AleaSoft, November 5, 2020. In the first days of November, the prices of most of the European electricity markets fell, although in many cases the decreases did not exceed €2.50/MWh. The decrease in demand in most of the markets and the downward trend in gas prices in recent days favoured this behaviour. However, the prices are expected to increase in some electricity markets in the second week of November because the wind energy production will be lower.

Photovoltaic and solar thermal energy production and wind energy production

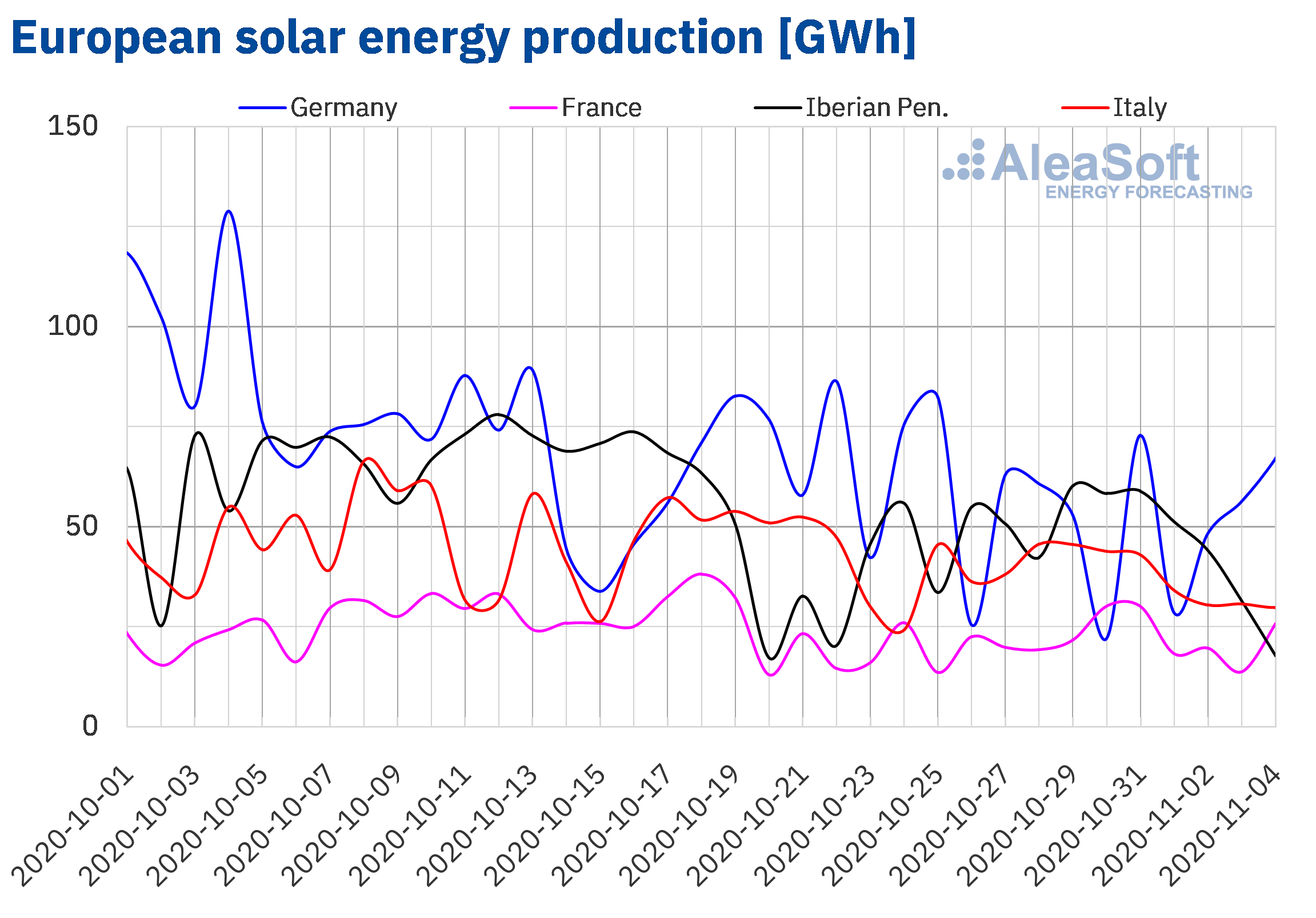

Between Monday, November 2, and Wednesday, November 4, the average solar energy production decreased in most of the markets analysed at AleaSoft compared to the average of the previous week. In the Iberian Peninsula it decreased by 42%, while in Italy and France it fell by 26% and 15% respectively. The exception was the German market where the production increased by 23%.

During the first four days of November, the solar energy production increased by 71% in the Iberian Peninsula and 58% in the French market compared to the same days of 2019. In the Italian market, 32% more was produced with this technology and in the German market, 24%.

For the first week of November, the analysis carried out at AleaSoft indicates that the solar energy production will decrease in most markets, while in the German market the production is expected to continue to be higher than that of the previous week.

