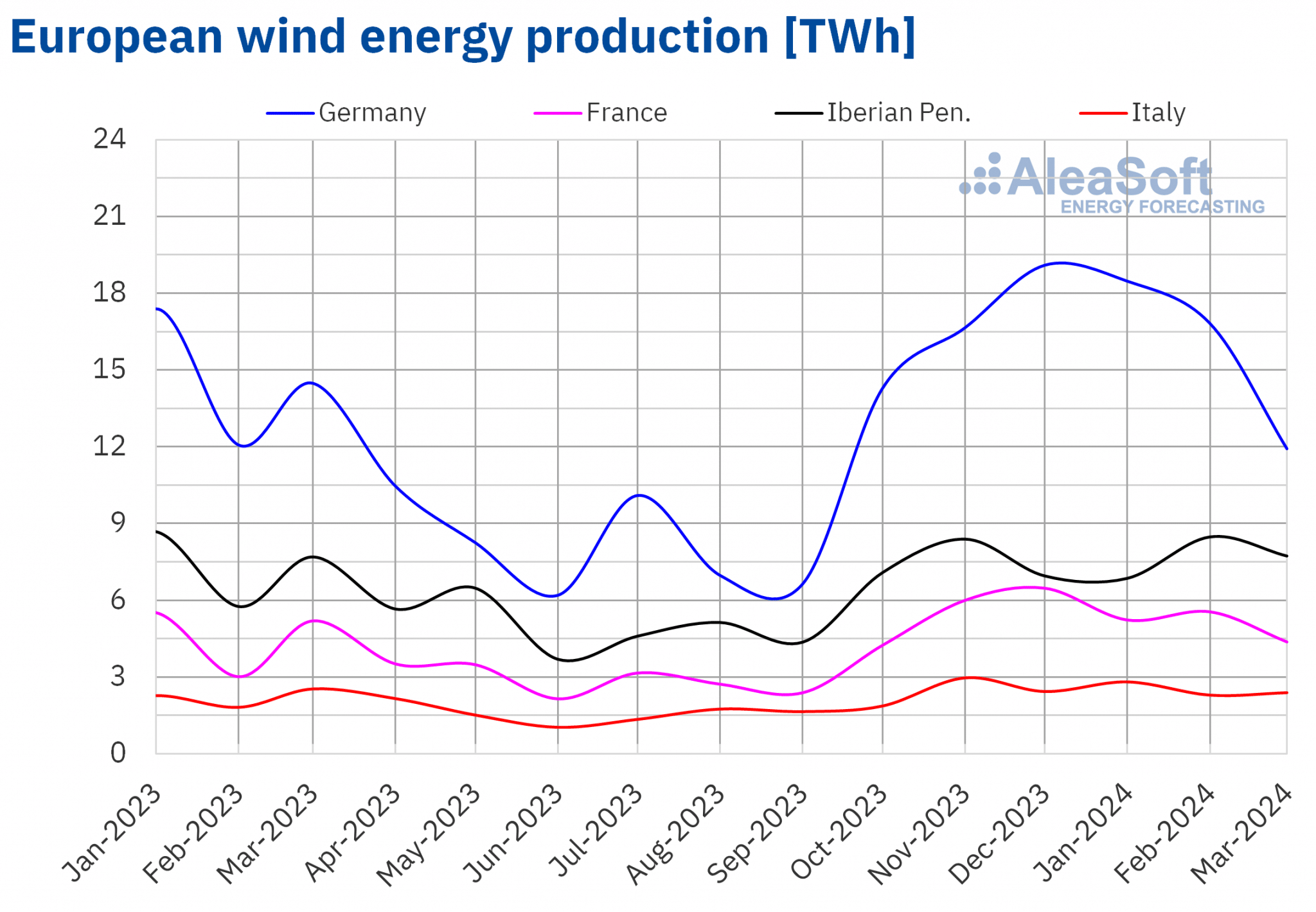

Wind energy

Wind energy production increased in the first quarter of 2024 compared to the same period of 2023 in most major European electricity markets. Increases ranged from 7.5% in the German market to 19% in the Portuguese market. The Spanish market was the only exception with a drop of 0.6%.

Comparing data of the first quarter of 2024 with the last quarter of 2023, wind energy production in Portugal, Italy and Spain increased by 9.3%, 3.1% and 0.4% respectively. However, in the French and German markets, wind energy production fell by 9.3% and 5.6% in each case.

