AleaSoft, November 16, 2020. On Monday, November 16, negative hourly prices were registered in the markets of Germany, Belgium, France, Great Britain and the Netherlands, something that also happened on the 15th in the German market. This occurred as a result of the increase in wind energy production. It is expected that in the third week of November the prices will decrease in a large part of the European electricity markets, also due to the increase in wind energy production, after the previous week the prices rose due to the fall in wind energy production.

Photovoltaic and solar thermal energy production and wind energy production

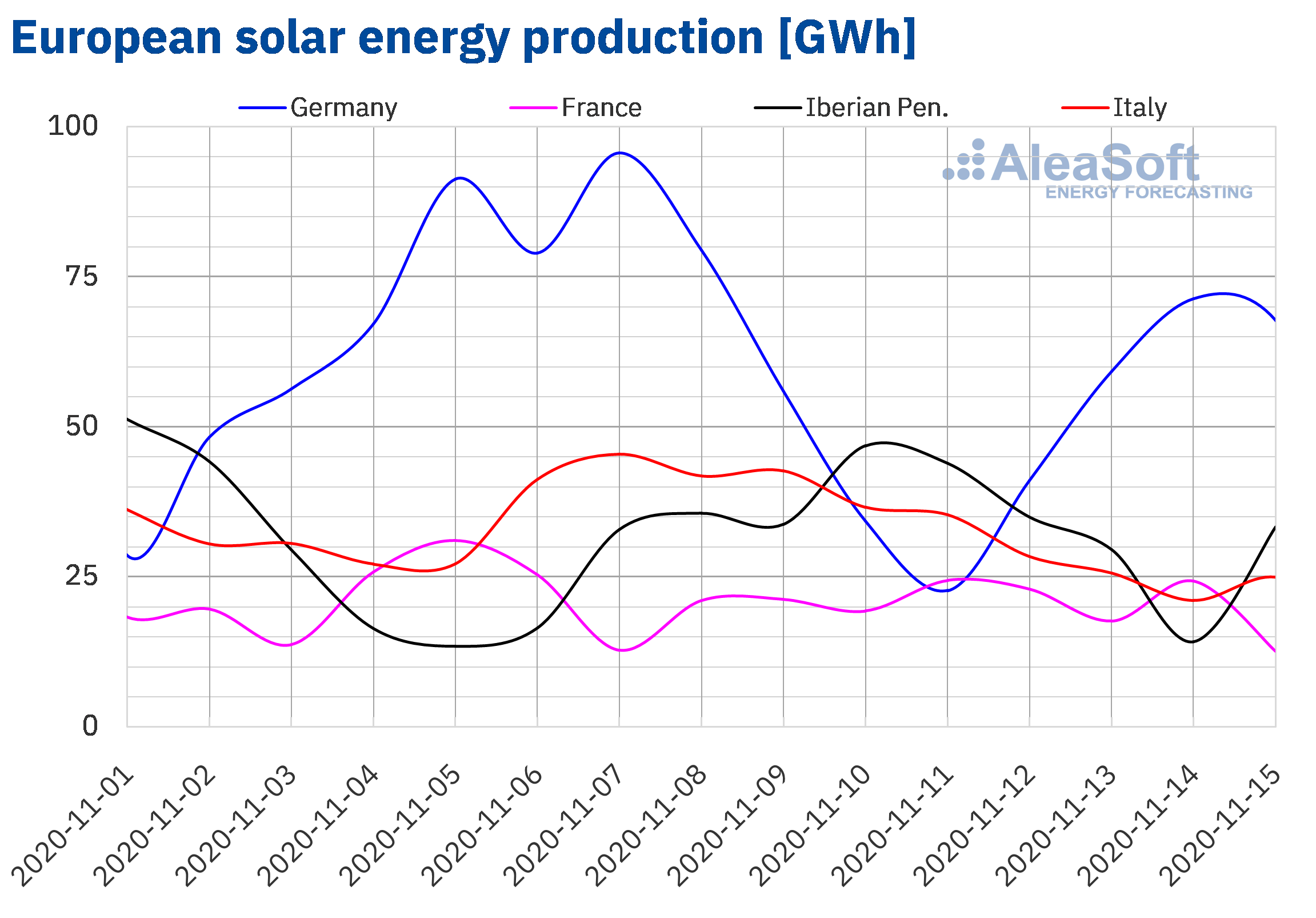

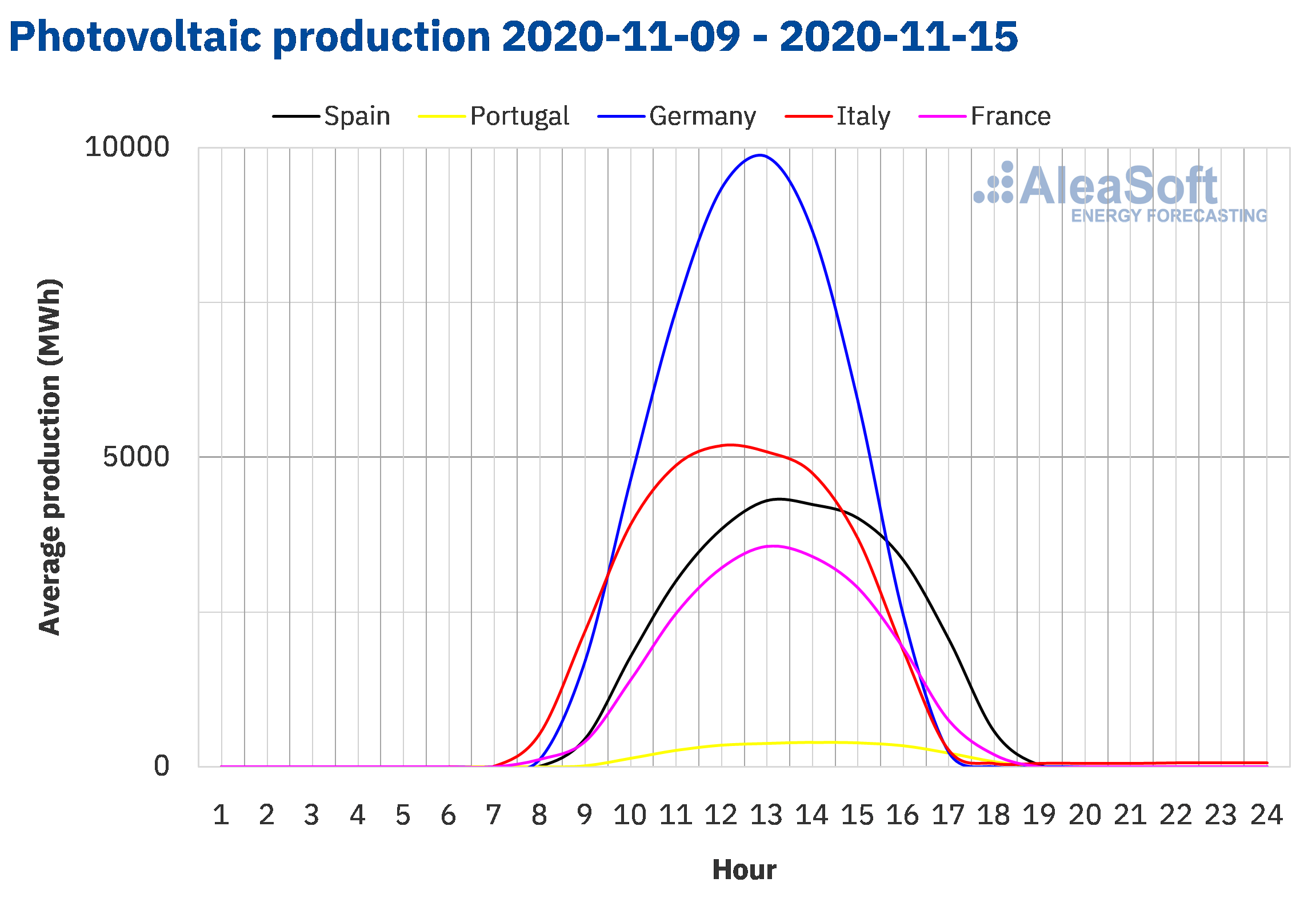

During the second week of November, the solar energy production decreased in most of the analysed European markets. In the German market it decreased by 32% compared to the previous week, while in the Italian and French markets the drops were 12% and 4.3% respectively. On the contrary, in the Iberian market, the production with this technology increased. In the case of Spain the growth was 25% and in Portugal 34%.

In the year‑on‑year analysis, during the first 15 days of November, the solar energy production increased in all the markets analysed at AleaSoft. The markets of the Iberian Peninsula were those with the lowest increase, 17% in the Portuguese and 32% in the Spanish, compared to the same period of 2019. In the German market, the production increased by 46% while in the French and Italian markets grew by 44% in both cases.

For the third week of November, the AleaSoft‘s solar energy production forecasting indicates that it will decrease in the German and Italian markets. On the contrary, an increase in production is expected in the Spanish market.

