AleaSoft, June 4, 2020. In the first days of June, the electricity markets prices rose compared to those of the previous week due to the decrease in wind and solar energy production. Values above €30/MWh were reached in the MIBEL market. The wind energy production is expected to rise over the weekend, driving prices down. The TTF gas prices, although still low, recovered in the first days of this month and those of Brent oil and CO2 continue the upward trend that began in May.

Balance of the month of May in the Spanish electricity market

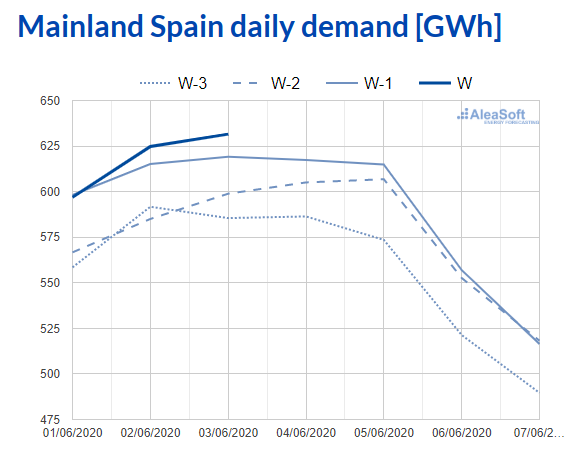

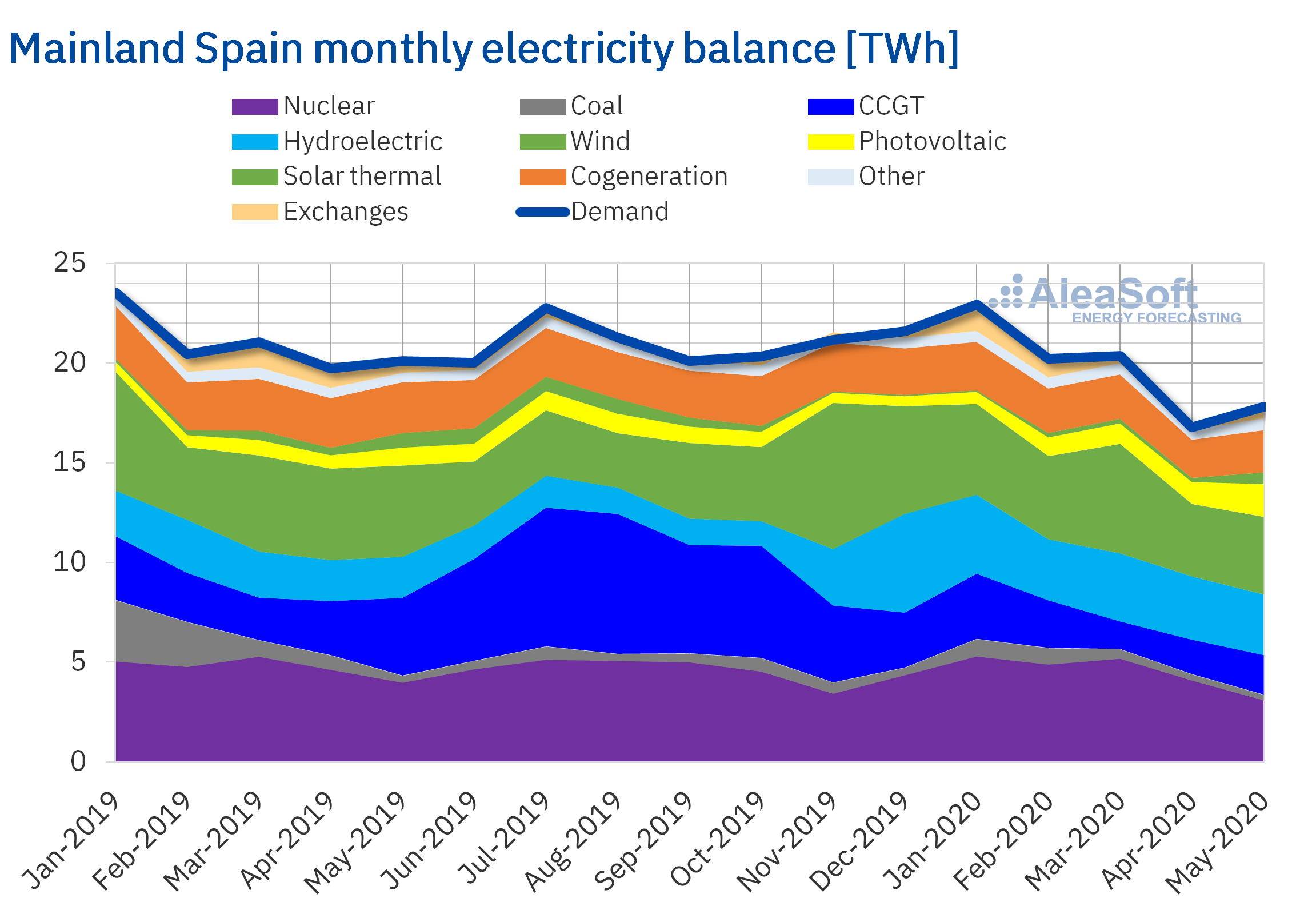

In the month of May, the electricity demand in Mainland Spain decreased by 12% compared to May 2019. According to REE data, once the effects of temperature and labour were corrected, the variation was ‑13%. However, due to the measures that began to be adopted since the beginning of May in the de‑escalation of the confinement of the population due to the SARS‑CoV‑2 coronavirus pandemic, the demand increased 4.7% compared to April of this year. On the AleaSoft website, it is possible to track the demand of the last three weeks at the energy markets observatory.