In Italy, 7510 GWh were generated using wind energy in the first quarter of 2024, which represents the historical record of generation using this technology during a first quarter of the year.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

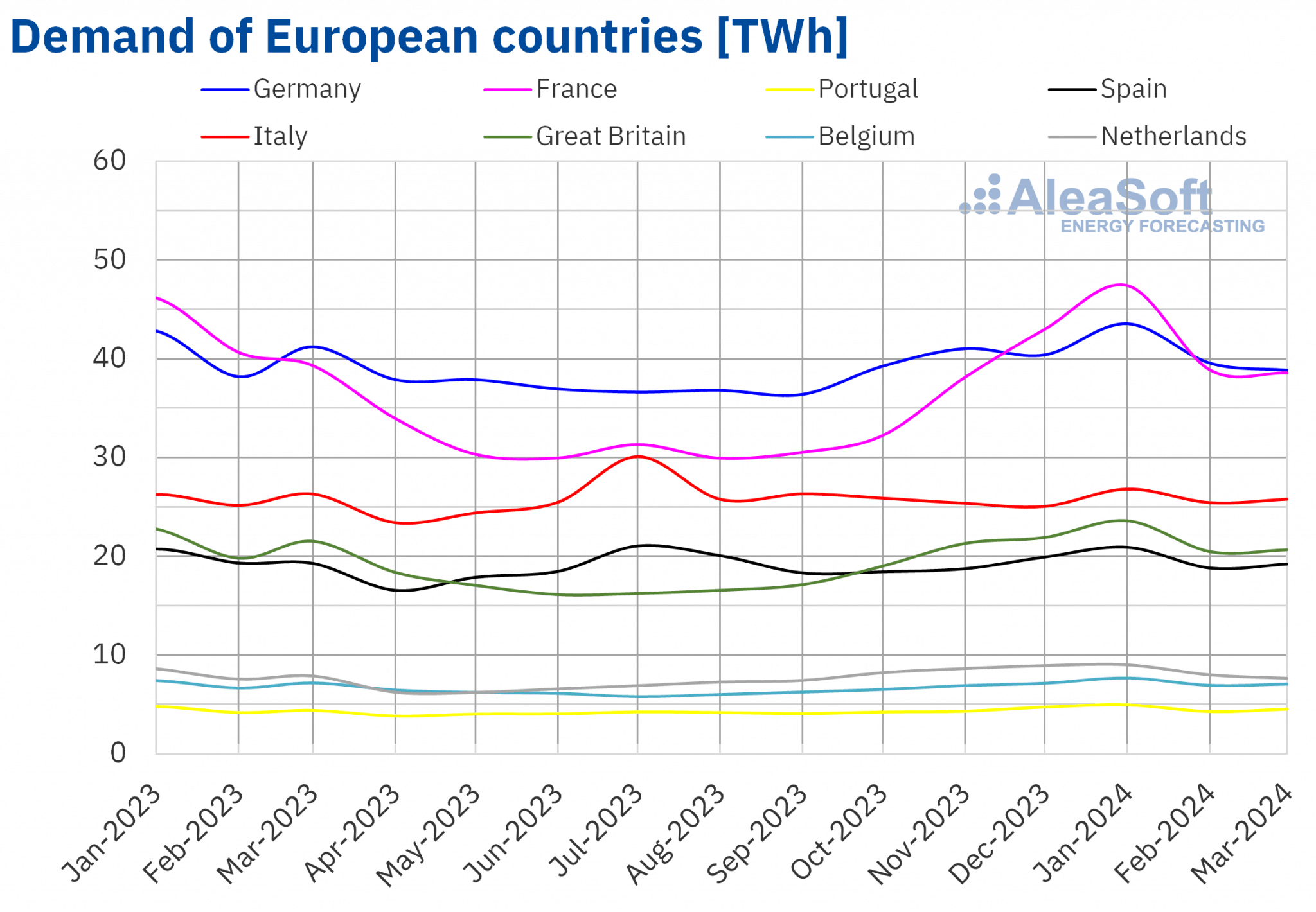

Electricity demand

In the first quarter of 2024, year‑on‑year electricity demand variations in the main European electricity markets were heterogeneous. In Italy, Great Britain, Belgium, the Netherlands and Portugal, demand increased compared to the same quarter of 2023. Increases ranged from 0.4% in the Italian market to 2.9% in the Portuguese market. In contrast, in Germany, Spain and France, demand decreased. The French market registered the largest drop, 1.0%, and the German market registered the smallest decline, 0.2%. In Spain, demand fell by 0.8%.