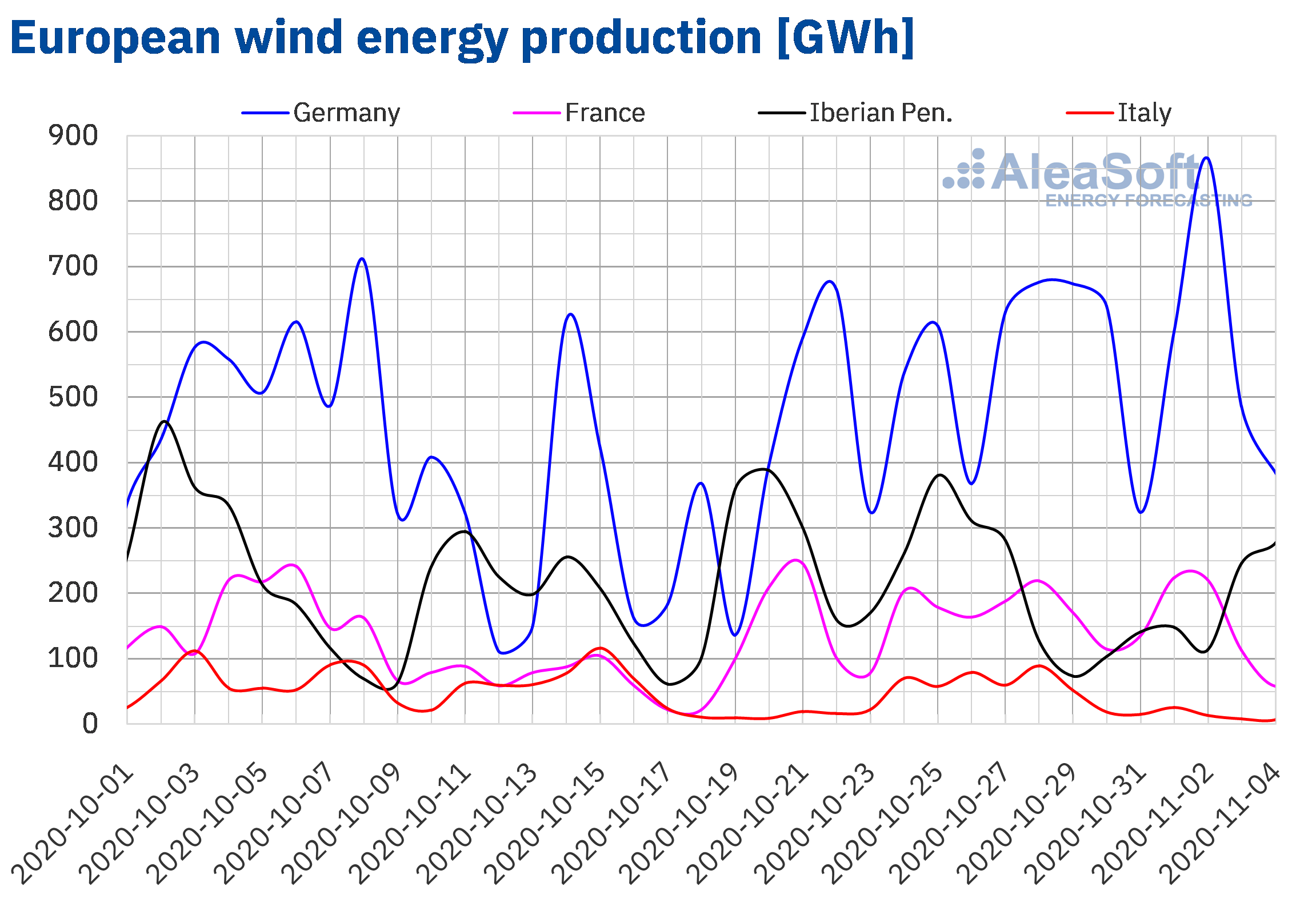

The average wind energy production the first three days of the week that began on Monday, November 2, increased by 26% in the Iberian Peninsula compared to the average registered during the previous week. In the German market it grew by 3.5%, while on the contrary in Italy and France the average production decreased by 80% and 25% respectively.

In the year‑on‑year analysis, between November 1 and 4, the production with this technology increased by 39% in the German market. In the rest of the analysed markets, the production decreased between 86% of the Italian market and 13% of the French market.

The AleaSoft‘s analysis indicates that at the end of the first week of November, the total wind energy production will be lower in Italy, France and Germany compared to that of the week of October 26, while on the contrary, an increase in production is expected in the Iberian Peninsula.