Source: Prepared by AleaSoft using data from REE

Source: Prepared by AleaSoft using data from REE

The solar energy production of Mainland Spain, which includes the photovoltaic and solar thermal technologies, increased by 64% in May compared to April of this year. With respect to the production registered in the month of May 2019, it increased by 36%.

The wind energy production registered a 3.7% increase last month compared to April. By contrast, in the year‑on‑year comparison, the production with this technology decreased by 15% last month.

On the other hand, the hydroelectric energy production increased by 46% compared to that of the same month of last year, although it decreased by 4.7% compared to April of this year.

The production with coal continues to decline and last May it was 15% lower than the previous month, while compared to the same month in 2019 it decreased by 22%. Likewise, the combined cycle gas turbines reduced their production by 49% compared to May 2019, however they increased by 11% compared to April.

The nuclear energy production also fell during the past month, as a result of the disconnection from the electricity grid of the Trillo Nuclear Power Plant to start to work on its 32nd recharge on May 18. In this way, the Trillo plant will remain shutdown for 35 days and joined the stops of unit 1 of the Almaraz Nuclear Power Plant on April 14 and unit 1 of the Ascó Nuclear Power Plant on April 28. The latter was restarted during this first week of June.

Source: Prepared by AleaSoft using data from REE.

Source: Prepared by AleaSoft using data from REE.

In May the hydroelectric reserves rose by 25% year‑on‑year. Compared with the accumulated in April 2020, they rose about 1%.

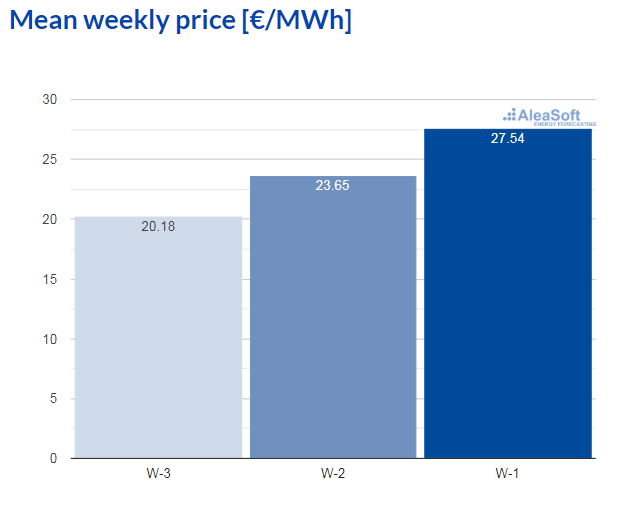

As for the MIBEL electricity market of Spain and Portugal, the average price increased by 20% last May compared to the average of April. This was the second largest price rise in Europe, after the one registered in the Nord Pool market. On the other hand, the prices were 56% lower than those of the same month of the previous year.

In the case of Spain, the monthly average price for May was €21.25/MWh. While in Portugal, the average was slightly higher, of €21.36/MWh. These prices allowed the Portuguese and the Spanish markets to rank third and fourth, respectively, among the European electricity markets with the highest average prices in May, after the British and Italian markets.

Source: Prepared by AleaSoft using data from OMIE

Source: Prepared by AleaSoft using data from OMIE

Regarding the Iberian electricity futures, the general behaviour of the prices of the next quarter in the EEX market of Spain and in the OMIP market of Spain and Portugal was slightly down during the month of May. In all three cases, the difference between the settlement price of the first and the last market session of the month was approximately €1.0/MWh of decline. However, fluctuations in prices were registered during the month. The first electricity futures trading of last month were held on May 4 and the negotiated prices were €32.64/MWh and €32.60/MWh for Spain in the EEX and OMIP markets respectively, as well as for Portugal in the OMIP market the price was €32.61/MWh. The maximum price was reached on May 11, and was €32.67/MWh, €32.68/MWh and €32.69/MWh in the EEX market of Spain and the OMIP market of Spain and Portugal respectively. On the other hand, the minimum value for the month was reached on May 22, when the EEX market of Spain registered a price of €30.50/MWh and the OMIP market of Spain and Portugal registered €30.25/MWh and €30.26/MWh respectively.

Regarding the product of the year 2021, the behaviour was very similar, in general a slight decrease of approximately €1.0/MWh between the first and the last market session. In this case, the settlement price of the first session of the month was €41.10/MWh in the EEX and OMIP markets of Spain and €41.13/MWh in the OMIP market of Portugal. The maximum price in the OMIP market of Spain and Portugal was reached on May 5, with figures of €41.33/MWh and €41.36/MWh. Meanwhile, in the EEX market of Spain the maximum price of €41.33/MWh was reached, as in the quarterly product, on May 11. The minimum of the month coincided in all, on May 22, with prices of €39.93/MWh, €40.03/MWh and €40.06/MWh in the EEX markets of Spain and the OMIP market of Spain and Portugal.