When comparing demand in the last quarter of 2023 with demand in the first quarter of 2024, variations were more homogeneous. As the winter season progressed and average temperatures dropped, demand increased in most of the markets analysed at AleaSoft Energy Forecasting. The French market registered the largest increase, 10%, and the German market the smallest increase, 1.1%. The Spanish market was somewhere in between, with a growth of 3.1%. The exception was the Dutch market, where demand fell by 4.3%.

Average temperatures in the first quarter of 2024 were higher than in the same period of 2023. Temperature variations ranged from 0.6 °C in Great Britain to 1.4 °C in Germany.

After the seasonal transition from autumn to winter, average temperatures fell in all analysed markets when comparing the first quarter of 2024 with the previous quarter. Italy registered the largest decrease, 3.6 °C, while Germany registered the smallest decrease, 1.9 °C.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

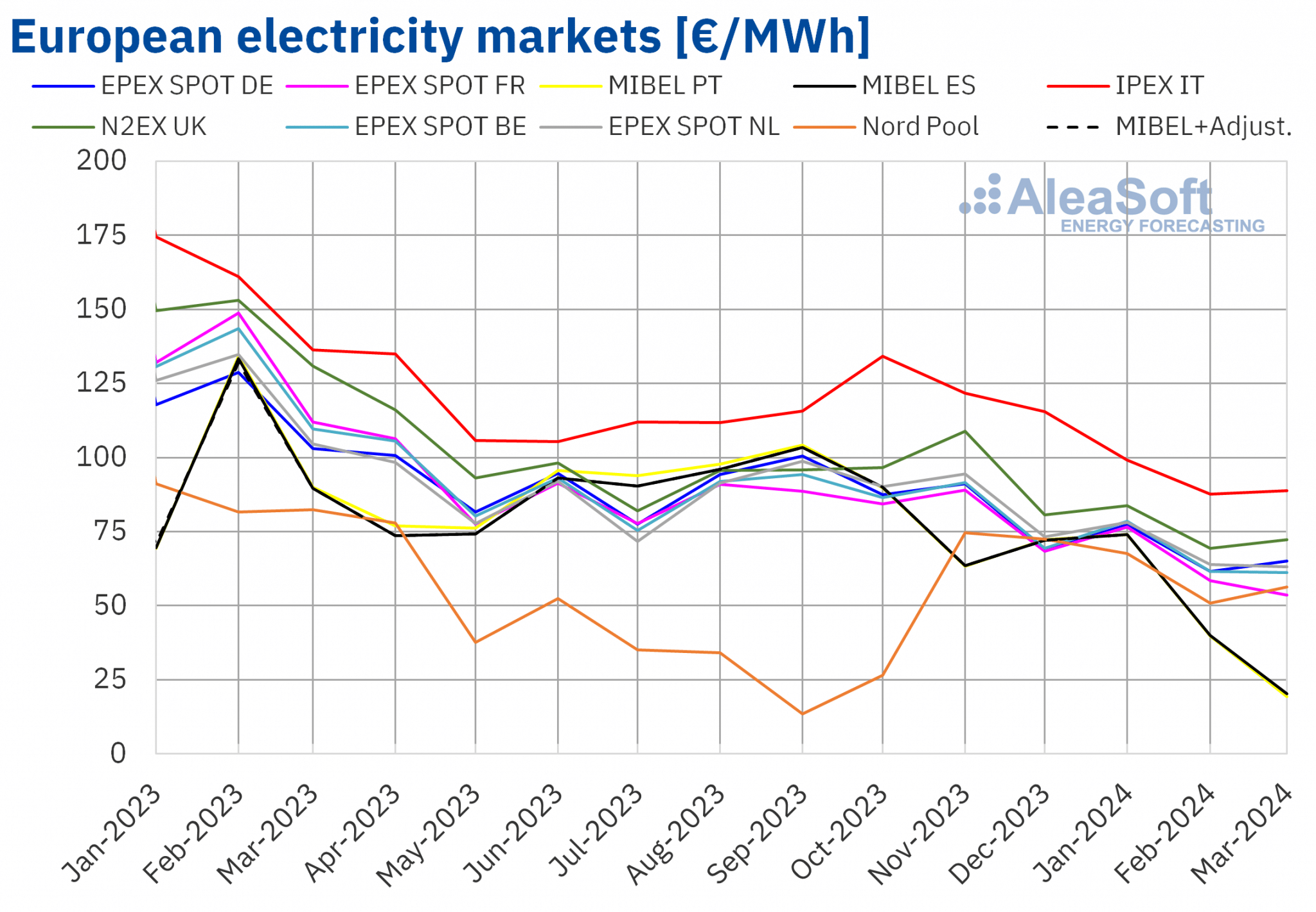

European electricity markets

In the first quarter of 2024, the quarterly average price remained below €70/MWh in most major European electricity markets. The exceptions were the N2EX market of the United Kingdom and the IPEX market of Italy, which averaged €75.25/MWh and €91.98/MWh, respectively. On the other hand, the MIBEL market of Portugal and Spain registered the lowest quarterly prices, €44.52/MWh and €44.92/MWh, respectively. In the other markets analysed at AleaSoft Energy Forecasting, the averages ranged from €58.48/MWh in the Nord Pool market of the Nordic countries to €68.50/MWh in the EPEX SPOT market of the Netherlands.