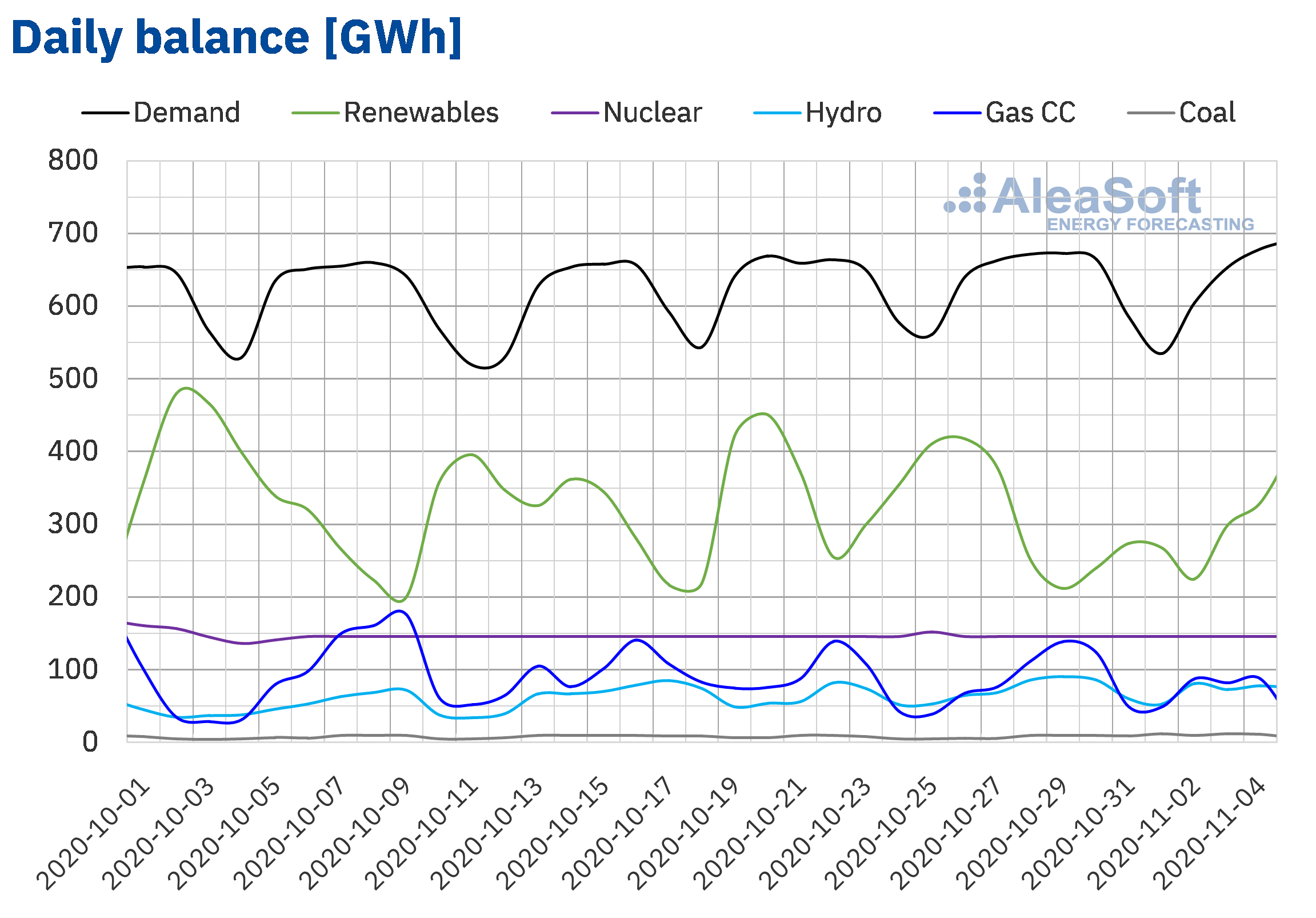

Electricity demand

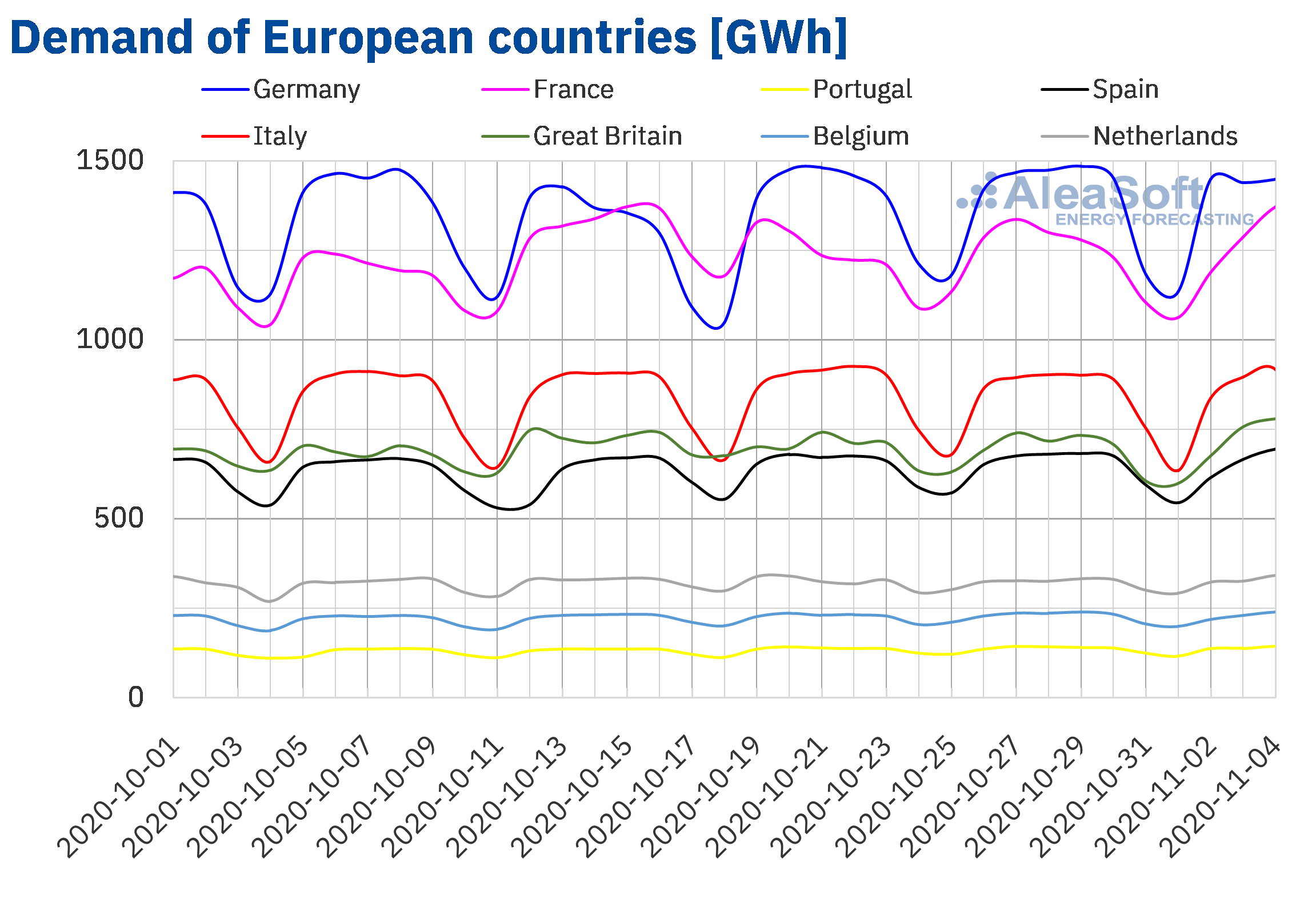

From Monday to Wednesday of the week of November 2, the electricity demand decreased in most of the European markets compared to the same days of the previous week. In the case of the French and Belgian markets, the decreases were 1.9% and 1.8% respectively. On the other hand, in the British market there was a recovery in demand of 3.0%. In the rest of the analysed markets there were falls of less than 1.6%.

However, in the last days of the week the temperatures will drop, for this reason the AleaSoft’s forecasting indicates that the demand of the European markets will be higher than that of the previous week at the end of the week, except in the German market where it is expected to decrease. Similarly, the behaviour of the electricity demand in the European markets could be affected by the restrictions to stop the spread of COVID‑19, such as the confinements decreed in France and the United Kingdom, the partial confinement of Germany during the month of November and the curfew in some regions of Belgium that will continue until mid‑December.

Mainland Spain, photovoltaic and solar thermal energy production and wind energy production

The electricity demand of Mainland Spain had a decrease of 1.6% from November 2 to 4 compared to the first three days of the last week of October. However, at AleaSoft the demand in the Spanish market is expected to be slightly higher than that of the previous week at the end of the first week of November.