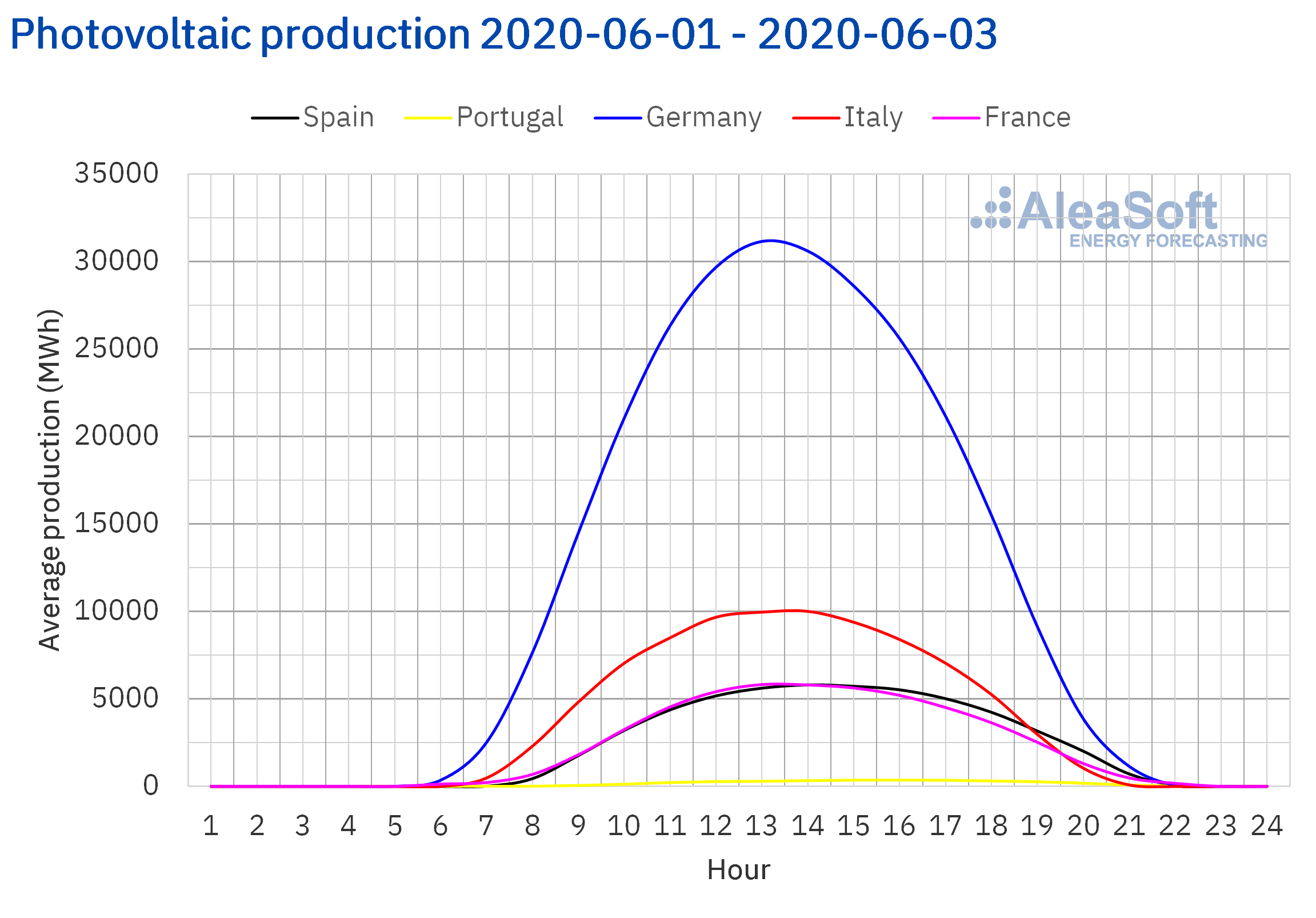

Photovoltaic and solar thermal energy production and wind energy production in Europe