Compared to the previous quarter, in the first quarter of 2024 average prices decreased in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exception was the Nordic market, with an increase of 1.5%. In contrast, the Spanish and Portuguese markets registered the largest falls, 40% and 41%, respectively. The rest of the markets registered price decreases ranging from 17% in the German market to 26% in the Italian market.

Comparing average prices in the first quarter of 2024 with those registered in the same quarter of 2023, prices fell in all analysed markets. The Spanish and Portuguese markets also registered the largest drops, 53% and 54%, respectively. In contrast, the Nordic market had the smallest decline, 31%. In the rest of the markets, price declines ranged from 41% in the German and Italian markets to 52% in the French market.

These price declines led the price of the first quarter of 2024 to be the lowest since the last quarter of 2020 in the Spanish and Portuguese markets. The markets of France and the United Kingdom reached the lowest averages since the first quarter of 2021. For the German, Belgian, Italian and Dutch markets, prices of the first quarter of 2024 were the lowest since the second quarter of 2021.

In the first quarter of 2024, lower gas and CO2 emission rights prices compared to the previous quarter, a general increase in solar energy production and an increase in wind energy production in most analysed markets led to lower prices in the European electricity markets compared to the fourth quarter of 2023, despite the increase in demand in almost all markets.

Compared to the first quarter of 2023, gas and CO2 emission rights prices also fell and solar energy production increased in all analysed markets. In addition, wind energy production increased in almost all markets. Moreover, electricity demand declined in some markets, also contributing to the year‑on‑year price declines in the electricity markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

