AleaSoft Energy Forecasting, April 2, 2024. In the last week of March, the Iberian MIBEL market registered the lowest prices in Europe for the eighth consecutive week and the Spanish market registered negative prices for the first time in its history on April 1. In most major European electricity markets, prices fell compared to the previous week. In several markets this was the week with the lowest average, or the second lowest average, in 2024 so far. Declining demand and increased renewable energy production favored these declines. Portugal and France registered wind energy production records for a March month on the 27th and 28th, respectively.

Solar photovoltaic, solar thermoelectric and wind energy production

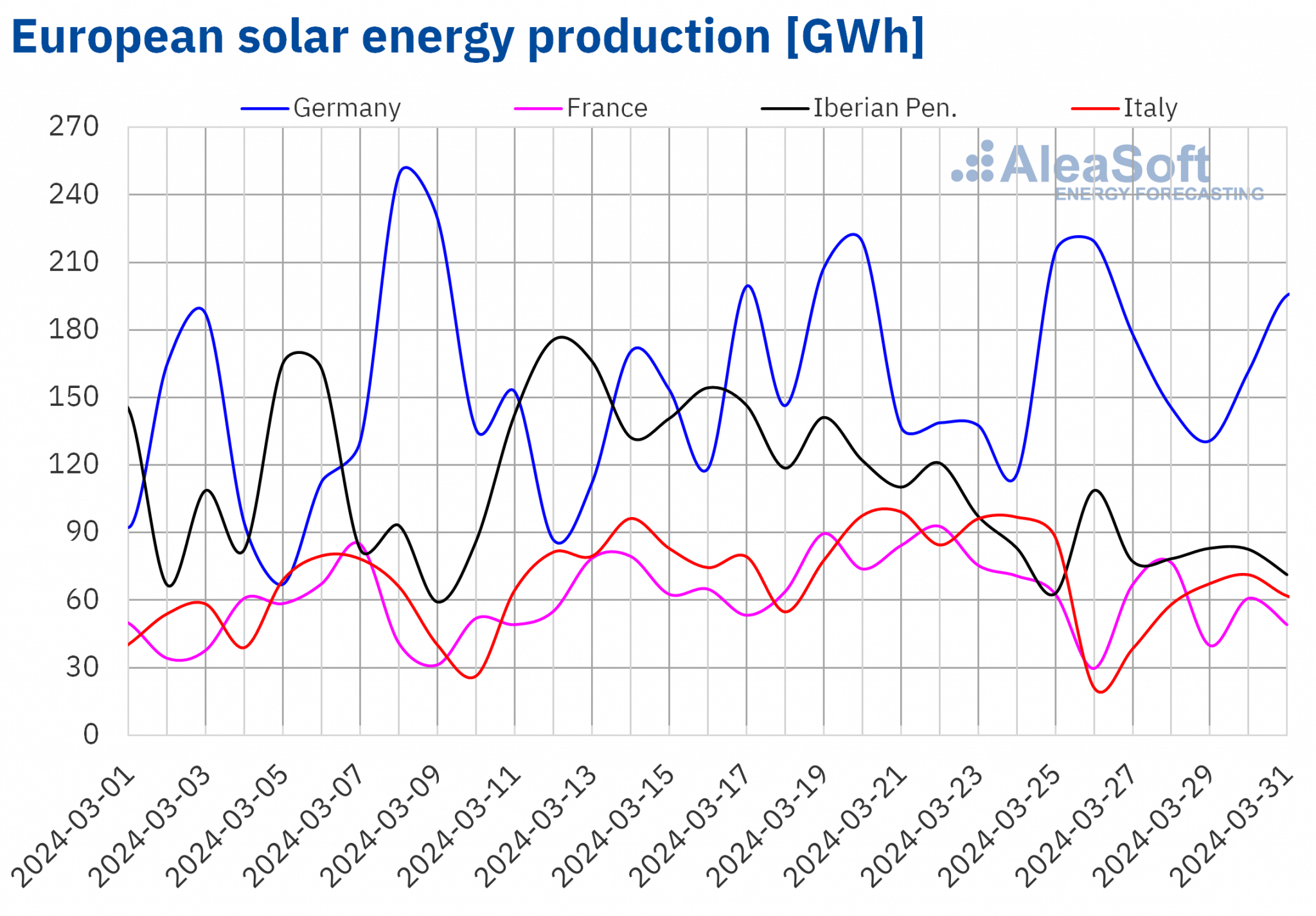