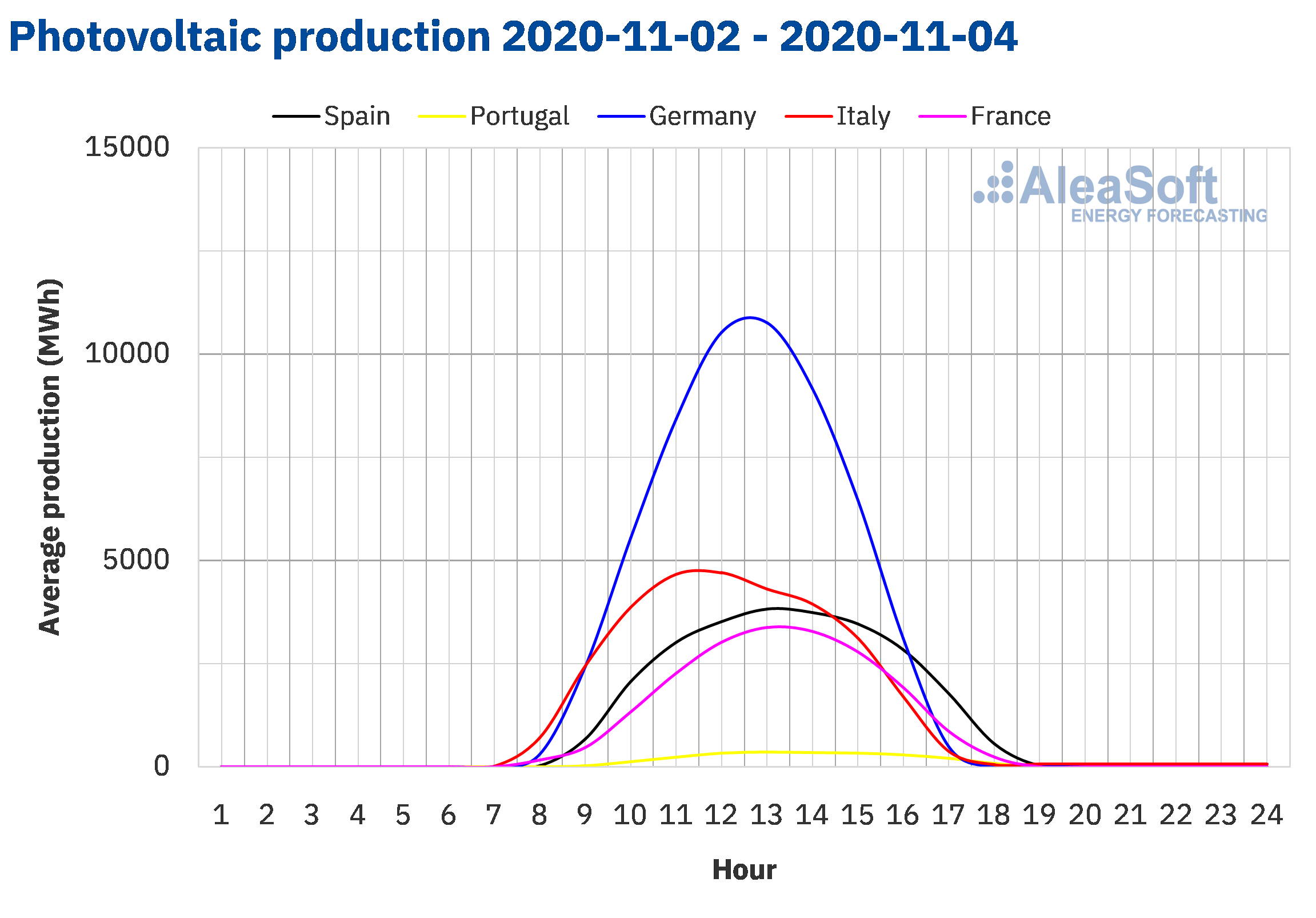

The average solar energy production of Mainland Spain, including the photovoltaic and solar thermal technologies, decreased by 43% between Monday and Wednesday of the week of November 2 compared to the average of the week of October 26. In the year‑on‑year comparison, the production with these technologies registered an increase of 71% during the first four days of November. At AleaSoft it is expected that at the end of the week the total solar energy production will be lower than that registered the previous week.

The average level of the wind energy production in Mainland Spain of the first three days of the week that began on November 2, increased by 8.1% compared to the average of the previous week. In the year‑on‑year analysis, the production registered between November 1 and 4 was 53% lower than that of the same period of 2019. According to the analysis carried out at AleaSoft, for the week of November 2 to 8, it is expected that the production with this technology increases compared to that registered in the last week of October.

The nuclear energy production remains with a daily average close to 146 GWh. The unit II of the Ascó nuclear power plant continues to be disconnected from the grid due to a scheduled shutdown since Saturday, October 3, and the recharge is expected to be completed during the first week of November.

The hydroelectric reserves currently have 10 558 GWh stored, according to data from the Hydrological Bulletin of the Ministry for Ecological Transition and Demographic Challenge number 44, which represents an increase of 100 GWh compared to the bulletin number 43.