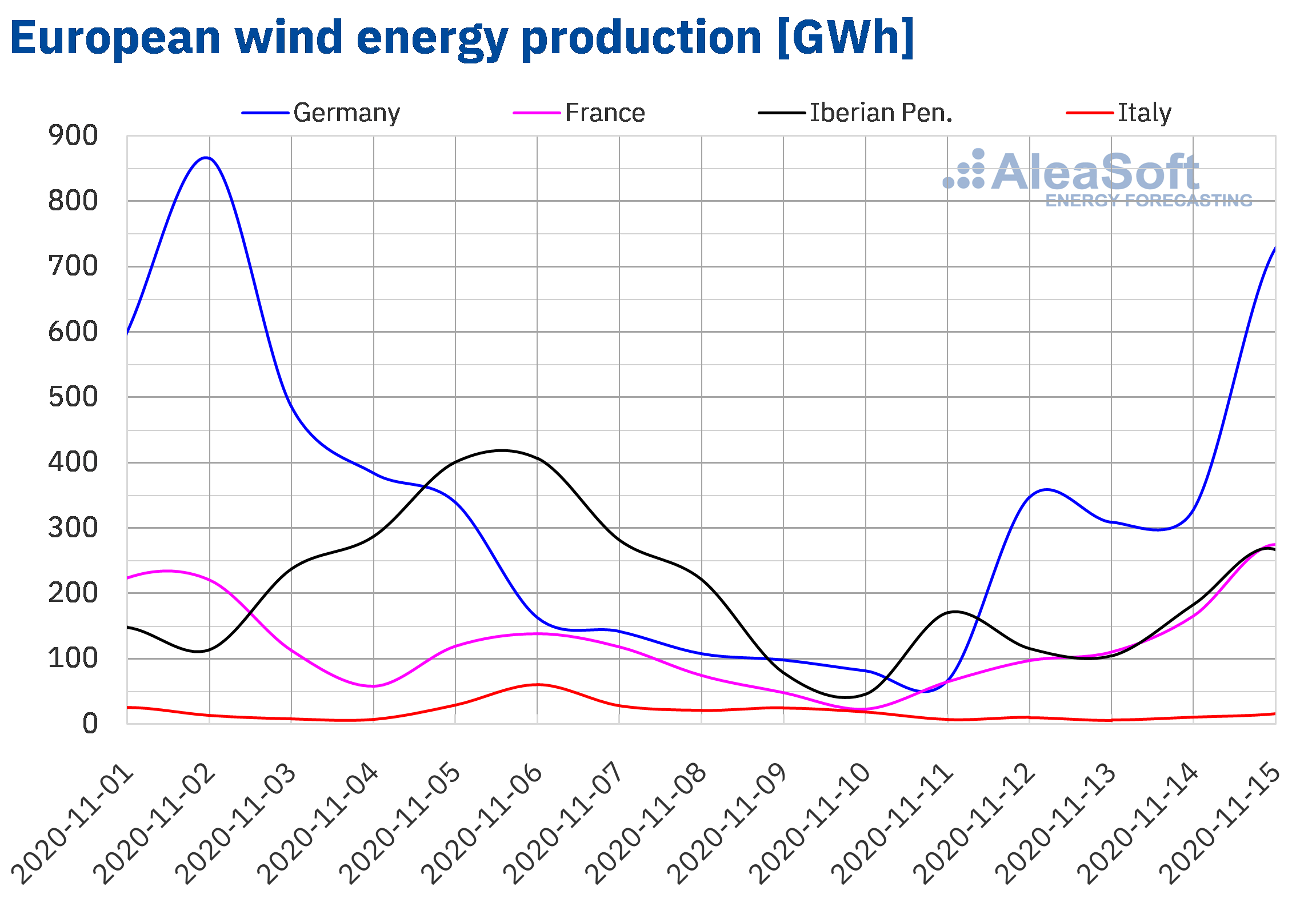

In the week of November 9, the wind energy production decreased in all the markets analysed at AleaSoft, compared to the week that preceded it. The largest drop, of 60%, was registered in the Portuguese market, followed by a 48% drop in the Spanish market and a 44% drop in the Italian one. In the markets of Germany and France the reduction was 21% and 6.7% respectively.

During the first half of November, the wind energy production increased by 10% in the French market compared to the same days of 2019, while in the German market it grew only 4.0%. On the contrary, in the Italian market, the production with this technology was 79% lower in this period, while in Spain and Portugal it fell by 42% and 40% respectively.

For the end of the third week of November, the AleaSoft‘s wind energy production forecasting indicates an increase in production in all the markets analysed at AleaSoft, except in the Portuguese market.