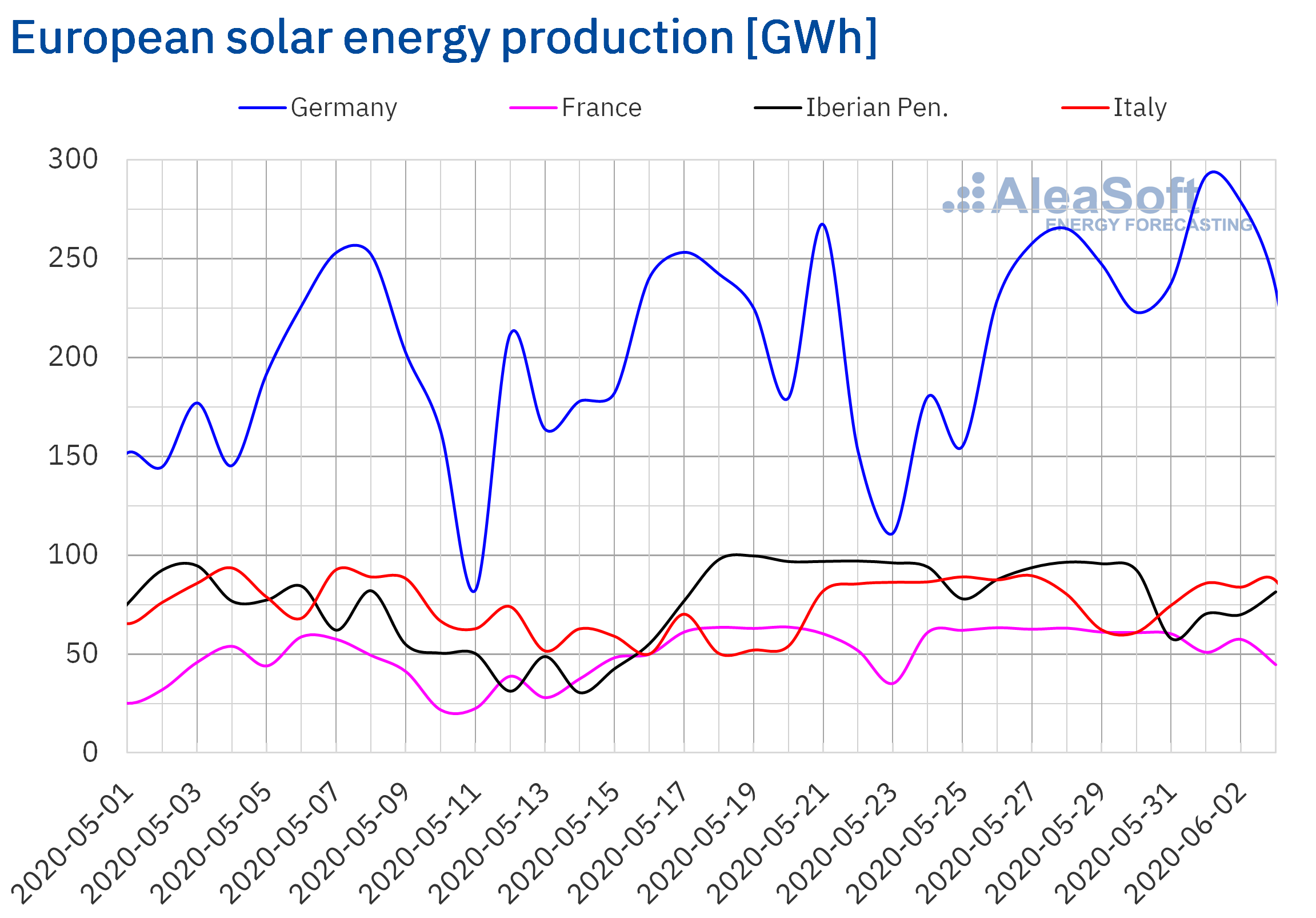

The solar energy production increased during the first three days of this first week of June compared to last week’s average in the German market and the Italian market by 17% and 10% respectively. On the contrary, in the French market it decreased by 18%, while in the Iberian Peninsula it decreased by 14%.

Comparing the past three first days of June with the first three days of June 2019, the solar energy production was 14% higher in the Italian market, while in the Iberian Peninsula and Germany it increased by 13%. In the French market, the production was similar during those days, with a slight increase of 0.3%.

For this week the analysis carried out at AleaSoft indicates that the solar energy production will decrease in Germany, Spain and Italy compared to last week.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

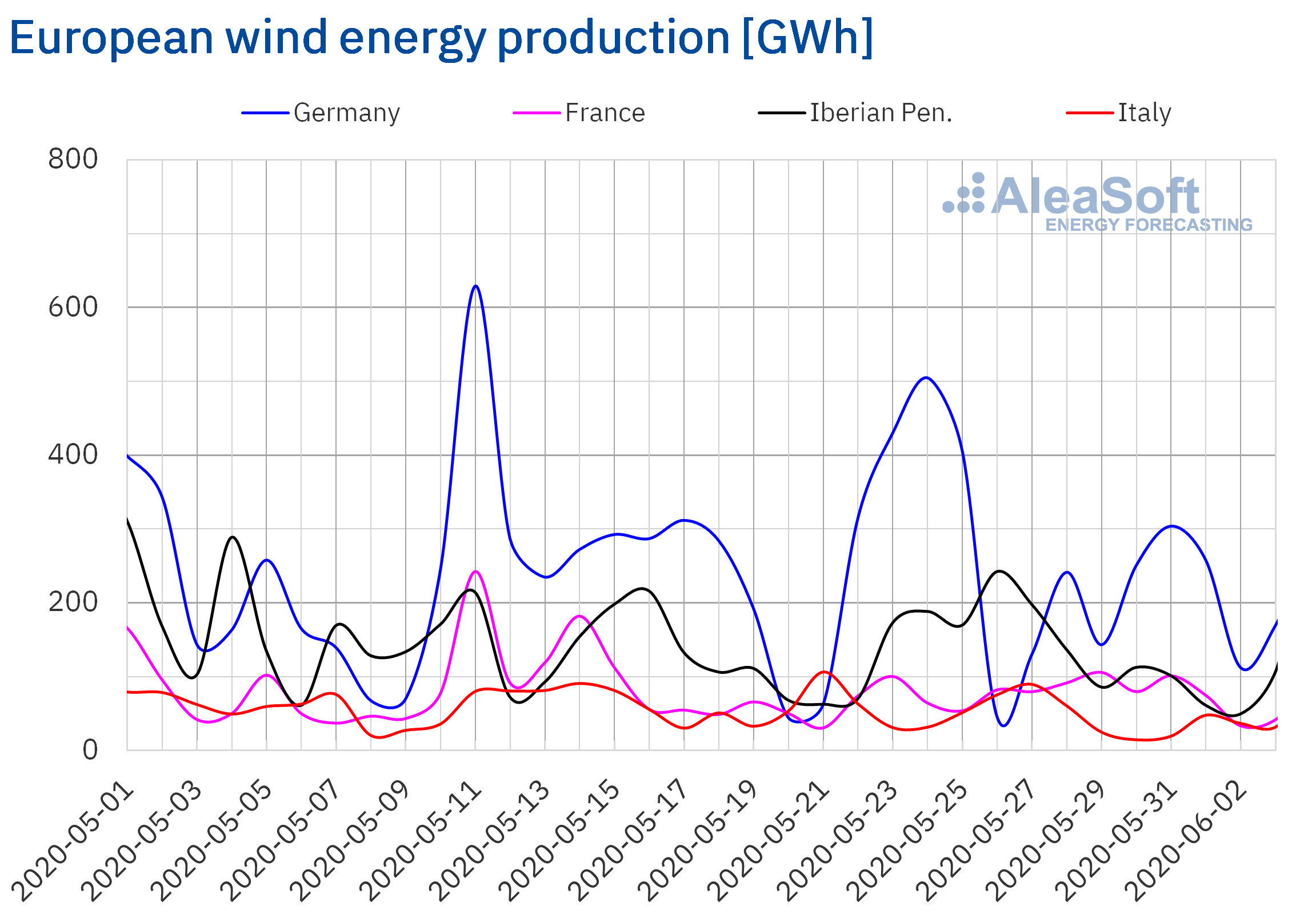

The wind energy production during the first three days of this week was lower than last week’s average in all the markets analysed at AleaSoft. The greatest variations were in the Iberian Peninsula and France, of ‑52% and ‑41% respectively. In the Italian market the production decreased by 19%, while in the German market it decreased by 17%.