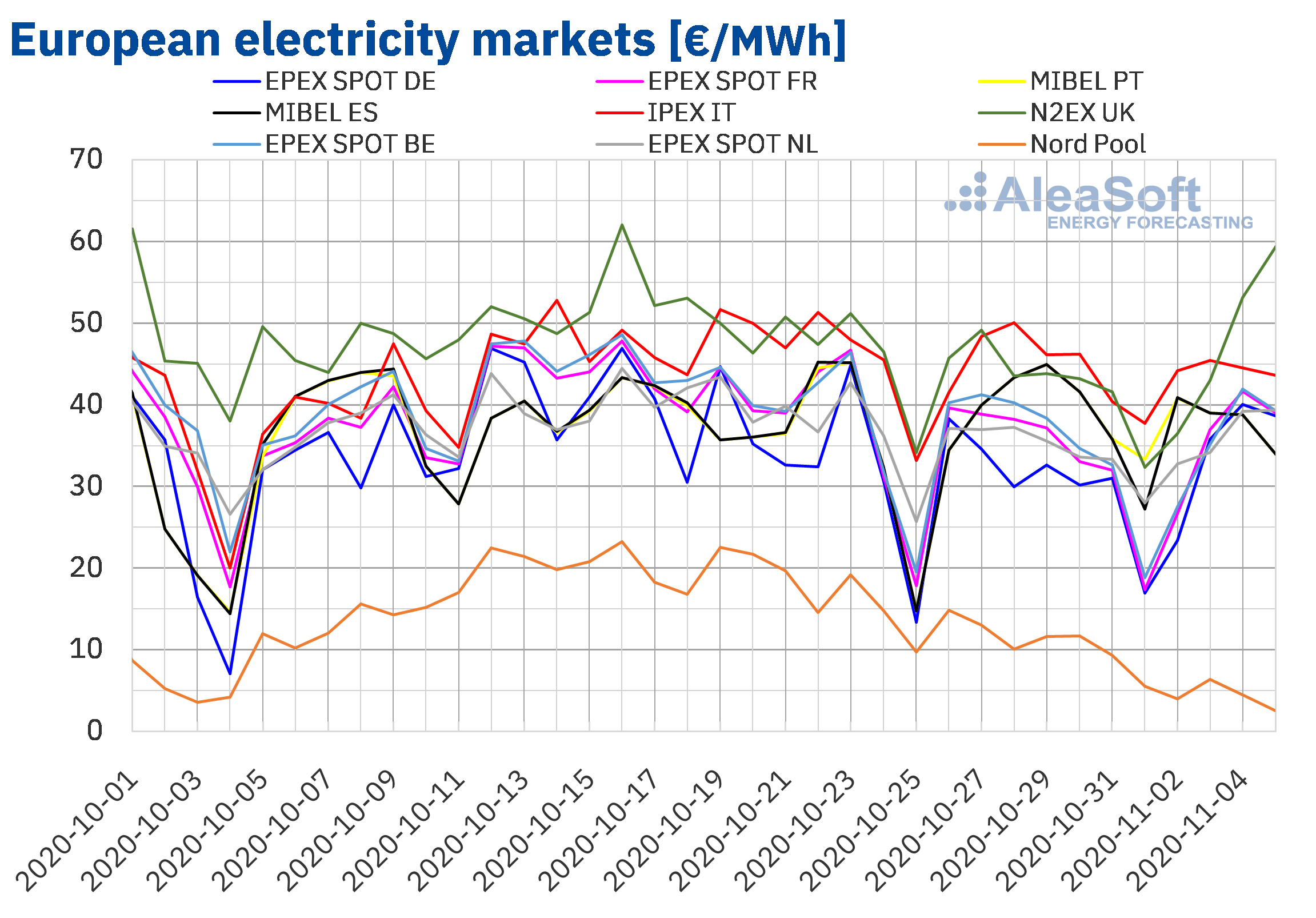

European electricity markets

The first four days of the week of November 2, the prices decreased in almost all the European electricity markets analysed at AleaSoft compared to the same period of the previous week. The exceptions were the EPEX SPOT market of Germany and the N2EX market of Great Britain, where price increases of 1.7% and 5.4% respectively were registered. On the other hand, the largest drop in prices, of 65%, was that of the Nord Pool market of the Nordic countries. In contrast, in the EPEX SPOT market of the Netherlands there was the lowest price decrease, of 1.0%. In the rest of the markets, the price decreases were between 4.5% of the IPEX market of Italy and 10% of the EPEX SPOT market of Belgium.

During the first four days of the first week of November, the market with the lowest average price, of €4.36/MWh, was the Nord Pool market of the Nordic countries. On the other hand, the highest average price in this period, of €48.01/MWh, was that of the British market, followed by that of the Italian market, of €44.44/MWh. The averages of the rest of the markets were between €34.45/MWh of the German market and €38.17/MWh of the MIBEL market of Spain.

From Monday to Thursday of the first week of November, the Nord Pool market had the lowest daily prices. On the other hand, the prices of the markets of Germany, Belgium and France were quite coupled. The rest of the markets had, in general, higher prices and less coupling, especially at the beginning of the week. On Monday and Tuesday, the highest prices were reached in the IPEX market. But, on Wednesday and Thursday, the N2EX market reached higher prices.

Between November 2 and 5, the daily prices only exceeded €50/MWh in the British market. On November 4, the price of this market was €53.14/MWh. But later, on November 5, the price was even higher, of €59.40/MWh. That same day, the lowest daily price, of €2.53/MWh, was reached in the Nord Pool market.

Regarding the hourly prices, on November 2, negative hourly prices were reached in the markets of Germany, Belgium, France, Great Britain, the Netherlands and the Nordic countries. The lowest hourly price was that of the hour 4 of the German market, of ‑€10.48/MWh. In the case of the Nord Pool market of the Nordic countries, this was the first time that the price of the system reached negative hourly values, at least, since 2011.

On the other hand, the highest hourly price of the first four days of the first week of November, of €213.63/MWh, was reached at the hour 19 of Thursday, November 5, in the British market. This was the highest hourly price since June 2019 in this market.