Electricity demand

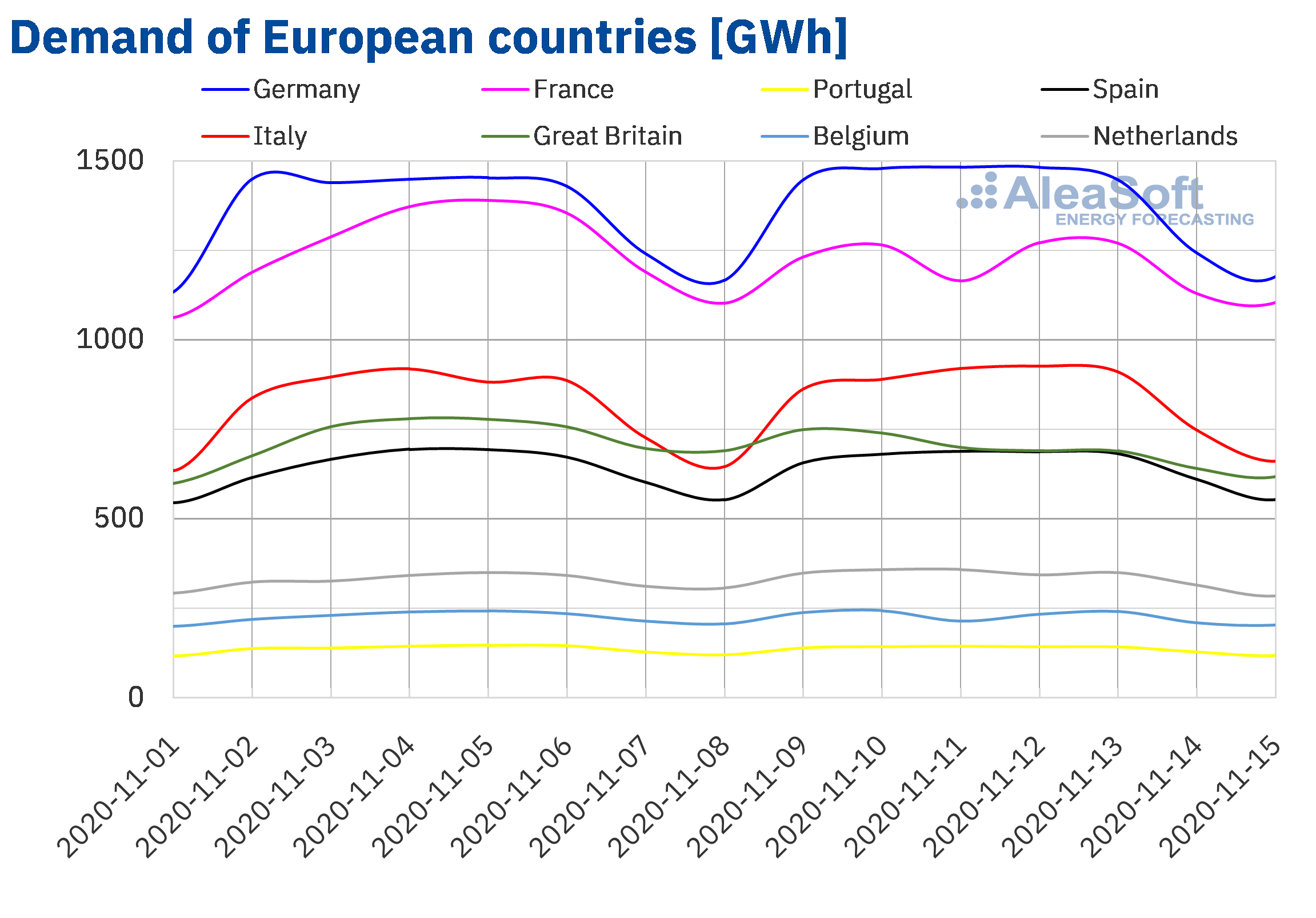

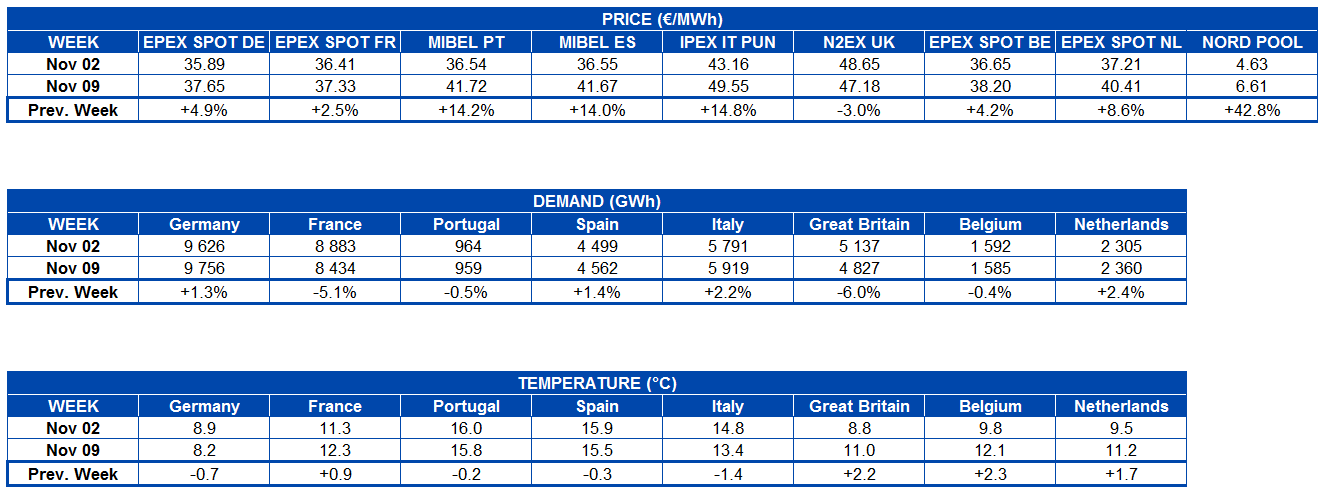

In the week of November 9, the electricity demand fell in most of the electricity markets of Europe compared to the previous week. The markets of France and Belgium registered decreases of 5.1% and 0.4%, due to the influence of the national holiday of November 11, Armistice Day in both countries. After correcting the effect of this holiday, the variations in demand were ‑3.5% in the French market and 1.5% in the Belgian. In the case of the Spanish market, the demand grew by 1.4%, due to the recovery during the second week of November of the effect of the holiday of November 2 in 6 autonomous communities. Once this effect and that of November 9 in Madrid were corrected, the increase was 0.5%. The steepest drop among the analysed markets was that registered in Great Britain, where the demand fell by 6.0%, while in the Portuguese market there was a decrease of 0.5%. On the other hand, in the markets of Germany and Italy, the demand increased by 1.3% and 2.2% respectively.

At AleaSoft, the demand is expected to increase in most of the electricity markets of Europe during the third week of November compared to the previous week. Although this trend may vary, depending on the changes in the mobility and work activity restrictions imposed to slow the spread of COVID‑19 in the European countries.

European electricity markets

In the week of November 9, the prices of almost all the analysed European electricity markets increased compared to those of the previous week. The exception was the N2EX market of Great Britain, with a decline of 3.0%. On the other hand, the market with the highest price increase, of 43%, was the Nord Pool market of the Nordic countries. In contrast, the market with the lowest price increase, of 2.5%, was the EPEX SPOT market of France. In the rest of the markets, the price increases were between 4.2% of the EPEX SPOT market of Belgium and 15% of the IPEX market of Italy.

The average prices of the week of November 9 were below €45/MWh in most of the analysed European electricity markets. The exceptions were the Italian market and the British market, with prices of €49.55/MWh and €47.18/MWh respectively. In contrast, the Nord Pool market of the Nordic countries had the lowest average price, of €6.61/MWh. The rest of the markets had averages between €37.33/MWh of the French market and €41.72/MWh of the MIBEL market of Portugal.