In the comparison of the first three days of this month with the same period of June 2019, an increase in production of 33% was registered in the French market, while on the contrary, in the Iberian Peninsula it decreased by 30%. In the case of the Italian market and the German market, the variation was 1.7% and ‑0.8% respectively.

However, the AleaSoft‘s analysis indicates that the wind energy production will recover in the rest of the days of the week and that the total for the week will end up being higher than that of last week in Italy, Germany and Portugal.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

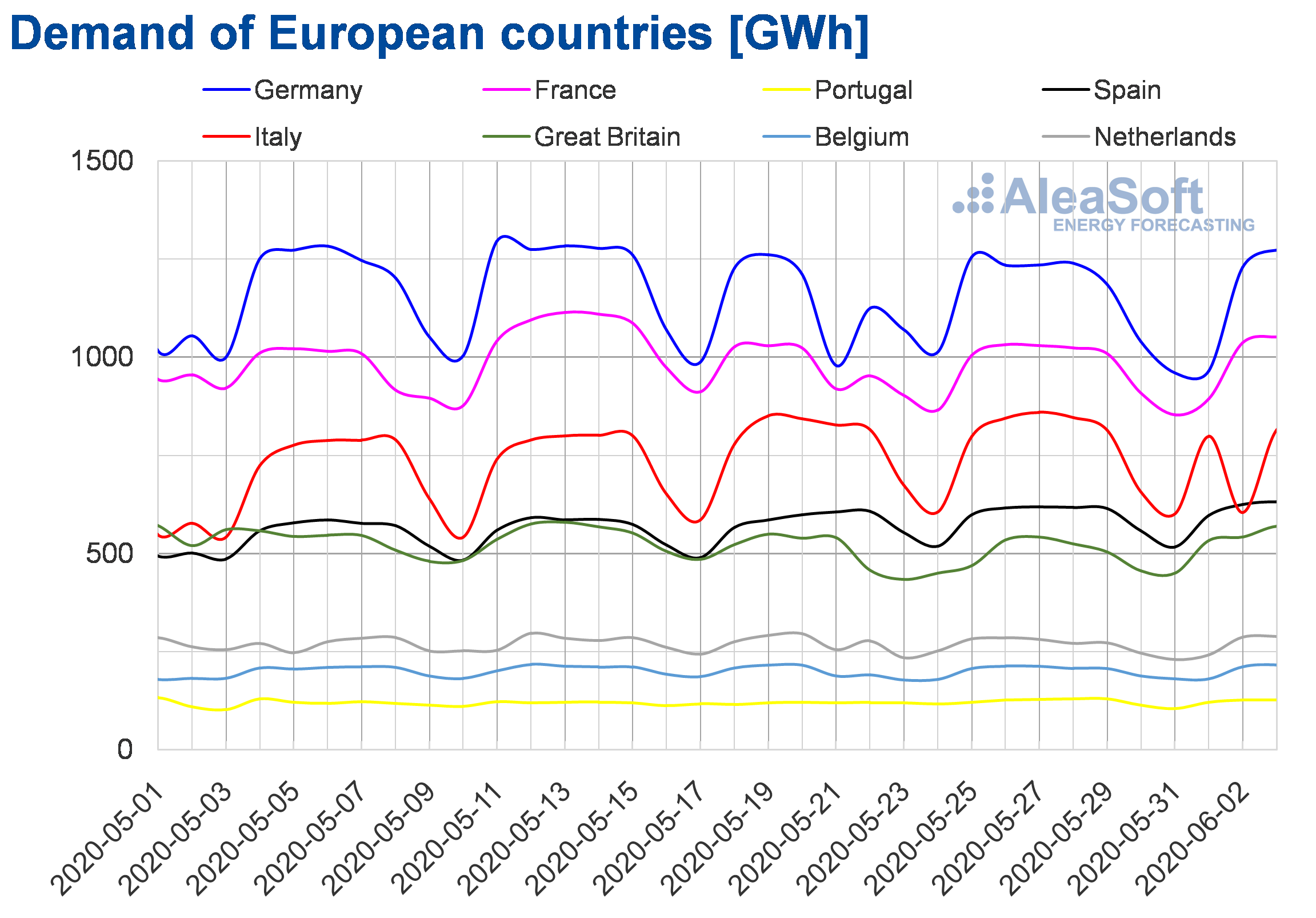

European electricity demand

During the first three days of this week, the electricity demand decreased in the vast majority of analysed European markets compared to the same period of last week. In the markets of Germany, Belgium, the Netherlands and France, the decreases were between 6.9% and 2.7%, related to the effect of the national holiday of Pentecost Monday that was celebrated on June 1. The Italian market was the one with the greatest variation, of ‑11%, due to the effect of the national holiday of Tuesday, June 2, the Republic of Italy day. In the Portuguese market, the demand for the first three days of this week behaved similarly to the same days of the week of May 25, with a slight decrease of 0.1%.