The drop in demand in most markets and the drop in gas prices, together with the increase in wind energy production in some cases, favoured the price drops of the first days of the week of November 2.

On the other hand, the AleaSoft‘s price forecasting indicates that for the rest of the week and for the week of November 9, the decrease in wind energy production in most markets will favour price increases.

Iberian market

In the MIBEL market of Spain and Portugal, the average price of the first four days of the week of November 2 decreased compared to that of the same period of the previous week. The decrease was 6.1% in Spain and 6.2% in Portugal.

Due to these decreases, the average price from November 2 to 5 was €38.17/MWh in the Spanish market and €38.16/MWh in the Portuguese market. These were the third and fourth highest prices in the European markets, after the averages of the British market and the Italian market.

Regarding the daily prices of the MIBEL market, from Monday to Thursday they fell progressively. Thus, the maximum price, of €40.89/MWh, was reached on Monday, November 2, in the Spanish market. The rest of the days, the daily prices were the same in both Spain and Portugal and the minimum daily price, of €33.99/MWh, was reached on Thursday, November 5.

During the first days of the first week of November, the decrease in demand and the fall in gas prices, together with the increase in wind energy generation, favoured the decrease in prices in the MIBEL market.

The rest of the week, the daily prices are expected to be even lower, but the AleaSoft‘s price forecasting indicates that they will increase during the week of November 9, influenced by lower wind energy production and a recovery in demand.

Electricity futures

The behaviour of the electricity futures prices for the next quarter was heterogeneous during the first four days of November. In the EEX market of Germany and the ICE market of Belgium and the Netherlands, the prices increased compared to the last session of the previous week. The German market was the one with the highest increase, of 1.7%. In the rest of the markets analysed at AleaSoft, the prices reduced for the same period. The ICE market of the Nordic countries was the one with the greatest decline, falling by 5.5% compared to the settlement price of the session of October 30.

As for the prices of the futures for the year 2021, there was a general decline in all the markets analysed at AleaSoft. The largest variations occurred in the ICE market and the NASDAQ market of the Nordic countries, both with a 23% decrease in their prices. The market in which the settlement price for this product fell the least was the EEX of Great Britain, with a decrease of 2.7%. In the case of the British ICE market, this product is not traded, but from the analysis of the monthly products of the year 2021, a barely perceptible variation was obtained in percentage terms, decreasing by only €0.01/MWh.