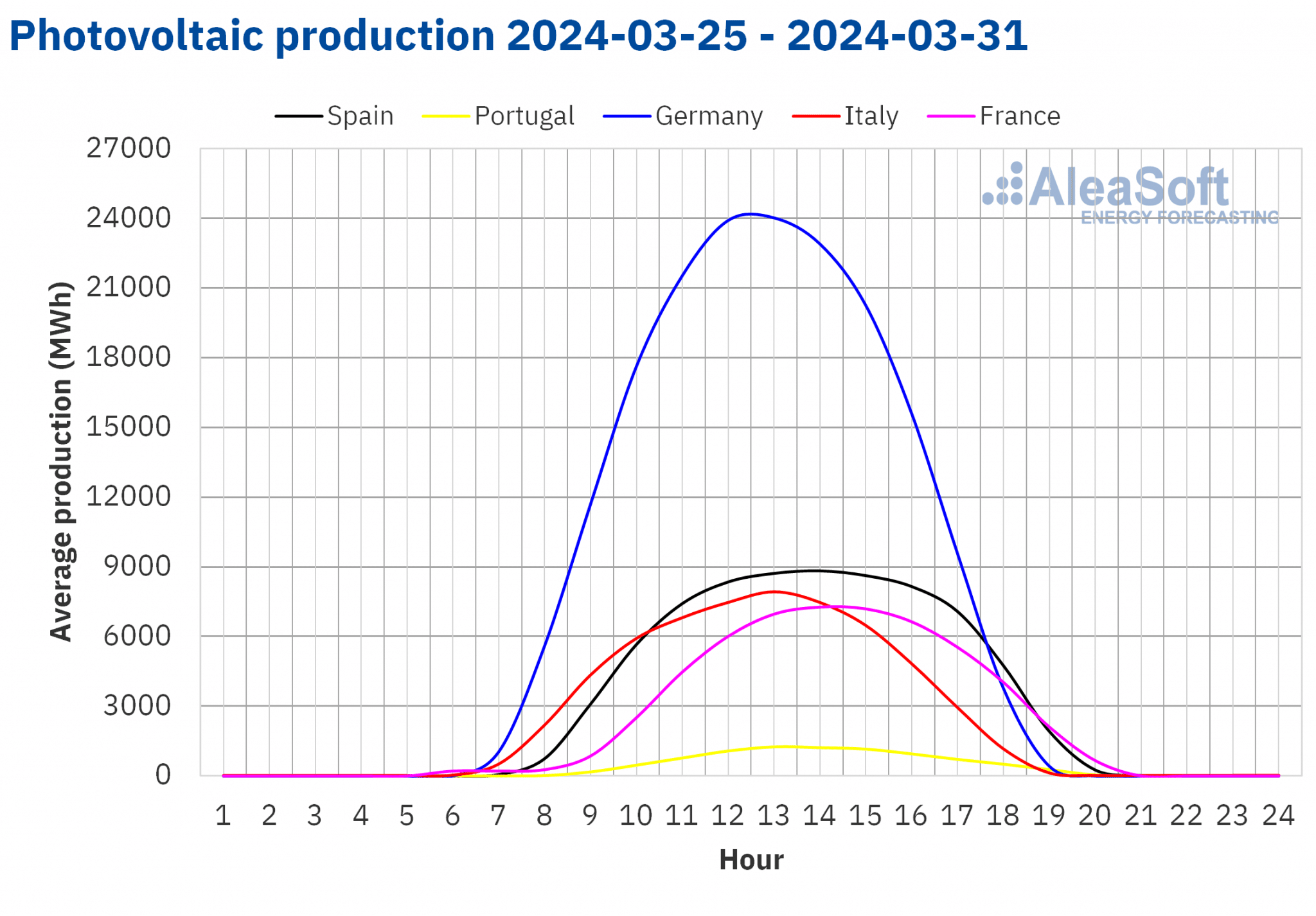

In the week of March 25, solar energy production decreased in most major European electricity markets compared to the previous week. The Italian market registered the largest drop, 33%, reversing the upward trend of previous weeks. The Portuguese market, which had the smallest decline, 16%, fell for the second consecutive week. The German market was the exception. In this market, solar energy production increased by 13%, continuing the upward trend of the previous week.

For the week of April 1, according to AleaSoft Energy Forecasting’s solar energy production forecasts, the downward trend will reverse and solar energy production will increase in Germany, Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