On the other hand, in the markets of Spain and Great Britain the electricity demand so far this week had an increase of 1.1% and 6.5% respectively. In the case of the Spanish market, this increase in demand is due to the fact that 70% of Spanish territory, since this Monday, June 1, is in phase 2 of de‑escalation of the confinement due to COVID‑19. In the case of the United Kingdom, the recovery in demand of this week was due to the effect of the holiday of the previous Monday, May 25, and to the fact that since Monday, June 1, some measures of confinement in this territory were relaxed, such as the reopening of schools and some shops.

At the AleaSoft’s electricity demand observatories it is possible to compare the behaviour of the demand during the current and the previous weeks.

The AleaSoft’s demand forecasting for the rest of the week show a recovery in most electricity markets, which will depend on de‑escalation measures in each territory.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

Source: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

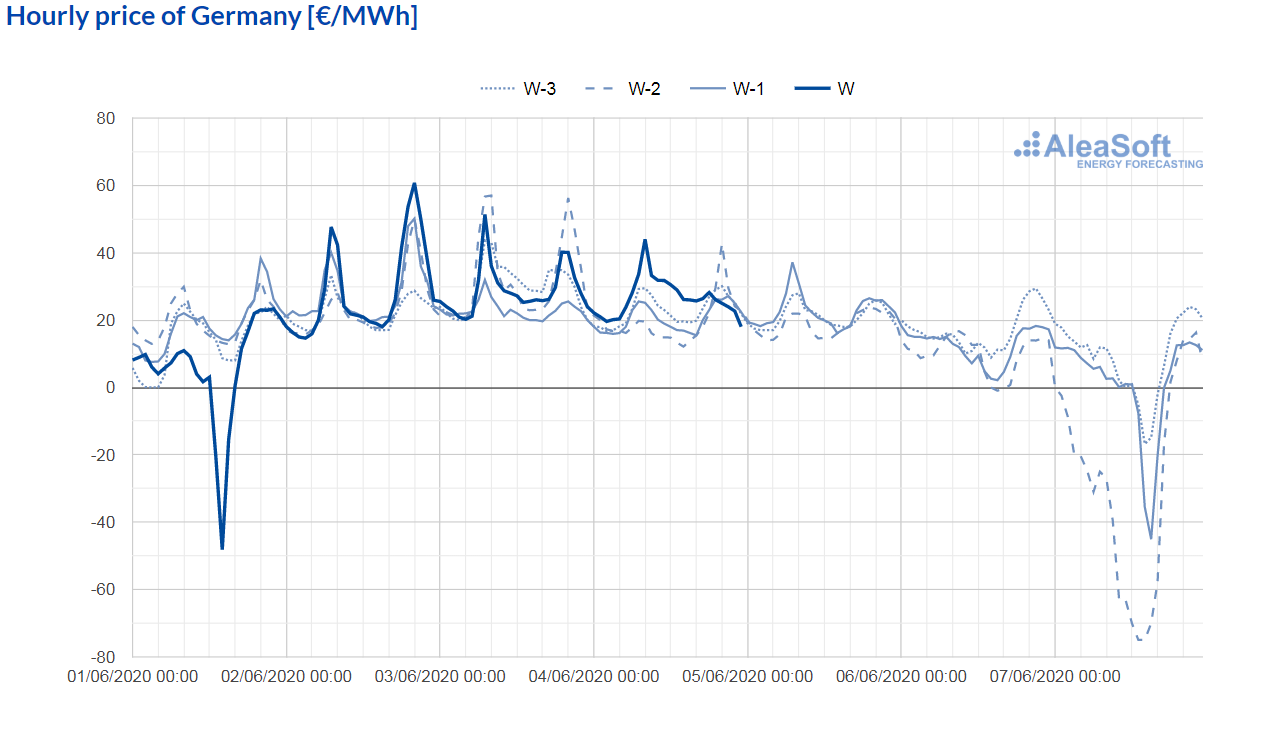

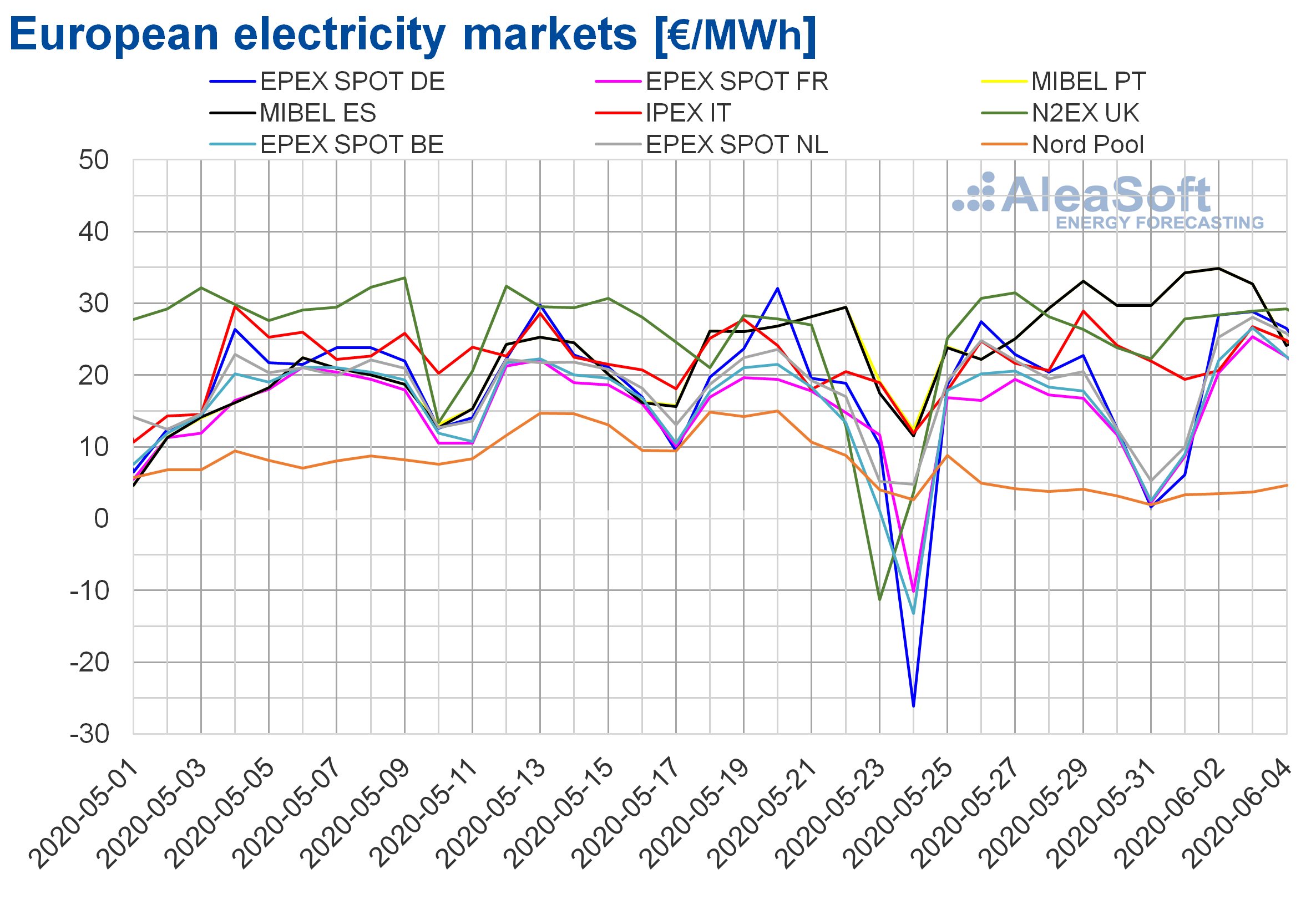

European electricity markets

The first four days of the week of June 1, the prices increased in most European electricity markets compared to those of the same days of the previous week. The exceptions were the Nord Pool market of the Nordic countries and the N2EX market of Great Britain, with declines of 30% and 1.0% respectively. On the other hand, the highest price increase, of 25%, occurred in the MIBEL market of Spain and Portugal. While the smallest increase was in the EPEX SPOT market of Germany, of 0.5%. In the rest of the markets, the price increases were between 4.2% of the EPEX SPOT market of the Netherlands and 10% of the EPEX SPOT market of France.

The market with the lowest average price so far this week, of €3.79/MWh, was once again the Nord Pool market. While the market with the highest average, of €31.52/MWh, was the MIBEL market of Portugal, followed by the MIBEL market of Spain, with a price of €31.47/MWh. The rest of the markets had average prices between €19.24/MWh of France and €28.59/MWh of Great Britain.