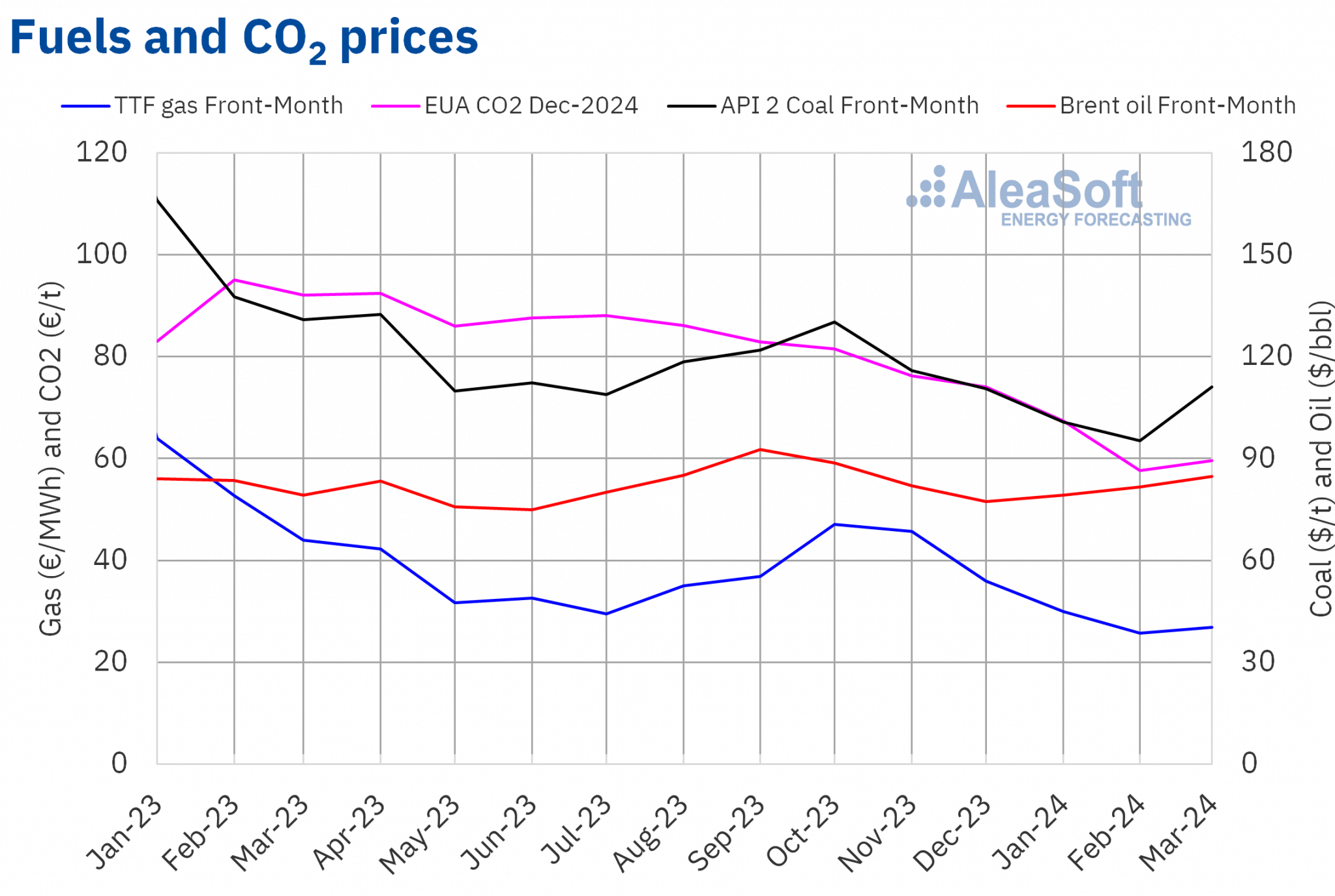

Brent, fuels and CO2

Brent oil futures for the Front‑Month in the ICE market registered a quarterly average price of $81.76/bbl in the first quarter of 2024. This was 1.3% lower than the value reached by the previous quarter’s Front‑Month futures, $82.85/bbl. It was also 0.5% lower than the price corresponding to the Front‑Month futures traded in the first quarter of 2023, $82.18/bbl.

In the first quarter of 2024, concerns about demand evolution exerted a downward influence on Brent oil futures prices. However, OPEC+ production cuts, upward demand forecasts by the International Energy Agency and instability in the Middle East limited price declines. Attacks on Russian refineries also exerted an upward influence on prices in the latter part of the period under review.

As for TTF gas futures in the ICE market for the Front‑Month, the average value registered during the first quarter of 2024 was €27.56/MWh. Compared to the average of the Front‑Month futures traded in the previous quarter, €43.15/MWh, the average decreased by 36%. Compared to the Front‑Month futures traded in the same quarter of 2023, when the average price was €53.41/MWh, there was a decrease of 48%.

In the first quarter of 2024, high European reserve levels and abundant supply led to lower TTF gas futures prices. However, supply concerns contributed to limiting the price decline. These concerns were influenced by problems at the Freeport liquefied natural gas export plant in the United States, supply disruptions from Norway and instability in the Middle East.

As for CO2 emission rights futures in the EEX market for the reference contract of December 2024, they reached an average price of €61.67/t in the first quarter of 2024, 23% lower than the average of the previous quarter, €80.08/t. Compared to the average for the same quarter of 2023, €94.18/t, the average for the first quarter of 2024 was 35% lower.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Prospects for energy markets and renewable energy financing

Current electricity market prices may be a problem for renewable energy developers who used overly optimistic price forecasts to improve financing conditions. Long‑term price forecasts of AleaSoft Energy Forecasting and AleaGreen have a scientific basis that provides coherence and quality. In addition, these forecasts have hourly granularity, confidence bands and up to 30‑year horizons. Long‑term price curve forecasting reports are available for the major European markets, as well as for markets in America and Asia.

Source: AleaSoft Energy Forecasting.