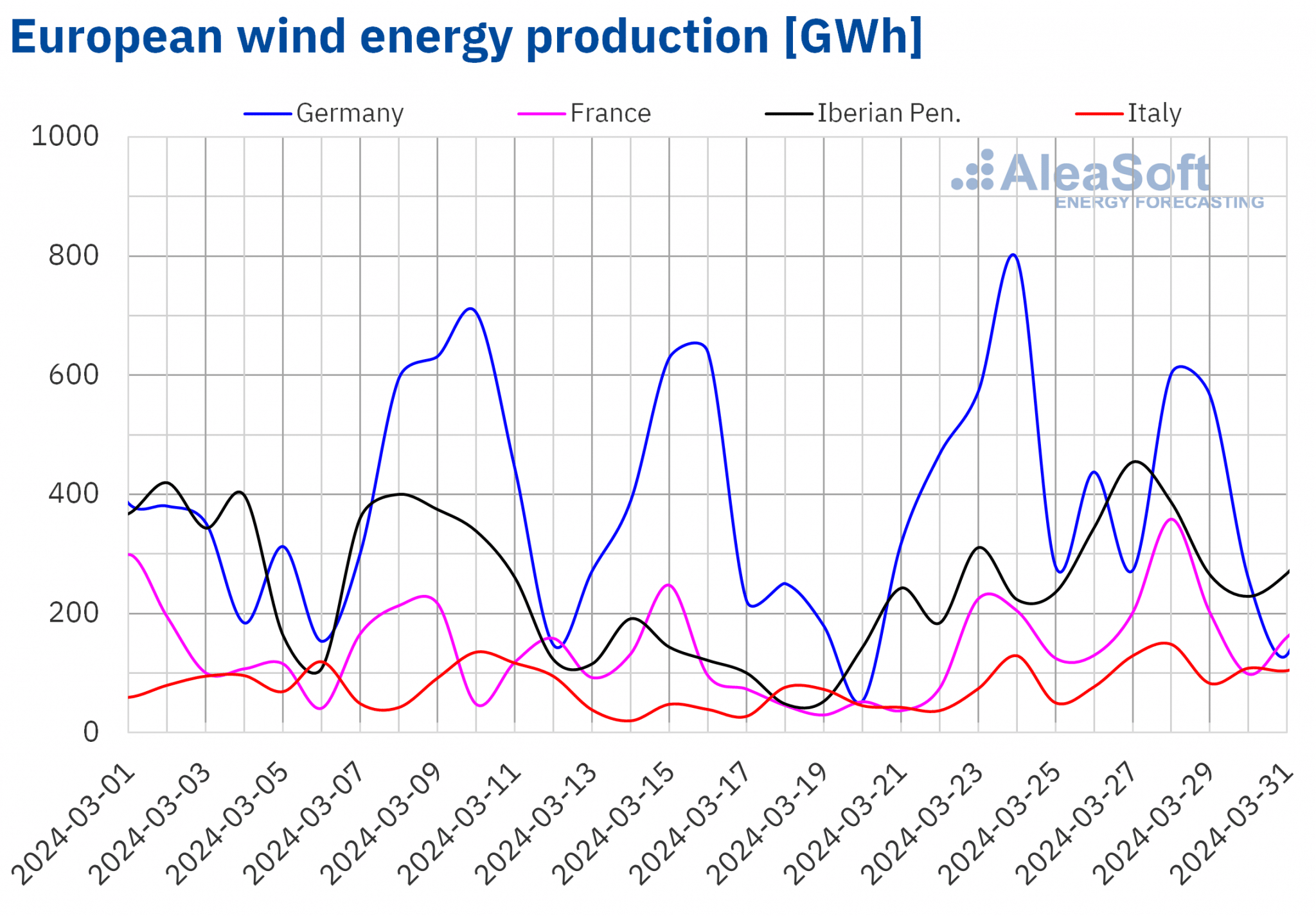

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

In the last week of March, wind energy production increased in most major European markets compared to the previous week, continuing the upward trend of the previous week. Increases ranged from 47% in the Italian market to 90% in the French market. In contrast, the German market registered a wind energy generation decrease for the third consecutive week, this time by 3.3%.

Portugal and France registered the highest levels of daily wind energy production for a March month in history. On March 27, the Portuguese market generated 106 GWh of wind energy and, on the following day, the French market generated 359 GWh. In both cases, production levels corresponded to values last registered in the second half of February.

During the week of April 1, according to AleaSoft Energy Forecasting’s wind energy production forecasts, it will increase in Germany and France and it will decrease in the Iberian Peninsula and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica and TERNA.