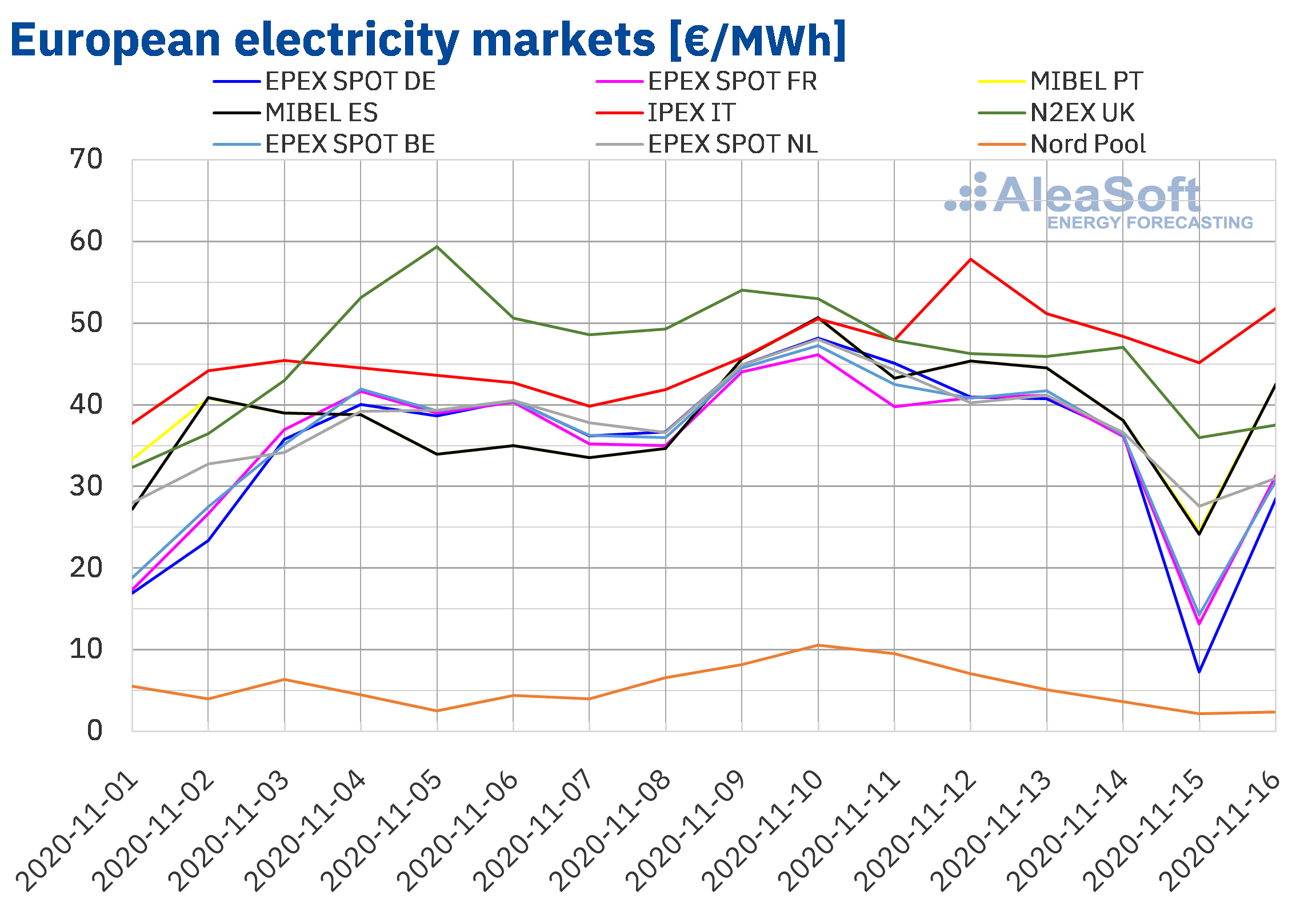

On the other hand, in the second week of November, the highest prices were reached in the Italian market and in the British market. Instead, the lowest prices were those of the Nord Pool market throughout the week. Out of the rest of the markets, those that presented a greater coupling in the second week of the month were the German, the Belgian and the French. On Sunday, November 15, there was a general drop in prices, which caused these three markets to approach the values of the Nord Pool market.

In the second week of November, the daily prices exceeded €50/MWh in the markets of Great Britain, Italy, Spain and Portugal. The highest daily price of the week, of €57.86/MWh, was reached on Thursday, November 12, in the Italian market. On the other hand, that week prices below €10/MWh were reached in the Nord Pool market and in the German market on Sunday, November 15. That day the lowest daily price of the week was reached in the Nord Pool market, of €2.16/MWh.

Regarding the hourly prices, the highest price of the second week of November, of €93.66/MWh, was reached at the hour 19 of Tuesday, November 10, in the British market. On the other hand, the lowest hourly prices of the second week of November were those of Sunday, November 15. That day a negative hourly price was reached in Germany. In the early hours of Monday, November 16, in addition to Germany, there were also negative prices in Belgium, France, Great Britain and the Netherlands. The lowest hourly price, of ‑€5.29/MWh, was that of the hour 4 of Monday in the German market.

The general fall in wind energy production and the decrease in solar energy production in countries such as Germany, France and Italy favoured the price increases in the second week of November. In the case of the British market, the drop in demand contributed to the decline in prices. But over the weekend, the wind energy production began to recover, which along with lower demand, allowed the prices to begin to decline.

The AleaSoft‘s price forecasting indicates that in the week of November 16, the prices will fall in most of the European electricity markets, favoured by the increase in wind energy production in Europe, which will be very significant in countries such as Germany or Italy.