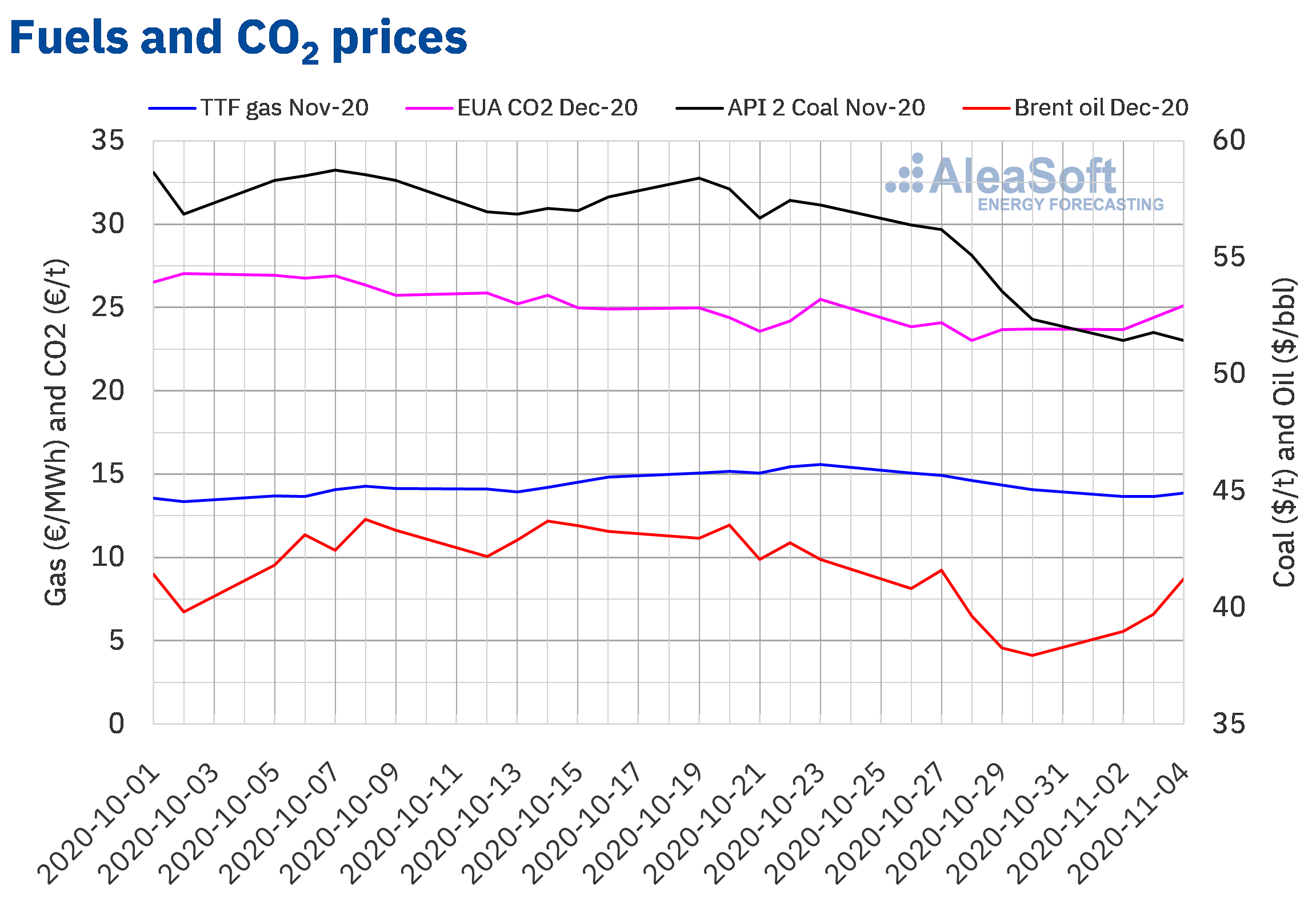

Brent, fuels and CO2

The Brent oil futures prices for the month of January 2021 in the ICE market, the first three days of the week of November 2, began an upward trend. After registering a settlement price of $37.94/bbl on Friday, October 30, the lowest since the second half of May, on November 2, the prices began to recover from the falls of the previous week. The settlement price of Wednesday, November 4, was already $41.23/bbl, 4.0% higher than that of the previous Wednesday.

The possibility that the OPEC+ postpones the increase in its production scheduled for the month of January favoured the recovery of the prices in the first days of the week of November 2. In addition, the decline in crude oil reserves of the United States also contributed to this recovery. However, the decrease in mobility in Europe and the United States due to the measures established to try to control the COVID‑19 pandemic is affecting the demand.

On the other hand, in the coming days, the results of the presidential elections in the United States could influence the evolution of the prices, due to the differences regarding the energy policies between the candidates’ programs.

In the case of the TTF gas futures prices in the ICE market for the month of December 2020, on Monday, November 2, they continued with the downward trend of the previous week. This day a settlement price of €13.66/MWh was reached, 9.4% lower than that of the previous Monday and the lowest since the beginning of October. But a slight recovery in prices began on Tuesday. As a consequence, the settlement price of Wednesday, November 4, was €13.88/MWh.

Regarding the TTF gas in the spot market, on Tuesday, November 3, an index price of €13.17/MWh was reached, the lowest since the first half of October. But, subsequently, the prices started an upward trend and the index price of Thursday, November 5, was €13.72/MWh.

As for the settlement prices of the API 2 coal futures in the ICE market for the month of December 2020, the first days of the week of November 2, they ranged between $51.80/t of Tuesday and $51.45/t of Monday and Wednesday. This last price is the lowest since the end of August.

Regarding the CO2 emission rights futures in the EEX market for the reference contract of December 2020, in the first week of November, the prices began to recover. On Wednesday, November 4, a settlement price of €25.11/t was reached. This price was 9.0% higher than that of the previous Wednesday.

AleaSoft analysis of the evolution of the energy markets in the second wave of the pandemic

On October 29, the AleaSoft webinar “Energy markets in the recovery from the economic crisis (II)” was held, with the participation of speakers from the consulting firm Deloitte. The webinar analysed the evolution of the energy markets in recent weeks, just at the time when Europe is in the second wave of the COVID‑19 pandemic. Project Finance was also discussed, a topic that is of great interest to the renewable energy sector. One of the conclusions of the meeting is that the PPAs are a very useful tool to mitigate the market prices risk. The experts also agreed on the need for reliable prices forecasting to design a robust financial model for a project. To know in detail all the topics covered, the recording can be requested here or by writing to webinar@aleasoft.com.

On November 26, a new series of AleaSoft webinars “Prospects for the energy markets in Europe from 2021” will begin, which will focus on the prospects of the energy markets and of the financing of renewable energy projects from year 2021.

At AleaSoft, the long‑term market prices forecasts are periodically updated, taking into account the economic evolution scenarios. These forecasts include confidence bands, which make it possible to determine the risk associated with assuming certain market prices in the future, for example when negotiating a PPA or when submitting offers for the renewable energy auctions. The forecasts include an hourly profile of the prices that allows obtaining the forecast of the price captured by the photovoltaic and wind technologies.

To analyse how the main European electricity, fuels and CO2 emission rights markets are evolving during the second wave of the pandemic, the AleaSoft observatories can be consulted. This tool includes graphs with daily updated data on the main variables of these markets.

Source: AleaSoft Energy Forecasting.