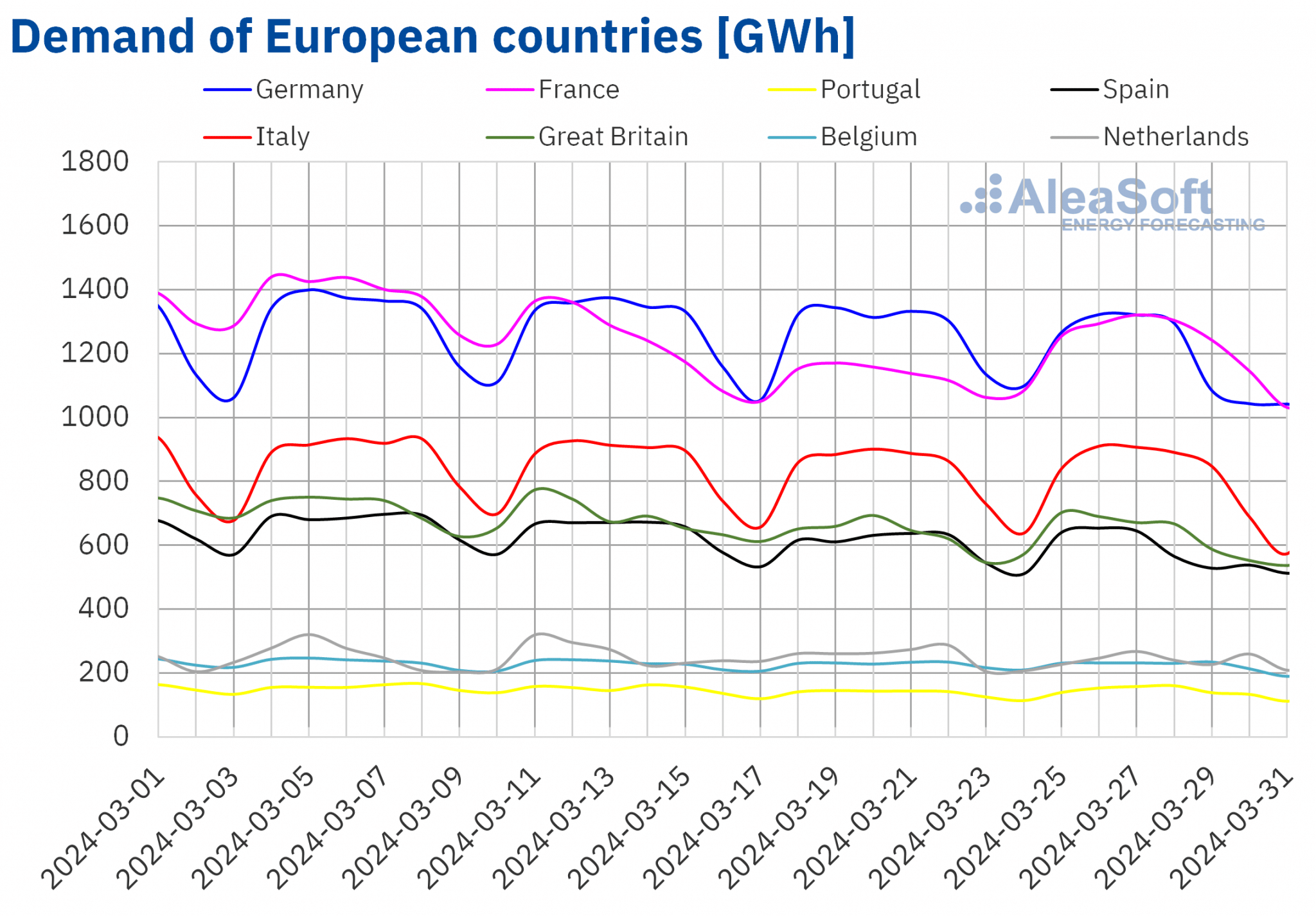

Electricity demand

In the week of March 25, electricity demand fell in most major European electricity markets compared to the previous week, continuing the downward trend of previous weeks. The German market, where demand fell for the fifth consecutive week, registered the largest drop, 5.4%. The Belgian market, which had the smallest drop, 1.4%, continued its downward trend for the fourth consecutive week. In contrast, France, Portugal and Great Britain reversed the previous week’s downward trend and registered increases in demand of 9.0%, 4.2% and 0.4%, respectively.

In the last week of March, several European countries celebrated Easter and in some regions there was a public holiday on Holy Thursday or Good Friday, which had an impact on demand.

Between March 25 and 31, average temperatures decreased in most analyzed markets. The decreases ranged from 4.9 °C in Portugal to 0.2 °C in the Netherlands. Average temperatures increased only in Germany and Italy, by 1.4 °C and 0.1 °C, respectively.

For the week of April 1, according to AleaSoft Energy Forecasting’s demand forecasts, it will increase in Germany, Portugal, Italy and the Netherlands. In contrast, demand will decline in France, Belgium, Spain and Great Britain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, Red Eléctrica, TERNA, National Grid and ELIA.