Electricity futures

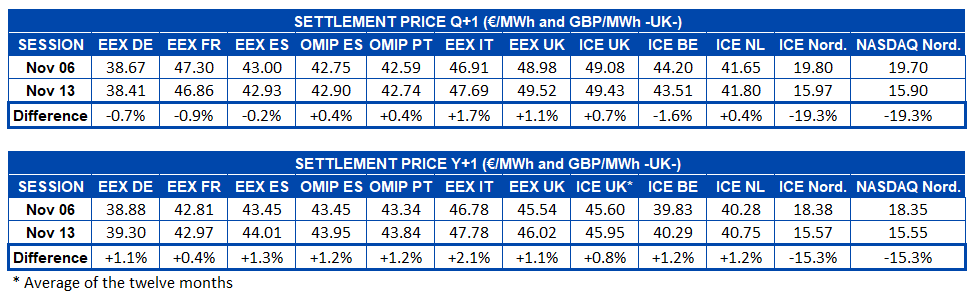

As for the European electricity futures markets, the prices for the first quarter of 2021 registered a heterogeneous behaviour at the settlement of the session of November 13 compared to that of Friday, November 6. The largest decreases, of 19%, were registered in the futures prices of the ICE market and the NASDAQ market of the Nordic countries, while the prices of the EEX market of Italy and Great Britain registered the largest increases, of 1.7% and 1.1% respectively. In the rest of the markets the variations were between ‑1.6% of the ICE market of Belgium and 0.7% of the ICE market of Great Britain.

Regarding the futures for the next calendar year 2021, there was a mostly upward behaviour in the prices of the markets analysed at AleaSoft. The exceptions were the ICE market and the NASDAQ market of the Nordic countries, in which there was a 15% drop between the sessions of Friday, November 13, and Friday, November 6. As for the increases, the EEX market of Italy stands out, where the price of this product increased by 2.1%. The rest of the markets registered increases of between 0.4% and 1.3%.