But, despite the increases of the first days of this week, on Monday, June 1, negative hourly prices were reached in the markets of Germany, Belgium, France and Switzerland influenced by the decrease in demand of the holiday of Pentecost Monday. The lowest hourly price, of ‑€48.17/MWh, was that of the hour 15 of the German market.

Source: Prepared by AleaSoft using data from EPEX SPOT

Source: Prepared by AleaSoft using data from EPEX SPOT

On the other hand, the general decrease in wind energy production and the decrease in solar energy production in countries such as Spain, France, Italy or Portugal favoured the price increases of the first four days of the week of June 1 of most of the analysed European markets. The recovery in CO2 prices is another factor that led to the rise in prices in the electricity markets.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Source: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

In the rest of the days of this week, the AleaSoft‘s price forecasting indicates that the prices will decrease in most markets, influenced by the decrease in demand over the weekend and the increase in wind energy production. In the case of the Nord Pool market, furthermore, high levels of hydroelectric energy production are expected due to the abundant rainfall and the thawing. But the next week, of June 8, is expected to start with price increases in most European electricity markets, with the exceptions of the MIBEL and N2EX markets.

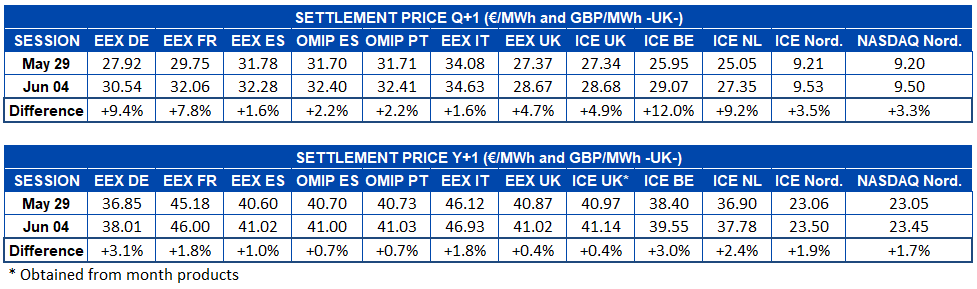

Electricity futures

The electricity futures prices for the next quarter registered increases so far this week compared to the end of last week, Friday, May 29. The highest rise was registered by the ICE market of Belgium, with a 12% difference. The EEX market of Spain and Italy registered decreases of 1.6% in both countries, thus being the countries that least changed their price in this period. In absolute terms, the NASDAQ market of the Nordic countries registered the lowest rise, of €0.30/MWh.