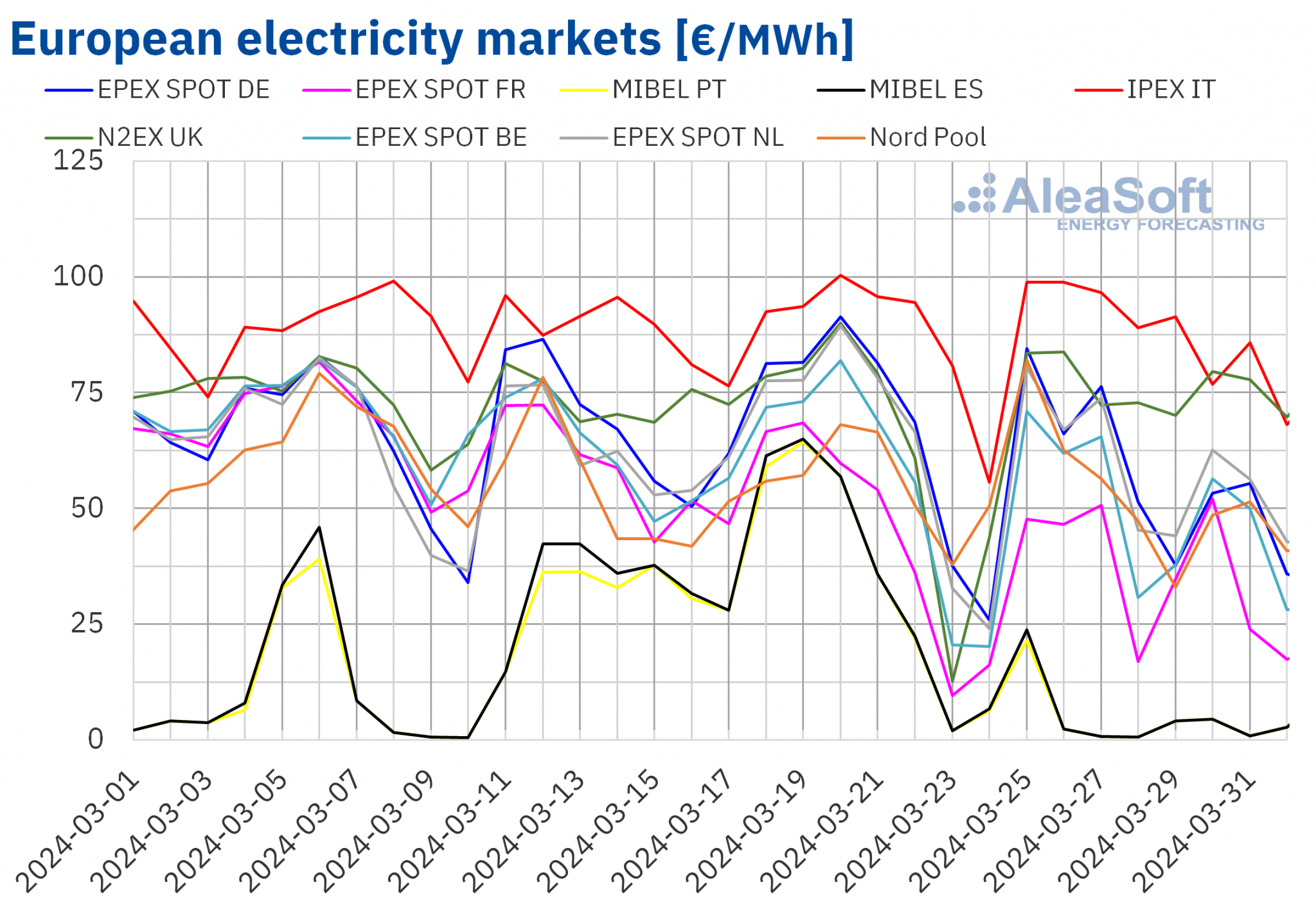

European electricity markets

In the week of March 25, prices in most major European electricity markets decreased compared to the previous week. Weekly prices of France and Belgium in the EPEX SPOT market, €39.01/MWh and €53.32/MWh, respectively, were the lowest this year to date in each of these markets. In the case of the MIBEL market of Portugal and Spain and the EPEX SPOT market of the Netherlands, average prices for the week of March 25 were the second lowest this year, with values of €4.98/MWh, €5.30/MWh and €61.37/MWh. Price declines ranged from 86% in the Portuguese market to 1.4% in the Nord Pool market of the Nordic market. On the other hand, in the IPEX market of Italy and the N2EX market of the United Kingdom prices rose, by 3.9% and 21% in each case.

In the last week of March, the Iberian MIBEL market prices were the lowest in the main European electricity markets for the eighth consecutive week. Daily prices in this market have been the lowest almost uninterruptedly since February 7, with the exception of five days when the Nord Pool market occupied this position. The highest weekly prices were those of the Italian market, which usually registers the highest prices, this time at €91.04/MWh.