Brent, fuels and CO2

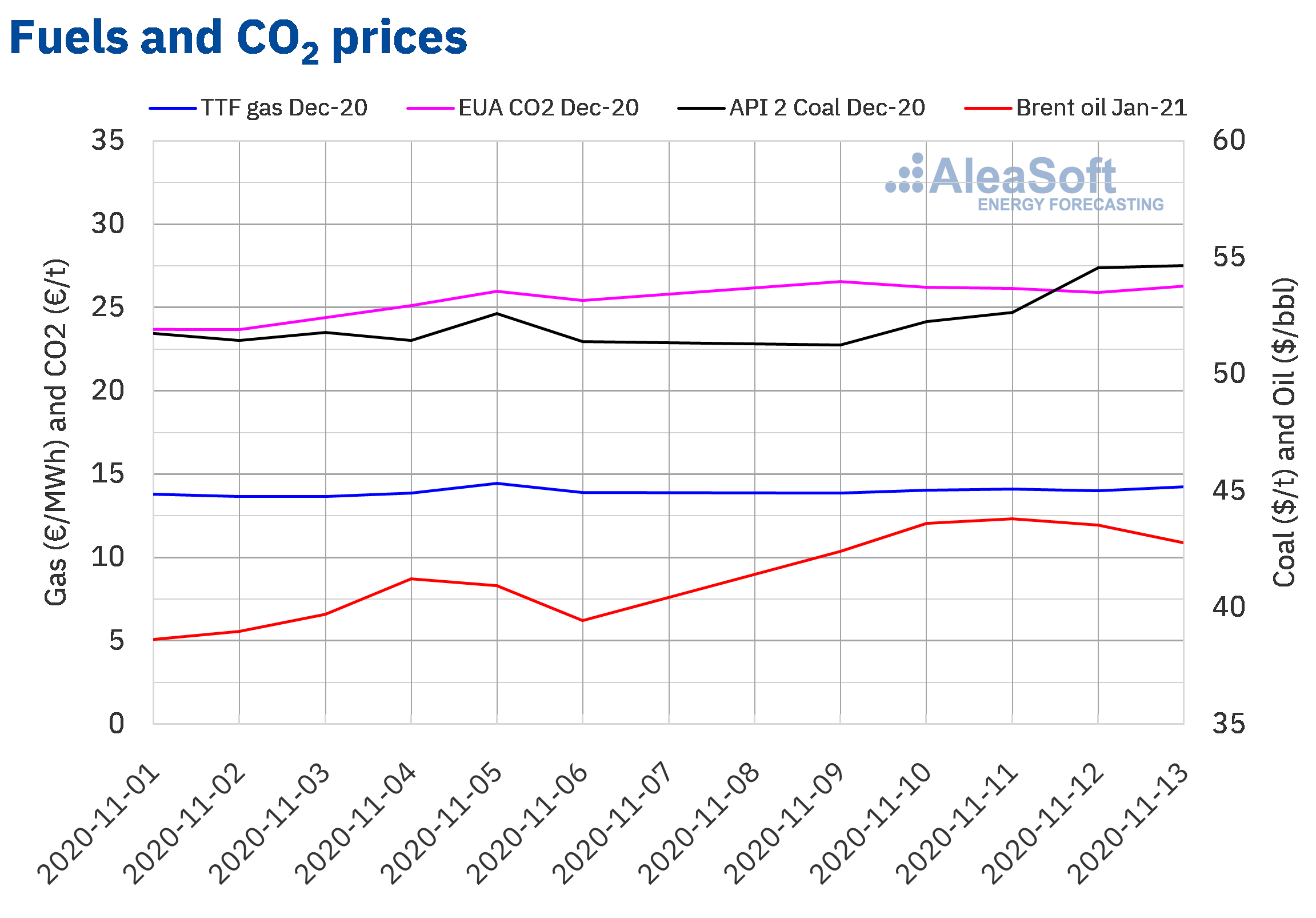

The settlement prices of the Brent oil futures for the month of January 2021 in the ICE market in the second week of November were higher than those of the previous week. The first three days of the week, the prices increased. As a result, on Wednesday, November 11, a settlement price of $43.80/bbl was registered, 6.2% higher than that of the previous Wednesday and the highest since the beginning of the second half of September. However, the week ended with declines and on Friday the settlement price was $42.78/bbl. But this price was still 8.4% higher than that of the previous Friday.

The price increases of the first days of the week of November 19 were favoured by the news about a vaccine capable of protecting against COVID‑19 infections, as well as by the US election results. However, the forecasting about the demand for crude oil made by the OPEC, which decreased compared to that made the previous month due to the measures adopted to try to contain the coronavirus pandemic, exerted its downward influence on the prices in the last days of the week.

On the other hand, the possibility that the OPEC+ extends its current production cuts in January, the signing on Sunday, November 15, of the trade agreement between 15 nations of the Asia‑Pacific region, and the data on the increase in crude processing in the Chinese refineries in October, may exert their upward influence on the Brent oil futures prices in the coming days.

As for the TTF gas futures in the ICE market for the month of December 2020, the settlement prices remained above €14/MWh during most of the second week of November, except for Monday, November 9, when a price of €13.85/MWh was registered. Besides, most days the prices increased. This allowed the settlement price of Friday, November 13, to be €14.24/MWh, 2.4% higher than that of the previous Friday.

Regarding the TTF gas in the spot market, the prices increased until reaching an index price of €14.10/MWh on Thursday, November 12. But, in the last days of the week, the prices fell and the index price of October 14 and 15 was €13.88/MWh.

On the other hand, the API 2 coal futures prices in the ICE market for the month of December 2020, in the week of November 9 registered a recovery. The settlement price of Friday, November 13, was $54.65/t, 6.3% higher than that of the previous Friday and the highest since the end of October.

As for the CO2 emission rights futures in the EEX market for the reference contract of December 2020, on Monday, November 9, they registered a settlement price of €26.55/t, 12% higher than that of the previous Monday and the highest since the first half of October. This increase was favoured by the news about the state of development of an effective vaccine to prevent COVID‑19. But, subsequently, the prices began to fall until reaching a settlement price of €25.92/t on Thursday. On Friday, the settlement price recovered to €26.29/t. This price was 3.4% higher than that of the previous Friday.

AleaSoft analysis of the evolution of the energy markets and prospects from 2021

On November 26, the last AleaSoft webinar of 2020 will be held, in which the prospects of the energy markets from 2021 will be analysed. In the webinar the renewable energy auctions and their effect on the market will be discussed, a topic that is currently generating a lot of interest in the sector, taking into account that the ministerial order proposal that regulates them in Spain is in the public consultation phase. The technical Due Diligence and its importance in the renewable energy projects financing will also be discussed. To address these issues there will be the participation of three speakers from Vector Renewables.

With the end of the year approaching, the time came to renew the supply contracts, something that in the current moments of coronacrisis is more uncertain than ever. At AleaSoft diversifying is recommended, placing part of the energy at different terms with the best conditions in each case. Having market prices forecasting in all horizons, short, mid and long term, will allow drawing up a robust energy purchase strategy.

The evolution of the energy markets can be followed in the observatories enabled on the AleaSoft website. This tool includes charts with updated hourly, daily and weekly information of the main variables of the European electricity, fuels and CO2 emission rights markets.

Source: AleaSoft Energy Forecasting.