In the case of the electricity futures for the calendar year 2021, the behaviour was similar. The increases in this case were less pronounced. The EEX market of Germany was the fastest growing. Great Britain was the country with the lowest price increase for this product, both in the EEX market and in the ICE market, with 0.4% in both.

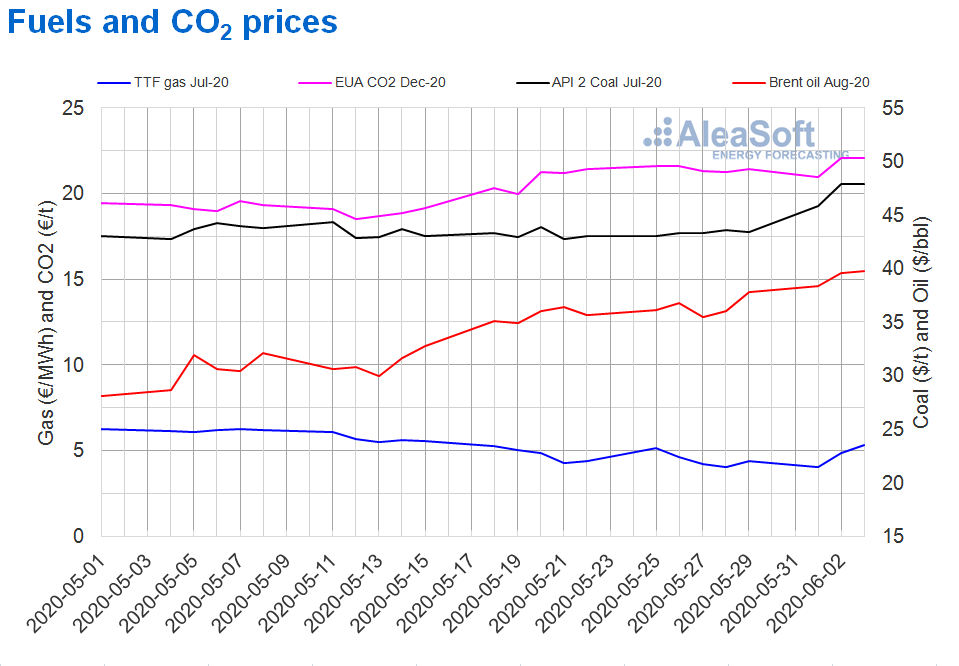

Brent, fuels and CO2

The Brent oil futures prices for the month of August 2020 in the ICE market started the week of Monday, June 1, with the upward trend started at the end of the previous week. On Wednesday, June 3, a settlement price of $39.79/bbl was reached, 12% higher than that of the previous Wednesday and the highest since the beginning of March.

The increase in demand associated with the relaxation of the confinement measures in some countries is favouring this trend. On the other hand, the OPEC+ has to meet on June 9 and 10 to decide on the continuity of the cuts in its production, which are also contributing to the recovery of the prices. In the case of Saudi Arabia, it already announced that it will maintain the current levels of production cuts regardless of whether an agreement is reached. However, the existing uncertainty about the outcome of the meeting may influence the Brent oil futures prices in the coming days.

The TTF gas futures prices in the ICE market for the month of July 2020 started the week of June 1 with an upward trend. As a consequence, the settlement price of yesterday, Wednesday, June 3, was €5.33/MWh, 26% higher than that of the same day of the previous week and the highest since May 15.

Regarding the TTF gas prices in the spot market, after falling in the last days of May, from Monday, June 1, the prices also increased again. Today, Thursday, June 4, the index price was €4.81/MWh, 34% higher than that of the same day of the previous week and the highest in the last two weeks.

The progressive increase in demand due to the de‑escalation of the confinement and the cancellation of some imports from the United States for June and July favour this behaviour of the gas prices. However, the levels of the reserves, which are very high, and the increase in the arrival of gas from Russia may limit this recovery in prices.

On the other hand, the API 2 coal futures prices in the ICE market for the month of July 2020, the first days of this week of June 1, were higher than those of the previous week. The maximum settlement price so far this week, of $47.85/t, was reached on June 2 and 3. This price was 10% higher than that of the same days the previous week and the highest since the first half of April.

As for the CO2 emission rights futures in the EEX market for the reference contract of December 2020, on Monday, June 1, they reached a settlement price of €20.98/t, 2.8% lower than that of the same day of the previous week. But on Tuesday and Wednesday the prices recovered. On Wednesday, June 3, the settlement price was €22.08/t, 3.5% higher than that of the previous Wednesday. This price is the highest since those registered in the first fortnight of March.

Source: Prepared by AleaSoft using data from ICE and EEX.

Source: Prepared by AleaSoft using data from ICE and EEX.

AleaSoft analysis on the effects on the electricity markets due to the coronavirus crisis

One of the initiatives carried out at AleaSoft to analyse the behaviour of the energy markets during the coronavirus crisis and the subsequent economic crisis is the observatory enabled on its website. With this tool it is possible to check the evolution of the main electricity, fuels and CO2 markets through comparative charts of the last weeks.

Since the beginning of the COVID‑19 pandemic, a series of webinars were held at AleaSoft to analyse how the energy markets have been affected by this situation. The financing of renewable energy projects at this stage, in which the investor appetite has not decreased, was also discussed. On June 25 the evolution of both topics will be updated in the webinar “Influence of coronavirus on electricity demand and the European electricity markets (III)”, which will have as speakers Pablo Otín, CEO and co‑founder at Powertis, Miguel Ángel Amores, Manager of Renewable Energies at Triodos Bank and Oriol Saltò i Bauzà, Manager of Data Analysis and Modelling at AleaSoft.

Source: AleaSoft Energy Forecasting.