As for hourly prices, the Spanish market registered the first three hours with negative prices in history. On Monday, April 1, between 14:00 and 17:00, the price in this market was ‑€0.01/MWh. Between March 26 and April 2, the MIBEL market registered 53 hours with zero or negative prices. Such low hourly values meant that the prices of March 28 and 27, €0.66/MWh and €0.75/MWh in each case, were the third and fourth lowest in the last decade, after the prices of March 10 and 9 of this year, €0.54/MWh and €0.59/MWh respectively.

Other European markets registered negative hourly prices between March 25 and April 2, although to a lesser extent than in the Iberian market. In the German, Belgian, French and Dutch markets there were some hours with zero or negative prices on April 1 and 2. In the Dutch market there was also an hour with a price of €0/MWh on March 28.

In the last week of March, the fall in demand in most markets, the increase in wind energy production in most of them and in solar energy production in Germany favored the fall in electricity market prices, despite the fact that gas prices remained similar to those of the previous week and CO2 prices increased. In contrast, the fall in solar energy production in Italy and the increase in demand in Great Britain led to higher prices in these markets.

AleaSoft Energy Forecasting’s price forecasts indicate that in the first week of April prices in most major European electricity markets will fall compared to the previous week helped by lower demand in several markets and higher renewable energy production in Germany, France and Italy. The exception will be the MIBEL market, which will recover from last week’s declines as a result of lower wind energy production, although weekly average prices will still be lower than the week before Easter.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

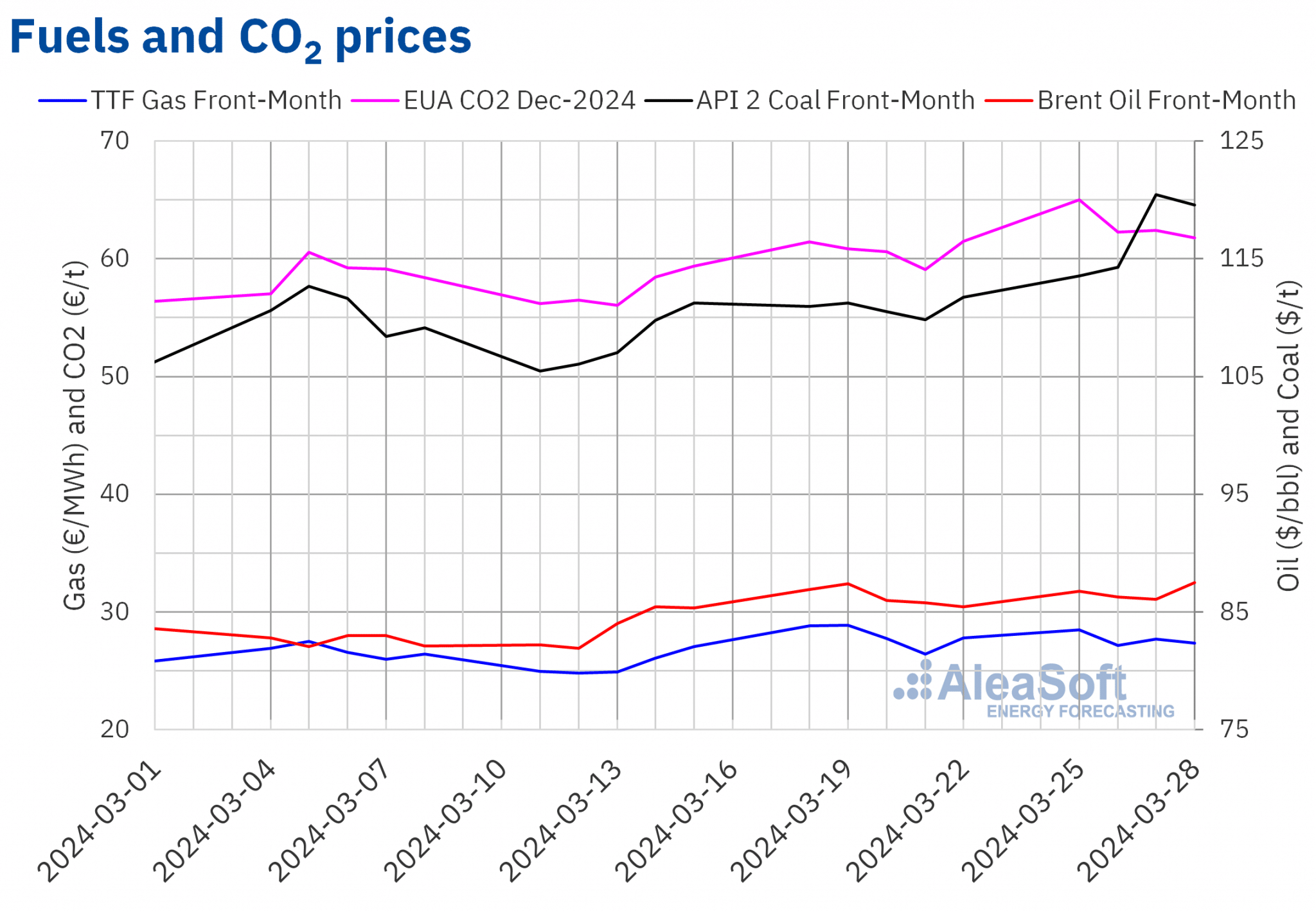

Brent, fuels and CO2

In the last week of March, settlement prices of Brent oil futures for the Front‑Month in the ICE market were above $85/bbl. On Wednesday, March 27, these futures registered their weekly minimum settlement price, $86.09/bbl. On the other hand, on Thursday, March 28, they reached their weekly maximum settlement price, $87.48/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was 2.0% higher than the previous Thursday and the highest since the end of October 2023.

In the last week of March, OPEC+ production cuts and instability in the Middle East helped to keep Brent oil futures prices above $85/bbl. In the first week of April, prospects of increased demand in China might exert its upward influence on prices. This week’s OPEC+ meeting will also influence the evolution of Brent oil futures prices.

As for TTF gas futures in the ICE market for the Front‑Month, on Monday, March 25, they reached their weekly maximum settlement price, €28.49/MWh. However, on Tuesday, March 26, the settlement price fell by 4.8% from the previous day. Tuesday’s settlement price, €27.13/MWh, was the weekly minimum. According to data analyzed at AleaSoft Energy Forecasting, this price was 6.0% lower than the previous Tuesday. In the last sessions of the week, settlement prices were higher, but remained below €28/MWh. On Thursday, March 28, the settlement price was €27.34/MWh, 3.6% higher than the previous Thursday.

European reserve levels, abundant supply from Norway and forecasts of higher temperatures in early April contributed to TTF gas futures prices remaining below €28/MWh in most sessions in the last week of March.

As for settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2024, during the last week of March they remained above €60/t. On Monday, March 25, these futures registered their weekly maximum settlement price, €65.00/t. According to data analyzed at AleaSoft Energy Forecasting, this price was 5.8% higher than the previous Monday and the highest since the second half of January. In contrast, on Thursday, March 28, these futures registered their weekly minimum settlement price, €61.80/t. This price was still 4.6% higher than the previous Thursday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

Current electricity market prices may be a problem for renewable energy developers who used overly optimistic price forecasts to improve financing conditions. Long‑term price forecasts of AleaSoft Energy Forecasting and AleaGreen have a scientific basis that provides coherence and quality. In addition, these forecasts have hourly granularity, confidence bands and up to 30‑year horizons. Long‑term price curve forecasting reports are available for the major European markets, as well as for markets of America and Asia.

Source: AleaSoft Energy Forecasting.